Roblox Corporation RBLX. Buy @ $97. Times recommended:2. First recommended: $70. Last recommended: $82.50

I am starting an occasional (hopefully not so occasional) series on companies delivering explosive growth. I don’t have a specific definition but in its latest quarterly report for the period ending 31 March 2021 Roblox co-founder and CEO, Dave Baszucki (America is a land of immigrants so CEOs frequently have wonderfully exotic names) revealed revenue of $387m, an increase of 140pc over the same quarter a year earlier.

Other metrics were even more dramatic. “In Q1 2021, total developer exchange fees were $118.9m, up 167pc year over year. On a trailing twelve month basis, the number of developers earning over $30,000 was nearly 800, or approximately 2x the trailing twelve month number measured at the end of Q1 2020. Similarly, the run-rate of earnings for the 1,000th developer was over $29,000 in March 2021, up from roughly $8,000 in March last year. We believe that we are on track to share nearly half a billion dollars with the community this year.”

One of my simple propositions on Quentinvest is that if a business is going to become very, very large at some point in its existence it needs to grow very fast. This is happening with Roblox right now.

Growth is also being reflected in a sharply rising headcount. Over the last year Roblox staff numbers have grown from 651 to 1054. They say. “The quality of people we are hiring is incredible.” As an example they cite Manuel Bronstein. “In March we welcomed Manuel Bronstein to Roblox as chief product officer. Manuel joined us from Google where he was vice president of product for Google Assistant and prior to that was vice president of product management for YouTube. Before his time at Google, Manuel was at Zynga and Microsoft.”

The company says that 79pc of its employees are engineers and product professionals. There is a sense in which Roblox is almost pure r&d, a bunch of boffins creating ever more extraordinary marvels. And that is before we consider all the developers (see above) using the platform to do amazing things. Roblox is a world of creativity.

The guys at Roblox are very excited about what they are doing. “A fundamental part of being human is connecting with others, and we’re inspired by the way in which the Roblox community creates and shares experiences to play, work and even learn together,” said David Baszucki, Roblox CEO. “The opportunity of what we’re building at Roblox is massive and we will continue to make long-term investments as we build a human co-experience platform that enables shared experiences among billions of users.”

We’ve only be looking at the stock for five minutes and already we can see that it is classic 3G (great chart, great growth, great story). What we now need to do to reassure ourselves that Roblox is the real deal is try to understand their story better. Remember we are not talking about short-term valuation here. I have no idea about that; Roblox could halve or double tomorrow. What we want to establish is that Roblox is in the game and has the sort of potential Baszrucki is referring to when he says the opportunity is ‘massive’.

Here is one clue. Roblox is all about what he calls ‘co-experience’. He expects co-experience to become bigger than gaming. How big is gaming? Taking PCs and mobile together worldwide gaming revenues in 2020 were $114bn. It’s big so bigger than that will certainly qualify as ‘massive’.

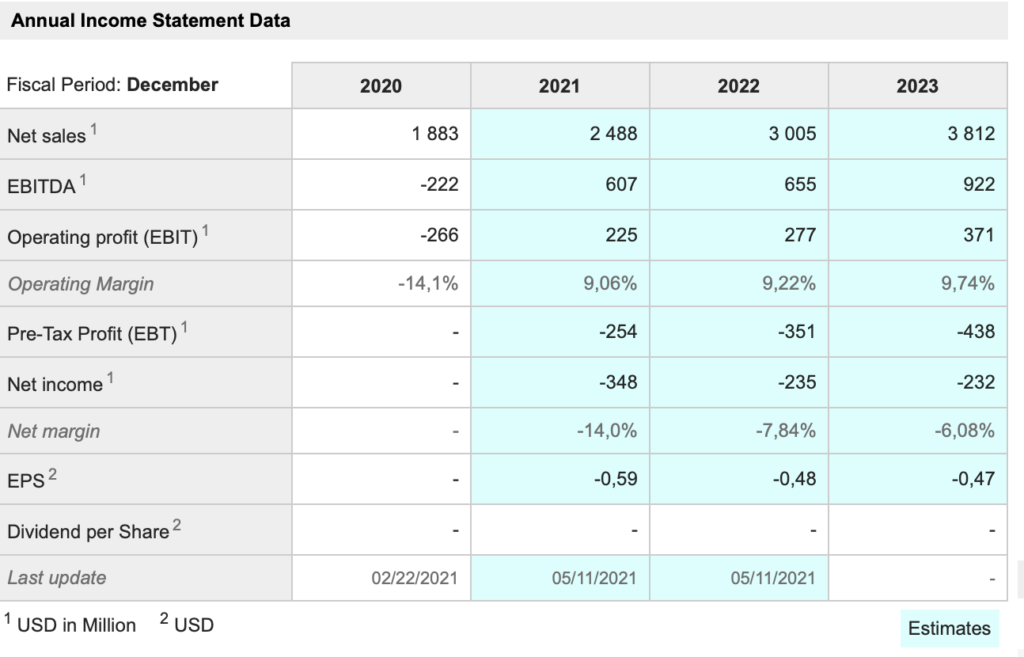

Before digging deeper into what co-experience is all about I should note that Roblox is loss-making and expects to lose money for the foreseeable future. This is because like many subscription businesses albeit for rather different reasons much of revenue is deferred but the costs are taken upfront. When a business is growing explosively deferred revenues and the cost base also grow explosively. This means continuing losses but for investors that is good news because it is the strong growth that is generating those losses. Before we become too worried about this we should also note that despite the losses, like Amazon, when it was making big losses, Roblox expects to be strongly cash generative. So much so that by the end of 2023 analysts are forecasting a cash pile reaching over $3.5bn.

Subscribers have heard me talk about the battle for territory as the key objective for 21st century technology businesses as they struggle for first mover advantage and winner takes all in their particular niche. Roblox appears to have clear first mover advantage and is striving for winner takes all and we already know that ‘all’ could be big.

When it comes to understanding Roblox as a business I am going to focus on two things. What they do? And how they monetise it. This involves a journey into a futuristic world, which for somebody of my generation is straight out of science fiction.

Here is an example. There is a pop group, from Brighton, called Royal Blood. The guitarist is famous for his base guitar sound. Roblox has something called its annual Bloxy Awards. Royal Blood, as Avatars (virtual versions of themselves) player a concert half way through the latest (eighth) Bloxy Awards. I was surprised to find I really liked their music.

Another thing I read was somebody, presumably very young, saying she loved playing Spiderman games on Playstation. Now she has fun creating Spiderman games on Roblox. A player becomes a developer. If people like her games, as we see below, she can start earning money from it.

Meanwhile I found this article in the Huffington Post from 2016, where Dave Barszucki spelled out his vision for Roblox and co-experience. I would love to give you a snappy summary of what it is all about myself but I am not there yet and Barszucki obviously does know what he is trying to do.

“What happens when 12m people are provided with an almost unlimited variety of immersive virtual environments where they can explore, create, and learn with their friends? We have been running this experiment monthly at ROBLOX for over ten years, and it has led us to a thesis. We believe the future of 3D immersive environments (and VR – virtual reality) is much bigger than the gaming space. Immersive 3D environments will ultimately power social networks that connect billions of users. For decades, science fiction authors have conjured visions of the Metaverse — a virtual world where people share experiences together under the guise of a photo-realistic simulation. This is the ultimate promise of VR, and it is the vision that has powered VR all the way from Snow Crash to JPL to The Matrix to today’s VR excitement. The future of VR is social.

People have been turning to technology for thousands of years to help communicate and share stories. Human communication has seen steady acceleration, stemming all the way from drums and smoke signals, to the modern evolution of telegraph, telephone, internet video calls, and ultimately VR telepresence. Similarly, people have been figuring out ways to spread stories beyond the campfire ever since we inked the first cave paintings approximately 40,000 years ago. A progression of increasingly high-fidelity storytelling technology has brought us oil paintings, books, movies, TV, and 3D movies.

Virtual reality will provide an enormous opportunity for companies in the communications and storytelling segments. Wherever we see images or videos today, we will ultimately see VR imagery and video in the future. Industries will expand to support new cameras, projectors, VR viewing technology, and distribution. There will ultimately be a VR YouTube, a VR Twitch, and, when the time is right, VR movies from Disney, Time Warner, Netflix, Amazon, and Comcast. In the communications segment, we will see bandwidth expand to support VR telepresence communication that goes beyond our Skype calls of today.

However, unlike communications and storytelling, it has only recently become possible to accelerate human co-experience with technology. The implications are large, because humans primarily form bonds through “doing things together” (co-experience). A networked virtual environment is required to support co-experience, and these have only been available in the last twenty years with the advent of social networks and multiplayer games.

Social networks provide a degree of co-experience, but they do it primarily through asynchronous text and the sharing of content. Even this somewhat limited level of co-experience is powerful, as social network companies today, such as Facebook, LinkedIn, and Tencent, have market capitalizations well in excess of communications and storytelling companies. Compare Facebook’s market capitalization at $334 billion with Disney’s $164 billion and Comcast’s $155 billion, and it becomes clear that social is currently the dominating category.

Games, on the other hand, provide a level of immersion beyond that of social networks, but they do not provide an “always on” social graph that friends can use from anywhere in the world. In addition, the content and environments provided by games is typically just that – a game. We don’t find many games that support “let’s play tag” or “let’s sit in the audience of a fashion show.”

I would like to introduce a new category that I believe will ultimately be larger than gaming, and that is the “Co-Experience” category. Mojang (Minecraft), Second Life, and ROBLOX have typically been categorized with games, but unlike traditional game businesses, these companies provide human co-experience based on user generated content (UGC). They provide a long tail of experiences that satisfy a wide range of social activities. On these platforms, one can participate with friends in the Hunger Games, hang out at a disco, or survive a tornado together. More and more, companies in this co-experience space will provide social graphs to play with friends across phones, tablets, computers, consoles and VR.

Which brings us back to the experiment we have been running at ROBLOX. Over 300,000 developers create millions of 3D experiences every year on our platform. More and more, we are finding the experiences they create go beyond games. Some of the experiences are educational, such as Bird Simulator. Some of the experiences are non-competitive and social games we find in the real world, such as Freeze Tag, Murder Mystery, or Hide and Seek. And we find a wide range of role playing, whether it be High School, a Prison Simulator, or the chance to be a Fashion Model. Our 12m monthly players [now 43.3m, see below, ed] are coming back not just to play games, but to be with their friends. Our players enjoy ROBLOX because it gives them the chance to do things together, and doing things together is ultimately social.

As we expand into VR, we see two general classes of growth ahead. In the communications and storytelling space, there will be huge dollars and much evolutionary development as the current image and video infrastructure makes a move towards VR. But it is the Co-Experience space where we expect to ultimately see more radical, disruptive developments. Ultimately all social networks will be powered by VR and support human Co-Experience. The future of VR is social, and co-experience will be the ultimate “killer app” for VR.”

So that’s what they do. The next task is to discuss how they monetise it. Before discussing that I just want to share this quote from the prospectus on the group’s ambitions. “Our mission is to build a human co-experience platform that enables shared experiences among billions of users. We are constantly improving the ways in which the Roblox platform supports shared experiences, ranging from how these experiences are built by an engaged community of developers to how they are enjoyed and safely accessed by users across the globe.” The ambition to have ‘billions of users’ compares with 43.3m currently.

Monetisation is based on users spending real money to buy virtual currency called Robux, which they can then use to purchase ‘cool’ items in the Roblox worlds being created by a vast army of developers. The developers receive a 30 pc share with the rest making up Roblox’s revenue. An idea of what is happening is that Roblox expects to share nearly half a billion dollars with its developer community in 2021.

This share is growing rapidly. “Earned Robux are deposited into the virtual accounts of the developers and creators, who can convert Robux into the real-world currency of their choice through our Developer Exchange Program. In the nine months ended September 30, 2020, developers and creators earned $209.2m, up from $72.2m in the nine months ended September 30, 2019. Developers and creators do not always cash out their Robux to real-world currency. Some choose to reinvest their Robux into developer tools, promote their experiences through our internal ad network, or spend the Robux as any other user would.”

Great growth shares have strong network effects. Roblox has two. The more developers there are creating content for the platform the more attractive it becomes to users. More users attract more developers. Secondly, the platform is social. Users play with their friends. The more people there are using it the more appealing it becomes to their friends to join. We have seen what this effect has done for Facebook. On that basis Roblox is very early days.

Similar to Facebook, Roblox has been building its community first and then learning how to monetise it. “We believe there is significant potential to increase monetization on our platform. First, we are actively working with our developer and creator community to help them improve their monetization. Second, we recently introduced our subscription service, Roblox Premium, which we believe will increase our conversion of our free users to paying users and the retention of our paying users. Finally, we expect to work with leading brands to build unique marketing opportunities on the Roblox Platform.”

There is no doubt that Covid-19 has accelerated growth at Roblox. This can clearly be seen in the numbers with a surge in all the metrics starting in March 2020. The company says growth is bound to slow as life returns to normal and people are no longer cooped up at home. However I suspect there is something else going on which will keep growth at elevated levels for years to come. The business has reached a tipping point with more developers coming on to the platform attracting more users and driving higher levels of engagement. In March alone the number of users climbed from 42.1m to 43.3m, which is a rise of 2.85pc in a month. Developer activity is increasing at a humungous rate. Not surprisingly given the opportunity for developers, who are young and often also players, to make a living from something they love to do. Engagement is climbing as the quality of the experience keeps improving.

On top of that the growing scale of the business is creating new monetisation opportunities. One of these is brand partnerships. The first major brand to partner with Roblox was Gucci, the lead brand in the Kering stable (Kering is in the QV portfolio) collaborating with Roblox designers to bring virtual items to the Roblox community. Other brands include Stella McCartney, leveraging Roblox designers to create virtual items based on real world products. Hasbro has entered a licensing partnership with Roblox around its Monopoly and Nerf franchises.

One reason why this may be happening is the rapid increase in Roblox users older than 13. “In Q1 2021, our demographics continued to expand with users over the age of 13 growing at 111pc and now accounting for 49pc of the user base.” This is also helping drive Roblox’s move into music. “We partnered with two labels from Warner Music Group to launch successful on-platform music activations that engaged millions of fans. Atlantic Records hosted a Launch Party for their band Why Don’t We. The band performed songs from their new album and answered questions from their fans. Roblox also partnered with Warner Records to have their band, Royal Blood, virtually perform at the Bloxys where they exclusively debuted their new single Limbo.”

Both these areas of expansion look like the first stirrings of what could become huge revenue drivers for the group in the future as it becomes an ever more all-embracing and increasingly VR-based ecosystem for young generations.

Not least of the growth drivers for Roblox, related to all the above, is that the revenue impact of growing numbers of users is multiplied by higher levels of engagement and higher spend per user. “Average bookings per daily active user (ABPDAU) was $15.48 in Q1 2021, an increase of 46pc from $10.58 in Q1 2020. Increased payer conversion in all of our geographies contributed to the growth in ABPDAU.

One of the key metrics tracked by the group is Bookings, which grew 161pc over Q1 2020 to reach $652.3m. Bookings is the value of the Robux purchased on the platform in the period.

It is a strange but important number. It consists of the revenue reported, which is not fully explained but I think refers to Robux bought which have been exchanged for virtual items on the platform. Another name for this is earned Robux. The difference between revenue for the quarter ($387m) and the bookings number is deferred revenue of $265m, which I presume is unearned Robux – bought but not yet spent. Add this together and the bookings total represents cash flowing into the business. A deduction from this cash outflow made at the moment when the Robux are bought is money to payments processors like Apple and Google of $97.9m.

This still leaves plenty of cash flowing into the Roblox accounts, which helps explain how the business can be simultaneously loss making (because unearned Robux cannot be counted as part of turnover) and cash generative (because they still get the money).

Last but not least of the impressive attributes of Roblox is that the business is already truly global. “Average daily active users were 42.1m in Q1 2021, up 79pc from 23.6m DAUs in Q1 last year. By region, US/Canada was the largest geography accounting for 30pc of users, growing by 62pc year over year. Users in Europe, which are nearly as numerous as in the US/Canada, grew 79pc.”

Asia and the rest of the world are also showing exciting signs of growth. “And we’ve seen very early signs of what we hope to have happened, which is we’ve seen some developers in China breaking to the top 250 in the world market. And we have many, many world outside of China devs who now live in China. The other thing to note is we’ve seen consistent growth in South Korea, in Hong Kong, in Russia, in Brazil, and really all around the world. So we can’t make any forward-looking predictions on China, but we see a lot of lovely patterns out there.”

The bottom line is that Roblox is in a powerful virtuous circle of growth by which the bigger it becomes the more attractive and engaging it becomes to developers, users and all sorts of brand partners. This in turn pours cash into the business to fuel ever-growing spending on innovation which helps the flywheel to turn even faster. It is easy to see how Roblox could become a very large company indeed. As they say they could become a business with billions of users rather than the 43.3m they have currently. The implication is that the business could scale by between 23 and 46 times or more, even without including higher spend per user, which is an electrifying prospect for shareholders.

Roblox is a share which can be played either way. You can either buy your intended stake right away, which is what I have done because of my generally gung-ho approach to investing. Alternatively, you can make them a candidate for a staggered approach based on my programmatic/ buying the green approach about which I shall have more to say early next month. My guess is that Roblox shares are going to be volatile. It has already had a good run since the IPO (although that was a direct listing so no new shares were sold, which tends to make for a tight market). It is on a chunky valuation and it is making huge accounting losses so it struggles to look cheap whatever happens to the share price. Against all that though it looks hugely exciting with a clear opportunity to build a massive business.

The shares are already doing well but I suspect the company is still widely perceived as a games developer with mostly rather clunky games (with blocky looking characters that appeal to young children). This could all change as investors become more aware of the potential of the whole co-experience about which Barszucki is so excited. Roblox would then be seen not so much as another games developer but as a pioneer in a new space, more like a blend of gaming and social, with, as he says, massive potential.

Virtual reality or VR too is looking like a product/ experience that could become a buzz word for investors and that could be good news for Roblox and other shares in the QV portfolio like Facebook ($332), with its Oculus Quest 2 VR product impressing observers and Vuzix ($19) with its AR (augmented reality) glasses.