I have been keeping a low profile with Quentinvest recently because with all my charts pointing down it is not a time to be taking new positions. In Great Stocks I noted that the fundamentals on many stocks remain as exciting as ever but if I didn’t need to publish Great Stocks with some recommendations in this market I would not have done so, albeit all the shares I chose had amazing fundamentals so if they don’t reach new highs the next time the market rallies we really are in trouble. The time to buy shares is when they are heading higher, not when the indicators are pointing down.

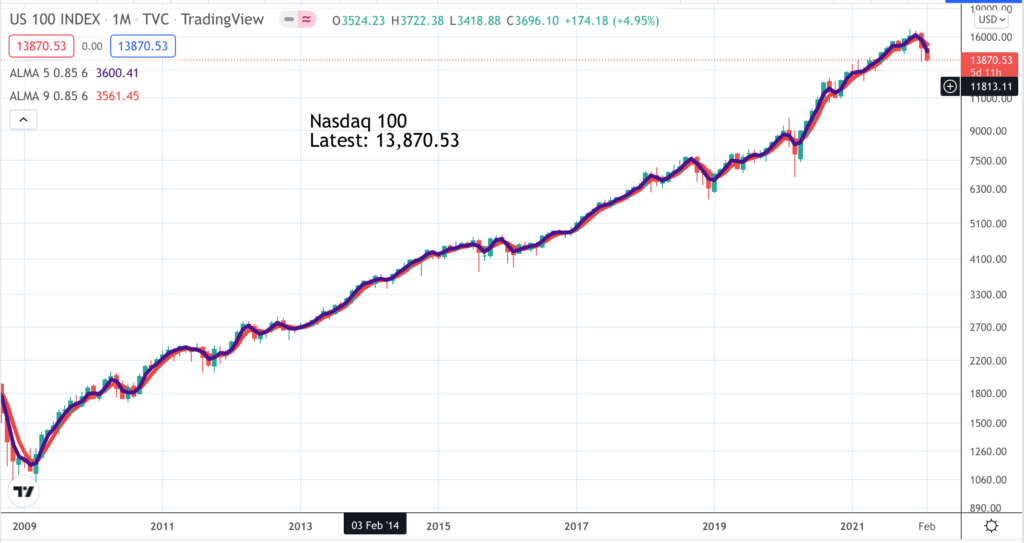

As you can see above even the indices like the Nasdaq 100 are now heading down and recently when I looked at the table of Quentinvest ETFs nothing looked bullish except for an ETF for oil. This does not mean it is not a time to buy. Charts always look terrible at the bottom of the market. The problem is that absent any buy signals how do you know it is the bottom. You would just be guessing. We have various techniques at Quentinvest for spotting important market low points quickly. One of these is the Coppock indicator invented between the wars in America and amazingly effective. As an example the Coppock indicator turned up in May 2009, two months after the stock market hits its low point. Because we did some forward projections we were even able to anticipate the Coppock buy signal and turn bullish right at the bottom in March 2009.

If you don’t wait for a buy signal but just buy into a falling market you can lose a great deal of money.

I am working with my cousin who is mathematically talented and good with both technology and statistics to learn more about Coppock and how it could help us.

We are also looking at another extraordinary phenomenon which is leveraged ETFs. I am posting a QV publication written recently which explains more about ETFs generally and leveraged ETFs particularly. I am becoming increasingly convinced (a) that they have become one of the wonders of the investing world since they first emerged a few years ago and (b) that we could really have some fun by combining leveraged ETFs with Coppock indicators.

The first point to note about leveraged ETFs is that they do much better than you would expect just from the leverage. Take QQQ3 which is a three times leveraged version of QQQ, an ETF which tracks the Nasdaq 100. Like the Nasdaq 100 QQQ is up around sixfold since December 2012 based on trough to recent peak. I chose this start date because that is when QQQ3 was launched. A six fold increase is a good performance but now let’s have a look at QQQ3.

It’s three times leveraged so you would expect it to be up 18-fold since 2009 which would be a phenomenal performance. But not as phenomenal as it has actually delivered. It is up 90 times (ninety times) !!! It’s an unbelievable performance. Forget bitcoin or almost any stock you can think of; QQ3 is one of the hottest investments out there only topped by some other leveraged ETFs.

My cousin and I are trying to understand why these ETFs perform so well. Our preliminary thought is that it is because they are rebalanced daily whereas QQQ is rebalanced quarterly. This means, we suspect, that they have phenomenally aggressive momentum.

In the latter stages of the bull market I started doing something similar with my own portfolio. Almost on a daily basis I rebalanced it around the strongest performers. The results were amazing. I have never made money as fast as I was making it in October/ November 2021. As usual I got caught by the bust which particularly affected shares with the strongest momentum. Shares like Cloudflare and Datadog which were exploding higher in early November driven by spectacular trading results suddenly fell out of bed and when I rebalanced out of them into other strong performers like Synapse, Morningstar and Snowflake, all shares with stunning fundamentals, they started to fall out of bed too so that I was eventually forced to go liquid ahead of what has been a torrid phase in stock markets.

Note that subscribers have been kept fully posted on this emerging sell-off with the first big go liquid call coming in 6 December and another on 6 January. As usual, I should have followed my own advice a little more closely.

My trading has given me a vivid insight into why leveraged ETFs might be such stunning performers. They do every day of the year what I was doing with my portfolio, rebalancing them around the hottest stocks. It’s a formula for great performance and also for stomach churning volatility. The trick for us is to try to devise strategies to use this fantastic performance and maybe even also the volatility to make a lot of money. My cousin and I are given this matter considerable thought and we will keep you posted on anything we come up with.

One thing we have already noticed is that Coppock seems to work very well with leveraged ETFs. Using Coppock buy signals to buy ETFs like QQQ3 looks like being a very profitable strategy and I mean very profitable. Presently the Coppock indicator for QQQ3 is falling. It peaked in September at around 330 and is presently around 185. A classic buy signal is given when the Indicator turns higher after becoming negative. There have been two previous buy signals, one in September 2016 when QQQ3 was around $13 and one in October 2019 when QQQ3 was around $45. The QQQ3 Coppock has never turned negative so we have based these buy signals on a long downswing almost into negative territory followed by the indicator turning higher.

Leveraged ETFs are one investment where buying into weakness can make sense because they never go bust and eventually they always turn higher. On past form when they turn higher they end up rising to new peaks.

We are watching and when we get buy signals for my favoured group of leveraged ETFs I will let subscribers know.

As discussed in the piece on ETFs published earlier today there are many possible strategies for investing in leveraged ETFs. If you decide to base some buying decisions on Coppock there is a case for investing quite heavily on a Coppock buy signal. They are rare and work very well.

As we know the problem is that leveraged ETFs are incredibly volatile so it does seem a pity not to have a strategy for locking in what can be some temporary very large gains. Coppock was not designed for sell signals but in this case I think we could make an exception. If you buy any leveraged ETF on a Coppock buy signal and then find yourself with large paper profits it could make sense to sell half your holdings when the Coppock curve turns down so you have plenty of ammunition for the next Coppock buy signal.