Exciting shares on the move as markets see shift in emphasis towards post-lockdown era

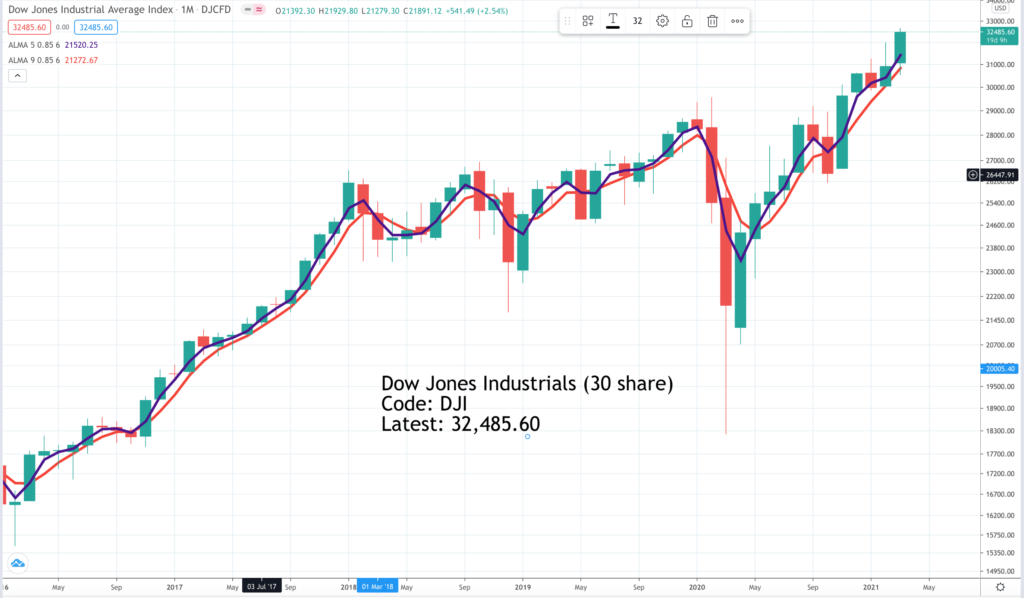

The Nasdaq 100 has taken a battering, albeit it has staged a partial recovery in recent days but meanwhile the more traditional Dow Jones 30 shares Industrials index is hitting new highs. Also hitting new highs is the German Dax index and European shares generally are looking positive after years of trading broadly sideways.

The most likely explanation of this is the success of the global vaccines programme raising hopes that lockdown is going to end and normal service is going to be resumed in the global economy, probably with an initial surge in activity.

I think the secular trends will remain in place – globalisation, the technology revolution, digital transformation, the rise of e-commerce, the massive increase in spending of the Chinese middle class and middle classes generally outside the developed world.

So my guess is that the fastest growing businesses will continue to be those driving and exploiting the technology revolution but I will keep an open mind to other opportunities in a fast changing world.

Meanwhile I look at some opportunities below. I don’t try to superimpose my views on the market. Quentinvest is a programme of patient long-term accumulation in shares in fast growing businesses, part of a process of building and expanding a portfolio of the best of the best.

The shares selected below are not being selected on programmatic grounds; that will come later. These shares are just ones I like now; similar to groups of selections that I have made in the past.

Ambarella AMBA Buy @ $113 MV: $4.2bn. Next figures: 8 June Times recommended: 2. First recommended: $105. Last recommended: $121 – “Our multi-year visual AI investment is the major factor in the accelerated business momentum we are reporting.”

Applied Materials. AMAT. Buy @ $114.5. MV: $107bn. Next figures: 20 May. Times recommended: 4 First recommended: $82 Last recommended: $121 – “Since the beginning of our fiscal year, we’ve seen a continued acceleration of demand in our semiconductor business as major macro and industry trends fuel increasing consumption of silicon across a wide range of markets and applications.”

AptarGroup ATR. Buy @ $140 MV: $9bn. Next figures: 29 April. Times recommended: 1. First recommended: $128 – “Broad-based demand for our industry-leading drug delivery devices and for our food dispensing closures drove double-digit core sales increases in our Pharma and Food and Beverage segments.”

Bio-Techne Corp. TECH Buy @ $377 MV: $15bn. Next figures: 4 May Times recommended: 5. First recommended: $279.50. Last recommended: $375. Lowest recommended: $252 – “The Bio-Techne team delivered another strong quarter, accelerating our organic growth year-over-year to 19pc, building on the strength we experienced last quarter. In fact our 19pc organic growth rate represents the strongest performance since I joined the company in 2013. This growth was broad based across our segments and geographies as our penetration in biopharma continued to be red hot. And even academia returned to double-digit growth.”

Booking Holdings. BKNG. Buy @ $2398. MV: $97bn. Next figures: 13 May. Times recommended: 4. First recommended: $1992. Last recommended: $2444 – “Without a doubt 2020 presented the biggest disruption to modern global travel the world has ever seen and our results for full year 2020 were down substantially from 2019. However travelers still booked 355m room nights through our platforms during 2020 and we remain profitable by generating approximately $880m in adjusted EBITDA. Our 2020 year end headcount decreased approximately 23pc versus 2019 primarily in volume-related position. We expect these reductions to result in annualized cost savings of about $370m in personnel expenses with about $110m of savings recognized in 2020. We believe there is once again a high level of pent-up demand for travel.”

Dynatrace DT. Buy @ $52.4. MV: $15.3. Next figures: 11 May. Times recommended: 1 First recommended: $46.54 – “Given this solid execution of our sales team and momentum in the market, we are now planning to accelerate the growth rate of primary quota-carrying reps into the 25pc to 30pc range.”

Fiserv. FISV. Buy @ $124. MV: $83bn. Next figures: 4 May. Times recommended: 4 First recommended: $73.50 Last recommended: $102.50 – “We’ve entered 2021 with tremendous momentum. We delivered 12pc adjusted earnings-per-share growth for the year, marking our 35th consecutive year of double-digit adjusted EPS growth, and we delivered record free cash flow. We are exiting the year stronger than we entered, and we’re well positioned to capitalise on our momentum in 2021 and beyond.”

Gamestop Corporation. GME. Buy @ $279. MV: $18bn. Next figures: 23 March. Times recommended: 1 First recommended: $91.71 – “We have made significant strides in stabilising and optimising our core operations and are excited about the transformational plan we are executing that will enable us to create long-term value as our industry continues its rapid growth. Our goal is simple. We are positioning GameStop to be the leading global omni-channel retailer for all things gaming and entertainment.”

Hermes. RMS. Buy @ €954. MV: €97bn. Next figures: 30 July. Times recommended: 10 First recommended: €523 Last recommended: €940 – “The reduction in tourist flows was offset by the loyalty of local customers and by the strong increase in online sales. The network has flexibly adapted to the global context changes by offering omnichannel solutions to its customers. The success of online sales was confirmed in all regions, and the deployment of the new digital platform continued in Asia and in the Middle East.”

Intuit. INTU. Buy @ $392. MV: $109. Next figures: 27 May Times recommended: 7 First recommended: $210.50 Last recommended: $378 – “Second quarter results reflect strong momentum across the company. We’re on track for Intuit to deliver another year of double-digit revenue growth. We’re seeing strong momentum and accelerating innovation across the business with our AI-driven expert platform strategy and five Big Bets. These Big Bets are focused on the largest problems our customers face and represent durable growth opportunities for Intuit.”

L’Oreal. OR. Buy @ €322 MV: €178bn. Next figures: 5 August. Times recommended: 1 First recommended: €281 – “L’Oréal has traversed this crisis in the best possible condition and has even grown stronger. As anticipated and announced, the group returned to growth in the second half, with a fourth quarter acceleration at +4.8pc, and won significant market share. Thanks to its strength in digital and e-commerce, which has again increased considerably during the crisis, L’Oréal has been able to maintain a close relationship with all its consumers and compensate to a large extent for the closure of points of sale. As a result, sales achieved in e-commerce rose sharply by +62pc, across all divisions and all regions, reaching the record level of 26.6pc of the total group’s sales for the year.“

LVMH. LVMH. Buy @ €563. MV: €279bn. Next figures: 27 July Times recommended: 9 First recommended: €249.45 Last recommended: €524 – “We are confident that LVMH is in an excellent position to build upon the recovery for which the world wishes in 2021 and to further strengthen our lead in the global luxury market. Profit from recurring operations, which amounted to 8.3bn euros in 2020, declined only 28pc over the year due to a return to growth in the second half, which was up 7pc.”

Lyft LYFT. Buy @ $64. MV: $20.9bn. Next figures: 12 May. Times recommended: 1. First recommended: $78.02 – “Given the improvements we’ve made to our unit economics and our overall cost structure, we’re like a tightly coiled spring positioned to drive strong organic growth and margin expansion as the recovery takes hold. We believe the future of transportation is as a service and we are the only company in North America that has a seamless multimodal transportation platform that can replace car ownership. We expect autonomous vehicles to accelerate this transition. They will transform the ridesharing industry and their business. We’ve spent nine years building a business that is uniquely capable of supporting and scaling AVs [autonomouys vehicles]. Our Level 5 data-driven autonomy program taps into our greatest asset, our rideshare network, to help tackle some of the hardest problems in self-driving. And our open platform partners will be able to leverage our rideshare technology stack, including our dispatching and routing algorithms, our shared rides platform and our pricing capabilities. We are excited about the transformative impact AVs will ultimately have on our industry and on transportation broadly.”

Pliant Therapeutics PLRX. Buy @ $38. MV: $1.34bn. Next figures: 2 June Times recommended: 1 First recommended: $30.50 – “Utilising breakthrough technology from UCSF [University of California San Francisco campus] with a focus on treating fibrosis. Leading Integrin platform with near term, potentially high-impact catalysts. Research collaboration [with Novartis] validates Pliant’s powerful integrin development platform. [Integrins are the principal receptors used by animal cells to bind to the extracellular matrix. They are heterodimers and function as transmembrane linkers between the extracellular matrix and the actin cytoskeleton. A cell can regulate the adhesive activity of its integrins from within. Still baffled – I’m sure they understand.]“

Roblox Corporation RBLX Buy @ $70. MV: $38.6bn. Next figures: n/a New entry – “Newly floated Roblox’s mission is to build a human co-experience platform that enables billions of users to come together to play, learn, communicate, explore and expand their friendships. Roblox is powered by a global community of over eight million developers who produce their own immersive multiplayer experiences using Roblox Studio, our intuitive desktop design tool. Roblox is ranked as one of the top online entertainment platforms for audiences under the age of 18 based on average monthly visits and time spent (Comscore). Our popularity is driven purely by our community of users and developers.” Sales for the nine months to 30 September 2020 grew from $350m to $589m year on year.

Rotork. ROR. Buy @ 375p. MV: £3.29bn. Next figures: 3 August. Times recommended: 3 First recommended: 355p. Last recommended: 321p. Lowest recommended: 250p – “Our investments in IT systems, targeted geographies, innovation and new product development, and aftermarket activities are progressing well and yielding benefits. We continue to strengthen our business and are well placed to benefit from recovering demand. We remain committed to delivering sustainable mid to high single digit revenue growth and mid 20s adjusted operating margins over time.”

Shake Shack. SHAK. Buy @ $121.5. MV: $4.76bn. Next figures: 6 May. Times recommended: 5 First recommended: $66.50 Last recommended: $108. Lowest recommended: $55.7 – “Looking back at Q4, despite the hurdles facing our business and with much of the country still under varying degrees of lockdown, we’re pleased to report revenue of $157.5m, with same-Shack sales improving to down 17.4pc, compared to down 31.7pc in the third quarter. We’ve got our sights set on accelerated development with great real estate in new and existing markets to evolving formats that allow us to capture sales in new ways. Second, capitalising on the adoption of our digital tools and doubling down on the investments in those channels, especially Shack Track. Diving into Shack development, we are really excited to accelerate unit growth, and we’ll be targeting between 35 to 40 new company-operated Shacks this year, while ramping up in 2022 to 45 to 50 Shacks, representing in total, about a 45pc increase to our year-end 2020 stack count over the next two years.”

Shift4 Payments FOUR. Buy @ $93. MV: $4.65bn. Next figures: 6 May. Times recommended: 2. First recommended: $74.95 Last recommended: $76 – “This marks our 21st consecutive year of year-over-year revenue growth. But mostly, it reinforces that Shift4’s value proposition is compelling, and it’s winning share during the best and during the most challenging of economic circumstances. We completed multiple capital market transactions to strengthen our balance sheet, diversify our base of shareholders and provide capital to fund organic and inorganic growth initiatives. We also completed two great acquisitions, including the 3dcart eCommerce platform, which we now call Shift4Shop, which has greatly expanded our eCommerce capabilities and significantly expanded our TAM [total addressable market]. Our ability to grow merchant count and volume while serving some of the hardest-hit industries is a testament to our technology, our business model, and, most importantly, our people. To make no mistake, this is a quarter that included some really rough business conditions. While volume growth is nice to see during a tough quarter, we also look at active end-to-end merchant count, which grew 4pc quarter over quarter. This continued growth in our merchant base makes us incredibly optimistic as we look forward into 2021.”

Square SQ Buy @ $240 MV: $108bn. Next figures: 6 May. Times recommended: 18 First recommended: $39.51 Last recommended: $237 – “Today, we announced a $170m purchase of Bitcoin on top of the $50m we bought in the fourth quarter. Why are we doing this? We believe the Internet needs a native currency, and we believe Bitcoin is it. Cash App continued to see strong adoption, both from new and existing customers. In December, Cash App had more than 36m monthly active customers, up 50pc compared to last year. We saw customers increase their usage of products beyond peer-to-peer transactions, including use of our Visa Cash Card, Cash Boost and Bitcoin. Boost is our Instant Rewards program within our Cash Card that enables customers to receive unique discounts based on their location and other attributes. For the Seller business, we will continue to focus on growing our omnichannel capabilities, expand globally and increase our financial service offerings to sellers of all sizes.”

Tractor Supply. TSCO. Buy @ $172. MV: $19.9bn. Next figures: 29 April. Times recommended: 3. First recommended: $134. Last recommended: $151 – “We delivered another strong quarter that exceeded our expectations. In the fourth quarter, we had strong net sales gains of 31.3pc, with comparable store sales up 27.3pc. We continue to gain market share and benefited from customers shopping with us with larger baskets. All customer segments and all value segments experienced growth. For the fiscal year, we added over $2bn in revenue, and we reached over $10bn in sales for the year, a significant milestone for the company. Once again, our quarterly results were remarkably consistent across all periods of the quarter, across all product categories, across all geographic regions of the country. For the third quarter, e-commerce saw strong triple-digit growth and increased significantly as a percentage of our overall sales. The work we did this year to improve our omni-channel capabilities has certainly resonated with our customers, as we’ve seen several years of digital adoption accelerate in just a matter of months. For the year, about 75pc of our omni-channel sales were picked up at a Tractor Supply store, further reinforcing the importance of our stores to our customers. As we’ve experienced in the last several quarters, we continue to have strong performance and market share gains in our consumable, usable and edible categories, with growth exceeding 20pc for the quarter. In 2020, we had more customers shop with us than ever before, with the increased sales across our existing customer groups, new customers and reacquired customers.”

The selections above are not part of the programmatic initiative. Programmatic is all about buying into exciting shares after a decline. The recommendations above are about buying into great stocks that are performing strongly. A share price can never be too strong for me. I like to see a business becoming more valuable as part of a high-powered long-term trend. However you can get caught, at least in the short term, with such an aggressive approach, which is why I am introducing programmatic, not so much as an alternative although it can be but more as a complementary strategy. The idea is to buy into strength, the traditional QV approach but also pick up after weakness, the programmatic approach.

There will be many recommendations but that’s OK. You don’t have to act on all of them and I think it is helpful to have a broad picture of what is happening. All the stocks I recommend will be 3G (great story, great growth, great chart) because if a business is not growing why should it become more valuable.

I think there is a bit of a transition going on with profit-taking in some of the high tech momentum plays and a shift to companies that have suffered from lockdown and stand to benefit from an economic rebound. Nevertheless I think the big picture will not change much. We are in a technology revolution and the most exciting investments are in companies driving that revolution, adapting to it and benefiting from it.