It is still necessary for investors to be selective in this stock market but shares in companies that are close to the generative AI action are starting to show explosive price action and like Covid, this virus is going to spread but in a good way.

So what is generative AI, this incredible computing algorithm or whatever, born out of that Enigma machine invented so long ago by Alan Turing, which helped the good guys win the Second World War.

Generative artificial intelligence or generative AI is a type of artificial intelligence (AI) system capable of generating text, images, or other media in response to prompts.[1][2] Generative AI models learn the patterns and structure of their input training data, and then generate new data that has similar characteristics.[3][4]

Notable generative AI systems include ChatGPT (and its variant Bing Chat), a chatbot built by OpenAI using their GPT-3 and GPT-4 foundational large language models,[5] and Bard, a chatbot built by Google using their LaMDA foundation model.[6] Other generative AI models include artificial intelligence artsystems such as Stable Diffusion, Midjourney, and DALL-E.[7]

Generative AI has potential applications across a wide range of industries, including art, writing, software development, healthcare, finance, gaming, marketing, and fashion.[8][9] Investment in generative AI surged during the early 2020s, with large companies such as Microsoft, Google, and Baidu as well as numerous smaller firms developing generative AI models.[1][10][11] However, there are also concerns about the potential misuse of generative AI, such as in creating fake news or deepfakes, which can be used to deceive or manipulate people.[12]

Wikipedia

I found an even crisper definition.

A generative AI system is constructed by applying unsupervised or self-supervised machine learning to a data set.

Wikipedia

That tells you straight away how amazing this iteration of AI could be and why it is taking humanity on an uncharted journey. Many people are frightened but there is not getting of this train now that it has left the station. All we can do is make shed loads of money from the companies making it happen so when the machines do take over at least we will be on our yachts in the Med sipping champagne.

AI is going to pop up in many places to transform the investment landscape. One clue as to where those pop-ups might be will lie in investment performance and there is a surprising amount of excitement already in the US stock market where a tsunami of r&d spending is driving a wave of innovation (sorry about the double metaphor but it is so appropriate).

Not, let’s look at a few names.

Table of Contents

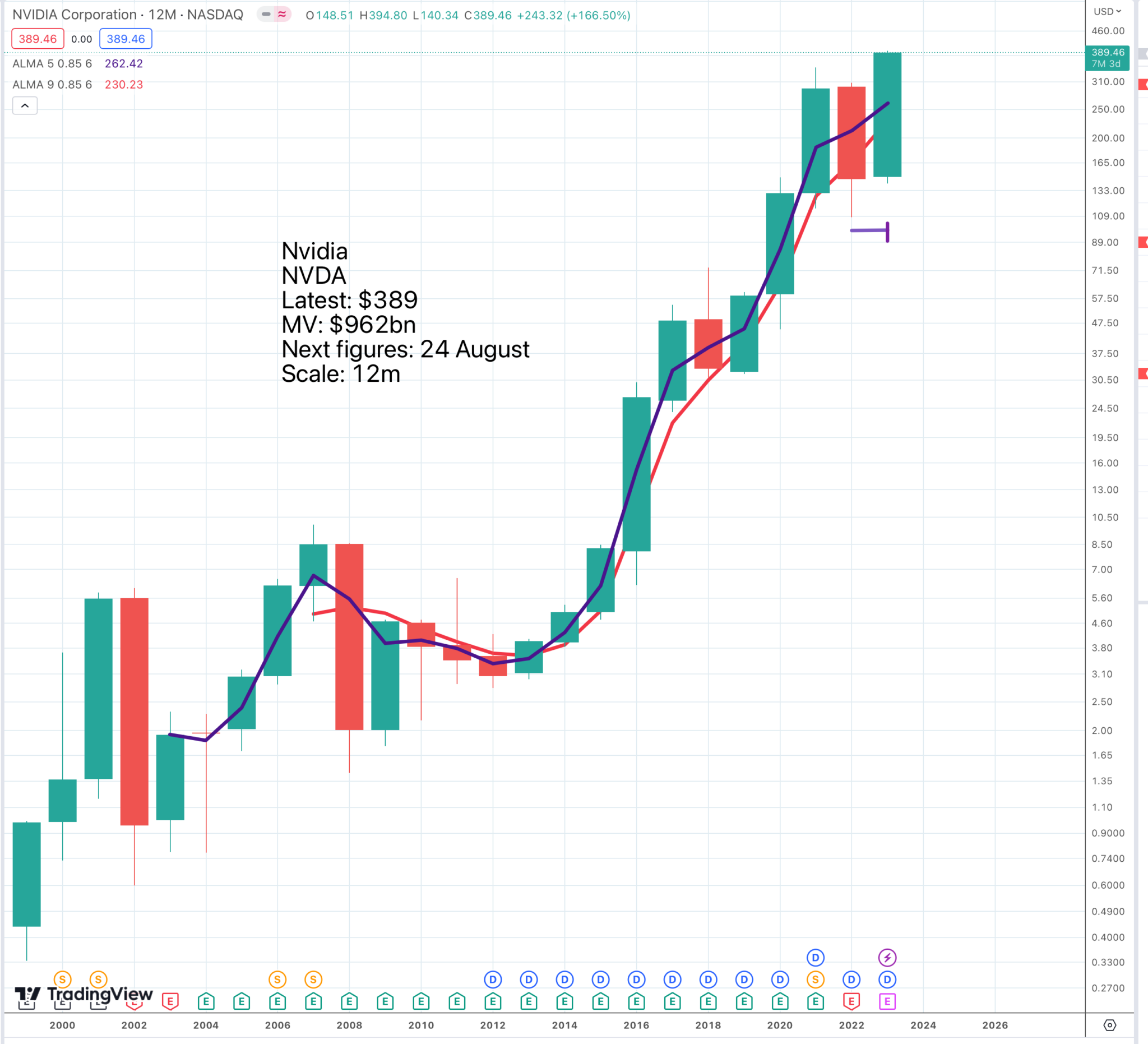

Nvidia not overcooked, just beginning

I went to Seeking Alpha to find some bears of Nvidia. I found plenty but they were all pre-earnings and as we now know the guidance that accompanied the latest quarterly reported stunned observers, blew all previous estimates out of the water and left the pre-earnings bears in considerable disarray.

That is the problem with trying to analyse shares using conventional metrics. It can be right but almost by definition if something really special is happening you will get it wrong and something really special is happening at Nvidia.

The world’s most exciting stocks are always going to be on high valuations. You want Erling Haarland in your team you are not going to get him for $10m or even $100m now, after his exploits with Manchester City, where he has been smashing goal-scoring records that have stood for decades.

It is this sort of potential I see with Nvidia. It is valued at almost $1 trillion, which, coincidentally is the value reached by Cisco Systems just before the Internet bubble burst in 2000. If you think there is a parallel by all means run for the hills like so many commentators.

But think about Jensen Huang the guy who brought this company from an idea to the current valuation. He says that Nvidia is completely geared up for accelerated computing and Generative AI and that ChatGPT marks an inflection point. Not only does he say that but the Q2 guidance was lifted from the $7.15bn expected by analysts to $11bn! The shares have not even caught up yet.

Talk about walking the talk.

And does the chart look good. I have sorted out my problems with presenting charts and you can see above that it looks amazing. Who knows where the price might go in the very short term but longer term we could see much higher levels. To me the pattern looks like a consolidation and a breakout, an explosive gap breakout, which is just what I love to see and as strong as it gets, like a volcano blowing the lid off.

A red-hot semiconductor ETF

SOXL is a leveraged ETF, which tracks the semiconductor sector. What a place to be just now. The problem is that you cannot buy this ETF on IG. I was not so worried because I already have some, bought before IG brought down the drawbridge because of some stupid regulations designed by the great and the good to protect us simple folk from our innocence and naivety. Americans, even hillbillies from the mid-West, being so much wiser, don’t need this protection.

My holding has already almost doubled in valued so I am pretty chuffed about it, especially because I think this ETF is just getting started. Incidentally a French lady I know who works in investment said, if you can’t buy these shares on IG, try Interactive Brokers, which operates the largest electronic trading platform in the US. I am going to do this. Maybe IG is not the only game in town.

There is no way of finding out what SOXL is invested in beyond the general idea that it is shares in the semiconductor sector but we can look at the unleveraged version, SOXX. It is a who’s who of the sector led by Nvidia which is almost 10pc of the fund.

This is a hell of a chart. My reading is that the latest correction in 2022, may well turn out to be a mid-term correction. If this is correct the implications for SOXX and SOXL over the next few years are mind-blowing. In the light of that potential I am interested in beefing up my holding in SOXL, because of the leverage.

However, if you do not like leverage, and many subscribers tell me that they don’t, then this ETF is a great one to buy and hold. Generative AI is like an injection of pure adrenaline into this sector.

Marvell Technology looks marvellous

This is a new share to Quentinvest, but one which offers serious excitement. The shares exploded on Friday as Wall Street began to realise the potential for AI to boost demand for the group’s chips.

Analysts say the chip maker’s components are poised to play a critical role in an AI-fueled transformation taking place across the economy. The infrastructure needed for the burgeoning technology is drastically different from what’s used currently, opening up a vast market as companies look to upgrade their hardware.

The potential was reflected in Marvell’s earnings results released Thursday, which analysts say demonstrated how the company is well-positioned to grow as the AI fervor continues.

“The AI potential has always been there, but the narrative for investors changed, and likely appropriately so,” says Ambrish Srivastava, an analyst at BMO Capital Markets, in a research note. He adds that the company’s steadier handle on gross margin and commentary on AI opportunities “ought to put the company back in the list of the potential other winners in AI.”

The revolution will take time. Marvell’s near-term outlook is slightly ahead of Wall Street’s estimates. But further out, chief executive, Matthew Murphy, said there are vast areas where the company sees AI driving demand for its chips, particularly among its cloud customers.

“Computing and AI applications has now grown to become the single largest revenue driver and opportunity for Marvell’s cloud-optimized silicon platform,” Murphy said.

AI revenue, which was about $200m in fiscal 2023, is expected to at least double in fiscal 2024 and then double again in fiscal 2025, Marvell said.

Dow Jones Newswires, 26 May 2023

This chart tells another interesting story. The shares have been tracking sideways for 20 years, since the start of the millennium, and staged a huge breakout in 2020. On this analysis, which is based on a very long term chart, 2022 was a pullback and the main uptrend has now resumed. These shares could be at the beginning of a multiyear uptrend.

The shares are overbought, not that I ever worry too much about that, and have just given a golden cross buy signal on a 3m chart.

Below is what they say they do, which is all I need to know. If you want to find out more go to their website and dig all you want but don’t forget plenty of wet towels to cool your boiling brain.

Today, Marvell optimised silicon, powers AI, cloud, carrier, automotive, and enterprise infrastructure. With a foundation built on breakthrough innovation, cutting-edge technology and deep system-level expertise, Marvell’s networking, accelerated compute, storage, and security solutions play a crucial role in enabling AI applications and driving advancements across industries.

Website

Performance is accelerating.

We are guiding revenue for the second quarter to grow to $1.33 billion at the midpoint and expect sequential revenue growth will accelerate in the second half of the fiscal year.

Q1 2024, 25 May 2023

They are seriously hyped about AI. There is a ton of stuff needed to make AI happen and they are at the heart of the process.

Given the speed at which AI infrastructure is advancing, the technology refresh rate is happening at 18 to 24 months versus four-plus years in standard infrastructure. Altogether, we expect the massive amount of connectivity in these AI clusters, increasing adoption of higher speed optical interfaces and faster refresh rates to be a major demand drivers for our PAM4 DSP platform. In fact, in our last earnings call, we indicated that the ramp in our industry leading 800-gig DSP platform was driven almost entirely by AI applications. We have also announced the industry’s first 1.6 terabit PAM4 DSP platform, doubling the throughput from the current generation.

And we expect AI to drive the initial adoption of these products as well. In addition, as inference is deployed at multiple regional data centers, these need to be connected by high-bandwidth, low-latency optical links over tens of kilometers. This technology is known as data center interconnect, or DCI, and Marvell has been a pioneer in this market. We created the industry’s first pluggable module for DCI, and we are now providing 400 gigabits per second in our latest DCI product line.

We’re already seeing that AI cloud data centers are driving a significant increase in demand for our 400ZR solution. Another demand driver for our DCI products is that the next-generation AI implementations are planning on clustering accelerators across different sites. AI is also a key growth driver of demand for switching inside the data center. Marvell has a growing position in the market for low-latency, high-capacity switches, and we are seeing strong demand for our products.

We recently announced our next-generation 51.2T Teralynx 10 Ethernet switching platform. Platform is based on the low-latency architecture we acquired from Innovium and is built on Marvell’s leading 5-nanometer technology platform. We are seeing strong interest for this product. We expect AI to lead the industry’s transition from today’s 12.8T switches to 51.2T, enabling a quadrupling in network bandwidth.

We expect 51.2T adoption will be a strong growth driver for the networking semiconductor market. Putting it all together, Marvell has built a leading position in network connectivity for AI. We expect tremendous growth for PAM4 optics, DCI, and Ethernet switching solutions fueled by the growing investment in AI. Perhaps, even more exciting is Marvell’s opportunity to address compute in AI for our Cloud-optimized silicon platform

Q1 2024, 25 May 2023

It is stories like these that are going to send investors wild with excitement. The market is on fire.

As a result, we expect Marvell’s overall AI revenue to at least double in fiscal 2024. Looking to fiscal 2025, we expect robust growth to continue from AI for network connectivity.

Layering on top of this is the growth we expect from the ramp of the cloud-optimized programs we discussed earlier in the call. In aggregate, we foresee our overall AI revenue to at least double again next year. In other words, we are forecasting an AI revenue growth CAGR over 100% over the fiscal 2023 to 2025 timeframe. In the future, we expect generative AI implementations involving video and images to provide a tailwind to overall storage and exabyte growth, both in HDD and flash.

Q1 2024, 25 May 2023

Just gets more exciting with every paragraph of the earnings report.

With AI becoming the ultimate data infrastructure application, Marvell is at the center of this incredible transformation. We are confident that we will be one of the most relied on semiconductor companies to help our customers achieve their vision.

Q1 2024, 25 May 2023

Microsoft is another of my favourite megacaps

This is another great chart with a promising consolidation built over the last two years and a golden cross (not shown) on the 3m chart.

Microsoft is a great AI play.

The world’s most advanced AI models are coming together with the world’s most universal user interface – natural language – to create a new era of computing,” said Satya Nadella, chairman and chief executive officer of Microsoft. “Across the Microsoft Cloud, we are the platform of choice to help customers get the most value out of their digital spend and innovate for this next generation of AI.”

“Focused execution by our sales teams and partners in this dynamic environment resulted in Microsoft Cloud revenue of $28.5bn, up 22pc (up 25pc in constant currency) year-over-year,” said Amy Hood, executive vice president and chief financial officer of Microsoft.

Q3, 2023, 25 April 2023

Total revenue for Microsoft was $59.2bn for Q3 2023 but if we forget about that and just think about the cloud revenue, which annualised, would be $114bn, so presumably $120bn for the year is well within reach. If we divide $120bn into $2,475bn, Microsoft’s cloud business is valued at 20.6 times sales, which is expensive but not wholly outrageous.

At current growth rates this would reach $180bn in two years dropping the EV/ sales ratio to 13.8.

Then there is net cash which could easily reach $100bn in two years time. This would drop the EV/sales multiple to 13.2 and that is before the biggest needle mover of all, which is the likelihood, given what is happening with AI and the inflection point that Nvidia’s Jensen Huang is talking about that growth at Microsoft could speed up, especially in its cloud business.

This is an amazing wild card and explains why share price targets for Nvidia are all over the place and range as high as $600. There is an interesting race going on just at the moment between Nividia and Microsoft’s share prices with the former moving ahead after its stunning Q2 guidance. The truth is that none of the analysts have a clue what could be coming in this brave new world. This brings us back to the charts which are telling us that this future could be more exciting than anyone presently imagines.

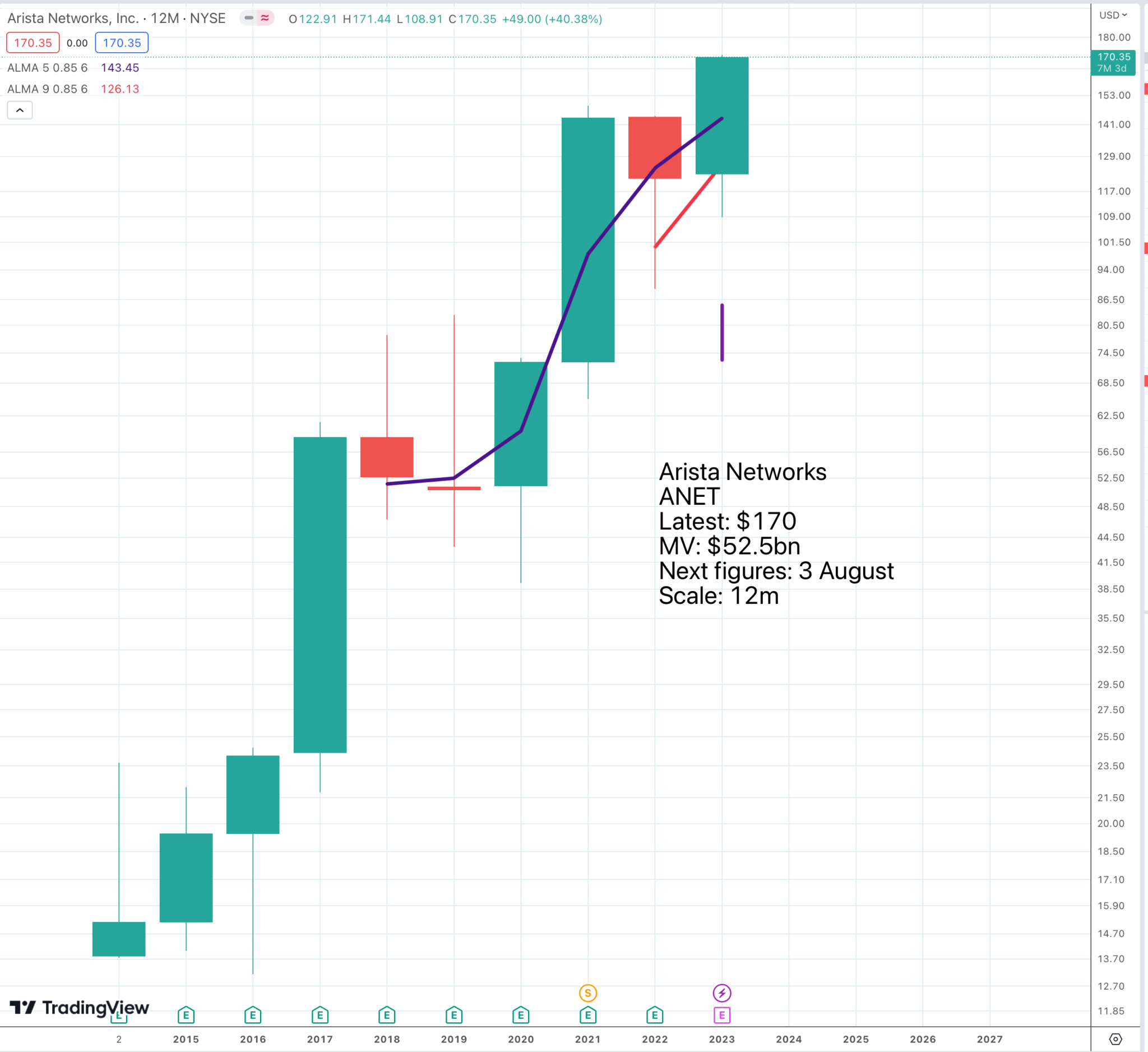

Arista Networks sits at the sharp end of the datacentre boom

The chart looks spectacular with a new chart breakout on the ultra long term chart and a golden cross on the 3m chart.

Arista has been led by Jayshree Ullal since 2008. This woman is a phenomenon and just happens to be beautiful although I know that is quite irrelevant. Part of the joy of nations though and must make it more fun for men working for Arista Networks; well, it would for me.

AI is starting to have what could be a huge impact.

I think AI is still in its infancy. I don’t think we know really how big it will be.

It’s clearly on a very good trajectory. It will keep on growing. And it is a great opportunity for us, for sure, and we’re doing very well with some of our top customers as Jayshree talked about in the primary script as well.

Q1 2023, 1 May 2023

AI is just starting to kick in at Arista Networks.

As we said, the 7800 is Arista’s flagship AI platform, and we have spent the better part of last year, maybe even the year before, Anshul, and you could correct me, doing a tremendous amount of simulation on how we work with GPU clusters and different types of network interface cards, the performance, the losses, the — you know, dealing with bursty traffic, the latency, the transactions. And we believe that this will be a critical year in seeing those trials come into production. So, we do expect AI to be meaningful this year as opposed to not material the last couple of years, and we believe the 7800 will be the flagship product for that.

Q1 2023, 1 May 2023

We can also see how power hungry AI is.

It’s a very exciting multiyear journey, and we really value our partnership with Broadcom, but what you’re seeing here is, you know, 100 gig for mainstream enterprises, 400 gigs for the cloud, and 800 gig and beyond for AI use cases.

Q1 2023, 1 May 2023

Red hot charts every where you look – Broadcom

This is an amazing chart. The price is up from $14 in 2009 to over $800 now and we have a spectacular new chart breakout. Just as an aside, I am not surprised that shares in SOXL were up 19.5pc on Friday and up 42.7pc altogether in the last two days of last week. The semiconductor sector is on fire.

This inspired me to have a look at a weekly candlestick chart of SOXL and it looks like a new breakout.

Trying to calculate targets from share price charts is going into mumbo-jumbo territory but let’s play that game anyhow. The target is calculated from the depth of the pattern. On that basis the minimum target is at least $50. That would be cool for me since my average cost for my SOXL shares is around $12 (I was lured in by a Coppock buy signal which you can just see, the purple vertical line on the chart) – woohoo!

Broadcom has grown so dramatically because it is an acquisition specialist, so growing both organically and by making well-judged purchases.

AI is already hot for Broadcom.

Keep in mind that at hyperscalers, a growing portion of our switches have been deployed within the AI networks, which are separate from the traditional x86 CPU scale outrunning existing workloads. Now, this is today.

Tomorrow, we generated AI using large-scale — large language, I should say, models with billions of parameters. We have to run thousands of AI engines in tower enabling large and synchronized bus of data at speeds of 400 and 800 gig. To support this massive processor density is critical and as important as SDAI engines. Such networks have to be lossless, low latency, and be able to scale.

So, as you know, such AI networks are already being deployed at certain hyperscalers through our Jericho 2 switches and Ramon Fabric. In fact, in 2022, we estimated our Ethernet switch shipments deployed in AI was over $200m. With the expected exponential demand from our hyperscale customers, we forecast that this could grow to well over $800m in 2023. We anticipate this trend will continue to accelerate, and mindful that we need even more higher-performance networks in the future.

We have been investing in a new generation of this lossless low-latency Ethernet fabric designed specifically to handle such data and compute-intensive AI workloads. Of course, additionally, the exciting growth prospects for generative AI are driving our compute offload accelerated business at hyperscalers. As we have indicated to you last quarter, this business achieved over $2bn in revenue in 2022. We are on track to exceed $3bn in revenue in our fiscal ’23.

Q1 2023, 2 March 2023

The numbers mentioned above may look small in relation to a market value of $339bn, but then consider how fast they are growing. At these rates of growth $3bn becomes $10bn in three years and they are taking about exponential demand from hyper scale customers.

These AI games can only be played by companies with gigantic resources which is why it plays into the hands of the mega caps.

I am beginning to realise I could go on for ever just in this semiconductor sector, which I suspect is exploding into a once-in-a-generation boom.

Let us look at another of my old favourites, which crashed and burned in 2022 but has turned around with a vengeance now.

Facebook and AI – a marriage made in heaven

Another fantastic chart and listening to Mark Zuckerberg talking about AI and the implications for his business is super exciting. He is not the most charismatic of guys but he is undoubtedly a super geek and that is what you need in today’s world and Meta Platforms/ Facebook has such an incredible footprint that AI is likely to be transformational, whatever happens to the famous Metaverse, and if that comes good too.

AI is going to be awesome for Meta Platforms, which is why the shares are exploding.

A key theme I want to discuss today is AI. I’ve emphasized for a number of these calls now that there are two major technological waves driving our roadmap — a huge AI wave today and a building metaverse wave for the future. Our AI work comes in two main areas: first, the massive recommendations and ranking infrastructure that powers all of our main products — from feeds to Reels to our ads system to our integrity systems and that we’ve been working on for many, many years — and, second, the new generative foundation models that are enabling entirely new classes of products and experiences.

Our investment in recommendations and ranking systems has driven a lot of the results that we’re seeing today across our discovery engine, Reels, and ads. Along with surfacing content from friends and family, now more than 20pc of content in your Facebook and Instagram feeds are recommended by AI from people, groups, or accounts that you don’t follow. Across all of Instagram, that’s about 40pc of the content that you see. Since we launched Reels, AI recommendations have driven a more than 24pc increase in time spent on Instagram.

Our AI work is also improving monetization. Reels monetization efficiency is up over 30pc on Instagram and over 40pc on Facebook quarter-over-quarter. Daily revenue from Advantage+ Shopping Campaigns is up 7x in the last six months.

Our work to build out business messaging as the next pillar of our business is making progress too. I shared last quarter that click-to-message ads reached a $10bn revenue run-rate. And since then, the number of businesses using our other business messaging service — paid messaging on WhatsApp — has grown by 40pc quarter-over-quarter.

Our success here depends on delivering results for other businesses, and at our scale that can have macroeconomic effects. We recently did a study with economists at UC Berkeley to understand the impact our services make, and they concluded that every dollar spent on our ads drives on average $3.31 in revenues for our advertisers in the US. So that means over $400bn in economic activity annually is linked to supply chains relying on our platforms, supporting more than 3m jobs.

Q1 2023, 26 April 2023

Meta Platforms is so full of promise with a massive innovation programme under way.

We’re seeing good momentum in our products and business. We have incredibly exciting opportunities ahead in our Family of Apps, AI and the metaverse. I’m confident that our efficiency work will improve our ability to execute on all of this.

Q1 2023, 26 April 2023

Taken altogether Meta Platforms is building a consolidation which stretches back for seven years. This could be the springboard for a massive rise.

Strategy – never underestimate the importance of the story

One of the advantages of having been investing for so long is that I have seen some incredible booms in my life. I was in Australia in the 1960s for the Aussie nickel boom where Poseidon rose 200-fold in a year and shares routinely doubled in a day.

Obviously I know all about the run up to the 2000- millennium, internet bubble and how wild and crazy that was.

I think AI could be one of those with frenzied investors chasing AI stories and values for favoured shares going ballistic. You need to be nimble in these markets but there could be an incredibly exciting period coming.

I am seeing AI-inspired breakouts all over the place and that is just what I would expect to see if a new boom is beginning. It is a time to be bold.

QQQ3 – a licence to print money

And this reminds me of my old favourite, QQQ3, which is behaving exactly as I would wish and showing every sign of being the proverbial licence to print money.

This chart shows a confirmed golden cross by the moving averages on the 3m candle stick chart. Previous signals have worked well. If this ultimately turns out to be a bull hook pattern what a money maker these shares are going to be. I know everybody, especially in the UK, things the world is going to hell in a hand cart, but that is exactly what you get in the early stages of a new bull market.

I have been watching Professor Brian Cox on the wonders of the universe and when you think what Homo Sapiens has achieved in a heartbeat on this time scale you have to believe in these guys (and girls). We may not be the good guys but that we are super-achievers cannot be doubted and in terms of technology we are just getting started.

The machines may be poised to take over but that thinking could be a bit like the Luddites in the 18th century when steam and water power were revolutionising the textile mills. Humans are amazingly resourceful and the machines are not going to beat us in a hurry. The Terminators may be coming but not in this century.

Share recommendations

Nvidia. NVDA Buy @ $388

Direxion Daily Semiconductor 3x ETF. SOXL. Buy @ $22.88

iShares Semiconductor ETF. SOXX Buy @ $489.50

Marvell Technology. MRVL. Buy @ $65.5

Microsoft MSFT Buy @ $332

Arista Networks. ANET. Buy @ $170

Broadcom AVGO. Buy @ $812

Meta Platforms. META. Buy @ $262

Wisdomtree Nasdaq 100 3x daily ETF. QQQ3. Buy @ $102.92