Stock market has a wobble with momentum stocks seeing heavy profits

There are plenty of reasons why share prices have been taking a hit, especially the kind of power-packed high-growth momentum stocks that I favour for Quentinvest. US 10 year Treasury bond yields have risen sharply from a very low level; there were huge profits to be taken from shares like Tesla, which is up 10-fold since last March; many technology and commerce shares have experienced accelerated growth because of Covid-19 and this may go back to more normal levels as lockdowns are lifted; margin debt has doubled in the last year and this leads to margin calls and forced selling, when share prices are falling.

But there is still plenty of good news around. Never in my life have I seen so many exciting companies with great leadership, exciting innovation programmes and the ability to disrupt and reinvent whole industries. Share prices for many companies, especially those playing a leading role in the technology revolution, have exploded in recent years but so have sales. Tesla’s sales have grown from $204m in 2011 to $31.5bn for 2020 and there are projections that this figure could rise 10-fold again by 2025.

I have frequently said that I believe the technology revolution now taking place is the greatest revolution in human history, arguably even more important that the shift from roving hunter gatherers to settled agrarian communities that took place 10,000 years ago. This revolution is taking place at an accelerating rate as we move into the technology age. Some of the companies driving these changes – Alphabet, Apple, Amazon, Microsoft, Nvidia, Netflix, Tesla and others are already huge. They are going to become even bigger and many other companies are going to become huge as this global revolution gathers pace and scale like a snowball rolling down a hill.

When people look back at the last quarter of the 20th century and the first quarter of the 21st, I suspect they will be looking at what they will think of as the dawn of the age of technology, when human life was changed out of all recognition by an explosion of innovation. This is an extraordinarily exciting time to be an investor.

There will be setbacks. We are experiencing one right now as stock markets experience a liquidation phase, which has led to declining moving averages for shares in many of the most exciting companies. It is overwhelmingly likely that this is just a phase, a healthy one to stop share markets from becoming dangerously overbought. The selling will run its course, the moving averages will turn higher and the bull market will come roaring back. It’s never if; it is always when will this happen, given the immense power of the global economy and the associated secular rising trends in values of the world’s growing roster of great, innovative businesses.

In the short term markets and share prices are unpredictable beasts and the volatility of shares in fast-growing companies, where much of the value is years into the future, can be terrifying but the rewards for patience and a long-term horizon can be equally dramatic.

Meanwhile at Great Stocks I am going to stick to my task, which is finding great shares for investors to buy. If you are nervous about the market use programmatic to stagger your investments over time, start small, keep adding and time and volatility will be on your side. At IG with three or more trades a month in your share account you pay zero commission on US shares and £3 on UK shares so regular, small purchases become economic. Other brokers have similar offers.

Accenture ACN. Buy @ $280 – “In Q2, our engines of growth across Accenture have roared to life.”

Aptitude APTD Buy @ 700p. – “Aptitude Software’s opportunity is worldwide.”

Epam Systems. EPAM. Buy @ $440 – “We believe all those investments are paying back and preparing us strongly for the future growth.”

Freshpet. FRPT. Buy @ $169. “We doubled our installed production capacity and broke ground on a project that will result in a tripling of our capacity by the end of next year.”

Liontrust Asset Management. LIO. Buy @ 1576p. – “10 consecutive years of net inflows shows the progress the business has made.”

LVMH. LVMH. Buy @ €623. – “Operating free cash flow equivalent to that of 2019.”

MSCI. MSCI. Buy @ $464 – “Growing investment industry presents incredible opportunities.”

Nvidia NVDA. Buy @ $610 – “The gaming laptop market has grown seven-fold in the past seven years and momentum is building.”

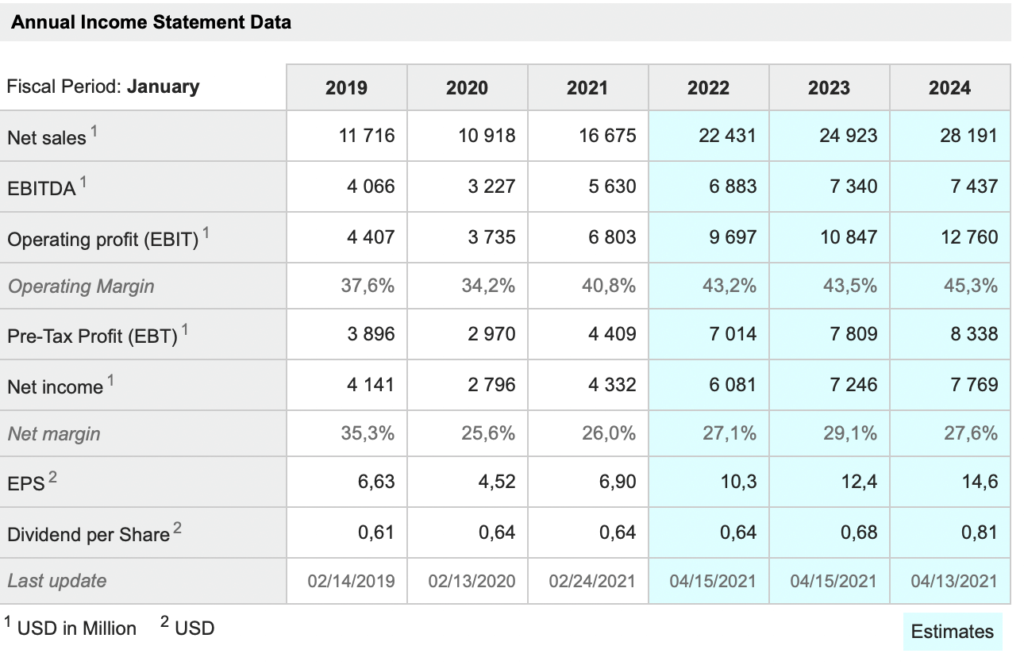

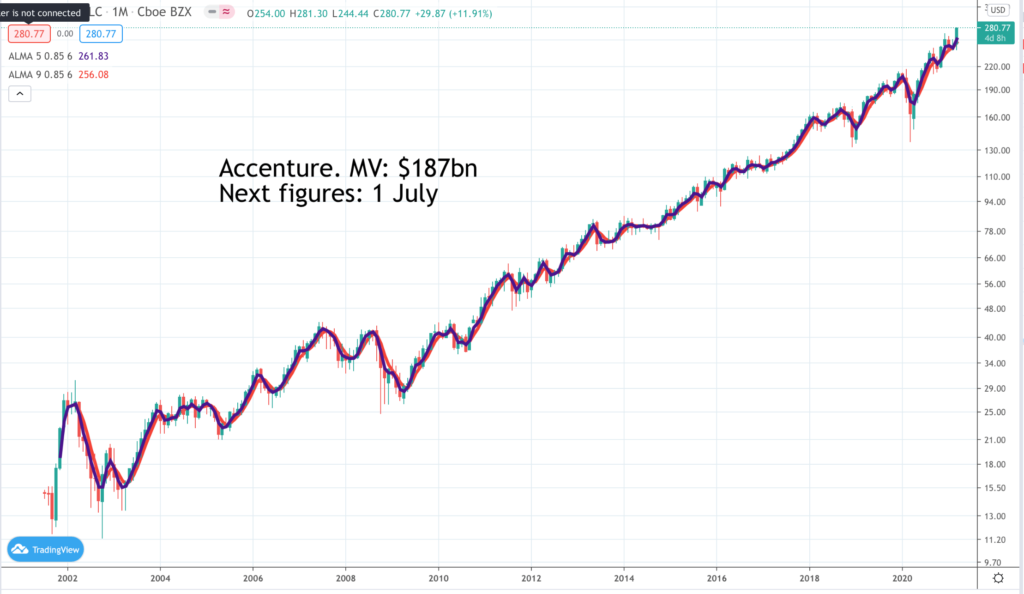

Accenture. ACN. Buy @ $280 Times recommended: 4. First recommended: $219. Last recommended: $265 (programmatic)

Management consultancy giant, Accenture, says Covid-19 has hit a giant fast forward button into the future

One of my rules with all recommendations across my publications is that I never advise buying when important moving averages are falling. This doesn’t mean I am necessarily negative about the shares but why take the risk. I prefer to buy when both charts and fundamentals look good as they do with Accenture, which has a great chart, showing an uptrend sustained over many years, has just reported a strong quarter and which has characteristics that make it likely that the uptrend will continue for many years into the future.

Accenture is a gigantic management consultancy with 537,000 employees at the latest count, which helps its enterprise and public sector clients run their businesses more effectively making use of the latest technology. It provides an outsider’s perspective, which is always useful but probably its greatest strength is its ability to attract high quality employees. Everybody knows that a period working for Accenture is a great springboard for a successful career so the best graduates battle for jobs at the business.

A newer element in the business is their role in helping their clients save the planet. There are now 185 partners specialising in ecosystems. This makes them an even more attractive destination for top-quality employees and clients increasingly realise the vital importance of considering the eco-impact of everything they do. My daughters probably think I should not even mention this but I am struck by the fact that the CEO of Accenture is a youngish woman called Julie Sweet, who has been named the most powerful woman in business and is clearly doing a very impressive job at Accenture, where she has been in charge since 2019.

Another impressive fact is that – “In H1, we have accelerated our investment in D&A, with approximately $1.1bn of capital deployed, and we are increasing our programmatic D&A investment to at least $2bn for FY ’21 from the $1.7bn we previously communicated.” D&A stands for data and analytics, which stand at the heart of what Accenture brings to its client base.

Accenture is a strong performer both in terms of looking after shareholders with roughly $3.1bn returned to shareholders via dividends and share buybacks in the first half of the year. On top of this the group expects to spend $2bn over the year on acquisitions, which is another way of adding value for shareholders since acquisitions contribute to future profits and cash flow so enable the business to spend more on dividends and share repurchases in the future.

Prospects for the business look exciting. “COVID has hit a giant fast-forward button to the future, and we believe the demand to innovate at unprecedented speed and scale with rapid adoption of cloud, AI and other disruptive technologies is accelerating.”

Everything that is happening at Accenture suggests a strong outlook. “Applied Intelligence with our data and AI solutions and security, both sizable but still in the early stages of the scale we expect long-term, both had strong double-digit growth in Q2.”

As noted earlier ACN’s greatest competitive advantage is its people as they well know. “Recruiting, hiring and managing supply and demand has always been a core competency, and we are confident in our ability to attract talent and continue to meet the increased demand. We increased hiring approximately 50pc both year-over-year and since last quarter and we’ve onboarded over 100,000 people virtually over the last 12 months with new innovative approaches.”

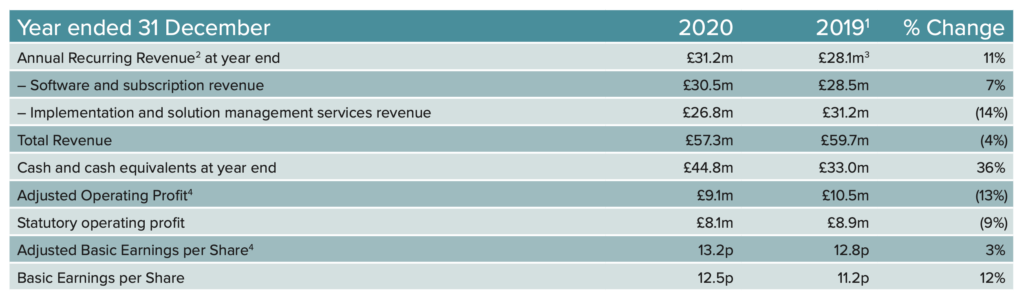

Aptitude. APTD. Buy @ 700p. Times recommended: 2. First recommended: 495p. Last recommended: 610p

New leader, shift to SaaS business model and aggressive hiring position Aptitude Software for more aggressive future

Aptitude Software helps companies with finance automation with many clients in the banking and insurance industries. Recently announced wins include the CAA Club Group of companies, an insurance customer and FWD Insurance (“FWD”), which has extended its relationship with Aptitude Software to expand the Aptitude footprint across its operations in Asia as it continues to prepare for the new IFRS 17 regulatory landscape.

An important ‘something new’ at Aptitude Software, which changed its name from Microgen in April 2019, was the arrival of Jeremy Suddards, who became CEO in September 2019 after two years as chief client officer for Europe and APAC (Asia Pacific). Prior to joining Aptitude, Suddards worked at Hewlett Packard Enterprises.

Even before his arrival, like many other 21st century technology businesses, Aptitude had been shifting from a software and upgrades sales model to a recurring revenue model. This provides higher quality income and is an easier sell to new customers but has an instant negative effect on profits because it defers sales into the future.

Aptitude’s products take data from complex systems, typically with multiple siloed data sources across multiple business entities, perform complex accounting calculations and create a unified view of finance. This allows clients to reap numerous benefits including significant efficiencies, business insights, enhanced control and regulatory compliance.

Clients include some of the world’s largest companies, typically organisations with complex financial data and technology landscapes. Development, together with a growing number of other services, continues to be performed at the Aptitude Innovation Centre in Poland with sales, support and implementation services provided from Aptitude Software’s London headquarters and the North American and Singaporean regional businesses.

The shares have been volatile but look poised for a stronger period helped by the new management team, the progressive shift to a recurring revenue SaaS business model and the growing importance of financial automation in an increasingly complex and regulated world.

The group is also spending heavily on research and development. “A key strategic highlight in the year has been the launch of Aptitude Accounting Hub (‘AAH’) and Aptitude Insurance Calculation Engine (‘AICE’) as SaaS offerings and the subsequent entry into multi-year SaaS agreements with two North American insurers for this new service.”

An important feature of the new products is to facilitate the greater use of the group’s technology by more organisations smaller in size than the current client profile, thereby expanding ther market opportunity. The group is also emphasising the’ land and expand’ strategy which has been so successful at driving growth for many US software businesses. “As the number of both our clients and products increases there is a growing opportunity for add-on sales to existing users.”

In a sign of intent headcount at the Aptitude Innovation Centre, based in Warsaw, Poland, increased by 18pc in the year to 162.

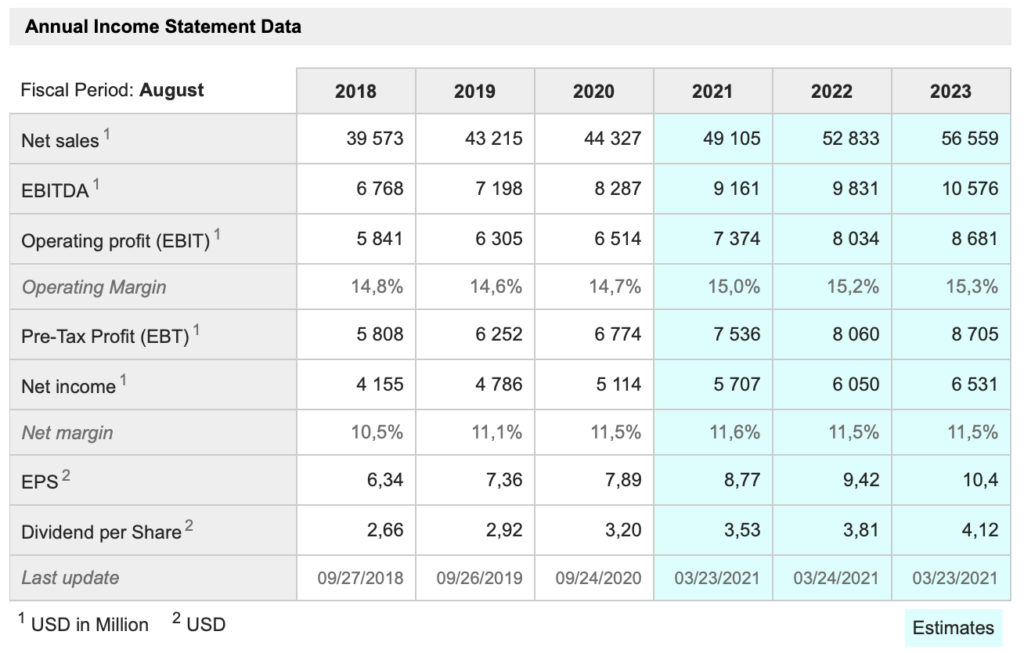

Epam Systems. EPAM. Buy @ $440. Times recommended: 10. First recommended: $163. Last recommended: $410

Epam bets heavily on AI, artificial intelligence positioning the group strongly for future growth

Epam Systems is a software engineering consultancy, which was founded in 1993 by two software engineers from Belarus. The CEO and co-founder is Arkadiy Dobkin. The company offers its services internationally and in North America with offices in New Jersey and in Belarus. The latter location helps the company to recruit engineers in Central Europe giving it a significant cost advantage.

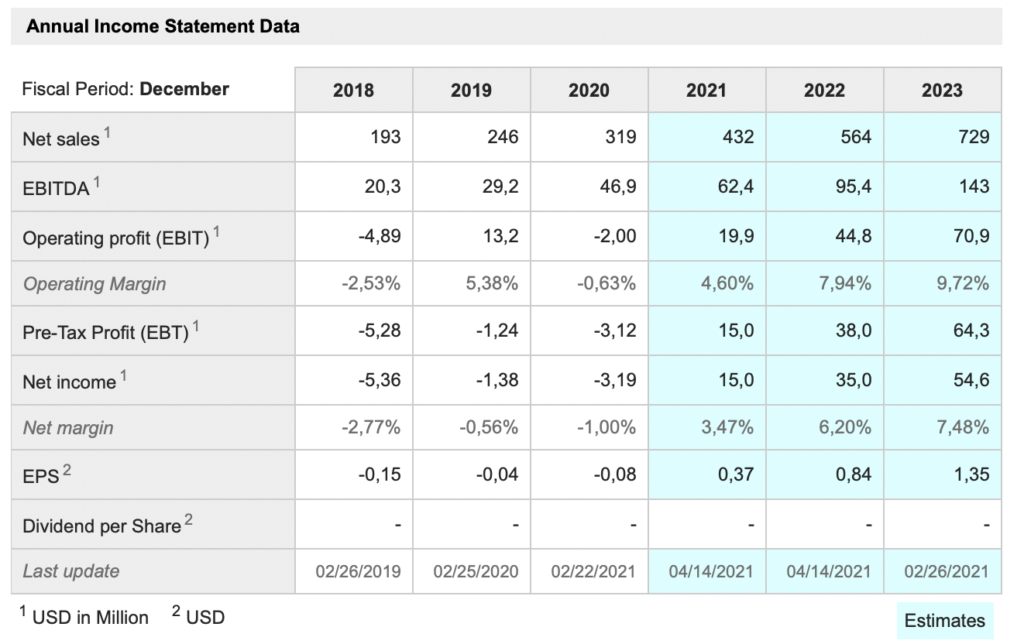

The growth has been consistently strong for many years as the group plays a key role in helping ts clients with digital transformation. A flavour of the growth comes from the table below where sales are forecast by analysts to climb from $1.84bn in 2018 to$4.95bn by 2023. Over the same period earnings per share are projected to grow from $4.24 to $11.2 to drop the PER to around 40, which looks very reasonable for such a fast-growing business.

Growth has been supplemented over the years by a string of acquisitions taking the group into new products areas and strengthening its geographical footprint. As a highly rated public company Epam Systems can do deals on favourable terms, giving an additional impetus to growth.

As for many technology companies the company went from alarm at the impact of Covid-19 to a positive impact as companies around the globe rushed to accelerate their digital transformation.

There are also many exciting new things happening. “Thanks to our investments into integrated consulting with EPAM Continuum, into cloud-enabled business transformation efforts and data analytics, AI and their test set of capabilities, strongly supported by our engineering DNA and by much more flexible, scalable and distributed delivery locations and delivery models, enabled in turn by our digital talent, productivity knowledge and educational platform for our EPAM Anywhere paradigm. We believe all those investments are paying back and preparing us strongly for the future growth.“

EPAM Continuum which began life as an acquisition is shaping up as an important future growth drive. “Our approach to EPAM Continuum goes beyond our working market, but extended very much into cross-pollination of all EPAM capabilities and experiences through network organizational approach comprised of people, tools and shared ways of working, which should enable us to build global, agile and expert teams more quickly and more efficiently. While this work is ongoing and represents a significant portion of our investment agenda, we are seeing strong results today in our current portfolio, results that are driving higher value for customers enabling EPAM to scale larger and more complex program faster than ever in the past.”

All systems remain go at Epam for the foreseeable future. “So looking ahead to 2021, we see a market that continues to be very active and one that demonstrate strong demand for our services. With the events of the past year, our clients are adapting to changing landscape, which requires hybrid business models and different ways of interacting with their customers in the end market. This requires even faster pace of transformation, the organization of application as well as the building of expansion of the platform with connect and powered enterprise, enabled first by the cloud and the need for really co-innovation partners. It means that we will have to lead large-scale transformation with consulting, product development engagement with design, data monetization and process optimization engagement with analytics, digital technology architecture and custom platform development engagement with engineering.“

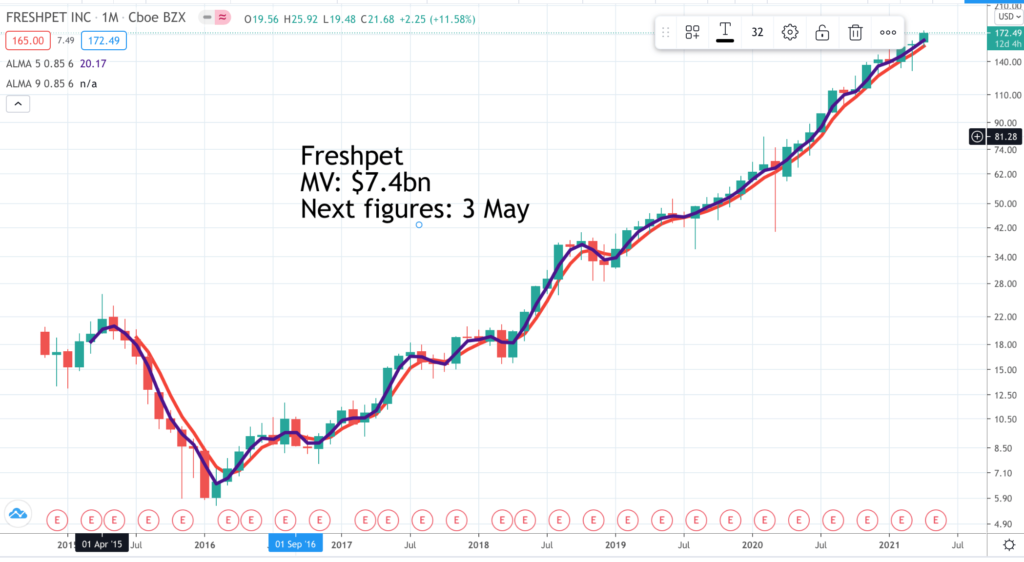

Freshpet. FRPT. Buy @ $169. Times recommended: 4 First recommended: $144 Last recommended: $157

Freshpet is on course to have tripled production capacity by the end of next year

“In that presentation [last year], I asserted that Freshpet had the potential to join the pantheon of iconic brands that change the world, brands that change things we do every day and reflected significant changes in society’s values and priorities, brands that leverage technology to make the previously impossible possible or more broadly available, brands like Nike, Starbucks, Gatorade, Netflix, and Apple. That may have seemed like a lofty ambition then, and to be clear, it remains a very lofty ambition today. But Freshpet is on that path and accelerating. Freshpet is changing the way people feed their pets. That change reflects the fundamental shift in how society views both pets and food. Our pets are no longer creatures who sleep in doghouses and backyards. They are the favorite child who sleeps in our beds, and our food needs to be fresh and natural, not dehydrated and preserved. Those fundamental changes in society’s values and priorities are here to stay, and Freshpet will lead the transition to fresh and natural food for our pets.”

I know it is a long quote but it says everything about Freshpet. What is happening in their market is a sea change in attitudes to pets. Frespet is playing a key role in this transition to feeding dogs with the same attention to quality and freshness with which we feed ourselves. And last and what I love about Freshpet is the sheer scale of their ambitions. They really do want to play with the big boys.

The group is also walking the talk. “Number one, we accelerated our growth for the fourth consecutive year, posting 30pc net sales growth for full-year 2020, and ended the year with 38pc consumption growth in Q4. Number two, we increased our adjusted EBITDA growth rate for the third consecutive year, growing adjusted EBITDA by 61pc. Third, we increased household penetration by 24pc, reaching almost 4m users for the first time, and increased the buying rate by 7pc at the same time. Number four, despite the retail challenges presented by COVID, we added 1,146 net new stores and, more importantly, installed double fridges in another 1,640 stores and upgraded 795 stores.”

Everything about Freshpet confirms the exciting things tat are happening. “When we met one year ago, we shared our plan to convert 5m more households to Freshpet by the end of 2025, getting to 8m households in total. As ambitious as that sounded a year ago, we are well ahead of schedule.”

Freshpet is another business playing to the Gen Z and Millennials audience. “The number of millennials and Gen Z, who have entered the household formation stage of life and acquired a dog is growing quickly, and they are our best prospects for future Freshpet users.”

This business is on fire, has a huge addressable opportunity, massive tailwinds and is performing at the top of its game. They are classic 3G and a market value of $7.4bn looks well short of the ultimate potential, which could well include another zero in the figure.

Liontrust Investment Management. LIO. Buy @ 1576p. Times recommended: 6. First recommended: 1200p Last recommended: 1490p

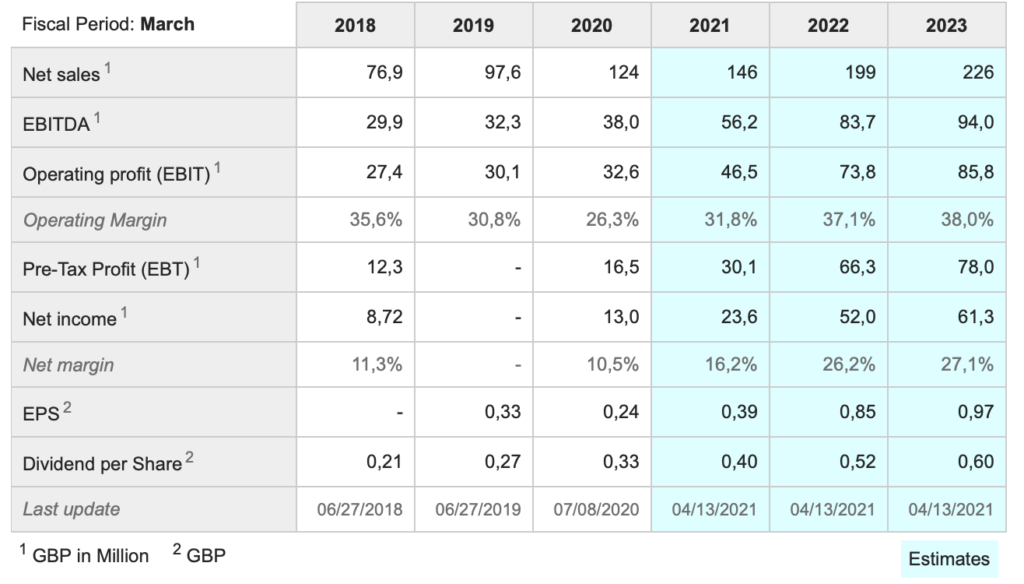

In roughly 10 years a John Ions-led, Liontrust Asset Management, has increased assets managed and advised on from £1.5bn to over £30bn

Liontrust Asset Management is on a roll. “Net inflows of £792m in the three months ended 31 December 2020 and £2,540m for the nine months ended 31 December 2020. Assets under management and advice (“AuMA”) were £29.4bn as at close of business on 31 December 2020, an increase of 43pc over the quarter and 83pc since the start of the current financial year. The acquisition of Architas Multi-Manager Limited and Architas Advisory Services Limited (together “Architas UK Investment Business”), announced on 1 July 2020 completed on 30 October 2020, adding £5.6bn to AuMA. On 2 October 2020, Liontrust announced the sale of the Asia Income investment team and the closure of the European Income and Macro Thematic investment teams. AuMA as at close of business on 11 January 2021 were £30.1bn.

As can be seen from the chart Liontrust Asset Management had a terrible time between 2007 and 2012. An important factor in turning the business around was the arrival of John Ions as CEO in 2010. As an indicator of progress assets under management and advice, AUMA, in 2012, were around £1.5bn. The latest figure, as noted above, is £30.1bn and with stock market trends strong and the bullish tone spreading from Wall Street to markets around the world, it seems like that the positive trends will continue.

One of my long term rules is if you feel like buying the funds buy the fund manager. The reason for this is that fund managers have great operational gearing. They charge a percentage of funds under management, which is their revenue. Because you don’t necessarily need more fund managers and analysts to manage more funds under management this can have a very positive effect own profitability and earnings.

Another advantage of fund management businesses is the double whammy effect of rising stock markets. Not only do the rising values raise AUMA without management doing anything but the strong performance makes it easier to attract strong fund inflows driving further growth in AUMA. If, as seems likely, the UK and Europe join. in a global bull market trend that over the last 10 years has been led by the technology-dominated US stock market, this could lead to accelerating growth at Liontrust Asset Management.

Historically in bull markets fund management groups can be some of the strongest performing businesses, suggesting great potential for Liontrust Asset Management in coming years. The company already has processes in place that enable it to deliver this strong performance.

“Active fund management can continue to benefit investors by meeting their expectations. The Liontrust Economic Advantage team have been doing this for more than 20 years through their robust and repeatable investment process, which is evidenced by long-term fund performance. Over the last 10 years, the Liontrust Special Situations Fund has outperformed the FTSE All Share by 6.88pc on an annualised basis and the Liontrust UK Smaller Companies Fund has outperformed the FTSE Small Cap ex ITs Index by 8.76pc. Over the past 10 years, the Liontrust SF UK Growth Fund has outperformed the MSCI UK by 5.64pc on an annualised basis and the Liontrust SF Global Growth Fund has outperformed the MSCI World by 2.32pc.“

The business also rows by acquisition. “On 30 October 2020, we completed the acquisition of the Architas UK Investment Business, adding £5.6bn of AuMA, creating a significant multi-asset multi-manager proposition and substantially enhancing our distribution potential and service to financial advisers. We have successfully integrated the investment team, funds and the rest of the team into Liontrust, ensuring as seamless a transition as possible for clients.”

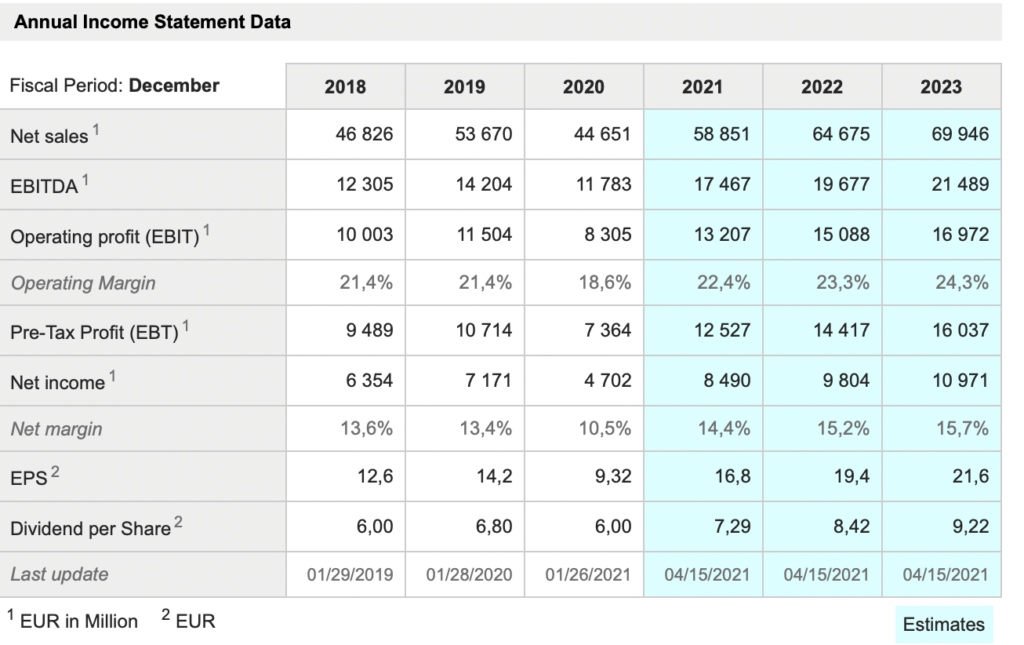

LVMH. LVMH. Buy @ €623. Times recommended: 11 First recommended: €249.45 Last recommended: €583

Bernard Arnault of luxury goods giant, LVMH, says ‘if you want luxury (circa-25pc) profit margins you need to sell luxury goods

LVMH is the luxury goods business, more like an empire, assembled by Bernard Arnault. The jewel in the crown at the heart of the empire is Louis Vuitton. I once worked out how sales of Louis Vuitton had grown since Arnault acquired majority control of Louis Vuitton Moet Hennessy in 1989. I’ve lost the figures but the growth has been astonishing. Just Louis Vuitton is one of the world’s greatest brands. Moet is for Moet & Chandon, a champagne label and Hennessy is for cognac.

Since then Arnault has used the massive free cash flow generated by Louis Vuitton and, to a lesser extent the growing stable of other luxury brands, to keep buying. The latest acquisition, launched pre-Covid and renegotiated during Covid, was of American jewellery brand, Tiffany. Other brands in the empire include a short list of the world’s finest in fashion, accessories, wines and spirits (think names like Chateau d’Yquem, founded in the 16th century), hotels (Bulgari, which also does fashion, watches and accessories), watches, jewellery, perfumes, cosmetics and even luxury yachts with the Princess Yachts brand. The group also owns a chain of duty free shops with multiple locations across the world’s major airports as well as the many outlets for its own brands.

Bernard Arnault is a man of many talents and has assembled an extraordinary group around him. There are all the skills of a great financier in the acquisition programme. The business is brilliant and marketing is top-notch, as witnessed by the high profile of brands like Louis Vuitton with its instantly recognisable suitcases, travelling bags and handbags. Lastly it is run with ruthless efficiency as evidenced by margins constantly above 20pc and approaching 25pc in the last reported year.

Bernard Arnault is famous for saying if you want luxury profit margins you need to sell luxury products. His company bears witness to what he says.

Covid-19 with its impact on travel and tourism has been a negative for the group but nothing like as bad as initially feared. In March 2020 the shares nearly halved but the group moved with great success to contain the impact on sales, profits and free cash flow and recovery began sooner than expected.

Part of the reason for expecting LVMH to do well is that shares in a whole raft of luxury goods companies are powering ahead, which suggests that there are powerful following winds in the global economy that are boosting demand for luxury goods new and are expected to be even more favourable in future.

One is the likelihood of a spectacular rebound in the travel and tourism markets after over a year of widespread lockdowns. The pent-up demand is likely to be enormous. The other is rising affluence around the world, especially in Asia and most especially inn China, where the emergence of an increasingly affluent and numerous middle class is becoming one of the most spectacular economic phenomenons in history. Google any statistics you like on the rising spending power of the Chinese middle classes and the numbers are jaw dropping. Nor is it just middle class spenders. The numbers of seriously affluent, the kind of people, who are target customers for LVMH, are also exploding.

I sometimes think that a simple snap shot of LVMH’s business is – made in France and sold in airports to Chinese travellers; that is a cartoon but not a complete misrepresentation of what is happening. And what is really amazing for LVMH and other luxury goods companies is that these customers certainly want great design and craftsmenship but they also want the stuff they buy to be reassuringly expensive. Companies like Louis Vuitton and Hermes don’t have sales, which is why they can generate such incredible margins.

Arnault gave some clues to was happening with the full year results. “Fashion & Leather Goods in particular, enjoyed a remarkable performance, with double-digit growth in both the third and fourth quarters. While Europe is still affected by the crisis, the United States saw a good recovery and Asia grew strongly. Profit from recurring operations, which amounted to €8.3bn in 2020, declined only 28pc over the year due to a return to growth in the second half, which was up 7pc. Operating margin reached 18.6pc in 2020. Group share of net profit amounted to €4.7bn euros, down 34pc.“

The performance of fashion and leather was particular notable with profits coming in at 63.4pc of total group profits. Overall group cash flow matched 2019, which is another extraordinary statistic. Online sales grew dramatically but even so it is astonishing that a group so dependent on bricks and mortar stores, travel and free spending tourists can do so well in a time of lockdowns. No wonder investors suspect that as recovery takes hold a bumper period of growth lies ahead for LVMH.

MSCI. MSCI Buy @ $464. Times recommended: 8 First recommended: $150 Last recommended: $437

MSCI to separate out ESG, environmental. social and governmental sales and profits as a key future growth driver

“Following closely on the incredible momentum we have built in 2020, MSCI has never been better positioned to take advantage of accelerating secular and disruptive investment trends, which will allow us to deliver sustained and significant top line growth.”

The above quote from the Q4 2020 earnings call released on 28 January gives a flavour of the strong growth momentum in the business and the powerful tailwinds helping the company make such strong progress. MSCI has benefited greatly from the continued increase in passive investing and the various ETFs that have been created to track a specific sector, sub-sector, region or country.

The group generates revenues from index subscriptions and licensing and asset-based fees. It also provides data and risk and portfolio management analytics software to asset managers and owners. The index segment is by far the powerhouse of MSCI, generating around 60pc of revenues and around 80pc of operating profits.

MSCI has been ramping up the ratings segment related to ESG, environmental, social and governance, as well as creating additional indexes and benchmarks. The ESG component falls into the other segment of MSCI, and while the other segment only accounts for roughly 10pc of revenues, ESG has seen rapid growth as further adoption and focus on the role of ESG factors has come into favor.

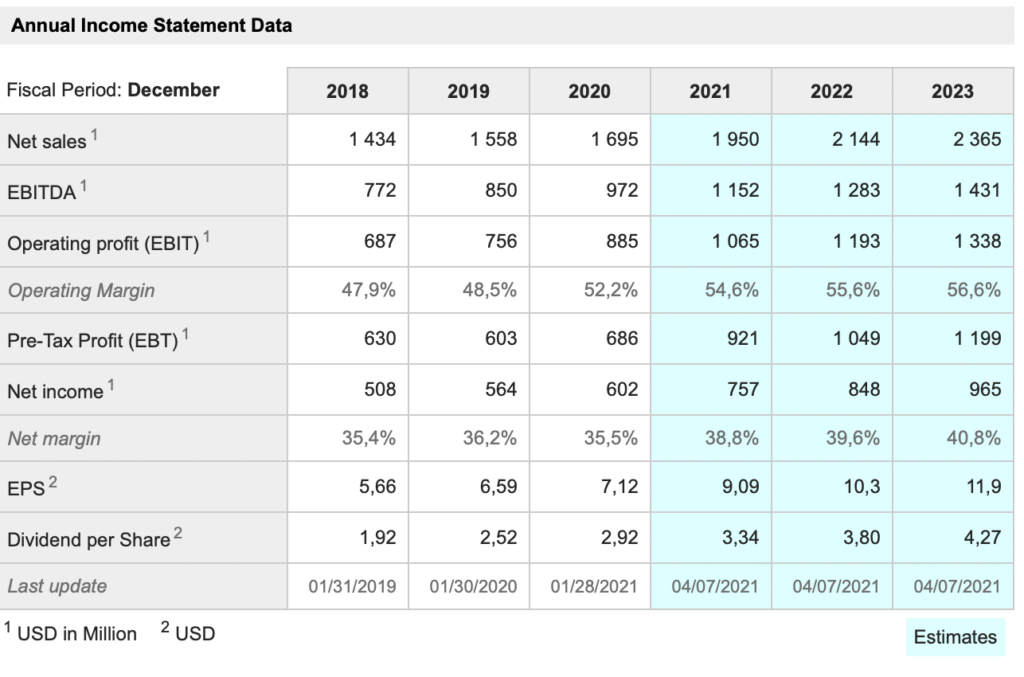

One of the attractions of the business is that it is very scaleable. Last year’s revenues of $1,695m were generated by 3,633 employees, which equates to $466,500 of revenue per employee. Net profit margins were 35.5pc in 2020 and are forecast to reach 40.8pc in 2023. A further advantage of the group’s operations, keeping costs down, is that 65pc of its employees are located in developing and emerging economies.

Further evidence of the strong momentum in the business comes from the number of new ETFs being launched tracking MSCI Indices. “In 2020, our asset management clients launched more than 150 new ETFs linked to MSCI Indices, over half of which were linked to MSCI ESG and climate indices. Regionally, our integrated client approach has led to high levels of engagement and activity. In Europe, regulatory requirements for our clients helped drive record quarterly recurring subscription sales during the fourth quarter. In Asia, new subscription sales in the fourth quarter improved 62pc sequentially after a very slow process during the year, given the early pandemic disruptions in the region.”

The scale of the opportunity facing MSCI looks gigantic. There are over $100 trillion of managed assets in the world and managers and investors need a growing range of tools and decision support systems to help them manage those assets. MSCI is in the business of providing and constantly improving those tools and has the credibility of 50 years of business experience.

The quality of the revenues is high because the vast bulk comes from recurring fees making growth steady and predictable. The group also generates strong free cash flows, which enable it to pay rising dividends while returning further cash to shareholders through share buybacks.

An increasingly important sector in investment decision making is saving the planet summed up as ESG, environmental, societal and governmental. The company has said that from Q1 2021 onwards it will be reporting this as a separate segment, which make become an important driver of share price performance as effectively a ‘something new’ for investors to focus upon.

More insight into what is happening at MSCI came from chief operating officer, Baer Pettit. “We had our best-ever quarter for subscription sales across MSCI and in our Index and ESG segments individually. Assets in equity ETFs linked to MSCI Indexes passed the $1 trillion mark for the first time in our history. As of last Thursday, these assets reached further all-time highs, above $1.16 trillion. AUM and equity ETFs linked to MSCI ESG and climate indexes were at $106bn at year-end, tripling year over year. And seven of the 10 largest equity ESG ETFs globally are benchmarked to MSCI Indexes. We’re pleased with these accomplishments and excited for the momentum we see in our business.”

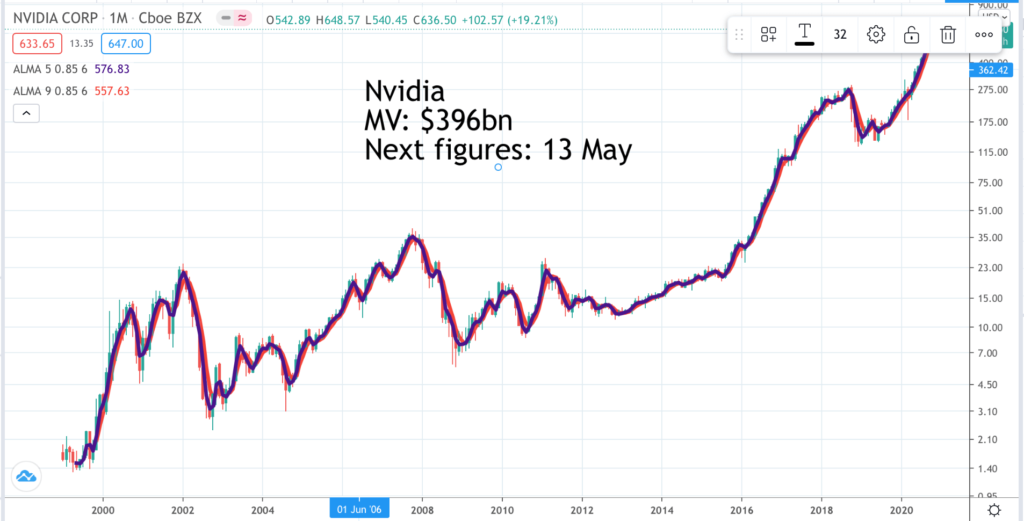

Nvidia NVDA Buy @ $610. Times recommended: 21 First recommended: $164.70. Last recommended: $565. Lowest recommended: $147.21

Nvidia says “demand is incredible for our new GeForce RTX 30 Series products” and is struggling to keep pace

Nvidia is a behemoth standing at the heart of the global technology revolution. The company invented the GPU (graphics processing unit) which plays a key role in mobile phones, video gaming and many other applications, where visuals are important. It also has applications in areas like the data centre, which has been an area of explosive growth for Nvidia as cloud computing has become the norm across the planet.

In a recent investor day Nvidia set out some of the areas where it is focusing its technology and research. Among the points they made. 'Accelerated computing is the future of computing. AI (artificial intelligence) is software that writes software.The data centre is the new unit of computing. AI on 5G kickstarts the 4th industrial revolution. Autonomous systems in real and future worlds.”

The UK government is looking at Nvidia’s proposed $40bn takeover of Arm Holdings, the Cambridge-based supplier of low power consumption chips used in 90pc of the world’s mobile phones but the betting seems to be that the deal will go through. It represents 20 times sales for a business that only made $50m profit last year so is hardly ungenerous and Arm is already owned by a Japanese concern.

The combination will greatly increase Nvidia’s reach and opportunity in the CPU (central processing units) making it a formidable competitor in areas like mobile phones and laptops.

Meanwhile the business is storming ahead. “Q4 was another record quarter with revenue exceeding $5bn and year-on-year growth accelerating to 61pc. Full year revenue was also a record at $16.7bn, up 53pc. Our Gaming business reached record revenue of $2.5bn in Q4, up 10pc sequentially and up 67pc from a year earlier. Full year Gaming revenue was a record of $7.8bn, up 41pc. Demand is incredible for our new GeForce RTX 30 Series products based on the NVIDIA Ampere GPU architecture. In early December, we launched the GeForce RTX 3060 Ti, which joined the previously launched RTX 3090, 3080, and 3070. The entire 30 Series lineup has been hard to keep in stock and we exited Q4 with channel inventories even lower than when we started. Although we are increasing supply, channel inventories will likely remain low throughout Q1.”

Every time I look at Nvidia I come away thinking this is a phenomenally exciting company and it is only a matter of time before the market value is measured in trillions rather than hundreds of billions. Think of an exciting area of technology in the global economy from gaming to data centres to artificial intelligence to autonomous driving and Nvidia’s chips play a vital role.

Some of these areas like gaming and data centres are already booming. Others like AI and autonomous vehicles are at a much earlier stage of development but are obviously going to be massive in the future. Analysts wrack their brains to forecast what is going to happen over the next several years to sales and profits and whether the current valuation is cheap or dear but that hardly matters to QV subscribers taking a long view.

The world needs companies like Nvidia if the technology revolution is to continue and accelerate. Nvidia is effectively a company that creates and sells IP (intellectual property), which is why it has those staggering 40pc plus or minus operating profit margins.

The group spends around a quarter of revenue on research and development and in the year to 31 January 2021 generated net cash from operating activities of $5.88bn. It strikes me as a wonderful business, with an exciting future. It is ideal for buying a chunk of shares right now or accumulating a position over time using programmatic or buying the green techniques.