Yougov. YOU. Buy @ 1555p. Times recommended: 13. First recommended: 435p Last recommended: 1440p

Before I talk about YouGov I want to refer to some of Warren Buffett’s favourite aphorisms, all of which are relevant to a 21st century growth share investor. He said:

“It is better to buy shares in a wonderful business at a reasonable price than a reasonable business at a wonderful price.”

“Buy a significant holding in the shares of a company that you expect to become meaningfully larger over time and hold for at least 10 years.“

“Investing in shares is like going into partnership with a manic depressive.”

I imagine that you may be thinking like me. This is all very well but what constitutes a wonderful business and what is a reasonable price to pay for such a business. This may be particularly hard to determine in a period like now when the ways in which shares in fast growing companies are valued is in a period of flux. Do we value them on earnings? Difficult when there are no earnings. Do we value them on sales? This creates the problem that values can move to very high levels making the shares vulnerable to changes in sentiment.

This is a hard one. Incidentally, apropos my last alert, I suspect we are in a period when investors are questioning values on some of the fastest growing businesses and worrying that a combination of an uptick in interest rates, a slackening of demand in some areas and some unravelling of margin funding could do some damage to some erstwhile high flying shares.

My reading of the charts is that there is some sort of flight to safety going on which is why shares in the really big guns, companies like Apple, Amazon, Alphabet and Microsoft are holding up well while shares in faster growing, more highly valued companies have been taking a beating.

We live in a low interest rate world and I don’t see that seriously changing. This justifies higher values for shares. In the 1960s, when returns available on bonds were much higher, a PE ratio of 20 (the reciprocal of an earnings yield of five per cent) seemed plenty for a fast growing business.

Now with bond yields between one and two per cent or even lower in some places, growth rates faster as companies invest at scale while targeting total addressable markets vastly expanded by globalisation and the Internet and an incredible wave of disruption affecting all industries, a PE ratio of 20 does not do justice to the opportunities on offer and we are getting used to much higher valuations.

Unfortunately there is no stock market deity who can just tell us mere humans what now constitutes a reasonable value for a fast growing business so we are (a) having to make it up as we go along and (b) leave it to the interplay of market forces (manic depressives and all) to somehow determine the right price for a great business.

It is a bit like trying to put a price on bitcoin. We are peering into the future at what may or may not happen and then trying to put a reasonable value on that. Understandably, it is very difficult and there are many different opinions which is why we all turn gratefully to what seems like the timeless common sense of Mr Buffet.

So how does YouGov stack up on all this. It is certainly 3G as can be seen from the chart, the table of financials and even a cursory knowledge of the business and what its CEO and co-founder, Stephan Shakespeare is trying to do.

“Our vision is for YouGov to be the world’s leading provider of marketing and opinion data.”

Yougov also has another characteristic I like to see with businesses in having a superstar, charismatic founder CEO in Stephan Shakespeare. He is awesome and I am sure inspires huge enthusiasm in his staff as well as his shareholders. Shakespeare became sole CEO of YouGov in May 2010 since when the share price has risen 39 times.

The first question we have to answer is – Is it a wonderful business? One interesting point is that essentially Yougov is a data collection business and data has moved to the heart of how we do business and create value in the 21st century.

Just thinking about the Quentinvest portfolio and there are a number of businesses that are all about data.

YouGov has a massive global panel of people that it can use to perform all kinds of real time market research and conduct opinion polls which typically prove extremely accurate.

Factset Research Systems (FDS) provides financial data and market intelligence and has been growing steadily for over 40 years.

ZoomInfo Technologies is a more recent and faster growing arrival on the scene which provides constantly updated data to help sales and marketing professionals spend less time identifying and monitoring targets and more time actually selling them stuff.

Snowflake is an incredibly fast growing business, in which Warren Buffett’s Berkshire Hathaway, has a significant stake, which provides a platform, which it calls the Data Cloud, where companies can store, access, share and analyse all their data from wherever it may be (different silos as Snowflake describes it) and also share it with others. Snowflake is growing at a triple digit rate, operates as a data utility, so charges are based on consumption not subscriptions and has a net expansion rate (business growth over the year by customers at the start of the year) of 173pc which is the highest I have ever seen.

And then there is Facebook. Facebook started as a way for people to connect online and the shares fell at first when the company floated because nobody could see how they could make much money from what they did. The business model seemingly only worked because it was free. In order to monetise it Facebook needed to sell ads without driving its customer base away. It did this by turning Facebook into a massive data collecting machine and then using that data to show people ads that it was confident they would want to see. As we know this was a huge success financially while attracting endless controversy about privacy and other issues along the way.

As Snowflake says in their latest report, which was so good one analyst describe their results as ‘thrilling’:-

“The overarching backdrop for Snowflake is the inexorable march toward direct-to-consumer operations and full-bloom digital transformation. Enterprises and institutions have grown acutely aware how much they will end up relying on data operations, data analytics, and data science. Data is becoming the beating heart of the modern enterprise.“

So there we have it straight from the horse’s mouth, data is becoming central to all commercial operations and much else besides, in the modern world. This leads us back to Yougov, a business which has been focused on collecting and analysing data since it was founded in 2000.

The best way to learn more about what they do and how they do it is to read the latest annual report, which can be found on their web site in the investor relations section. If we are deciding to become part owners of the business I think the least we should do is read a bit about the business so we know what we think and can find it easier to commit to Warren Buffett ‘s other mantra of holding the shares for at least 10 years.

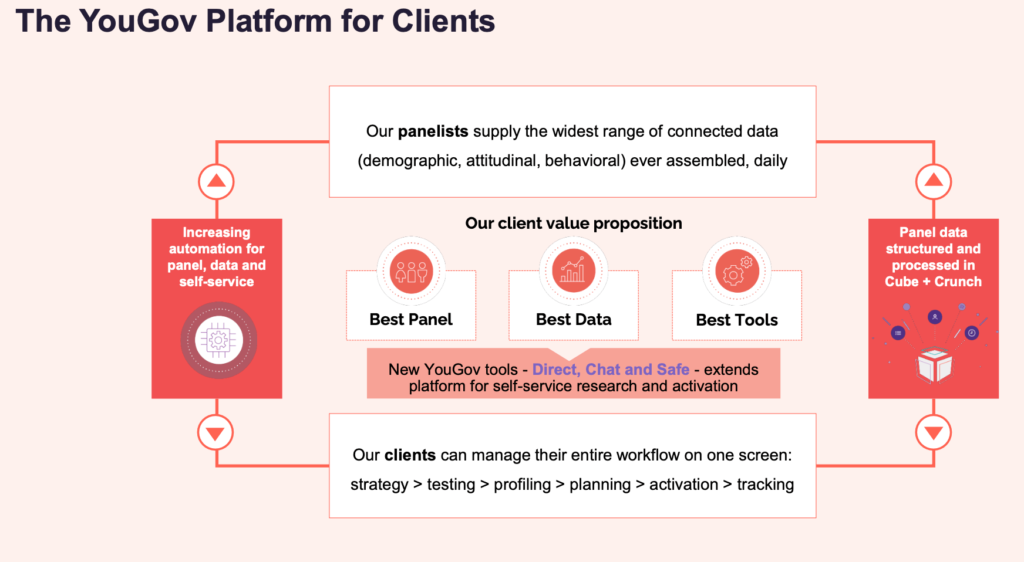

I have also found a webinar which the company presented to investors in November 2020. A chart from the webinar is displayed below.

You can see immediately here the structure for an exciting data-based business with great growth potential as the whole world makes this huge global shift to basing all decisions on a tidal wave of data. As we know many companies are already making this shift but this is just the tip of the iceberg. There is much more to come, let alone the 87pc of the iceberg, to stay with the metaphor, which is below the surface and has not even started to move.

In answer to an analyst’s question, Snowflake’s CEO, Frank Slootman, had something to say about this at their latest analysts’ presentation.

“I agree with your assessment that we are just seeing the tip of the iceberg. Snowflake was built from the ground up as a data sharing platform and we’ve been at it from the beginning. Now you see a lot of other players following our lead.

But we are in the beginning. What happens a lot in our field and in our business is that people look at modernising legacy workloads. Those kinds of things often have priority over getting to data sharing, because we cannot even consider data sharing unless we get our data to the cloud. We start moving those workloads, we migrate our databases, and so on.

So we are in the very early stages. But as you see from the metrics that we report on, there is a very, very steady aggressive growth happening quarter-on-quarter. But we haven’t reached that tipping point yet where the floodgates are open and things are expanding at a meteoric rate. But we’re anticipating that that will happen at some point.“

Imagine, if he is right, the fireworks that could be coming but back to Yougov.

“YouGov Direct is a fully opted-in and transparent research and marketing platform. With accurate profiling data and granular consent from our members, we enable precise audience targeting and go beyond traditional market research.”

Part of what Yougov is doing is finding new ways to engage with people which is fun for them but provides an endless source of great data.

“YouGov Chat is the “people-engine” – using fun, engaging and interactive chat content to bring tens of millions of people into the YouGov ecosystem seamlessly and efficiently, using individual passion points.”

YouGov Chat is a huge project. At the time of the webinar they had 300,000 members but the plan is to scale to 10s of millions of users supplying a tidal wave of valuable, real-time data.

Yougov is not just a data collection machine. They are acutely aware that your data belongs to you.

“YouGov Safe is a tool which enables YouGov members to securely and safely store data which companies, platforms and institutions hold about them, and then anonymously share with 3rd parties to create value. YouGov Safe only ingests closed historical data sets that the member has deliberately transferred to us for this purpose. The data is encrypted and anonymised.“

Yougov describes everything it is doing as the next phase of the Yougov platform which means there is an important something new happening at the business which can be an important driver of shareholder value. This gives us yet another reason for being excited about the shares.

Yougov is big.

“With a proprietary panel of over 17m registered members globally and operations in the UK, the Americas, Europe, the Middle East, India and Asia Pacific, YouGov has one of the world’s largest research networks.”

It is also the second most quoted market research source worldwide, which is an incredible achievement for a London-based company. The world’s largest market research firm with revenues of $6.3bn a year v $202m for Yougov, is Neilson so Yougov looks to be punching well above its weight.

The company says:-

“Our clients use our data products, tools and research services to manage their entire marketing workflow, from strategy and planning, brand tracking and media planning to campaign effectiveness and audience profiling. The interoperability and connectedness of our products and services serve as a strong differentiator and we have made great strides in bringing the entire YouGov offering onto a universal platform, while enriching its capability and increasing the use cases of our offerings.”

I think we can safely say that Yougov meets Buffett’s criteria of being a wonderful business. Is the valuation reasonable? This has become one of those how long is a piece of string questions but I think there is an excellent case for saying that the valuation is reasonable.

Unlike many fast-growing companies Yougov makes profits, has earnings per share and even pays dividends. At 1560p the prospective PE ratio for the year to end July 2024 would be around 53. This is hardly screamingly cheap but if we think about the big picture of what we are buying it does seem reasonable, especially given the scope for upside surprises.

We can also reflect on what it has already achieved.

“Yougov celebrated its 21st anniversary this year having evolved from an Internet-based, UK polling company into a world-class global analytics provider.“

There is something else going on that is probably helping Yougov and is contributing to this huge demand for data and data analytics and that is the trend to direct to consumer. Everybody is cutting out intermediaries and dealing with the final consumer and that enables them to collect huge amounts of data and also makes it helpful to share data with all the other players in their ecosystem.

Snowflake SNOW Buy @ $365. Times recommended: 4 First recommended: $311. Last recommended: $386

A big player in helping companies to do that [share data] is Snowflake, which since 2019 has been led by two key executives from Servicenow, CEO, Frank Slootman and CFO, Mike Scarpelli. This is what Slootman had to say in answer to a question about collecting and powering first party data [first party data is data collected directly from consumers as opposed to data based on things like cookies].

“It’s really rippling through the entire economy. You have to view it in the context of the whole world going direct-to-consumer. Eevery industry, even people that have historically not been direct-to-consumer are moving toward direct-to-consumer. Now, that obviously triggers enormous investments and people trying to get up to speed on data operation, data science, and being able to run a real data-driven enterprise. In order to do that we need to have very, very, very refined data enrichment strategies to really tune and optimise and make these relationships work.

And that’s what’s fueling this enormous focus on data sharing and people being able to enrich their data with attributes that come from other sources. So, the ability to own your own data as an institution, as an enterprise, and to fully operationalize and mobilize it is going to become incredibly important. I mean, even industries that historically have not been direct-to-consumer, I think of retail and things of that sort, retail, obviously, the brick-and-mortar type, they’re all changing now under the influence of the likes of Instacart and DoorDash. So, it’s all changing.

So, the interaction method becoming digital is a real tailwind for companies like Snowflake.”

You may be thinking, reading this that Yougov looks an exciting investment but so does Snowflake. It does indeed. Snowflake is growing at an incredible rate. Not only are sales projected to rise from $269m for the year to 31 January 2019 to $3.14bn by the year to 31 January 2024 but also the company has a target for sales reaching $10bn by the year to 31 January 2028.

In one way that looks very ambitious but amazingly it also assumes sales growth slowing dramatically after 2023-24 which doesn’t quite square with Slootman’s comment that there could be some kind of tipping point ahead.

In any event Snowflake is clearly a 3G stock which is currently in hyper growth mode. Interestingly also Snowflake does not have any interest in add-on modules and all the things that so many other enterprise software companies do. All Snowflake wants to do is constant improvement in its data sharing platform so that it makes it ever easier for its customers to make use of all the data they are collecting across their businesses.

You can understand why they feel like that. In a recent presentation the company said the market for data warehousing is $14bn, the market for a cloud data platform is $90bn and the market for the data cloud they are now building is – think of a number.

I have been scratching my head trying to figure out the difference between the cloud data platform and the data cloud. Let’s start with data warehousing. AWS (Amazon Web Services) says – “A data warehouse is a central repository of information that can be analysed to make more informed decisions.”

I suppose a cloud data platform is the same thing but runs in the cloud. So what is a data cloud. It seems to be Snowflake’s description of what they are creating with different data clouds for different industry verticals.

This is one simple description that I found.

“The Data Cloud allows organizations to unify and connect to a single copy of all of their data with ease. The result is an ecosystem of thousands of businesses and organizations connecting to not only their own data, but also connecting to each other by effortlessly sharing and consuming shared data and data services.”

Snowflake creates, tools, software, a platform, whatever to help companies and whole industries operate their own data clouds. They get paid by usage rather than by subscription hence their description of their business as using a utility model. The more gas you use the more you pay the utility supplying you with gas, ditto for data with Snowflake.

You might think this makes their business very unpredictable but they say not because companies contract in advance for the amount of data they expect to use and this figure is captured by Snowflake as RPO (remaining performance obligations).

You can see what is going on with CFO, Mike Scarpelli’s comments with the latest quarterly results.

“Q3 was also an impressive quarter of sales execution. The remaining performance obligations grew to $1.8bn [v $928m a year earlier] with our key industries leading net new bookings. We are also pleased with our progress to mature the sales motion to sell large multi-year deals. In the quarter, we signed a three-year $100m deal to an existing customer, as well as five additional eight-figure multi-year deals.

These commitments signal organizations’ intent to expand their use of Snowflake, and we look forward to seeing their consumption follow. Of the $1.8bn in RPO, we expect approximately 55pc to be recognized as revenue in the next 12 months. We remain focused on penetrating the largest enterprises globally as we believe these organizations provide the largest opportunity for account expansion. In Q3, the number of customers with greater than $1m in trailing 12-month product revenue increased to 148, up from 116 last quarter, including eight consuming more than $10m.”

The quotes also reflect the company’s strategy of focusing its sales efforts on the largest customers who once started on the platform typically see dramatic growth in usage which leads to the incredibly high 173pc net revenue retention rate.

Another advantage of the growing focus on the data cloud is that it comes with powerful network effects. The more companies from a particular vertical like say finance, health or advertising and media there are in a data cloud the more data is being shared which makes the platform progressively more valuable to all the users.

Since it also takes quite a while for users to transfer data into Snowflake’s data cloud(s) this builds a powerful moat around the business.

I don’t think anyone would disagree that Snowflake is a wonderful business. The question is about the valuation and whether it is reasonable or not with the company valued at around $110bn against expected sales for calendar 2021 of around $1.2bn and significant losses.

The amusing thing here is that Berkshire Hathaway, the master company of Warren Buffett, who gave us the quote is a big shareholder in Snowflake. They were bought more cheaply but I don’t suppose there are any plans to sell, which is a kind of endorsement of the current valuation.

The truth is that when a company is growing at a triple digit rate it becomes incredibly hard to value. This is not remotely a forecast but if by some strange miracle Snowflake could sustain growth at 100pc over the next few years sales by fiscal 2028 would not be the ambitiously targeted $10bn but would be more like $77bn, such is the power of compound interest.

The only way to value Snowflake is to forecast how fast they are going to grow over the next few years and that is completely impossible for them and anyone else. It is a bit like geese who supposedly can count to one, two, lots. Once growth goes hyper anything can happen and sometimes does which is why businesses like Alphabet, Amazon, Apple and Microsoft have become so big.

The data market is huge and Snowflake is a key player within it as referenced by this quote from the latest results.

“The race is on to lay the foundation for a digital data-driven infrastructure. Snowflake is and will be a critical enabler of this journey.”

Last but not least of the attractions of Snowflake is that their product is every bit as relevant internationally as in the Americas but currently they still do 82pc of their business in the America’s leaving EMEA (14pc) and APAC (4pc) as huge opportunities. Opportunities which are already seeing explosive growth.

“We continued our international expansion with product revenue from EMEA [Europe, Middle East and Africa] and Asia Pacific, outstripping the company’s year-on-year growth, up 174 and 219 percent, respectively.”

What started as an alert for YouGov has also become an alert for Snowflake. These are two wonderful companies and although shares in Snowflake look very highly valued we can claim that since Berkshire Hathaway is a major shareholder that gives them some claim to being reasonably priced. Actually at the end of the day I think that is too much of a stretch. Only the future will tell us if Snowflake shares are reasonable value or not but the company is super exciting.

YouGov celebrated its

21st anniversary this year, having evolved from an internet- based, UK polling company

into a world-class global data analytics provider.