Mirror, Mirror on the Wall, which is the Greatest Superstock of All

There are a number of candidates for ‘greatest super stock of all’. It could be any of the Megacaps, Apple, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia and Tesla, now deservedly known as ‘The Magnificent Seven.

The technology revolution has reached the stage where only companies with the deepest pockets and the largest footprints can play the game, which makes ALL of these companies exciting investments.

Similarly, many ETFs like QQQ and QQQ3 have massive exposure to these stocks and should do well accordingly. They are not all trillion dollar plus market cap companies as I write but my guess is that they soon will be. Apple has already briefly topped $3 trillion showing the future for these businesses.

What is extraordinary is how fast these companies are moving. So much is this the case that I increasingly think of their current businesses as like cash cows to fund the next Great Leap Forward. Their spending on research and development is colossal, well on the way to $200bn in 2022; admittedly that includes a massive $73.21bn for Amazon which cannot be pure r&d. It must include hefty spending on content creation for Amazon Prime Video. Nevertheless we are talking a big number and one which is climbing rapidly, funded by the huge cash flows these companies generate from their existing businesses.

Table of Contents

The megacaps are almost like a top tier of the stock market and should form the lynchpin of their portfolios for most investors. My megacaps are only the biggest of the big. The usual definition for megacaps is stocks valued at over $200bn of which there are 40 worldwide.

Seven seems to be a magic number in the stock market. Back in the day there were The Seven Sisters, giant oil companies which dominated stock markets. Now we have seven giant technology businesses, which are equally, if not even more dominant.

One of the most exciting of the companies, Tesla, run by the force of nature known as Elon Musk, appears to have the lowest spend on r&d by a huge margin yet is a phenomenally innovative business. Maybe we are being misled in some ways because to me Tesla seems to be all about innovation. Musk is like almost all the guys who lead these megacaps, very geeky. The exception is Tim Cook of Apple who is the quintessentials Operations Director, the guy who makes it happen.

Musk seems to be everything, innovation, operations, entrepreneur, maybe the most complete businessman package the world has ever seen. He blows my mind that is for sure. It seems he also has women all over the place and a growing brood of weirdly named children. Is there anything this guy doesn’t do? Talk about a life well lived and at 52 this guy is just getting powered up (and cashed up) with the most incredible plans.

I think Musk makes Tesla the greatest super stock of them all and indeed the greatest stock of all time. It is no wonder that there are Tesla and Musk groupies all over the place; what’s not to love. I am totally starstruck myself and on top of all that the guy has a great sense of humour and a mum who is some kind of supermodel.

Dojo Looks Like a Massive Something New

At least that is what I thought but my son in law by my younger daughter, who is known in the family as Leonardo da Vinci for his extraordinary range of skills, tells me Dojo is kind of old news and the breakthrough is a new end-to-end neural self driving system which is being enabled by Dojo and Nvidia cards.

One of the films about Alan Turing, who invented the computer which broke the German’s Enigma code, helped the allies win the Second World War and then was abandoned by people who should have sprung to his defence, is called The Imitation Game. The name reflects Turing’s idea that his computer would imitate the operations of the human brain but perform calculations much faster.

This is how Tesla’s new approach to full self driving is intended to work. Instead of equipping the car with loads of sensors and teaching it rules to cover every situation you feed a super computer/ neural network with stupendous amounts of data to enable it to mimic how a good driver, say a five star Uber driver, would react to every situation including all the outliers, the things that happen infrequently but still need the right reaction.

This requires insane amounts of compute power, Dojo plus an endless supply of Nvidia cards and vast amounts of data being fed back by the more than 4m Teslas that have been sold since sales first began. By the end of 2024 Dojo will provide 100 exaflops of processing power.

So what is an exaflop.

This is powerful.

“Exa” means 18 zeros. That means an exascale computer can perform more than 1,000,000,000,000,000,000 FLOPS, or 1 exaFLOP. That is more than one million times faster than ASCI Red’s peak performance in 1996 (Intel’s ASCI Red marked the beginning of a new supercomputer era).

In May 2022, the Frontier supercomputer at the Oak Ridge National Laboratory in Tennessee clocked in at 1.1 exaFLOPS, becoming the first exascale computer on record and the current fastest supercomputer in the world. Over the coming years, Frontier could reach a theoretical peak of two exaFLOPS.

A zettaflop supercomputer would have the computing capability of 1,000 exaflops.

A gigaflop is a billion floating-point operations per second, a teraflop is one trillion, and a petaflop is a quadrillion. An exaflop is a measure of performance for a supercomputer that can calculate at least 1018 or one quintillion floating point operations per second. FLOPS particularly matter when you are talking about high-performance computing.

Old School Gamers, frequently asked questions.

You begin to see why the big guns like Apple and Tesla are developing their own chips because otherwise they will be totally dependent on Nvidia and possibly unable to customise what they are doing exactly to their own requirements.

Self driving systems need to be able to see and then react like humans but better and faster, hence The Imitation Game, which Tesla began playing in earnest in 2023.

I think this makes the shares hard to value but potentially very valuable indeed and thus an exciting investment.

Gigatrucks, Optimus Robots, Robo-Taxis and Much, Much More

It seems incredible but the Tesla story could still be just beginning. Cybertrucks should be on sale later this year from the Texas gigafactory and most likely will be a huge success, no doubt with the usual teething problems. As Musk says, the more things you try to do the more mistakes you will make but even the mistakes are valuable because that is how you learn. The trucks look amazing and reportedly have incredible functionality even without all the self driving stuff that is happening.

Musk says Optimus Robots will be a bigger business than Tesla cars and that the robots are easier to make. Initially there will be industrial robots and then robots in every home. At my age I am not sure I am going to see this incredibly exciting world where we all live like Roman senators or Regency England aristocrats with robo-servants at our beck and call. Expect the value of large houses with huge parks and gardens to explode when staff to run them become a capital investment. Time to buy that bargain basement French Chateau.

One thing which is clear is that Tesla’s success as a business is a supply issue. As he says demand is likely to be quasi-infinite if he comes up with these promised wonders. As he also says, he may often be optimistic on the timescales but in general he delivers on his promises.

His towering presence also makes for quick decision making, a characteristic shared by all the Magnificent Seven stocks. Teamwork is crucial but they have characteristics of dictatorships and can change direction on a sixpence when the need arrives.

Strategy – Keep Taking the Pills, Buy More Tesla

Any strategy should work, buy and hold, leveraged CFDs or Spread Betting, Kamikaze (topping up on margin calls and adding more shares on growing investible profits) and Kamikaze for Income (Kamikaze but sell and start again when your profits equal your funds).

There are still many Tesla bears out there. Not surprising given that the the company is valued at more than all the rest of the world’s car companies, GM, Ford, Toyota, Volkswagen, Mercedes, BMW and co., put together.

It’s a faith thing. Either you believe in Musk and the formidable team that he is building around him or you don’t. I do and think the sky is the limit for this guy and his business. Just pray he does not get hit by a bus or decides (no sign of that so far) to become a monk.

Tesla Has a High Potential Chart

The chart is also interesting because the latest pattern, as I have noted before, looks like a diamond which is a powerful continuation pattern. In such a pattern the shares trade sideways, break higher, break sharply lower, trade sideways and then head for the stars. If you connect everything up you get something that looks like a diamond. We look to be in the final trade sideways bit of the pattern with heading for the stars still to come.

Spotting the breakout may be tricky at first but is not that important; my attitude is just assume it is coming and act accordingly, so if you want to buy some today that is fine by me and, more or less, what I have just done.

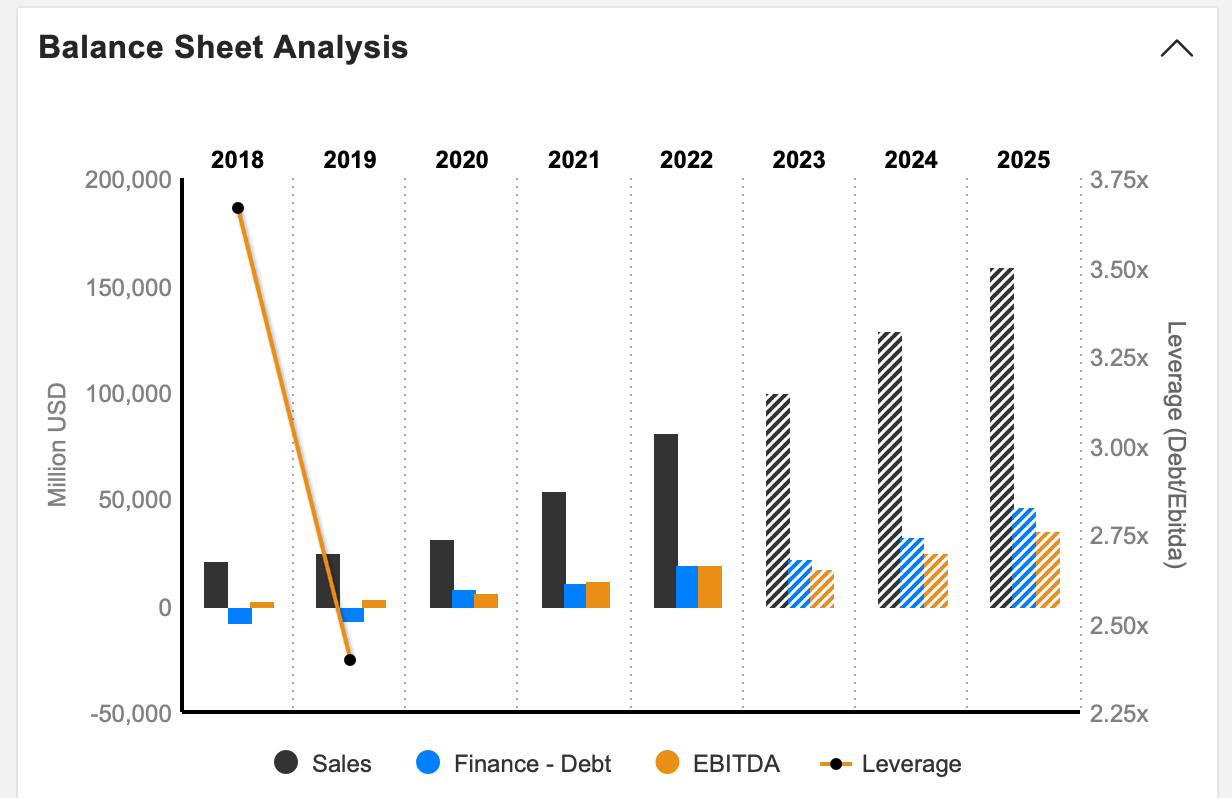

Below are projections for Tesla sales and balance sheet strength. They paint an impressive picture of growth. This business is walking the talk. As has been said, the last motor company to grow as fast as this was Henry Ford with the Model T and he invented mass production. It is similar to Musk’s contention that Tesla’s true innovation is not the cars but the gigafactories that make them.

And then think of all the side hustles this guy has got going, Space X (rockets to Mars), Twitter (social media, payment systems, whatever), The Boring Company (hyperdrive intercity transport) and no doubt other stuff in this guy’s endlessly fertile mind.

Incredible to think that for many years Tesla shares were the most shorted shares on Wall Street. They are a classic example of the rubbish theory of value. When they looked like rubbish they were a screaming buy. This relates to biographer, Walter Isaacson’s analysis that Musk is a an insane risk taker, so insane that he gets bored if he is not taking a risk. I know the feeling. Musk’s advantage is that he is also a genius, a kind of latter day Napoleon as the latter’s biographer, Niall Ferguson, has been saying.

Share Recommendations

Tesla TSLA. Buy @ $274