I have been saying that if QQQ3 could break through $300, that would be an exciting development. It has done it, and it looks exciting. As noted in the last alert, TECL, the pure technology leveraged ETF, looks good, as does XLK, an unleveraged technology ETF. The yellow smiley for the moving averages, the blue smiley for Coppock, and the green smiley for a chart breakout are all flashing buy. I have decided to add both of these to my Top 30, even though TECL may be difficult for UK-based investors to buy.

Also looking great on the chart is Nvidia.

If you don’t hold any Nvidia or don’t hold enough, this could be a great moment to buy some more. The chart looks amazing. Just to bring you up to speed on my Top 30 shares. The average gain is 16.69%. This portfolio was only launched on 21 May with 10 shares, with subsequent additions taking the total to 33 shares presently.

The Nasdaq 100 is up 16.3% since 21 May, but this is not a fair comparison since so many Top 30 recommendations have been made since then. If we look at the gain in the Nasdaq 100 on its average level since 21 May, the gain is more like 7.2pc.

Even to match the performance of the Nasdaq 100 would be good going when it is rising so strongly, so I am chuffed to be beating it.

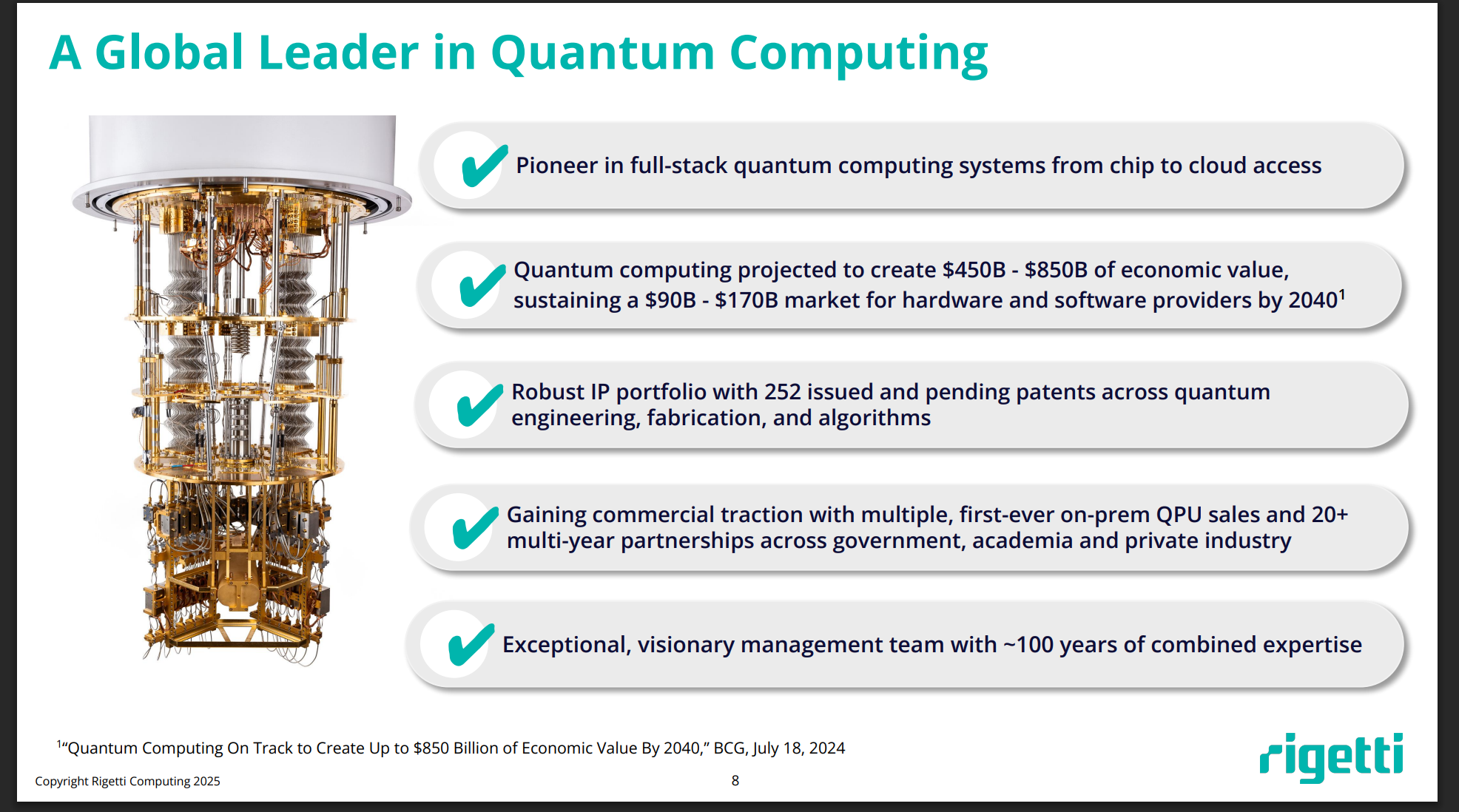

Shares in the Quantum Computing sector are super strong. IonQ is already in the Top 30 and performing well. Shares that I have alerted in the past, like D-Wave Computing (QBTS) and Rigetti Computing (RGTI) are racing ahead.

I don’t pretend to offer any insights into what Quantum Computing is, when and whether it will ever happen or what it will mean if it does. I just listen to what the companies say, and they say it will happen and it will be amazing.

What they do to have to offer is open-ended, super exciting potential. They are placing huge corporate bets which, if they come off, will have a transformational impact on their businesses.

How do these businesses look on my 3G analysis? They all have great charts, see Rigetti below. They are scaling their businesses rapidly, and they have exciting stories (a technology which could transform life on earth). They are working on superlong timescales, but that does not mean their shares cannot perform well in the short and medium term. It is all about newsflow.

Everything is pointing higher on this chart. Below is how Rigetti describes its mission.

The time for quantum is now. Our mission is to build the world’s most powerful quantum computers to help solve some of the most important and pressing problems in the world. In areas like climate simulation, fusion energy, drug discovery, logistics optimization, and quantitative finance, Rigetti is deeply collaborating with market leaders to help advance what’s possible in their industries.

Building on years of pioneering work, Rigetti is poised to develop quantum computers that could scale to solve problems of staggering computational complexity at unprecedented speed. We have invented and patented core technology, owning critical IP for our breakthrough multi-chip processor and the hybrid quantum-classical approach that has become the predominant quantum computing architecture.

We believe our full-stack development approach – from chip design and manufacturing through cloud delivery — offers the fastest and lowest risk path to building quantum computers that could begin to unlock a potentially world changing opportunity.

Rigetti Computing, website

When I look at these companies, I realise two things. I have no idea whether their plans and dreams are realistic, nor do I know what they are worth. Rigetti shares are over $28. A year ago, they were 70 cents. This could be classic rubbish theory of value (assets move from worthless to valuable almost overnight), or it could be insane. The shares have been incredibly volatile. In January, they peaked at $21.68 and fell as low as $6, in just one month

A cautious approach might make sense, based on newsflow. Buy a few now or hold what you have. Buy a few more each time the company news suggests their ambitious programmes are on track. The same applies to IonQ and D-Wave Computing.

The key point for the bulls is that successful quantum computers would be a game-changer for the planet, but the timescales are long. Things could really be happening by 2040. These shares are likely to have many ups and downs between now and then, but if you think you are going to be around in 2040, tucking a few away or building a position over time looks a reasonable thing to do.

Plus, the shares will anticipate 2040 if the results are going to be that good.

Share Recommendations

QQQ3

TECL

XLK

Nvidia NVDA

IonQ. IONQ

D-Wave Computing. QBTS

Rigetti Computing. RGTI

Maybe a part of what is happening is that investors believe that AI is going to accelerate the development of Quantum Computing. Will it or not? God alone knows, and He keeps his own counsel.

Strategy – Buy Quality; Dip A Toe In Quantum

Trump is pro-America, pro-stock market and pro-technology, so no surprise that his administration wants to help America take the lead in Quantum Computing. Serious money is flowing into the sector, so they must feel they are on to something.

In general, with my Top 30 shares, I am looking for an underlying quality, a certain magic, which will help them achieve their goals and make them valuable assets to own. I don’t want the portfolio to be too speculative, but I most certainly want it to be exciting.

Many thanks to all the subscribers who have emailed to say they read my alerts, value the information, and want me to continue. The mystery lies in the many people who subscribe but don’t appear to use the service. I want to give them a wake-up call.

Meanwhile, the bull market keeps rock and rolling on. What’s not to like?