How Geoff Wilding & team are transforming Victoria from humble carpet maker to floor coverings giant

Victoria. VCP. Buy @ 1035p. Times recommended: 8. First recommended: 614p. Last recommended: 884p. Lowest recommended: 528p

I often talk in QV about the power of something new happening to move share prices. Victoria had an important new development on 3 October 2012 when, after a prolonged and bitter boardroom battle, Geoff Wilding was appointed executive chairman. This was an incredible ‘something new’ because Wilding was a former investment banker and he set out to transform the then-struggling carpet making business, in particular by making acquisitions. [Think what Bernard Arnault has achieved at LVMH by a combination of organic growth and relentless acquisitions and think also that Victoria can claim to be a luxury goods business].

His strategy involved all the usual stuff of cutting costs, improving marketing and strengthening the management team but the real game changer in his approach was a string of acquisitions. Victoria went from being a small UK carpet manufacturer to a pan-European floor coverings specialist and not just inside the home. Victoria is about to become Europe’s biggest supplier of premium artificial grass.

Wilding is not a modest man but then he has much to be immodest about. Since his arrival, as investors learn on the first page of the Victoria web site, the shares have risen 30-fold and with dividends reinvested the gain is more like 60-fold. This is supported by impressive fundamentals. Ebitda for 2013 was £4.1m; for the year to 3 April 2021 it is officially forecast to exceed £120m and I think (see below) for the year to end-March 2022 it could be well on the way to £200m. No wonder shareholders think he can walk on water.

Many of us may think that a carpet maker is unexciting in the digital era but they can pump out cash, which is why Warren Buffett, owns Shaw Carpets, the world’s second largest carpet maker and Koch Industries, a privately owned $115bn behemoth, which has just injected a hefty chunk of funding into Victoria and taken a significant equity stake, owns two carpet making businesses. This cash generating ability makes Victoria an ideal acquisition vehicle.

The top management team has been further strengthened by the appointment of Philippe Hamers as CEO. Hamers previously ran Europe’s largest carpet manufacturer. The finance director is Michael Scott, who spent eight years at Rothschilds working with company mergers and acquisitions.

The group also has powerful financial backing in the form of BFG (the British Growth Fund), Spruce House Partnership and Koch Equity Development (see above), all of whom have significant shareholdings and non-executive directors on the board contributing to what is a formidable team.

The arrival of Koch on 22 October 2020 with a planned £175m investment in convertible preferred equity was another massive ‘something new’ for Victoria and the shares have been racing higher since that time. The fund raising and various associated share transfers were priced based on a 350p share price with the hope that five years later the price might have reached 1000p. This has happened in six months!

The injection of funds didn’t go unnoticed by Quentinvest. On 27 October I recommended the shares at 528p and have recommended them again three times since then as my conviction has grown that very exciting things are happening at Victoria. A major reason for the deal with Koch was to give Victoria serious fire power at a time when the Covid-19 disruption was creating many important acquisition opportunities in the severely disrupted European floor coverings market.

As Victoria said at the time. “The events of the last few months have revealed some potentially exceptional acquisition possibilities in Europe and the UK to grow Victoria substantially and the purpose of raising the £175m of new preferred equity capital is to enable Victoria to move quickly and decisively to capitalise on these potential opportunities.”

There were some other things going on, pointing to exciting times ahead for Victoria. At the time the largest shareholder was Invesco with around a 30pc stake. As part off the deal with Koch the latter bought from Invesco a 10pc stake at 350p a share, a deal about which they must be feeling very happy.

The company itself then bought back a 6.82pc stake, also at 350p. This has the effect of reducing the number of shares in issue and raising earnings per share. It is extraordinary that they were able to pull off this deal since their argument for doing it was that the shares were “very materially undervalued”. In yet a further deal, Spruce House Partnership, which already held a 14.8pc stake, bought a further 2.8pc from Invesco. The bottom line of all these transactions is that Victoria has a powerful financial war chest and equally powerful institutional support for all its future plans.

It is no wonder that the shares are moving up so strongly but also no surprise they have paused for breath at 1000p. This is both an important round number resistance level and the level of the former all-time high reached in December 2017. My hunch is that once through this level the shares will again move up strongly.

One reason for the excitement is that the new money just raised is starting to be used. On 21 April Victoria announced that it was spending €35m to buy an Italian ceramic tile manufacturer, which was expected to generate ebitda of at least €10m and this figure was expected to increase as the group used the acquisition to “insource tile production that is currently outsourced due to lack of capacity, plus capitalising on the new brands to drive revenue growth”.

These numbers are significant because the terms are a considerable improvement on the group’s stated goal (see below) of spending £700m on acquisitions to generate £100m of ebitda.

Wilding commented on the deal that – “International demand for the ceramic tiles produced by our Italian business continues to grow at a remarkable rate due to the successful blend of quality, style, and value. The use of a high proportion of recycled raw materials in the tiles has proven attractive to consumers. However, maintaining service levels for our customers has, in recent months, required the business to outsource production to third parties to meet the ever-increasing demand. This is expensive in terms of margin forgone – and is addressed by this acquisition.”

Two weeks later, on 4 May, Victoria announced a deal to acquire Edel Group BV, a Netherlands-based manufacturer of artificial grass and carpets. The total consideration including acquired debt was €62.9m for a group with ebitda above €10m. Not only did this deal also improve modestly on Victoria’s expected 7:1 ratio of acquisition cost to ebitda but it is also before the group works its magic to improve that ebitda as Edel is integrated into the larger group.

CEO, Philippe Hamers commented – “Victoria’s 2017 investment in the premium artificial landscaping grass sector has been very successful and this acquisition represents an opportunity to create Europe’s largest and most profitable business in the sector. The addition of production facilities benefits our customers by enabling them to source locally in Europe, avoiding inflationary and disruptive imports from the Far East. Furthermore, the outlook for this product category is positive due to growing consumer acceptance and increasing demand for sustainable products that address climate change.”

While executive chairman, Geoff Wilding noted – “Victoria has, so far this financial year, invested a little over £90m to add approximately £17m of EBITDA to the group. We continue to have substantial amounts of capital to deploy and are in active discussions with additional high-quality opportunities to grow our business. Therefore, shareholders can expect further acquisitions in the weeks and months ahead.”

Floor coverings is an interesting area for an acquisition specialist because privately owned floor coverings businesses are not typically highly valued so they can be bought on earnings enhancing terms. Like other specialist acquisition companies such as Halma and Keywords Studios (both stalwarts of the QV portfolio), Victoria makes a point of buying niche businesses that are profitable and come with a talented management team that is given great autonomy within the Victoria umbrella. It is a powerful formula for sustaining growth.

Victoria’s year end is 3 April 2021. On 12 April the group issued a trading update showing that it was trading strongly. Full year sales were expected to rise modestly to £640m despite losing £50m of sales in the March-April 2020 lockdown period. Ebitda (earnings before interest, tax, depreciation and amortisation) was expected to be over £120m v £118m the year before.

The group also noted. “The trading outlook for the current FY22 financial year is very encouraging in terms of both revenue and margins. The group continues to experience strong, ongoing consumer demand across its key markets. Furthermore, housing transactions, a key 12-18 month leading indicator of flooring sales, are at very high levels – not only in the UK, but across our markets (more than 70pc of the group’s earnings are now generated from outside the UK), which suggests demand will be maintained for some period.”

One thing to focus on here is the expected ebitda of £120m because we also know that Wilding is expecting to spend £700m to acquire a further £100m of ebitda and so far the deals are being done on significantly better terms that that 7:1 ratio. The deals are being funded by the injection of equity from Koch Industries, from bond transactions which I have not elaborated on here and with an offset from a significant share buyback by the group. (The group issues more equity with the one hand but offsets it by buying a chunk back at what already looks like a very good price).

The implication is that at some point in the not too distant future ebitda could be running at around double the levels reported for 2020-21, with much of the impact falling straight through to earnings per share.

Investors looking at the share price chart will see that the price collapsed between December 2019 and March 2020. The reasons for this were that in 2019 the group made a loss, mainly because of goodwill write-offs and that as Covid-19 struck investors were worried about the impact of a sharp fall in demand on a group that carries a considerable burden of debt. Net debt as at 3 October 2020 was £323m, which must have looked scary on 1 March 2020 when the group was capitalised at £437.5m and even scarier at the end of the month when the total value fell to £168m at a time when demand for floor coverings was collapsing.

The group has been able to reassure investors that most of its operating costs are variable so its operational leverage is much less than they might have imagined. This partly explains how it has survived 2020 with an increase in sales and profits. The other reason is an unexpectedly strong rebound in demand. Work from home has led to consumers building their savings and increasingly directing spending towards home improvement.

More recently the group has moved onto the front foot with its expansion plans. This includes the additional finance, a restructuring of its debt to cut interest costs and its aggressive reopening of factories even ahead of shops reopening, which has positioned it to take full advantage as demand recovers. As we have seen it is also being increasingly aggressive on the acquisition front.

I have been taking a look at where ebitda might be heading over the next year or two. The base line is the £120m plus expected to be reported for the year to 3 April 2020. Wilding has told us that the new acquisitions add £17m a year to ebitda, which should grow as they reap advantages of being part of a larger group. He also told us that the group lost £50m of sales in March and April 2020. If we assume 20pc margins, a modest improvement on the 18.3pc achieved in a Covid-19 affected 2020-21, that adds a further £10m to ebidtda taking the base line to £147m.

We are also hearing that there will be more acquisitions in coming weeks and months and that the year has started ‘very encouragingly’. OK, this is finger in the air stuff but with margins expected to improve on all the sales and sales themselves growing significantly (beyond the £50m already accounted for) you can start to see why I am thinking of full year 2021-22 ebitda trending towards £200m. Sales of £1bn in 2021-22 on ebitda margins of 20pc would do it and with more acquisitions in the pipeline I don’t think £1bn is a ridiculous expectation. Then beyond that, once all these deals are done, the opportunities for rationalisation, cross-selling, more funding for businesses that had been starved of capital and other benefits would be considerable but would take another year or two to realise.

This starts to become interesting on the valuation front. Victoria is capitalised at £1,145m. Add the net debt and we have an enterprise value of £1,468m although I expect that debt to be paid down rapidly given the cash generating characteristics of the floor coverings business with modest cap ex requirements. If we assume £200m ebitda is when not if the business should fairly soon be valued at around seven times ebitda (at the current share price).

Keeywords Studios and Halma have similar business models and are valued respectively at 23.9 times and 30.7 times enterprise value to ebitda. I may be cheating a little by assuming deals by Victoria ,which haven’t been done yet and not really ascribing much cost to doing those deals but even so you can see why Victoria’s shares could be seen as very good value, especially given the prospects for a dramatic surge in demand for floor coverings as the global economy bounces back from lockdowns.

Note also that in a clear statement of intent Victoria does not pay dividends but prefers to reinvest all its free cash flow in growth and acquisitions. The share buyback was an opportunistic move to take advantage of a depressed share price, not a sign of what is going to happen in the future.

The Italian business incidentally, where the group made an acquisition, is emerging, like the artificial grass business, as a jewel in the crown. On 29 March 2021 Victoria announced – “In December 2017, Victoria began its expansion into Italy by acquiring Sassuolo-based ceramic tile manufacturer, Ceramiche Serra – a mid-sized factory with revenues at the time of €28m. As shareholders will recall from earlier announcements, Serra continued to perform very strongly under Victoria’s ownership and, notwithstanding investment in a new production line shortly after acquisition, outgrew its production capacity during 2019. Therefore, in February 2020, Victoria acquired, for £9.9m, the factory of a neighbouring business, which was facing closure, complete with its plant, equipment and brands. This was a highly efficient way of adding production capacity as it provided more-or-less instantaneous additional production capacity versus the 18-24 months it would take to build a factory, install the plant, and acquire emission rights. This factory was fully integrated into the existing Italian operation during the following six months, with a reduction of employees from 368 to 250 FTE [full time employees] alongside production output increasing by 1.2m m² of red body tiles and 0.7m m² of porcelain tiles. The product mix was also optimised. Victoria is delighted to report that, despite the constraints of the last 12 months, the management team has taken full advantage of the additional capacity. Growth has accelerated over the last 12 months with new significant customers and new markets – mainly in Eastern Europe and North America – being secured (nearly 100pc of output is exported globally). As a result, on Friday 26 March, the business reached a remarkable milestone – invoicing €100m of sales for the year since 30 March 2020. Organic growth has again filled capacity and some production is once more being outsourced. Consequently, Victoria is now actively seeking to efficiently add further capacity to enable this production to be insourced to improve margins further as we are confident of additional growth in 2021/22.”

It’s a long quote but I have included it all because it shows that Victoria is not just about making and integrating acquisitions but also about playing an exciting role in a changing and growing floor coverings market. A growing market plus a team driving dramatic in-house efficiency gains plus a well-honed acquisition team could really bring Victoria onto the radar of bigger investors and if that happens those institutions are going to struggle to find shares to buy in such a tightly held group.

One striking statistic is that the ceramics business, which Victoria barely had before 2017 now provides around two thirds of ebitda. The underlay business, which can be described as a nice little earner, is now, at 16pc of ebitda, almost as big as the carpets business at 18pc. Finally the artificial grass business, which was just four per cent of ebitda, is going to leap in importance following the Edel acquisition. Victoria has been transformed between 2012 and 2016, transformed again between 2017 and 2020 and looks as though it is at an early stage in a third transformation. This is heady stuff for shareholders.

I can see these shares at £50 one day or even more. They look super-exciting.

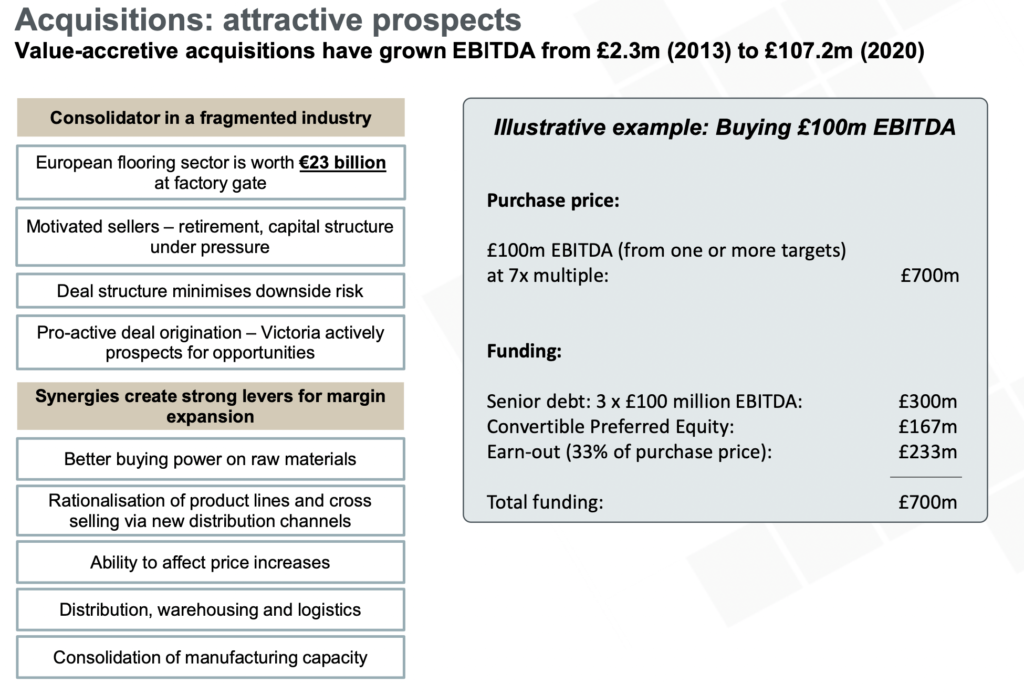

The chart above shows how effectively Victoria creates value for its shareholders. First of all, since 2013, value accretive acquisitions have lifted ebitda from £2.3m to £107.2m. This shows what these guys can do. Second is the market opportunity. The European flooring sector is worth €23bn at factory gate prices, which compares with Victoria’s 2020-21 revenue of £640m (€735m). Victoria has around a three per cent share of a fragmented market, which should help the deals keep coming. Finally, there is the example of how the group can deploy £700m to buy ebitda of £100m. The funding is £300m is debt, £233m is deferred and only £167m is the convertible preferred equity and even that may be refinanced in some clever way to mitigate the impact one earnings per share.

This is about as close as it gets to the alchemist’s dream of turning base metal into gold. The company said the shares were ‘very materially’ undervalued at 350p. They still look a screaming buy to me even after they have trebled. No wonder, last October, even with such an extraordinary pipeline of acquisition opportunities needing to be funded, Wilding just could not resist the chance to buy a big chunk of Victoria’s own shares. He is clearly very confident indeed that an exciting future awaits the business.

I have been writing a lot in recent issues about staggered investing, £-cost averaging, programmatic buying on successive buy signals and buying the green. I would not do that here. Whatever your intended final holding is for a share I would buy immediately. All the risks with Victoria are on the upside as a growing crowd of investors becomes aware of the exciting things that are happening and as more exciting things happen. There is scope here, not just for rapid earnings growth but for a significant rerating.