It has struck me forcibly that ArgenxSE and other companies like it are all about creating new products, new treatments for patients that have never existed before. They are totally at the cutting age. ArgenxSE announced on 30 October, as part of an update on progress, that it expected five registrational readouts in 2026. So what are they?

A registrational readout refers to the public release of the primary data and results from a registrational clinical trial.

Key aspects of a registrational readout:

Registrational Trial: This is a specific type of clinical trial (typically a large Phase 3 study) designed to establish a new drug or treatment’s safety and efficacy. The data collected from this trial is intended to be sufficient to support an application for marketing approval from regulatory authorities, such as the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA).

The “Readout”: In the context of a clinical trial, “readout” means the point at which the final, analyzed results of the study are made public, often shared with investors, the scientific community, and the public.

Significance: These readouts are major milestones for pharmaceutical and biotechnology companies. Positive results are crucial for gaining regulatory approval and demonstrating the value of a new treatment to stakeholders.

Transparency: Clinical trials are required to be registered on public databases like ClinicalTrials.gov. The results of registrational trials must also be reported publicly, which helps prevent publication bias (the selective reporting of only positive results).

AI Overview 16 November 2025

2026 could be a banner year for ArgenxSE, a year in which it also expects to initiate registrational studies for Graves’ disease, expanding its reach into thyroid-driven autoimmunity.

Thyroid-driven autoimmunity, or autoimmune thyroid disease (AITD), is a condition where the body’s immune system mistakenly targets the thyroid gland, leading to inflammation and damage. This breakdown in immune self-tolerance results in a range of disorders, most commonly Hashimoto’s thyroiditis (leading to hypothyroidism) and Graves’ disease (leading to hyperthyroidism).

Key Mechanisms

The process involves a complex interaction of genetic and environmental factors:

Loss of Self-Tolerance: Normally, the immune system distinguishes between “self” and “foreign” cells. In AITD, this ability is lost, and self-reactive immune cells (T and B cells) are activated against the thyroid gland.

Immune Cell Infiltration: The thyroid gland is infiltrated by lymphocytes (white blood cells), causing chronic inflammation and tissue damage.

Autoantibody Production: The immune system produces specific antibodies that target thyroid proteins. The main autoantibodies include:

Thyroid Peroxidase Antibodies (TPOAbs): Found in most people with Hashimoto’s thyroiditis and many with Graves’ disease. They are associated with the destruction of thyroid cells.

Thyroglobulin Antibodies (TgAbs): Also commonly found in both conditions, targeting thyroglobulin, a protein precursor to thyroid hormones.

Thyroid-Stimulating Hormone Receptor Antibodies (TRAbs): The hallmark of Graves’ disease. These antibodies bind to the TSH receptor and mimic the action of TSH, stimulating the thyroid to produce excessive hormones (hyperthyroidism). In some cases, they may block the receptor, leading to hypothyroidism.

AI Overview, 16 November 2025

These two conditions affect many people.

Estimates vary, but globally, the prevalence of Hashimoto’s thyroiditis is about 7.5% of the population, while Graves’ disease affects approximately 1.2% of people in the United States. In the US, an estimated 14 million people have Hashimoto’s, and up to 60% of those with hypothyroidism may be unaware of their condition. Both conditions are more common in women, with one in eight women developing a thyroid condition in her lifetime.

AI Overview 16 November 2025

The Eli Lilly chart shows how successful effective drug companies can be.

Eli Lilley operates on a huge scale with drugs in phase 111 trials that are addressing widely prevalent conditions.

Eli Lilly has at least 5 drugs in Phase 3 trials as of late 2024, with specific examples including orforglipron for diabetes and obesity, the once-weekly insulin efsitora, and remternetug for Alzheimer’s disease. The exact number can fluctuate as clinical trials progress.

Orforglipron: A small molecule oral GLP-1 receptor agonist that has been in multiple Phase 3 trials, including ACHIEVE-1 for type 2 diabetes and other weight management studies.

Efsitora: A once-weekly insulin being tested in a series of five registrational Phase 3 studies (QWINT trials) for type 1 and type 2 diabetes.

Remternetug: An investigational drug for Alzheimer’s disease that is in Phase 3 trials.

Tirzepatide: Eli Lilly is conducting head-to-head Phase 3 trials comparing its approved medication (Zepbound) to Novo Nordisk’s semaglutide (Wegovy) for weight loss.

Other drugs: Eli Lilly has many other drugs in development across various therapeutic areas, and some of these may also be in Phase 3 trials. A comprehensive list is best found on clinical trial registries, such as ClinicalTrials.gov.

AI overview, 16 November 2025

I went onto the Eli Lilly website and counted 32 phase three trials, though many of these were for the same drug in different indications. Lilly’s current big success is its weight loss drug, where it is going head-to-head with Novo Nordisk and seemingly winning the battle.

Q3 was another strong quarter for Eli Lilly and Company. We made progress across all our strategic deliverables. We delivered compelling financial results, advanced our pipeline, and achieved key milestones to expand our manufacturing footprint. In Q3, revenue grew 54% compared to the same period last year. Revenue from key products more than doubled as our medicines continued to increase their global impact. In the U.S., Lilly gained market share in the incretin analogs market for the fifth consecutive quarter. Lilly medicines account for nearly six out of 10 prescriptions within this large and growing class. Outside the U.S., Mounjaro performance accelerated driven by robust uptake around the world.

Dave Ricks, CEO, Eli Lilly, Q3 2025, 30 October 2025

Incretins are an important class of drugs.

Incretins are hormones released from the gut after eating that help lower blood glucose levels by stimulating insulin production and inhibiting glucagon release. The two main incretin hormones are glucagon-like peptide-1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP). They also slow down how quickly food leaves the stomach and can reduce appetite.

How incretins work

Stimulate insulin: Incretins signal the pancreas to release more insulin when blood sugar levels are high after a meal. This effect is glucose-dependent, meaning they don’t cause dangerously low blood sugar.

Suppress glucagon: They also suppress the release of glucagon, a hormone that raises blood sugar.

Slow gastric emptying: Incretins slow down the rate at which food is emptied from the stomach, which helps prevent rapid spikes in blood sugar after eating.

Reduce appetite: They can decrease appetite, which can lead to weight loss.

Incretins and diabetes

In people with type 2 diabetes, the natural incretin effect is often diminished.

Because of this, incretins are a target for diabetes treatment. Medications like GLP-1 receptor agonists and DPP-4 inhibitors are based on the incretin system to help manage blood glucose levels.

AI overview, 16 November 2025

Mountjaro is a weight-loss drug.

Mounjaro (active ingredient tirzepatide) is a prescription medicine used to treat adults with type 2 diabetes and for chronic weight management. It is administered as a once-weekly self-injection using a pre-filled pen.

How it Works

Mounjaro is a first-in-class dual agonist, meaning it mimics two natural gut hormones, glucagon-like peptide-1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP).

By activating these two hormone receptors, Mounjaro helps to:

Suppress appetite and reduce food cravings.

Slow down stomach emptying, making you feel fuller for longer after eating.

Increase insulin production when blood sugar is high.

Reduce the amount of sugar produced by the liver.

This dual action helps to regulate blood sugar levels more effectively and leads to significant weight loss when combined with a reduced-calorie diet and increased physical activity. In clinical trials, some patients lost up to 22.5% of their starting body weight over 72 weeks on the highest dose.

Who Can Use It

Mounjaro is a prescription-only medication and a healthcare provider will determine if it is appropriate for you.

For type 2 diabetes: It is approved for use with diet and exercise to improve blood sugar control.

For weight management:

UK: It is approved for adults with obesity (BMI of 30 kg/m² or more) or who are overweight (BMI of 27 kg/m² or more) and have at least one weight-related health condition (e.g., high blood pressure, high cholesterol, type 2 diabetes, or obstructive sleep apnoea).

US: Mounjaro itself is not FDA-approved for weight loss, but its active ingredient, tirzepatide, is approved for this use under the brand name Zepbound.

AI overview, 16 November 2026

The many brand names are confusing, but the bottom line is that Lilly’s weight loss drugs are on an incredible growth charge.

Finally, moving to cardiometabolic health, Zepan and Mounjaro both posted strong global performance. Beginning outside the U.S., Mounjaro performance was robust. We have now launched in 55 countries and all major markets. We have seen a strong reception globally and have gained significant share in most major markets as a result.

While obesity reimbursement remains limited internationally, we are encouraged by the strong uptake. Approximately 75% of Mounjaro revenue outside the U.S. is coming from people with obesity paying out of pocket, demonstrating a high level of clinical need and high willingness to pay. Moving to the U.S., Zepan prescription tripled in Q3 2025 compared to the same period last year. While the impact of the CVS template formulary change was disruptive to patients and physicians, the impact on Zepan performance was modest. Share of total U.S. prescription in the branded anti-obesity market declined by approximately two percentage points compared to Q2 2025. However, performance is back to Q2 levels, and Zepan exited Q3 with 71% share of new prescriptions.

We saw strong uptake of sebumin in vials, which comprised approximately 30% of total U.S. Zepan prescriptions and over 45% of new prescriptions in Q3. Mounjaro posted robust Q3 in the U.S. as total prescriptions grew by over 60%. Mounjaro also gained share of market in the type two diabetes incretin analog market, increasing by four percentage points compared to Q2 2025. Mounjaro is the most widely prescribed incretin for people with type two diabetes in the U.S. As shown on slide 10, the combined U.S. Synchrony Nanalog market growth was strong, increasing by 36% in Q3 compared to the same period in 2024.

Lilly incretins gained share of market compared to Q2 2025, and approximately two out of every three new prescriptions in the incretin analog market is a Lilly medicine.

Lucas Montarce, CFO, Eli Lilly, Q3 2025, 30 October 2025

A massive amount is happening at Eli Lilly, as one would expect from a company valued at nearly $1 trillion, the first pharmaceutical company to reach this milestone. A critical new drug is set to be launched in 2026.

Eli Lilly’s new oral weight-loss pill, orforglipron, is expected to be available in 2026, pending regulatory approval from agencies like the FDA and EMA. The company anticipates receiving FDA approval by March 2026 and is preparing for a global launch, with the UK expected to be among the first countries to receive it.

Orforglipron details

Drug type: A daily oral pill in the GLP-1 class, similar to injectable drugs like Mounjaro and Wegovy.

Uses: Approved for weight loss and type 2 diabetes.

Key benefits:

Oral administration, making it easier than injections.

Has shown promise in trials for weight loss and for improving cardiovascular factors like blood pressure and cholesterol.

Potential side effects: May include gastrointestinal issues like nausea, vomiting, constipation, and diarrhea, which is consistent with other drugs in this class.

Manufacturing: Eli Lilly has already begun manufacturing and stockpiling the pills in anticipation of demand.

AI overview, 18 November 2025

In the chart above, the green triangles are buy signals, but they are best used as a signal to examine the company and see if something new and exciting is happening. A significant chart breakout, combined with a notable new development, represents a powerful buy signal. Lilly’s weight loss drug, tirsepatide, was first launched as Zepbound in the US in November 2023 and as Mounjaro in the UK in February 2024. Phase 3 trials for tirsepatide began in 2019, with the first FDA approval in 2022.

The shares started climbing before then, but have risen almost 10-fold since tirsepatide appeared on the scene as a serious contender.

In general, it appears that the behaviour of both Lilly and Argenx shares since 2017 particularly suggests that we are in an exciting period for drug development, which can only be further boosted as computing power and the amount of data being collected globally both increase exponentially.

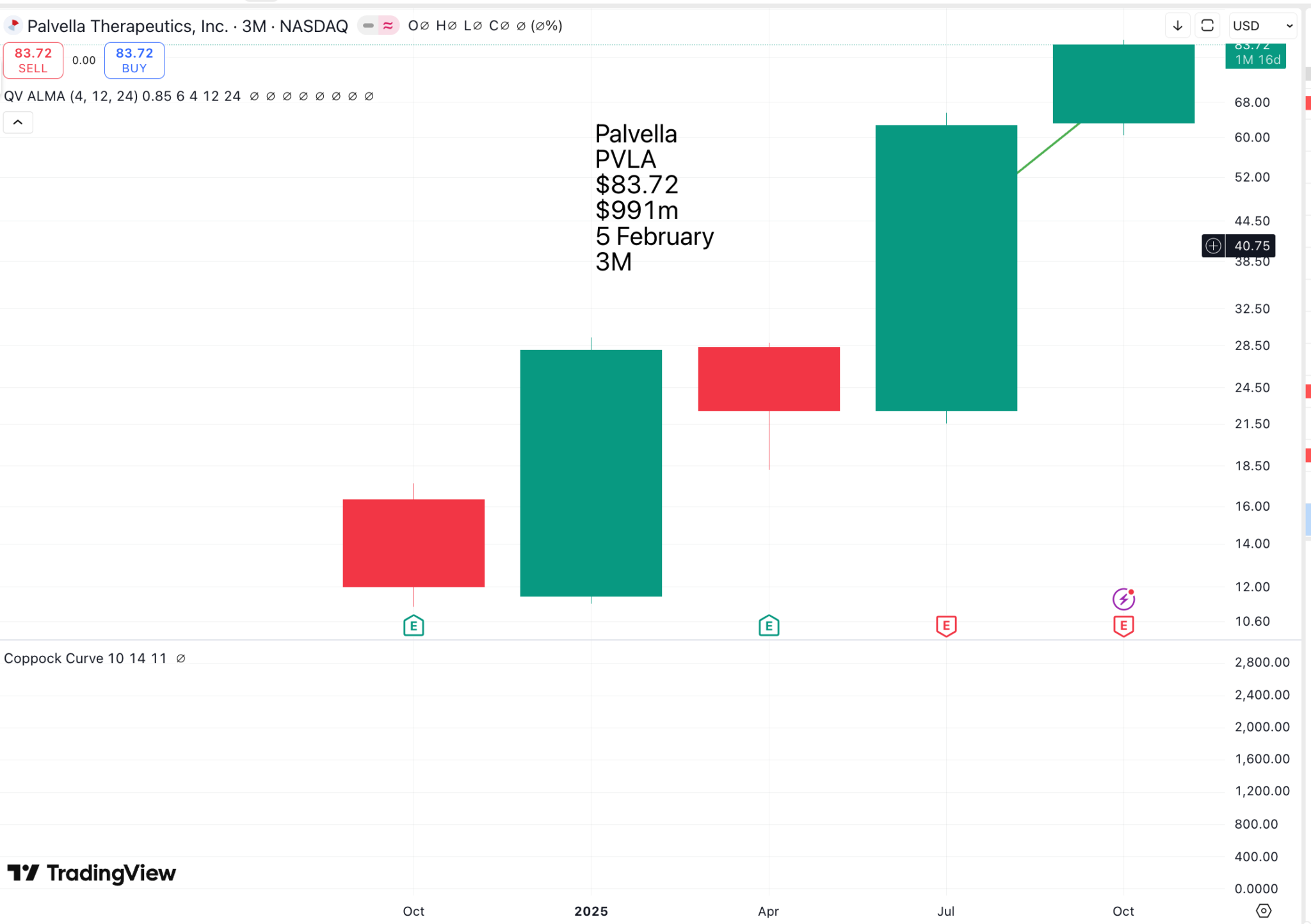

Palvella looks a little like ArgenxSE, but at a much earlier stage of development, with a market value of around $1bn and no commercial drugs as yet. It aims to lead in the treatment of rare skin diseases, where it has the potential to develop the first and only approved therapies. As you can imagine, there will be many people eager for the company to succeed.

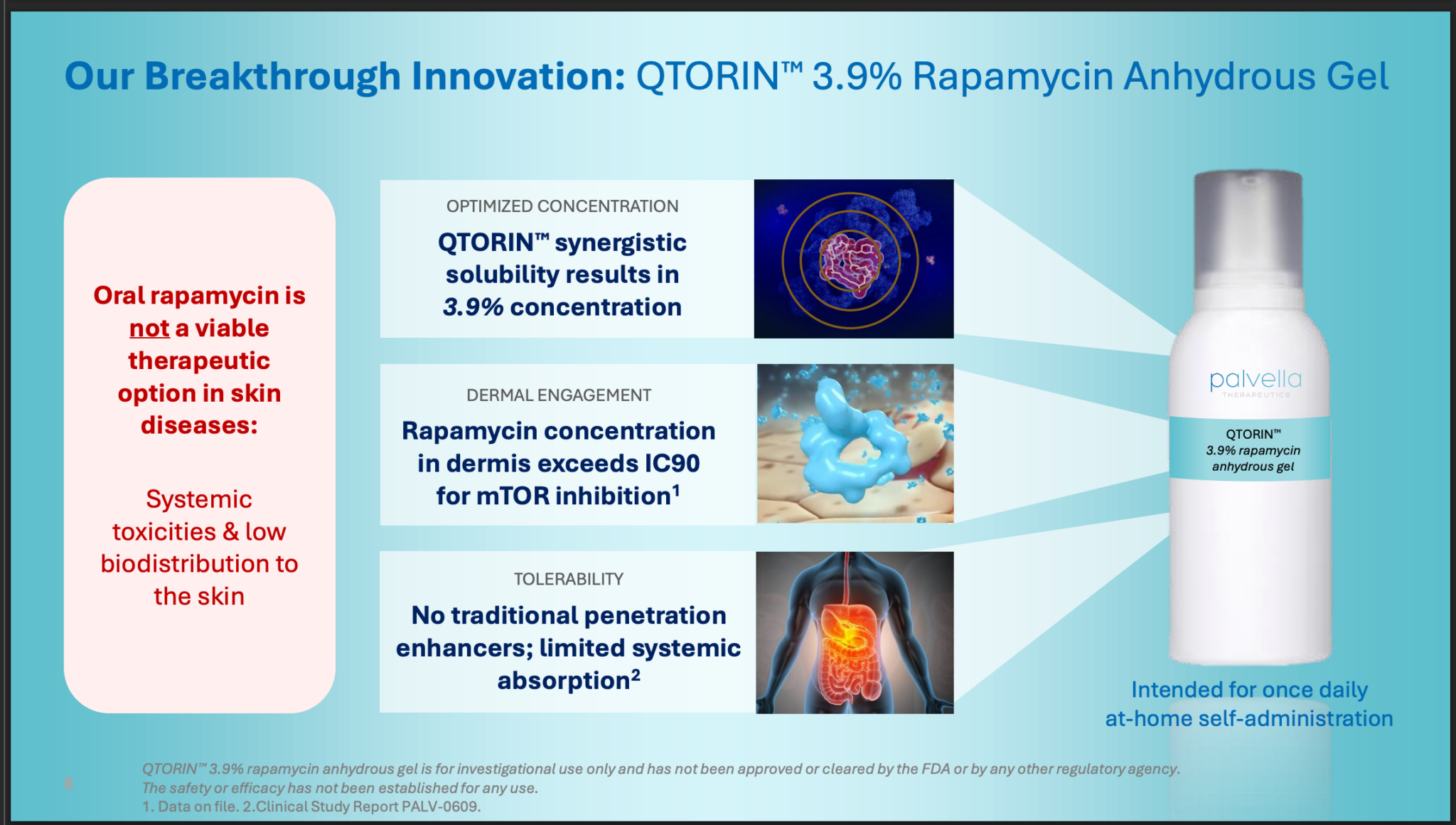

Its lead candidate is Qtorin, a gel

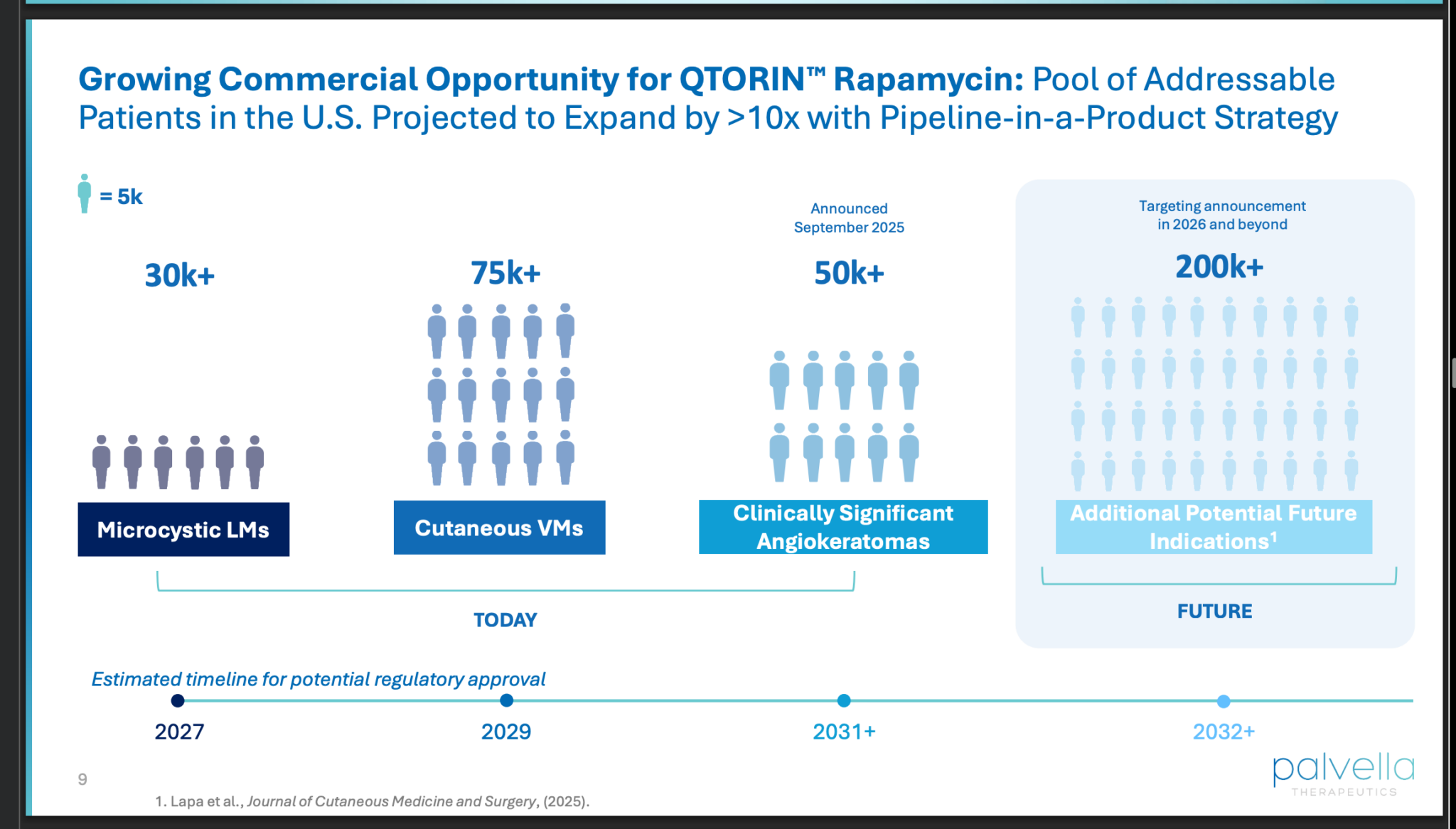

No question, it is a big opportunity.

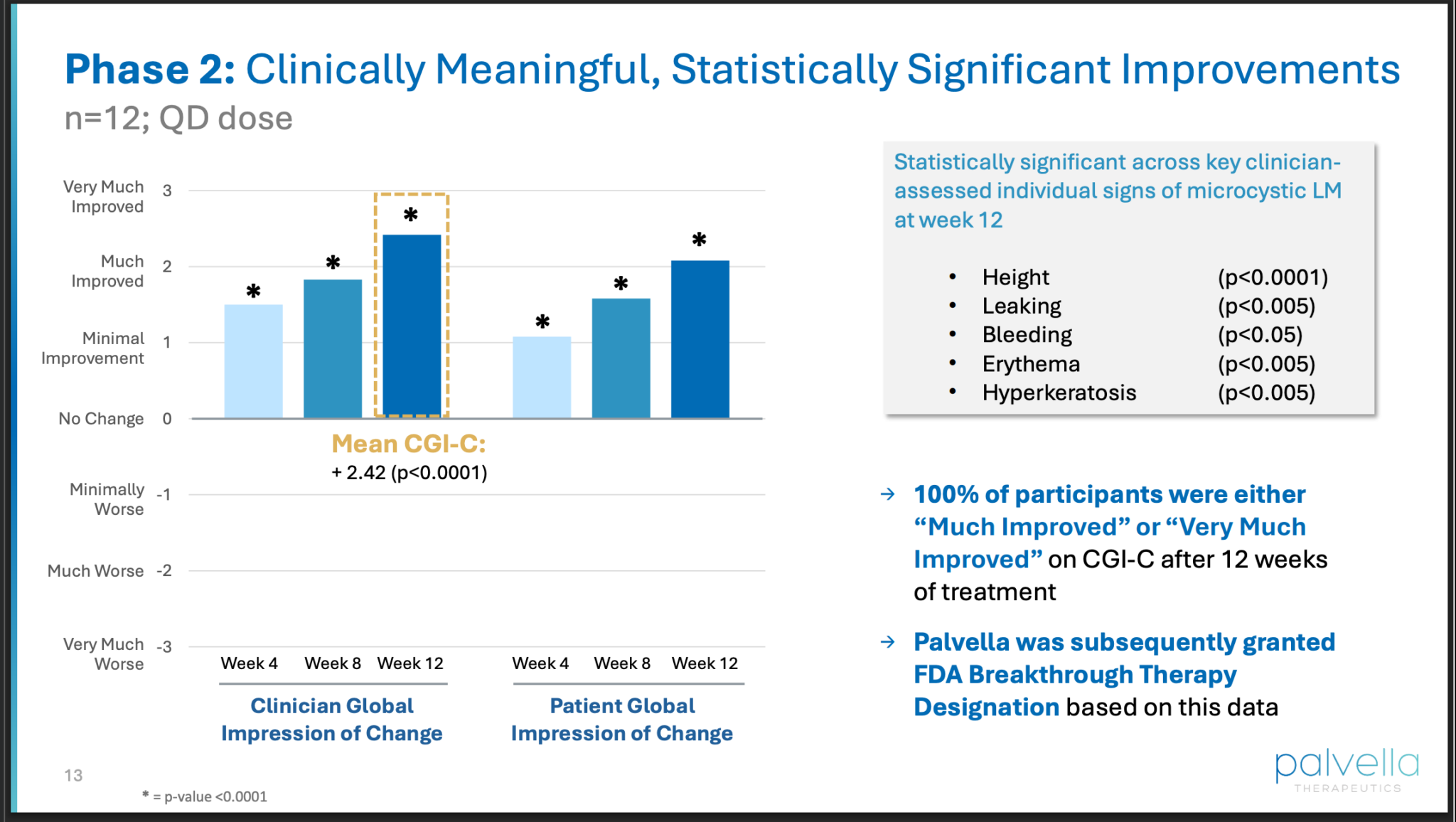

Phase 2 trial results look promising.

FDA Breakthrough Therapy Designation is important.

The FDA’s Breakthrough Therapy Designation is a process that expedites the development and review of drugs for serious conditions when preliminary evidence shows the drug may offer a substantial improvement over existing therapies. Receiving this designation offers sponsors more intensive FDA guidance, senior management involvement, and eligibility for rolling review and priority review. This process is intended to get promising, safe, and effective therapies to patients more quickly.

Key criteria and benefits

Serious condition: The drug must be intended to treat a serious or life-threatening condition.

Preliminary evidence: There must be early clinical evidence indicating that the drug may demonstrate substantial improvement over available therapies on a clinically significant endpoint.

Benefits for sponsors:

Intensive FDA guidance: The FDA provides more focused guidance throughout the development process to ensure it’s as efficient as possible.

Senior management commitment: The program involves an organizational commitment from senior FDA managers.

Rolling review: The sponsor can request to submit parts of a marketing application as they are completed, rather than waiting for the entire application.

Priority review: The drug may be eligible for priority review, which allows the FDA to take action on a marketing application within six months.

How the designation works

A sponsor can request this designation at any time after submitting an Investigational New Drug (IND) application, but a request is typically made around the end-of-Phase-II meeting.

The FDA evaluates the request to determine if the criteria are met.

If granted, the designation provides a structured pathway to get a drug to market faster while maintaining a high level of safety and efficacy.

AI overview, 16 November 2025

There is plenty more in the presentation about the efficacy of the drug and the indications it could treat. Finally, there is the summary of where things stand.

There are clearly risks investing in a company without approved drugs, but Palvella looks like a good bet.

As we enter year-end 2025, Palvella is now advancing innovative QTORIN™-derived therapies for four serious, rare skin diseases, each lacking a single FDA-approved therapy, giving us the opportunity to potentially be first for each of these deserving rare disease communities,” said Wes Kaupinen, Founder and CEO of Palvella Therapeutics. “Our lead product candidate, QTORIN™ rapamycin, continues to demonstrate its potential as a pipeline-in-a-product for mTOR-driven skin diseases, with a planned Phase 2 top-line readout in cutaneous venous malformations expected in mid-December. This will be followed by a Phase 3 topline readout in microcystic lymphatic malformations which we anticipate in the first quarter of 2026. Overall, we anticipate the next 18 months will be a catalyst-rich period highlighted by our objective to advance QTORIN™ rapamycin toward its first potential regulatory approval, with a steady flow of clinical, pre-commercialization, regulatory, and indication expansion milestones for QTORIN™ rapamycin and our additional QTORIN™ pipeline programs expected. Achievement of these milestones will advance our vision of becoming the leading biopharmaceutical company addressing serious, rare skin diseases with no FDA-approved therapies.”

Palvella results, Q3 2025, 11 November 2025

I am no pharmacist, so I cannot offer a remotely expert opinion on how likely QTORIN is to become successful, but I do feel that the climate is favourable for companies like Palvella. It just feels as though their time has come, and the opportunity looks huge.

A “pipeline-in-a-product” refers to a single lead drug candidate being developed by a company for multiple distinct indications, effectively creating a diversified product pipeline from a single asset.

For mTOR-driven rare skin diseases, this strategy is being notably pursued by Palvella Therapeutics with its lead product candidate, QTORIN™ rapamycin (3.9% rapamycin anhydrous gel).

“Pipeline-in-a-Product” Strategy in Action

Palvella Therapeutics is leveraging its proprietary QTORIN™ platform to develop topical therapies for serious, rare skin conditions that currently lack FDA-approved treatments. The QTORIN™ rapamycin gel targets diseases driven by the over-activation of the mammalian target of rapamycin (mTOR) pathway.

The single product candidate, QTORIN™ rapamycin, is being developed for the following distinct rare skin diseases:

Microcystic Lymphatic Malformations (Micro LMs): A rare genetic disease characterized by abnormal lymphatic vessels that lead to chronic lymphorrhea, bleeding, and risk of severe infections. The product is in a Phase 3 trial.

Cutaneous Venous Malformations (VMs): Localized malformations resulting from an error in vascular embryogenesis, forming dilated venous channels. A Phase 2 trial (TOIVA) is ongoing, with top-line results expected in mid-December 2025.

Clinically Significant Angiokeratomas: Characterized by superficial vascular malformations of lymphatic origin that can cause pain, bleeding, and infection. A Phase 2 study is planned for initiation in the second half of 2026.

By pursuing multiple indications for the same active pharmaceutical ingredient (rapamycin), the company aims to maximize the clinical and commercial potential of a single development program.

AI overview, 16 November 2025

There is an urgent need for successful therapies in this area.

Rare skin diseases driven by the activation or dysregulation of the mammalian target of rapamycin (mTOR) pathway are often part of a group of genetic conditions called hamartoma syndromes or phakomatoses. These conditions are characterized by the development of multiple, benign, tumor-like growths (hamartomas) in various organs, including the skin.

Key mTOR-driven rare skin diseases and related syndromes include:

Tuberous Sclerosis Complex (TSC): Caused by mutations in the TSC1 or TSC2 genes, which are key upstream regulators of mTOR. This results in the development of characteristic skin lesions (e.g., facial angiofibromas, shagreen patches, hypomelanotic macules, subungual fibromas) and hamartomas in the brain, kidneys, heart, and lungs.

Cowden Syndrome: Associated with mutations in the PTEN gene (another mTOR pathway regulator), leading to hamartomas in multiple organs and a high risk of certain cancers. Skin manifestations include facial trichilemmomas, cutaneous papillomas, and acral keratoses.

Bannayan-Riley-Ruvalcaba Syndrome (BRRS): Also linked to PTEN mutations, this syndrome involves hamartomatous polyposis of the intestines, macrocephaly, and speckled pigmented macules on the glans penis.

Proteus Syndrome: A rare and complex condition involving mosaic activation of the PTEN gene pathway, characterized by progressive, disproportionate overgrowth of various tissues, including the skin, and a propensity for tumor development.

Birt-Hogg-Dubé Syndrome (BHD): Caused by mutations in the FLCN (folliculin) gene, which affects mTOR signaling. It is characterized by multiple hair follicle tumors (fibrofolliculomas and trichodiscomas), lung cysts, and an increased risk of kidney cancer.

Pachyonychia Congenita (PC): An autosomal dominant disorder caused by mutations in keratin genes that activate the mTOR pathway, leading to painful palmoplantar keratoderma (thickened skin on palms and soles) and nail abnormalities.

Neurofibromatosis type 1 (NF1): Caused by mutations in the NF1 gene, which regulates Ras, an upstream component of the mTOR pathway. It is characterized by neurofibromas (nerve sheath tumors) and café-au-lait spots on the skin.

In these diseases, the dysregulation of the mTOR pathway leads to uncontrolled cell proliferation and abnormal tissue growth, making mTOR inhibitors like rapamycin and its derivatives potential therapeutic targets for managing symptoms and disease progression.

AI overview, 16 November 2025

As with ArgenxSE, I suspect it is only now, with great advances in genetic understanding, that it is possible to address these conditions with effective therapies. The Palvella share price is likely to react dramatically both up and down to trial results.

Abivax is another biologic with an explosive chart pattern. I looked at the company’s latest presentation on its drug pipeline, serious science and way beyond my pay grade. Let’s leave it to AI to explain.

Abivax is a clinical-stage biotechnology company that develops therapeutics for chronic inflammatory diseases by using the body’s natural mechanisms to stabilize the immune response. Its lead drug candidate, obefazimod, is in Phase 3 clinical trials for moderate to severe ulcerative colitis and works by enhancing the expression of a microRNA called miR-124, which regulates the immune system. The company is also researching new drug candidates based on obefazimod’s mechanism.

Focus and technology

Core mission: To develop and commercialize treatments for chronic inflammatory diseases like ulcerative colitis, and has also explored indications like rheumatoid arthritis and Crohn’s disease.Mechanism of action: Uses a small molecule, obefazimod, which enhances the expression of microRNA-124 (miR-124). MiR-124 is a key regulator of the immune response, and enhancing its expression helps to stabilize it.Delivery: Obefazimod is an orally administered small molecule, taken once daily.

Key drug development

Obefazimod (ABX464):

Ulcerative Colitis: Currently in Phase 3 clinical trials for moderately to severely active ulcerative colitis.

Crohn’s Disease: Patient enrollment for a Phase 2b trial was initiated in late 2024.

Other potential uses: Initial research was for viral indications, but the company shifted its focus after obefazimod showed potential in inflammatory diseases.

Company status

Clinical stage: Abivax is in the clinical-stage of development, with its lead drug in late-stage trials.

Transition: The company is in the process of transforming into a commercial-stage company, aiming to bring obefazimod to market.

AI overview, 18 November 2025

I asked AI the big question: Why are small biopharma companies doing so well in 2025?

Small biopharma companies are succeeding due to a combination of breakthrough scientific innovations, a surge in mergers and acquisitions (M&A) by large pharmaceutical companies, and favorable macroeconomic conditions like easing interest rates.

Key Drivers of Success

Pioneering Innovation: Small biopharmas are at the forefront of groundbreaking research in areas such as:

Cell and gene therapies.

Personalized medicine and targeted therapies, especially in oncology and rare diseases, which address high unmet medical needs.

Artificial intelligence (AI) to accelerate drug discovery, optimize clinical trial design, and improve efficiency in R&D.

Increased M&A Activity: Large pharmaceutical companies are facing a wave of patent expirations for their own blockbuster drugs and need to replenish their pipelines. This has led to a significant increase in M&A, with big pharma acquiring smaller biotechs with promising late-stage assets and innovative technology, often at a premium.

Favorable Economic Environment:

Lowering interest rates reduce the cost of capital for small, cash-intensive biotechs, making it easier for them to fund research and development.

A rotation in the stock market has seen investors move capital from large-cap tech stocks to growth-oriented sectors like biotech, which were previously undervalued.

The market has also shown a renewed willingness to reward small companies for positive clinical trial results, a key performance driver for the sector.

Strategic Adaptability: To manage funding constraints, small biopharmas are focusing on core, high-ROI therapeutic areas and leveraging strategic partnerships and outsourcing to efficiently advance their drug development programs.

Supportive Regulatory Environment: There is a supportive regulatory backdrop, including faster approval processes for innovative therapies and rare diseases, which creates commercial opportunities for smaller companies.

AI overview, 18 November 2025

I think this answer shows both the benefits and the limitations of AI. There is something more going on. The search for drugs to treat hitherto untreatable or hard-to-treat conditions is having a moment, and the scene is set for even more exciting progress in the coming years. As a result, like daffodils popping up in spring, share prices are bursting higher at what could be the start of a new boom. These companies, often on small valuations, are playing for massive stakes. Even ArgenxSE is a relative tiddler in the world of biopharma.

Abivax looks exciting to me, but I don’t want us all to get lost in the details, so let’s see what the CEO has to say.

So we are very excited to share this obefazimod data that shows its first-in-class molecule can work in induction in all type of population from naive to the most refractory population. In the next few months, we will continue to update the medical and financial community about the Phase III quality of life data, the biomarker data as well as preclinical combination data with other oral and injectable agents. We thank you for your continued interest in obefazimod, as our intent is to build a premier IBD company.

Marc M.de Garidel, CEO, Abivax, shareholder/ analyst call, 6 October 2025

So, what is a premier IBD company?

An “IBD company” in healthcare can refer to a few different entities: a company that develops medical devices, such as IBD Biomed; a company that provides patient support through digital platforms, like Ampersand Health; a pharmaceutical company working on IBD drugs, like Pfizer or Gilead; or, less commonly, an umbrella organization for IBD services, such as IBD UK. The specific meaning depends on the context, but it generally involves a business with a focus on inflammatory bowel disease (IBD) or related healthcare solutions.

AI overview, 18 November 2025

I am learning more about how to ask AI the right questions.

Abivax is considered exciting primarily due to its lead drug candidate, obefazimod, which has shown promising results in late-stage clinical trials for ulcerative colitis (UC) with a novel mechanism of action and a favorable safety profile.

Key reasons for the excitement include:

Novel Mechanism of Action (MoA): Obefazimod is a first-in-class, oral small molecule that works by enhancing the expression of a specific microRNA, miR-124, which in turn reduces inflammation. This is a differentiated approach compared to existing broad immunosuppressants.

Strong Phase 3 Results: The company announced positive results from two Phase 3 induction trials (ABTECT-1 and ABTECT-2) in July 2025 for patients with moderate to severe UC. The drug achieved statistically significant clinical remission at week 8, including in patients who had not responded well to prior advanced therapies.

Differentiated Safety Profile: Obefazimod has a “clean” safety profile, with no serious adverse events, malignancies, or cardiovascular safety signals observed in trials. This superior safety profile is a significant advantage over some existing treatments (like JAK inhibitors) that carry greater risks.

Potential for Long-Term Efficacy: Early data from maintenance trials suggests potential for durable response, which is a highly important factor for chronic conditions like UC. The 44-week maintenance trial data is a key upcoming catalyst, expected in Q2 2026.

Large Market Opportunity: The global UC treatment market is large and growing (estimated at over $15 billion annually for IBD). If approved, obefazimod could capture a significant share of this market, positioning it ahead of other options due to its efficacy and safety.

Pipeline Potential: In addition to UC, Abivax is exploring obefazimod for other inflammatory diseases like Crohn’s disease. The molecule was also initially studied as a potential functional cure for HIV, demonstrating its versatility and broad applicability of its MoA.

The combination of a novel, well-tolerated, and effective treatment for a major chronic condition makes Abivax an exciting prospect, both clinically and commercially.

AI overview, 18 November 2025

Share Recommendations

ArgenxSE ARGX

Eli Lilly. LLY

Palvella PVLA

Abivax. ABVX

Strategy – Add To Your HealthCare Positions

I am putting Eli Lllley and Abivax in the Top 50 portfolio. ArgenxeSE and Palvella are already there. I have a feeling that something is happening in healthcare, that we are at the dawn of an era of medical breakthroughs, an exciting time for humanity, where many distressing conditions have been accepted as cruel fate for so long. Maybe at last that will change.

Subscribers will notice growing use of artificial intelligence in my alerts. This is deliberate. Even the buy signals on the charts are now generated automatically. This partnership between Quentinvest and AI is just beginning. We plan to do much more.

.