Five hot stocks for investors who are ready to take high risks for high rewards

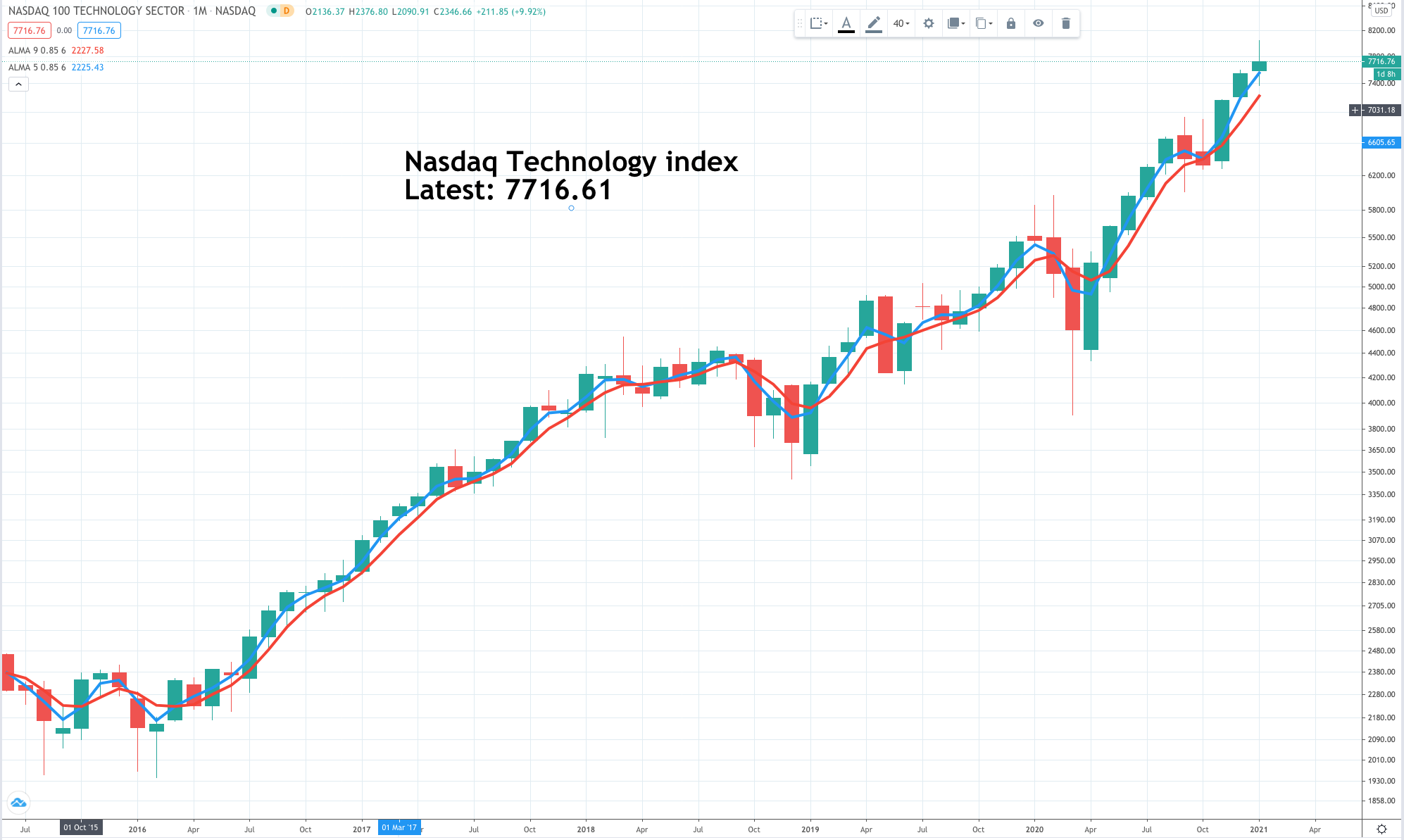

I love this index, the Nasdaq Technology index. It keeps going higher and higher, up 15 times since 2009 and no wonder when you see what is happening with technology in the world. Surrounded by my 30-something children I feel like a dinosaur and so eventually will they as the new century marches on and their children come of age. We live in a very, very exciting time and it is no surprise that this is finding expression in the stock market. It is a time for investor to be bold even if they are not fully up to speed on what is happening. Below are some particularly bold choices of stocks which could crash and burn but which could also become giants.

C3.AI AI Buy @ $144.50 MV: $13bn Employees: 482 Next figures: 31 March Times recommended: 1 First recommended: $137

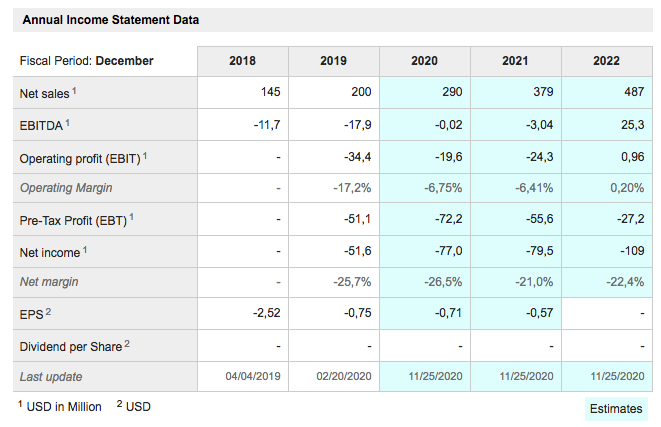

Like the others in this selection the capitalisation to sales ratios of these stocks would make a value investor’s hair stand on end. C3.AI is valued at 82.8 times sales for its last reported full year. Even by 2023 on the projections below that ratio would still be a sky-high 40.8.

Clearly something is out of kilter but I am beginning to wonder if it is the way we try to value these stocks that is the nonsense. The stock market has historically been a world of analysts and analysts are paid to use quantitative analysis to value stocks. This may have been useful in the past but I am not sure it is any more.

There is another way of looking at companies like C3.AI. It is a a bet on a possible glittering future. They think and I don’t see any reason to disagree that they have an exciting business with a huge opportunity. If they are right almost any vaguely reasonable current value would look cheap eventually.

All the companies that are big now started small. The ones that become big have great leadership, great products and relentless execution and they grow fast. They have to grow fast in order for small to become big in a reasonable period of time – say 10 to 20 years.

This is where the miracle of compound interest becomes so important. A company with starting sales of $100m a year, the sort of numbers we see with the companies studied here, if it grows by 50pc a year for a decade will have sales of $5.8bn, which could well be valued (20 times sales) at over $100bn, if as is likely, the company is still growing fast. Remember that as these companies grow the opportunity grows with them.

A $100bn plus market value would be a stunning achievement but that is exactly the sort of performance these companies are looking to deliver and I am ready to feature them here because I think exactly that could happen.

C3.AI was founded by Tom Siebel, whose business, Siebel Systems invented CRM [customer relationship management software] before the business was sold to Oracle, where Siebel had been one of the original employees, for $6bn plus.

Its current strategy is to sell its software to marquee names to establish the references that will enable the group to roll out sales to a much wider range of customers in the future. This is why in the short run it is not sales growth so much as the total achievement of the business that is driving the share price.

The shares rose recently, when they announced the general availability of, C3 AI Ex Machina, a next-generation predictive analytics application that empowers anyone to develop, scale, and produce AI-based insights without writing code. Consolidated Edison is a customer and achieving great results from using the platform to identify in advance electric meters at risk of overheating.

Before that, on 17 December, they announced a linkup with Microsoft and Adobe to build a new CRM platform. Why the link up? “

“What C3.ai has are the industry models and templates so they can do the customisation for an industry, instead of it being a custom solution every customer needs to invest time and resources in. They have a long-standing history of large deployments at an industry level with specific extensions and models.” C3.ai customers are large organisations like 3M, Shell and the US Department of Defence. The combination delivers “industry solutions that are powered by Dynamics, that are off-the-shelf, and that start to work out of the box.” That’s especially important these days: “Typical CRM implementations that were known for months of implementation have happened in literally days.”

The recently issued prospectus talks about an addressable market of $294bn by 2024. I don’t really have much idea what they are talking about when it comes to the technology but the company feels very exciting and has already had a warm reception from the stock market.

Fastly FSLY Buy @ $108.50 MV: $12.5bn Employees: 752 Next figures: 17 February Times recommended: 4 First recommended: $63.50 Last recommended: $95

If anything Fastly’s technology is even more baffling than that of C3.ai. Here is what they say they do. “As the consumption of online content continues to grow globally, organisations must keep up with complex and ever-evolving end-user requirements. We help them surpass their end-users’ expectations by powering fast, secure, and scalable digital experiences. With Fastly’s edge cloud platform, our customers are disrupting existing industries and creating new ones. Today, our platform handles hundreds of billions of internet requests a day.”

The shares were recently added to one cloud focused portfolio on the argument: “We believe the company can become part of the plumbing of the next generation Internet”. If they do this gives them the opportunity to become a very large business.

Fastly is sometimes described as a CDN. “A CDN (Content Delivery Network) is a highly-distributed platform of servers that helps minimise delays in loading web page content by reducing the physical distance between the server and the user.”

This is what Fastly CEO, Joshua Bixby, said at a recent investment conference about why the company was so successful and had such a huge opportunity. “You’ll see some real stark differences, thousands of servers versus hundreds of thousands of servers, less than 100 locations to thousands of locations. And ultimately, what matters is can it scale to the largest workloads in the world? Can it perform and is it secure? And I think when you look at the organisations that are picking us, the largest in the world, the most innovative and now really accelerated by COVID, those who maybe aren’t the most innovative, but have to catch up, you’re seeing both of these communities move because the architecture that we have is faster, more scalable and more secure. And that’s counterintuitive to a lot of people, who think you’ll always win with 300,000 servers over 3,000-ish.”

I am not going to go into more detail about the technology because many of you will quickly become as lost as I am. What I think is key is that this company believes they are doing something critical to the future of the Internet and their products are aimed at developers, who do understand what they are talking about and who are moving to the heart of corporate progress in this new technology-driven world.

The shares fell heavily last October because political developments meant that their largest customer, TikTok, had to stop using them. Since much of Fastly’s revenue is usage based this hit revenue growth but otherwise they grew strongly in terms of customers and look as exciting as ever.

Companies like Spotify and Shopify are customers and the company looks full of potential.

Lemonade LMND Buy @ $152.50 MV: $9.1bn Employees: 459 Next figures: 25 February Times recommended: 4 First recommended: $80 Last recommended: $167

Lemonade is a company founded by two Israelis, Daniel Schreiber and Shai Winiger, to use technology to disrupt the insurance market. It reminds me of the clever people at Carvana, who are using technology to disrupt another deeply unpopular business, used car sales. Lemonade’s ambition is to do the unthinkable and somehow make buying insurance and filing claims a delightful experience. They are having great success in doing this which makes me think that their disruptive plans could succeed.

And they are very ambitious. So far they are mainly in home and contents insurance but recently branched out successfully into pet insurance, which is surprisingly big business in North America. They say they plan eventually to be in every branch of insurance and have imminent plans to move into life insurance, which is a huge market.

One of the keys to their success is that they sell insurance to young people who mostly don’t have any insurance. As these people grow older and go through life events like marriage, buying a house and starting a family they continue to use Lemonade but their spend goes up dramatically, without Lemondae having to incur any extra marketing costs. This is very profitable for Lemonade and already happening on a significant scale.

One key sign that Lemonade is poised to do well is a net promoter score of 79pc, which is incredibly impressive. A score of 79pc is the second-highest of the 67 companies with a minimum of 100 reviews on Clearsurance. Only perennial customer choice award winner USAA, at 80pc, has a higher NPS. Customers rate Lemonade as the No. 1 ranked renters insurance company in the U.S. out of 300-plus rated renters insurance companies

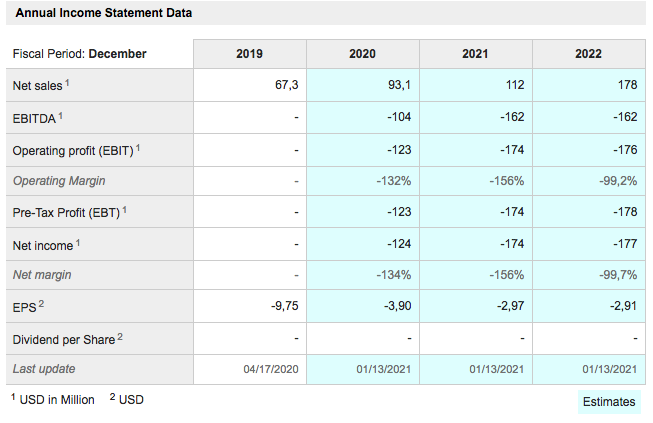

The shares are ambitiously valued at $9.1bn, which is almost 100 times sales. Many observers think this is ridiculous and the shares have been heavily short sold by investors hoping to profit when a reality check sends the price sharply lower. The latest short position as a percentage of shares traded in the market is 19pc, less than it was as short sellers become more cautious after the recent incredible gyrations in the shares of a heavily shorted stock called Gamestop.

I never assume that the shorts are right. Other heavily shorted shares in the Quentinvest portfolio have included Shopify, Tesla and Match Group and it hasn’t hurt their share prices, rather the contrary.

Lemonade is very like the other shares in this issue of Quentinvest. You either believe or you don’t as I have said many times in the past when writing about Tesla. I find the ambition and the sheer cleverness of Schreiber and Wininger, the latter also co-founded Quentinvest portfolio stock, Fiverr, almost intoxicating.

They know exactly what they are doing and where they are going and I believe they are going to hit the world insurance industry like a rocket. Sales are small and the valuation seems high partly because they only founded this business in 2015.

Investors buying the shares now are buying close to the beginning of what could be an incredible journey.

Zscaler ZS Buy @ $198.50 MV: $27.7bn Employees: 2,020 Next figures: 27 March Times recommended: 11 First recommended: $60 Last recommended: $214

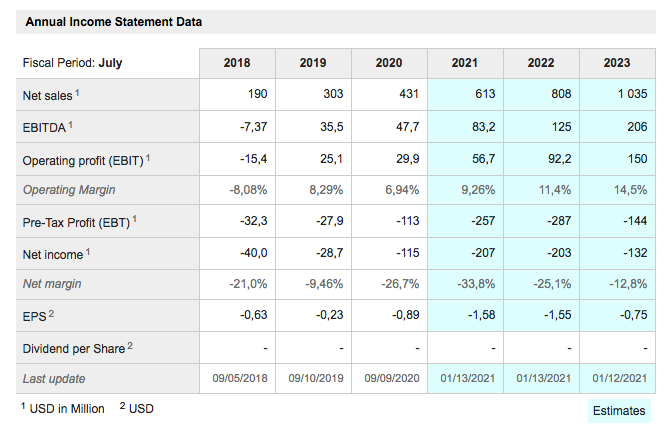

Zscaler is an exceptionally fast-growing cyber security business. Again the valuation is demanding on 64 times historic sales falling to around 27 on projected sales for the year to 31 July 2023.

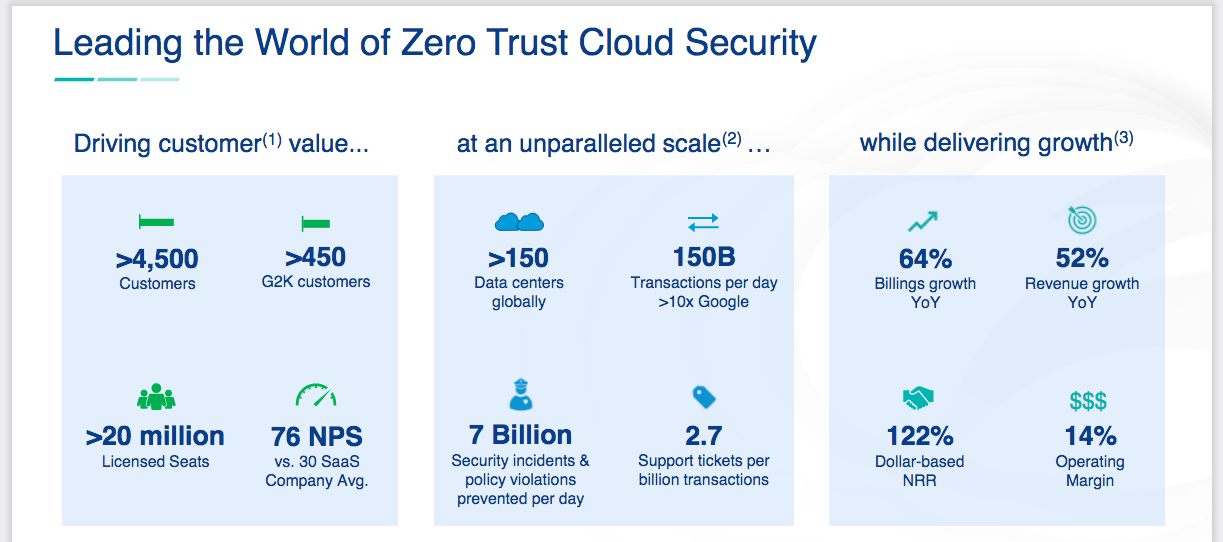

Zscaler describes itself as “a leader in cloud security enabling new zero-trust architecture to protect the hyperconnected world of users, customers, devices and workload”. At its analysts day, held on 11 January, the group outlined an ambitious goal – “Our big audacious goal is to become the strategic business policy and security enforcement platform for 200m users, 100m workloads and billions of OT/IoT devices.

Zscaler is already an impressive business as illustrated in the graphic below from the presentation.

As usual I am not going to pretend that I know exactly what Zscaler does let alone how they do it but they are clearly winning hearts and minds in their target customer community and achieving rapid growth. As CEO, Jay Chaudhry said in his opening remarks at the Q1 2021 analysts’ presentation.

“I’m proud of our strong results and an exceptionally strong start to fiscal ’21 in our first quarter. We delivered 52pc growth in revenue, and 64pc growth in billings, while also generating record operating profits and free cash flow. I believe our financial results demonstrate Zscaler’s pivotal role in enabling our customers’ digital transformation journeys, which are accelerating at a pace never seen before. Our visibility and business momentum remains strong. And we are pleased to increase our fiscal year guidance. I believe the market is coming to us and we are investing across our organization to capture a significant share of our large and growing opportunity.”

The company has been investing in its sales organisation to great effect. “One, our newly hired sales reps are contributing at a faster pace. And two, our sales productivity is higher than a year ago, despite a high percentage of ramping sales reps.”

Chaudhry concluded: “I believe, we have the best sales team top to bottom, and we are hiring at a rapid pace. We are now a destination for top talent around the globe. Second, we are deepening our ecosystem of technology partners, which are contributing to deal wins and adding leverage to our sales model. In addition to our ongoing partnership with Microsoft and CrowdStrike, we have now extended our strategic partnership with VMware to integrate with the SD-WAN solution and to partner for joint go-to-market engagements. I believe, we have built a go-to-market engine that will generate long-term sustainable growth.”

Chaudhry has been saying things like this for a while but he is walking the talk with the strong growth being achieved by his business. I see Zscaler as a future corporate giant.

Upstart Holdings UPST Buy @ $64.5 MV: $4.72bn Employees: Next figures: 3 March Times recommended: 1 First recommended: $61.50

I am thinking about Upstart Holdings, a very recent IPO, as Lemonade for credit. “Upstart is a leading artificial intelligence (AI) lending platform designed to improve access to affordable credit, while reducing the risk and costs of lending for our bank partners. By leveraging Upstart’s AI platform, Upstart-powered banks can offer higher approval rates and experience lower loss rates*, while simultaneously delivering the exceptional digital-first lending experience their customers demand.”

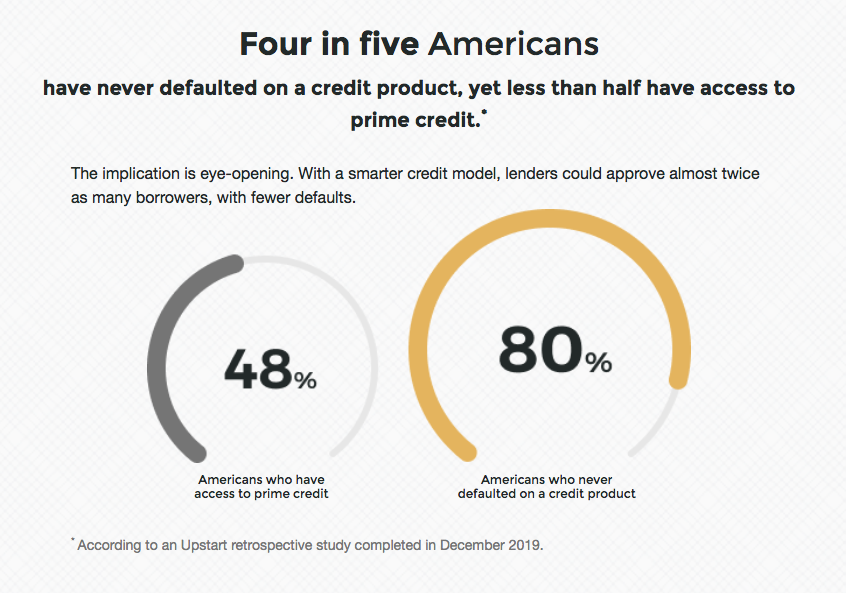

This graphic says it all about traditional bank lending. There is obviously huge room for improvement in the way lenders provide credit if so many first class borrowers are not receiving first class treatment.

Upstart is one of the first to apply AI to the multi-trillion dollar credit industry. Upstart goes beyond the FICO score, using non-conventional variables at scale to provide superior loan performance and improve consumers’ access to credit. The results provided from the access to credit comparison show that the tested [Upstart] model approves 27pc more borrowers than the traditional model and yields 16pc lower average APRs [annual percentage rates] for approved loans.

AI has the opportunity to improve most types of lending globally over the next decade. While Upstart is focused today on the US consumer market, similar techniques can be applied to all credit markets.

Very like Lemonade in insurance, Upstart is able to make fully automated loans, defined as loans originated end-to-end (from initial rate request to final funding) with no human involvement. This ability means that they can approve a majority of loans nearly instantly.

Upstart looks to me like another exciting business with potential to use technology to disrupt a massive industry, banking, which still does things in very traditional ways, which do not provide anywhere near the best possible experience for the customer or the most efficient model for the lender.

In one way Upstart is not a disrupter because they are not trying to replace banks, rather they want to partner with them to make them more efficient and user friendly by using all the resources of technology and artificial intelligence to take better and quicker lending decisions.

The founders left senior positions at Google in 2012 to found Upstart to use technology to improve what they describe as a broken model. The founders believe that they have an eight year head start and that their AI lending platform is well positioned to help power one of the largest transformations facing the financial services industry.

They believe that there are thousands of banks out their who will be ready to partner with Upstart to exploit the power of technology and AI to take quicker and better lending decisions. If they are right the business opportunity they are addressing is huge.

Analysts are looking for the sort of fast growth in sales that suggest Upstart is exploiting its opportunity but I don’t think sales growth will be the main driver of the shares in the early days. The key will be news flow. The shares rose on 14 January when Puerto Rico’s Oriental Bank, a subsidiary of OFG Bancorp, said it had selected Upstart’s s application programming interface to deliver faster loan decisions and more accurately price price auto loans for applicants on its online banking site. Investors will be hoping for many more such announcements.

Also exciting is that Upstart is not going to stop here. In classic software business fashion it will be using the growing stream of data pouring into the business to refine and improve its platform and develop exciting new products.

Like all these fast growing technology businesses the bigger they get the stronger they become in a powerful virtuous circle of growth.

And these businesses have phenomenally talented leadership. Co-founder and CEO, Dave Girourd, is not alone in having a CV to die for – “Dave is Upstart’s co-founder and chief executive officer. Dave was formerly president of Google Enterprise and built Google’s billion-dollar cloud apps business worldwide, including product development, sales, marketing, and customer support. He started in Silicon Valley as a product manager at Apple and was an associate in Booz Allen’s information technology practice. Dave’s career began in software development with the Boston office of Accenture. He graduated from Dartmouth College with an AB in Engineering Sciences and a BE in computer engineering. Dave also holds an MBA from the University of Michigan with high distinction. No surprise that every single company Dave Girouard has worked for is in the QV for Shares portfolio.

It is very early days in Upstart’s growth story but what an opportunity they have and what an exciting ride they could be for early bird investors.

As subscribers know I use charts a lot in my investment decisions but at the end of the day it is all about the fundamentals. If these companies do what they are setting out to do they will be incredibly exciting investments. They have great ideas and great stories; now it is all about execution. Can they walk the talk? if they can the sky is the limit for their shares.

If you think about their current value as being like an option on what their value might be a decade from now you can see how that present value will be volatile as investor expectations move around but also how almost any reasonable present value is likely to prove a bargain entry level if they do prosper.

And personally I think the odds are good that they will.