The Amazon share price exhibits a classic pattern of strongly performing stocks. There is a sharp run-up, a dramatic value-destroying meltdown, and then a sustained bull market begins. It happens time and time again.

One reason may be related to the corporate cycle. Companies start with a product, a service or an idea. Bringing it to market eats money, and in this period, the shares appear exciting to some and wildly overpriced to others. Initially, there is excitement, and the optimists take charge. As time passes and profits remain elusive, the value guys take the lead, and the shares are often crushed to levels where the company appears almost valueless.

Behind the scenes, the company carries on doing its thing, bloodied but unbowed, and optimism returns. This applies to companies that are successful. In the dot-com boom, most companies didn’t succeed and never emerged from the rubbish stage of the cycle. The difference now is that the technology boom is an established phenomenon, and the venture capital companies have become smarter. There are many successful companies, and that is driving a more durable bull market.

Even so, the cycle still happens and shares in many companies boom, bust and boom again. The classic example from the 1990s boom was Amazon, which boomed, busted, with the shares falling from a peak $5.60 to 27 cents and then entered a sustained bull market, which has taken them to around $220.

The ‘rubbish theory of value’ (RTOV) was developed after WW2, when a columnist in Encounter magazine was working on building on sites and noticed that Georgian houses in Islington, which had dropped to value levels where you could hardly give them away, were becoming much sought after. They now change hands for prices in the sterling millions.

I remember from my youth the same phenomenon with all things Victorian, which were regarded as rubbish. The architects whom King Charles described as doing more damage to London than the bombs rushed around pulling down glorious Victorian structures and replacing them with identikit glass boxes. I lived in a much sought-after Kensington neighbourhood full of beautiful houses that change hands for £20m or more, yet down the end of my street is a building of zero architectural merit.

It was the product of a left-wing idea of seeding upmarket neighbourhoods with totally crap buildings to make it feel more egalitarian. Let the nobs rub shoulders with the proles. But it was worse than that. The earnest, bearded idiots who designed these buildings actually liked them.

Mansion flats like the one I live in also went through a period of being treated with disdain, though they are much sought after now for their build quality, large windows, single-floor convenience, spaciousness and wealth of Victorian detailing.

Georgian houses were not notable for build quality, but their beauty and location are such that it is worthwhile for buyers to fix their problems. I am not a huge fan of London Georgian houses because the rooms tend to be small and boxy, but even that can be fixed, at least to some extent. Like Georgian houses, Victorian houses and flats in London are much sought after.

New-build property has improved massively since the Thatcherite 1980s, as people were again allowed to be rich, but for most people, anything remotely central and newly built tends to be insanely expensive. They all tend to be apartments and prices can range up to the 10s of millions of pounds. A rare newly-built house around the corner from me was being offered for £44 million. Whole neighbourhoods in Newcastle would cost less, but so far, nobody wants them. People have learned that it is quality, not quantity, that counts.

The problem with RTOV shares is that much of their perceived value lies in a distant future. This makes them easy to attack on the basis of their fragile present-day achievements, but also appealing to investors who like an exciting story. Share prices react to which investor group is in charge, driving wide gyrations in value.

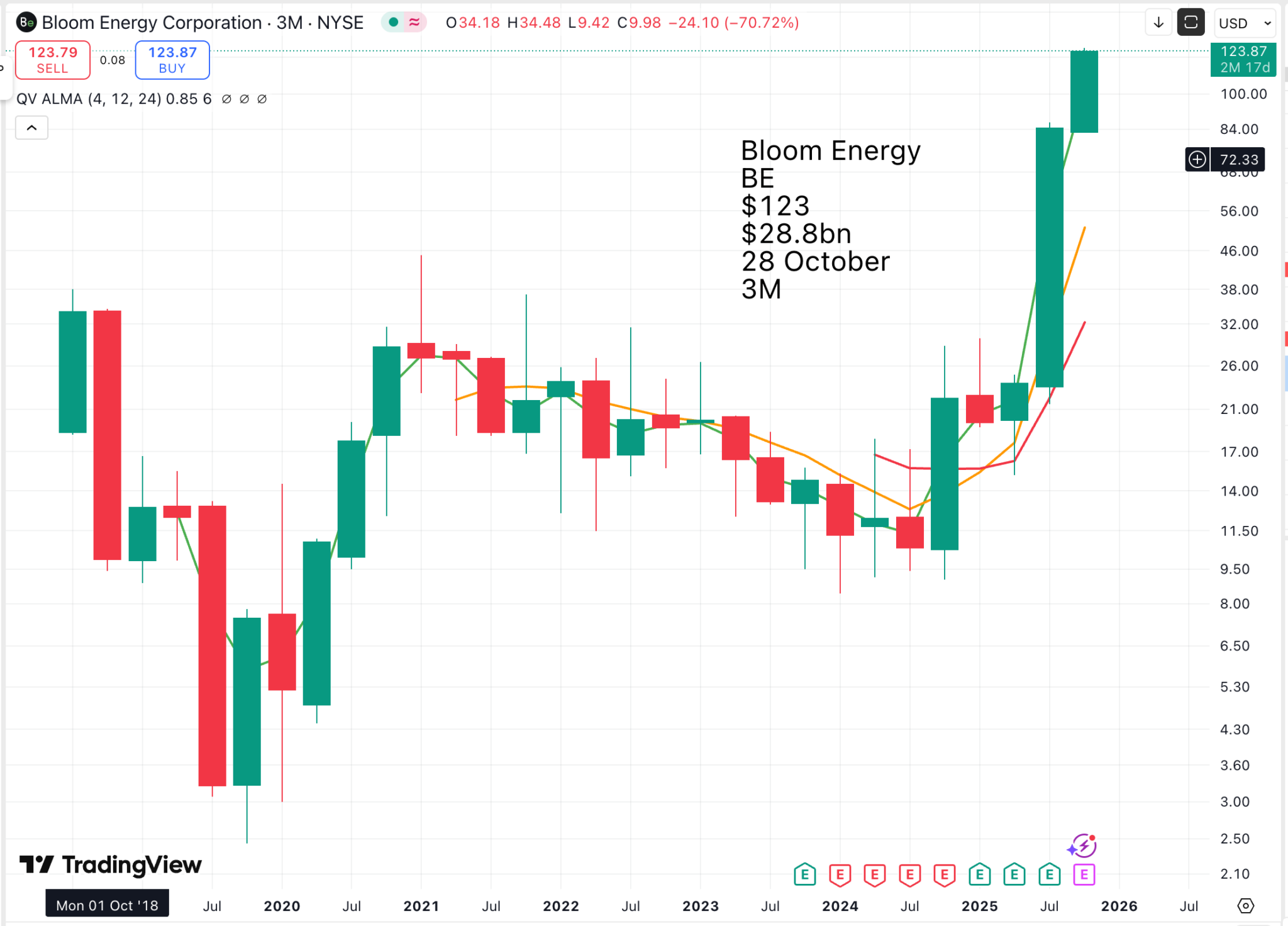

A classic RTOV stock is clean energy provider Bloom Energy, regraded by value investors as ludicrously overpriced.

Zacks had this to say about Bloom Energy.

How the AI boom is shaping the future of renewable energy, can be understood from the example of Bloom Energy‘s (BE) stock. The BE stock jumped 26.5% Oct. 13, 2025, thanks to a deal with Brookfield to put fuel cells in AI data centers, as quoted on CNBC. The BE stock surged about 29.4% over the past five days.

Bloom has already placed hundreds of megawatts of fuel cells through deals with utilities, including American Electric Power and data center developers such as Equinix and Oracle, according to the company, as quoted on the same CNBC article.

[A fuel cell is a device that converts chemical energy into electrical energy through an electrochemical reaction, producing electricity, heat, and water. Unlike a battery, it doesn’t run out of power as long as fuel and oxygen are supplied. Fuel cells are used in applications ranging from spacecraft and vehicles to stationary power generation. Bloom Energy fuel cells work by converting fuel into electricity through a non-combustion electrochemical process. Fuel (like natural gas or hydrogen) is sent to the anode side, where it’s stripped of electrons to form hydrogen ions. These ions move through a solid ceramic electrolyte to the cathode, where they combine with oxygen from the air to produce electricity, water, and heat. The displaced electrons travel through an external circuit, creating an electric current. ]

Zacks, 15 October 2025

Below is a description of what they do.

Bloom Energy empowers businesses and communities to responsibly take charge of their energy. The company’s leading solid oxide platform for distributed generation of electricity and hydrogen is changing the future of energy. Fortune 100 companies around the world turn to Bloom Energy as a trusted partner to deliver lower carbon energy today and a net-zero future.

Bloom Energy website

Below is a recent deal which added fuel to the share price.

Bloom Energy (NYSE: BE), a global leader in power solutions, and Brookfield today announced a $5 billion strategic partnership to implement a reimagined future for AI infrastructure. This partnership marks the first phase of a joint vision to build AI factories capable of meeting the growing compute and power demands of artificial intelligence.

AI factories require infrastructure that tightly integrates compute, power, data center architecture, and capital. Bloom Energy’s fuel cells deliver reliable, scalable and clean onsite power that can be rapidly deployed without legacy grids. Brookfield brings world-class expertise in infrastructure development and financing. Together, the two companies are redefining how AI factories are built and powered.

At the center of the new partnership, Brookfield will invest up to $5 billion to deploy Bloom’s advanced fuel cell technology. The two companies are actively collaborating on the design and delivery of AI factories globally, including a site in Europe that will be announced before the end of the year.

“AI infrastructure must be built like a factory—with purpose, speed, and scale,” said KR Sridhar, Founder, Chairman and CEO of Bloom Energy. “Unlike traditional factories, AI factories demand massive power, rapid deployment and real-time load responsiveness that legacy grids cannot support. The lean AI factory is achieved with power, infrastructure, and compute designed in sync from day one. That principle guides our collaboration with Brookfield to reimagine the data center of the future. Together, we are creating a new blueprint for powering AI at scale.”

“Behind-the-meter power solutions are essential to closing the grid gap for AI factories,” said Sikander Rashid, Global Head of AI Infrastructure at Brookfield. “Bloom’s advanced fuel cell technology gives us the unique capability to design and construct modern AI factories with a holistic and innovative approach to power needs. As the world’s largest AI infrastructure investor, this partnership adds a powerful new tool to our global growth strategy, especially in a grid-constrained market environment.”

Over the next decade, foundational models and generative AI are expected to drive ongoing demand for power. According to experts, power demand from AI data centers in the United States is expected to grow exponentially and surpass 100 gigawatts by 2035. Fuel cells have become a key solution for this issue and the partnership between Bloom Energy and Brookfield is designed to address this supply gap.

Bloom Energy has already deployed hundreds of megawatts of its fuel cell technology to data centers, powering some of the world’s most critical digital infrastructure through partnerships with American Electric Power (AEP), Equinix, and Oracle.

This partnership will form Brookfield’s first investment in its dedicated AI Infrastructure strategy focused on investing in large AI factories, power solutions, compute infrastructure, and strategic capital partnerships. The strategy builds on Brookfield’s track record of over $100 billion invested in digital infrastructure globally.

Brookfield has over $550 billion of critical assets and services operating across the U.S. Today’s announcement follows recent investments in leading U.S. energy, utility and digital infrastructure businesses including Compass Datacenters, Duke Energy Florida, Colonial Enterprises and Hotwire Communications, as well as a landmark agreement to supply Google with up to 3GW of hydro power in the U.S.

Bloom Energy, 13 October 2025

The company insists that it has passed a key inflexion point in demand for its services, an assertion that receives strong support from the explosive chart breakout.

Bloom had an excellent quarter, the highest revenue and most profitable second quarter in our 24-year history. When the company was founded and again, in our IPO prospectus 7 years ago, we painted a bold vision to become the power provider of choice for the digital world.

Over the last couple of calls, I’ve told you that our business is at an inflection point as demand for clean, reliable and rapidly deployable power is surging. Now there is tangible evidence. Six months ago, we announced a strategic partnership with a major U.S. utility company, American Electric Power. Yesterday, AEP announced that Amazon Web Services and Coralogix, both data center operators, are deploying Bloom systems in Ohio.

AEP’s CEO, Bill Fehrman, noted that demand for power is, “Growing at a pace I haven’t seen in my 45-year career.” But he notes interconnection agreements take 5 to 7 years in many U.S. states, even for AEP, the largest owner of electric transmission systems in the U.S. To avoid such a long delay, Bill also added that AEP is giving its customers solutions so they can come online quicker. Fuel cells will get AWS and Coralogix up and running quickly. Indeed, AI companies need power at AI speed, waiting 5 to 7 years is untenable and Bloom moves at AI speed.

Just last week, for instance, we announced our partnership with Oracle to power their AI data centers. We have committed to having power available to their first data center in 90 days. Time to power is one of many value propositions Bloom brings. We are also cleaner, more reliable and more cost effective than alternatives. Because our power systems are designed and purpose-built for data centers and other mission-critical applications, our installations do not require the band-aids that turbines and engines need to power data centers.

For example, we don’t need multiple AC to DC converters or specialized equipment to suppress harmonics. Eliminating these band-aids enable data centers to lower costs, increase reliability and reduce carbon footprint. We are excited to collaborate directly with Oracle to help them leverage all of the benefits the Bloom platform provides. The result, Oracle can optimize the watts-to-flops ratio, resulting in increased revenue growth and margins.

Commercial and industrial customers are also increasingly valuing the velocity with which we operate. Quanta Computer, for instance, builds the AI servers that are used in the AI data centers. Their demand growth is highly correlated with AI data center demand growth.

K. R. Sridhar, CEO and co-founder, Bloom Energy, Q2 2025, 31 July 2025

The company is confident of an exciting future in a world desperate for easily accessible clean energy.

Bloom is in a strong place. In the 12 years since we began shipping product, we have generated over 40 terawatt hours of electricity. We have deployed more than 22,000 energy servers, our power generators, totaling well over 1 million fuel cell stacks. Each of those 1 million-plus fuel cell stacks has a unique digital twin. And over our history, we have collected over 4.5 trillion data points from the field.

Now thanks to AI, we are unlocking new ways to improve our performance, reduce costs and deliver more value to our customers. We are operating at scale and are scaling with purpose. Now our robust product has robust demand. We will double our factory capacity from 1 gigawatt a year now to 2 gigawatts a year by the end of next year. Our mission has never felt more urgent, and we are ready.

K. R. Sridhar, CEO and co-founder, Bloom Energy, Q2 2025, 31 July 2025

Bloom Energy looks like a company whose time has come.

Our fuel cell solution was built for this moment when on-site, scalable, reliable, low following power is required in a matter of months. We are well-positioned to meet the moment.

Maciej Kurzymski, CFO, Bloom Energy, Q2 2025, 31 July 2025

Share Recommendations

Bloom Energy. BE

Strategy – Adapt Your Portfolio For A Durable AI Boom

Sometimes amazing things happen. The Generative AI boom is one of them, rewriting the industrial landscape of America and the world in ways at least as profound as the railway boom, which had many consequences only dimly understood at the time.

The world is not only spending on an epic scale to boost its computing power, but it is consuming vast quantities of energy to power those data centres, energy that ideally will not exacerbate the problems associated with more carbon in the atmosphere and accelerating climate change.

Bloom Energy is such a company, so it is hardly surprising that the shares look expensive as it is adapting to such explosively growing demand.

I have decided to add the shares to my Top 30, which, as a result, becomes a Top 40. The portfolio is becoming higher risk, but this is an inevitable consequence of rebalancing it to look forward in a fast-changing world. New companies are emerging into the spotlight all the time, and we need to acknowledge that in our portfolio strategies.

My attitude to risk is that the best way to manage it is to embrace it. The greater risk is to stick with the safe old names of the past.

At the heart of the AI revolution are a handful of giant companies, the Tech Titans, but being dragged along in their slipstreams and essential to their success are a growing host of smaller companies. It is an exciting time. There will be mistakes, duds, companies that do not live up to their initial promise, but hopefully the winners will far exceed the losers both in number and in the scale of their gains.

Bloom Energy is a good example with technology which is playing an increasingly key role in the GAI (generative artificial intelligence), data centre boom.

Bloom Energy is ideally placed to benefit in this changing environment.

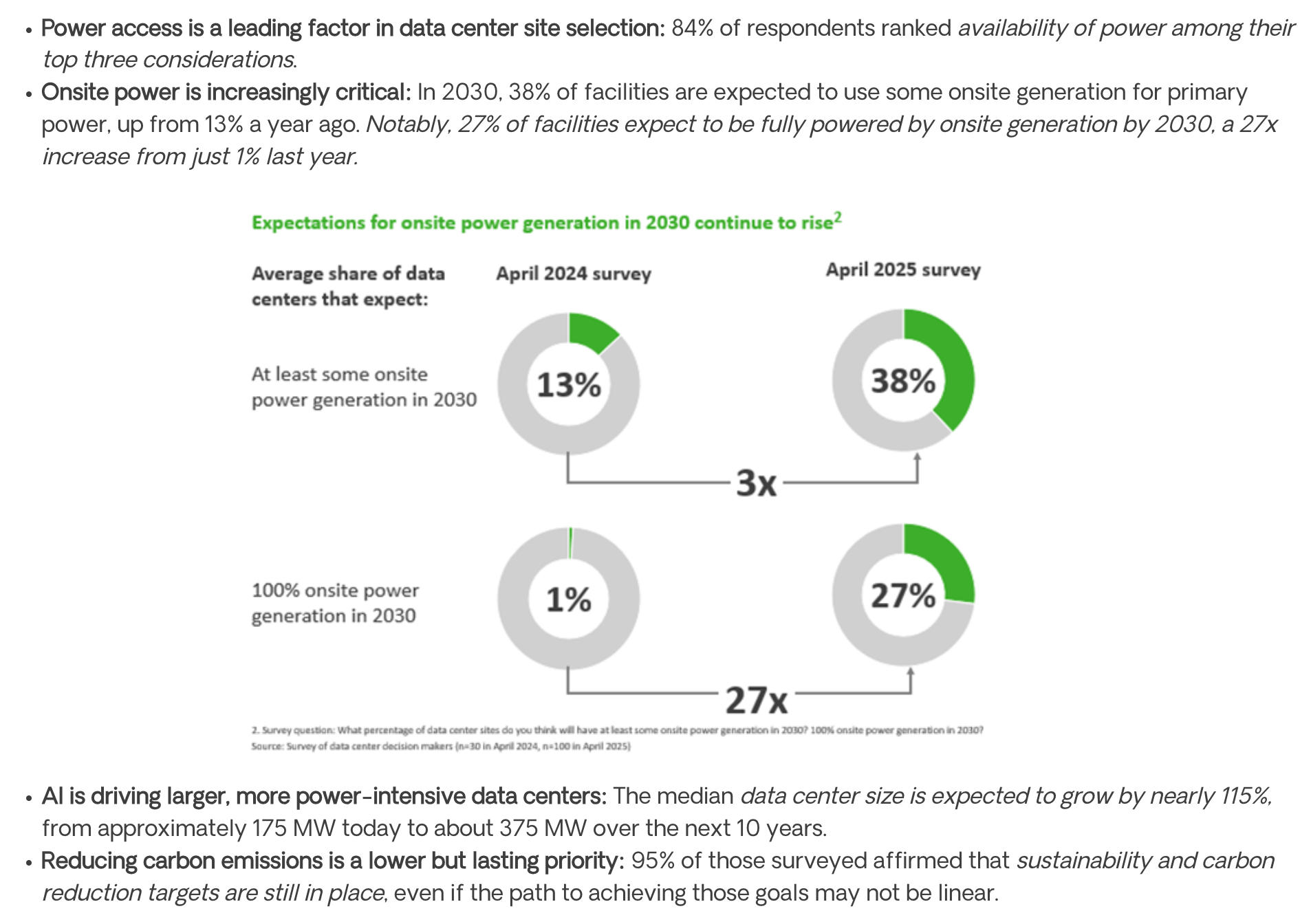

“Decisions around where data centers get built have shifted dramatically over the last six months, with access to power now playing the most significant role in location scouting,” said Aman Joshi, Bloom Energy’s Chief Commercial Officer. “The grid can’t keep pace with AI demands, so the industry is taking control with onsite power generation. When you control your power, you control your timeline, and immediate access to energy is what separates viable projects from stalled ones.”

According to the survey, operators are looking beyond legacy power generation to solutions that offer fast deployment timelines, low emissions, and the ability to handle intense and fluctuating AI workloads, all while meeting the industry’s uncompromising reliability standards and cost requirements.

The latest report is based on data collected from April 2024 to April 2025, which surveyed approximately 100 decision-makers across the entire data center power ecosystem, reflecting perspectives from hyperscalers, colocation developers, utilities, and GPU service providers.

Aman Joshi, chief commercial officer, Bloom Energy, 17 June 2025

In the same way as demand for massively increased computing power is driving a reinvention of the technology infrastructure across the world, the need for more and cleaner energy is driving a reinvention of the energy infrastructure.

Bloom Energy recently appointed Aaron Hoover, formerly co-head of global energy investment banking at Morgan Stanley, to lead business and corporate development. This is what CEO, Sridhar and Hoover said about the appointment.

KR Sridhar, Founder, Chairman, and CEO of Bloom Energy, said:

“In a digital world where electricity abundance is a necessity, we see real opportunity to partner with the broader gas ecosystem to convert their molecules to reliable, clean power at AI speed and scale. Additionally, we are moving toward a future that demands not only the clean and reliable electricity we provide today, but also a near-zero emission power option. This decarbonization can only occur in the midterm with carbon capture and sequestration. While Bloom has an ideal platform for carbon capture at scale, sequestration can only be achieved through deep collaboration with the natural gas sector. Aaron joins Bloom at a pivotal moment in the global energy transition. His expertise, energy relationships and vision for evolving markets will help us scale our impact, and deliver clean, reliable energy where and when it’s needed. I’m thrilled to welcome Aaron to our leadership team.”

Aaron Hoover added:

“I’m deeply honored to join Bloom Energy and partner with KR, its world-renowned board, and the entire team at such a pivotal moment in the company’s journey. The energy sector is undergoing a profound transformation, and Bloom’s technology is well positioned to meet the urgent demand for clean, reliable, and scalable power solutions. I look forward to helping accelerate Bloom’s growth, forge lasting partnerships, and contribute to its leadership in the energy transition. As Bloom strives to become the world’s most meaningful energy company, I’m excited to leverage my expertise and relationships to help evaluate partnerships that are aligned with the company’s growth strategy.”

Bloom Energy news release, 21 August 2025