Luxury goods, stock market operators & fund managers looking good as shares rally

For many of you Great Charts by Quentinvest (formerly Chart Breakout) is part of your total Quentinvest package. This is affecting how I use GC to fit into the overall strategy. Great Stocks by Quentinvest features individual stocks, which I like, whether already in the portfolio or new entries. Quentinvest Alerts, which are only available online (hard copy printing and posting would be impossibly expensive) features alerts, duh, also profiles of individual stocks and groups of stocks. It is also likely to be the place where I talk about shares giving programmatic and ‘buy the green’ buy signals. So, for example, it is likely that early in May I will be alerting stocks from the QV portfolio that have given buy the green buy signals based on April closing prices.

The way that Great Charts by QV fits into this is that it will include stocks, both in the portfolio and newcomers, which are 3G, that is a must for selection in any publication or alert, and which are giving chart buy signals. The problem is that when I went through my master list (shares in the portfolio and shares under consideration) I ended up with 64 names. I wanted to recommend all of them. My daughter says no; that is too many. So this is my compromise. I will choose 18 shares to be listed on the front page and with charts. The remaining 46 I will cover with prices in brackets in the text or mentioned in dispatches at the end. They are all recommended and will all be added to the QV portfolio at current prices.

Although a number of indices are hitting new highs and look likely to keep climbing there is some rotation taking place. Many QV momentum favourites have been experiencing heavy profit-taking as overbought and heavily margined positions are unwound and day traders move to the next exciting prospect. I think this is all compatible with my never sell strategy. In the first throes of a reaction shares can fall steeply. They then bounce around for a while, maybe even testing recent lows but finally the loose money is out and more lasting recoveries can begin, typically leading to new highs and a continuation of the secular bull trend.

It is this secular bull trend, which is the principal argument for never selling. Its is partly a matter of faith. Way, way back in the day an unscrupulous fund manager called Bernie Cornfield, lured in punters, especially US military personnel stationed in Europe, with the slogan – ‘Do you sincerely want to be rich?’. It worked very well; it certainly made him rich until he was arrested for ascribing implausibly high values to thousands of acres of frozen tundra that he had bought for nothing for the funds. My version of his slogan is – Do you have faith in the bull market, in the accelerating technology revolution, in the impact of globalisation, in the rising wealth of middle class consumers across the Far East especially and in the sheer entrepreneurial energy being unleashed in the 21st century by boomers, millennials, Generation Z and the likely even more tech savvy generations following on behind.

I do and that faith greatly simplifies my approach to investing in equities and ETFs (tradable portfolios of equities). I KNOW this market is going to keep climbing because that is the only logical response to what is happening. I have never, ever, ever seen so many exciting companies doing so many exciting things. Equitywise it is a candy store of delights out there and that is why it makes sense (a) to build a great portfolio and (b) to hang on to the shares you buy through thick and thin.

You need to hang on because although we are in a secular bull market there is no question that it is a roller coaster ride. Share markets have always been volatile, always been at the mercy of the wild mood swings of the manic depressives, Warren Buffet’s term, who buy shares. Trying to remain level headed in this frenzy is not easy but it is the way to go.

Exciting shares are often so highly valued that even a hint of a misstep is punished severely. A share I like and have been enthusiastic about in the past is called Gear4Music (900p). It was featured in last month’s issue. It sells all kinds of musical kit online and has used its great success in the UK market to expand into other markets like Scandinavia. The shares climbed from 136p in 2015 to 904p in 2017 as excited investors bid the price higher on dreams of world conquest. A combination of slowing growth and rising costs punctured the bubble and the shares fell all the way back to earth. It turns out though, with a little help from Covid-19 that it is still very much game on at Gear4Music and the shares, after falling to 136p in March 2020 are back up to 900p. They are valued at less than £200m. The operation is highly scaleable and the total addressable market is large. The shares are classic 3G and still look worth buying but for a never sell investor the journey has been testing.

There are similar stories all over the place just like share prices. My theory is that volatility is the new valuation technique. In a world where sales growth of 30pc, 50pc, 100pc or even more is become increasingly routine nobody knows what businesses are worth. Traditional metrics such as yield and PE ratio don’t help, especially if the share you are studying is in a company, which is growing fast but investing so aggressively to be a winner in its particular niche that it makes consistent losses.

So shares are valued by seeing the price whipped up and down to find out where it settles. The fun part and the rationale for never sell is that for well-chosen 3G businesses this volatility takes place around a rising trend so the levels at which prices settle move steadily higher over time. Against this background volatility provides opportunities for buying cheap through a process akin to £-cost averaging. I do this on Quentinvest through my programmatic and buy the green buy signals as referenced above.

Vaccine rollouts to drive economic recovery

The world economy is in uncharted territory. Some places like Brazil, India and much of Europe are still battling an escalating Covid crisis. Other places like the UK and now the US with more responsive leadership seem to be on the brink of sharp economic rebounds. Punters are flooding to all kind of outdoor venues, restaurants and pubs, wherever they are allowed, in huge numbers setting the scene for a dramatic rebound. Cruise ship operators are seeing unprecedented bookings. My Airbnb operations are booked solid into the future from May onwards such that we have to book ourselves if we want to go and I am considering paying myself to go because that is the cost in lost revenue.

This is being reflected in the stock market. We have just had disappointing subscriber numbers from Netflix, which was an obvious beneficiary of lockdown. This doesn’t mean it is no longer a great business but one following wind is no longer blowing so strongly. They are still in the same old virtuous circle where great content attracts more subscribers which funds the creation of more great content. I increasingly watch stuff on Netflix and with plans to spend some $17bn on content this year there is going to be plenty to watch. On a value for money basis it is hard to see why anyone would cancel their subscription. I also have Amazon Prime and my daughter with young children has Disney Plus as well and all together the monthly cost is less than one family visit to the cinema.

What was happening during lockdown was that accumulating savings were being channelled into a relatively narrow group of stocks, a bit like the Nifty Fifty of great US growth stocks back in the 1970s. As we come out of lockdown the choice of stocks to buy opens up, the pressures for digital transformation may ease a little though they certainly won’t go away and rising bond yields and maybe eventually an uptick in short-term interest rates will work against the appeal of the hyper-growth stocks.

Even so, all this together, is not going to change the main story of an advancing and accelerating technology revolution. We live in an age of wonders and this will continue to be reflected in the stock market. It is noticeable that most of the shares being hit by heavy profit taking are still trading at levels not too far from the peaks and way above the levels at which they traded two or three years ago.

No way is it game over for growth stocks. On the contrary it is still very much game on.

Stock market operators and data providers do well

In my list of strong performers I find Morningstar ($246), MSCI ($483), Nasdaq Inc. ($160), the company not the exchange and S&P Global Inc ($384). They are all 3G, in the portfolio, with strong charts and boasting chart breakouts. If we extend the group to include fund managers we find names like Blackrock ($814) and Lio Investment Management (1566p) also looking good.

This makes sense if the future holds rising stock markets, growing numbers of IPOs and greater participation by retail investors, more in short of all the things we are seeing happening at the moment. It is a bit like the old argument that in a gold boom the safest way to make money is to invest in the companies making the tools. The companies above make the tools which help stock markets to function, provide key services for the supply side like fund managers and share trading platforms and which facilitate retail investor participation.

This makes them leveraged plays on a rising stock market and in a sustained period of rising activity and prices they can do very well indeed.

Luxury goods shares also look good.

Obvious luxury goods companies are businesses like the French trio, Hermes International (€1041), Kering (€643) and LVMH (€624) and shares in all three are either featured here or have been featured recently. I am keen on the sector because it seems that the world may be on the brink of a wealth explosion, a tsunami of spending and a surge in travel and tourism. If this does happen it will create a spectacular following wind for the companies just mentioned and many other names. Others I like are Estee Lauder ($313), L’Oreal (€341) and a company called RH ($675), which featured recently in QV for Shares for its plans to dominate the global market for luxury furniture. There are many others.

Shares in prestige Italian suits and accessories group, Bruno Cucinelli (€43), have almost doubled since July and have a great-looking chart. Most people think of Apple ($134) as a device and technology business but it could also be described as a provider of luxury goods and services. It should benefit in the same way as any other luxury goods business if we are to see a massive global rise in consumer spending and the chart looks very promising. I rate them a buy right now but the chart would look particularly exciting on a close above $140.

Buy signals apply logic instead of emotion

Most of us are affected by our emotions, when we decide to buy and sell shares. When share prices fall we fear they made fall further and I am asked the unanswerable – what to do. I don’t know which is why I have adopted the mantra never sell. If I could sell at the top and buy at the bottom I would; who wouldn’t but nobody knows and only charlatans and stopped clock wonders think they do.

When shares rise it is only human to become excited and greedy, which is why it is so easy to buy at the top. You watch and wait. Will I, won’t I? It just keeps climbing. I will and then it falls. Murphy’s law strikes again. Buy signals don’t totally solve this problem. Nothing does although I think my programmatic strategies come close but at least if you use buy signals they are triggered by the price action and not by your emotions.

I don’t use any special rocket science, when I alert shares for buying in Great Charts. Anyone looking at the charts, if they are interested in charts at all, would see what I see – a breakout from a period of consolidation. Indeed, they are so obvious it sometimes amazes me that they still work but that is because there are so many other factors at play from day trading to high margins to buyer’s remorse to macro factors that cloud the picture so charts somehow do work if you are patient, have faith and use charts for shares in companies with exciting 3G fundamentals.

Always remember that any share featured in Great Charts has already passed a much sterner test of being considered 3G. These shares are the elite of the world’s quoted businesses. It is like backing Julius Caesar to win, when his legions started to move. They were the finest, most disciplined, best armed soldiers on the planet, an elite fighting force. Why wouldn’t they win; that’s how I think of the shares in the QV portfolio.

Mentioned in dispatches

Align Technology ($617); ArcticZymes Technologies (€9.50); ASML Holdings ($667); Baillie Gifford European Growth Trust (153p); Burlington Stores ($321); Carl Zeiss Meditec (€146); Dechra Pharmaceuticals (3892p); Edwards Lifesciences ($96); Epam Systems ($459); Fair Isaac ($544); Fortinet ($203); Globant Holdings ($238); Hubspot ($572); Logitech ($114.50); MasterCard ($387); McDonalds ($232); Mettler-Toledo International ($1312); Microsoft ($261); ProLogis ($115); Sea Limited ($272); Starbucks ($115); Stryker Corp. ($265); Team17 Group (823p); Teleflex Inc. ($440); UnitedHealth Group ($395); Visa ($230); Waste Connections ($116); Water Intelligence (890p); West Pharmaceutical Services ($322); Zai Lab Limited ($173.50)

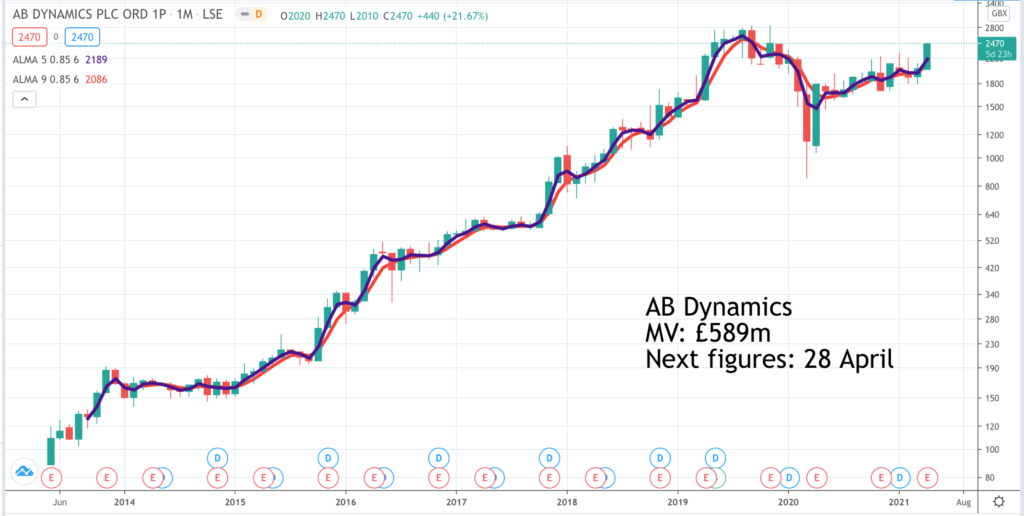

AB Dynamics ABDP. 2420p

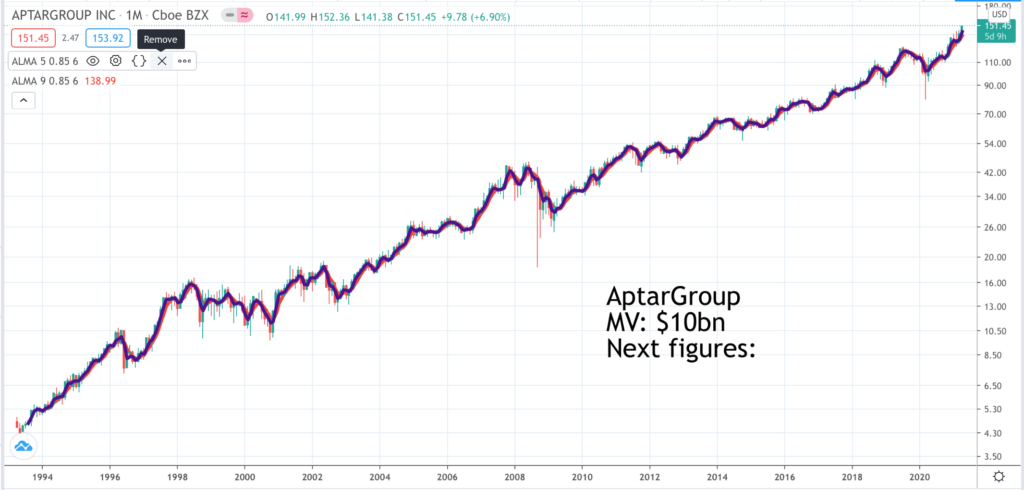

AptarGroup ATR. $151

Ashtead Group 4765p

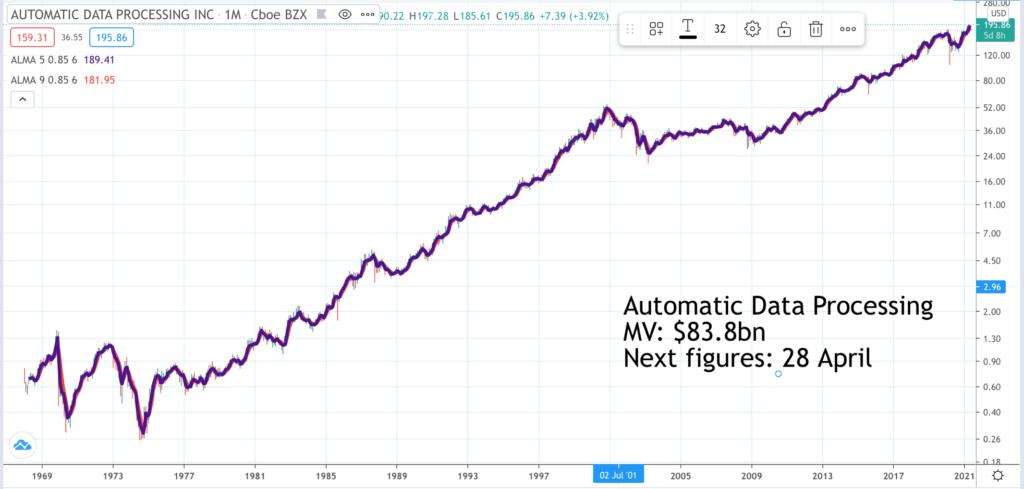

Automatic Data Processing. ADP. Buy @ $195

Berkshire Hathaway. BRK.B. Buy @ $271

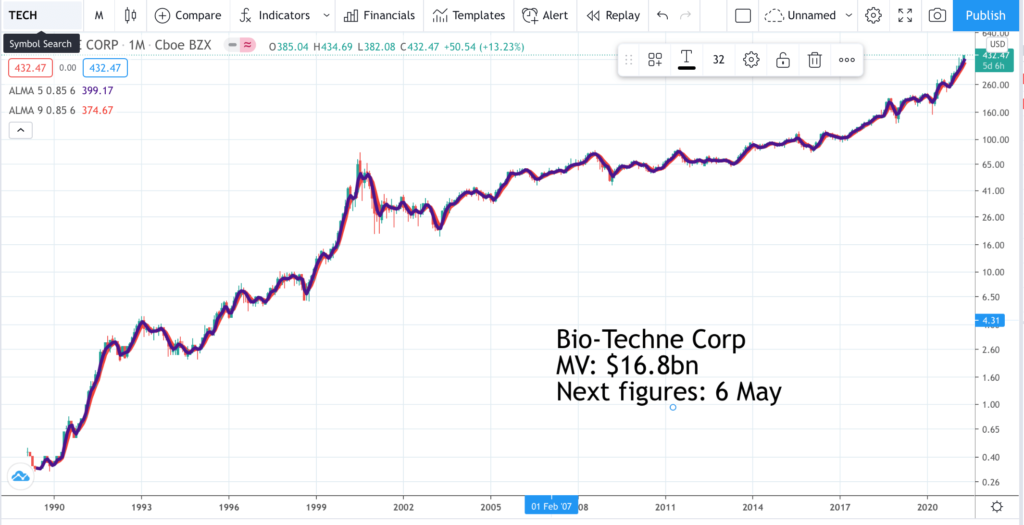

Bio-Techne. TECH. Buy @ $432

Charles River Laboratories. CRL. Buy @ $334

Croda International. CRDA. Buy @ 6850p

Diploma DPLM Buy @ 2934p

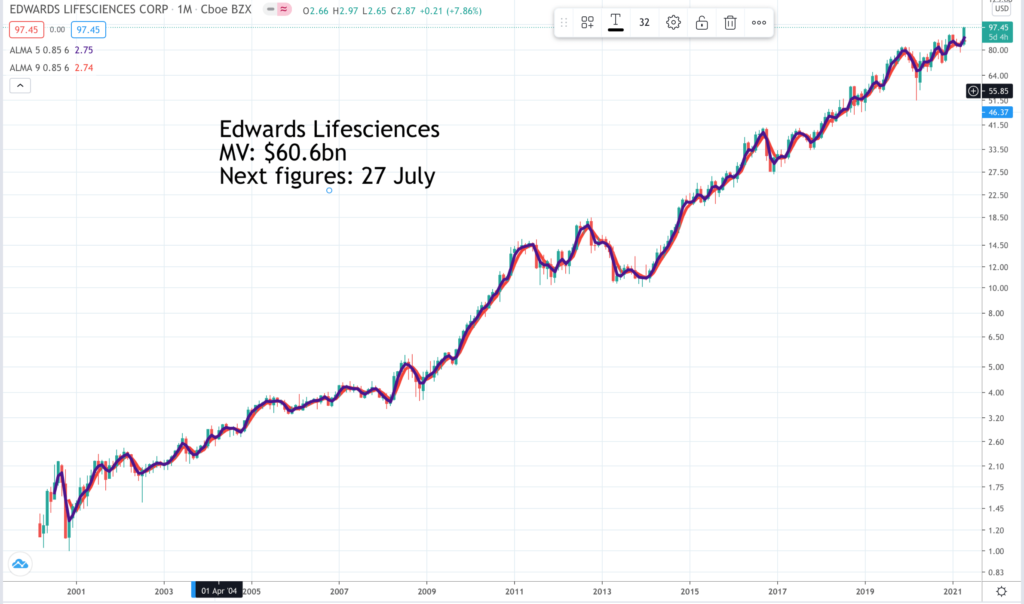

Edwards Lifesciences. EW. Buy @ $96

Halma. HLMA. Buy @ 2630p

Home Depot. HD. Buy @ $319

InMode. INMD. Buy @ $87.60

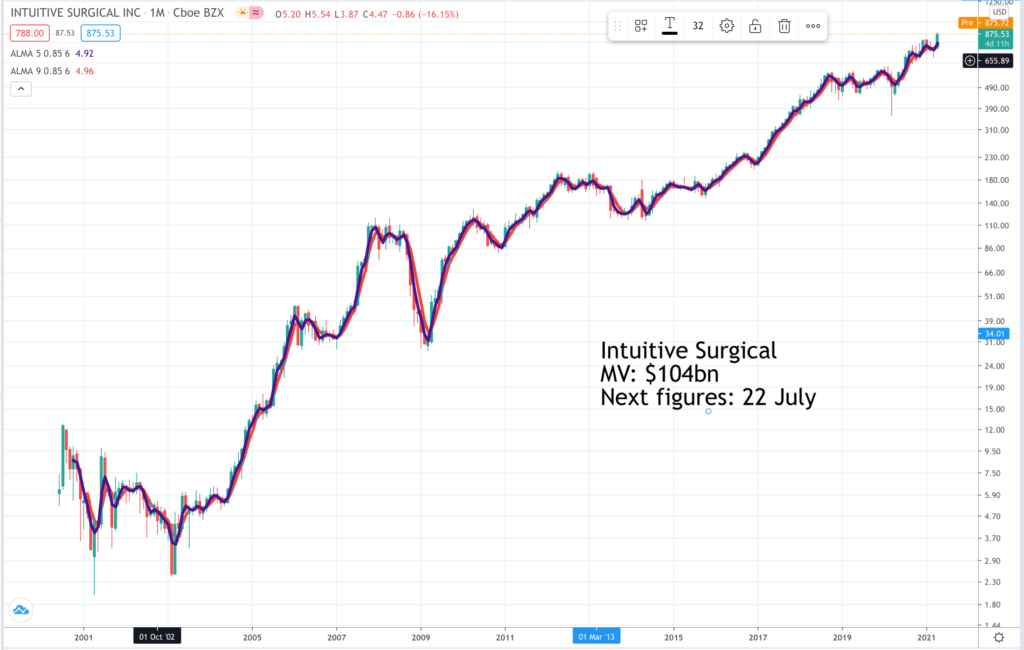

Intuitive Surgical. ISRG. Buy @ $860

Middleby Corp. MIDD. Buy @ $181

Pool Corporation POOL. Buy @ $409

S4 Capital SFOR. Buy @ 559p

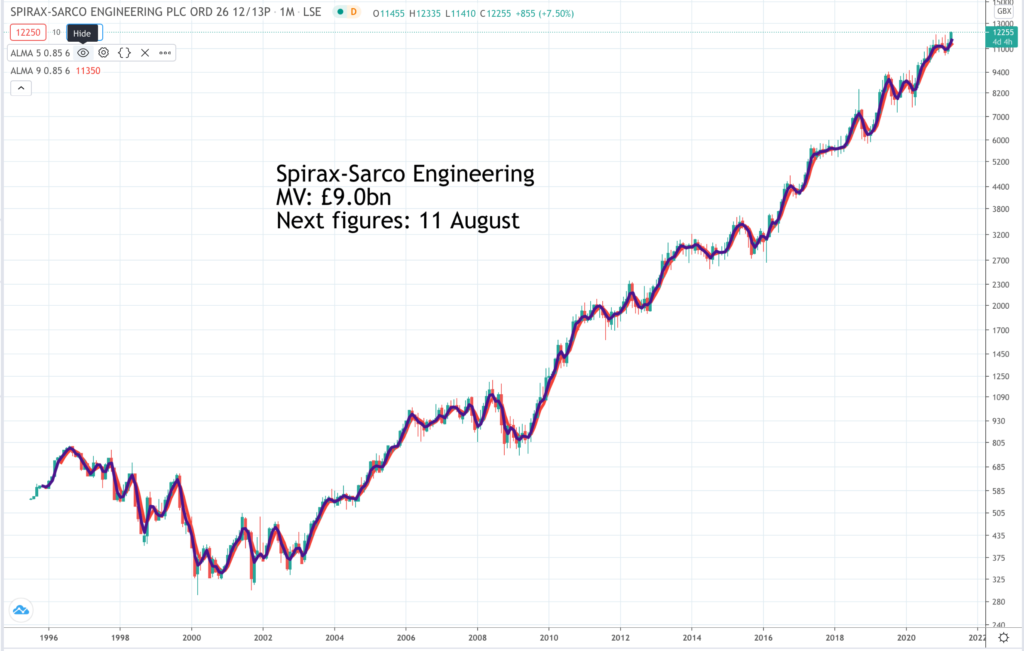

Spirax-Sarco. SPX. Buy @ 12280p

Visa. V. Buy @ $230

AB Dynamics. ABDP. Buy @ 2420p

In order to make exciting progress companies need something new to be happening. The ‘something new’ at AB Dynamics is Dr Jeremy Routh, CEO since 2018. He came from Diploma (see below, a fast-growing, acquisitive distribution business) and, no surprise, since Routh’s arrival at ABDP, the company has been active on the acquisition front. The latest deal is the acquisition of Vadotech for up to €26m in cash. Vadotech is headquartered in Singapore with comprehensive testing services in China, Germany and Japan including a 60,000 sq ft testing centre in Beijing. Latest results for the year to 31 August 2020 showed sales six per cent higher and profits 16pc lower as lockdowns hampered operations. However the group, which is becoming a significant global player in the automotive testing market is well positioned in many key areas including autonomous and electric vehicles and car safety in general. Routh still has everything to prove but it would be no surprise to see the group resuming the exciting progress being made between 2014 and 2019. The world needs better, safer, more fuel efficient, less polluting vehicles and post the VW scandal confidence has been lost in in-house testing.

AptarGroup. ATR. Buy @ $151

AptarGroup is a classic example of what I call a win-in-the-end type of business. The shares have setbacks, mostly as part of general market events but the long-term performance is steady, relentless and outstanding. Since the IPO in 1993 the shares have risen at least 30 times and that doesn’t take account of dividend payments that have increased every year for 27 years consecutively. This is a perfect stock for the bottom drawer. AptarGroup makes dispensing and packaging products for the health and beauty industries and also supplements growth with regular acquisitions. The year to 31 December 2020 was impacted by Covid so sales only grew by two per cent but the dividend still increased for the 27th consecutive year. the group is constantly changing and improving “We have successfully implemented the vast majority of our plant initiatives related to our transformation over the past three years, including implementing new commercial strategies, reducing costs and adding capabilities in Asia and in fact growing application fields that we believe will position the segment for future growth and expanded profitability.” Aptargroup is an outstanding business and investment.

Ashtead. AHT. Buy @ 4765p

It is staggering to think that in March 2003 the value of Ashtead’s equipment rental business on both sides of the Atlantic fell to just £895,000 and is now over £21bn. I wonder if anyone bought at the bottom and is still holding now. Even £1,000 invested would be worth £2.4m. Three things explain this performance. First, in March 2003 investors were convinced that Ashtead was bankrupt. Second, has been a massive secular shift in the US, where Ashtead has the bulk of its operations, from owning equipment to the greater flexibility and value for money of renting. Ashtead caters for this by always having a wide choice of well-maintained up to date equipment at a location not far away. It makes total sense for its customers across a wide range of industries beyond construction to rent rather than own. Thirdly, Ashtead is a very well managed and efficient business that does its job very well and uses every opportunity to raise its return on capital. Huge reflation programmes and infrastructure spending in North America and the UK should drive strong demand, which a well-funded Ashtead is ready to meet. As the group says to its investors – “We continue to build market share because we are in the right locations, providing better equipment and delivering a higher quality of service than our competitors.”

Automatic Data Processing. ADP. Buy @ $195

Automatic Data Processing is another example of a great win-in-the-end stock. It may not go through the roof in any one year like some of the cutting edge technology stars but for a patient investor the rewards can be outstanding and sure. ADP helps enterprises run their businesses, especially anything to do with the workforce, what it calls HCM or strategic human capital management. Like Ashtead in a different field it is an outsourcer, helping you perform more efficiently in a non-core part of your business. The company was hit by Covid but still managed to negotiate 2020 with flat earnings. Now it is seeing improvements. “As a result of all these factors, we are raising our new business bookings guidance range by another 5pc to 15pc to 25pc. Pays per control and booking trends were both positive, but retention was the main highlight for us the second quarter. With ES [employee services] and PEO [professional employer organisation] retention both reaching record levels.” Also exciting is the amount of innovation going on at ADP, which bodes well for strong growth continuing for the foreseeable future as the group leverages the power of what it calls the data cloud. As CEO, Carlos Rodriguez, says – “we are increasingly focused on reaccelerating growth in the quarters and years ahead”.

Berkshire Hathaway. BRK.B. Buy @ $271

Berkshire Hathaway is the investment vehicle and multi-line insurance business for famed investor Warren Buffett, sometimes known as the sage of Omaha and currently worth $102.9bn making him the seventh richest person in the world. Research published at the University of Oxford characterizes Buffett’s investment methodology as falling within “founder centrism”, defined by a deference to managers with a founder’s mindset, an ethical disposition towards the shareholder collective, and an intense focus on exponential value creation. Essentially, Buffett’s concentrated investments shelter managers from the short-term pressures of the market. It’s working well. A recent investment is in RH, a luxury US furniture business with global ambitions where BRK has built an eight per cent plus stake. RH recently featured in QV for Shares and in last month’s issue of Great Charts. Other major investments made in more recent times include Apple and Amazon, which are both behaving well currently and looked poised to move higher. BRK has a patient approach, a great belief in the US economy and strong US brands like Coca-Cola, Gillette and American Express, a strategy of rarely selling and strong cash flow from the insurance operations enabling the group to invest when others are selling.

Bio-Techne (Techne). TECH. Buy @ $432

If you look at where it has come from Bio-Techne has been an incredible performer. The shares are up around 1000-fold since the IPO yet the company is still only valued at $16.8bn. Similar to the businesses in the technology sphere providing products that enable digital transformation, Bio-Techne provides the enabling products of the health care revolution. I have been looking at a company presentation and some of their largest addressable markets like cell culture and gene therapy and liquid biopsy are also their fastest growing divisions with growth expect to continue at greater than 20pc. Not only that but in these newer and faster growing areas their penetration rate is less than one per cent. The group is not setting the world on fire like some of the digital transformation businesses but since 2014 organic revenue growth has steadily accelerated from low single figures to 10pc. Even that understates what is happening as latest quarterly results showed revenue growth of 19pc with the biopharma space running ‘red hot’. There is a ton of innovation taking place at the group and also strategic moves to help address the vast Far Eastern markets including China.

Charles River Laboratories. CRL. Buy @ $334

Charles River Laboratories is not the easiest investment to deal with because a big part of the business is supplying research models to the pharmaceutical industry and these models are animals. I can see why it has to be done and certainly hope and expect that they do this in the most humane way but it is a bit like farming. In order for us to eat them animals have to die. The explosive growth of funding and activity in the global biopharma business with over $130bn raised in 2020 is driving strong growth in CRL’s business. Sales growth was seven per cent for the year but over 10pc for Q4. The company expects a strong start to 2021 and the year also includes an important something new – “the expansion of our early stage research and manufacturing support portfolio into a complementary high growth sector”. The company also says – “We are expanding our portfolio and scientific expertise through a combination of acquisitions, strategic partnerships and internal investments. This morning, we announced our intent to acquire Cognate Bioservices, a premier CDMO [contract development and manufacturing organisation] partner for clients’ comprehensive cell and gene therapy, development, and manufacturing needs”. The company concludes – “We are very enthusiastic about the outlook for 2021. We believe our exceptional market position, the strategic expansion of our unique portfolio and our focus on operational excellence, combined with continuing robust client demand position us extremely well for the year ahead”.

Croda International. CRDA. Buy @ 6850p

Croda International is a specialty chemicals company with operations across the globe. The bane of chemicals companies is commoditisation and the loss of pricing power. Croda deals with this by what it calls Smart Science to develop innovative products otherwise known as NPPs or new and protected products. Its key strategy is to develop the proportion of NPPs leading to constant margin improvement and profits growing faster than sales which grow faster than volume. They are focused on consumer care, which used to be called personal care, life sciences and performance technologies. When you buy a skin care or beauty product you will often find that the sexy bit that makes the product effective is the specialty chemical supplied by Croda. As a result the group enjoys operating profit margins between 23 and 25pc making it a highly profitable operation. The massive global rollout of the Pfizer Covid vaccine is being helped by products developed by Avanti Polar Lipids, a company acquired by Croda in August 2020. Avanti has been able to use Croda’s mass manufacturing capabilities to scale production in a world desperate for vaccine supplies. The company’s strong profitability has also “allowed us to make almost £1bn of organic and inorganic investments in fast growth markets of the future, capitalising on emerging trends in existing and adjacent markets”.

Edwards Lifesciences. EW. Buy @ $96

Edwards Lifesciences is all about the treatment of patients with heart disease, especially with a range of valves and catheters. It has manufacturing operations in Utah, Costa Rico, The Dominican Republic, Puerto Rico and Singapore and is building a facility in Limerick, Ireland. As might be expected from a life sciences company in the current environment the group is trading ahead of expectations across all product lines and continues to believe “that 2021 will be an important growth year for Edwards with mid-teen sales growth highlighting the importance of treating structural heart patients even during this pandemic. We also anticipate meaningful progress on expanding large under-appreciated and underserved transcatheter opportunities in 2021.” Like so many other groups Edwards is also pressing on with an ambitious innovation programme. “Just last week, in transcatheter aortic valve replacement or TAVR, we received approval to initiate a pivotal trial for patients suffering from moderate aortic stenosis. Also earlier this month, we received approval to begin treating patients at low surgical risk in Japan with SAPIEN 3. And in Transcatheter Mitral and Tricuspid Therapies, or TMTT, I’m pleased to announce that the first patients were recently treated with EVOQUE Eos, our next-generation Transcatheter Mitral Replacement System. Also in TMTT, we initiated the TRISCEND II US pivotal trial for transcatheter tricuspid replacement.”

Halma. HLMA. Buy @ 2630p

Halma is one of the greatest win-in-the-end investments off all time. This chart only shows the recent performance. I first began recommending these shares, when I was a young journalist on The Investor’s Chronicle back in the 1970s and they were stunning performers even then with a business model almost identical to that being followed so successfully today. The CEO and effective founder of the business was David Barber, who was a remarkable entrepreneur. The company specialises in niche areas of environment, health and safety and is a full-time expert in the business of endless acquisitions, which are small in relation to the size of the group, already profitable and come with a talented management team, who are given great discretion to operate independently. This makes Halma like a growing collection of successful niche businesses with monopoly-style profit margins. It is a business model that takes great skill to operate and Andrew Williams, who has been CEO since 2005, is a master of the art. Calendar 2020 was a typical year for Halma with four acquisitions. In a recent trading update the group said it was seeing continuing sequential improvement from an earlier Covid-affected trading performance with the strongest growth in Asia Pacific. Typical of the strategy – “In December, we acquired Static Systems Holdings Limited, a UK-based manufacturer of critical communication systems, for £37m and divested Fiberguide Industries, Inc., a US-based manufacturer of fibre optic technology, for $38m”.

Home Depot. HD. Buy @ $319

Home Depot, which operates a chain of diy centres in North America, was originally described as a category killer in its early growth stages. One of its innovations was to stifle competition by siting stores relatively close together in clusters, a technique being used with great effect by Ashtead (see above). The later stores cannibalised some sales from the earlier stores but the overall effect was a bigger slice of the pie for Home Depot. As seen with recent results from the UK’s B&Q, which used to be separately quoted but is now part of Kingfisher, diy sales have boomed during lockdown as stay at home injunctions have encouraged an orgy of home improvement. Calendar 2020 has been an amazing year for the business. “At the beginning of the year, I would have never thought it possible for the business to grow over $21bn in 2020. For context, it took us 19 years as a company to achieve the first $20bn in total sales and we outgrew that in this year alone. This was enabled by investments we’ve made in the business as well as the team’s exceptional execution and cross-functional alignment…. Our results for the year clearly indicate that for many customers, the home has never been more important. Fiscal 2020 sales grew $21.9bn to $132.1bn, up 19.9pc from last year. We finished this year with another exceptional quarter as we saw the continuation of outsized demand for home improvement projects. Sales for the fourth quarter grew $6.5bn to $32.3bn, up 25.1pc from last year. For the quarter, sales leverage in our digital platforms increased approximately 83pc versus the prior year and approximately 55pc of online orders were fulfilled through a store.”

InMode. INMD. Buy @ $87.60

This is another share, like Charles River Laboratories (see above), which I feel slightly queasy about recommending but you can’t argue with the performance of the shares and the business. InMode has leveraged its medically accepted minimally invasive RF technologies to offer a comprehensive line of products across several categories for plastic surgery, gynaecology, dermatology, otolaryngology and ophthalmology. The company uses radio frequency devices and other techniques to change the way you look in minimally invasive ways. Its web site is full of before and after pictures of patients who have benefited. Initially the company was severely affected by Covid but they determined to carry on much as usual and this has – “paid off big time when business began to get back to normal just before the summer. In the fourth quarter of 2020, InMode generated record revenue of $75.2m, a 60pc increase from the fourth quarter of 2019 and $39.9m of net income. In the full-year 2020, approximately 62pc of our revenue derived from our surgical platforms engaged in minimally invasive and subdermal ablative treatment. 32pc derived from our recently introduced hand-free platform and only 6pc from our traditional laser and noninvasive RF platforms. The record revenue in the fourth quarter and the full year was driven by demand for our minimally invasive and hand-free proprietary electro-surgical bipolar RF technology.”. Prospects for the business look outstanding.

Intuitive Surgical. ISRG. Buy @ $860

Intuitive Surgical’s share price has risen 175 times in the current millennium. There are two principal reasons for this. ISRG is the runaway global market leader in selling robotic systems for carrying out medical procedures. Secondly, it operates a razor and razor blades style business model so each sale generates a requirement for a steady stream of consumable items driving growing recurring income. A third element is that the group is highly innovative, developing its core Da Vinci systems for new medical indications, which have to be approved by the US FDA. The group has been affected by Covid-19 as overwhelmed hospitals have slowed or stopped doing operations but demand has not gone away. Meanwhile the group is working hard on further innovations. “We’re in the early innings of commercialisation of two new platforms for Intuitive while advancing digital enablement of our ecosystem. Our teams are making good progress in all three areas.” The group is truly global and notes – “In the U.S., gynaecology, and urology returned to growth after pandemic-related declines. Growth in our second-largest market, China, continued to be strong with multiple specialties contributing.” Most encouragingly – “Overall, capital strength indicates anticipation of future procedure opportunity by our customers”.

Middleby Corp. MIDD. Buy @ $181

Middleby Corp. has used an endless series of acquisitions to become a global giant in the food preparation business. A who’s who of catering businesses use their equipment and since 2013 they have applied the same acquisitive strategy to the residential market scooping up brands like Aga, La Cornue and Rangemaster. In total the group owns more than 75 brands. It’s most recent acquisition is a company called Welbilt, which is to be acquired for around $4.3bn in an all-stock transaction to create a group with around $3.7bn of global sales of which 75pc are commercial food equipment. The acquisition offers great scope for cost savings, enhances Middleby’s exposure to faster growing areas of the world and is expected to be strongly earnings enhancing. Middleby CEO, Timothy FitzGerald says – “The acquisition of Welbilt is a transformational opportunity for Middleby and a compelling combination that will benefit all of our stakeholders.” The timing looks perfect with the hospitality industry poised for post-Covid recovery and the residential equipment side benefiting from strong demand for luxury items.

Pool Corporation POOL. Buy @ $409

As the chart suggests Pool Corp is an amazing business. “POOLCORP is the world’s largest wholesale distributor of swimming pool and related outdoor living products operating over 395 sales centres in North America, Europe and Australia. With a long history of consistent organic growth and market share expansion, strategic acquisitions and disciplined operating execution, POOL has generated compound average annual shareholders’ return of over 26pc since our IPO in October 1995.” The shares are another fabulous example of win-in-the-end and win big. In their 2020 results report the group noted – “The demand for our products was unparalleled. The challenges to keep up with that demand while remaining safe were extraordinary but we found innovative ways to get things done, and deliver amazing results. In 2020, our total sales came in at $3.9bn, a 23pc increase over 2019. In the fourth quarter, we saw sales grow an amazing 44pc, capping off a phenomenal year by any measure.” There is no sign of a slowdown. “Demand in virtually all of our geographies remain strong with particular strength noted in our seasonal markets. Europe had a very robust quarter once again and grew revenues by 48pc in the quarter and 24pc for the year.” Pool scores one all fronts, great management, recurring income, luxury products and growth by acquisition.

S4 Capital SFOR. Buy @ 559p

Martin Sorrell is one of the world’s great acquisition specialists. As finance director he helped the Saatchi brothers make Saatchi & Saatchi the world’s fastest growing advertising business, becoming known as ‘the third Saatchi’ in the process. He left to take over a tiny shell concern, Wire & Plastic, which ended up as the advertising behemoth, WPP. Now he is at it again with a new vehicle, S4 Capital, which is building an advertising services conglomerate fit for purpose in the digital age. Even though Sorrell is in his 70s the magic, ambition and master’s touch seem still to be as effective as ever. The group reported full year 2020 results in March showing 43.4pc growth in billings to £653.4m accompanies by the comment – “New age/ new era digital model starts to convert at scale”. As well as a string of deals the following quote from the latest results gives a flavour of why the business is growing so strongly. “In addition to new client BMW/MINI and the significant broadening of our relationship with Mondēlez, there were major new remits from clients such as Google, Facebook, Amazon, Netflix, Procter & Gamble, T-Mobile, Bayer & HP and major new assignments from Cisco, Embibe, Harley Davidson, PayPal, LA28, Shopify and Verizon amongst others, reflecting the strong tech orientation of the company’s client base and the growing healthcare and FMCG [fast moving consumer goods] focus.”

Spirax-Sarco. SPX. Buy @ 12280p

Spirax-Sarco Engineering plc is a British manufacturer of steam management systems and peristaltic pumps and associated fluid path technologies. Since 2009 it has been a very reliable performer delivering a phenomenal total return (includes dividends reinvested). The great performance goes back even further but is not captured on this chart. There are three companies in the group offering different types of expertise relating to steam and fluids and all highly regarded globally. The products are used in almost every industry worldwide: from the food industry where steam products are used in blanching, baking, packaging and cleaning; to the pharmaceutical industry where pumps and associated fluid path equipment are critical to the production of life-saving medicines; through to the aviation industry where electrical heating elements are used in the de-icing of aeroplanes. Over 130 years the group has built a servicing and distribution network that would take decades to replicate. Despite modest falls in sales and profits in 2020 the dividend still rose seven per cent. Spirax-Sarco is the type of company the British do so well. The future holds more onwards and upwards.

Diploma DPLM Buy @ 2934p

Diploma resembles Halma (see above) in that growth is partly organic and partly supplemented by a steady stream of small acquisitions funded from the group’s strong cash generation. The group is mainly a distributor with a global footprint. It focuses on essential products and services, which means next day delivery of often low value but important items and providing solutions, where customers would otherwise need to employ additional staff and other costly alternatives. The result is steady growth in sales and excellent operating margins, in the high teens, which is very high for a distributor and highlights the value the group provides for customers. Around the turn of the millennium the group was completely reinvented with the industrial distribution interests sold and the acquisition programme focused on three core areas, life sciences, seals and controls. Three quarters of sales are now generated in North America and continental Europe. Performance in the year to 30 September 2020 was resilient and over the long term the group expects to sustain double figure growth through the cycle.

Visa. V. Buy @ $230

Most people are familiar with Visa, which describes itself as a global payments technology company. It is like a twin of MasterCard so no surprise that both shares have almost identical charts. A complication is that Visa is due to report Q1 2021 results on 27 April and that will likely affect the price in the short run. The shares are benefiting from a global transition from cash to card and other devices to make payments and also from the fast-growing digital economy. Where vendors used not to accept cards now many do not accept cash. As Visa says – “In consumer payments, we continue to focus on digitising the $18 trillion spent in cash and check globally by working with partners to grow end points and deepen customer engagement with innovation.” Much of the last quarterly report focuses on the rollout of Visa cards and technology across the globe, often in partnership with banks or fast growing fintech companies like the UK’s TransferWise. Among many initiatives in the financial space Visa is becoming involved with cryptocurrencies. As the global economy rebounds the group should be a major beneficiary of increased spending.