Elon Musk or somebody coined the phrase gigafactory, initially to describe the giant battery factories being built by Tesla but now to describe all their factories. They are all part of the relentless quest by Tesla to drive down costs and make their cars more affordable while improving the package and lowering prices.

As you can imagine this makes them a terrifying competitor, especially as world domination of the electric vehicles market may only be the first act for this emerging behemoth. And they are not alone. There are other companies out there, mostly American, pursuing a path which will lead already very large businesses to become gigantic, corporations fit for the 21st century and of a scale never seen before.

One of our objectives as investors should be to identify these potential behemoths and buy their shares, not at the beginning of their journey, that has already been and gone, but while there are still plenty of gains to come.

Table of Contents

An obvious candidate is Tesla, which is already big, is growing fast, has huge plans and a chart, which not only matches those ambitions but has just given an important buy signal. It is my new favourite Coppock + 3m (golden cross on the moving averages on a three monthly candle stick chart) buy signal.

Tesla and Other Gigas Moving Fast

One of the amazing things about Tesla and the other giga corporations is how fast they are moving. The first Tesla Model S was only launched in 2012, when, as you can see from the chart, the whole Tesla thing was just a twinkle in Elon Musk’s eye. Now we have the Model S, the Model X and the two big sellers, the Model 3 and the Model Y and the fast charging network has become so large that America’s two largest car makers, General Motors and Ford, are adapting their EVs so they can use the Tesla network.

Tesla builds its gigafactories close to its markets to reduce shipping costs and draw on an ever wider pool of workers and suppliers. Its new factories are expected to make a million cars a year so to reach its stated objective of annual production of 20m cars it will need 20 factories.

It is hard to see how anyone can compete with the production efficiencies being achieved by Tesla and like Apple with its hardware they are going to build a large services business, based on their huge diaspora of hardware.

Nor are they going to stop there. Musk is a master of hype but that doesn’t mean that his bombastic remarks never come true. He is optimistic about timescales but not about achievements. When he says he is going to make robots he is going to make robots and they are going to be a huge needle moving ‘something new’ for the Tesla valuation.

And how this is all going to mesh together with autonomous driving, services and who knows what else, the mind boggles. It certainly makes me think that Tesla has every prospect of becoming a true 21st Century giga corporation, which means that high as the shares have risen they could yet rise much further.

Nvidia to Dominate Accelerated Computing and AI

Another giga corporation in the making is Nvidia, with its plans to dominate accelerated computing and generative AI.

The chart could not be stronger.

Like Tesla, Nvidia is mostly a child of the 21st century although the GPU which lies at the heart of its success was invented in the 1990s.

Two decades ago, GPUs were used primarily to accelerate real-time 3D graphics applications, such as games. However, as the 21st century began, computer scientists realized that GPUs had the potential to solve some of the world’s most difficult computing problems.

This realization gave rise to the general purpose GPU era. Now, graphics technology is applied more extensively to an increasingly wide set of problems. Today’s GPUs are more programmable than ever before, affording them the flexibility to accelerate a broad range of applications that go well beyond traditional graphics rendering.

Intel fact sheet

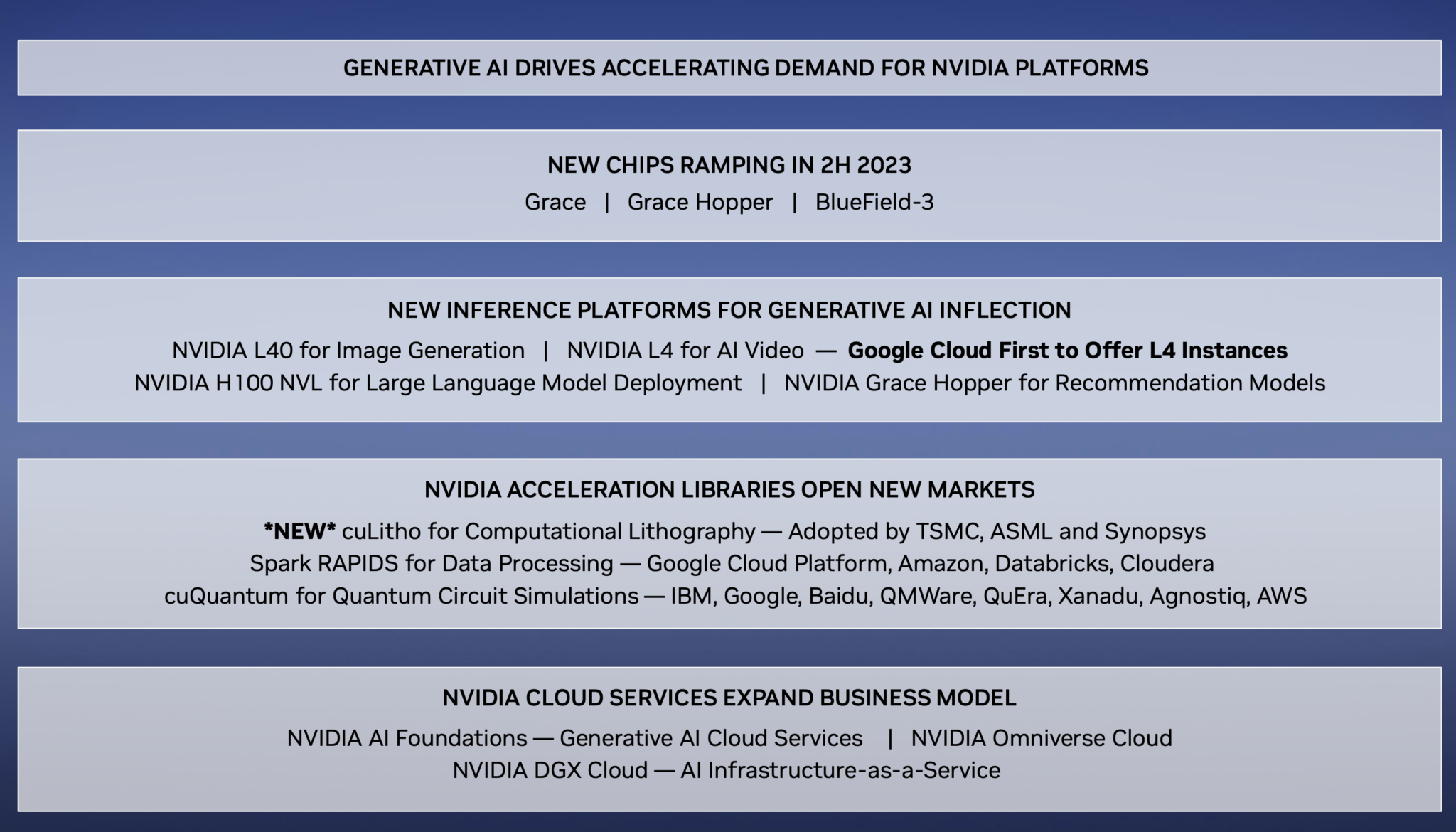

The slide below highlights what is happening at Nvidia and their importance to the development of accelerated computing and AI, which are expected to be huge markets. Not only that but the move to this brave new world is expected to proceed rapidly which explains the recent incredible leap in Q2 revenue guidance.

Q1 2024, 6 June 2023Let me turn to the outlook for the second quarter of fiscal ’24. Total revenue is expected to be $11bn, plus or minus 2pc. We expect this sequential growth to largely be driven by data centre reflecting a steep increase in demand related to generative AI and large language models. This demand has extended our data centre visibility out a few quarters, and we have procured substantially higher supply for the second half of the year.

That $11bn number compares with the prior expectations of $7.1bn; hence my description of this spectacular leap in guidance as like a ‘black swan’ event.

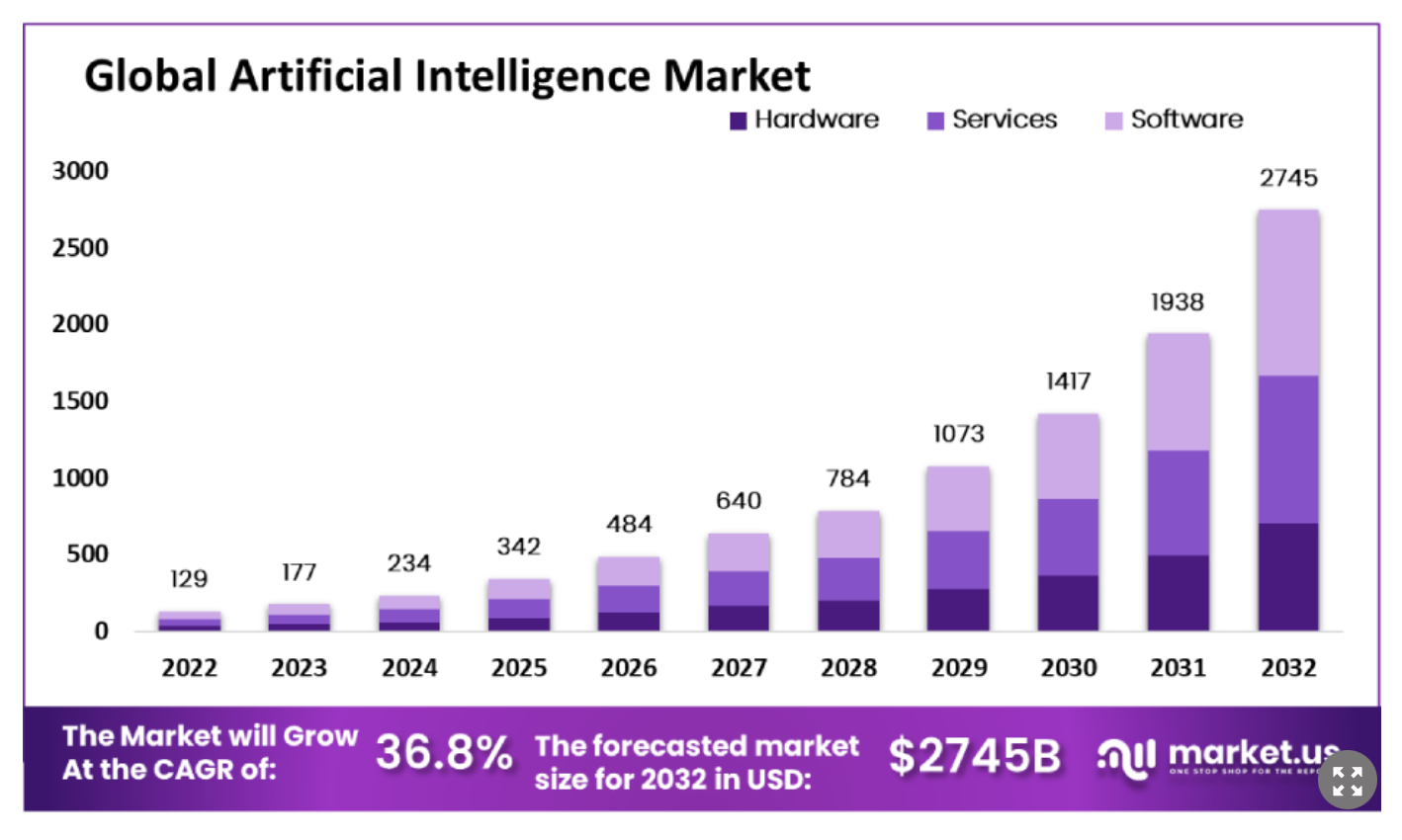

I found a chart for the expected growth in the AI market over the next decade.

I think at the moment Nvidia and Tesla are my two favourite candidates to become gigacorporations by which I think I mean businesses valued at over $10 trillion so nearly four times the size of Microsoft today. I know it is hard to imagine how a business could ever reach such an astonishing valuation but in a way we have been here before in the early years of the 20th century when a handful of gigantic corporations like Standard Oil (Rockefeller) and US Steel (Carnegie) were even more dominant.

There will also be a huge hinterland of suppliers, peripheral businesses and much else orbiting round these giants.

Other obvious choices to be part of this group of giants are Apple, Microsoft, Alphabet, Amazon, Meta Platforms and Netflix often gets a mention although it is smaller but ambitious and superbly managed.

Use QQQ3 (or QQQ) to invest in the gigacorp story

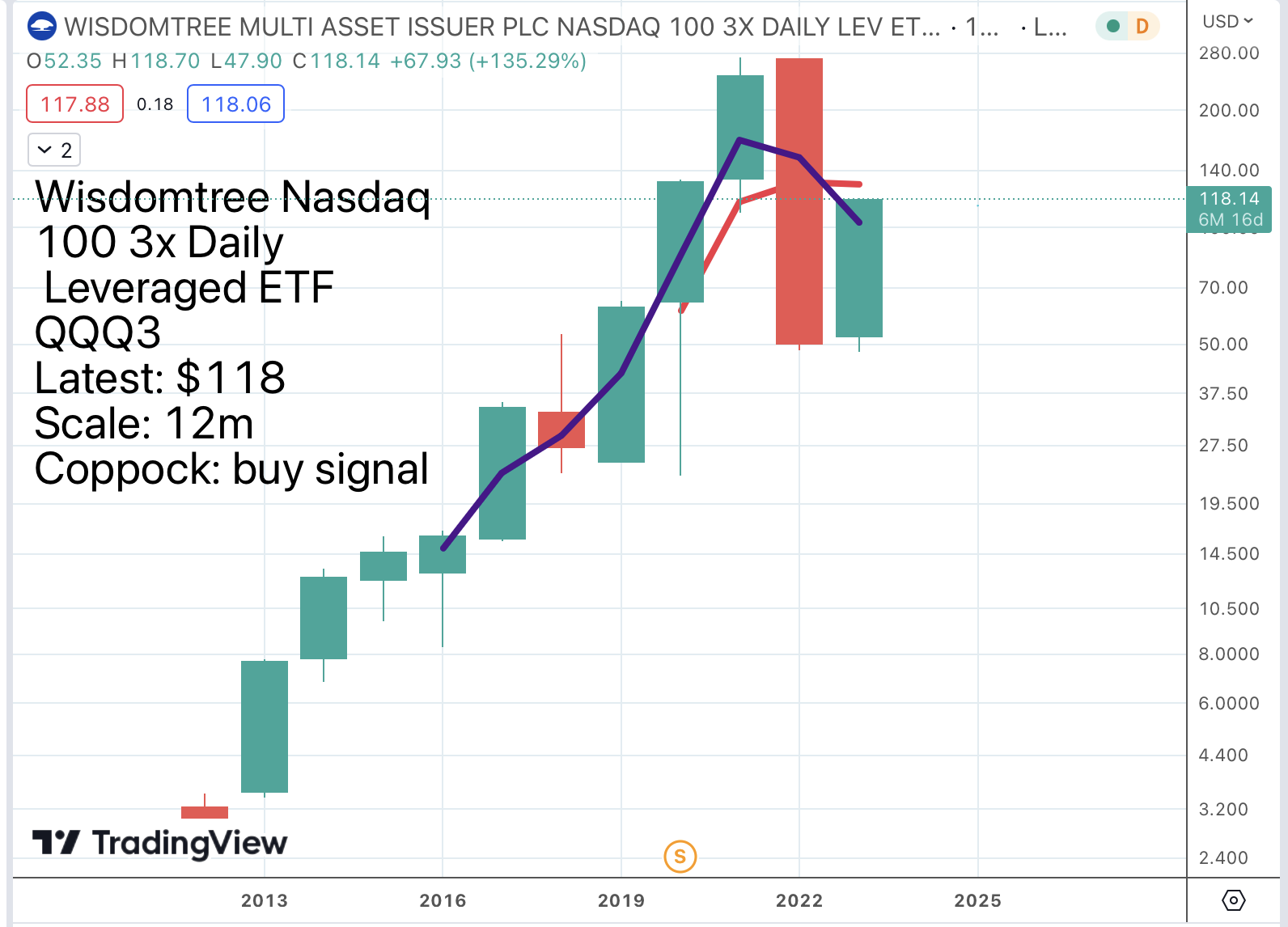

This leads us straight to my old friend, QQQ3, the leveraged ETF, quoted in London, which tracks the Nasdaq 100 but with three times leverage and daily rebalancing (as explained in a recent alert). If you only buy one stock I think QQQ3 has to be an excellent choice for an aggressive investor who is not too phased by volatility.

So far this year QQQ3 is up from a low of $47.70 to $118, which still leaves it well below the 2021 peak of around $280. Since 2012 it is up from $3. Around half its portfolio is in the shares mentioned above so if my gigacorporation theory proves correct QQQ3 will do very well.

A less aggressive option is QQQ, quarterly rebalancing and no leverage unless you want to buy the shares in a CFD or spread betting account. The advantage of QQQ3 in a share account is that you have no margin so no pressure to sell, you can add more on buy signals or every month or just stick with your original holding.

I think human beings find it hard to imagine a future that is too different from their present so it is hard to imagine some future date when QQQ3 shares might be $500 or even $1,000 but if you extrapolate from the past such moves seem not only possible but even likely.

If we look at the long term chart above of QQQ3 we have 12 candlesticks, each one representing a year or part of a year. Three are red and nine are green reflecting the long-term bullish trend which I see as underpinned by the strength of the US (and global) economy and the unfolding, even accelerating, technology revolution.

QQQ3 reminds me of that famous expression when somebody looks well – keep taking the pills. For QQQ3 that means keep buying the shares and be ready to weather the occasional storm.

After declining since August 2021 and becoming negative in the process Coppock is now heading firmly higher indicating that it is early days in a new bull market.

I am very pleased with how well Coppock is working. Almost all my predictions are looking good and we are now seeing confirmation from other indicators such as golden crosses on the moving averages.

Strategy – Clearly at the Buying Stage of the Stockmarket Cycle

In its classic format Coppock gives signals by turning down, falling steadily, becoming negative and then turning higher. These buying opportunities don’t come that often so should be taken. As you would expect from an early stage bull market we have a growing number of Coppock buy signals. You can buy into lots of them or just buy ones where you really like the growth and the story.

You can even focus on ETFs like QQQ, AIQ (artificial intelligence) or OGIG (global internet giants).

There will always be ups and downs in stock markets. Bull markets climb a wall of worry and day traders and other short term speculators are always building positions or taking profits. In the short term, as Geoffrey Rush, the hapless producer in Shakespeare in Love, might have said ‘It’s a mystery’.

Longer term we have a better chance that things will work out as we want them to.

Share Recommendations

Tesla TSLA Buy @ $256.5

Nvidia NVDA. Buy @ $412

Wisdomtree Nasdaq 100 3x daily leveraged. QQQ3 Buy @ $117.5

Invesco QQQ. QQQ. Buy @ $364.50

What I like about this chart is not just the current double whammy buy signal but the huge upwards momentum. It is because of this momentum that Coppock works so well. There is some mighty force driving US shares higher and my guess is that it is a combination of real belief in capitalism as the best economic system out there (by far) and the unfolding/ accelerating technology revolution. Humanity is on a journey which has a long way to go.

Why the UK Economy is Stuck at 20MPH

The UK seems to be ever more paternalistic, witness these 20mph speed limits and even suggestions that 20mph good, 10mph better and, I suppose, stationary best of all. More and more we have rules for everything which makes risk taking in any field including economic ever harder. Hence all this nonsense about all these US ETFs we can’t buy. Life is about saving as much money as you can so you can give it all to the government in inheritance tax. Thank goodness more and more of us hate these b****y jobsworths. Boris may be everything people say he is but at least he is not one of them. Men, and even occasionally women (just joking), are adventurous creatures and will not be shut in a box for ever.

I feel like Mel Gibson in Braveheart – FREEDOM!