I have a love/ hate relationship with Futu Holdings. The chart looks good with a 6/6 score and on the chart above, where each candlestick is three months, you could see that it is building a springboard that could drive the shares much higher.

The other thing I like is the business model. The company provides a platform for some of the world’s most gung-ho investors in Hong Kong and Singapore to invest in the world’s most exciting stock markets in the US and Hong Kong.

This is a business model with high leverage because much of the cost base is fixed. Operating margins are around 50pc so additional turnover, which would be generated by stronger stock markets, feeds through to profits.

The bad news is that every time I buy the shares, like Snowflake, they promptly fall, I lose patience and sell at which point they start climbing again. The company profile makes the case for buying the shares.

Futu Holdings Limited (Nasdaq: FUTU) is an advanced technology company transforming the investing experience by offering a fully digitalized brokerage and wealth management platform. The Company primarily serves the emerging affluent population, pursuing a massive opportunity to facilitate a once-in-a-generation shift in the wealth management industry and build a digital gateway into broader financial services. The Company provides investing services through its proprietary digital platforms, Futubull and moomoo, each a highly integrated application accessible through any mobile device, tablet or desktop. The Company’s primary fee-generating services include trade execution – which allows its clients to trade securities, such as stocks, ETFs, warrants, options and futures across different markets – as well as margin financing and securities lending. Futu has also embedded social media tools to create a network centered around its users and provide connectivity to users, investors, companies, analysts, media and key opinion leaders.

Web site

It almost seems to good to be true, especially given the growth track record. Sales growth has slowed dramatically in 2022, hardly surprising given what has been happening in stock markets, but even so we are looking at over HK$7bn (around $1bn) v nearer HK$1bn in calendar 2019.

n answer to a question CFO, Arthur Chen said:

I think we are still in the early stage of Futu’s long-term growth strategy. So it is too early to tell ideal capital ratios we should focus. Instead to give a fixed number, I think what we focus will be our long-term growth potential, especially in the new markets, and also further deployment of our resources on the key technology operations going forward.

Q3 2022, 21 November 2022

Strategy

One of the few advantages of being so old is that I can remember the past as though I was there because I was. The 1980s saw an incredible boom in stock markets which ended with a dramatic bust in the early 1990s. It seemed inconceivable that the new decade could be as exciting as the previous one but it was; it was more exciting.

I am beginning to wonder if that is where we are now. The decade preceding 2022 was so amazing it is hard to imagine it could be that exciting again but all past experience suggests it could be; it could be better.

The technology revolution is not slowing down, probably the contrary. Globalisation is a genie which, having been let out of the bottle is not going back. Just in relation to Futu Holdings, if the next decade is going to be even more explosive in stock market terms than the last one, that is going to be a huge opportunity for this business and if you buy them now you have the support of a rising Coppock.

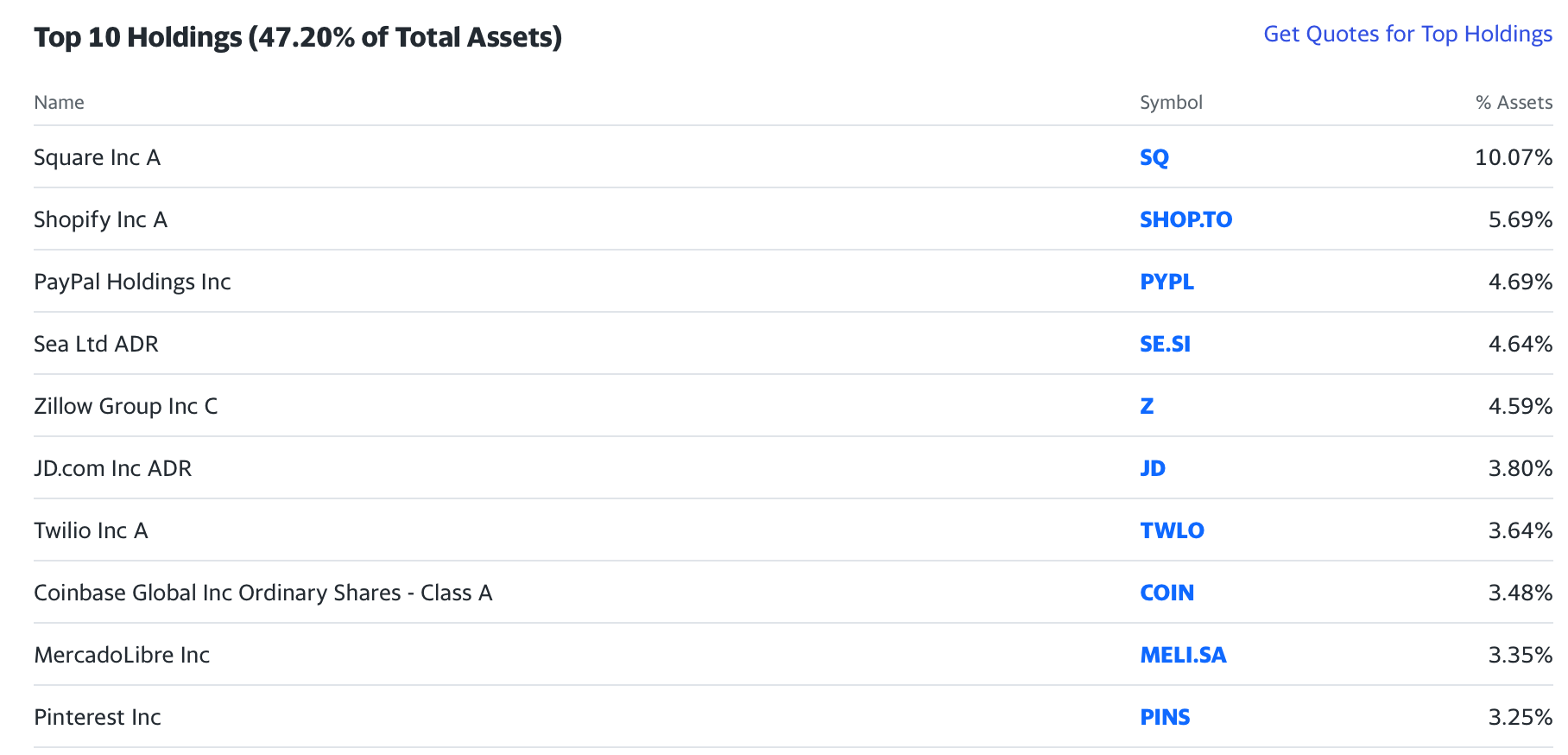

EMFQ (Amplify Emerging Markets Fintech) ETF holds Futu

I have been looking for an ETF with a reasonable exposure to Futu and the one I have found is Amplify Emerging Markets Fintech (EMFQ). It has an interesting portfolio.

It is full of shares which have had a brutal bear market like almost everything to do with fintech but a number now have rising Coppock indicators. I think I would feel more comfortable buying Futu Holdings directly rather than diluting it with some of these other shares.

Block (formerly Square) is an exciting fintech

Still on the theme of fintech I have been looking at Block Inc., formerly known as Square. CEO, Jack Dorsey, can really focus on the business now that he has sold Twitter to Elon Musk and the shares look good, scoring 3/3.

There seems to be plenty going on at Square.

As we’ve discussed before, we are building multiple ecosystems to serve different audiences, Square for sellers, Cash App for consumers, TIDAL for musicians, and TBD for developers. What makes Block unique is our ability to connect all of these together. We’ve made a lot of progress on each and I’ll share some highlights from Square and Cash App before Amrita’s remarks and your questions.

Q3 2022, 3 November 2022

Block’s management realises that there is a lot going on because after spending his entire section of the report for analysts talking about it CEO and founder, Jack Dorsey ended with this comment.

We recognize that understanding our business today may seem complex, especially in a changing macro environment. We’re working to distill how we invest and operate into a clearer and more cohesive framework to help you better understand our business in 2023 and the longer term.

Q3 2022, 3 November 2022

What is clear from the CFO’s comments is that Block Inc. is doing the most important thing we expect from a growth company, it is growing.

In the third quarter, we delivered strong growth across our ecosystems with gross profit of $1.57bn, up 38pc year-over-year and 46pc on a three-year CAGR basis. Gross profit includes a $90m impact from the amortization of acquired technology assets, primarily related to Afterpay, and excluding these noncash expenses, gross profit was $1.59bn.

This quarter, overall inflows in the Cash App totaled $52bn for growth of 19pc year-over-year and represented our highest quarterly inflows into Cash App. Let’s look into the drivers using our inflow framework across actives, inflows per active, and monetization rate. First, our network reached 49m transacting actives in September, up 20pc on a year-over-year basis, with daily and weekly actives growing even faster.

We continue to expand globally. In the third quarter, GPV from our markets outside the U.S. grew 40pc year-over-year or 55pc on a constant currency basis as foreign exchange was a significant drag on year-over-year growth across all international markets.

We continue to see a compelling opportunity for long-term growth, and we’re prepared to be dynamic with our spend as we see the macro environment play out, both investing more when we see returns and pulling back with lower or uncertain returns as we’ve done in the past. We’ll look to share more on our approach for the coming year in our fourth quarter earnings call in February. Ultimately, we remain focused on balancing growth and profitability in this environment. We want to operate with efficiency and agility in 2023 and beyond, with an increasing focus on not only top-line growth, but also profitability across both adjusted EBITDA and profit metrics that factor in stock-based compensation, where we intend on driving leverage over time.

Q3 2022, 3 November 2022

Like companies across the technology space there is more emphasis on profitability and less on headlong growth at all costs. This is good news for investors. What is the grand strategy at Block? I think we are seeing the emergence of a fully fledged digital bank and because it is digital, instead of being on the retreat closing branches and playing catch up with technology like Barclays and the other old school banks it is able to expand internationally without making a huge investment in infrastructure.

I don’t think there is any doubt that Block could become a very large business indeed.

Letting your imagination soar

I am increasingly coming to the conclusion that it takes imagination to pick stocks. Detailed analysis such as is practised across the investing community almost invariably ends up concluding that shares are worth around where they are at the time. This is not surprising because any given share price reflects all the information available at the time.

IF you want to look at a company and see how these shares could double, treble, rise 10-fold or whatever this is all about imagination. You have to make a leap and see where the business could be in five or 10 years time and you can’t do that with analysis. It is all about the man, or woman, the business, the opportunity and stuff you can’t measure on a spread sheet. At the end of the day it is all about the magic and whether they do or don’t have it.

Maybe there is only one question you need to answer. Could this business become huge? If it could the shares will be exciting to own. If not, what is the point.

ARK Fintech Innovation ETF holds Block

This is a good looking chart. ARKF is part of the Cathy Wood stable of actively managed ETFs and she invests with imagination; incredible really, I have never seen anything like the way she invests. As a result, like Quentinvest she has experienced boom and bust but now appears to be on a recovery path with a chart breakout supported by a rising Coppock indicator from a negative position. ARKF has a punchy portfolio (see below) – wall to wall Quentinvest.

Because these Ark ETFs are not UCITS you cannot buy them in share accounts but only in leveraged accounts like CFD and spread betting accounts, which as subscribers know, are what I use all the time. The only exception is leveraged ETFs, which can only be bought in share dealing accounts so as not to pile leverage on leverage.