QV round-up – shares to buy from the portfolio plus some newcomers

As I write this shares are heading lower. The Nasdaq Technology index is down 625 points (7.28pc) from its recent highs. I don’t pretend to know what the next few days hold. I don’t suppose any of you do either. What I pin my hat to is what I believe we can expect for the next few years, which is rising share prices, underpinned by the many positives in the global economy – digital transformation, low interest rates, an explosive increase in the spending power of the Chinese middle class and many opportunities for companies to deliver sustained strong growth.

QV is a buy and hold strategy. I recommend shares to buy and re-recommend them again and again if they continue to exhibit the growth, progress and 3G characteristics for which I am looking. I very rarely recommend selling and by the time I do, if I do, it is usually obvious that a company has problems and the shares are no longer 3G.

Sometimes, fortunately rarely, companies lose the plot completely. There is often some kind of fraud involved when this happens. This is why if a share is heading down in a sustained fashion I would always suggest selling and moving on. There is never any point in staying loyal to a dud. Since the shares will always remain in the QV portfolio, reminding me how badly they disappointed, I will also notice signs of recovery. If these seem strong enough I will recommend the shares at lower levels. This works surprisingly frequently but rarely happens with shares that have really crashed and burned.

Happily, so far at least, the vast majority of companies added to the QV portfolio, are performing as expected or better and delivering the sustained growth and rising share prices for which I am looking.

Periodically I go through the table of recommendations. I can tell a lot about what is happening from the share price performance. I am not a great technical analyst in the sense of pouring over a chart trying to read some message in the tea leaves. Mainly, what I am looking for, is a strong share price. I already know the fundamentals are impressive; that is why shares are in the table.

If a company and a share is going to climb to the stars the company will perform brilliantly and the shares will spend most of the time rising. sometimes very strongly. I am never put off by a share price which has already risen steeply. As the years pass it is amazing (a) how big a successful business can become and (b) how far a share can climb.

Microsoft was floated in 1986 at a price, adjusted for subsequent share splits, of nine cents. At a current price around $243 [now $233] it has climbed 2,700 times since then. Yes, Microsoft is one of the all time great equity stories but it was recommended very early in that climb in Quantum Leap, the predecessor to Great Stocks by Quentinvest, is in the current QV for Shares portfolio and is recommended again below after reporting another exciting set of results.

Microsoft is a good example of what great companies can do. Its first great run was triggered by its near monopoly of providing the operating and applications software for the desk top revolution. It then struggled for a while as the world moved on, desktops became less central to our lives as smart phones became ubiquitous and software was sold on subscription from what has come to be known as the cloud – the millions of computer servers powering the data centres on which this story is stored.

Microsoft saw the way the world was changing and in 2014, under the leadership of newly appointed CEO, Satya Nadella, the company changed direction and has adapted brilliantly to the new environment. No surprise that prior to his appointment Nadella was running Microsoft’s cloud and enterprise division.

I sometimes refer to the Quentinvest approach as a win in the end strategy. If you buy a reasonable cross-section of the shares I add to the portfolio, there will be some bumpy periods but faith and patience will pay great rewards eventually.

I have proved over the years that I am good at selecting shares that go on to perform very strongly. This is the key to why QV for Shares delivers such amazing results. People usually like but are sometimes astonished by my relentless optimism but it is obvious from even a cursory examination of long term charts like the S&P 500 or the Nasdaq 100 that it pays to be an optimist to win in the stock market and most likely in business too.

I have never met a successful company founder who was not super- positive. Pessimists are daunted by the obstacles ahead and mostly don’t even make the attempt to launch a new business. This is probably why when reading the comments of the CEOs of the companies, which I feature in QV, they are always totally confident that world conquest is only a matter of time.

What is really amazing is how often they are right.

Two behemoths on the move

Alphabet. GOOGL. Buy @ $2083 MV: $1389bn. Next figures: 28 April. Times recommended: 15. First recommended: $985.19 Last recommended: $1919

Microsoft. MSFT. Buy @ $234.5. MV: $1759bn. Next figures: 29 April Times recommended: 17. First recommended: $75.56. Last recommended: $236

Note that when I talk about times recommended and first recommended above this only refers to the period since the summer of 2017, when Quentinvest for Shares was launched. If I look back at the table for Quantum Leap, now Great Stocks for Quentinvest, this goes back to 2009, when Alphabet was recommended at $288.50. Microsoft was recommended at $52.5 in 2015. I no longer maintain the records before that but there will be recommendations at lower prices for both stocks, much lower prices in the case of Microsoft. I also remember recommending Alphabet, then Google, as a buy in opening dealings, when the price was $48 adjusted for one subsequent share split.

Chinese e-commerce stocks boosted by surging consumer spending

BiliBili. BILI. Buy @ $127.1. MV: $33.8bn. Next figures: 24 February Times recommended: 5. First recommended; $62.50. Last recommended: $122

Futu Holdings FUTU. Buy @ $$163 MV: $11.7bn. Next figures: 24 March. Times recommended: 6. First recommended: $29.40. Last recommended: $117

Meituan 3690. Buy @ HK$370 MV: HKS2342bn/ US$302bn. Next figures: 3 May. Times recommended: 6 First recommended: HK$223. Last recommended: HK$414.

Netease. NTES. Buy @ $117.5 MV: $81.2bn. Next figures: 25 February. Times recommended: 3. First recommended: $86. Last recommended: $124

Nio. NIO. Buy @ $51.25. MV: $65.5bn. Next figures: 9 March. Times recommended: 5. First recommended: $11.50. Last recommended: $48.30

Pinduoduo. PDD. Buy @ $179. MV: $165bn. Next figures: 17 March. Times recommended: 10. First recommended; $49.57. Last recommended: $185

Sea Limited. SE. Buy @ $245. MV: $90.8bn. Next figures: 2 March. Times recommended: 8 First recommended: $79.80. Last recommended: $233

Chinese Internet-related shares are among the strongest in the world right now. I believe this is soundly based. Consumer spending in mainland China is surging. By 2030, China’s private consumption is set to reach $12.7 trillion, about the same amount that American consumers currently spend. That figure is up from Morgan Stanley’s forecast three years ago of $9.7 trillion, and the $5.6 trillion Chinese consumers spent in 2019.

Part of what makes this such an opportunity for Chinese companies is that it is hard for outsiders to sell into a country protected by cultural factors and an authoritarian government, which is wary of outside influences.

Another factor is that the whole Chinese economy is like a gigantic start-up. The vast infrastructure supporting consumer spending, retail chains, traditional banks and much else, built over many decades in developed countries, doesn’t exist in China. This is creating the conditions for companies launched in the Internet era to grow explosively and become giant businesses almost overnight.

It is a potent combination and explains how businesses like Meituan and Pinduoduo can be on course for 2022 sales of 240bn renminbi (US$37.2bn) and 111bn renminbi (US$17.2bn) despite only being founded in 2010 and 2015 respectively. PDD has 731m active consumers and has been described as the fastest growing technology company in the world. Meituan is the world’s largest food delivery business with over 290m monthly active users and has been described as the world’s most innovative company. The growth being delivered by some of these Chinese businesses may be unprecedented in the history of capitalism. It is no wonder their share prices have been strong, albeit with gains like these there is likely to be considerable volatility.

Subscribers will know that Sea Limited is a South East Asian operation, which doesn’t operate in China but I have included them in this group of Asian-focused stocks.

Global consumer brands look to China and a global recovery in spending

Boston Beer SAM. Buy @ $1,080. MV: $12.7bn. Next figures: 28 April. Times recommended: 4 First recommended: $554 Last recommended: $1,062

Estee Lauder. EL Buy @ $294 MV: $106bn. Next figures: 3 May. Times recommended: 7 First recommended: $150 Last recommended: $256

Hermes International. RMS. Buy @ €940. MV: €99.5bn. Next figures: 30 July. Times recommended: 9 First recommended: €523 Last recommended: €891

Estee Lauder operates a family of global beauty products brands. Hermes is arguably the world’s greatest luxury goods brand up against Louis Vuitton of LVMH (also in the QV portfolio but recently recommended at close to the current price) and Chanel, a private company, which it is thought would be worth €100bn in an IPO.

Recent results from Estee Lauder for Q2 showed a 12 point positive swing in sales from a nine per cent decline in Q1 to a three per cent rise in Q2. The importance of the Asian consumer is indicated by the comment – “Among the regions, Asia Pacific delivered the strongest sequential improvement, with sales growth accelerating from 7pc to 27pc. Mainland China, prospered, while Korea and several smaller markets contributed organically. In Mainland China, momentum in brick-and-mortar carried into the quarter, with sales again growing double digit.”

Online is also booming. “We nearly doubled our rate of online investments, including accelerating our consumer-facing investment like Virtual Try-On, social selling, omnichannel or loyalty programs. We’re also increasing our investment in our digital infrastructure and fulfillment network to meet the much higher traffic and demand.”

Asia is also important to Hermes as they noted when returning to growth in Q3 2020. “Asia excluding Japan (+4pc) pursued its very favourable dynamic, driven by an excellent third quarter up 29pc. It benefited from the remarkable performance of Mainland China, Korea, Australia and Thailand. Activity in Hong Kong and Singapore improved. Online sales are growing strongly and benefit from the new digital platform, deployed this year in Hong Kong, Macao and Korea. In China, the Dalian store was expanded and renovated in September.”

While Estee Lauder and Hermes have similar stories to tell the position at Boston Beer is completely different. The shares have been staggering performers in the new millennium, up from $6.65 in 1998. The original charge was driven by a huge shift to craft beers, where Boston Beer is the US market leader. A more recent growth surge is based on a boom in innovative new drinks like alcoholic iced tea.

“We achieved depletions growth [a proxy for sales growth] of 26pc in the fourth quarter and 37pc for the full year. We remain positive about the future growth of our diversified brand portfolio and we believe that our depletions growth is attributable to our key innovations, the quality of our products and our strong brand. We see significant distribution and volume growth opportunities in 2021 for our Truly, Twisted Tea and Dogfish Head brands which remain our top priorities for 2021.”

The company describes Twisted Tea as follows “Half & Half is real iced tea with lemonade flavor that’s blended with smooth, triple-filtered alcohol, resulting in an authentic Southern-style iced tea taste. The perfectly balanced blend of alcohol, tea and fresh lemon flavour create a refreshing, smooth beverage that’s just a little twisted.”

Cryptocurrencies – Litecoin joins the party

Litecoin. Buy @ $200. Times recommended: 3. First recommended: $160. Last recommended: $163. Lowest recommended: $101

Silvergate Capital Corporation. SI. Buy @ $140. MV: $2.4bn. Next figures: 5 May. Times recommended: 2. First recommended: $126.50 Last recommended: $143.50

I don’t go too much into fundamentals with cryptocurrencies because you can become lost in a myriad details that don’t tell you much about likely price trends. “Litecoin is a peer-to-peer cryptocurrency and open-source software project released under the MIT/X11 license. Litecoin was an early bitcoin spinoff or altcoin, starting in October 2011. In technical details, Litecoin is nearly identical to Bitcoin.” One difference is that the supply ceiling on litecoin is four times that of bitcoin. About three quarters are already in circulation and litecoin is one of the more highly capitalised cryptocurrencies, which is why I recommended them in the first place. I alert on buy signals and we have another one now. Could the litecoin price go massively higher? I have no idea but it seems that in the world of cryptocurrencies anything is possible. Apparently the not entirely tongue in cheek answer to why litecoin is so much cheaper than bitcoin is fewer investors.

I have included Silvergate in the cryptocurrency section because its fortunes are so closely linked to that of the cryptos that it is like a cryptocurrency.

Dating apps – Match and Bumble

Bumble BMBL. Buy @ $68.5. MV: $12.4bn Next figures: not yet available but company has a 31 December year end. New entry

Match MTCH. Buy @ $160.5. MV: $41.9bn. Next figures: 11 May. Times recommended: 4. First recommended: $99.50. Last recommended: $144

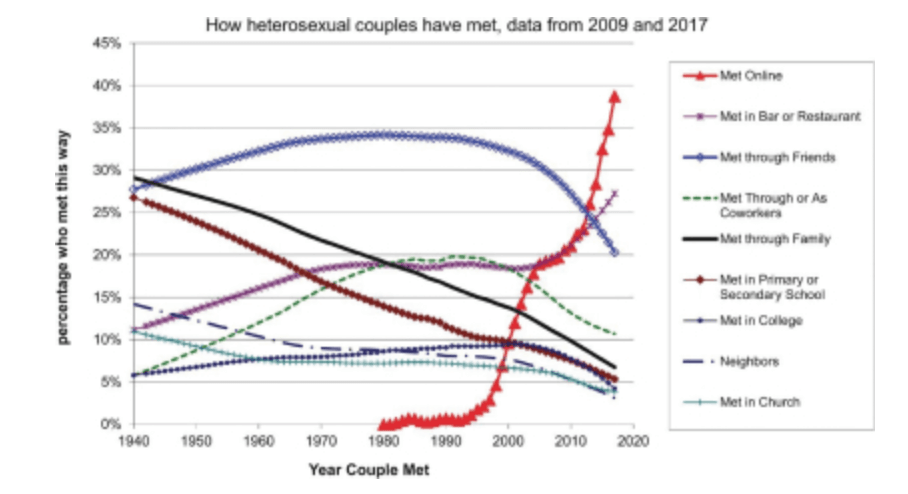

The argument for both these shares is that as the world increasingly engages online that is how couples are going to meet. There is a chart in the Bumble IPO document, which illustrates what is happening and which would look even more dramatic if updated for a post Covid world. As you can see meetings online are soaring, while all other ways of meeting are in freefall.

This is a background which creates a powerful following wind for companies facilitating online meeting of which Match and Bumble are two leaders. Match is much bigger and best known for Tinder but has other platforms. Bumble focuses on empowering women and making it easier for them to initiate meeting potential partners.

This is what Bumble says about itself. “The Bumble app, launched in 2014, is one of the first dating apps built with women at the centre. On Bumble, women make the first move, and have done so more than 1.7bn times from September 2014 to September 2020. Bumble is the second highest grossing dating app in the world according to Sensor Tower, with 12.3m monthly active users (“MAUs”) as of September 30, 2020. Bumble is a leader in the online dating sector across several countries, including the United States, United Kingdom, Australia and Canada. We believe that because women feel more confident and empowered on our platform, they are more engaged than on other dating apps. For example, the Bumble app experienced approximately 30pc growth in the number of messages sent by women from the three months ended March 30, 2019 to the three months ended September 30, 2020.”

Match is also in good shape. “Q4 saw our fastest top line growth of the year, 19pc year-over-year, a one point acceleration from Q3 levels. Tinder grew direct revenue 13pc and the non-Tinder businesses continued to accelerate, with direct revenue up 28pc year-over-year. All major non-Tinder brands contributed year-over-year direct revenue growth in Q4. This was the third consecutive quarter of non-Tinder brands showing growth in aggregate. Pairs, as well as our newer brands, Hinge, Chispa, BLK and PlentyOfFish live streaming, all grew rapidly in the quarter. We believe Q4 results would have been even better had COVID lockdowns not sent so many people back inside their homes and colder weather limited people’s activities in many parts of the globe. The growth in Q4 was very balanced by geography, with each of North America and international contributing 19pc year-over-year direct revenue growth.”

Enterprise software companies are the key drivers of digital transformation

Anaplan PLAN Buy @ $79. MV: $11.0bn Next figures: 25 February. Times recommended: 5 First recommended: $52. Last recommended: $74.80. Lowest recommended: $40.40

Atlassian. TEAM. Buy @ $240. MV: $60.4bn. Next figures: 6 May Times recommended: 12 First recommended: $110. Last recommended: $248.50

Bill.com. BILLBuy @ $169. MV: $14.1bn. Next figures: 6 May. Times recommended: 9. First recommended: $37. Last recommended: $140

Crowdstrike CRWD Buy @ $216 MV: $48.3. Next figures: 16 March. Times recommended: 14 First recommended: $92. Last recommended: $216.50. Lowest recommended: $51

Coupa Software. COUP Buy @ $348. MV: $24.5bn. Next figures: 16 March. Times recommended: 13 First recommended: $79 Last recommended: $313

Docusign DOCU Buy @ $239.5. MV: $45.4bn. Next figures: 12 March. Times recommended: 10. First recommended: $83. Last recommended: $242

Five9. FIVN. Buy @ $181. MV: $11.8bn Next figures:5 May. Times recommended: 7. First recommended: $51.45. Last recommended: $172

Hubspot. HUBS. Buy @ $518. MV: $23.3 Next figures: 12 May. Times recommended: 7 First recommended: $163.8 Last recommended: $381

MongoDB MDB. Buy @ $398. MV: $22.9bn Next figures: 17 March. Times recommended: 14 First recommended: $74 Last recommended: $394

Smartsheet. SMAR. Buy @ $74. MV: $9.1bn. Next figures: 17 March Times recommended: 9. First recommended: $38. Last recommended: $73.43

Twilio TWLO Buy @ $409. MV: $62bn. Next figures: 4 May. Times recommended: 14. First recommended: $61.5. Last recommended: $373

Veeva Systems VEEV. Buy @ $291. MV: $44.1bn Next figures: 2 March Times recommended: 11. First recommended: $100.76. Last recommended: $294

Zebra Technologies ZBRA Buy @ $512.5. MV: $26.2bn. Next figures: 4 May. Times recommended: 5. First recommended: $232. Last recommended: $405

ZoomInfoTechnologies (not to be confused with Zoom Video Communications) ZI. Buy @ $56.5. MV: $8.6bn. Next figures: 13 May Times recommended: 1 First recommended: $49.97

As you can see, with alerts for 14 companies, all in the QV portfolio, I am very enthusiastic on prospects for the enterprise software sector.

Digital transformation has become a buzz word since widespread lockdowns made it even more imperative for businesses to shift their operations online, let their staff work from home and use technology to drive dramatic improvements in efficiency and effectiveness. This is triggering massive demand for the companies enabling this digital transformation, companies which were already experiencing rapid growth before. anyone had ever heard of Covid 19.

“According to IDC [a leading global market intelligence firm], investments in digital transformation will nearly double by 2023 to $2.3 trillion, representing more than 50pc of total IT spending worldwide. And Deloitte [an accounting and consultancy giant] recently released a report stating that during the next 18 to 24 months, they expect to see leading companies embrace the bespoke-for-billions trend by exploring ways to use human-centred design and digital technology to create personalised, digitally enriched interactions at scale.”

I took this quote from Twilio’s Q4 earnings reported, released on 19 February but it has relevance, not just for them – and wow are they an exciting business – but for all the companies recommended here as they drive this staggering worldwide digital transformation of how business is conducted.

Incidentally by, ‘bespoke-for-billions’, Deloittes means where digital meets physical to design for an audience of one. I can see that this is an amazing idea. When I shop on Amazon they make suggestions to me based on my preferences as expressed by previous purchases. They do the same for everybody so a billion people interacting with Amazon get a different experience tailored for them. It takes a lot of technology to make that happen and that is one simple example. This journey could be huge.

As you could imagine from what Twilio CEO and co-founder, Jeff Lawson had to say about the outlook for his company. “We’ve made great progress, but we are just getting started in each of our focus areas, and that’s what makes this opportunity so exciting. We are going to continue to invest in these areas going forward to address the huge opportunity ahead of us. I couldn’t be more thrilled for how we are positioned for 2021 and beyond.”

There are many enterprise software companies in the QV portfolio. The above are just a selection from one of the world’s most exciting sectors. These are companies which are brilliantly led and staffed, growing rapidly, aiming their products at huge TAMs [total addressable markets] and investing in growth, spending on research and development and sales and marketing, at a scale never seen before in the corporate sector.

I sometimes describe what is happening as the battle for territory. Profits don’t matter, at least in the short term, it is all about building a customer base, benefiting from network effects, planting the flag in as many geographies as possible, adding exciting new products and services to build average spend per customer and trying to become either the market leader in a niche or one of the key players in an oligopoly.

The speed at which many of these companies are moving is incredible and brings into play another key force – the miracle of compound interest. Some of these companies are growing annually at rates between 50 and 100pc, sometimes even faster. A company with starting sales of $100m which grows by 50pc for 10 years would have sales of 5.8bn for a 58-fold increase.

When you are playing for stakes like that it is no wonder that investors find these businesses so hard to value and why markets are seeing so much volatility as even minor swings between optimism and pessimism can drive significant shifts in valuations. If you take a long view you don’t need to worry about volatility and can even use the opportunity to buy shares more cheaply.

Entertainment companies benefit from new ways of consuming video content

Disney (Walt) DIS. Buy @ $196. MV: $357bn. Next figures: 11 May. Times recommended: 5 First recommended: $140 Last recommended: $178.45. Lowest recommended: $109

Gamestop Corporation. GME. Buy @ $91.71. MV: $6.40bn Next figures: 1 April. New entry

Roku. Roku Buy @ $413.5. MV: $51.7bn. Next figures: 12 May. Times recommended: 2 First recommended: $319 Last recommended: $420

Spotify. SPOT. Buy @ $328 MV: $61.2bn Next figures: 5 May Times recommended: 8 First recommended: $175. Last recommended: $323

In the world of software the key trend has been companies shifting from traditional software offerings to a cloud based Saas [software as a service] approach. It was painful initially but has delivered huge rewards for businesses as varied as Microsoft, Adobe and Intuit.

Something similar is happening in the entertainment world, where for cloud read streaming. Netflix was the pioneer but Disney is doing a great job jumping onboard as even Netflix’s Reed Hastings has acknowledged.

Disney Plus launched in November 2019 and since then, it has amassed more than 60m subscribers. Alongside Disney’s other streaming initiatives — Hulu and ESPN Plus — Disney has more than 100m subscribers paying monthly for its various offerings. Disney Plus has grown so quickly that even Netflix CEO Reed Hastings noted in a Netflix earnings call that over the last 20 years, “I’ve never seen such a good execution of the incumbent learning the new way and mastering it.”

Most of Disney’s businesses were hurt by lockdowns and Covid-19. People are continuing to cut cable (not great for ESPN), ratings are mostly down on linear TV channels (not great for ABC, FX, and Disney Channel), and audiences are stuck at home (not great for movie theatres or theme parks). The prospect now is that the new streaming led business will continue to see dramatic growth, while easing restrictions will revitalise its ability to monetise content in all the other ways.

Gamestop is the traditional video store business that was hit hard by lockdowns and ended up in an incredible short squeeze as hedge funds and retail investors battled over the share price. Behind the scenes exciting things are happening at the company. The founder of Chewy (see below) is the new CEO and a big shareholder. He is rebuilding the business around e-commerce, where sales in the latest quarter grew by over 300pc and he is bringing in talented new managers to help him with his plans. Last but not least gaming is booming which should be good for the shops as lockdown eases.

Roku makes finding the best streamed content easy for consumers while helping ad-funding streaming service find the audiences that justify the ad spend. Spotify is the ubiquitous music streaming business that is riding a new boom in podcasting. “In the last year alone, we’ve tripled the number of podcasts on our platform, moving from about 700,000 in Q4 2019 to 2.2 million podcasts today.” Spotify now has 345m monthly active users and 155m subscribers. The company is uncertain on the immediate outlook given the Covid effect in pulling forward subscriptions but CEO, Daniel Ek, says – “However, the trend lines are healthy and long-term the shift from linear to on-demand that COVID accelerated will continue and remains a massive multi-billion user opportunity.”

Three new companies innovating strongly in the green revolution

Enphase Energy ENPH. Buy @ $180.5. MV: $21.2bn Next figures: 4 May New entry

GrowGeneration. GRWG. Buy @ $50.50. MV: $2.46bn. Next figures: 25 March. New entry

HydroFarm Holdings HYFM. Buy @ $72.50. MV: 2.52bn. Next figures: 3 March New entry

Founded in California in 2006, Enphase Energy pioneered the concept of a microinverter. The basic idea behind a microinverter is to convert, manage and monitor energy per panel, rather than the entire array of panels. This reduces the size of the inverter that can be placed on the back of the panel, producing an “AC panel”. Such a system can be connected directly to the grid, or to each other to produce larger arrays. This contrasts with the traditional central inverter approach, where many panels are connected together in series on the DC-side and then run en-masse to a single larger inverter.

There is plenty going on at Enphase, which is expanding globally, actively driving innovation and growing strongly. As they said in their recent Q4 results – “We are excited about the strength in worldwide demand, the ramp of our storage systems, our upcoming new products, and our digital transformation efforts.”

GrowGeneration (GWGR) is a hydroponics business, which has just acquired Grow Warehouse, a hydroponics chain in Colorado, taking the group to 46 US locations. Hydroponics, which means growing plants in an aqueous solution rather than soil, paradoxically uses less water so is great for drier areas. ” To grow 1 kilogram of tomatoes using intensive farming methods requires 400 litres of water but using hydroponics only 70 litres.

GWGR is all about cannabis. The company sells grow equipment and hydroponic supplies to the cannabis growing community, including the commercial industry. They are the largest hydroponic dealers in America Their services are essential to the cannabis industry. Professional grow facilities use a lot of supplies, especially lights, grow media, and nutrients.

Cannabis demand is growing strongly for both recreational and health reasons as investigators research the applications for cannabis products in areas like pain relief. Analysts project GWRG sales growing from $14.4m for 2017 to $435m for 2022. Latest results saw sales up 140pc and same store sales up 63pc. The company has announced four acquisitions since 26 January.

HydroFarm is similar to GrowGeneration. “The company operates at the forefront at a huge new opportunity, that is supplying the consumer-led movement related to the legalization of cannabis and the controlled environment agriculture revolution, called CEA. The latter is a huge opportunity as it requires less land, less water, fewer chemicals, less carbon emissions and superior crop yields, while many believe that cannabis is the next large consumer industry. With these markets set to become huge industries in the future, the company aims to play a leading role in this by focusing on innovation, its trusted brands, best-in-class service and desire to capitalize on the fragmented industry, looking to play a leading role in M&A. With trailing sales of just over $300m the company is relatively small, yet the long term growth rate is very impressive. Between 2005 and now, the company has grown sales at an average rate around 16pc. Products supplied to the customers include lighting, growing media, soil alternatives, nutrients, equipment, with over 6,000 SKUs in the assortment. The company has branded and leading products, supported by quite a few trademarks and patents, supplied by superior JIT service.” Analysts see sales growing to $443m by 2022.

ETFs have a role to play even in a portfolio mainly built around shares in individual companies

Impax Environmental Markets. 1QR. Buy @ €5.30. MV: €1.5bn. Next figures: n/a New entry

O’Shares Global Internet Giants. OGIG. Buy @ $58.90. Times recommended: 1 (in the shares portfolio) First recommended: $61.42

Polar Capital Technology Trust PCT Buy @ 2235p. Times recommended: 4. First recommended: 1690p. Last recommended: 2110p

Invesco QQQ Trust QQQ Buy @ $321. Times recommended: 1. First recommended: $183.45

SPDR S&P 500 ETF. SPY. Buy @ $390. Times recommended: 1. First recommended: $382.93

Wisdomtree Nasdaq 100 3x Daily. QQQ3. Buy @ $138.85. Times recommended: 1. First recommended: $147.50

Does it make sense to recommend ETFs and other collective investments like those above in a portfolio overwhelmingly focused on shares in individual companies? I’m not sure, which is why QQQ, for example, has gone up so much since it was first recommended. In Quentinvest for ETFs it has been recommended loads of times like the other ETFs in this list and many others.

One reason why I have included some ETFs in the Shares portfolio is because I am so impressed by how QV for ETFs is doing. The performance is great, virtually every single ETF alerted is showing games, often substantial ones. It seems that you can have the extra safety of building a portfolio, which is itself a collection of portfolios, without sacrificing so much in the way of capital gains. In a nutshell, ETF investing really works.

The ETFs featured above, apart from the environmentally specialised Impax, are broadly focused on the US with high exposure to America’s special role in driving the technology revolution.

Financial technology companies spearhead a diy financial revolution

Square. SQ Buy @ $237. MV: $109bn. Next figures: 6 May. Times recommended: 17. First recommended: $39.51. Last recommended: $238

Up Fintech Holdings TIGR. Buy @ $27. MV: $3.32bn Next figures: 31 March Times recommended: 1. First recommended: $25.50

Upstart Holdings. UPST. Buy @ $74.50. MV: $5.88bn Next figures: 17 March Times recommended: 4. First recommended: $62.50. Last recommended: $78

There has been an explosion in retail participation in equity markets. Some people regard this, like taxi drivers passing on share tips in 1929, as a sign that the bull market is in its final frenzied stages. They may be right but I think the phenomenon is much bigger. It is part of a continuing process of individuals using technology to take responsibility for their lives and their finances. I think it is a good thing, an exciting development and one which has much further to go.

The three shares mentioned here and many other in the QV for Shares portfolio are playing a key role providing the technology that is allowing this to happen. Not mentioned above and not yet quoted but coming soon is a share trading platform called Robinhood. This company has had a huge impact on making it possible for Joe Public to buy shares, learn about shares and experience the thrills and spills of fast-moving global stock markets.

Although Robinhood was only founded in 2013 it is expected to be valued at $50bn or maybe more when dealings begin. It vividly illustrates how rapidly this market is moving and the opportunities for growth. Square provides financial services for merchants and individuals including making it easy for them to buy shares and cryptocurrencies on its platform. Up Fintech, which has been described as an Asian Robinhood, is still very small but growing explosively. Upstart is all about making credit markets fairer and more efficient for individuals and as anyone who has had to deal with the UK banking system will know there is much room for improvement.

Holiday boom ahead

Airbnb. ABNB. Buy @ $200. MV: $118bn. Next figures: 25 February. Times recommended: 2. First recommended: $156. Last recommended: $179

Booking Holdings. BKNG. Buy @ $2443.50. MV: $100bn. Next figures: 13 May. Times recommended: 3. First recommended: $1992. Last recommended: $2162

Booking Holdings’s shares moved up when they said that after a sales slump in 2020 business was at last starting to improve, Airbnb reports today so we shall soon know more about their performance. The big picture though is the possibility of a dramatic rebound in business as the people rush to make up for the holidays they have missed.

Opportunities in health care

Abcam ABC. Buy @ 1649p. MV: £3.74bn. Next figures: 8 March. Times recommended: 4. First recommended: 1128p. Last recommended: 1435p Highest recommended: 1505p

Align Technology. ALGN Buy @ $573. MV: $45bn. Next figures: 28 April. Times recommended: 7 First recommended: $254 Last recommended: $543

BioXcel Therapeutics. BTAI. Buy @ $57. MV: $1.37bn. Next figures: 11 March. Times recommended: 1 First recommended: $58

Charles River Laboratories. CRL Buy @ $288. MV: $14.3bn. Next figures: 13 May. Times recommended: 1. First recommended: $268

Horizon Therapeutics HZNP. Buy @ $95.5. MV: $20.8bn. Next figures: 12 May. Times recommended: 3. First recommended: $55.50. Last recommended: $81

IDEXX Laboratories. IDXX. Buy @ $533. MV: $45.4bn. Next figures: 4 May Times recommended: 5. First recommended: $320. Last recommended: $497

Inspire Medical Systems. INSP. Buy @ $231. MV: $6.2bn. Next figures: 11 May New entry

Maxcyte MXCT. Buy @ 1020p MV: £737m Next figures: 28 April Times recommended: 1 First recommended: 665p

Progeny PGNY. Buy @ $53. MV: $4.65bn Next figures: 24 February New entry

Teladoc Health. TDOC. Buy @ $238. MV: $36.7bn Next figures: 24 February. Times recommended: 3 First recommended: $201.50. Last recommended: $275

Wuxi Bio. 2269. Buy @ HK$104.3. MV: $449bn/ US$57.9bn Next figures: 22 March. New entry

The above is a very varied bunch of healthcare stocks. Abcam supplies antibodies online, Align provides the Invisalign clear plastic system so teenagers can dazzle their online friends with their wonderful teeth, Charles River Laboratories supplies animals to help with drug development, which will make many people feel uncomfortable but seems a necessary part of the research process, IDEXX Laboratories is the global leader in veterinary diagnostics so maybe belongs in the next section, Inspire Medical, a new entry, develops minimally invasive systems to help sufferers from sleep apnea and sales are expected to grow more than sixfold between 2018 and 2023, Maxcyte is a UK quoted but US based provider of cell-engineering platform technologies for next generation cell-based therapies, Progeny is another new entry, which partners with large companies to finance the most effectivity fertility treatments for their female employees. One in eight couples has problems conceiving so this is a valuable service and the company is growing explosively. Teladoc Health is the US market leader in online health services, which grew dramatically during lockdown but seem set to become a permanent feature of future health care. Wuxi Bio could have been in the Chinese section since it is a Hong Kong-listed company nd is a leading global open-access biologics technology platform offering solutions to empower organisations to develop biologics from concept to commercial manufacturing. It has an impressive record of growth and is another new entry to the portfolio. BioXcel Therapeutics and Horizon Therapeutics are both drug development companies. BioXcel is developing a product to deal with opiod withdrawal symptoms for which there is a very large US market. Horizon Therapeutics delivered more than doubled Q4 2020 sales based on the rollout of two successful drugs including TEPEZZA, claimed as one of the most successful rare disease medicinal launches ever.

Online market booms as pets become our new best and increasingly expensive friends

Chewy CHWY. Buy @ $105.23. MV: $43.6bn. Next figures: 1 April Times recommended: 1 First recommended: $82

FreshPet. FRPT. Buy @ $154.5. MV: $6.36bn. Next figures: 10 May. Times recommended: 2. First recommended: $144 Last recommended: $149.50

As subscribers know I love to see ambition in the companies I recommend. FreshPet CEO, Bill Cyr, clearly received the memo. “In our investor day presentation one year ago I asserted that Freshpet had the potential to join the pantheon of iconic brands that change the world, brands that change things we do every day and reflected significant changes in society’s values and priorities, brands that leverage technology to make the previously impossible possible or more broadly available, brands like Nike, Starbucks, Gatorade, Netflix, and Apple. That may have seemed like a lofty ambition then, and to be clear, it remains a very lofty ambition today. But Freshpet is on that path and accelerating. Freshpet is changing the way people feed their pets. That change reflects the fundamental shift in how society views both pets and food.” These guys are walking the talk even if they have some way to go to catch Apple. Sales are projected to grow from $193m for calendar 2018 to $742m for calendar 2023. Their excitement is understandable.

Chewy is bigger and growing even faster than FreshPet. “Third-quarter net sales reached $1.78bn, increasing $552.2m or 44.9pc year over year. In absolute dollar terms, third-quarter growth marked the biggest increase we have reported in the company’s history. Year to date, net sales are up 46pc on accelerated customer growth and solid increases in per-customer spending.” Potentially very exciting is a move into pet health care, which is showing great momentum. “Total pharmacy operations are expected to generate over $500m of gross revenue this year, which we believe makes us the largest e-commerce pet pharmacy in the U.S. To achieve this milestone just over two years after our launch is a remarkable achievement.”

Semiconductors sit at the heart of the technology revolution

Applied Materials. AMAT. Buy @ $121. MV: $112bn Next figures: 20 May. Times recommended: 3 First recommended: $82. Last recommended: $105

Ambarella. AMBA Buy @ $121. MV: $4.26bn. Next figures: 2 March. Times recommended: 1. First recommended: $105

ASML. ASML. Buy @ $595. MV: $240bn. Next figures: 21 April Times recommended: 5. First recommended: $420. Last recommended: $544

Cadence Design Systems. CDNS. Buy @ $139.50. MV: $38.9bn. Next figures: 26 April Times recommended: 10 First recommended: $71.55. Last recommended: $135.50

Lam Research Corporation. LRCX. Buy @ $596. MV: $83.3bn. Next figures: 28 April. Times recommended: 2. First recommended: $445. Last recommended: $507

Nvidia. NVDA. Buy @ $562. MV: $359bn. Next figures: 13 May. Times recommended: 20 First recommended: $164.70. Last recommended: $588. Lowest recommended: $147.21. Highest recommended: $588

Taiwan Semiconductor Manufacturing. TSM. Buy @ $130.5. MV: $669bn. Next figures: 22 April. Times recommended: 4. First recommended: $95.50. Last recommended: $130

“Semiconductors will be to the 21st century and the transition to an information society as steel was to the 20th century and the industrial revolution.” This is why a cross section of the world’s leading semiconductor businesses is a key element in a growth share portfolio.

You can see what is happening with Q4 2020 results just reported by Nvidia showing sales up 61pc from a year earlier accompanied by these comments by CEO, Jensen Huang. “Q4 was another record quarter, capping a breakout year for NVIDIA’s computing platforms. Our pioneering work in accelerated computing has led to gaming becoming the world’s most popular entertainment, to supercomputing being democratised for all researchers, and to AI [artificial intelligence] emerging as the most important force in technology. Demand for GeForce RTX 30 Series GPUs is incredible. NVIDIA RTX has started a major upgrade cycle as gamers jump to ray tracing, DLSS [deep learning super sampling] and AI. Our A100 universal AI data centre GPUs [graphics processing units, which Nvidia first developed in the 1990s] are ramping strongly across cloud-service providers and vertical industries. Thousands of companies across the world are applying NVIDIA AI to create cloud-connected products with AI services that will transform the world’s largest industries. We are seeing the smartphone moment for every industry. Mellanox has expanded our footprint across the data centre. And we are making good progress toward acquiring Arm, which will create enormous new opportunities for the entire ecosystem.”

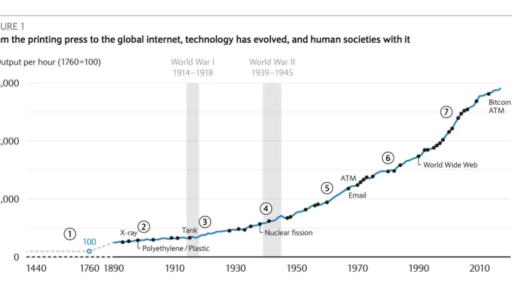

This is a company and an industry firing on all cylinders and playing a key role in the most dramatic period of progress in human history since the agricultural revolution.

Social media giant in the making

Snap Inc. SNAP. Buy @ $68.5 MV: $195bn. Next figures: 27 April. Times recommended: 2. First recommended: $48. Last recommended: $58.87

Snap is an exciting business on a roll as demonstrated by recently released figures. “We added 16m daily active users this quarter for a total of 265m up 22pc year-over-year. This growth validates the broad appeal of our service and the role we play in the life of each member of the Snapchat community. Our quarterly revenue increased 62pc year-over-year to $911m, showing the trust advertisers have placed in us and our communities’ receptiveness to brands with shared values.”

As usual the sky is the limit for opportunities ahead. “Snapchat is embraced by a generation that is driving the future. The Snapchat generation, primarily Gen Z and millennials, are 150pc more likely to communicate with pictures than words and 82pc of them believe they have a personal responsibility to change the world. Our opportunities to serve and uplift this community in the coming decades will continue to grow and we are inspired by the world that the Snapchat generation is working to create. At the core of this opportunity is the power of our Camera. It is one of the world’s most used cameras with an average of over 5bn Snaps created every single day.”

Good times for new wave of online service providers

Agora. API. Buy @ $79.92. MV: $6.04bn. Next figures: 2 June. Times recommended: 2 First recommended: $58.50. Last recommended: $74.87

Chegg. CHGG. Buy @ $97. MV: $13.8bn Next figures: 3 May. Times recommended: 6. First recommended: $67.81. Last recommended: $98.50

Epam Systems EPAM Buy @ $369. MV: $20.7bn. Next figures: 13 May. Times recommended: 8. First recommended: $163. Last recommended: $370

Fiverr International FVRR. Buy @ $279. MV: $10bn. Next figures: 13 May. Times recommended: 7. First recommended: $65. Last recommended: $284.50

Globant. GLOB. Buy @ $222. MV: $8.8bn. Next figures: 13 May. Times recommended: 4. First recommended: $155 Last recommended: $214

Par Technology. PAR. Buy @ $86. MV: $1.87bn. Next figures: 18 March Times recommended: 1. First recommended: $79

Tyler Technologies. TYL. Buy @ $473. MV: $19.2bn. Next figures: 5 May. Times recommended: 4. First recommended: $375. Last recommended: $447

Wix.com WIX. Buy @ $351. MV: $19.5bn. Next figures: 12 May. Times recommended: 4. First recommended: $221. Last recommended: $285

Zillow Group Z. Buy @ $164. MV: $39.5bn. Next figures: 13 May. Times recommended: 1. First recommended: $145

This is a bit of a mixed bag of stocks that don’t fit easily in a single group. There are the tech consultancy businesses like Epam, Globant and Tyler Technologies, which provide value for money by having many of their staff outside the US. There is Agora, technology to help developers embed real-time video and voice into their systems, Chegg, online education, Fiverr, a platform to bring freelancers and corporate customers together, Par Technology, system design and engineering services, Wix.com, web design and related services and Zillow online property services.

The common factor is that they are all highly innovative businesses using technology to provide services online more cheaply and effectively, often in ways that are disrupting traditional industries. The other common factor is that they are all 3G and growing fast.

Some UK shares doing well

Ashtead AHT Buy @ 4006p. MV: £17.8bn. Next figures: 2 March Times recommended: 11. First recommended: 1803p. Last recommended: 3731p

Best of the Best. BOTB. Buy @ 2700p MV: £230m. Next figures: 14 January. Times recommended: 6. First recommended: 1480p. Last recommended: 2260p

London Stock Exchange. LSE Buy @ 9664p. MV: £44.1bn. Next figures: 5 March. Times recommended: 9. First recommended: 4350p. Last recommended: 9344p

Victoria VCP Buy @ 806p. MV: £909m. Next figures: 29 July. Times recommended: 5. First recommended: 614p. Last recommended: 528p. Highest recommended: 880p

Ashtead and BOTB are long-time favourites of mine and I have said numerous times that I think the latter’s shares are insanely cheap but impossible to buy. LSE has finally completed its long drawn out acquisition of Refinitiv, which I think could prove a game changer for the group as it massively increases the focus on data, the new oil of the 21st century. Victoria is an old school business, floor coverings, led by a talented, ambitious, super acquisitive and well funded management team.

The markets have taken a hit in recent days on fears about inflation and rising US bond yields. There is always going to be stuff to worry about. My feeling is that in some mysterious way globalisation and the technology revolution have tamed inflation and that interest rates, short and long, are going to stay low for the foreseeable future. So I think this is just a blip; that the vast majority of companies in the QV portfolio are trading out of their skins, that the technology revolution is just getting warmed up and that the medium and long term outlook for share prices, in exciting companies, is onwards and upwards.

I am always experimenting with ways to write QV. This is the monthly round up by I have tried doing it in groups so subscribers get a better feeling for how the portfolio reflects all the exciting things happening in the world.