The combination of buy signals on a 3m candlestick chart with Coppock buy signals based on one month intervals is a powerful one. We must always remember that 20:20 hindsight makes investing looking easier than it is in real time but even so there are some clear buy signals marked on the Nasdaq Techno9logy Sector index chart above which worked well.

We can also see that we don’t have a buy signal at the moment. At some point we will have and that will be an exciting development. One thing which does help is that we are not solely dependent on this chart for our reading of where the stock market is going. We have other indices, we have ETFs, we have individual shares and we have my benchmarks list. I am hopeful that using all those things we are going to spot any important turning points.

We also have common sense. We can look a things like what is happening to inflation and interest rates and whether there has been some key black swan event. The effect of the riots leading to Xi Jinping abandoning the strict lockdowns in China could be regarded as a minor black swan which, allied to a more accommodating stance by China on the regulatory issues with the USA has boosted Chinese shares, which had previously been very depressed.

Tencent on a roll

Tencent shares are barreling away as you can see from the chart below. The Coppock indicator has turned higher from minus around 100, which is the lowest level it has been since Tencent shares were floated in June 2004. I discussed the fundamentals in an earlier alert. The key point is that Tencent has pivoted to focus on returns to shareholders and has spectacular resources to make good on that plan.

Quentinvest rules of engagement

As we all know rules are made to be broken but here are three simple rules for using Quentinvest. I like the symmetry because the stocks that make it onto my short list are 3G and I emphasis three indicators when timing buying and selling of shares.

The three rules are:

Number one: only buy shares which score 10/10 and ETFs which score 3/3

Number two: do not sell shares while the Coppock indicator is rising

Number three: sell when my other indicators turn negative once Coppock is falling, which effectively means sell. when a share’s individual score is 0/3.

The difficulty people have with a programme like this is that it almost certainly means leaving a lot of money on the table. The alternative is to use rules one and two to build your portfolio on a never sell basis and then sell, everything once share and ETF scores start to fall to 0/10. It is no doubt an oversimplification but we want to be in the market while many shares and ETFs score 10/10 and 6/6 respectively and out of the market when the overall picture turns negative.

Just to summarise we are starting to put together what I hope will be a helpful body of dictums to inform our investment strategies – 3G, three key indicators, three rules and common sense.

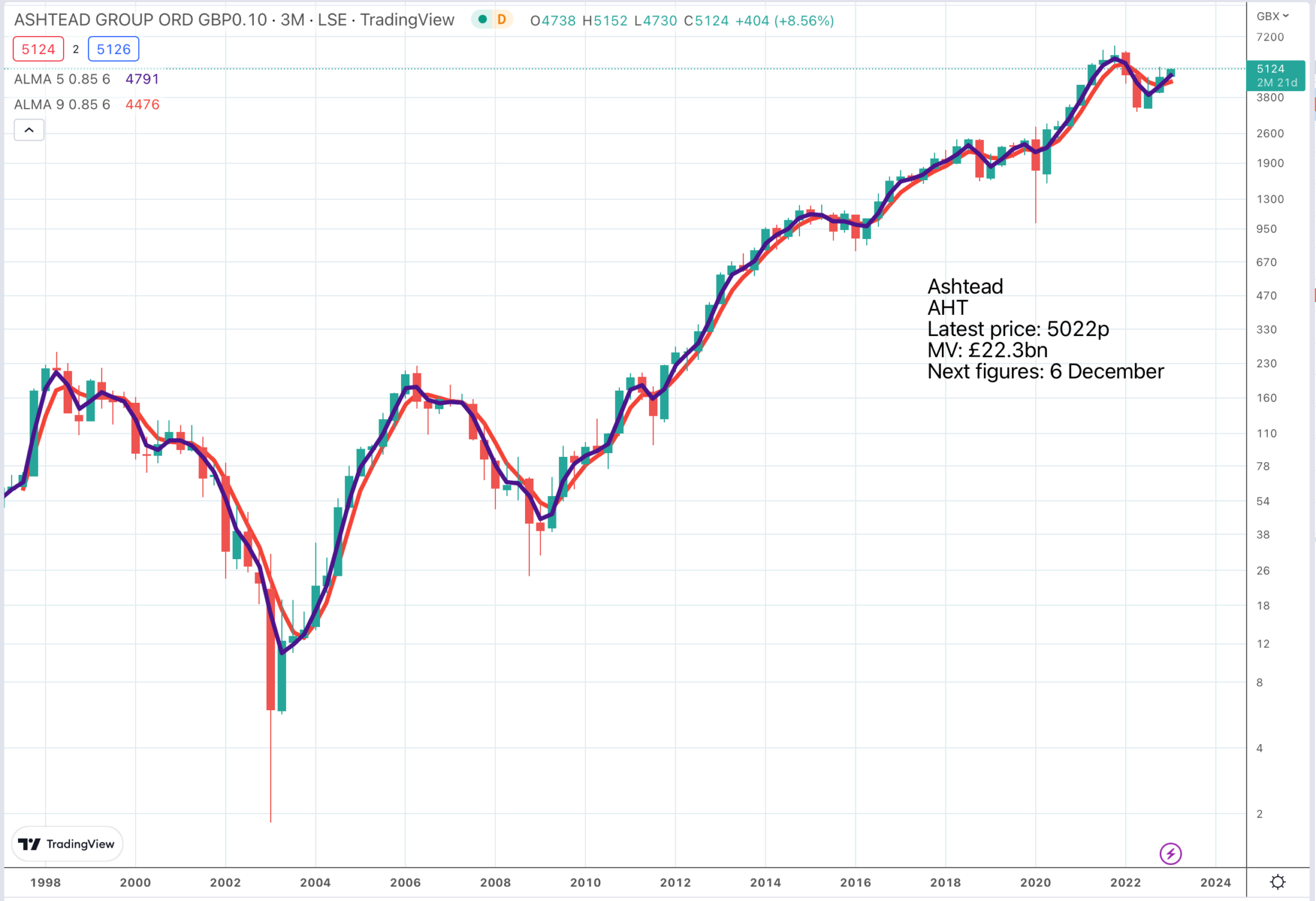

Coppock turns higher for Ashtead Group

I am beginning to realise that there is a clash between two of my key observations rules about the stock market. One rule (see above) is only buy 3G stocks when they scorer 10/10. The other rule, more an observation, is that it is always, as far as I can tell, safe to hold a share while its Coppock indicator (curve, line, whatever you care to call it) is rising. Ashtead Group is 3G, it scores 3/3 as a stock and as part of that 3/3 its Coppock line is rising.

As we know the latest fundamentals were excellent.

Our end markets remain strong and half-way through our strategic growth plan, Sunbelt 3.0, we are ahead of plan. In the period, we invested $1.7bn in capital across existing locations and greenfields and $609m on 27 bolt-on acquisitions, adding a combined 72 locations in North America. This significant investment is enabling us to take advantage of the substantial structural growth opportunities that we see for the business as we deliver our strategic priorities to grow our general tool and specialty businesses and advance our clusters. We are achieving all this while maintaining a strong and flexible balance sheet with leverage near the bottom of our target range.

Q2 2023, 6 December 2022

I would feel very confident that in the next bull market Ashtead Group shares are going to surpass the old peak around 6500p. In the process they may well build a springboard to drive the shares much higher over time. Investors who have them or buy them can take comfort in the fact that Coppock has given a buy signal and is rising.

Breakout for the FTSE 100

While looking at Ashtead I have noticed something else. We have a chart breakout and a rising Coppock for the FTSE 100 so Ashtead scores at least 6/10 and maybe 7/10 since the latest results beat expectations. I have also found an ETF containing Ashtead Group, IEFA, iShares Core MSCI EAFE ETF, which is a whisker away from being a 3/3 itself which would make Ashtead Group a 10/10.

I think Ashtead Group is going to become my first full-blooded recommendation for a long time.

Ashtead Group AHT Buy @ 5116p

Strategy

Ashtead scores 9/9 on the technicals and has long been one of my most admired companies. They have played a huge part in converting America from owning to renting a huge range of non-core equipment and grown dramatically while doing it.

What they don’t have, at least not yet is a huge pattern chart breakout or a striking ‘something new’.

Against that Ashtead is a wonderful business. Its return on investment in the USA in the 12 months to 31 October 2022 was 27pc.

Our business is performing well with clear momentum in robust end markets. We are in a position of strength and, with increased market clarity, have the operational flexibility to capitalise on the opportunities arising from the market and economic environment we face, including supply chain constraints, inflation and labour scarcity, all factors driving ongoing structural change. We now expect full year results ahead of our previous expectations and the Board looks to the future with confidence.

Q2 2023, 6 December 2022

As subscribers will know, only too well probably, I only buy shares with maximum leverage in a spread betting account on IG. This is why I like my three rules. I can make so much money holding rising shares that I can afford to leave something on the table and still come away with dramatic tax-free capital gains.