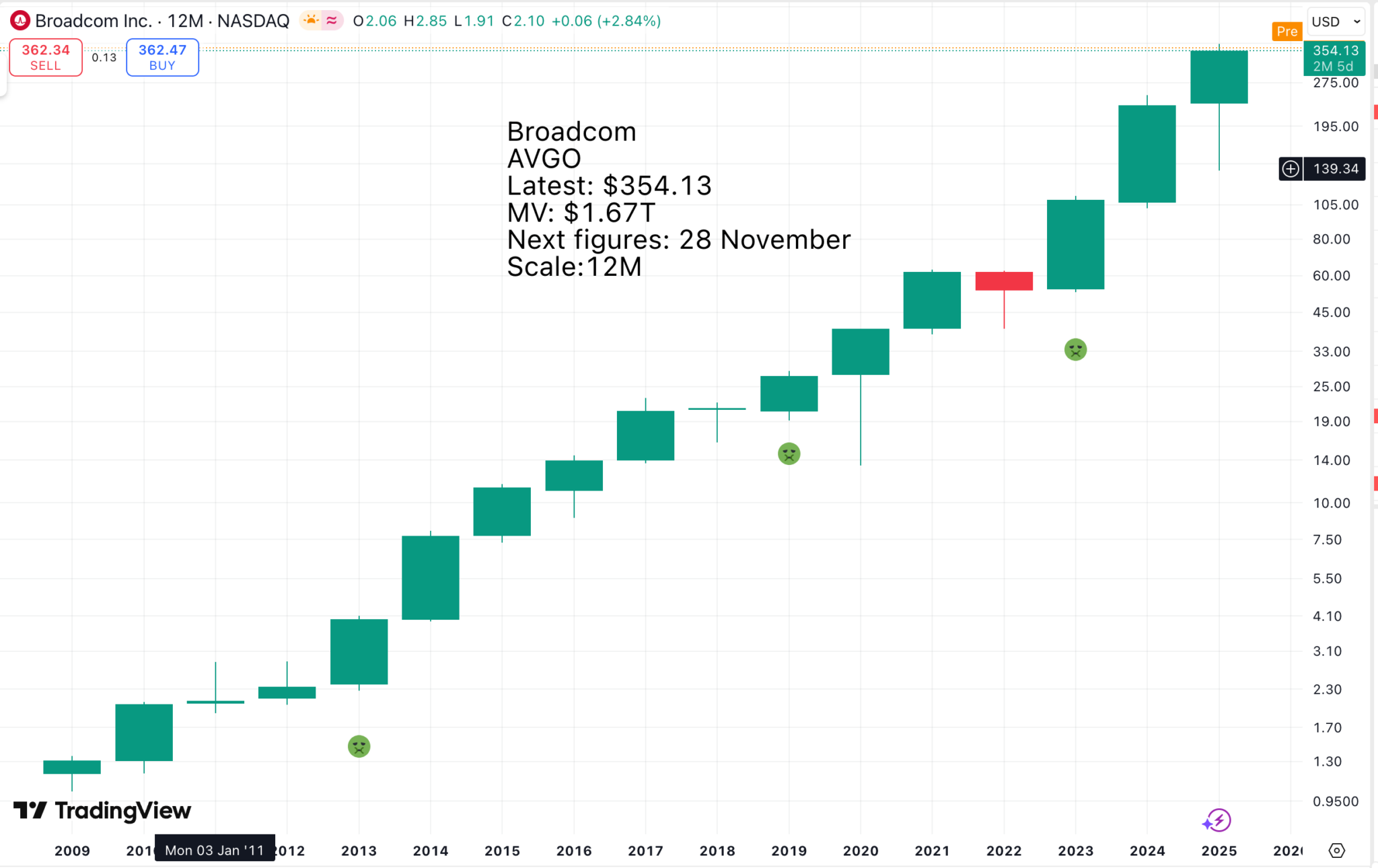

Shares in great growth shares are either rising or trading sideways. It is these periods of sideways trading that set up the best opportunities for buying. You might also think, looking at this chart, that you can buy whenever as long as you have the patience to hold long-term. In the last 17 years, Broadcom has only had one down year!

Broadcom is perfect 3G. It has a great long-term chart, it is growing rapidly (latest sales rose 22pc with EBITDA up 30pc and AI semiconductor revenue up 63pc), and it has a great story with across-the-board exposure to the technology boom and a history of successful acquisitions.

The message is that you should buy now and pile in whenever there is a new breakout.

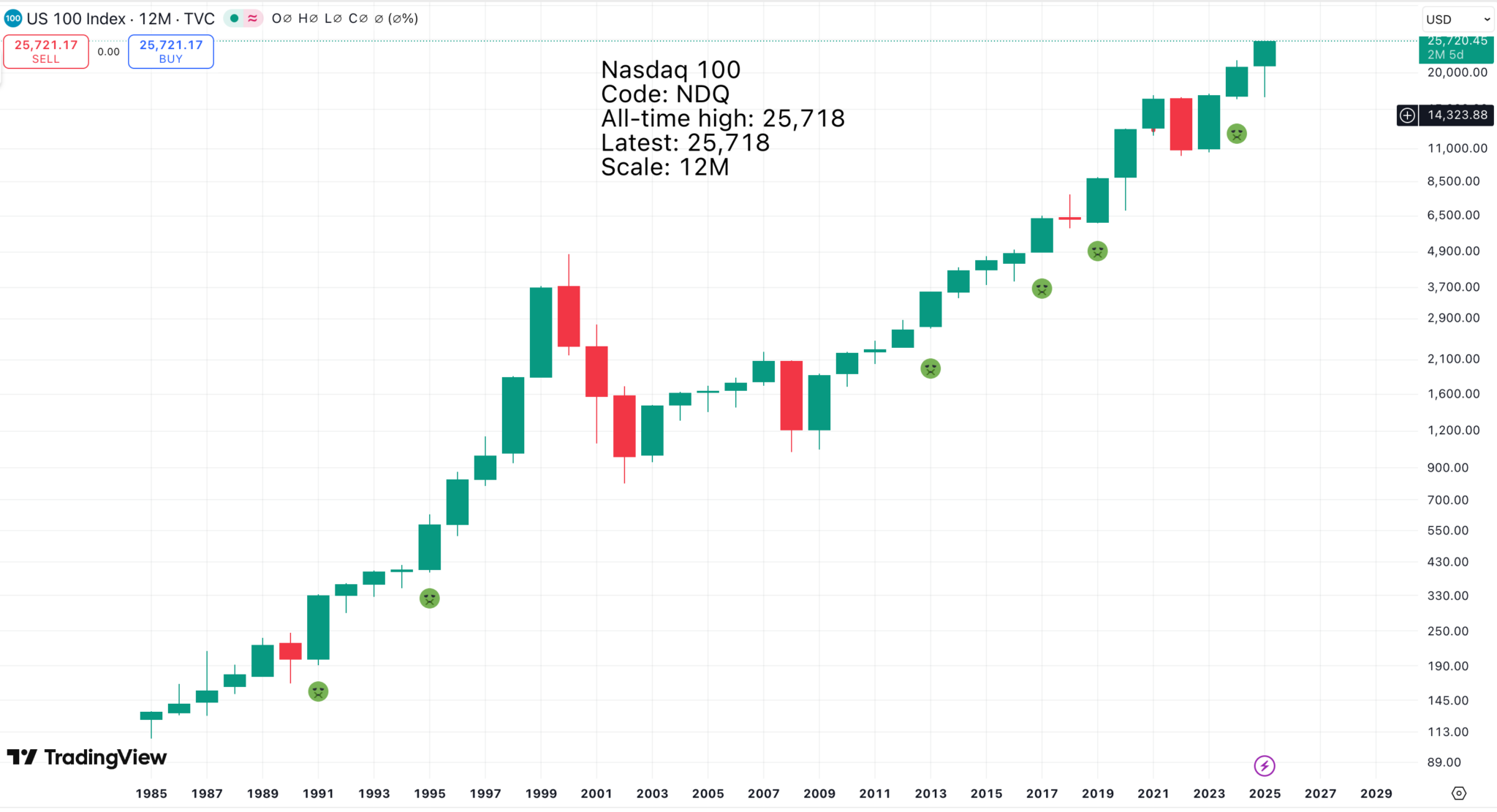

The shorter the period of the chart, the harder it is to see through the noise and figure out what is happening.

The one-month candlestick chart is strong, but there have been some scary sell-offs, when the price has dropped dramatically, over 50pc in one case. Even here, signals are infrequent, but if you want the frequency of signals offered by weekly and daily charts, the trade-off is that they are much less reliable.

The key to being a successful investor is to have a long life.

I have marked in the obvious buy signals on a long-term chart of the Nasdaq 100. The most important buy signals follow a consolidation which contains a red candlestick. This suggests we are early in a big move – exciting times for investors!

My belief is that we are in the biggest bull market of all time. It doesn’t get much more exciting. The volatility is incredible. My Top 40 shares, fast approaching a Top 50, are all over the place but mostly higher and it is early days. I only launched the portfolio with 10 constituents on 21 May.

Palantir is a contender for my favourite share of all time. The shares are up almost 60pc since they becme one of the original constituents of my Top 40 list (then a top 10). The chart is blisteringly strong. The fundamentals are incandescent. The story is out of this world and the company is due to report in seven days time. Hot shares often swing all over the place after results as momentum investors jump in or out but most likely the results will be somewhere between excellent and incredible. The company is riding a wave of technological change which is gathering momentum with every passing day.

Extraordinary companies have extraordinary CEOs and Palantir has Alex Karp, the Jeremy Clarkson of American CEOs. I love both these guys. Karp doesn’t have a woke bone in his body and he is a staggeringly effective CEO.

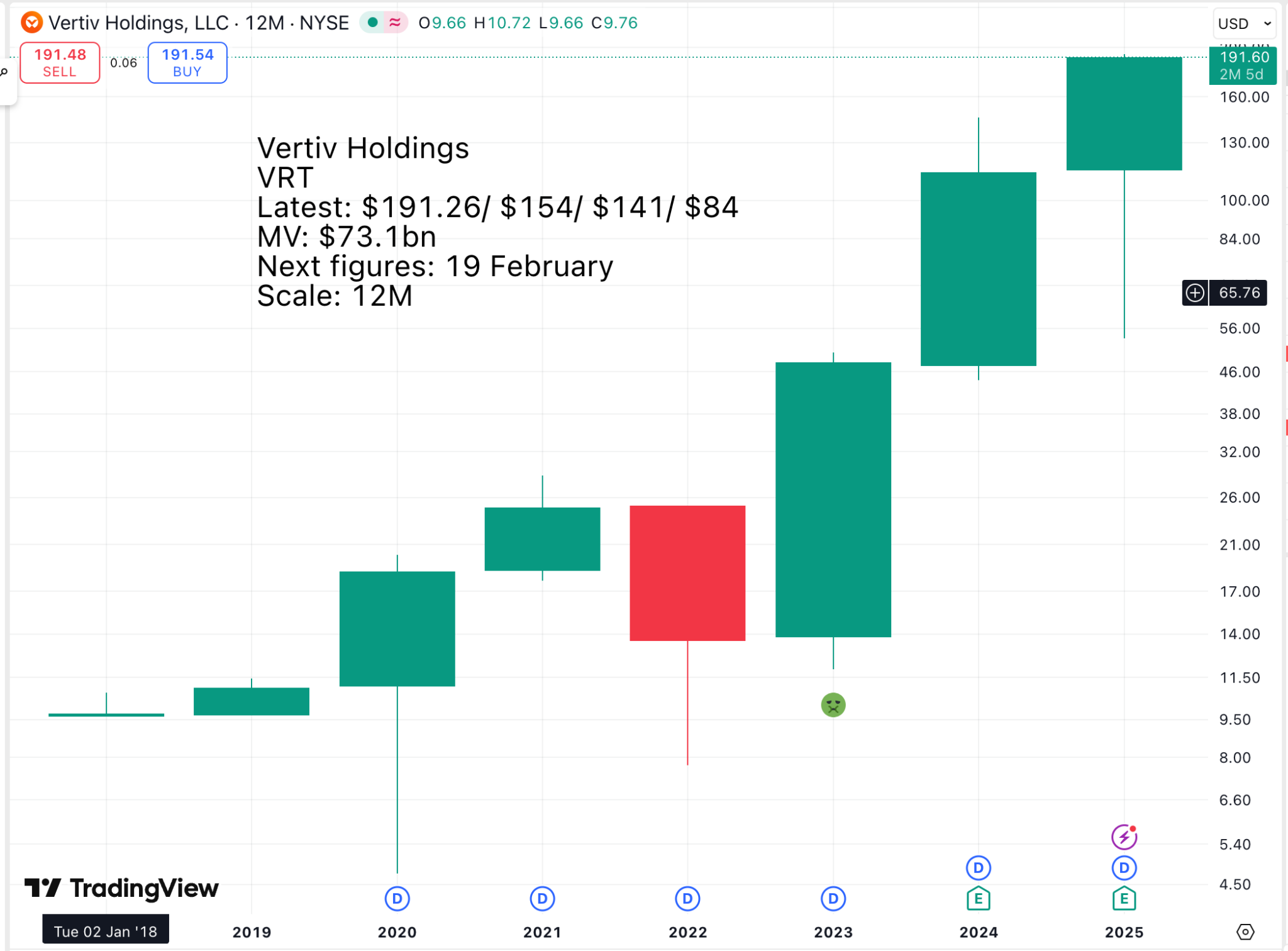

Vertiv sits at the heart of the data centre boom. The shares took off in 2023 which is when Nvidia stunned investors by revealing that demand for its GPUs to build data centres was exploding. Around this time also OpenAI released the original version of ChatGBT, which electrifed investors and alerted them to the power of the AI revolution.

You could hardly get a stronger statement than the one from executive chairman, David Cote, with the recently released Q3 figures.

Well, this is a very strong quarter by any measure. Although I have to say, by looking at the stock price reaction right now, I wonder what would have happened if we hadn’t blown the doors off of every single metric. We exceeded guidance across all metrics in a very convincing way. I continue to say I’m more excited now than ever, and you’re seeing why. We’re in the early stages of the digital age, and Vertiv’s position today reflects the years of focus on customer relationships, disciplined investment, operational excellence, and R&D expansion. Selecting a good strategy, sticking with it day by day, and reinforcing it with monthly growth days works.

Our technology leadership comes from consistently staying ahead of where the industry is going. This digital transformation is just beginning. The scale and speed of what we’re seeing in AI and data centers today is just a preview of what’s ahead. Data will continue to increase rapidly, and data centers are essential to storage and processing. We are very well positioned to continue to lead through it. I’ve seen many business transformations over the years, and what’s clear is that our strategy is working.

As our technology focus grows market share, investments we’ve made in R&D and capacity are delivering results today, and more importantly, we believe they’re building a sustainable competitive advantage that will serve us well for years to come. I’m more confident than ever that we’re in the early stages of what I believe will be a multiyear period of significant growth and value creation.

David Cote, executive chairman, Vertiv, Q3 2025, 22 October 2025

No arguing with the growth.

The overall market growth is accelerating. We continue to outgrow the market through superior technology and execution. Q3 adjusted operating profit reached $596 million, up 43% year on year with a 22.3% margin and exceeding guidance. Adjusted free cash flow of $462 million was up 38%, reflecting our strong operating performance. Our 0.5 times net leverage demonstrates our strong balance sheet. Given our momentum heading into Q4, we’re raising full-year guidance for adjusted EPS, net sales, adjusted operating profit, and adjusted free cash flow.

Giordano Albertazzi, CEO, Vertiv, Q3 2025, 22 October 2025

The data centre boom is having a transformational effect on companies like Vertiv and despite the worries about a bubble this boom still seems to be scaling as planet Earth moves from embracing the Internet and a world where billions carry mobile phones to a whole new level of digital infrastructure and unimaginable problem-solving capabilities. I am adding Vertiv to my Top 40.

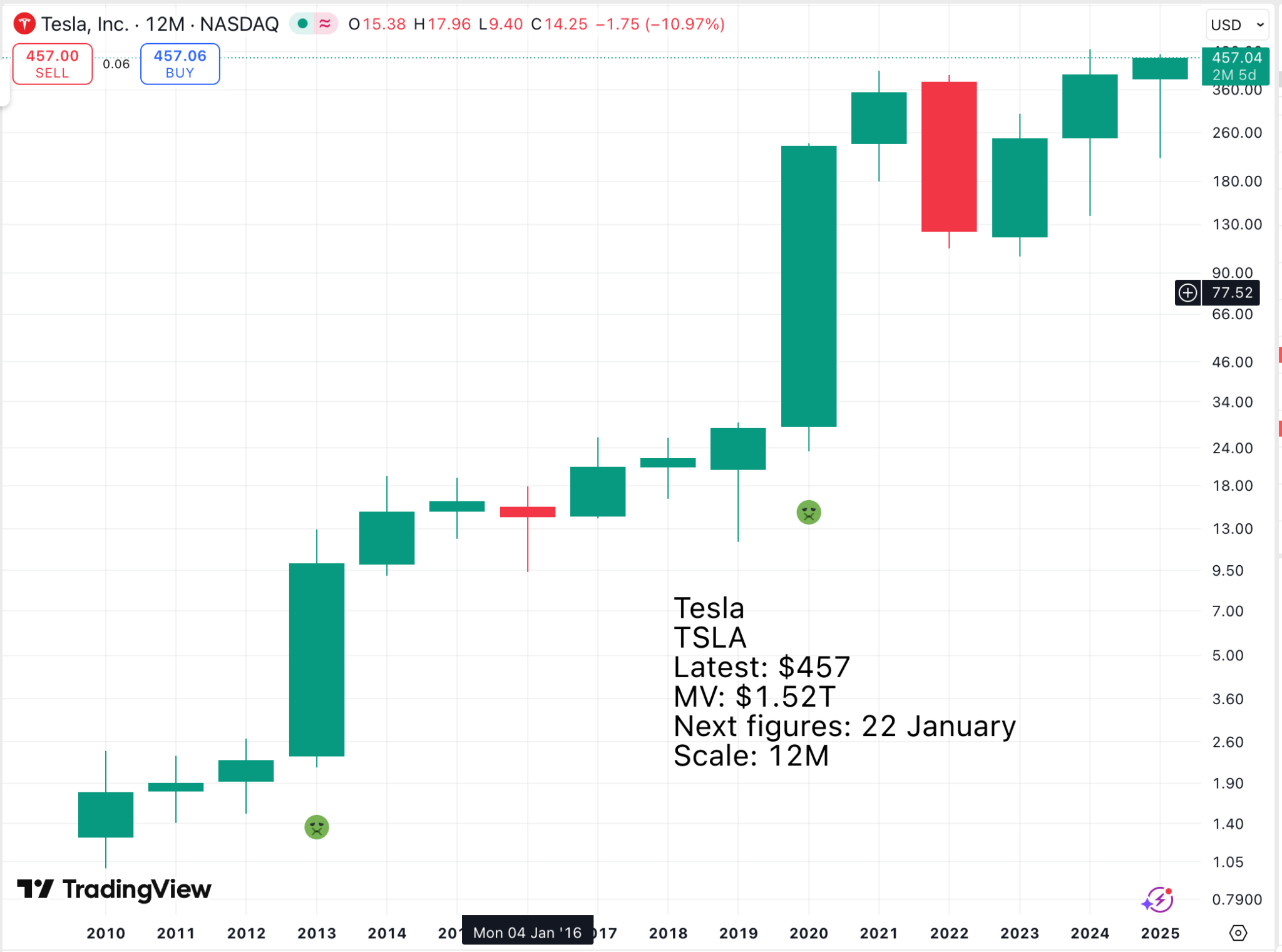

Like Palantir, Tesla is already in my Top 40 List but this chart is looking very promising. It doesn’t quite qualify for a green smiley buy signal but it is close. Tesla has sold a lot of cars but the share price drivers are surely more to do with what is coming, self-driving cars and their pedestrian counterparts, robots.

Tesla (TSLA, Financials) got a bullish update from Cantor Fitzgerald, which boosted its price target to $510 from $355 and reaffirmed an Overweight rating. The firm pointed to steady progress in the company’s upcoming product launches — including the Cybercab, Semi truck, and Optimus robot — as signs of long-term growth potential.

Cantor expects Tesla’s capital spending to rise to about $12 billion in 2026, up from $9.2 billion next year, as the company expands production capacity. The investment is aimed at accelerating development across vehicle, energy storage, and robotics segments.

Tesla’s results for the third quarter backed up that view. The corporation made $28.1 billion in sales, which was far more than analysts expected. This was due to record deliveries and increased energy sales. Its gross margin of 18% was a little lower than certain expectations, but it was still more than what most people thought it would be.

GuruFocus, 27 October 2025

Tesla is all about the ability of Elon Musk and his team to pull a never-ending stream of rabbits out of hats. They have huge plans and they have proved their ability to dream big and execute on those dreams.

Share Recommendations

Broadcom AVGO

Palantir. PLTR

Vertiv. VRTV

Tesla. TSLA