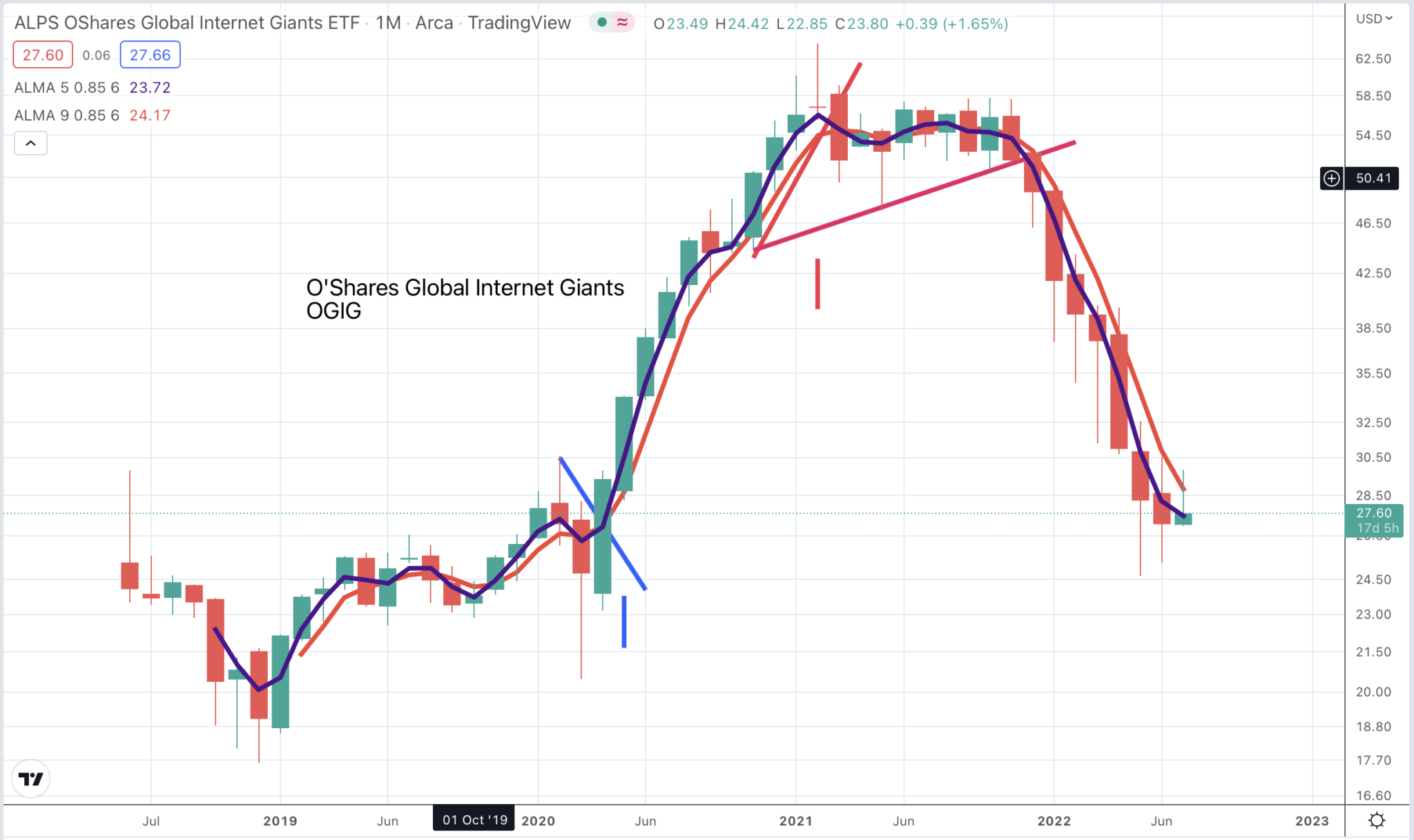

This is the chart of O’Shares Internet Giants. The portfolio is focused on the kind of shares I choose for Quentinvest and it shows a picture of almost unrelieved gloom. There are some Chinese technology shares in the OGIG portfolio which may have helped it produce a green candle so far in July but there is very little to feel positive about. The Coppock indicator turned down in February 2021 and began falling steeply in June 2021. It is still falling steeply.

There is something about Coppock that some readers may find a little weird. Its founder, Edwin Coppock, asked bishops how long periods of mourning lasted and was told 11 to 14 months. He used these intervals to calculate his indicator. The implication is that after falling for around 14 months the indicator should be ready to turn higher.

In the case of OGIG, Coppock has been falling for 17 months. It has also become negative which Coppock also regarded as a common precursor of a new bull market. So I guess if he was still around he would imagine that OGIG was set up to give a new bull signal.

No sign of it yet and another indicator to which I attach great importance, the balance of shares looking bearish versus those looking bullish could hardly be more negative.

This creates another problem. There are one or two shares, Naspers for instance and one or two biotechnology shares, which have given 3B buy signals but given the general background these are clearly special situations. My preference is to avoid shares in a bear market and buy and hold shares in a bull market. We are not in a bull market.

The problem for commentators like me is that we are expect to commentate, if that is the correct verb, on a regular basis which means finding stuff to say when really, like bears (pun or whatever intended) we should go off an hibernate.

In Three Men and a Boat, a humorous account of a two week boating trip written by Jerome. K. Jerome in 1889, he noticed that, as long as your were watching, kettles on the feeble portable gas stoves of the time never boiled. Bull markets are a bit like that; while you are waiting for a new one to start it never happens. When you give up in despair, the next thing you know is that a new bull market has begun.

As noted, ad nauseam, I am very hopeful that my indicators (Coppock, moving averages, trend line breaks, balance of shares looking bullish v those looking bearish, common sense) will tell me when that happens and we can start to take a positive approach to investing. Until then it is only too easy to lose money.

Strategy

The ferocity of this bear market is incredible, fully up there with setbacks seen in the past. Observers may not always realise this because they base their conclusions on looking at the indices. The Nasdaq 100 lost around 83pc of its value in the early 2000s. In 2008-09 the S&P 500 lost 58pc of its value. So far in 2021-22, the Nasdaq 100 has lost 30pc, peak to trough. Many individual shares have faired far worse, especially many of the stars of the bull market. Netflix is down 75pc, Shopify is down 82pc and Carvana, another star performer picked at random, is down 94pc.

How has this happened? Because these shares are like bitcoin, very hard to value. Bitcoin itself is down 75pc peak to trough; ether is down 83pc on the same basis. Given the wisdom of hindsight we can see that these shares were given a free pass as the basis of valuation shifted from profits to revenue.

Imagine if you said to the CEO of a company with exciting and disruptive technology that his business was no longer going to be valued on 20 times after tax earnings but in future would be valued at 20 times revenue even if he was losing money. In effect he has been given carte blanche to run the business for sales growth and the way to achieve that is to spend massively on driving the technology forward to make the products more exciting and even more massively on sales and marketing to drive forward sales.

Before you know it you have companies spending more than their total revenue on these two cost items helping them to drive forward sales at a spectacular rate. Not only does this make for great excitement in the businesses, which go on massive hiring sprees but it also pumps up the CEOs who are often founders with large stakes in the businesses and who are becoming unimaginably rich as a result.

This is a cocktail for a frenzied bull market even before you throw into the pot a growing army of debt financed momentum investors using platforms like Robinhood to chase shares higher and social media to swap excited stories about what is happening. The US stock market and especially those hard to value bitcoin type shares turned into rockets which rose into the stratosphere and have now now dropped back to earth.

I didn’t see all this in the fundamentals before the event but I did see it in the charts; hence my growing enthusiasm for charts as a key technique for deciding when to buy, hold and sell shares. It is these bitcoin-like shares that make us the most money in bull markets but they are the most dangerous when the bull finally sputters and the rockets fall back to earth.