I am currently working my way through the Dan Brown books. I am on The Lost Symbol, which comes after The Da Vinci Code (sales 80 million books and counting). The biggest mystery is why Dan Brown has not won the Booker Prize. I suppose he is far too successful. I’m joking, but I do think writing is an overrated talent. The key is the ability to tell a good story, and that is where Dan Brown excels, even if all his stories are the same.

When discussing a mysterious phenomenon known as The Lost Portal, his hero, Robert Langdon, a professor of symbology at Harvard University, with a striking resemblance to George Clooney, notes that widespread acceptance of an idea does not necessarily make it true. Tell that to the Pope.

People will believe the most astonishing things. Apparently, the founder of The Mormons was able to translate The Book of Mormon from buried golden plates, to which angels had led him. He translated the books with the help of magic spectacles. The Mormons have been reading too many Harry Potter books. In any case, why couldn’t the angels have just given him the books written in English? God must surely be up to speed with speaking English, or has he been stuck forever rambling on in Latin?

Back in the day, people thought that if it was written down, it must be true; hence, major religions, Judaism, Christianity and the Muslim religion all had their ancient, sacred texts. The concept of novels and fiction had yet to be invented. Their heads would have been spinning if they were alive now. The ancient Egyptians had the Book of the Dead, which, according to leading modern authorities like Denis Wheatley, was all about Devil Worship, even though ancient Egyptians had never heard of the devil. In China, they had ‘Confucius, he say’. Buddha had The Book of Buddha written by a guy called Sid Arthur, OK, Siddhartha.

Can they all be true, I wonder. Now we have Dan Brown and J.K. Rowling, but they are too hot off the presses to have yet developed into major religions. When my young son read the first of the Potter books, ‘Harry Potter and the Philosopher’s Stone’, he asked me if he could go to Hogwarts. When I read the book, I realised this was not possible because he had the wrong parents. He needed to be born a wizard (slight racist overtones here, making Voldemort a bit like the Grand Wizard of the Ku Klux Klan), but he was part of a Muggle family.

We all fall about laughing at the thought that any grown-up might seriously believe the Potter books refer to actual events, but when it comes to the Bible, we suspend belief at strikingly similar claims. Harry Potter is reminiscent of a young Jesus Christ, and Voldemort is clearly the devil. There is so much detail about Harry in the Potter books that I think he probably did exist. Muggles don’t realise that Wizards are all around us because they have spells that make us forget what we have seen.

The thing which is intriguing is who Jesus Christ was. We cannot think about this in a spirit of rational curiosity because He was the Son of God, aka God. This is a matter of faith, and if you questioned it in 16th-century Spain, they handed you over to the Inquisition to explain to you the error of your ways. So much for faith! I asked AI and received the following diplomatic answer.

Jesus ( c. 6 to 4 BC – AD 30 or 33), also referred to as Jesus Christ, Jesus of Nazareth, and many other names and titles, was a 1st-century Jewish preacher and religious leader in the Roman province of Judaea. He is the central figure of Christianity, the world’s largest religion.

AI overview, 3 December 2025

That answer seems to me to be almost blasphemous, but it would be a surprise if AI and robots generally turned out to be deeply religious believers in Christianity.

I don’t know which is more extraordinary. If Christianity somehow came into being, even though Christ was not an actual person or God at all or if there was some extraordinarily charismatic leader in early Judaea, who somehow launched the Christian era. Most probably, he did exist, but like so many people, including my father, subsequent authors and raconteurs, describing his life, never allowed the facts to get in the way of a good story.

It was a secret society that appealed to the poor (rich folk get stuck in the eyes of needles) and thrived on persecution. It was able to spread widely because of the Roman Empire, its rapid communications networks and universal language. It was then legalised by Constantine and made the official religion of the Empire by Theodosius 1.

Emperor Constantine I was the first Roman emperor to convert to Christianity and he made it legal throughout the empire, but it was his successor, Emperor Theodosius I, who made Christianity the official religion of the Roman Empire in 380 CE.

Constantine I (reigned 306–337 CE): After converting to Christianity around 312 CE, he issued the Edict of Milan in 313 CE, which legalized Christianity and ended state persecution. This granted legal status to Christianity, allowing it to coexist with other religions and paving the way for it to become a dominant force.

Theodosius I (reigned 379–395 CE): Theodosius I made the crucial step of making Christianity the state religion of the empire with the Edict of Thessalonica in 380 CE. This meant that all citizens were required to be Christian, and other religions were no longer tolerated.

AI overview, 3 December 2025

Nothing to do with winning hearts and minds then. Like so many other religions, Communism, anyone, non-believers were put to death. I suppose this started the process where people describe themselves as Church of England, I do it myself, without believing a word of this fabulous nonsense, angels, demons, heaven, hell, miracles, saints, virgin births, Christ coming back to life again after being crucified. How can grown-ups give any more credence to this than they do to Santa Claus and his ability to turn thin air, aka five loaves and two fishes, into presents for a multitude of children?

As Gibbon noticed, the adoption of Christianity coincided closely with the collapse of the Western Roman Empire, of which Rome was the capital. By contrast, the ancient Gods did a much better job of making Rome a success. The Jews rated Jehovah on his ability to deliver military success. If the Romans did the same, they would have stuck with the original team.

Considering miracles in relation to the stock market, I guess Larry Page and Sergey Brin are probably believers. Page recently became the second richest man on earth with a fortune of $273bn, with Sergey Brin not far behind. If Alphabet is poised to become almost as dominant in AI as it has been in search, who knows how rich this pair might become.

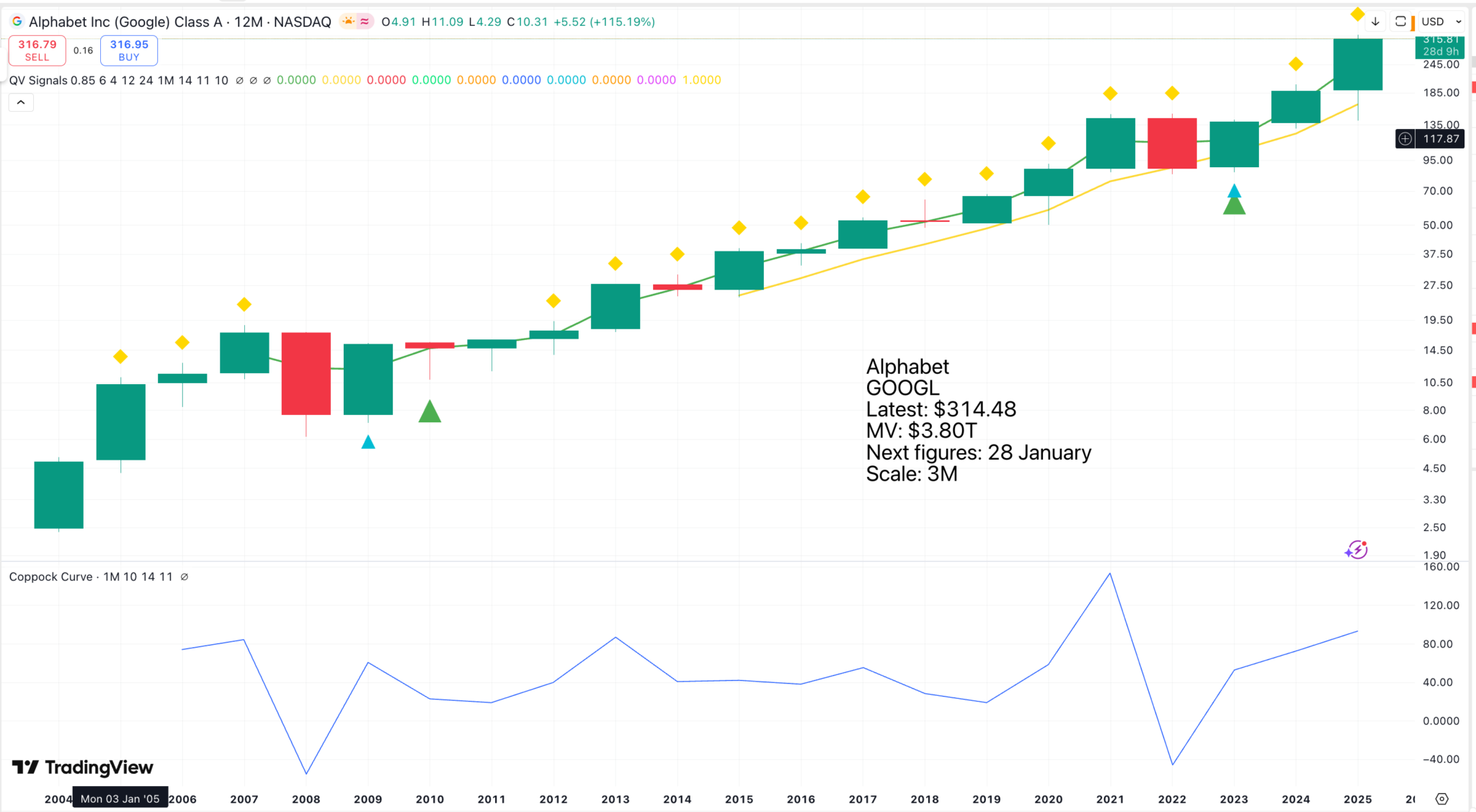

If we look at the Google chart since the IPO in 2004, we can see that there have been only two significant declines in 2008 and 2022, and both were caused by external events. There was a global financial crisis in 2008 and a dramatic rise in interest rates in 2022. There has never been a company-specific reason to sell Alphabet shares, and neither Page nor Brin has sold more than a tiny proportion of their holdings.

Google/ Alphabet has shown a great ability to ride each unfolding wave of the technology revolution, search, video streaming, cloud, device proliferation and associated software, and now it is moving successfully into the world of AI with autonomous vehicles, quantum computing and who knows what other marvels to come. A business valued at around $80bn on flotation (absurdly high in the opinion of the experts) is now approaching a valuation of $4 trillion.

The slope on the chart may look gentle, but in just over 20 years, the price has risen from $2.40 to $316! All the indications are that Alphabet is still full of vigour and as innovative as ever, while possessing businesses that throw off a tidal wave of cash.

The AI-enabled recommendation and conversion pipeline is feeding into stronger CPM* rates, while YouTube’s subscription products — YouTube Premium and Music — continue expanding their paying user base. Together, these shifts are turning YouTube into a hybrid revenue model capable of double-digit growth through both ad and recurring revenue streams.

*CPM rates, or cost per mille (thousand), are an advertising pricing model where the advertiser pays for every 1,000 ad impressions. This is a common metric for brand awareness campaigns because it focuses on reaching a wide audience rather than specific actions like clicks or sales. The CPM rate is calculated by dividing the total ad spend by the number of impressions and then multiplying by 1,000.

Alphabet’s operational excellence extends well beyond product innovation. The company’s cash from operations reached $48.4 billion in Q3, up 57.7% year-over-year, while free cash flow rose to $14.02 billion despite record CapEx. Alphabet’s liquidity remains formidable, with $98.5 billion in cash and short-term investments and minimal leverage on a $536.4 billion balance sheet.

Alphabet’s return metrics — 35.45% ROE [return on equity], 23.16% ROA [return on assets], and 32.23% net margin — place it at the top of the global large-cap technology cohort. These ratios underscore Alphabet’s ability to generate higher earnings from every dollar of capital than any peer in the Communication Services sector.

At the same time, the company is rewarding shareholders. Alphabet declared a $0.21 per-share dividend and continues to execute aggressive buybacks, repurchasing $15 billion in Q3 alone. Its workforce has expanded to 190,167 employees, up from 181,269 a year prior, yet margins improved, showing exceptional operating leverage as AI deployment scales.

Warren Buffett’s $4.3 billion investment in Alphabet Inc. (NASDAQ:GOOG) is one of the most meaningful capital shifts of the decade. Berkshire Hathaway — long known for avoiding fast-growing tech — has placed Alphabet among its top 10 holdings, signaling that the Oracle of Omaha views Google’s AI-anchored ecosystem as a new standard of durable value. The move completes a two-decade loop: in 2004, Google founders Larry Page and Sergey Brin modeled their IPO “Owner’s Manual” after Buffett’s writings on long-term discipline and transparency. Today, Buffett’s own endorsement validates that philosophy.

AI overview, 3 December 2025

Is Alphabet the greatest company the world has ever seen? I am beginning to think so. Its AI business is going ballistic.

Google Gemini is a family of large language models (LLMs) and a suite of AI-powered products developed by Google. It acts as a conversational AI assistant that can handle tasks, answer questions, and generate content across various modalities like text, images, and code. Gemini powers Google’s conversational AI chatbot, replaces the Google Assistant on many devices, and is being integrated into other Google products like Workspace and Maps to help with tasks like writing, data analysis, and creating summaries.

AI overview, 3 December 2025

Some statistics below for the growth of Gemini.

Google’s AI model has rapidly grown in user adoption, technical capabilities, and product integration since its late 2023 launch.

User Adoption:

Over 350 million monthly active users across Google products and over 650 million monthly active users on the standalone app as of late 2025.

Gemini powers 1.5 billion monthly AI Overview interactions in Google Search.

The Gemini app has been downloaded over 185 million times on Android and iOS.

The Nano Banana image model’s introduction in August 2025 led to record app store performance, with iOS revenue up 1,291% from January.

Technical & Product Growth:

Google has released versions 1.0, 1.5, 2.0, and 3.0 throughout 2024 and 2025, with each generation showing significant performance gains in benchmarks.

Key models include Gemini 3.0 Pro, which topped industry leaderboards.

Gemini has been integrated across Google’s ecosystem, including Search, Gmail, Docs, Android, and Google Cloud, contributing to strong Cloud revenue growth.

Enterprise users of Gemini for Google Workspace save an average of 105 minutes per user per week.

AI overview, 4 December 2025

The late financier, Jim Slater, in relation to stocks, used to say ‘elephants can’t jump’. He might change his mind if he saw the effect of technology on the biggest corporations. They are jumping all over the place, and Alphabet is one of the ones jumping the highest.

The only negative is that the shares look overbought in the short term, but otherwise, this is a fantastic chart. If you were to hold only one share, this would be a candidate. It has everything. Market-leading businesses purpose-built for the technology revolution, staggering cash generation, aggressive programmes to reward shareholders and innovation on multiple fronts funded by that titanic balance sheet.

There is a case for saying that the recent price action, which resembles that seen when Alphabet first floated, is a new chart breakout and that a sustained period of rising prices lies ahead. This would make sense if AI is going to make everything Alphabet does more valuable to its customer base.

I use Google every day, through Gmail, Search, YouTube, AI, Chrome, but I pay them nothing. I pay for lots of other things, Netflix, Amazon Prime, AppleTV, which I use, but my daughter pays for. I spend a fortune on logs in the winter months. I am considering paying £290 a month for membership of a posh local gym. I think if Google, OpenAI or whoever can come up with a Jeeves-like all-purpose digital assistant, I would pay a serious subscription for such an amazing service that could look after everything for me.

It could be called Jack or Julie or even Julie darling, and whenever I wanted anything done, I would just ask, and my digital guy or gal would spring into action. How WOW! would that be. Meanwhile, Alphabet is on an incredible roll for such a large company.

You can pick quotes at random to illustrate the power of this incredible company.

In Q3, revenue from products built on our generative AI models grew more than 200% year-over-year. Over the past 12 months, nearly 150 Google Cloud customers each processed approximately 1 trillion tokens with our models for a wide range of applications. For example, WPP is creating campaigns with up to 70% efficiency gains. Swarovski has increased e-mail open rates by 17% and accelerated campaign localization by 10x. Earlier this month, we launched Gemini Enterprise, the new front door for AI in the workplace, and we are seeing strong adoption for agents built on this platform. Our packaged enterprise agents in Gemini Enterprise are optimized for a variety of domains, are highly differentiated and offer significant out-of-box value to customers.

We have already crossed 2 million subscribers across 700 companies. Next, YouTube. In the living room, YouTube has remained #1 in streaming watch time in the U.S. for more than 2 years, according to Nielsen. Last month marked YouTube’s first time as a live NFL broadcaster. This exclusive global broadcast live from Brazil drew more than 19 million fans and set a new record for most concurrent viewers of a live stream on YouTube. YouTube Shorts also continues to perform well. In the U.S., Shorts now earn more revenue per watch hour than traditional in-stream on YouTube.

Sundar Pichai, CEO, Alphabet, Q3 2025, 28 November. 2025

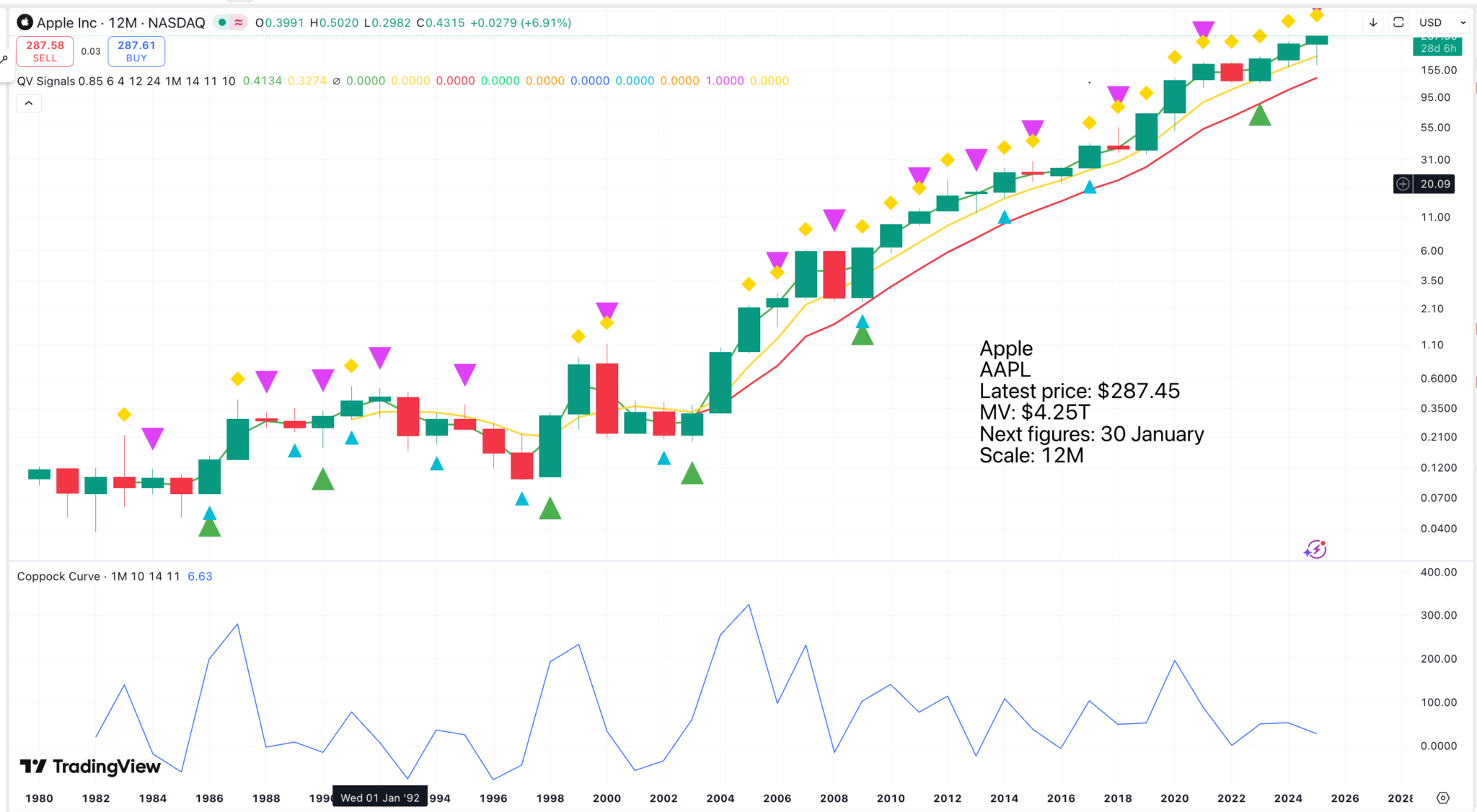

This is another amazing chart for a stock market giant. Google, now Alphabet, floated in 2004, and it is around then that Apple shares began their relentless climb. What did Apple do in 2004?

In 2004, Apple launched the iPod mini, expanded the iTunes Music Store to Europe, and released new products like the Xserve G5, iMac G5, and the U2 iPod Photo. The year also saw the beginning of the project that would become the iPhone, as engineers worked on a tablet prototype that was later “shrunk” to fit in a pocket.

AI overview, 3 December 2025

The iPhone was a game-changer.

The first iPhone was launched on June 29, 2007, after being unveiled by Steve Jobs earlier that year at Macworld. The original device was marketed as a combination of three products: a widescreen iPod, a revolutionary mobile phone, and a breakthrough internet communications device. Its launch featured key innovations like a multi-touch interface and a single home button.

AI overview, 3 December 2025

The iPhone has been a massive success.

As of July 2025, more than 3 billion iPhones have been sold, and Apple has been the largest vendor of mobile phones since 2023.

The iPhone, which operates using Apple’s proprietary iOS software, is one of the two major smartphone platforms in the world, alongside Android. The first-generation iPhone was described by Steve Jobs as a “revolution” for the mobile phone industry. The iPhone has been credited with popularizing the slate smartphone form factor, and with creating a large market for smartphone apps, or “app economy“; laying the foundation for the boom of the market for mobile devices. In addition to the apps that come pre-installed on iOS, there are nearly 2 million apps available for download from Apple’s mobile distribution marketplace, the App Store, as of August 2024.

Wikipedia, 3 December 2025

Something is happening at Apple in its development of AI, which may prove a turning point.

Apple AAPL is reshaping its AI leadership team, bringing in longtime Google engineer Amar Subramanya as its new vice president of AI while announcing that John Giannandrea, one of the company’s most influential AI voices, will retire next spring.

Subramanya spent 16 years at Google, moving from research scientist to VP of engineering and helping lead development of the Gemini assistant. He briefly worked at Microsoft earlier this year and will now report directly to Craig Federighi, Apple’s head of software. Tim Cook said Apple is pleased to welcome Amar, adding that his expertise will help drive Apple’s next wave of AI features, including a more personalized Siri expected next year.

Giannandrea, who joined Apple seven years ago after a distinguished career at Google, will remain as an advisor before retiring in spring 2026. Cook thanked him for shaping Apple’s machine-learning strategy during a period of rapid technological change. Investors care because Apple is signaling a more aggressive push into AI at a moment when rivals are moving quickly.

AI overview, 3 December 2025

Share Recommendations

Alphabet. GOOGL

Apple AAPL

Strategy – Time To Bet The Ranch On Alphabet

The more I read about Alphabet, the more impressed I am. AI and Alphabet are a match made in heaven. I think these shares are headed way higher.

Gemini 3 was released a few weeks back to major acclaim. Analysts praised the innovation engine of Google in signs Google could take the next step to close any technology gap with OpenAI.

OpenAI is forecasting ending 2025 with an annualized revenue run rate reaching $20 billion with a plan to reach $200 billion by 2030. Google already has $400 billion in revenues and operating cash flows of $151 billion, providing the cash flow to fund AI spending.

While OpenAI sees growth in AI subscriptions, Google monetizes AI via the utilization of AI in the Search business and Google Cloud. On the Q3’25 earnings call, CFO Anat Ashkenazi confirmed the massive growth in backlog as follows:

Google Cloud’s backlog increased 46% sequentially and 82% year-over-year, reaching $155 billion at the end of the third quarter. The increase was driven primarily by strong demand for enterprise AI. As Sundar mentioned earlier, Cloud has signed more billion-dollar deals in the first 9 months of 2025 than in the past 2 years combined.

While the market is constantly focused on excessive AI capex spending due to OpenAI forecasting burning $8 billion in cash this year, Google spent nearly $24 billion on capex last quarter alone, but the company still generated nearly $25 billion in free cash flows. The tech giant has still produced over $73 billion in free cash flows over the last the year and appears poised to handle upwards of $100 billion in annual AI spending now.

Seeking Alpha, 1 December 2025. Stone Fox Capital

Generative AI is the ultimate game-changer for homo sapiens. At the moment, the world divides into those with and those without smartphones. I hadn’t realised. There are around 7.5bn smartphones in the world. Crikey! This is the potential market for all-singing digital personal assistants.

And soon, like early life, they will leave the sea (the cloud) to walk on earth. They will shed their metallic exteriors and acquire soft skin, blue eyes, and long hair, and they really will be Julie darling. They will teach you yoga, massage your back, walk the dog, do the shopping, and cook delicious meals. The future awaiting mankind is mind-blowing, and paying for the technology to stand behind these incredible achievements will take the deepest of pockets, hence the rise in the early years of the new millennium of mega corporations with cash flows running into the $100s of billions and the power to innovate relentlessly.

People may worry about the power of these megacaps, but without them, the technology revolution would grind to a halt. Be thankful that there are a growing number of them so that there is plenty of competition for our money.

It has occurred to me that there is another parallel with the data centre boom, and that is the medieval boom in building churches, abbeys, monasteries, nunneries and cathedrals, and that boom ran and ran. We seek to harness the power of data. They were trying to harness the power of the Divine. In the time of Alexander the Great, there was a project to store every book in the world in a great library in Alexandria, which became one of the Seven Wonders of the World until it burned down during the time of Cleopatra. Now the planet is becoming a gigantic data library which can be accessed by increasingly powerful computers in nanoseconds.

This process generates valuable tokens of intelligence, as referenced by Alphabet above, in vast and explosively growing numbers. At the moment, we have training and inference, but coming soon are AI agents which can reason like humans.

AI training is the process of teaching an artificial intelligence model to recognize patterns, make predictions, or perform tasks by feeding it large amounts of data. This process involves providing the AI with examples, measuring its performance, and then adjusting its internal “weights” or “rules” to minimize errors and improve accuracy over time. The goal is to enable the AI to interpret new, unseen data and perform tasks with increasing reliability, much like teaching a person a new skill through repetition and correction.

AI inference is the process where a trained AI model uses its learned knowledge to make predictions or decisions on new, unseen data. It’s the stage that follows training, where the model applies patterns and relationships it learned from a training dataset to new inputs, allowing it to perform tasks like identifying an object in an image or translating text.

AI reasoning is the process where artificial intelligence systems use logic to analyze information, draw conclusions, and make decisions, mimicking human-like thought processes. Unlike AI that solely relies on pattern recognition, reasoning AI interprets data, solves problems, and can explain its conclusions based on structured knowledge and logical rules. This allows it to handle complex tasks in domains like law, medicine, and robotics that require higher-order thinking.

AI overview, 4 December 2025

My impression is that just like Search before it, AI and the answers it provides are getting better almost daily. People may have forgotten how clunky Search was in the early days.