Two of my favourite technical indicators are (1) consolidations and breakouts on 12m candlestick charts and (2) Coppock buy signals. These are both big picture indicators with buy signals occurring only at extended intervals.

As an aside this is what makes bear markets painful but also exciting because these are the conditions which give rise to these big picture buy signals. Already we are starting to get some and I anticipate many more over coming months.

The principal drawback is that they are all about the big picture so tell you nothing about what might happen in the short term. I find this an advantage but it does mean that time and again I send an alert and the first thing that happens is that the stock, ETF or crypto moves against you.

My attitude is that asset price. movements are unpredictable in the short run which is why I have never even attempted to be a day trader. One thing to remember is that there are over 100,000 quoted shares in the world. Many of those are 3G (great growth, great story, great chart) and at any given moment some of them will be giving buy signals based on my big picture indicators. It is those shares for which I am looking.

There is another key advantage of my big picture approach. Big breakouts and Coppock buy signals typically occur early in big moves so there are great attractions to following my strategy.

Table of Contents

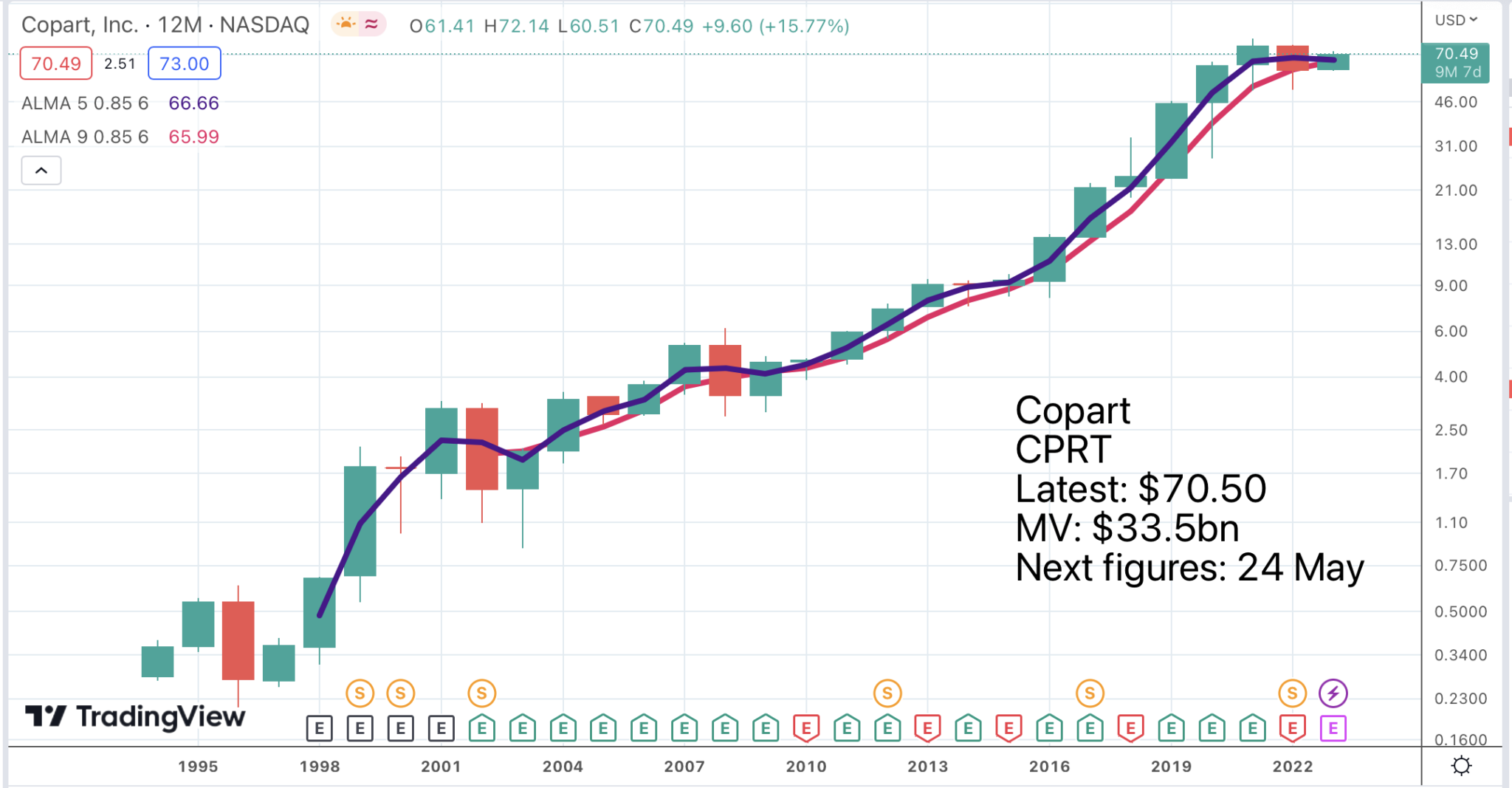

Copart gives a big picture buy signal

What I like about these very long term charts, where each candlestick equals a year, is the power of the signals. When you do get a signal it is typically the start of a move measured in years.

This chart looks like many others at the moment. The dramatic rise in interest rates and bond yields in 2022 led to an indiscriminate bear market with all shares falling, good and bad, overvalued and fairly valued.

2023 has seen a steadying of the ship with shares that were unjustly hammered in 2022 recovering close to former peaks. The odds are always good that such consolidations will end by breaking higher but this likelihood is reinforced by Coppock buy signals such as the one we have just had for Copart.

Below is a brief description of what they do.

We provide vehicle sellers with a full range of services to process and sell vehicles primarily over the internet through our Virtual Bidding Third Generation internet auction-style sales technology, which we refer to as VB3. Vehicle sellers consist primarily of insurance companies, but also include banks, finance companies, rental car companies, charities, fleet operators, dealers, and individuals.

From our modest beginnings, Copart has now grown to operate over 200 locations in 11 countries, together comprising approximately 16,000 acres of storage capacity around the world. At our core, we are a technology company that provides a global marketplace platform to connect vehicle buyers and sellers around the world. We sell well over three million cars per year on behalf of our sellers, including insurance companies, automotive dealers, rental car fleets, financial institutions, and many others.

Web site

As you might imagine from the share price performance (up 340 times in 26 years) Copart is a special company.

Across multiple technology waves – from personal computing to mobile telephony to cloud services and beyond – Copart has always prioritized the use of innovative technology for the efficiency of our operations, the reliability and accuracy of our services to our customers, and enhanced access to the world’s buyers of our vehicles. Today, we employ approximately 800 people in technology alone and invest substantially more than others in our industry. Our understanding of our customer’s business processes, coupled with decades of experience as in-house applications developers, enables us to deploy uniquely powerful and tech-oriented solutions to our customers. Recent examples of our innovations include an image-based rapid total loss decision tool for our sellers and a location-based dispatch app for our towing providers, among many others.

By facilitating the world’s re-use of vehicles and harvested parts and raw materials, Copart is a unique enabler in the circular economy.

FY 2022, shareholders’ letter

It is intriguing to see what is happening in the world of car accidents.

Today, as has nearly always been true, total loss frequency is rising due to a combination of two forces. First, repairs are more expensive and less attractive due to increasing accident severity, vehicle complexity, labor costs and rental car costs. And secondly, salvage economics are more attractive because the fastest growing economies in the world in Central and South America, Africa and Eastern Europe lean on our damaged vehicles to provide the mobility they need.

Q2 2023, 24 February 2023

And these guys certainly think long-term

We continue to make decisions for the 30-year prosperity of our customers and our shareholders. We will invest in the technology of today and tomorrow to enable us to serve both our members and our sellers.

We will invest to recruit members to engage them and to expand the marketplace of services available to them to continue to expand the buyer universe. For every vehicle we sell, we are committed to finding the highest and best use of that vehicle anywhere in the world. And finally, we will invest in land. We will own our land whenever possible to ensure that our ability to serve our customers is never compromised by the wins or economic optimizations of third party landlords.

Q2 2023, 24 February 2023

This is what one analyst said about the company.

Copart (NASDAQ:CPRT) is a wonderful business that auctions damaged vehicles. The company offers an enormous network, with almost 200 sites in 10 different countries, to sell damaged cars. The market is benefiting from solid tailwinds, but those will be stronger in the coming years. Then, Copart will benefit from the trend and will significantly grow for many years.

Seeking Alpha, 13 February 2023

Surprisingly the company benefits from the trend to electric vehicles.

This increase will continue in the future, especially with electric cars, with 2.3 times more chips than in an internal combustion engine-powered car. Therefore, cars tend to become more complex and have more advanced technology. Then, repairs are more demanding, which increases the salvaged vehicles’ rate (i.e., recovered by insurers). As a result, owners are more likely to do away with their cars, resulting in more vehicles for Copart.

Seeking Alpha, 13 February 2023

I think you get the idea that Copart is classic 3G, has an great long-term future and a great long-term chart.

Nasdaq 100 is looking promising

How is that for cool. We have a valid Coppock buy signal for the Nasdaq 100 and also a promising looking chart. This is a shorter term chart with each candlestick representing one month and we have a chart breakout from a decent period of consolidation. It is looking increasingly probable that a new bull market has begun.

I am also expecting technology shares to be as much involved in this bull market as they were in the last one thanks to breakthroughs in areas such as artificial intelligence (AI).

I am increasingly seeing Coppock buy signals all over the place which is just what you would expect as a new bull market gets under way.

Fragile banks struggle with sharply rising interest rates

It is becoming clear to central banks that being too aggressive on interest rates could reap a whirlwind in the form of collapsing banks. This doesn’t mean that they have to give up on the battle against inflation but they do need to have more faith in capitalism. The global economy is spectacularly effective at raising production to meet supply if it is given the freedom to do its thing.

My guess is that in a head on confrontation between AI and inflation, AI will win so there is plenty of room for optimism though this is unlikely to be reflected in the media which thrives on bad news.

Share recommendations

Copart. CPRT. Buy @ $70.50

Nasdaq 100 (and related ETFs like QQQ – $313 and QQQ3 – $78.8). Buy @ 12,850

Stop press

Coinbase ($69) is being sued by the SEC so care may be needed with that one.

Shares of leading U.S. crypto exchange Coinbase Global dropped Thursday morning after the company said late yesterday that the Securities and Exchange Commission has informed it of its plan to take enforcement action (https://www.wsj.com/articles/sec-plans-lawsuit-against-coinbase-according-to-exchange-624f3a69) against the company.

Wall Street Journal, 23 March 2023