This is the demon which is freaking out stock markets, the relentless rise in US 10 year bond yields after reaching historic low levels in March 2020. I was talking to a bond markets specialist over the weekend and he was sceptical of my theory that US bond yields could reach five per cent but this chart says that they could. We have had a period of consolidation, then a rise, another period of consolidation and another rise and now the yield is breaking higher from another period of consolidation. My guess is that my target of five per cent for the yield on US 10 year Treasury bonds is still very much on. If that happens it will drive bond yields higher around the world and keep up the downward pressure on prices for shares and cryptocurrencies.

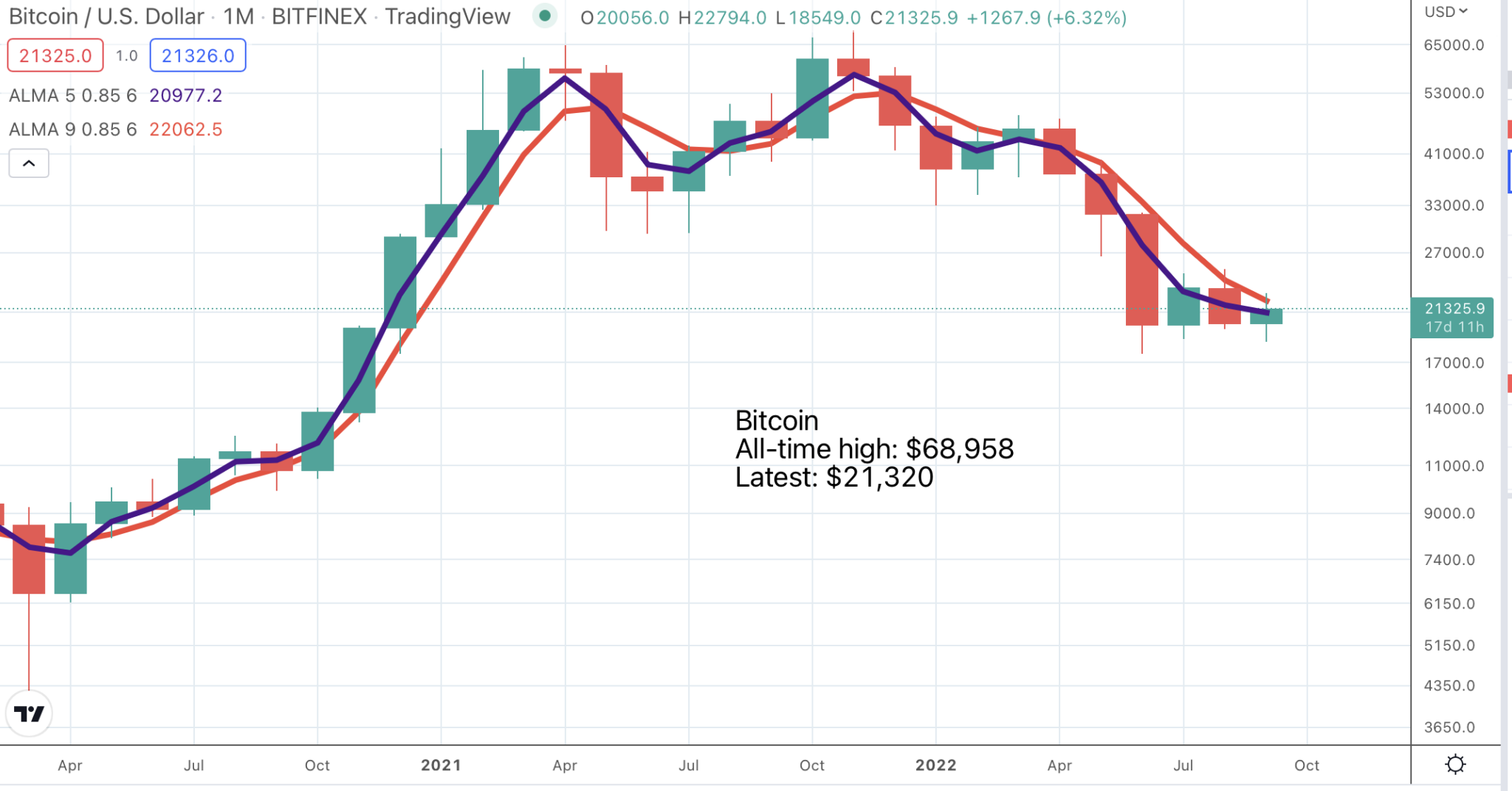

This consolidation for bitcoin is becoming ever more important. The price is fighting to hold around $20,000 but it is doing this against the background of falling moving averages, a falling Coppock indicator and a breakdown below a major top area. The odds favour a further breakdown for bitcoin, which generates zero income and is vulnerable to rising yields on government bonds.

It is weird what is happening in the world. For nearly 15 years governments and central banks have been pumping stimulus into the global economy and much of this stimulus has found its way into asset prices. Now that stimulus is going into reverse which is hitting asset prices but the overhang is feeding into an explosive burst of global inflation.

Eventually inflation will feed into asset prices but in the shorter term it needs to be contained or it accelerates and becomes embedded. The process of containment which involves rising interest rates and slowing economic growth, if not recession, is painful.

Like bitcoin the Nasdaq 100 is consolidating but there is nothing in this chart to suggest a change of direction. The Coppock indicator is on course to be approaching minus 100 for September and minus 200 for December, which suggests a stock market under severe pressure.

The £/$ rate is still in sterling crisis mode which is going to be a problem for Liz Truss especially given her plans to cap energy prices. As an owner of period houses which consume large amounts of energy I will benefit from her price caps though it is hard to believe that subsidising consumption is a good idea. Yet again the law of unintended consequences is kicking in. Attempts to move the UK rapidly towards renewables made us vulnerable to energy shocks. These are big numbers. I worked out that £150,000,000,000 divided by 60,000,000 (the approximate population of the UK) is worth £2,500 per head. My energy bills are so high I would not be surprised if the subsidy I am going to get is nearer £10,000. Thanks Liz but are you sure this is a good idea. We all need to learn to wear woolly jumpers and even scarves inside which is quite a good look. Dogs don’t need central heating and we should try to use it less. We would if we were getting the full hit from those energy bills.

My old favourite, QQQ3, (Nasdaq 100 x 3) is also looking wobbly. The latest Coppock number is minus 80 and this could easily double for September and double again for December. If anyone is curious about what a raging bear market looks like we are in one.

I mentioned the Nvidia chart recently as being under severe pressure. Nothing has changed. There is a clear breakdown from a small continuation pattern. These shares are most likely heading significantly lower.

I am keeping a close eye on the Alphabet chart, which is close to an alarming breakdown. It is significant that it has been bouncing around just above $100, which is an important round number support level. A clear break below $100 would put the shares on a slippery slope to lower levels with the first support at $75.

Adobe is a terrific company, creator of such useful tools as Adobe Illustrator and PDFs. It is widely used around the world. In the early years of the last decade the group switched from selling packaged software with regular paid-for upgrades to selling from the cloud on subscription. This was expensive initially but then helped generate sustained strong growth. The shares rose accordingly especially as interest rates fell to near-zero levels. Adobe is still an excellent company but the investment climate has changed dramatically and the shares have dropped accordingly.

Human nature can only take so much change at a time, especially when the business still looks great so after falling so far so fast most recently the price has been consolidating. This happened regularly on the way up and we must now assume that it is also happening on the way down. The most likely direction of travel for these shares is a further breakdown.

It’s not all doom and gloom. There are many exciting companies in the Quentinvest portfolio, which are showing just how well businesses can adapt to changing circumstances. A classic example is IT consultancy and solutions provider, Epam Systems. Their business model is that they have loads of clever guys across Central Europe but provide services into high value locations like the US.

The Ukraine war came as a huge shock to a company with something like 14,000 employees in Ukraine and 18,000 in Belarus and Russia out of a total 58,000 employees. The shares crashed on news of the war but have since rallied, partly because of the astonishing resilience of Ukraine but also because of the rapid response of the company.

In its latest quarterly results it noted that its Russian labour force was down to 1,000 and that its Ukrainian employees were performing well. It also added that the company had a $100m assistance fund for Ukraine.

The company is adapting, rapidly returning to former levels of profitability and is confident that its traditional 20pc or higher growth rate will be back on course shortly and ready to continue for the foreseeable future.

While we really are doing better today than we expected, we, like our competitors and all of you, see a growing number of mixed economic indicators and caution in the market. At the same time, we still believe the near-term demand environment remains intact. We also believe the medium-term broad-based demand trends, which have driven activity in our industry in the past will continue to support our ability to drive strong organic growth at or above our old normal 20pc target. So while we are not immune to the impact of the global economic events, we are much better positioned today than in the past to address any future shifts.

Q2, 2022, 4 August 2022

This is an excellent share to buy into weakness or on fresh buy signals. The Coppock indicator is falling and is presently around minus 50. Increasingly though I view a combination of brilliant fundamentals with a negative Coppock as a buy signal for long-term investors.

Strategy

Warren Buffett tells us that investors should always have faith in the ingenuity and energy of the American people and something similar can be said of people everywhere, especially in a capitalist world where individual effort is rewarded. I share this faith and I am sure the next bull market is just a matter of time, perhaps early next year as I have been suggesting. Whatever happens it will come one day and no doubt astonish us with its power and longevity. It is not happening just yet though as markets continue to adapt to a fierce burst of inflation and a normalisation of interest rates from unsustainably low levels.