Ashtead Group. AHT . Latest 2550p . MV: £11bn . Employees: 17,803 Next figures due: 3 March

I think I can fairly claim to be a serious fan of Ashtead Group as an investment. The shares have featured six times in QV, all profitable and 20 times in all my publications, starting at 207p in December 2011. In the 1980s, famous fund manager, Peter Lynch, coined the phrase, 10-bagger, for shares that go up more than tenfold after you buy them. Ashtead is comfortably a 10-bagger for me.

When shares go up this much it is usually a sign of a high-quality business with excellent management and that is very much the case for Ashtead. The game changer at Ashtead was its purchase, via a series of deals starting in 1990, of an equipment rental business in the south eastern United States.

This did not immediately pay dividends because equipment rental businesses can be vulnerable to the business cycle. Basically what companies like Ashtead do is borrow money to buy equipment which they then sell slowly (rent) to their customers. If it works it is a great business but a combination of high interest rates and falling rental demand, just what happens in recessions, affects equipment rental companies rather like kryptonite effects Superman.

Not shown on the chart but Ashtead had two near-death experiences in 2003 and 2009. It clung on grimly and as the old saying goes – what doesn’t kill you makes you stronger. Forged by the fire not once but twice, Ashtead emerged from the ashes as a formidable business, which in January 2007 appointed Geoff Drabble as CEO. He proved the perfect man to take advantage of what has proved to be an extraordinary opportunity in the USA.

The UK in the early years of the new millennium was way ahead of the US in seeing the advantages of rental. Perhaps because we were more accustomed to living with high interest rates and violent business cycles UK construction companies had long realised the advantages of outsourcing their equipment requirements to specialists like Ashtead, leaving them to take the financing risks and giving construction companies the flexibility to downsize rapidly if the business cycle turned against them.

American companies had been different, typically owning and replenishing their own equipment fleets. This was fine until 2009, when the global economy generally and US housebuilding and construction particularly had a savage near-death experience. After that the salesmen from Ashtead, known as Sunbelt Rentals in the US, were pushing at an open door when they advised US construction companies to switch from owning to renting. Since then there has been a sustained secular trend in favour of renting, which has created a strong following wind, especially for market leaders like Ashtead, which is the second largest but I would argue best, US equipment rental business.

The business took off and has been roaring ahead ever since, confounding the many observers who have been calling for a renewed cyclical downturn ever since the boom began around 2010-11. Various factors have driven growth since then. Most obviously has been Ashtead’s success in adding to its US branch network. This has been partly by greenfield openings and partly by acquisition in a highly fragmented industry. The result is that the two US market leaders, United Rentals and Sunbelt Rentals have not only grown strongly in a growing industry but have steadily increased their market share. Sunbelt even more rapidly than United Rentals, which has more exposure to the even more cyclical oil patch. Even with the latest results Ashtead grew sales by three times the growth in the overall market. The group has also grown and continued to grow by infilling (siting depots ever closer to each other) in a way which enables the group to provide superb customer service while crushing the competition.

Ashtead has also greatly expanded the scope of the equipment rental business. Examples are music festivals and football games, which have dramatic spikes in their need for items such as power and air-conditioning equipment. It makes sense for them to outsource this requirement to companies like Ashtead, especially as the rental businesses have grown to a scale where they can cope with these spikes in demand.

The end results is that Ashtead is now a critical partner to a huge swathe of companies and organisations in the USA and now Canada, which turn to Ashtead for almost all their equipment needs. They have it when they want it; it is always in almost-new or new condition and when they don’t need it anymore they give it back. It works for them and has provided the steady growth in demand, which has taken Ashtead all the way from virtually bankrupt to the FTSE 100.

In terms of share price appreciation the best has happened but there is no sign that the growth is over. Many businesses and organisations that could use Ashtead still don’t. The company has even branched out into tools for individual tradesmen. It is the same phenomenon, which has transformed the software industry, which overwhelmingly now rents software to customers rather than selling it.

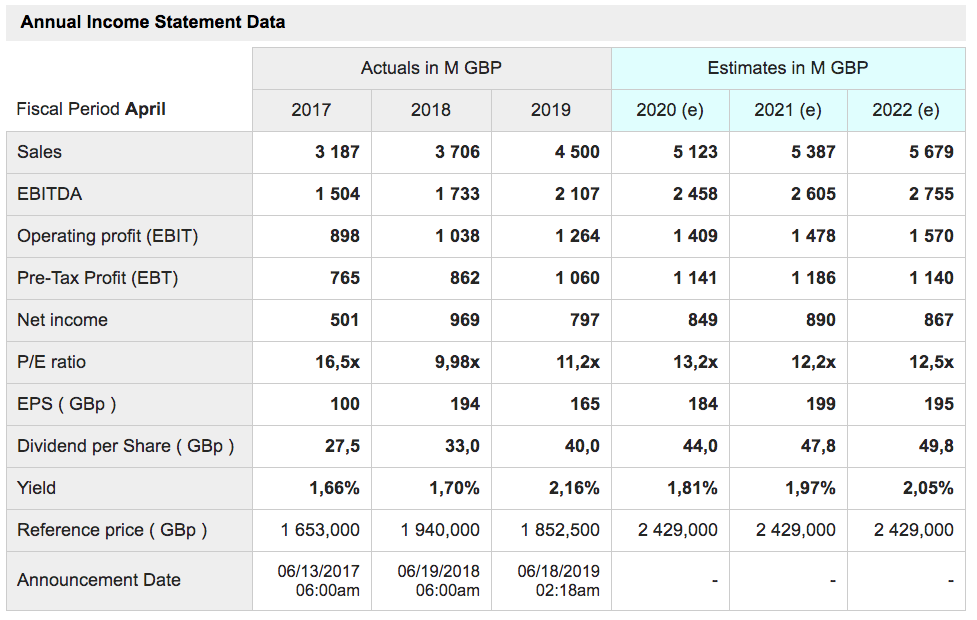

The shares look timely to buy right now partly because they have a great chart but also because the business continues to grow strongly. Ashtead consists of three geographical businesses, the US, the UK and the newest operation, in Canada. The two latter operations are very roughly around 10pc of sales. The UK is flat but surely looking to recovery, Canada grew latest sales by 20pc and the USA by 15pc leading to 14pc growth overall.

The group is still investing heavily in new equipment, bolt-on acquisitions and share buybacks, all of which will drive growth in sales, profits, earnings per share and dividends in the future. An election year in the US is likely to see a continuing strong economy so all looks set fair for solid, even exciting progress to continue. The shares remain a great buy for income and capital growth. There is a new CEO, after Geoff Drabble’s retirement in May 2019 but the new man, Brendan Horgan, was already the CEO of Sunbelt Rentals so is steeped in all the disciplines that have made the group so successful.

The latest presentation on Ashtead results for the half year to 31 October, gives a vivid picture of a superbly managed business in great shape and benefiting from a robust US economy. My expectation is that results for Q3, due 3 March, will show great progress continuing. The shares look excellent value and timely to buy to add to existing holdings or as a new addition to your portfolio.