Super Micro Computing has been in the wars with its accountant storming off in a huff, but underneath the angst, there is a great business trying to get out.

The March quarter results were negative, but the company looks well placed for growth to resume.

“We continue to make great progress with our DCBBS (Data Center Building Block Solution), DLC (Direct Liquid Cooled-2) and AI technology leadership, but some customers delayed making platform decisions in the quarter,” said Charles Liang, Founder, President, and CEO of Supermicro. “We do expect many of those commitments to land in the June and September quarters, reinforcing my confidence in our ability to meet our long-term targets, however economic uncertainty and tariff impacts may have a short-term impact. We believe that we are well positioned in the long-term to capitalize on the growing market opportunity.”

Super Micro Computer, Q3 2025 results, 6 May 2025

The company has been somewhat of a basket case, but seems to be getting its act together.

The Company has made progress on strengthening its corporate governance practices and implementing recommendations by the Special Committee of the board of directors. All outstanding financial statements have been filed and the Company is in compliance with all Nasdaq filing requirements. Since December 2, 2024, Supermicro has strengthened its board of directors and management team with the additions of Scott Angel, who joined the company’s board of directors, Yitai Hu, as the Company’s General Counsel & Senior Vice President of Corporate Development, and Kenneth Cheung, as the Company’s Senior Vice President and Chief Accounting Officer.

Super Micro Computer, Q3 2025 results, 6 May 2025

Prospects look good for a sharp improvement in results.

Despite macroeconomic conditions and tariff impacts, our ability to expand market share in IT and AI remains strong. On the earnings front, our fiscal Q3 non-GAAP EPS stood at $0.31 per share, compared to $0.66 last year. This decline was largely driven by a one-time inventory write-down of older-generation GPUs and related components, while the new platforms are finally ramping quickly now.

Charles Liang, CEO, Super Micro Computer, Q2 2025, 6 May 2025

The other positive is that the company is bringing new technology on stream.

Although our quarterly performance did not align exactly with our expectations, we successfully fulfilled our commitment to regaining financial regulatory compliance. At the same time, we continue to enhance technological innovation and development, which resulted in the successful high volume delivery of our new generation AI products at the end of March.

Looking ahead, some major groundbreaking new innovations are set to service the market in this quarter and the new fiscal year especially with our coming soon DCBBS [data centre building block solutions]. With a clear time-to-market advantage, Supermicro once again leads the AI infrastructure technology and DLC [direct liquid cooling] solutions. This strong position enables us to explore new opportunities and expand market share.

Charles Liang, CEO, Super Micro Computer, Q2 2025, 6 May 2025

It looks potentially exciting.

Built on our strong foundation of technology leadership, building block solutions, and green computing DNA, we have been deeply focused on developing the industry’s first end-to-end AI/IT datacenter total solution. We are now about fully ready to share this exciting news with the market in the coming days by launching our brand-new Datacenter Building Block Solutions, we call it “DCBBS”, featuring our second-generation system liquid cooling technology, we call it “DLC-2”.

With DCBBS, we are able to dramatically shorten customers’ efforts to build a datacenter, reduce their cost, and most importantly make their datacenter better quality and performance, greener and with higher availability. DCBBS consolidates critical components — including (AI) server systems, storage, rack PnP, all different kinds of switches, DLC systems, water tower or dry tower, chilled door, power shelf, battery backup unit (BBU), onsite deployment, networking design, cabling, and datacenter end-to-end management software and all different scopes of services — into a streamlined process.

The true value of DCBBS lies in its ability to reduce power consumption, optimize space, and decrease water usage, delivering up to 30% lower TCO. More importantly, it accelerates new datacenter deployments and upgrades existing datacenters in a matter of months or even weeks, rather than many quarters or years driving significant improvements in datacenter time-to-deployment (TTD) and time-to-online (TTO).

One of the key components of DCBBS is our industry-leading DLC solutions. Supermicro remains at the forefront of driving industry adoption of DLC technology, setting new standards for performance, efficiency and sustainability. Last year, we shipped 4,000 100kW AI racks equipped with DLC, helping our customers reduce energy costs by up to 25%. We are committed to doubling this volume in the coming year, further amplifying the impact of green computing.

With the upcoming DLC-2 technology, Supermicro will be able to deliver even greater savings and benefits to our customers. For example, it saves power and water up to 40% and reduces data center noise levels down to about 50 dB, that is almost as quiet as a library. We are going to announce the details in the coming days. Green computing can be everywhere, and with our DLC-2 solutions, we are making that vision a beautiful reality.

Our long-term investments and leadership in DLC have solidified a sustainable competitive edge, providing economies of scale and keeping us far ahead of the competition.

Charles Liang, CEO, Super Micro Computer, Q2 2025, 6 May 2025

Prospects look promising.

In summary, fiscal Q3 was dynamic and productive. We successfully navigated financial challenges while continuing to strengthen our leadership in product and technology innovation. Our first-to market advantage in AI infrastructure, along with the expanded reach of DCBBS and advancements in DLC technology, further solidifies our industry position. I remain highly confident and optimistic about our long-term strong growth and market share gain. However, near-term macroeconomic and market uncertainties make it difficult to precisely forecast the pace of technology adoption.

Despite this, I am confident that we will close the fiscal year on a strong note. Given the current conditions, we anticipate Q4 revenues of at least $6 billion and will resume providing a broader forecast range once we have more clear visibility.

Charles Liang, CEO, Super Micro Computer, Q2 2025, 6 May 2025

It is not usually a metric to which I pay much attention, but there is an argument for saying that SMCI is seriously undervalued.

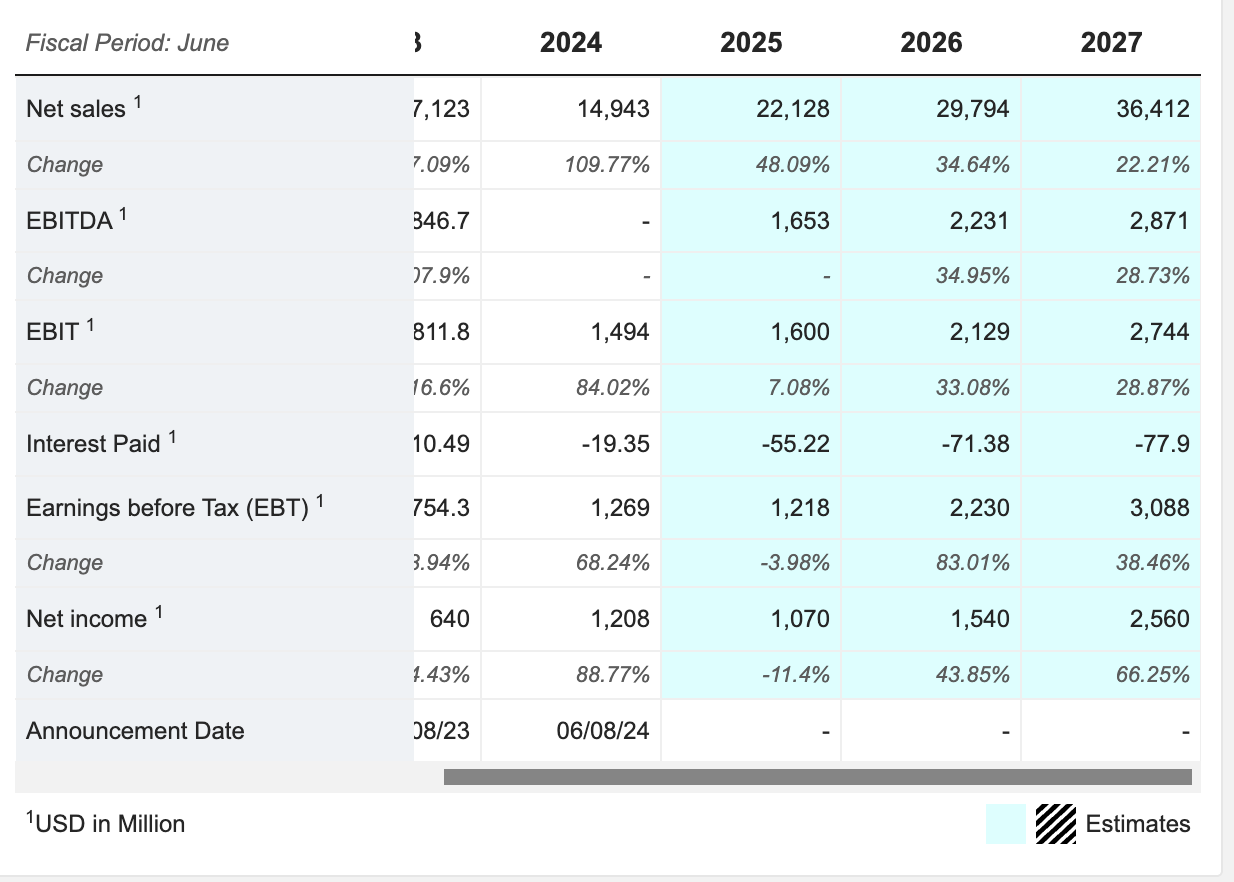

Based on the projections above, Super Micro Computer is valued at one times sales for the 12 months to 30 June 2027. This looks screamingly cheap for an AI stock. Part of the problem has been the history of dodgy accounting, compliance, etc. Another problem is the disappointing profitability. $1.5bn net income on some $30bn of sales is a wretched performance.

The company needs to improve its execution dramatically. Whether this can happen under existing management, I have no idea, but major shareholders must surely be making their views known and seeking improvement.

Strong sales growth and technological prowess suggest this business could be an exciting AI infrastructure play, but so far, investors have had a bumpy ride. The chart suggests better times lie ahead.

WOW figures and great projections for Microsoft

Stunning figures from Microsoft and a bullish analysis from Dan Ives of Wedbush Securities.

Despite Microsoft’s solid growth, Wedbush analyst Dan Ives wrote in a recent investor note that the company’s AI investments will truly take off in fiscal 2026.

“While AI use cases are building markedly in FY25, [it’s] clear FY26 for Microsoft remains the true inflection year of AI growth as CIO lines build for deployments behind the velvet ropes in Redmond,” Ives wrote.

Dan Ives, Wedbush Securities, 30 July 2025

The business is fizzing.

It was a very strong close to what was a record fiscal year for us. All up, Microsoft Cloud surpassed $168 billion in annual revenue, up 23%.

The rate of innovation and the speed of diffusion is unlike anything we have seen. To that end, we are building the most comprehensive suite of AI products and tech stack at massive scale. And to provide more context, I want to walk up the stack, starting with Azure.

Azure surpassed $75 billion in annual revenue, up 34%, driven by growth across all workloads. We continue to lead the AI infrastructure wave and took share every quarter this year. We opened new DCs across 6 continents and now have over 400 data centers across 70 regions, more than any other cloud provider.

There is a lot of talk in the industry about building the first gigawatt and multi-gigawatt data centers. We stood up more than 2 gigawatts of new capacity over the past 12 months alone. And we continue to scale our own data center capacity faster than any other competitor.

Every Azure region is now AI-first. All of our regions can now support liquid cooling, increasing the fungibility and the flexibility of our fleet. And we are driving and riding a set of compounding S curves across silicon, systems and models to continuously improve efficiency and performance for our customers.

Satya Nadella, CEO, Microsoft, Q4 2025, 30 July 2025

The group is planning far ahead.

The next big accelerator in the cloud will be Quantum, and I’m excited about our progress. In fact, earlier this month, we announced the world’s first operational deployment of a Level 2 Quantum computer in partnership with Atom Computing. This is how we will continue to think and make investments, with decade-long arcs, while making progress every quarter.

Satya Nadella, CEO, Microsoft, Q4 2025, 30 July 2025

So many exciting things are happening.

The next layer is data, which is foundational to every AI application. Microsoft Fabric is becoming the complete data and analytics platform for the AI era, spanning everything from SQL to no-SQL, to analytics workloads. It continues to gain momentum with revenue up 55% year-over-year and over 25,000 customers. It’s the fastest-growing database product in our history.

Fabric OneLake spans all databases and clouds, including semantic models from Power BI, and therefore, it is the best source of knowledge and grounding for AI applications and context engineering.

Satya Nadella, CEO, Microsoft, Q4 2025, 30 July 2025

Wherever you look, there is excitement.

Before I wrap, I want to talk about 2 consumer businesses of ours with massive end-user reach: LinkedIn and Xbox. LinkedIn is home to 1.2 billion members with 4 consecutive years of double-digit member growth. All up, comments on LinkedIn rose over 30% and video uploads increased over 20% this year. We continue to bring AI to every part of LinkedIn experience, introducing agents across hiring as well as sales.

When it comes to Gaming, we have 500 million monthly active users across platforms and devices. We are now the top publisher on both Xbox and PlayStation this quarter with successful launches of Forza Horizon 5 and Oblivion Remastered. The Call of Duty franchise has never been stronger. 50 million people have played Black Ops 6; total hours surpassed $2 billion. Minecraft saw record monthly active usage in revenue this quarter, thanks in large part to the success of the Minecraft Movie.

And we have nearly 40 games in development, so much, much more to come. We surpassed over 500 million hours of gameplay stream via the cloud this year. And Game Pass annual revenue was nearly $5 billion for the first time.

In closing, we are going through a generational tech shift with AI, and I have never been more confident in Microsoft’s opportunity to drive long-term growth and define what the future looks like.

Satya Nadella, CEO, Microsoft, Q4 2025, 30 July 2025

When I last looked on Friday, QQQ3 was down 7.7pc. It is precisely this volatility which makes QQQ3 so perfect as an investment. Buy at intervals, whatever amount and periodicity works for you, and you will accumulate a position at an attractive entry price. And one day, the big bull I am talking about will arrive, and you will make a fortune.

Great figures, great prospects at Meta Platforms.

I will be returning to the subject of Meta Platforms in future issues. I recently added the shares to my Top 20 list about which I remain positive. I have a hunch that Meta Platforms, against some incredible competition, may be a candidate for the World’s Most Exciting Company.

Zuckerberg is young and ambitious. See what he says about META’s plans.

We had another strong quarter with more than 3.4 billion people using at least one of our apps each day and strong engagement across the board. Our business continues to perform very well, which enables us to invest heavily in our AI efforts.

Over the last few months, we’ve begun to see glimpses of our AI systems improving themselves. And the improvement is slow for now, but undeniable and developing superintelligence, which we define as AI that surpasses human intelligence in every way, we think, is now in sight. Meta’s vision is to bring personal superintelligence to everyone, so that people can direct it towards what they value in their own lives. And we believe that this has the potential to begin an exciting new era of individual empowerment.

A lot has been written about all the economic and scientific advances that superintelligence can bring, and I’m extremely optimistic about this. But I think that if history is a guide, then an even more important role will be how superintelligence empowers people to be more creative, develop culture and communities, connect with each other and lead more fulfilling lives.

To build this future, we’ve established Meta Superintelligence Labs, which includes our foundations, product and FAIR teams as well as a new lab that is focused on developing the next generation of our models. We’re making good progress towards Llama 4.1 and 4.2, and in parallel, we are also working on our next generation of models that will push the frontier in the next year or so.

We are building an elite, talent-dense team Alexandr Wang is leading the overall team, Nat Friedman is leading our AI Products and Applied Research, and Shengjia Zhao is Chief Scientist for the new effort. They are all incredibly talented leaders, and I’m excited to work closely with them and the world-class group of AI researchers and infrastructure and data engineers that we’re assembling.

I’ve spent a lot of time building this team this quarter. And the reason that so many people are excited to join is because Meta has all of the ingredients that are required to build leading models and deliver them to billions of people. The people who are joining us are going to have access to unparalleled compute as we build out several multi-gigawatt clusters. Our Prometheus cluster is coming online next year, and we think it’s going to be the world’s first gigawatt-plus cluster. We’re also building out Hyperion, which will be able to scale up to 5 gigawatts over several years, and we have multiple more titan clusters in development as well. We are making all these investments because we have conviction that superintelligence is going to improve every aspect of what we do.

Mark Zuckerberg, CEO and founder, Meta Platforms, Q2 2025, 30 July 2025

He is deadly serious about building a talent-dense team. Rumour has it that senior recruits are receiving signing-on bonuses ranging up to $100m. Bonuses at that level are not for people whose primary goal is wealth because that is a given. These are people who want to change the world and enjoy the massive scale and resources of Meta Platforms to help them do it.

The opportunity for Meta Platforms is enormous because they have the scale, they have the money, and increasingly, they will have the technology to transform our lives.

Overall, this has been a busy quarter. Strong business performance and real momentum in assembling both the talent and the compute that we need to build personal superintelligence for everyone. I am very grateful to our teams who are working hard to deliver all of this, and thanks to all of you for being on this journey with us.

Mark Zuckerberg, CEO and founder, Meta Platforms, Q2 2025, 30 July 2025

Share Recommendations

Super Micro Computer. SMCI

QQQ3. (Top 20 stock)

Microsoft. MSFT. (Top 20 stock)

Meta Platforms. META (Top 20 stock)

Strategy – Best Way To S-Cost Average

Just a quick recap. Dollar-cost averaging means investing equal dollar amounts every month, week, day, whatever to bring your average entry price well below the latest price. For most of us, with limited resources at our disposal, this means investing small amounts cost-effectively. Forward spread bets are a good way to do this because you can invest modest amounts, and dealing costs are low.

Suppose you want to start with Meta Platforms. The minimum bet on a March 2026 contract is 0.01 of a point, which is equivalent to buying one share. (1.0 point equals 100 shares, 0.1 point equals 10 shares, and 0.01 equals one share).

One share on a nine-month forward contract costs around $779, which requires a margin of around £111. It may not seem much, but if you are doing this monthly for several or many shares, it soon adds up. If the shares are well chosen, with plenty of excitement, growth, and volatility, this should prove rewarding.