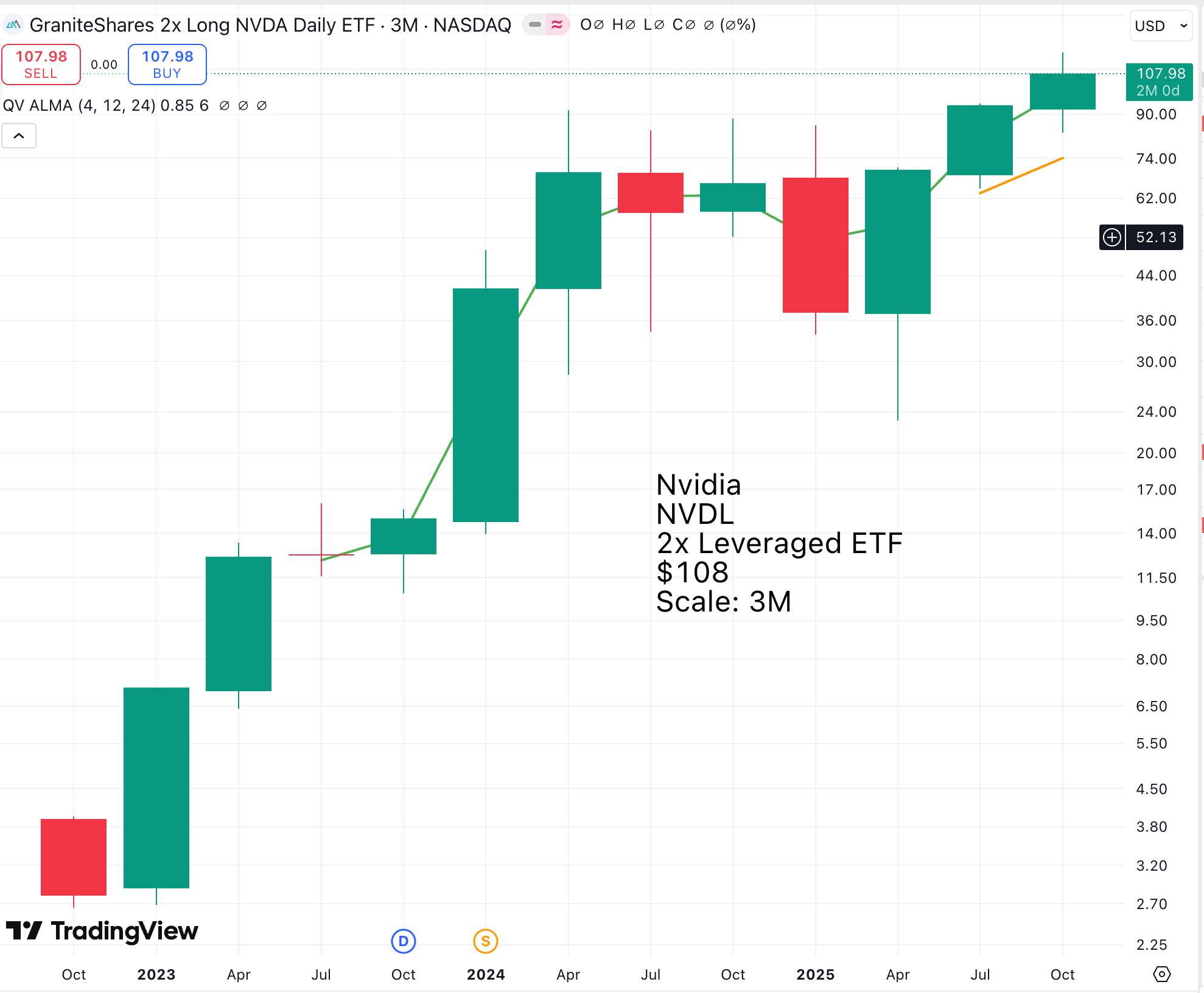

Increasingly, investors can buy shares with built-in leverage. Instead of buying Nvidia (NVDA), you can buy Nvidia x 2, code 2NVD on the London Stock Exchange and NVDL on the US exchange. Below is a commentary on these single stock leveraged ETFs, which are seeing booming demand.

AI hype that has helped push U.S. stocks to fresh records this year has driven an explosion in leveraged single stock exchange-traded funds, a universe of speculative products that is likely to be tested by Nvidia’s NVDA.O Wednesday earnings.

Companies that investors expect to benefit either directly or indirectly from the AI revolution now dominate U.S. single stock leveraged and inverse ETFs, underscoring investor demand for products that magnify their AI-themed bets, according to a Reuters analysis of industry data from issuers, Morningstar and CFRA Research.

So far in 2025, asset managers have launched 112 U.S.-listed leveraged and inverse ETFs tied to a single stock, compared with 38 in all of 2024, according to data from Morningstar, CFRA Research and issuers, leading some analysts to warn the market is getting overcrowded.

Leveraged and inverse ETFs, which allow investors to profit when shares rise or fall, use swaps or options to produce those targeted returns and are attractive to speculators eager to play daily price moves.

All told, more than half of the total 190 single stock leveraged and inverse ETFs listed in the U.S. now riff off the AI theme, accounting for $17.7 billion of the $23.7 billion invested in the inverse and leveraged ETF universe, the Reuters analysis found.

Those ETFs provide exposure to companies like AI-focused chipmakers like Nvidia, as well as hot AI plays like electric carmaker Tesla TSLA, whose futuristic robo-taxis rely on AI, data analytics software company Palantir PLTR, as well as energy companies powering AI data centers, like NuScale Power SMR.

One of the largest, the GraniteShares 2x Long NVDA Daily ETF NVDL, has accumulated $4.56 billion in assets since its launch in December 2022.

Some of the biggest swings in share prices and, in turn, leveraged stock ETFs, occur when a company announces earnings, said Bryan Armour, ETF analyst at Morningstar. Options traders are pricing in about a $260 billion swing in Nvidia’s market value following its results, Reuters reported on Monday.

“There are more and more opportunities every day for investors to gamble on individual stocks that are part of this dominant AI theme, and any earnings announcement is going to be key,” Armour said.

That effect was highlighted on Tuesday, when shares in AI-driven database company MongoDB MDB skyrocketed more than 23% in after-hours trading, after it reported better-than-expected second quarter earnings and announced big gains in AI-related clients.

That triggered a 46% gain in the Tradr 2x Long MDB Daily ETF MMDBX launched by Tradr ETFs only two weeks earlier.

Matt Markiewicz, head of product and capital markets at Tradr ETFs, said the company is looking for new ways to explore the AI theme, pointing to a 2x ETF tied to Constellation Energy CEG it launched in July. He expects that the demand for power generation to support data centers will surge alongside AI adoption.

“There is such a thirst for companies benefiting from the AI buzz,” he said.

RISKY PRODUCTS?

But price swings in the underlying stocks magnify these ETFs’ volatility, and critics caution that retail investors who are the predominant users may not fully grasp how the ETFs will react.

In late January, Nvidia shares plunged 17% on reports that Chinese AI lab DeepSeek released a large language model investors thought might chip away at Nvidia’s dominance. The GraniteShares 2x ETF fell nearly 34%.

“We’re providing what people want; if people want AI exposure, that’s where we’re going to focus resources,” said Will Rhind, founder of GraniteShares.

There are now just as many ETFs offering leveraged exposure to Nvidia as there are ETFs tied to the entire $52 trillion Standard & Poor’s 500 index SPX.

“If you factor in the risk surrounding AI right now after all of its gains, and add the risk of leverage on top of that, well, there’s more potential for losses,” said Dave Nadig, president and director of research at ETF.com.

While performance can vary depending on how the issuer obtains the leverage, or on the holding period, many of these ETFs have delivered results that hew closely to their target returns of 1.5x or 2x, industry executives point out.

“The underlying stock is going to do what it’s going to do, our job is to make sure ETF does what it says it will do,” said Tradr’s Markiewicz.

For issuers, the products are attractive because they generally command fees averaging 0.96% compared to 0.54% for the ETF industry as a whole. But Nadig warned the market is overcrowded, adding there will likely be a “shakeout.”

Reuters, 27 August 2025

This is a great chart. I would expect these shares to go higher. They track Nvidia but times 2.

Nvidia also has a great chart, unsurprisingly. Since October 2022, Nvidia shares have increased by roughly 20 times. The 2x leveraged version is up roughly 40 times, as expected. I can see the attraction of NVDL; the leveraged version outperforms the regular shares. But buying regular Nvidia shares with your chosen leverage in a spread betting account still looks the better strategy. If you want 2x leverage, you can have it, and crucially, any gains are tax-free. Financial spread bets are a UK phenomenon; they are not allowed in the US, which is why no US brokers offer the facility.

In case you didn’t realise, you must reinvest additional free equity in buying more Nvidia shares to maintain your initial leverage. This is notionally what NVDL has to do. If you don’t do it, the leverage becomes less over time, assuming the shares rise.

OpenAI Is Something Else

OpenAI’s IPO could be an exciting moment for the US stock market generally and AI stocks in particular. The story is that in 2026, OpenAI, the creators of ChatGPT, is going to IPO on a valuation of $1 trillion. Talk about zero to hero. Before the launch of ChatGPT in November 2022, nobody had heard of OpenAI. Four years later, it could be worth $1 trillion, and that could be just the beginning.

OpenAI is considered an exciting investment due to its pioneering technology and research, rapid commercial success, strategic partnerships with tech giants, and potential to disrupt numerous industries on a global scale.

Key factors driving investor enthusiasm include:

Technological Leadership and Innovation: OpenAI is at the forefront of AI research and development, known for groundbreaking models like the GPT series (GPT-4, GPT-5, etc.), DALL-E (text-to-image), and Sora (text-to-video). Its continuous innovation in large language models (LLMs) and the pursuit of Artificial General Intelligence (AGI) position it as a leader in shaping the future of technology.

Rapid Commercialization and User Growth: The launch of the consumer-oriented ChatGPT in late 2022 was a game-changer, achieving unprecedented user adoption rates that surpassed those of early tech giants like Google and Facebook. This viral success has translated into substantial revenue growth from subscriptions (ChatGPT Plus/Pro), API usage for developers, and enterprise solutions, with annualized revenue reaching $12 billion by mid-2025.

Strategic Partnerships and Financial Backing: Key alliances with major players like Microsoft, Nvidia, Oracle, and AMD provide critical financial backing and access to essential high-performance computing (GPU) infrastructure and cloud resources. Microsoft’s significant stake and integration of OpenAI’s models into its products (e.g., Copilot, Azure AI Service) offer major distribution channels and a strong competitive advantage.

Disruptive Potential and Market Opportunity: Investors see OpenAI as a once-in-a-generation opportunity to unseat current tech leaders and reshape nearly every industry, from healthcare and finance to software and logistics. AI is expected to have a multi-trillion dollar economic impact, and OpenAI is positioned to capture a substantial market share due to its first-mover advantage and technological superiority.

Exceptional Talent and Vision: The company attracts top-tier researchers and engineers, and its ambitious mission to ensure AGI benefits all of humanity, while facing current challenges, fosters a strong, committed team.

Despite significant potential, investors acknowledge risks, including substantial current financial losses due to high computing costs, intense competition, regulatory scrutiny, and the speculative nature of AGI development. The potential for a future Initial Public Offering (IPO), reportedly with a valuation up to $1 trillion, further fuels excitement over the potential for high returns.

AI Overview

If OpenAI were worth $1 trillion now, it would be on a valuation of around 80 times sales. Palantir is valued even more highly at a valuation approaching $500bn (half a trillion) against likely 2025 sales around $5bn.

The plot thickens. OpenAI is projected to have sales of around $30bn in 2026 (incredible growth by any standards!) but is also forecast to lose $14bn. Palantir is highly profitable and generates loads of cash. OpenAI is pouring zillions into building data centres. On the other hand, internal reports suggest that by 2030, OpenAI could have revenue of up to $200bn.

Let’s have a look.

OpenAI’s future plans center on the development of artificial general intelligence (AGI), the massive infrastructure required to support it, and the evolution of ChatGPT into a universal “AI super-assistant”. These initiatives are being funded through a major corporate restructuring and a potential multi-trillion dollar market listing.

Key Strategic Areas

AGI Development: OpenAI’s core mission remains achieving AGI, defined as highly autonomous systems that outperform humans at most economically valuable work. This involves continuous model improvement, with recent releases including the GPT-5 flagship model and its variants.

Massive Infrastructure Investment: The company is transitioning from a research lab to a major infrastructure company. CEO Sam Altman has announced a plan to build 30 gigawatts of computing capacity at an estimated cost of $1.4 trillion to power next-generation AI systems.

AI Super-Assistant: The vision is to evolve ChatGPT from a chatbot into a “super-assistant” that acts as the primary interface for all digital interactions, deeply integrated into daily life, work, and personal time.

Hardware Development: To avoid reliance on existing mobile ecosystems like Apple’s iOS and Google’s Android, OpenAI is developing its own AI-specific hardware, a move reinforced by its acquisition of Jony Ive’s startup, io.

IPO and Capital Raising: OpenAI is preparing for a potential initial public offering (IPO) in late 2026 or 2027, aiming for a valuation of up to $1 trillion to raise the vast capital needed for its infrastructure and research goals.

Upcoming Milestones and Projects

AI Researcher AI: OpenAI plans to create an “intern-level” AI research assistant by September 2026, with the goal of a fully autonomous “legitimate AI researcher” by March 2028.

New Models: The company is continuously refining existing models and releasing new ones. GPT-5 is the current flagship model, and an addendum for a model called GPT-5-Codex, optimized for coding tasks, was recently released.

Partnerships and Global Expansion: OpenAI is expanding its global footprint, including a new strategic partnership with the UK government to accelerate AI infrastructure and transform public services. It is also securing massive compute deals with companies like Oracle and Nvidia.

Safety and Ethics Research: The non-profit OpenAI Foundation is committing $25 billion to research in health and disease curing, and to develop “AI resilience” solutions for minimizing risks, which includes new safety evaluations for models like GPT-5.

OpenAI Academy: The company is piloting a certification program to equip workers with AI skills to meet the demands of the new “Intelligence Age”.

AI Overview

The first thing that jumps off the page is that if OpenAI is valued at $1 trillion in its IPO, the shares will likely be a screaming buy! This must be the fastest-growing business in history. Sales have tripled every year since ChatGPT launched in November 2022, and there is no sign of a slowdown in sight. The lack of profits may give investors pause, but it is the massive scale of the company’s ambitions that generates those losses. The potential for vast profits is there.

Note that Microsoft owns 27% of OpenAI. Nvidia’s investment in OpenAI is an investment in infrastructure. Hence, the worries that Nvidia is paying OpenAI to buy Nvidia’s chips. I guess that both parties are aware of what they are doing.

I have just been watching an interview with Sarah Friar, the CFO of OpenAI since June 2024. Her personal charisma is incredible. I’m in love. But what she also makes clear with those adorable, twinkly eyes is that nobody, not even Nvidia, stands as close to the beating heart of the AI revolution as OpenAI. They are the cutting edge for AI and the reason why Nvidia cannot build more powerful computing power based on its GPU chips fast enough to meet insatiable demand.

The pace of innovation at OpenAI is breathtaking. What these guys might be doing by 2030, when Friar will still only be 57, beggars belief. I would say it is almost a stone-cold certainty that this business will be valued at more than $10 trillion before 2030.

You cannot invest directly in OpenAI stock because it is a private company, not publicly traded. However, accredited investors may be able to buy shares through private marketplaces like Forge Global or Nasdaq Private Market before a potential IPO. Non-accredited investors can also invest indirectly by purchasing stock in publicly traded companies with significant stakes in OpenAI, such as Microsoft, or by investing in funds that hold shares in private companies.

Direct investment (for accredited investors)

Private marketplaces: You can invest in pre-IPO shares through secondary market platforms that cater to accredited investors.

Verification: You must first qualify as an accredited investor and complete identity verification on the platform to access these opportunities.

Liquidity: Investments in private companies are less liquid, as you can’t sell the shares on public stock exchanges.

Indirect investment (for all investors)

Publicly traded companies: Invest in companies that have a significant partnership with or stake in OpenAI.

For example, Microsoft is a major investor and has integrated OpenAI’s technology into its products, making Microsoft stock a way to gain exposure to OpenAI’s success.

Exchange-Traded Funds (ETFs) and mutual funds: Some funds invest in private companies or focus on the AI sector, providing indirect exposure to OpenAI through a portfolio of other companies.

AI Overview

The next question is what are ‘accredited investors’?

An accredited investor is an individual or entity deemed sophisticated enough, through their financial standing or professional expertise, to understand the risks of certain private market investments.

This status grants them access to investment opportunities that are not subject to the same stringent regulations as public offerings.

These investments can offer high potential returns but also come with high risks.

Common requirements in the U.S.

Income: An individual must have an annual income exceeding

$200,000 for the last two years, with a reasonable expectation of the same for the current year. For joint accounts, the combined income must be over

$300,000.

Net Worth: The individual’s net worth must be more than

$1 million, either alone or with a spouse or spousal equivalent, not including the value of their primary residence.

Professional Certification: Individuals can qualify by holding certain professional certifications, such as a Series 7, 65, or 82 license.

Other entities: Institutional investors, family offices, and other financial entities can also be accredited investors.

What accredited investors can invest in

Private companies (startups), Private equity funds, Venture capital funds, Hedge funds, and Private placements.

AI overview

I would strongly advise, if you qualify, setting things in motion so you can buy shares in OpenAI while the business is still private. Failing that, make sure to jump in on day one.

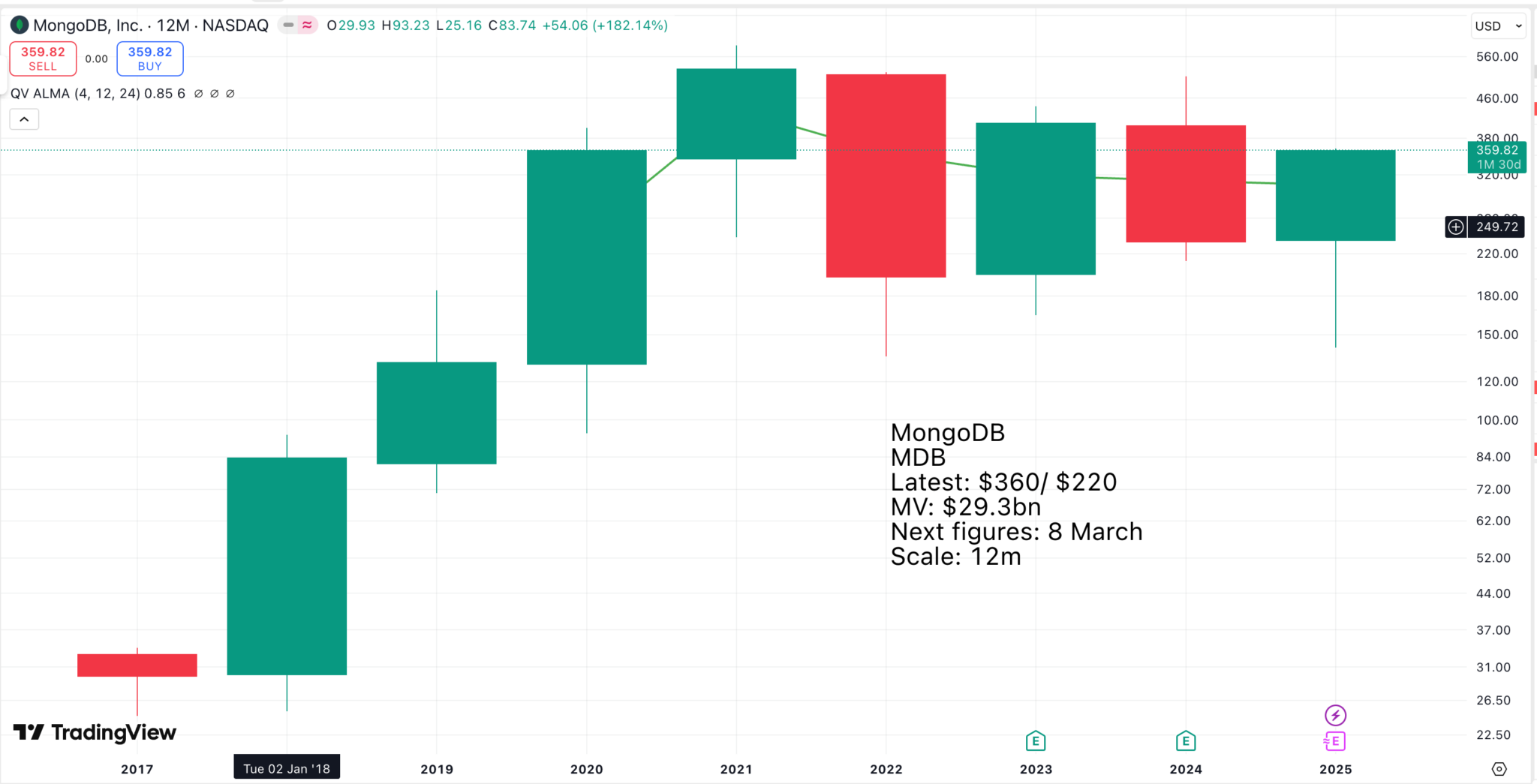

Another key element of the AI boom is data. All the computing power in the world can do nothing without feeding copious quantities of data into its voracious maw. This brings data companies like MongoDB into the spotlight.

MongoDB is an exciting company with a promising future. No breakout yet on the chart, but when it comes, it will be massive.

MongoDB MDB: This company which provides general purpose database platform, has seen the Zacks Consensus Estimate for its current year earnings increasing 20.5% over the last 60 days.

Zacks, 10 October 2025

A leadership change at MongoDB is exciting investors.

MongoDB (MDB) said on Monday that it has named Cloudflare executive Chirantan Desai as its new Chief Executive Officer, effective November 10, succeeding long-time head Dev Ittycheria.

Shares of MongoDB jumped nearly 9% in premarket trading. The company said that Ittycheria has been leading MongoDB for 11 years and has announced his decision to retire from a full-time operating role.

MongoDB noted that Ittycheria will remain on the company’s board and serve as an advisor to Desai, helping with the execution of the company’s long-term strategy.

Stocktwits, 3 November 2025

Desai is an interesting guy.

Cloudflare said in a filing on Thursday that Desai would step down on Nov. 7, to become CEO “at another notable, publicly-traded company.” Desai previously served as operating chief at ServiceNow. He resigned in July 2024, after the software company found a policy violation with the hiring of the U.S. Army’s chief information officer. Previously Desai held leadership positions at EMC and Symantec.

“We talked to people close to ServiceNow, as well as other people who know CJ really well, and we felt very, very comfortable that CJ is the right person to lead MongoDB in this next era,” Ittycheria said.

Desai, whose first job out of college was at Oracle, said he will split his time between New York and the San Francisco area.

MongoDB also said it expects to exceed the high end of its guidance ranges for revenue and adjusted earnings per share in the fiscal third quarter. The top end of its range was 79 cents per share in earnings, and $592 million in revenue.

Desai said he’s “looking forward to grow MongoDB to $5 billion-plus in a durable, profitable way, in revenues, and most importantly, to be the gold standard for modern database technology, no matter what kind of workloads exist.” He did not offer a timeline for the revenue goal.

Tech, 3 November 2025

The news that sales and earnings would exceed expectations would also boost the shares. Desai has been on an incredible fast track in the last three or four years.

SAN FRANCISCO–(BUSINESS WIRE)– Cloudflare, Inc. (NYSE: NET), the leading connectivity cloud company, today announced the appointment of Chirantan “CJ” Desai as President of Product & Engineering to further accelerate the company’s next phase of growth to $5 billion in annual recurring revenue and beyond. Desai’s 25+ years of experience spans product innovation, go-to-market strategies, and operational efficiency—all key in building high-performing teams and driving sustained business growth at scale.

Desai most recently served as President and Chief Operating Officer at ServiceNow (NYSE: NOW), overseeing ServiceNow’s products, platform, design, AI research, engineering, customer support, and cloud infrastructure operations as well as customer success. Joining ServiceNow in December 2016 as Chief Product Officer before being promoted to the role of Chief Operating Officer in January 2022, Desai helped scale the company from $1.5 billion to more than $10 billion in annualized revenue during his tenure.

“CJ’s track record of driving innovation, operational excellence, and customer-centric growth speaks for itself and makes him an ideal fit for Cloudflare as we continue to scale our company and push the boundaries of what’s possible,” said Matthew Prince, co-founder & CEO at Cloudflare. “Just this year, we’ve brought on some of the best and brightest executives in the world. They could go just about anywhere, but they believe Cloudflare is the next iconic technology company. They’re betting their careers on Cloudflare and joining us to further accelerate our growth. I look forward to working with CJ as we continue to scale our research and development organization for the next chapter of our business.”

“I have always believed in the power of technology to make our work and personal lives better and safer. Cloudflare’s vision for world-class innovation and its commitment to delivering exceptional value to customers align with my own passion for driving transformation and growth,” said CJ Desai, President of Product & Engineering at Cloudflare. “I look forward to working together with the incredibly talented team at Cloudflare to advance our mission of helping to build a better Internet, all while delivering best-in-class solutions that drive meaningful business outcomes for our customers.”

To learn more about why CJ joined Cloudflare, check out our latest blog post:

Blog: Why I Joined Cloudflare Click on the link. It is an interesting blog.

About CJ Desai

CJ Desai is the president of product & engineering at Cloudflare. He has 25+ years of experience spanning product innovation, go-to-market strategies, and operational efficiency—all key in building high-performing teams and driving sustained business growth at scale. Most recently, CJ Desai served as president and COO at ServiceNow. Desai oversaw ServiceNow’s products, platform, design, engineering, customer support, and cloud infrastructure operations as well as Customer Success. Prior to joining ServiceNow, Desai was the president of the Emerging Technologies Division at EMC where he had a full P&L responsibility for emerging technology products with a focus on launching and growing new product lines. Desai ran various product lines for 9 years while at Symantec including Endpoint Security, Email & Web Security, Server Security, Mobile Security. Desai began his career with Oracle Corp and was a key member of the team that launched Oracle’s first cloud service.

Cloudflare, 10 October 2024

I cannot find his age, but I am guessing he is around 50. It’s a compliment to MongoDB that he chose to join them when he was on a fast track at another exciting technology business, Cloudflare. He must see great opportunities for the business.

Share Recommendations

OpenAI (if you can buy shares in a private company)

MongoDB MDB (going into Top 50 portfolio)

It is insane what is happening at OpenAI.

While talking about the potential for OpenAI to go public in the coming years, Bg2 host Gerstner floated revenue estimates topping $100 billion a year in 2028 or 2029.

“How about ’27?” Altman interjected.

Fortune Magazine, 1 November 2025

My speculation that the company is losing $14bn a year (see above) may also be wide of the mark. In the Fortune article, the magazine said that Microsoft took a quarterly charge of $4bn on its holding in OpenAI. Work that through and losses could be approaching $50bn a year.

Altman is like Musk. He has incredible self-belief.

“We do plan for revenue to grow steeply. Revenue is growing steeply,” he said. “We are taking a forward bet that it’s going to continue to grow and that not only will ChatGPT keep growing, but we will be able to become one of the important AI clouds, that our consumer device business will be a significant and important thing, that AI that can automate science [and] will create huge value.”

Altman added that one of the rare instances when being a publicly traded company would be appealing is when there’s an opportunity for short-sellers to lose big.

Fortune Magazine, 1 November 2025

I love what he is doing. He is my kind of entrepreneur, and with Sarah Friar at his side, anything is possible. OpenAI represents a gigantic bet on the future of AI, but everybody these two talk to signs up for the story. And they have impressed some hard-headed people.

But Microsoft CEO Satya Nadella, who also appeared on the podcast, said OpenAI has exceeded all the business plans that he has seen.

“Everyone talks about all the success and the usage and what have you,” he said. “But even I’d say all up, the business execution has been just pretty unbelievable.”

Fortune Magazine, 1 November 2025

And if Altman is to be believed, growth is accelerating (see his hint above that sales could reach $100bn in 2027). Friar has said that the limiting factor on OpenAI’s growth is the ability to put in place sufficient computing power. It appears that demand for AI is raging way ahead of the technology industry’s ability to deliver.

OpenAI recently launched a product called ‘Deep Research’ for which they charge $200 a month, £200 a month in the UK. Sarah Friar told her audience of entrepreneurs during a recent interview at Goldman Sachs that everybody in the room should buy ‘Deep Research’ because it was incredible. So what is the big deal?

The “big deal” about OpenAI’s Deep Research is its ability to perform complex, multi-step online research tasks for professionals, automating tedious work like creating literature reviews and identifying knowledge gaps in minutes. It’s significant because it represents a strategic expansion into AI-powered research solutions and uses a more advanced reasoning model to synthesize information from the web and uploaded files into comprehensive, cited reports.

What it does

Performs complex research: It’s designed to handle intensive knowledge work in fields like science, finance, and engineering.

Automates tasks: It can write literature reviews, identify knowledge gaps, and synthesize information from hundreds of websites into a structured, cited report.

Is multi-modal: It can process and analyze information from text, images, and PDFs, going beyond traditional text-based AI assistants.

Connects to data sources: It can search the public web and connect to third-party data sources that users enable.

Includes documentation: It provides citations to back up its claims, and some users have found its reports to be as good as or better than published review papers.

Why it’s a big deal

Time efficiency: It can complete tasks that would normally take hours in a fraction of the time.

Strategic expansion: Its launch signals OpenAI’s strategic move into the market for AI research solutions, competing with other professional-grade AI tools.

Advanced reasoning: It’s built on a more advanced version of OpenAI’s o3 model, which allows it to reason and work for longer periods than previous models.

Professional utility: While it may not replace a human expert, it has the potential to significantly boost productivity for knowledge workers by handling the manual work of research.

AI Overview