As we highlighted in last month’s issue of Great Stocks from January onwards Great Stocks will only be available online though it will be in a version that you can print at home if you have a home printer and that is what you prefer.

The shift will enable us to make Great Stocks more explicitly part of an investment ecosystem focused entirely on shares that we call 3G (great chart, great growth, great story) and since all subscribers will receive everything we publish online (Great Charts, Great Stocks, Quentinvest for Shares and Quentinvest for ETFs) it will become much easier to research and write the copy so that everything works together in a holistic way.

Subscribers will notice the benefits immediately on top of the fact that they will be receiving everything and we will be well placed, like any software business, to introduce constant improvements. I urge subscribers who want to build a portfolio of top quality growth shares for the 21st century to make the switch and get on board. It’s fantastic value and you will like it.

Note also that unlike most other services out there, let alone the financial press, Quentinvest is not about informing you about what is going on though that may happen as a by-product of what we do. Quentinvest is ALL about share recommendations. We study the stock market and tell you which shares we think you should buy; that is the whole of what we do and why we exist. Pure share tipping if you want to call it that but with the purpose of building a long-term portfolio.

Long-term is important because in the short term anything can happen and often does. There is no relation between company fundamentals and the short-term performance of the shares but in the long term the link is very close and stock selection becomes all important. Short term is just a roll of the dice.

It is an exciting time to be making share recommendations based on our 3G strategy because there are so many 3G shares out there ranging up to some of the largest businesses on the planet. The last QV for Shares Alert featured Alphabet and Microsoft, both of which are growing at a rate which belies their size. Shortly before that we alerted Netflix and Nvidia, two other very large businesses that are still delivering astonishing growth.

The tables of past recommendations that I refer to when selecting shares about which to write have become so big that they are like mini stock markets. They contain 100s of names but names with a difference because they are all companies that qualified as 3G when they were first selected to go into the table.

This means they form a short list of growth shares from which I select stocks that appear timely to write about in Great Stocks, Great Charts or as alerts to be emailed to subscribers as potential purchases. Many of these stocks, maybe even most of them are trading well, have outstanding leadership and are addressing very large market opportunities in an increasingly globalised world. We are also regularly adding new names to the lists.

My tables are short lists of the world’s most exciting stocks. if you think that there are maybe 100,000 quoted companies across the planet then my short lists are already special even before I make choices from within those lists.

And always remember we are in it for the long haul, thinking of ourselves as part owners of the shares we buy. Then look at the background, the strong performance of the indices like the Nasdaq 100 of which so many of these companies are constituents. Since 2009 the Nasdaq 100 is up over 15-fold and trading a whisker away from its all-time peak. Buying into the shares that are driving that performance surely has to be a great investment strategy.

How you make your investments is another story. There are platforms now which allow for zero commission trading in US stocks and fractional investing so you can buy part of high-priced shares like Alphabet/ Google. You can use CFDs to leverage your investments (risky but appealing to some). You can even use spread bets to keep your profits out of the hands of the tax man.

I increasingly make smaller pilot investments as CFDs (leveraged but taxable) and if I decide to go big on a stock I use spread bets, which I can roll on for ever and which are just a more complicated way of investing in shares – a one point bet is like buying 100 shares.

If you do use leverage you need a strategy for dealing with stock market corrections. You can either just use modest leverage and ride out the corrections or do what I do. When I get a margin call I sell shares showing losses and then reinvest, sometimes but by no means always in the same shares, when prices start climbing again. if the correction really starts to bite I may sell everything and start again – whoosh down the snake and resume climbing up the ladder.

I call this dynamic investing because I have to be very active but I do it with a long-term mindset. I am never trying to make trading profits, always trying to build a bigger and more valuable portfolio.

It works for me because I have a gambling temperament. Others will prefer a steadier approach, more akin to my never or almost never sell approach which has worked so well for Warren Buffett over the years. He makes great choices, holds for decades and piles up billions.

The key reason for the never sell strategy is not to avoid making mistakes. They are inevitable. Never sell is about allowing miracles to happen like Netflix which is still climbing, having risen over 1,000-fold since the early years of the millennium. Never sell is probably the only way you are going to hang on to a stock like that to reap those gains.

Accenture. ACN. Buy @ $358 – “…the use of new technologies across the enterprise is a once in a digital era profound transformation.”

Ambarella. AMBA Buy @ $185 – “We expect FY2022 to represent a major inflection in our business.”

Arista Networks. ANET. Buy @ $406 – “I believe Arista, which means to be great in Greek, will live up to its name.“

Datadog. DDOG. Buy @ $167 – “We are optimistic about our long-term opportunities and believe we will deliver high growth for the foreseeable future.”

Enphase Energy. ENPH. Buy @ $231 – “We expect the demand to be broad-based. We expect the demand to go up and up and up.“

Etsy. ETSY. Buy @ $250 – “We are incredibly excited about the massive opportunity ahead of us at Etsy.”

Lululemon Athletica. LULU. Buy @ $466 – “So we are early innings in our growth.”

Accenture. ACN. Buy @ $358. Times recommended: 9. First recommended: $219. Last recommended: $337

Accenture adds 118,000 employees as it responds to a world undergoing digital transformation

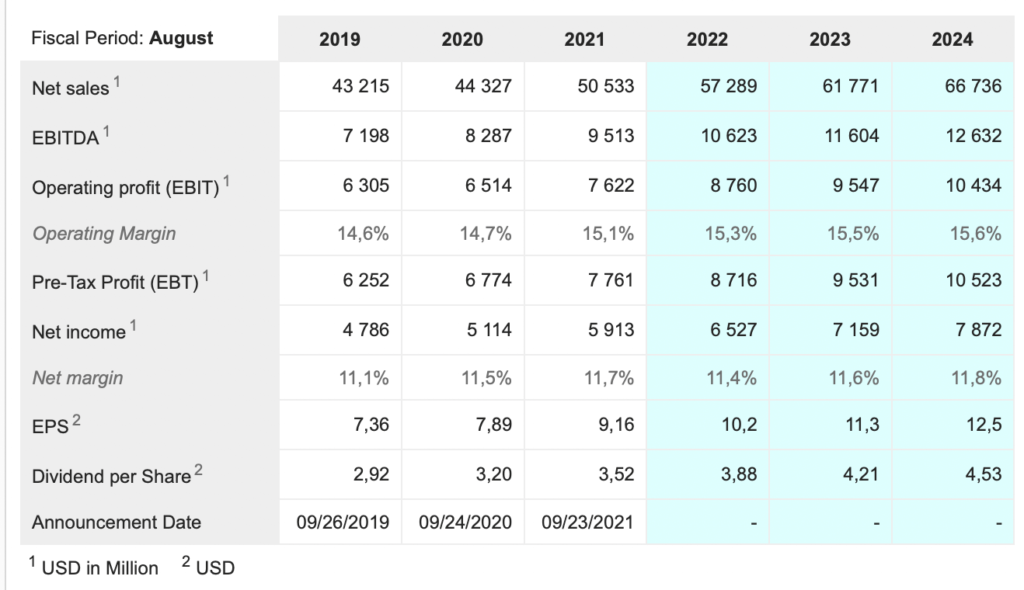

One of the things that seems to be happening on the US stock market is that very large companies still can offer very impressive growth but you pay less for it. Based on projected earnings per share of $12.5 for the year to 31 August 2024 IT consultancy, Accenture, would be on a price to earnings ratio around 28 which looks bargain basement compared to many other shares in the technology sector.

Nor can anyone complain at the performance. The shares are up roughly 30-fold since 2002 making them one of the stars of the new millennium.

Nor is there anything sleepy about the most recent results.

“FY’21 demonstrated our leadership in helping our clients achieve compressed transformation with 72 clients, with bookings greater than $100m compared to 53 last year and 229 Diamond clients, our largest client relationship compared to 216 last year. With the 20pc increase in bookings to $59bn, we have strong momentum across all dimensions of our business, across geographic markets, industries and services, reaching revenues of $50.5bn, a significant milestone, representing 11pc growth. We added $6.2bn in revenue this year, gaining significant market share with 40 basis points of operating margin expansion, demonstrating yet again our ability to grow profitably and at scale. We achieved this profitable growth while investing at a higher level than ever before with $4.2bn in acquisitions, $1.1bn in R&D and assets platforms and Industry solutions, including growing our portfolio of patents and pending patents to more than 8,200, and total training investment of $900m.”

Not mentioned above but perhaps most impressive of all. “We delivered beyond our financials, from the over 120,000 promotions and over 31m training hours, an increase of 40pc for our people, to increasing our workforce by approximately 118,000 people.” Accenture’s business is scaling at an incredible rate.“

Accenture helps its clients achieve digital transformation and acts as a central market place for learnings from all its 6,000 plus clients about the best ways of doing things. This is why clients don’t just go to Accenture for a one-off meeting with the experts but form relationships which carry on indefinitely and often become more extensive over time. Hence the frequent references to partnerships.

Nor is it just about IT. Another key issue for Accenture in its own operations and for its clients is sustainability, where they also need advice and exposure to the latest thinking.

Here is another quote to highlight what a terrific business Accenture is under the leadership of 54 year old Julie Sweet who has been CEO since September 2019.

“At the beginning of FY’21 after investing in cloud for a decade, we saw that the pandemic would dramatically accelerate our clients move to the cloud. More than technology, the move to the cloud would be about the adoption of a new operating system for the future enterprise, a dynamic continuum of capabilities from public to edge to everything in between, opening up radically new ways for companies to work, compete and drive value. Just over one year ago, we created Accenture Cloud First to capitalize on this momentum, bringing together all of our capabilities from migration to cloud native development, data AI, industry talent and change. Accenture Cloud First was the biggest driver of our overall cloud business growth from $12bn to $18bn, a 44pc increase.”

Nor are shareholders forgotten in all this excitement.

“With regards to our ongoing objective to return cash to shareholders. In the fourth quarter, we repurchased or redeemed 3m shares for $915m at an average price of $305.61 per share. Also in August, we paid our fourth quarterly cash dividend of $0.88 per share for a total of $558m. And our Board of Directors declared a quarterly cash dividend of $0.97 per share to be paid on November 15th, a 10pc increase over last year and approved $3bn of additional share repurchase authority.”

Accenture is a classic blue chip investment for the digital age.

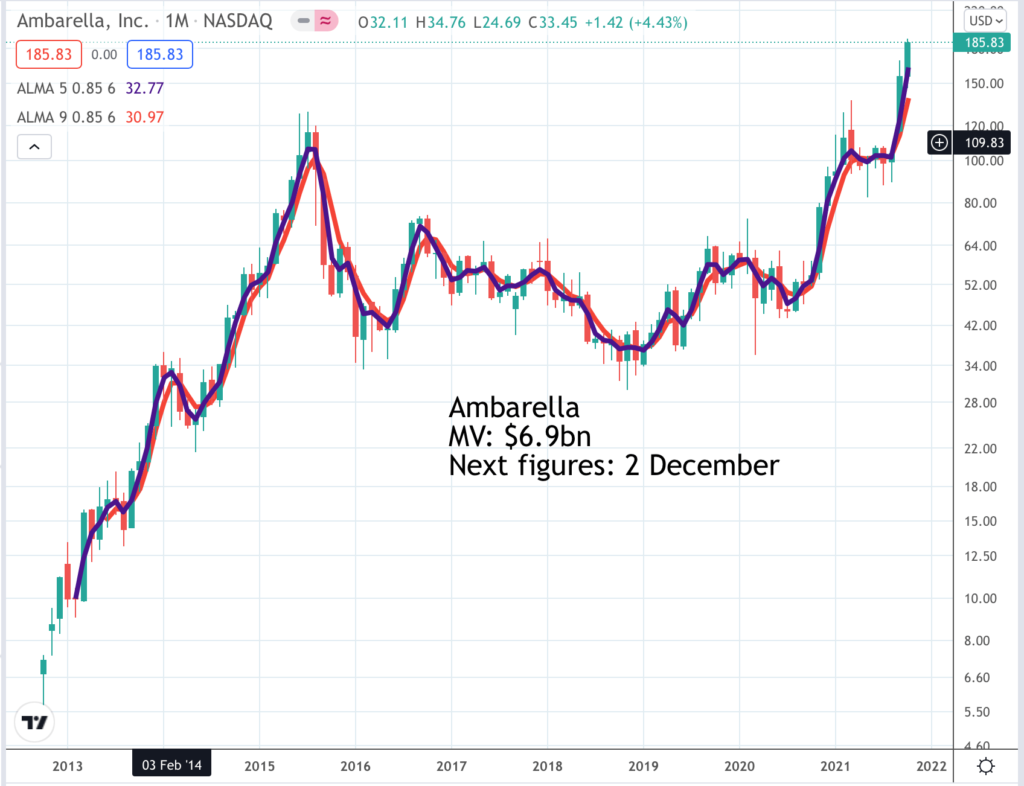

Ambarella AMBA. Buy @ $185. Times recommended: 7 First recommended: $105. Last recommended: $143

Ambarella keeps improving its CV (computer vision) chips as it targets a rapidly growing array of opportunities

AMBA is in the midst of a surge in growth. The latest report makes that clear. Sales contracted for two consecutive quarters before growth returned in Q4 FY2021. Growth accelerated in Q1 FY2022 and it did so once again in Q2 FY2022, easily surpassing expectations. Q2 revenue increased by 58.3pc to $79.3M and non-GAAP EPS increased by 483.3pc to $0.35.

In terms of end markets, security accounted for almost two-thirds of revenue, ahead of automotive with a share of more than 20pc. The former grew by more than 20pc sequentially and the latter by 10pc, partially offset by a decline of more than 20pc in other product revenue. Automotive revenue is still expected to more than double in size this year.

There is something very exciting going on at Ambarella, which first came to prominence supplying chips for businesses like GoPro with its all-action cameras. When the latter boiled over it took Ambarella down with it but the latter has since reinvented its business and is storming ahead again.

“We expect F2022 to represent a major inflection in our business, and we are excited about our future.”

Ambarella has changed dramatically from the old GoPro days. “A majority of our revenues are now driven by enterprise capex, public infrastructure spending, and consumer durable growth investment. For example, our automotive and IoT camera businesses, mostly security cameras, both decisively achieved record quarterly revenue levels, while our non-focused other revenue, mostly discretionary consumer leisure goods, represented 10pc of revenue.”

There is also great excitement about its computer vision chips. “CV momentum continues to rapidly build. Since introducing our CV SoC family to the market, we have had more than 240 unique customers purchase engineering parts, and or development systems, with almost 60 unique customers achieving production status in the first half of this year. Even at this early stage of our transformation, we are realizing a revenue mix that is of a higher quality and with more diversity.”

This is a big part of why the group is so upbeat about prospects.

“The global economic picture is strong. New stimulus programs are in the works, like infrastructure build in the U.S. Supply side cyclical dynamics are extended. But to be clear, the inflection you are seeing with Ambarella, what gets us most excited is how we are driving AI into numerous IoT [internet of things] endpoint verticals and how we are demonstrating we can capitalise on this tremendous growth opportunity to drive shareholder returns.

The demand for deep learning in AIoT [a blend of AI and IoT] endpoints is a new and a critical phase of the digital transformation that is just beginning to impact to so many verticals. Our confidence in our long-term prospects is high. We expect to achieve record revenue in fiscal year ’22, ahead of the $316m revenue in fiscal year 2016 and we remain comfortable that CV revenue will be at least 25pc of total revenue this year.”

If you look at the Ambarella chart you can see that the price took off in November 2020. This was the month when Ambarella launched computer vision (CV) chips for edge AI so a big something new. This is what they said about it.

“Chip designer Ambarella has announced a new computer vision chip for processing artificial intelligence at the edge of computer networks, like in smart cars and security cameras.

The new CV28M camera system on chip (SoC) is the latest in the company’s CVflow family. It combines advanced image processing, high-resolution video encoding, and computer vision processing in a single, low-power chip.

Ambarella packed a lot of AI processing power into the chip to anticipate the way computer networks will evolve as everything gets connected to the internet. Since networks could become inundated with data traffic, self-driving cars, for example, will have to do their processing at the edge of the network, or in the car itself, rather than interacting heavily with datacenter processors.

This means the sensors and image processors in edge devices will have to be very powerful, Ambarella VP Chris Day said in an interview with VentureBeat. “We’re working on new markets, including IP security cameras, consumer home monitoring cameras, drones, automobiles, and autonomous vehicles.

The Santa Clara, California-based company started out making low power chips for video cameras but it parlayed that capability into computer vision expertise and in 2018 launched its CVflow architecture to create low-power artificial intelligence chips.”

I think Ambarella is on to something really exciting with these CV chips and they could become massive given the advantages and the number of applications.

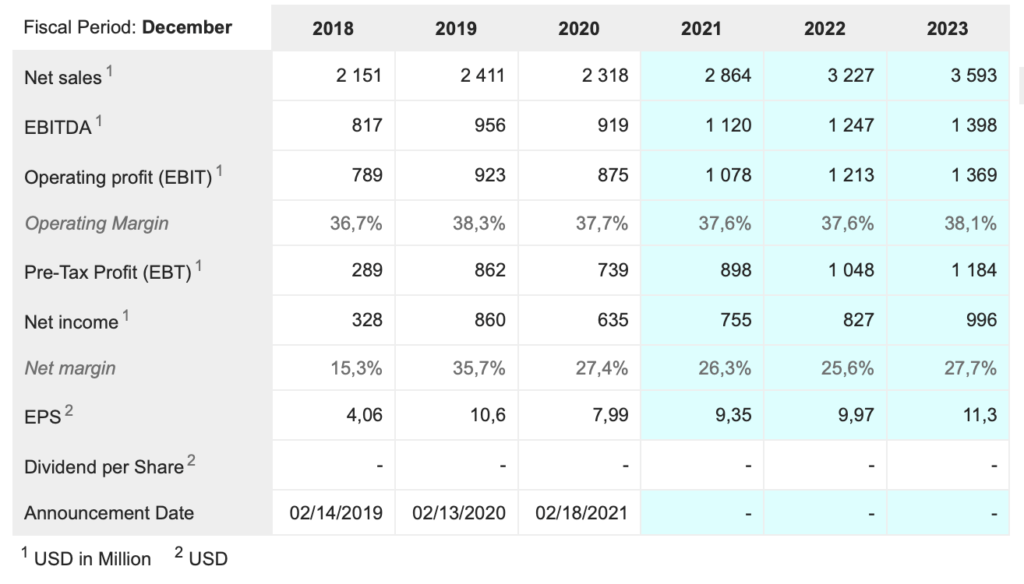

Arista Networks. ANET Buy @ $409 Times recommended: 8 First recommended: $188.90. Last recommended: $379

Arista Networks keeps winning market share in the high speed ethernet switching market

The key to the success of Arista Networks and its move from nowhere to taking on networking giant, Cisco Systems, is the arrival of Jayshree Ullal, who left Cisco in 2008 to become CEO of the then tiny Arista in 2008. Ullal began working at Cisco in 1993 and rose rapidly through the ranks to become head of switching, a cash cow that brought in a third of the company’s revenue by helping businesses link their computers, printers and servers to the same network. She then left to join Arista which she took public in 2014.

When she took Arista public it was valued at $2.75bn versus over $31bn currently. It competes with Cisco for share of the ethernet market with Arista’s share rising from zero to 5.6pc in the five years to 2018 while Cisco’s shares fell from 62.5pc to 53pc.

The company is dependent on network spending by industry titans like Microsoft, which slowed in the last years of the last decade and into 2020. As that picks up, which is happening strongly, the company sees strong growth resume.

“Total revenues in Q2 were $707.3m up 30.8pc year over year and well above the upper end of our guidance of $675 to $695m. Shipments remain constrained in the period as we continue to carefully navigate industrywide supply chain shortages and COVID-related disruptions. Services and subscription software contributed approximately 22.3pc of revenue in the second quarter, up from 21.4pc in Q1. International revenues for the quarter came in at $193.2m, or 27pc of revenue, up from 25pc in the first quarter.”

An intriguing feature of Arista Networks, similar to Ambarella, is that the chart looks very strong with a breakout from four years of sideways trading. These breakouts don’t come with guarantees but it is not uncommon for the shares to rise multiple times after such breakouts,

Growth is expected to slow in the second half of the year as comparisons become harder.

“We reported strong year-over-year revenue growth of approximately 29pc for the first half of 2021, reflecting healthy demand across all our market sectors combined with favorable comparisons from the first half of 2020. While we expect continued strength in demand as we move through the second half, we will likely see some deceleration in year-over-year revenue growth, given the top-line recovery experienced in the back half of 2020.”

I quickly get out of my depth when I am studying cutting edge technology businesses like Arista. On their web site there is a white paper detailing the Arista Advantage. It makes impressive reading and also makes clear that this is a company playing a critical role in the unfolding technology revolution. I just get the feeling this is a very exciting, well led company which has done very well over the last decade or so but may be poised for an even more exciting future.

We live in a world where demand seems to be overwhelming supply with shortages everywhere. If we are to emerge successfully it is technology and companies like Arista that will make this happen. Their work has never been more important. We need capacity, incredible amounts of capacity and that is what they do, which is why they are winning market share so fast. As at January 2021 its share of the high speed Internet switching market (data centres) had grown to 16.3pc.while Cisco has dropped from 78.1pc in 2012 to 43.7pc in the first half of 2020.

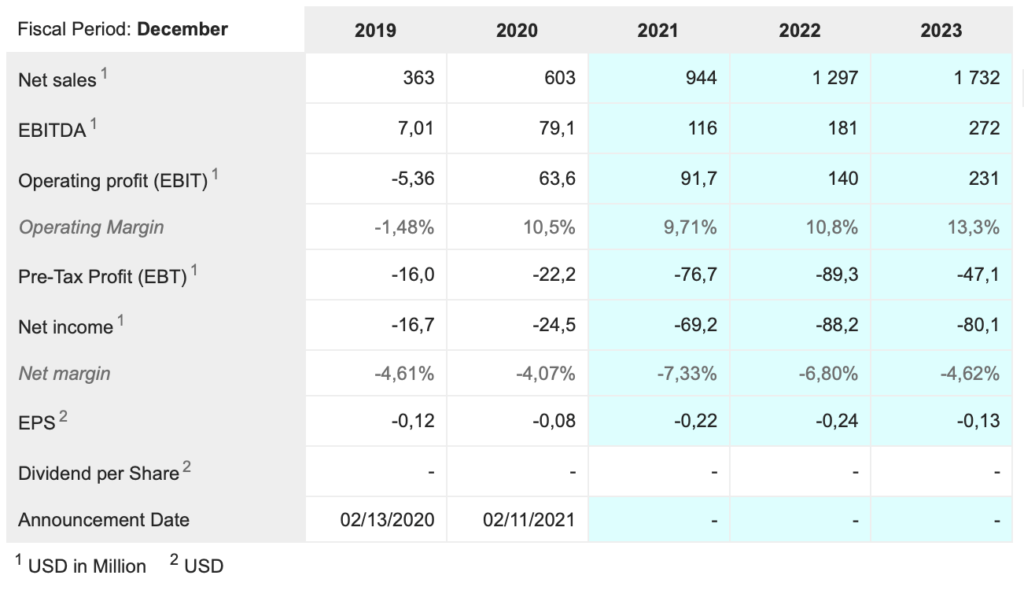

Datadog. DDOG. Buy @ $167. Times recommended: 12 First recommended: $55.50 Last recommended: $138

Datadog sees high growth continuing for the foreseeable future

There is a chart in the Datadog prospectus, the shares were floated in September 2019, which shows the growth in annualised quarterly revenue since Q1 2016. The figure is calculated by multiplying the quarterly number by four and the growth is relentless from around $35m for Q1 2016 (guessing from the chart) to $333m (actual figure) for Q2 2019. The latest figure for Q2 2021 is $936m. This company is an absolute growth machine which helps explain the high valuation – over 50 times sales is special even by the standards of 2021 growth share valuations.

The company makes losses but that is a reflection of the opportunity they see. There is a wonderful simplicity about the profit and loss statements of many fast-growing enterprise software businesses. We start with sales less variable costs which gives us a gross profit of $176.5m for Q2 2019, up from $111m for the same period a year earlier.

We then subtract general and administrative costs of $21.5m to leave something not dissimilar to operating profits of $155m. So why is this business not hugely profitable. The answer is because it is investing massively in growth. In just the one quarter it spent $95m on research and development and $70m on sales and marketing.

This is why it is growing so fast. All that r&d spend creates new must have modules (functionalities) for its existing customers who spend more. You can see from the quote below what happens when you spend this heavily on r&d.

“As of the end of Q2, 75pc of customers are using two or more products, up from 68pc a year ago. Additionally, 28pc of customers are now using four or more products, which is up from 15pc last year. And this quarter, approximately 70pc of new logos landed with two or more products. Our platform saw strong growth in the second quarter, which included another record of ARR [annual recurring revenue] added for infrastructure monitoring in a single quarter.

This product is still early in its fast cycle. Meanwhile, we continued to see very strong performance with other products in our platform. Our APM suite [application performance monitoring] , including RUM [real use monitoring] and Synthetics and log management, together, reached over $400m in ARR. The APM suite and log management also remained in hyper-growth mode, but our newer other products are growing even faster.”

There is much more to say about new product development but readers must take it on trust that the group has a great new product pipeline.

Sales and marketing spend meanwhile is directed to acquire new logos (new customers) and as they come in they start the whole process of buying new modules and spending more.

This is all summed up in the quote below.

“New logo generation was also strong, and customers continued to adopt more products across the platform. To provide some more context. First, growth of existing customers was again robust in Q2, and our dollar-based net retention rate remained above 130pc for the 16th consecutive quarter. Usage growth was strong, driven by customers’ expanded usage of existing products and the adoption of new products.”

The reason why companies like Datadog are so highly valued is because (a) as software businesses they are fundamentally highly profitable with huge gross margins (75.5pc in the latest quarter), (b) they have a high growth formula which can be repeated almost ad infinitum subject to their ability to recruit top talent for staff and (c) they have a large addressable market (TAM).

Many of the companies go to great lengths to quantify this but I think that is unnecessary. Datadog was born out of a desire to improve communications between development and operations teams and as it has been successful at doing this has added more and more relevant products. It is obvious that the market is both huge and growing all the time, easily big enough to enable Datadog to become a much larger business than it is now.

They have first mover advantage, winner takes all potential, they are operating in one of the sexiest areas of technology and they have great leadership under CEO and co-founder, Olivier Pomel. Both the founders are of French descent, they now have an office in Paris and the business was born in the cloud.

It is one of those companies that is obviously going to be a huge success and people are going to look back a decade from now and kick themselves for not buying the shares.

Enphase Energy. ENPH. Buy @ $231. Times recommended: 3 First recommended: $180.5 Last recommended: $195.5

Enphase plays key role in helping households set up energy management systems

There is huge pressure to save the planet. We all know that not least because of Cop26 which is being held in the UK and which one of my daughters is playing a part to organise. I struggle to persuade my eco-warrior wife to let me turn the lights on even though they are all LEDs. ESG (environmental, social, governmental) is becoming as ubiquitous as cloud computing in our lives and some of the companies making it happen are proving to be electrifying investments.

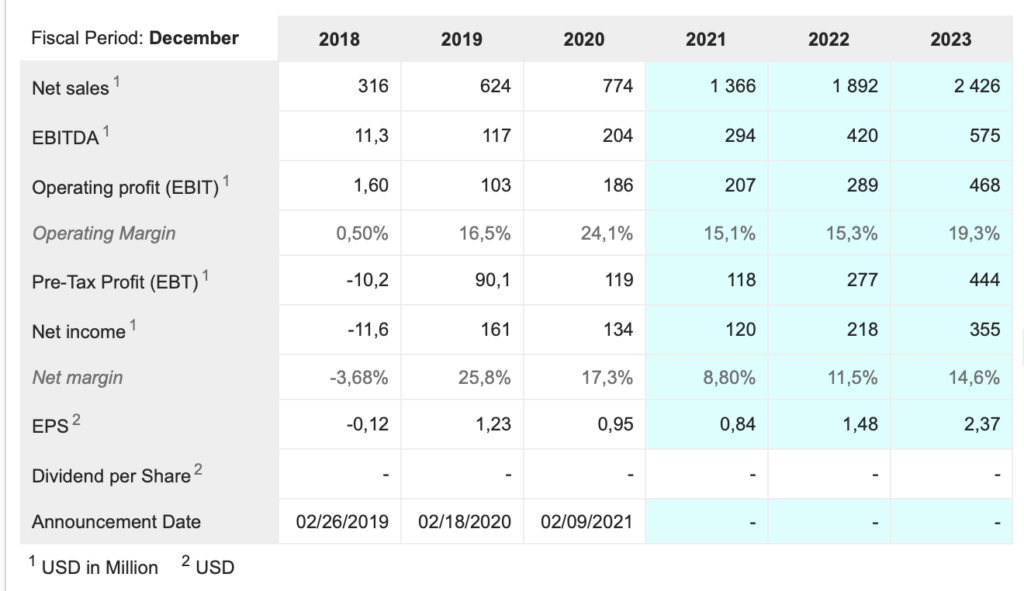

One of the most exciting is Enphase Energy. The table below points to the growth path the business is on with sales projected to rise from $316m for 2018 to $2.43bn for 2023. It seems that for Enphase Covid has set the scene for already strong demand to strengthen further.

“As people worldwide were under strict stay-at-home orders, they began to pay closer attention to their homes and ways to save costs, including the migration to renewable clean energy.”

Enphase Energy pioneered the concept of a microinverter. Enphase has shipped about thirty million solar micro inverters, primarily into the residential and commercial markets in North America, Europe and Australia. Microinverters convert the direct current power from the solar panel (DC) directly into grid-compatible alternating current (AC) for use or export. Enphase was the first company to successfully commercialise the microinverter on a wide scale, and remains the market leader in their production.

The company has also moved into energy storage systems. In Q3 2021 the company shipped around 2.6m microinverters and 65 megawatt house of Enphase Energy storage systems.

Demand is strong. The issue for Enphase is supply.

“So given our strong demand, we are adding a fully automated line in Mexico in Q4, bringing our quarterly capacity in Mexico to approximately 2.2m microinverters. We have already added a second fully automated line in Q2 at our contract manufacturing partner in India, bringing that quarterly capacity to over 1.5m microinverters in India.

Along with our existing capacity in China, we expect to easily achieve our target global capacity of 5m microinverters per quarter by the end of the year. We have now geographically diversified two-thirds of our contract manufacturing capacity outside of China. Let’s now talk about batteries. Our two sources for battery cell packs have increased their capacity to a total of approximately 180 megawatt hours per quarter from 120.”

There are still problems but they are not stopping the group from growing strongly.

“Our existing suppliers are capable of adding more capacity as required. In the meantime, we are working on adding additional suppliers in 2022 to achieve global diversification. Our lead times for storage systems are long today at approximately 14 weeks due to the global logistics challenges. These lead times will come down once the shipping constraints and port congestion improve. Despite these headwinds, we expect to increase shipments of our Enphase storage systems by approximately 45pc sequentially in Q4.”

Like other technology companies Enphase is all about innovation.

“New features, plus our laser focus on customer experience, we continue to see an acceleration in demand for our Enphase storage systems. As a result, we expect to ship between 90 and 100 megawatt hours of Enphase storage systems in Q4.

Yesterday, we announced the all-new all-in-one Enphase Energy System with IQ8 solar microinverters for customers in North America. IQ8 is Enphase’s smartest microinverter yet. Now with IQ8, homeowners can realize the true promise of solar to make and use their own power. IQ8 solar microinverters can provide sunlight backup during an outage even without a battery.”

I see Enphase as a bit like Apple for solar energy. Is is giving householders ever more sophisticated systems for managing their solar power and energy requirements and because it is so innovative we can expect it to move into new markets in the future. There is every possibility that Enphase will be able to use its leading position in microinverters to become a very large business indeed,

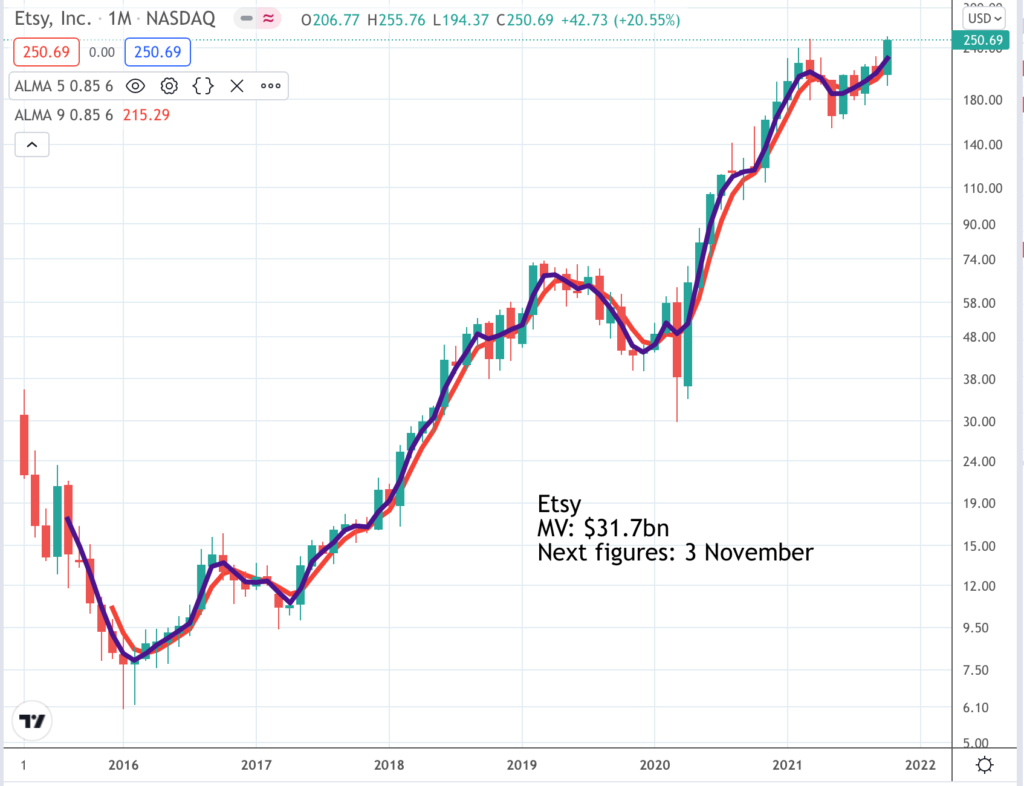

Etsy. ETSY. Buy @ $250. Times recommended: 15 First recommended: $30 Last recommended: $218.50

Etsy moves strongly into booming second hand markets to supplement its craft markets expertise

My son is a carpenter who makes furniture. I mentioned to him that he should consider using Etsy to sell his stuff. He hasn’t done that yet but he did buy the shares and they are doing very well for him. My children look at my stuff but take their own decisions on which shares they buy just like all my subscribers.

I am having a fresh look at Etsy and I am very impressed with what is happening, in particular the success of their international expansion and the fact that Etsy is now four brands, Reverb, music e-commerce, Depop, fashion e-commerce, elo7, handmade ,craft (effectively Etsy for South America) and the original Etsy.

Depop is all about second hand fashion which is being adopted especially enthusiastically by Gen Z and millennials. Fashion generally is a huge market and second hand fashion and the second hand market in the USA is projected to double to $77bn over the next five years. Depop operates in the US, Australia and UK.

Elo7 provides a local brand in the fast-growing South American market. Currently it operates in Brazil targeting Gen Z and millennial women. Brazil’s ecommerce market is forecast to reach $50bn by 2025. Currently Elo7 has 1.9m active buyers, 24m monthly visitors and 62pc of GMS [gross merchandise sales] comes from repeat buyers. All LatAm is expect to reach $160bn by 2025 so this is potentially a huge opportunity.

Reverb also looks like a big opportunity given how well Gear4Music has done in the UK.

Last but not least is the estimated $1.7 trillion TAM (total addressable market) for Etsy not including their latest market in India. Also impressive is the effort Etsy is making to help its sellers improve the buyer experience which in turn will lead to better results for them. They mention a 700pc increase in engagement on Etsy’s social channels as evidence of what is happening. They also mention the Q2 launch of XWalk…dramatic expansion of our search capabilities to more effectively help buyers find what they are looking for. Yet again we are seeing how AI can be a game changer for businesses.

Etsy had an incredible lockdown partly because of an explosion in demand for masks but it now seems that this was not a one-off boom but more like lift-off for the business, which is still doing well, especially excluding masks even as bricks and mortar buying opportunities open up.

“Many brick-and-mortar stores have reopened and there are a wide range of e-tailers ready to ship almost anything to your doorstep without delay. And even in the face of this renewed abundance of choice, again and again, shoppers chose to return to Etsy. In fact about 90m of them. And most importantly, they chose to shop with us more frequently.

Given the massive pull forward in new buyer acquisition last year, it’s no surprise that new buyer growth has decelerated materially in recent months. However, that deceleration has been offset by growth in GMS per active buyer, which as you know, is a big focus area for us. We’re encouraged to see that shoppers loved the experience they’ve had with Etsy over the past year, and are coming back for more, even in a world of greatly expanded choice.”

CEO, Josh Silverman, under who’s watch the performance of Etsy has been transformed, says:- “We’re extremely pleased with the strength and stability we’re seeing in our cohort performance, and our conviction to invest in what we believe is Etsy’s tremendous long-term opportunity.”

Videos are starting to have a huge impact. “We’ve mentioned listing videos on our last few calls, and we’re now starting to get real traction as they’re incorporated throughout more and more of the Etsy experience on-site and off-site. In fact, there are now nearly 8m videos uploaded on Etsy. Listing videos are driving engagement on social and we’re seeing measurable wins from adding videos to the homepage.”

I didn’t realise until now just what an exciting business Etsy is becoming.

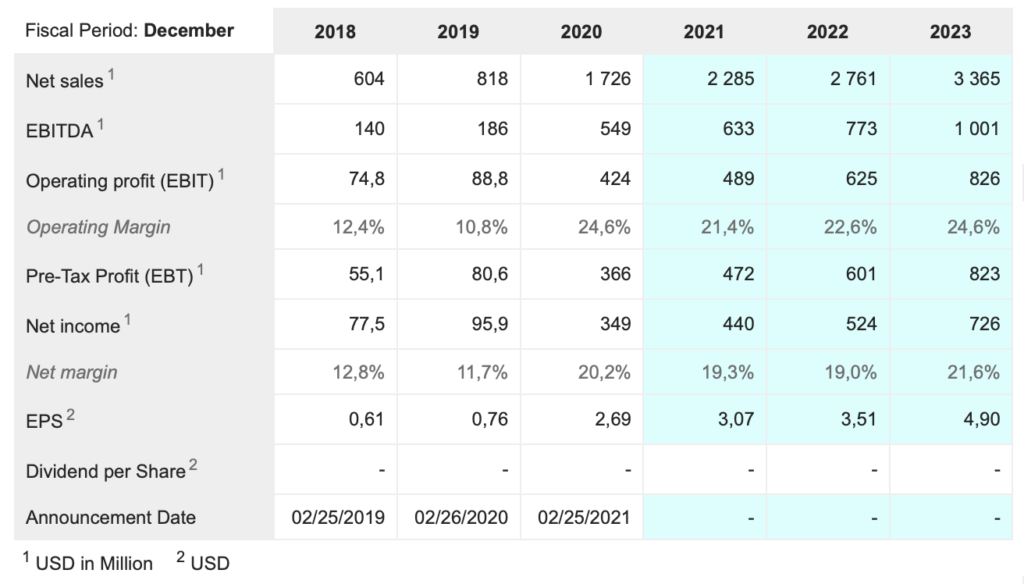

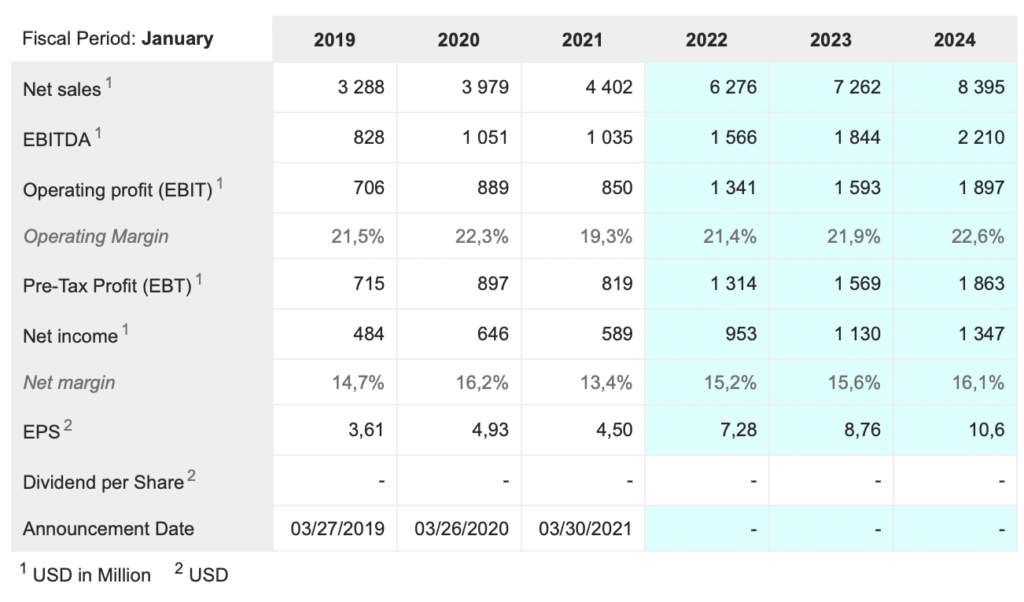

Lululemon Athletica. LULU. Buy @ $466. Times recommended: 8 First recommended: $106 Last recommended: $407

Look in the Mirror to find a new, even more exciting Lululemon Athletica

Lululemon Athletica is a Canadian company which pioneered the retail category of yoga kit and has been riding the global boom in yoga. My wife and I and all my children do yoga. We love it and find it a great addition to our wellbeing. We are not alone as can be seen from the phenomenal success of Lululemon which is forecast to have sales of $6.3bn in the year to 31 January 2022, a 43.2pc increase on fiscal 2021 and up even more on the pre-Covid fiscal 2020.

Business currently is on fire as evidenced by the latest quarterly results.

“For Q2, total net revenue increased 61pc to $1.5bn, above our expectations of $1.3bn to $1.33bn. This included a 63pc increase in North America and a 49pc increase in our international business.

On a two-year CAGR [compound annual growth rate] basis, total revenue increased 28pc with North America up 26pc and International increasing 43pc. In our digital channel, revenues increased 66pc on a two-year CAGR basis, above our expectations of approximately 55pc growth. E-com contributed $597m of top-line or 41pc of total revenue. In our store channel, sales increased 9pc on a two-year CAGR basis, above our expectations of approximately flat.

Productivity in stores returned to 2019 levels, representing continued improvement versus 88pc productivity we realized in Q1 of this year. At the end of the second quarter, we had 95pc of our stores open. Square footage increased 8pc versus last year, driven by the addition of 28 net new stores since Q2 of 2020. During the quarter, we opened 11 net new stores.”

The group is super positive on prospects.

“Our vertically integrated model and high margin structure allows us to use more airfreight while still delivering gross margin expansion. Our focus on technical athletic apparel allows us to benefit from trends in consumer behavior that are becoming more important year after year, and our inventory, which leverages many key core styles with less seasonality, helps us navigate and mitigate disruptions within the supply chain.

Looking at our business over the course of the second quarter and the first half of the year, I continue to be excited about our day-to-day progress. Our ability to sustain momentum quarter after quarter and year after year, and the incredible long-term prospects for our brand.”

Their recent acquisition, home fitness business, Mirror, looks amazing too. Only available in North America at the moment you buy an internet-connected mirror which goes on your wall and you exercise with the mirror and and an instructor in the background. It seems amazing and I can imagine it becoming a large part of Lululemon’s business and highly complimentary to the whole Lululemon experience.

International growth is another massive opportunity.

“So overall, what’s very exciting is the balance of growth across all international markets, meaning they are all contributing significant growth and into our goal of quadrupling our international business by ’23.

China, in particular, is a market where we have leaned in on investment. We’ve opened a head office in Shanghai, we’re leaning in on hiring and supporting local teams within that market, and in our store expansion, as well as our digital innovation and support. So China is definitely one of our key markets. We are seeing good growth, we are investing in the country, supporting the teams, and overall, the international business, like our business in North America and some of our category opportunities, very early, and growth across all channels in the markets and product categories.“

Overall prospects look strong.

“So we are early innings of our growth. That’s why we see such balanced growth across markets, channels, and product categories. And the impact that COVID has had on TAM plays to the strengths and plays to our growth story and the opportunity that we see ahead for our brand.”

Other stocks to buy now

A new subscriber wants to know which 200 shares to buy now to create an instant portfolio. One answer is to look through back copies of QV Alerts. The List (200 core shares for your portfolio) was published on 23 July 2021 and won’t have changed dramatically between now and then.

An alternative approach is to build your portfolio more slowly. This could be either just by buying shares signalled for buying in Great Stocks, Great Charts and regular Alerts or at any pace you choose. My only proviso is that you should make sure that they are 3G (great chart, great growth, great story).

When doing the research for my publications I update my tables and get a feeling for the stocks that have strong positive momentum. 3G investing is a form of momentum investing so buying shares with strong momentum is a good idea. You need momentum to climb high. Below is the not so short list of stocks from the QV table that I identified as having strong momentum right now. I consider them all worth buying.

Advanced Micro Devices. AMD. Buy @ $119.50Advanced Micro Devices. AMD. Buy @ $127

Affirm Holdings. AFRM Buy @ $162.50

Alphabet. GOOGL. Buy @ $2,960

Asana. ASAN. Buy @ $135.80

Ashtead. AHT. Buy @ 6116p

Atlassian TEAM Buy @ $458

Automatic Data Processing. ADP. Buy @ $224

Bio-Techne. TECH. Buy @ $523

Cloudflare. NET Buy @ $194.50

Crocs. CROX. Buy @ $161.50

Croda International CRDA. Buy @ 9406p

CyberArk Software. CYBR. Buy @ $180

Digital Turbine APPS. Buy @ $86

Epam Systems. EPAM. Buy @ $673

Ether ETHUSD. Buy @ $4,320

FactSet Research Systems. FDS. Buy @ $443

Ferrari. RACE. Buy @ $237

Fortinet. FTNT. Buy @ $336

Globant. GLOB Buy @ $319

Hermes. RMS. Buy @ €1385

Home Depot HD. Buy @ $371.50

Horizon Therapeutics HZNP. Buy @ $119.50

Impax Environmental Markets IEM. Buy @ 534p

Inmode. INMD. Buy @ $94.50

Inspire Medical Systems INSP. Buy @ $269

Intuit INTU. Buy @ $626

Intuitive Surgical Systems. ISRG. Buy @ $361

iShares World Momentum IWMO. Buy @ $69

Masimo Corporation MASI. Buy @ $283

Microsoft. MSFT. Buy @ $331.50

MongoDB. MDB. Buy @ $521

Morningstar. MORN. Buy @ $316.5

MSCI. MSCI. Buy @ $664

Nasdaq Inc. NDAQ. Buy @ $209.50

Netflix. NFLX. Buy @ $690

Next Fifteen Communications. NFC. Buy @ 1235p

Novanta. NOVT. Buy @ $172.50

Nvidia Corporation NVDA. Buy @ $255.5

Palo Alto Networks. PANW. Buy @ $509

Paycom Software. PAYC. Buy @ $547

Paylocity. PCTY. Buy @ $305

Pepsico. PEP. Buy @ $161.50

Pool Corporation. POOL Buy @ $515

Prologis. PLD. Buy @ $144.5

Invesco QQQ Trust QQQ. Buy @ $386

Rapid7. RPD. Buy @ $128.5

S&P Global. SPGI. Buy @ $474

Salesforce.com CRM. Buy @ $299.50

ServiceNow. NOW. Buy @ $697

Silvergate Capital. SI. Buy @ $156.5

Snowflake. SNOW. Buy @ $353.50

SPDR 500 Trust. SPY. Buy @ $459

SolarEdge Technologies. SEDG. Buy @ $354.5

Spotify Technology. SPOT. Buy @ $289

Tesla. TSLA. Buy @ $1114

Tractor Supply. TSCO. Buy @ $217

Tyler Technologies. TYL. Buy @ $543

UnitedHealth Group. UNH. Buy @ $460

Waste Connections. WCN. Buy @ $136

Watches of Switzerland Group. WOSG. Buy @ 1138p

Wisdomtree Nasdaq 100 3x daily leveraged QQQ3. Buy @ $227

Workday. WDAY. Buy @ $290

Workiva. WK. Buy @ $149.5

Xilinx XLNX. Buy @ $178.50

Zoetis. ZTS. Buy @ $216

Zscaler. ZS. Buy @ $318.50