Microsoft (NASDAQ:MSFT) is likely to become the next company to surpass a $4 trillion market capitalization, driven by accelerating enterprise adoption of artificial intelligence.

Analysts led by Daniel Ives said Microsoft’s position in the AI ecosystem continues to strengthen as demand grows across financial services, retail, and the public sector. The team noted that customer deal activity tied to large-scale AI deployments is accelerating, with many use cases rolling out across Microsoft’s enterprise base.

Wedbush estimated that by fiscal 2028, over 70% of Microsoft’s commercial users will be leveraging its AI tools, particularly through services like Copilot. Based on recent partner feedback, the firm projects these offerings could add nearly $25 billion in revenue by fiscal 2026.

The analysts described this period as Microsoft’s shining moment, with AI transforming its cloud trajectory. They view the company as the current leader in enterprise-scale AI, ahead of rivals Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL).

Wedbush reiterated its Outperform rating on the stock with a $600 price target. Microsoft remains on the firm’s Best Ideas List.

GuruFocus 25 July 2025

“We think Microsoft’s going to be a $5 trillion market cap in 2026 … when I look at what [Microsoft CEO Satya] Nadella is doing in terms of the cloud strategy, those are [cloud computing platform] Azure numbers that were beyond bull case…

When you think about the big tech growth story in the AI (artificial intelligence) revolution, this is just the next phase of growth that’s now going to the second, third, fourth derivative.”

Microsoft has a market cap of $3.896 trillion and is trading for $524 per share at time of writing.

The Daily HODL, Dan Ives, Wedbush Securities, 2 August 2025

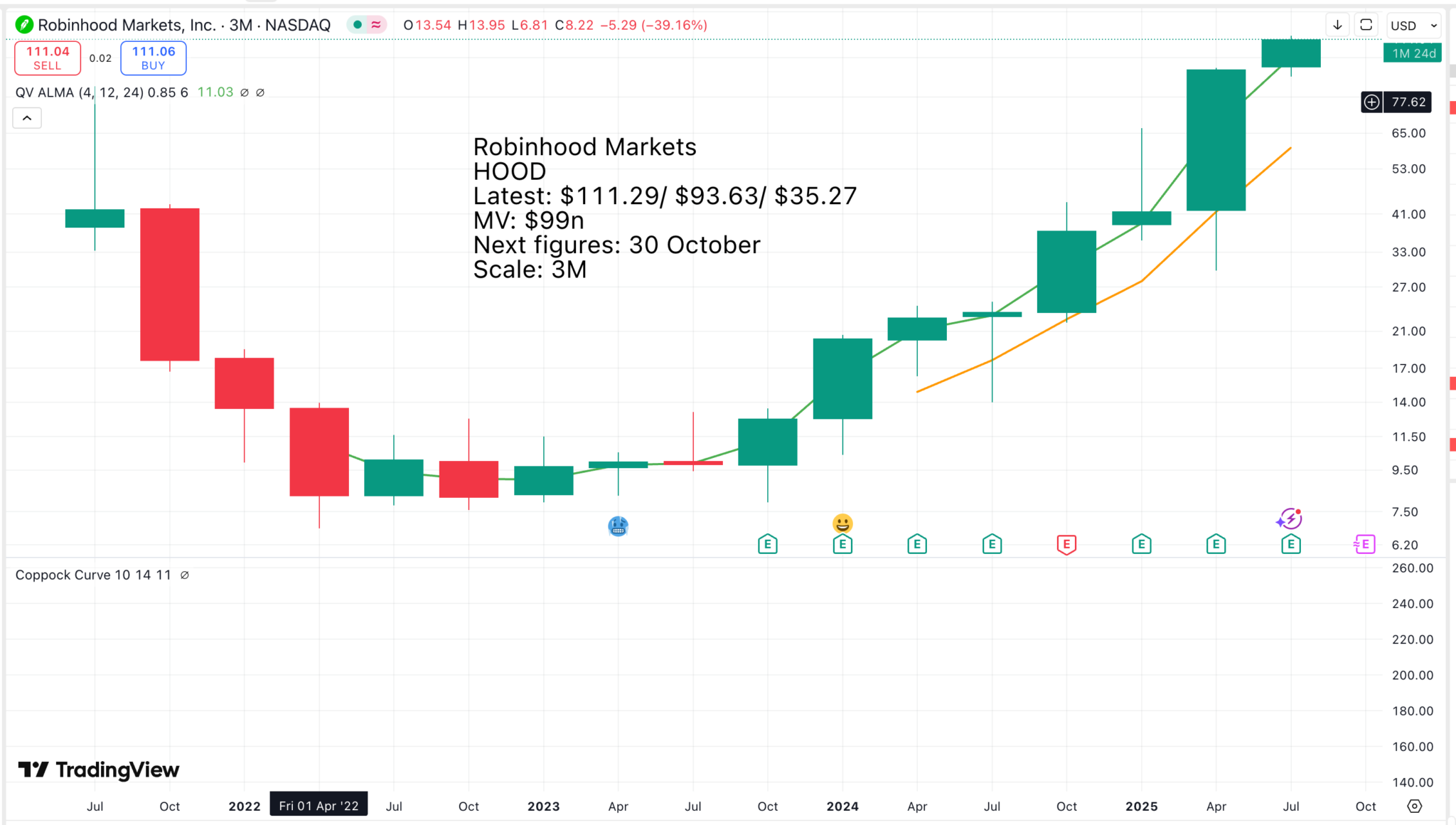

This is a strong chart, but it conveys no particular message. The last buy signals were long ago, so the shares could react anytime, but both the chart and fundamentals are compatible with a share at an early stage in a secular uptrend.

I am bullish on the prospects for the stock market, and if I am right, this is likely to be reflected in rising prices and higher trading volumes. Both are great news for a trading platform like Robinhood. This is why analysts find it almost impossible to predict revenue and earnings for a business like HOOD, as they have to make numerous assumptions about unpredictable events. In addition to this are all the internal initiatives the company is making to grow its customer base and the range of products offered to those customers.

A positive wild card is the likelihood that Robinhood will be added to the S&P 500, for which it easily qualifies on market value grounds.

This is shaping up as one of the clearest resistance levels I have ever seen. Six times in four years, the shares have been rebuffed by a level around 280. It is like being stuck in quicksand, but eventually the rising Nasdaq 100 is going to carry QQQ3 into clear high ground, and that will be a powerful buy signal.

I am with Dan Ives on what is happening. He says AI is the biggest thing to happen to tech in 40 or 50 years, and the Mega Caps, perhaps so far absent Apple, are at the heart of the action. This is likely to be good for earnings going forward as huge capital expenditures bring rewards, and that will propel the Nasdaq 100 and QQQ3 sharply higher.

Share Recommendations

Microsoft. MSFT

Robinhood. HOOD

QQQ3