Tesla TSLA . Latest $850 . MV: $140bn . Employees: 40,817 Next figures due: 29 April

On 18 December I recommended Tesla shares in QV for the second time. I actually waited until the price topped my first recommendation price because I prefer to buy on rising prices. Part of the reason for the new recommendation was a historic chart breakout, shown above. I have done something funny with the chart to flatten it. The right hand price vertical now goes up to over $50,000; even I am not expecting the shares to rise that high but what it does do is highlight what an incredible chart breakout Tesla is making.

Arguably the most powerful pattern in technical analysis is a line. The flattened chart shows that Tesla has made an incredible line, which runs from mid-2013 to almost 2020. This is an unusually long line and now we have an explosive breakout, again one of the most explosive I have ever seen. If this chart is right Tesla is just getting started.

Elon Musk may be the most ambitious CEO I have ever encountered. He is not aiming for the moon, he is aiming for Mars! He wants to change the cars we drive, the way we drive, the way we pay for transportation and he also wants to change the way we generate electricity and says that business, SolarCity, may end up even bigger than the transportation business. It is no wonder that many observers take Elon Musk’s prognostications with a pinch of salt and even think he may be a little bit crazy; but clearly he is not just talk. There is some real achievement happening here and there are believers as well as sceptics out there.

Let’s see what one believer has to say.

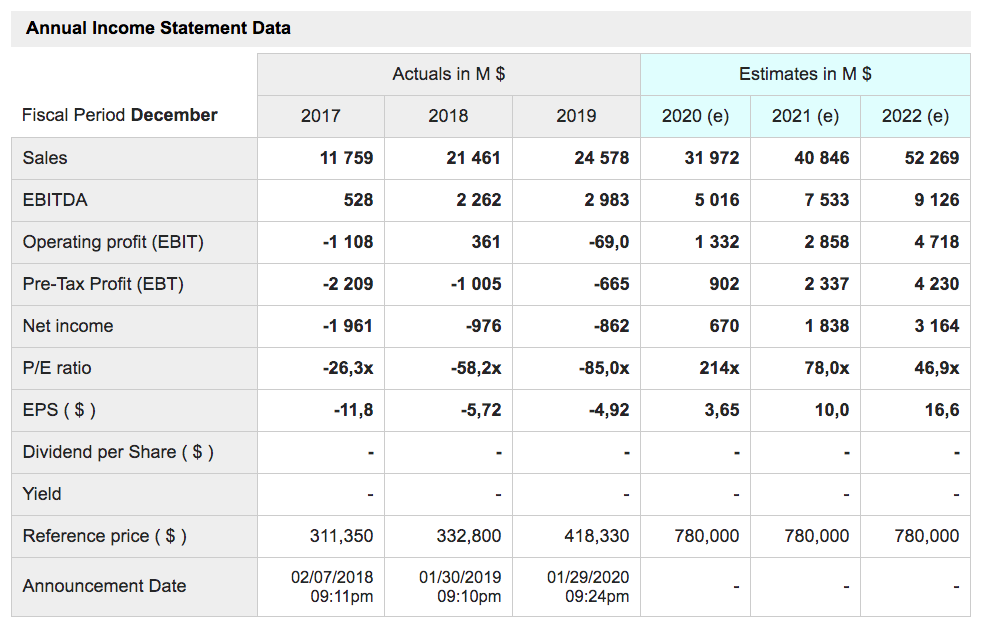

“Forget about joining the $1-trillion valuation club: early Tesla Inc investor Ron Baron said Tuesday that Tesla will generate $1 trillion in revenue in 10 years. Baron, a billionaire mutual fund manager, said Tuesday morning on CNBC’s “Squawk Box” that Tesla’s stock surge over the past few months is merely the “beginning.” Tesla will ultimately be one of the world’s largest companies but has lots of work to do to get there, he said. The automaker has demonstrated an ability to overcome hurdles and challenges over the years, Baron said. Most notably, Tesla was expanding rapidly and simultaneously fighting against auto dealers who tried to prevent the electric automaker from selling directly to consumers, he said. “But now things have all come together.” From 2014 through last summer, Tesla’s stock price hasn’t changed much [it has now], but as an investor Baron said he was more focused on watching the business. During that time period, Tesla’s annual revenue rose from $2.8bn to $25bn. Current estimates call for 2020 revenue to come in at around $32bn. The stock’s recent momentum is merely a “catch up” phase, Baron said. Tesla should be able to expand to $100bn in annual revenue in four years before hitting $1 trillion in 10 years, Baron said. But the growth won’t end there, as Baron said revenue will merely continue to grow.”

But even he is not as bullish as Elon Musk. First off Musk looks ahead to what the next 10 years may bring by looking back to what has happened in the last 10.

“It’s hard to think of another company that has a more exciting product and technology roadmap. So super-fired up about where Tesla will be in the next 10 years. If you look back 10 years from today to 2010, we will produce approximately a 1,000 times more cars in 2020 then we produced in 2010, 8,000 and we have also Solarglass and solar retrofit, Powerwall and Powerpack other things too.

So where we will be in 10 years, very excited to consider the prospect.”

Musk’s also plans to emulate Apple (and Gillette) and use the hardware (the cars) to sell highly profitable software, add-ons and services. An example is insurance, where the group plans to offer Tesla insurance.

“Right, but I think — I think it would make sense for us to close the loop on higher use of Autopilot, reduces the insurance costs as well as the probability of injury. So I think insurance is going to be I think quite a major product of Tesla over time. The amount of money that people spend on car insurance is like a remarkably big percentage of the cost of a car, like you can lease a Model 3 right now for $400 a month, but a typical owner in California will be paying somewhere between a $100 and $200 a month in insurance. So we’re talking about something which is maybe a quarter or even half of the cost of the lease of the car is insurance. And a lot of that insurance cost is just because the insurance companies don’t have good information about the drivers and that there is no good way to provide feedback where it’s a very poor feedback mechanism in terms of the insurance rates versus the actual way that the car is being driven, whereas we can do that in real time. It’s a fundamental information advantage that insurance companies don’t have.”

Musk is also excited about the solar business (I know, what is he not excited about)

“Well, I think we do — we are seeing, from a small base, exponential growth in demand and output for our Solarglass Roof. So it’s hard to predict what that will be this year except that the demand is very strong and we are working also not just through Tesla but also through new homebuilders and through just the roofing industry in general, where there are in North America on the order of 4 million new roofs per year. So, we see a lot of interest and so it’s just a question of refining the installation process, getting lots of crews trained to do the installation. But over time I would expect a significant percentage of new roofs to use solar glass in one form or another. It’s really going to be your choice, do you want a roof that is alive with power or dead without. And I think people will want a live roof that generates power and it looks good and lasts a long time and it’s the future we want. So it will be a significant product but because it is a new and quite revolutionary product and that there is a lot of challenges to overcome, but they will be overcome and this will be a major product line for Tesla. And the Buffalo factory (making solar roof panels) is doing great.

Also coming along fast is FSD (full self driving). Given that Tesla’s are computers on wheels they are perfect to become autonomous vehicles and progress is happening fast.

“Well, I mean, to be precise, I said I was hoping we would be feature complete with both FSD by the end of last year. We got pretty close, it’s looking like we might be feature complete in a few months. The feature complete just means it has some chance of going from your home to work let’s say with no [debentures?]. So, that’s — it does mean the features are working well, but it means it has above zero chance. So I think that’s looking like maybe it’s going to be couple of months from now. And what isn’t obvious regarding Autopilot and full self-driving is just how much work has been going into improving the foundational elements of autonomy. The — like the core autopilots in Tesla or Autopilot software and AI team is just is I think very, very strong in making great progress. And we’re really only getting to take full advantage of the Autopilot hardware and the FSD hardware.

So, I think it’s — the apparent progress as seen by consumer as well seems to be extremely rapid, but actually what’s really going on my head it seems like I said having the foundational software be very strong and with really strong foundation. And then really fundamental thing is moving to video training. So in terms of labelling, labelling with video in all eight cameras simultaneously. This is a really, I mean in terms of labelling efficiency arguably like a three order of magnitude improvement in labelling efficiency. For those who know about this it’s extremely fundamental, so that’s really great progress on that.”

The message is not the clearest except in one respect – there is a lot going on and big news will come. Plus there is something about Elon Musk and his team that they really cut to the chase in their thinking. Listen to his explanation for the gigafactories and their locations.

“Yes, there is a pretty big fundamental efficiency gain that Tesla has by just making cars, especially affordable cars 3 and the Y, at least on the continent where the customers are. It kind of makes sense it’s — but what we’re doing will happen, during the past was really pretty silly in making cars in California and then shipping them halfway around the world to Asia and Europe. And this created a lot of cost, because you got to ship those cars, so they got lot of finished goods, sitting on the order or waiting at the port or going through customs, tariffs, transport, it’s — and then the factory complexity in California is very high, because you’ve got different regulatory requirements in China, North America and Europe. So we got three different types of cars that are being built, it’s very complex and just having a factory in China, a factory in California, a factory — North America factory in Europe. Well, just that alone is a massive improvement in our formula operating efficiency. Now that I think this may not be fully appreciated.”

Musk also gave a strong hint on how he sees the future.

“Yes, I think a few years ago, I said I — yes, I think on our growth a few years ago, I said in my estimate first is that Tesla would grow at an average compound average rate of in excess of 50pc, I hold to that belief.”

One of the key issues in making this exciting future possible is batteries. This is what Musk had to say about Tesla’s battery plans, which he prefaced with an answer to a question on how many Cybertrucks might be made.

“Yes, I think we don’t comment on those detailed numbers except the demand [for Cybertrucks – his recently launched space age Tesla pickup] is just far more than we could reasonably make in the space of, I don’t know, three or four years, something like that. So the thing we’re going to be really focused on is increasing battery production capacity because that’s very fundamental because if you don’t improve battery production capacity, then you end up just shifting unit volume from one product to another and you haven’t actually produced more electric vehicles. So that’s part of the reason why we have not for example really accelerated production of the Tesla Semi because it does use a lot of cells and unless we’ve got a lot of battery cells available then — and say like accelerating production of the Tesla Semi would then necessarily mean making fewer Model 3 or Model Y cars. So we’ve got a really — make sure we get a very steep ramp in battery production and continue to improve the cost per kilowatt of the batteries. This is very fundamental and extremely difficult. So that we said we’re going to do kind of like a Battery Day just to kind of explain more about this what our plans are. I think probably it’s going to make sense to do that after the end of this quarter, because I think it’s going to be kind of an intense end of quarter as it was last quarter. So tentatively sort of in the April timeframe, we will do a Battery Day and kind of go through what the challenges are, how do you get from here to, I don’t know a couple of thousand gigawatt hours a year or something.”

Musk also gave a great summary of the current strategy, which is clearly more about growth than about maximising profits – similar to that of many companies in the enterprise software space and highlighting that Tesla is a very different kind of car company.

“Yes, I mean we’re trying to make the cars as affordable as possible, as fast as possible, while maintaining reasonable — while still being at least a little bit profitable and growing the company like crazy and having good free cash flow and accumulating our cash balance.”

Sounds like a plan. And then he highlighted what could be really exciting and goes a long way to explain why Tesla shares have taken off in recent weeks.

“Yes, I mean the thing that’s really going to I think probably just have a profound effect on our financials is like is high volume and high margin obviously and that high-margin part comes from autonomy (self-driving vehicles). So, do people buy the full self-driving package or not and do they buy it worldwide or only in certain places. For example, our autonomy is not as good in China as it is in the US, so fewer people — a very small percentage people buy the FSD package in China. But as we — as we fix that then we will see a much higher percentage of people buying. And as we’re close to full self-driving that is just going to become more and more compelling. So that’s for our financial standpoint, that’s the real mind-blowing situation is high volume, high-margin because of autonomy.”

Incidentally in the latest analysts’ conference call I really noticed that there was somebody else fielding questions, the CFO, whose name is Zach Kirkhorn. He has only been CFO for a year, got the job after a period of turmoil in the department and is only 34 years old. He studied at Harvard and worked at Microsoft and McKinsey (the management consultants) before joining Tesla and rising rapidly through the ranks. I think he could turn out to be an important player in the Tesla story and a good counterfoil to the impetuous visionary, Musk.

Tesla has become a full-blown stock market event and maybe the world’s most exciting share. I wouldn’t get too mathematical about the price at this stage. If you haven’t got any buy some; if you already have some buy more. Of course, there is going to be volatility but if you believe in where this company is going or could be going (nothing is ever a sure thing; it is always about possibilities and probabilities) then the shares are nowhere near finished in their journey. Tesla is disrupting one of the biggest industries on the planet and, as we have seen time and time again, incumbents with huge legacy operations find it very hard to deal with disruptors.