This is a long-term chart. It starts in 1871 when W. E. Gladstone was the British Prime Minister and Ulysses S. Grant, fresh from leading the North to victory in the American Civil War, was the US President. For 70 years subsequently, shares tracked sideways, interrupted by a spectacular boom and bust in the 1920s and 1930s. Nobody realised it at the time, but Pearl Harbour marked the beginning of a long-running bull market in US shares, which continues to this day.

There are various reasons for this incredible bull market. The good guys won the war. Americans believe in freedom and capitalism and admire success. The log cabin to White House story resonates with every American.

The country is a land of immigrants. This may not have been so great for native Americans, who arrived 10,000 years earlier to an empty land, but it means America is full of people who went there to make it. The country pulsates with an energy unmatched anywhere else in the world.

London was starting to feel the same in the Thatcher years, but it has been crushed as subsequent governments, both Tory and Labour, have unleashed the politics of envy. This I can never forgive. I doubt I will ever vote for the Tories again. It is especially annoying because with the slightest encouragement, London would rebound explosively. It is bursting with suppressed vitality. For starters, we need a new mayor, not Shish Kebab or whatever he calls himself, but somebody who feels and appreciates the energy of London and its potential as a magnet for ambitious people across the globe.

Thatcher became Prime Minister to effect change, and she did it. Subsequent prime ministers talked the talk but just wanted the job, a sorry crew all of them. It is to the eternal shame of the small-minded jobsworths, Geoffrey Howe and co, that they drove from office the only decent peacetime prime minister of the 20th century.

The third factor behind the sustained rise in US shares, which has underpinned asset booms worldwide, is inflation, the devaluation of paper money. This process was already underway, but received a dramatic boost when Nixon broke the link between the dollar and gold in 1971.

Much hated by the bien pensants and driven out of office in disgrace, Nixon was not a bad president, ending the Vietnam War, among other things. There is a pattern in the USA. Democrats start wars and Republicans end them.

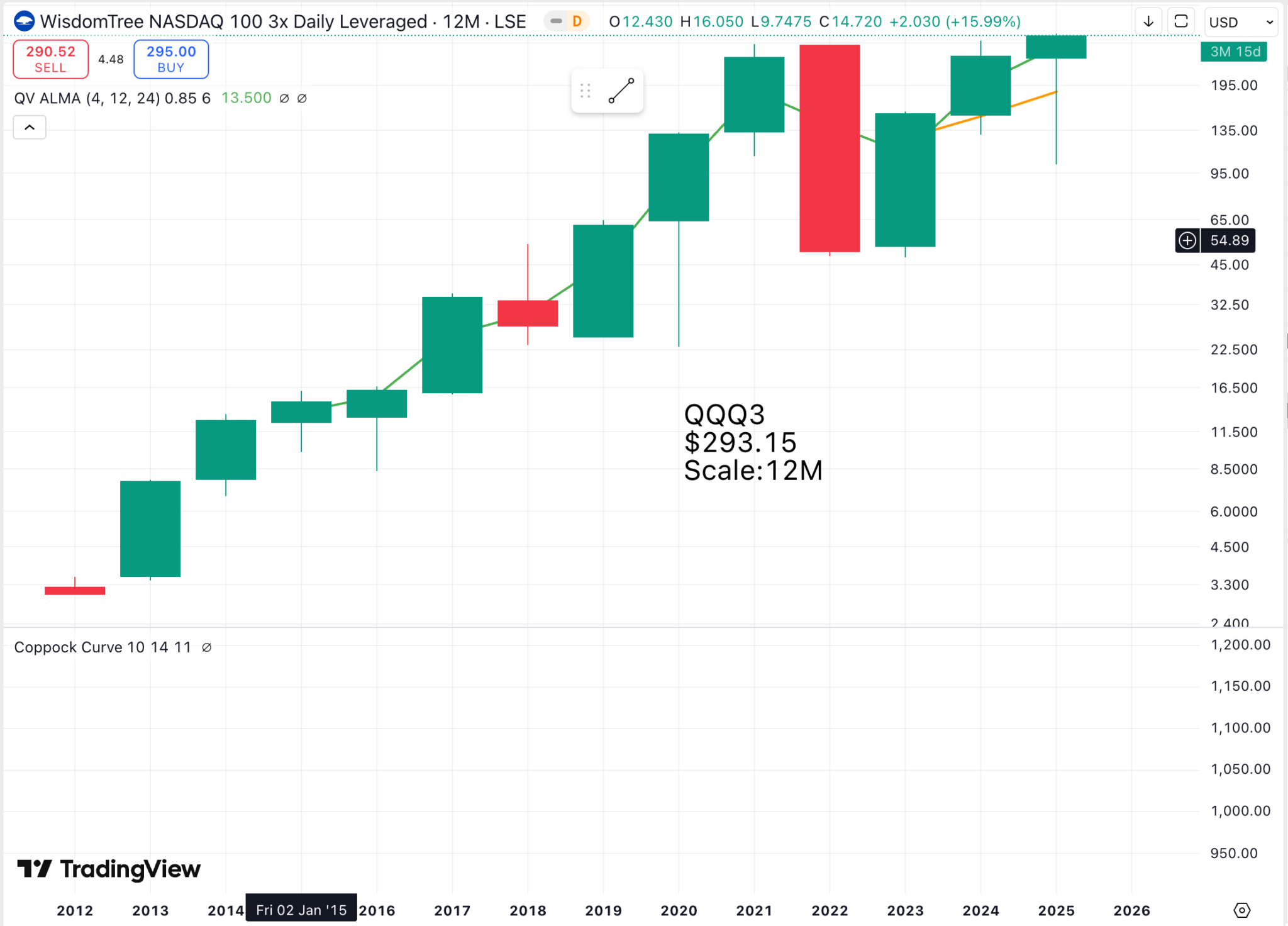

The Coppock indicator plotted from this long-term chart has produced excellent buy and sell signals. The sell signals indicate a period of sideways volatility until a fresh buy signal tells us that the long-term uptrend is resuming.

I have realised something important about QQQ3. The unleveraged version, QQQ, is 50pc above its 2021 peak, whereas QQQ3 is trading close to the former peak level. QQQ is much better at faithfully tracking the index and can be bought with leverage. What makes QQQ3 so exciting as an investment is that when it falls, it falls so dramatically, offering great buying opportunities for investors following $-cost averaging programmes.

QQQ3 peaked at $271 in 2021 and fell to $48 in 2022. You need to hold your nerve and buy resolutely into that decline because long-term charts of the US indices, including the Nasdaq 100, which QQQ3 roughly tracks, suggest that the secular trend is up. This means that QQQ3 will always recover.

As Warren Buffett says, when all looks dark, believe in your fellow Americans. That is hardly the issue at the moment with the indices hitting new peaks and QQQ3 on the verge of breaking higher.

Another thing to remember is that share prices fluctuate. There is a great deal of meaningless noise. Try to pay no attention. Ultimately, if the business is growing, the shares will increase in value.

An investment service called Zachs identifies three key characteristics of outperforming shares:- strong sales growth, example Palantir; margin expansion, example, Netflix and relentless innovation, example, Nvidia. All three of these shares are in my Top 30.

Share Recommendations

QQQ

QQQ3

I think QQQ deserves to be in my Top 30, taking the total to 31. It performs well, is suitable for leverage and faithfully tracks the Nasdaq 100.