I don’t think this chart means much except that there is no sign of 10-year UK interest rates falling sharply. It does open up the possibility of a political crisis ahead if rates break higher.

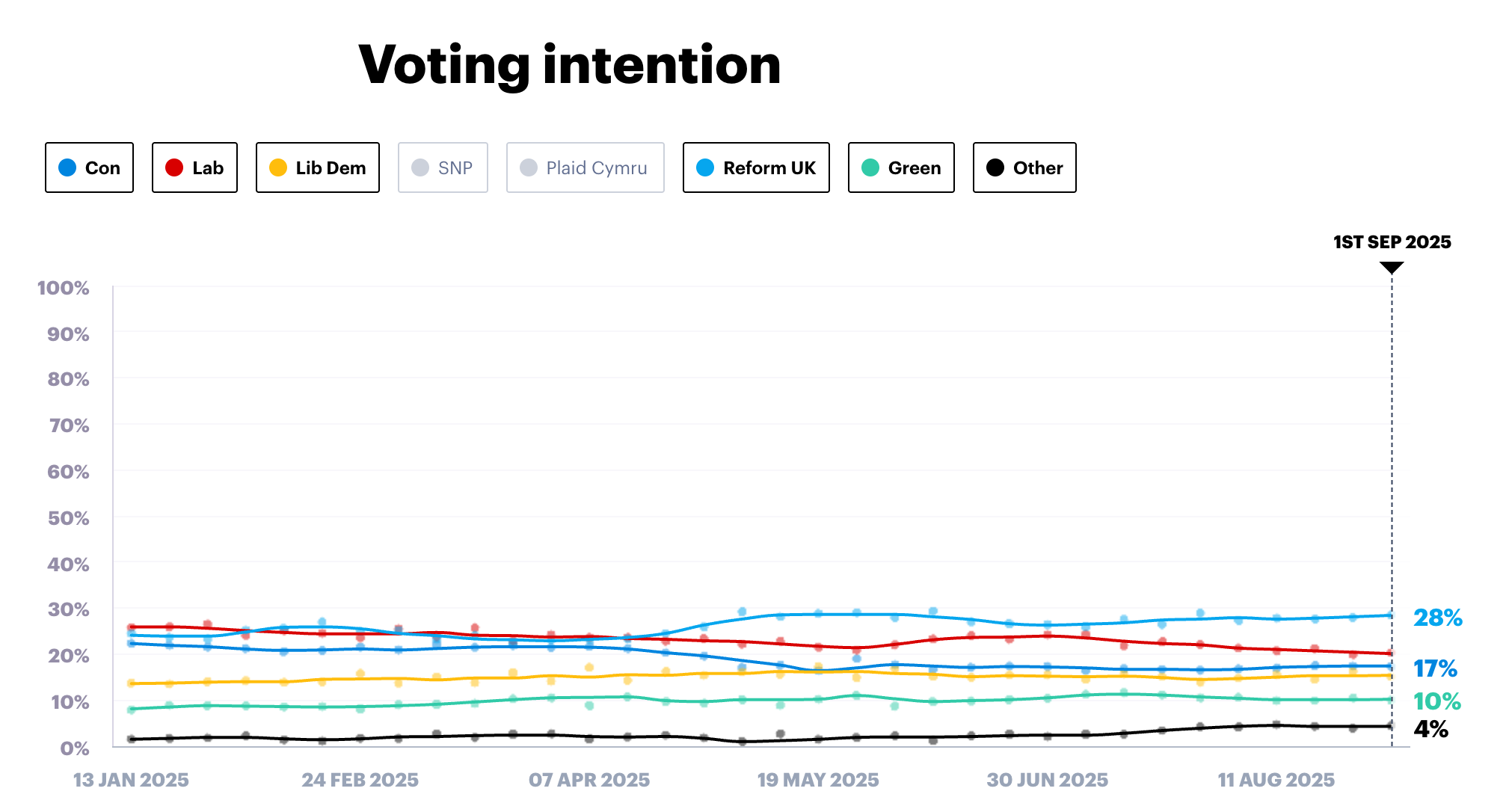

Reform UK is way ahead in the polls. The next key date is 6 May 2026. The possibility is that reform will win a smashing majority, becoming a major force in local government and firing a broadside over the traditional parties.

Who in the current circumstances is going to vote for any party that has formed a government over the last 25 years? Most people would probably regard me as a diehard Tory. I am never going to vote Labour, that’s for sure, but in the last election I voted for Reform and they will almost certainly get my vote in the next one. Keir Starmer comes across as a boring left-wing toff, which has zero appeal to the traditional working class, whereas Farage is a guy they would feel comfortable with in a pub. The Tories are a car crash, and the Lib Dems appeal to a wet, virtue-signalling, why-can’t-they-all-be-friends middle-class vote. People who prefer broccoli to steak.

The next election is for Farage to lose, and the Starmer, Reeves, and Raynor triumvirate, which is ruling Labour, looks lost in the face of the political challenges they are facing. There are solutions, but they are not available to a Labour government, which is trapped in its statist mindset.

Farage has the opportunity to win a majority and reset the political agenda, and that is the hope which is making me give them my vote. Immigration is not a big issue for me. There are not many hotels in Kensington full of refugees, and the typical immigrant around here is a guy, or a girl, who thinks in millions and drives a Porsche.

My big issue is the burgeoning size of the state and its inability to deliver. The system, which does work, was devised by Adam Smith, David Ricardo and others in the 18th century, and delivered incredible results in the 19th century. I want something on those lines reinstated with the UK becoming a magnet not for refugees in boats but ambitious, hungry entrepreneurial people who could live anywhere but choose a country which believes in low taxes, opportunities for all and rewards for success.

London is a wonderful city, and England is a green and pleasant land, rich in history, which is being crippled by the politics of envy. Nobody minds if sportsmen, actors and singers become rich, so why not the rest of us? Take the brakes off and this country could explode, and that is never going to happen with dreary people like Starmer, Reeves, Raynor and co. in charge.

I talk about England because, left to me, I would cut Scotland. Wales and Northern Ireland are adrift. Let them stew in their left-wing politics and religious obsessions. They would soon change their tune when they saw England racing ahead, and who cares if they didn’t?

The job of politicians is not to run the country but to allow the country to run itself, and that is the miracle of Adam Smith, that when every man pursues his own selfish agenda, he benefits everybody. Does anybody in politics get that? I don’t know, but my hope is that maybe Farage and Reform do.

Trump is almost the opposite of Starmer and the rest. I disagree with many of the specific things Trump is doing, tariffs, hostility to immigrants, preventing Nvidia from selling its high-powered chips to China, and favouring Putin over Zelensky in Ukraine, but the big picture is that he wants a powerful, prosperous America, and in his erratic way, that is what he will get. I sometimes feel that most bien-pensant people, the kind who work for the BBC and The Guardian, dislike America and everything it stands for, but they are succeeding, where we, Europe and much of the rest of the world are failing.

The only current British entrepreneurs most people can name are Richard Branson, who has made a considerable amount of money but not done much for others, and James Dyson, who has relocated to Singapore. America is home to numerous entrepreneurs who have become household names. They resemble the great names of the Victorian era – Stephenson, Brunel, Edison, Bell, Cadbury, Rowntree, Rothschild, Cayzer, Bessemer, the armaments tycoon Armstrong, and many more.

US shares are drifting as I write, with many analysts struggling to read the tea leaves on the outlook for tech stocks generally and AI stocks particularly. This is a mug’s game. The big picture is that AI is early days in realising its massive potential and shares will head higher sooner or later.

I have been listening to interviews with AI tycoons like Sam Altman, who is still just 39. His key point is that AI, or AGI as he calls it, is getting smarter every year, and this heralds a future of dramatic change. The first Chat GPT was released on 30 November 2022, and we are about to see Chat GPT 5.

The intriguing thing about AI/ AGI is that it can improve forever, which means there is infinite demand for faster, more powerful compute capacity, for data and probably for energy, the raw materials driving the latest phase of the technology boom.

This puts humanity on a roller coaster ride to goodness knows where and seems to put America in the driving seat. The obvious conclusion is that American shares, generally, and technology, particularly, are a great place to invest.

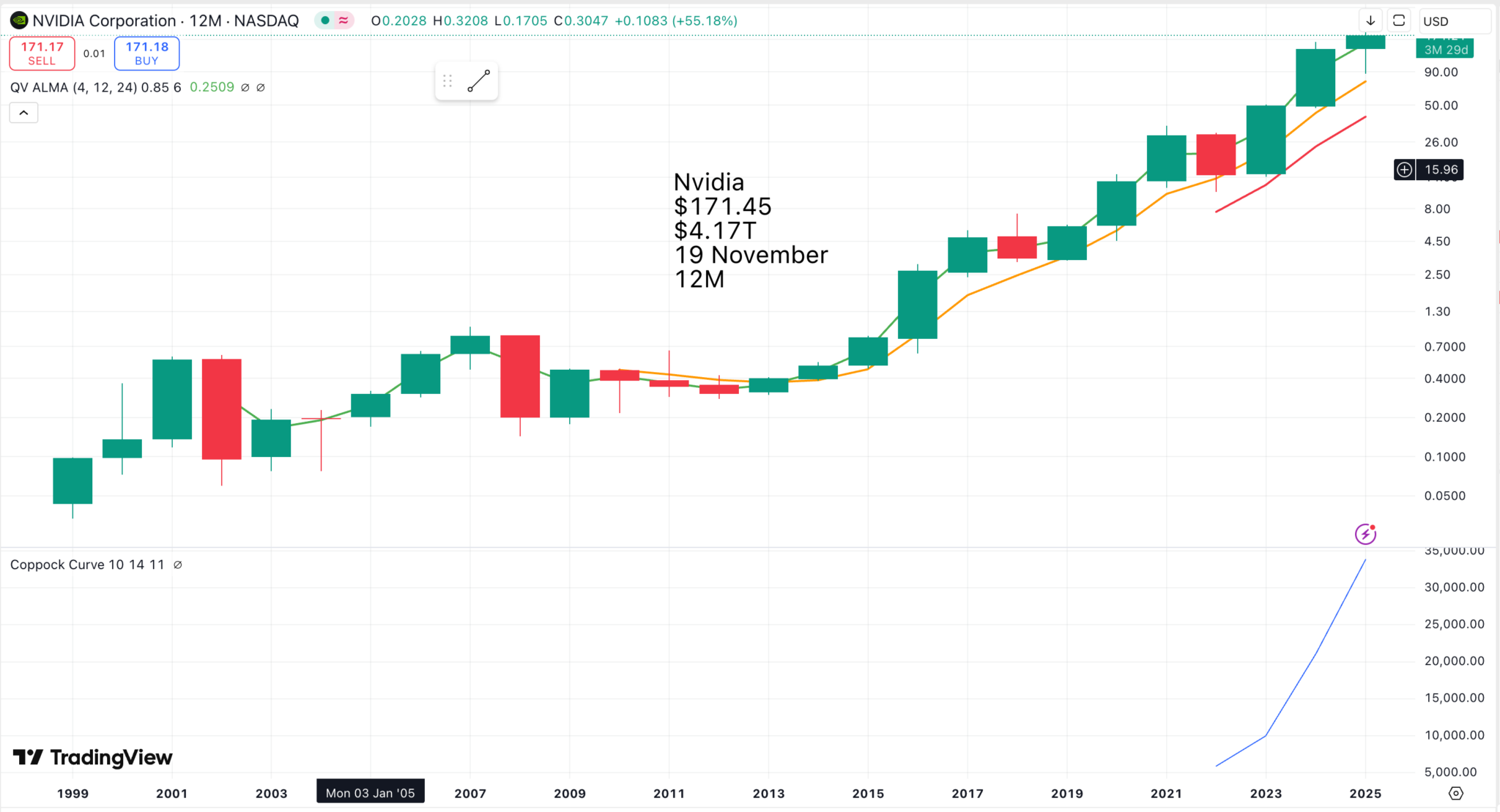

Nvidia is at the epicentre of the AI boom, and its share price has skyrocketed since 2016, making it the most valuable company in the world with a market value exceeding $4 trillion. Other key AI stocks are also shooting higher.

Another fantabulous chart, 17 years relentlessly onwards and upwards.

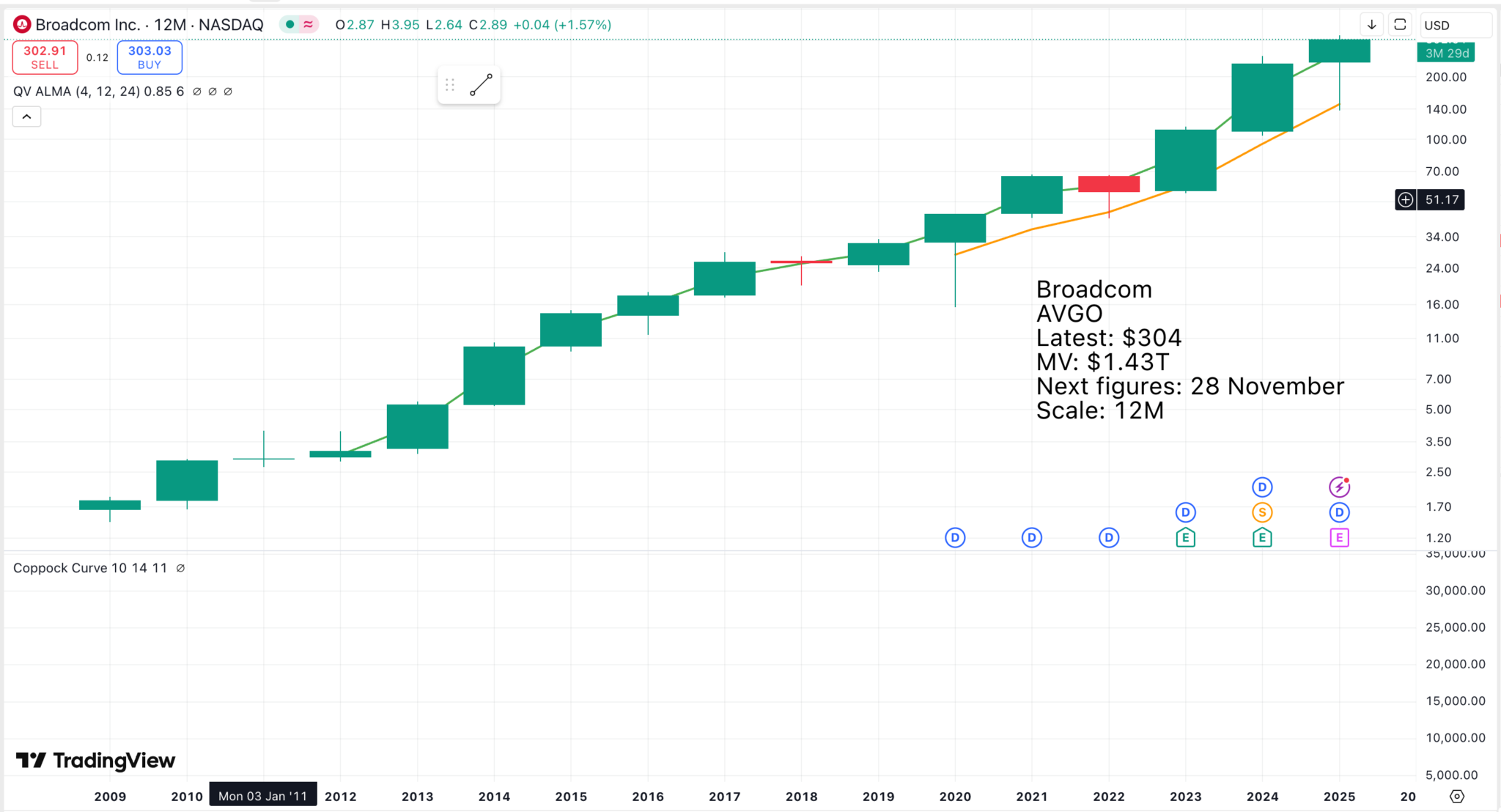

I haven’t changed it on the Broadcom chart, but they are reporting tomorrow. I am sure their figures will be amazing, but since that is expected the shares may be volatile. The long-term trend is onwards and upwards.

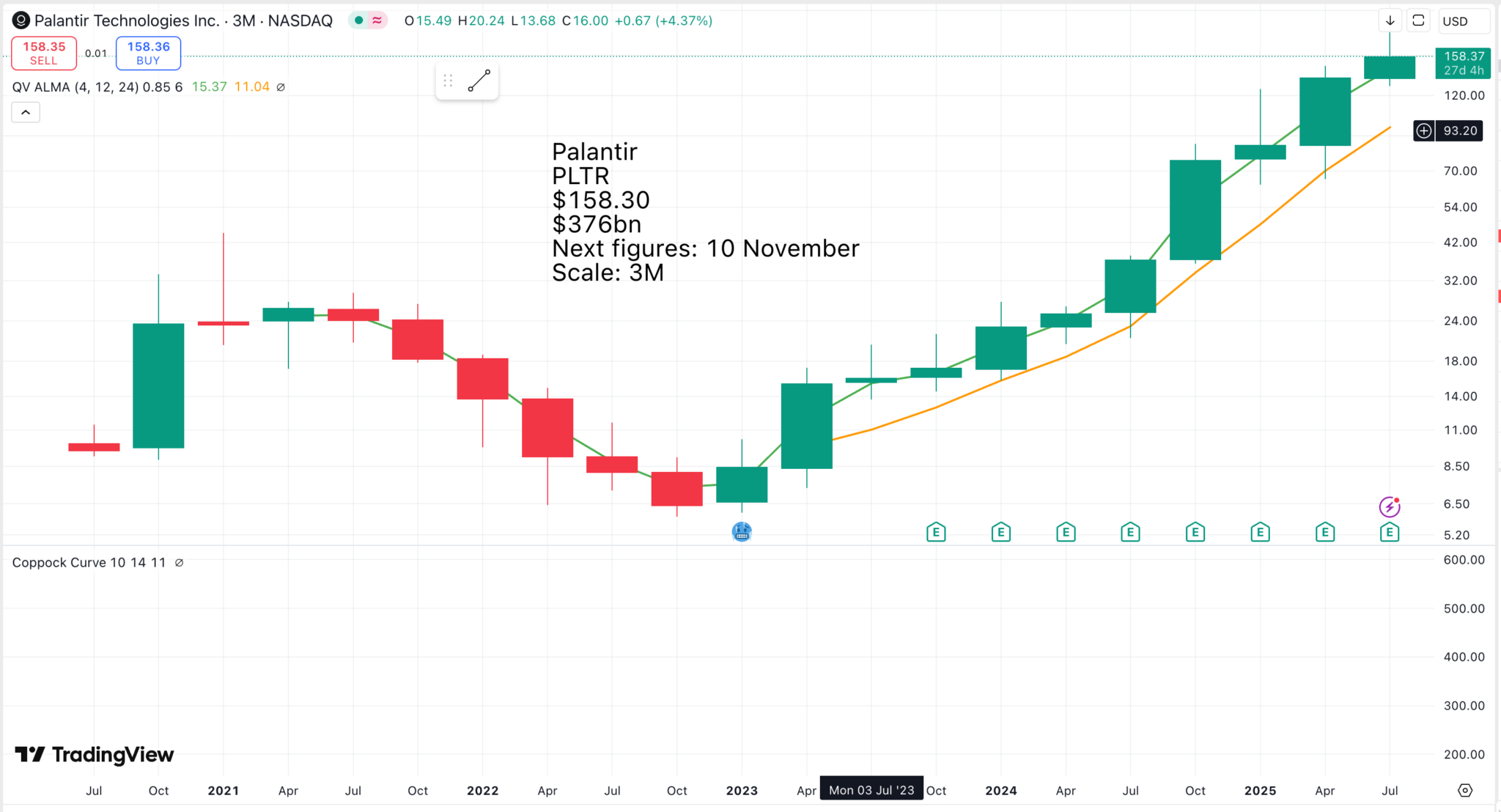

My other favourite AI stock is Palantir.

Palantir is being targeted by short sellers, Citron Research, on valuation grounds. That is almost a rite of passage for these high-momentum growth shares. I don’t pretend to know the right price for Palantir or any of these great growth businesses at any given moment in time. I just expect the uptrend to continue.

It’s a bit like Colonel Parker with Elvis. He went to see Elvis. Not surprisingly, he failed to appreciate the music or the magic of Elvis. What he did see was the effect Elvis had on his audience, especially teenage girls. It was seismic. Elvis went on to be the greatest phenomenon in the history of popular music, possibly rivalled by The Beatles.

These tech stocks are a bit like that; we can see they are amazing businesses, and that gives them an unstoppable momentum that can take them to undreamed-of heights of achievement. Palantir could easily prove to be the Elvis of the technology revolution. The business could also be unrecognisable from its present form. Technology is moving with increasing speed, and so are the companies leading the revolution.

I had a shock today. I listened to a great country song, which I duly added to my liked list. The performer was Country Angel. I tried to check it out, but it was curiously amorphous. Eventually, I asked Google if Country Angel was something to do with AI. This was the reply.

Our new channel COUNTRY ANGEL shares nostalgic country treasures and fresh AI originals inspired by legends like Patsy Cline, Tammy Wynette, Conway Twitty, and many others.

Country Angel, 2025

The song I liked is called ‘Are There Roses In Heaven’ and it is good. I love it, but what wrote it, what is singing, not the gorgeous, busty blonde holding a guitar in the illustration, that is for sure.

I like books by Georgette Heyer, who wrote about the Regency period. I have myself written books in the style of Georgette Heyer, which are not bad, though not as good as hers. But what about AI? Could AI start writing GH books? I guess if it can’t yet, it soon will be able to, and if it does, they will probably be good, and I will probably buy them. Will her heirs be able to cash in on this? I don’t know. It is going to pose some challenges.

These are just the first tremors of the challenge that AI is going to pose to the world to which we have become accustomed, and AI, all the experts tell us, is just getting started.

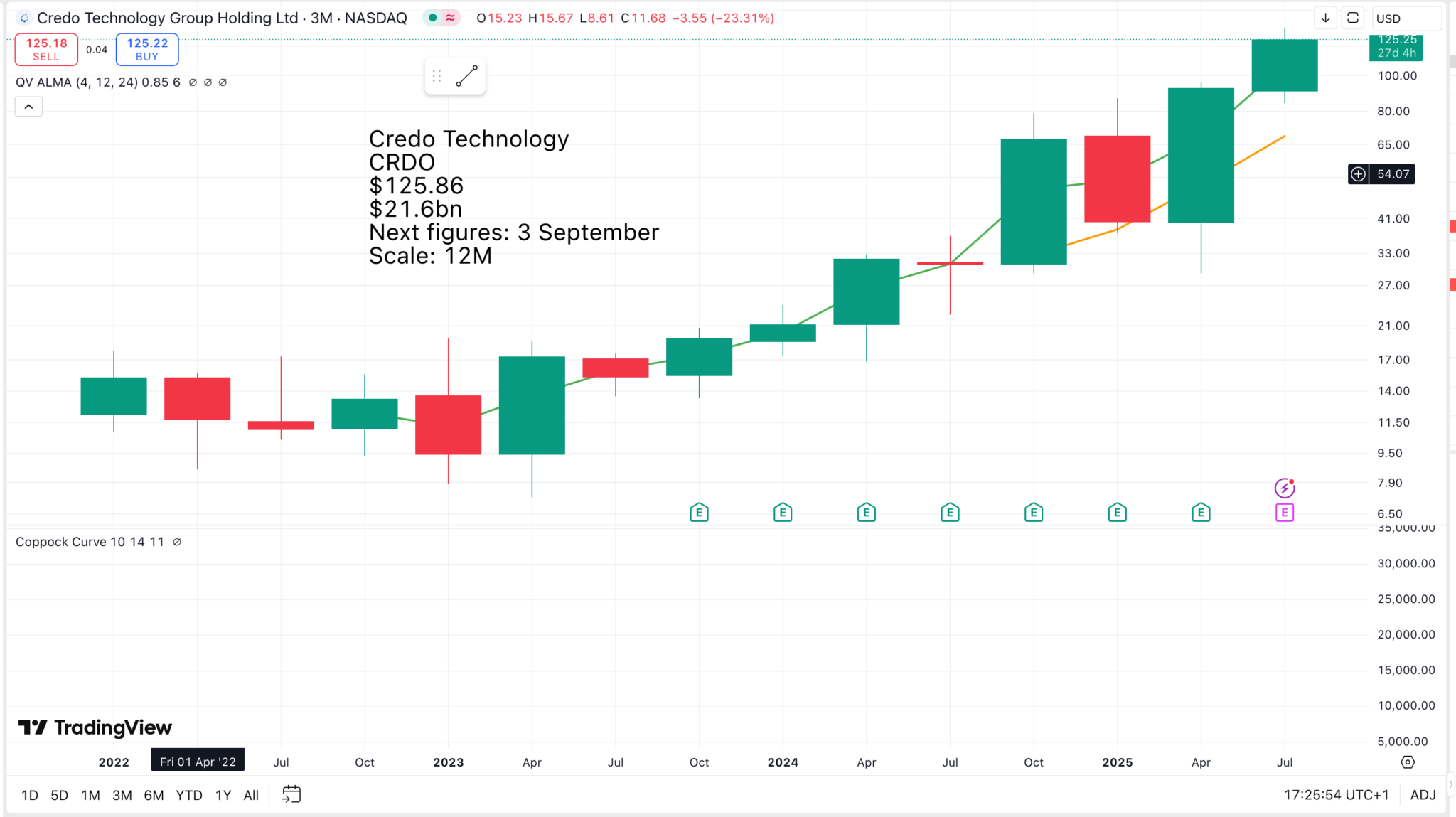

Another great stock at the heart of the AI boom is Credo Technology.

This is a hot-off-the-presses commentary on Credo.

Results are due after US markets close today.

Credo Technology Group Holding investors are eagerly anticipating the company’s fiscal first-quarter earnings, due after the market close on Wednesday. The growth numbers should be robust. The consensus among analysts is for Credo to report July-quarter revenue of $190.6 million, or 219% year-over-year growth, with adjusted earnings per share of 36 cents. For the current quarter, analysts estimate revenue of $201.9 million and earnings per share of 38 cents, according to FactSet. Credo is a leader in high-speed data connections used in artificial-intelligence data centers. The company offers a variety of products, including optical devices and data networking chips, but its active electrical cables, or AECs, are the most exciting part of their business. Credo invented the AECs, copper-based cables used to attach AI servers to networking switches. They are more reliable and consume less power than optical cables and can be used over longer distances than traditional passive copper cables can. According to research firm 650 Group, Credo has 73% of the AEC market as of the last reported quarter. AECs are in the sweet spot right now as the market moves to rack-based servers that have a higher density of graphics processing units. More AECs will be needed to connect the larger AI server clusters. According to Needham, Amazon, Microsoft, and Elon Musk’s xAI are among Credo’s top customers.

Dow Jones Newswires, 3 September 2025

The shares may be volatile, but the business will likely be in great shape, in a phase of explosive growth which should have further to run.

Share Recommendations

Nvidia NVDA

Broadcom. AVGO

Palantir. PLTR

Credo Technology. CRDO

Strategy – Exploit Volatility

A commentator on shares once said – Shares go up and down, not necessarily in that order. The more exciting the company, the more violent those ups and downs. The easiest way to turn this volatility to your advantage is to stagger your purchase. Play a win in the end game.