This chart looks like a breakout. US 10 year bond yields are heading higher and if this chart is anything to go by could exceed five per cent. Could they even go to a seemingly unthinkable six per cent? A chart like this suggests that they could; that would be a test for US share prices and indeed for the global economy.

An early casualty of this strong trend in US bond yields has been sterling against the dollar which has wakened sharply in recent days.

I am looking at shorter scale charts because it is the short term we are thinking about for the moment. It is hard to make predictions from this chart except that the blue line (shorter term moving average) has turned down and often, though not invariably, in the past this has signalled an extended period of weakness.

Could there be drama ahead? The next General Election must be held by January 2025 so we will soon be in a pre-election period which Labour look odds-on to win. This does not seem to be the background for a notable strengthening of the pound.

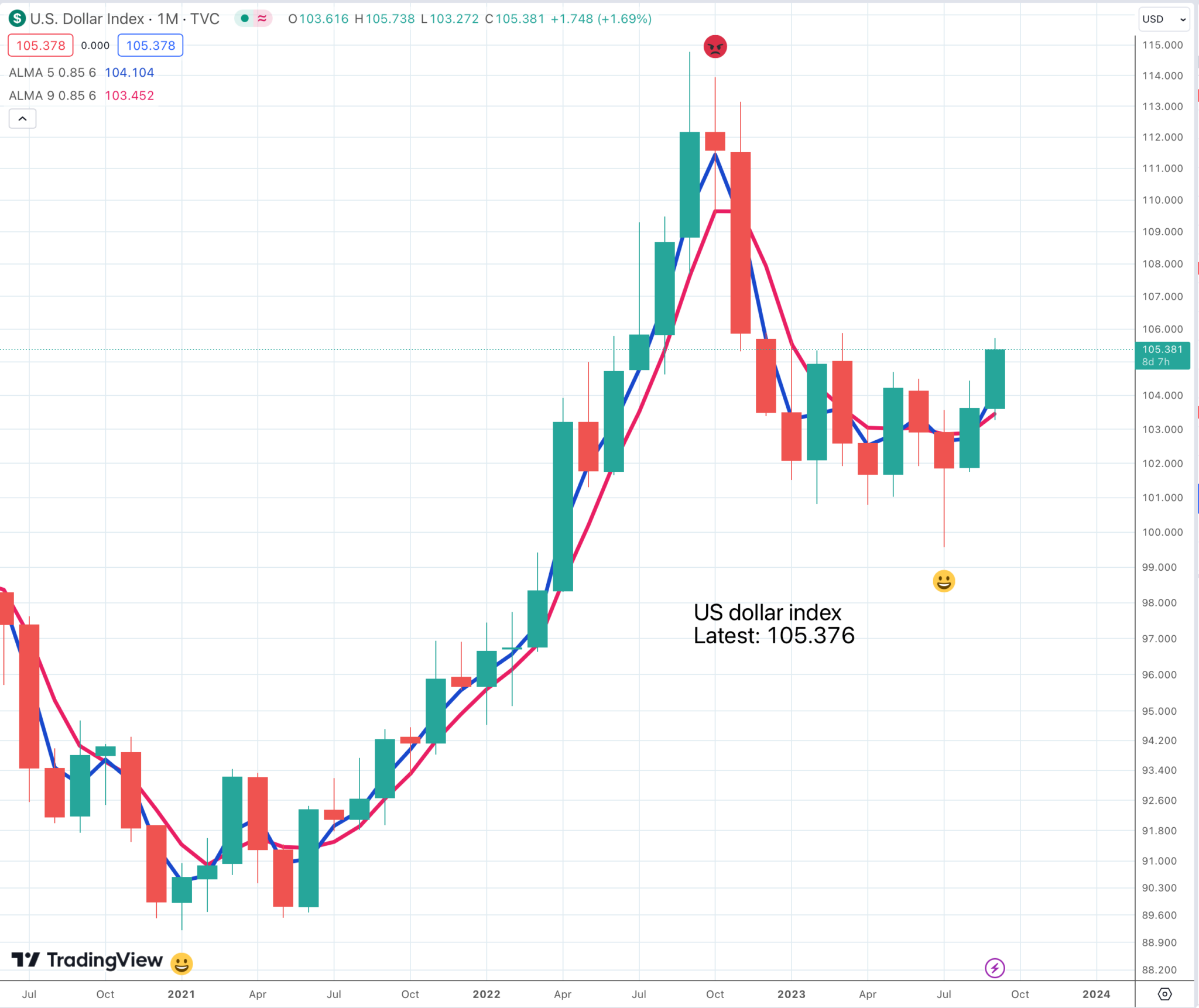

The next US presidential election is scheduled for November 2024 and incredibly may again be fought between Trump and Biden. The chart of the US dollar index looks well capable of going higher against a basket of currencies.

None of this is the most positive background for US shares and again, on a shorter term chart where each candlestick represents a month and the moving averages cover similarly shorter periods a period of weakness for US shares look very possible with the blue, shorter term moving average rolling over for the first time in seven months.

Strategy – Macro Trumps Micro in the Short Term

Below is a quote from ServiceNow, a super growth, high quality US software services company.

We’re set up very well for a strong second half. As you’ll hear from Gina, we are raising our full-year guidance for subscription revenue and operating margin. This is an unprecedented market environment for enterprise software. Our good friend, NVIDIA Co-Founder and CEO, Jensen Huang, joined us at Knowledge ’23 earlier this year.

And Jensen stated the expanded NVIDIA-ServiceNow partnership is really important. Their partnership of choice for enterprise IT. He thinks it’s an exciting growth opportunity for both companies. We agree.

We’re in the midst of a dramatic expansion of the software economy. In 2023 alone, IDC says Platform-as-a-Service spending will grow 30pc, and Software-as-a-Service applications will grow 17pc. When you correlate that to ServiceNow’s platform and our workflow leadership, it’s clear we live in a great neighborhood on a super nice street, and maybe we’re in the best house. With regard to artificial intelligence, especially large language models, ServiceNow strategy has been laser-focused for years.

We accelerated that focus with our Element AI acquisition in 2020. Today, by some estimates, generative AI could boost global GDP by almost $7 trillion. We see unprecedented parallel adoption across consumer and the enterprise. Our platform experts who have worked for the greatest brands and technology believe this moment is as transformative, if not even more so than the Internet or even the iPhone.

Bill McDermott, CEO, ServiceNow, Q2 , 2023, 26 July 2023

This is an exciting company in fabulous shape but the short term chart is mildly negative.

There are presently loads of charts that look like this. The shorter blue line (5m moving average) turned higher in January 2023 but is now turning down. Nvidia, Tesla, ELF, Microsoft and many others look the same.

The longer term chart still look good with a buy signal on the 6m candlestick chart. These don’t happen very often but are typically important, especially when a company has fundamentals as strong as those of ServiceNow.

If this was a private company about to join the stock market investors would be wild with excitement.

This has fueled our rise into the Fortune 500 for the first time. And this is another tribute to Fred Luddy’s founding vision for a hungry and humble market-leading company, and we’re only getting started.

Bill McDermott, CEO, ServiceNow, Q2 , 2023, 26 July 2023

And Bill McDermott is a man to be reckoned with as a former CEO of Europe’s leading software business, SAP. It all depends on your perspective. If you are a patient investor the odds are excellent that what is happening is a buying opportunity.

Share Recommendations

ServiceNow. NOW. Buy @ $554

Nvidia. NVDA. Buy @ $420

E.L.F. Beauty. ELF Buy @ $106

Tesla. TSLA. Buy @ $243

Microsoft. MSFT. Buy @ $316

If you feel cautious you could wait until the shorter term charts looks more positive but it is often a good rule to buy when nobody else wants to. One of my subscribers told me once that he bought relentlessly into a falling Tesla price, which worked very well for him. And another investor reported doing very well by doing the same thing with Nvidia.

It is hard to do but buy into fear and sell into greed is often a good strategy.

If you look at the Microsoft chart there are two possibilities. It is forming a top area or it is forming a continuation pattern which will eventually break higher. Given the fundamentals and what is happening with technology generally and generative AI in particular the odds strongly favour an upside breakout.