At this stage of the market (a strong bull market), I find my preferred chart configuration is three monthly candlesticks. In this configuration, Coppock can be slow to catch turning points, but generally, a falling Coppock strikes a note of caution, and a rising Coppock is decidedly bullish.

This chart of my favourite leveraged ETF looks great and should presage a sustained period (years rather than months) of rising share prices ahead.

TECL (chart not shown) looks similar.

I remain a raging bull of Applovin on fundamental rather than chart grounds, though the chart is strong. It puts into perspective what is happening. There may also be an element of buy the rumour, sell the fact now that 1 October 2025 has arrived. I am sure Adam Foroughi will not be selling any shares, not a significant number anyhow, because of where he thinks this business is going.

I am still trying to get my head around what they do. I found this on their website.

AppLovin, the company behind Axon, started in 2012 with a simple app that let friends share the games they were playing with each other. Like many startups, we needed a way to promote ourselves and grow our users, but the marketing tools at the time didn’t meet our needs. So we pivoted; instead of building just another app, we built a platform to solve the broader marketing challenges we were facing.

For more than a decade, we focused on helping mobile game developers market their apps effectively. Having come from gaming ourselves, we built a network that reached over a billion daily active users through targeted ads in mobile games. It was incredibly rewarding to see how our platform helped studios worldwide scale their businesses, leading to fresh investments, hit game launches, and significant job creation in the industry. Built on the Axon AI technology, this progress naturally evolved into today’s Axon platform.

In 2024, we expanded our vision, believing our marketing tools could benefit businesses beyond gaming. We rolled out an initial version of our solution to e-commerce and direct-to-consumer brands, and the results exceeded our expectations, proving we could drive growth for many business. That momentum fueled the launch of Axon Ads Manager, our self-serve, AI-powered advertising platform. With access to over a billion daily active users and precision targeting designed to drive real results, Axon Ads Manager helps companies reach their ideal customers and make the most of every marketing dollar.

Our goal is to make profitable growth accessible to every business, allowing you to focus on what you do best.

Applovin website

As far as I can tell, Applovin cornered the market in selling games to gamers, helping developers of games make a great deal of money. They are now proposing to use the power of their AI-driven platform to sell everything that their over a billion daily active users might want to buy, from cosmetics to clothes to Xmas presents, whatever. They reckon this market is 10 times the size of their existing games to gamers market, and they are launching into this market on 1 October 2025, so this has just happened, and then in 2026, they are going global.

They are excited, and so am I. Applovin is a classic example of a share where the story guys, me, are excited, and the value guys, many analysts and most of Seeking Alpha, think the shares are ridiculously overpriced. This is a combination, which makes for considerable share price volatility, but the bulls will likely, I believe, win in the end.

Who would have imagined that Nvidia could reach a market value of $4.6 trillion and have a chart that looks headed strongly higher?

Another great chart for another great AI stock.

What a wall of scepticism Palantir has had to climb. The analyst community is almost united in saying the shares are insanely overpriced, yet still they forge relentlessly higher. Investing in US stocks has much in common with a religious experience. Either you have faith or you don’t. There are plenty of believers out there. They don’t spend much time studying spreadsheets. They think Alex Karp is a superstar, and so do I.

Credo Technology, a power in the field of networking for data centres, reported almost unbelievable growth with its last quarterly figures and expressed great confidence in a glittering future. The chart could hardly be more powerful. They have just had a sharp setback, but that is healthy to shake out loose holders and position the shares for a fresh advance.

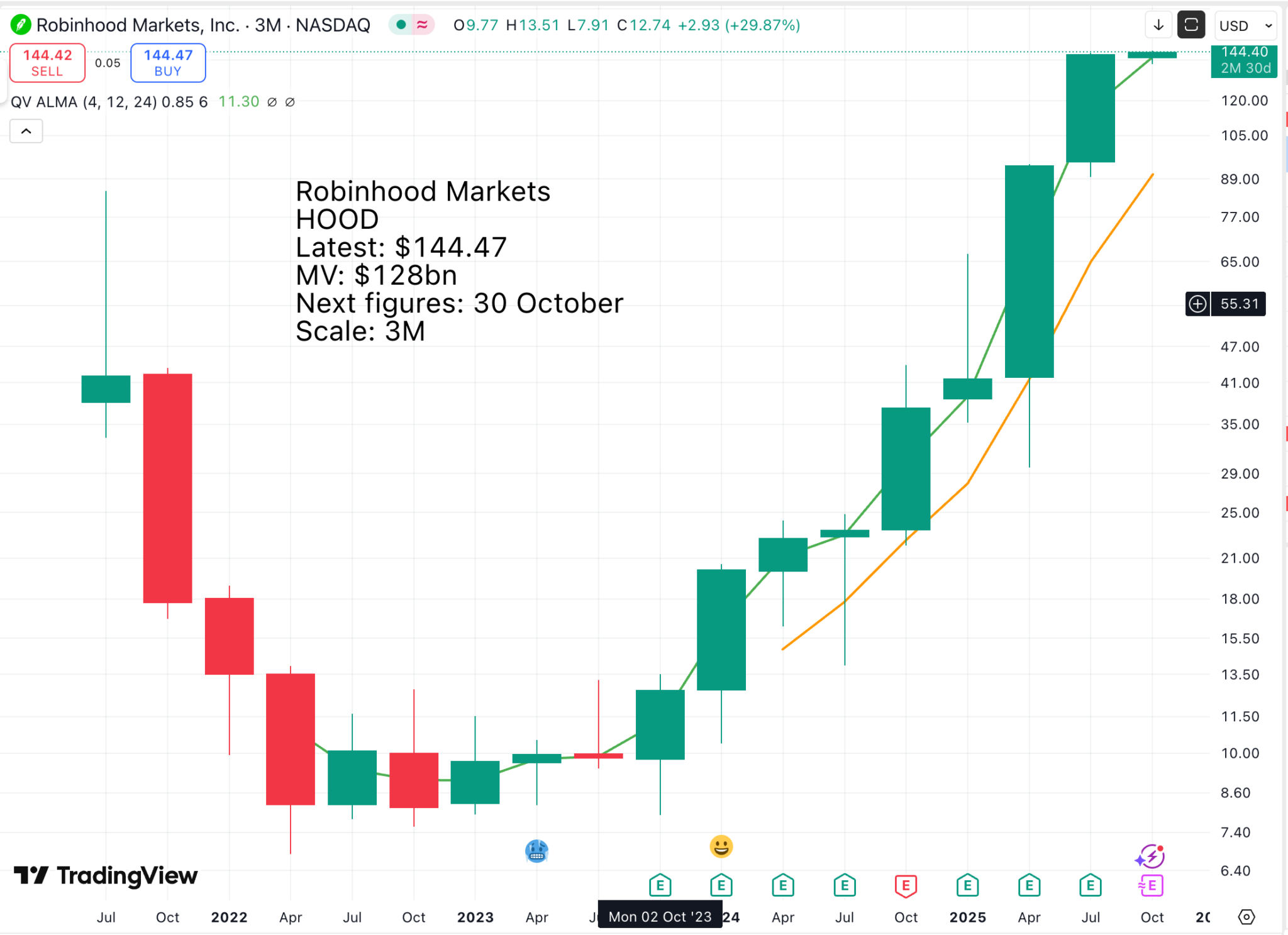

Bitcoin has a strong chart. It is also becoming increasingly entrenched in mainstream finance with ETFs, more corporate buying, government interest, including from the Trump administration and more brokers, including Robinhood, offering a platform for trading and holding bitcoin.

The Strategy chart is not so obviously strong, although it is forming what is likely to prove a continuation pattern. The shares are a massive bet on what happens to bitcoin. If they go to $1m, as some people expect at some future date, executive chairman Michael Saylor will be a happy man. He already has 640,031 bitcoin worth around $77bn. I am sure he plans to have 1m Bitcoin, ultimately worth $1 trillion, which would be an incredible coup.

Robinhood is a play on bitcoin, too, with a big chunk of revenues and profits generated by bitcoin and options trading. This may make earnings volatile in the short term, but Vlad Tenev, CEO and co-founder, insists that Robinhood is primarily a technology company building a financial ecosystem around a fast-growing core of monthly paying subscribers.

Carvana has been the ultimate roller-coaster ride. Facing bankruptcy in late 2022 when investors wrote off the shares, the star-studded Stanford and Harvard alumni running this innovative used car company buckled down and have done an incredible job in turning the business around and going for growth and world conquest (at least of the US used car business, which is no small target), yet again. Still young, these guys are nowhere near finished yet.

Oracle has suffered a recent decline in its shares, down from a peak of around $350, but I still like the story of Oracle becoming a major player in data centres and AI. I like the chart too. I see the latest move as a breakout from a massively extended upward-sloping consolidation.

This is a fabulous chart for ArgenxSE. Bio-pharmaceuticals are as mysterious as high technology for laymen to understand, but there is something about Argenx that ticks all the boxes and leads me to include the company, like all the others mentioned above, in my Top 30 (34) portfolio. Buy them all, and I hope that you will do well. No doubt there will be winners and losers, but I hope there will be plenty of winners and some of the winners will win big.

Remember that losers can only fall 100pc, but the sky is the limit for winners.

Also looking amazing are the quantum computing stocks. Since I have no idea which one to back and I have been recommending three stocks in the sector, of which IonQ, chart below, is in the portfolio, I am going to add the other two, D-Wave Computing and Rigetti Computing, taking the portfolio to 36, on the way to becoming a Top 40.

Share Recommendations

QQQ3

TECL

Nvidia NVDA

Applovin. APP

Broadcom AVGO

Palantir. PLTR

Credo Technology. CRDO

Bitcoin. BTCL

Strategy. MSTR

Robinhood Markets. HOOD

Carvana. CVNA

ArgenxSE. ARGX

IonQ. IONQ

D-Wave Computing. QBTS

Rigetti Computing. RGTI

Strategy – Buy Top 40 Or Mix And Match

The core of the QV strategy is to build a portfolio of the world’s most exciting stocks. I like great stories, great charts, and explosive growth. Such stocks freak out the value guys, so they tend to be volatile; hence my enthusiasm for accumulating positions in stocks over time, so volatility becomes an asset.