My life is chaos at the moment because we have cleared our flat of 36 years of accumulated possessions so that we can redecorate before the place falls apart completely. In the process I have lost all the notes I made from going through the QV for ETFs table so will have to rely on my memory.

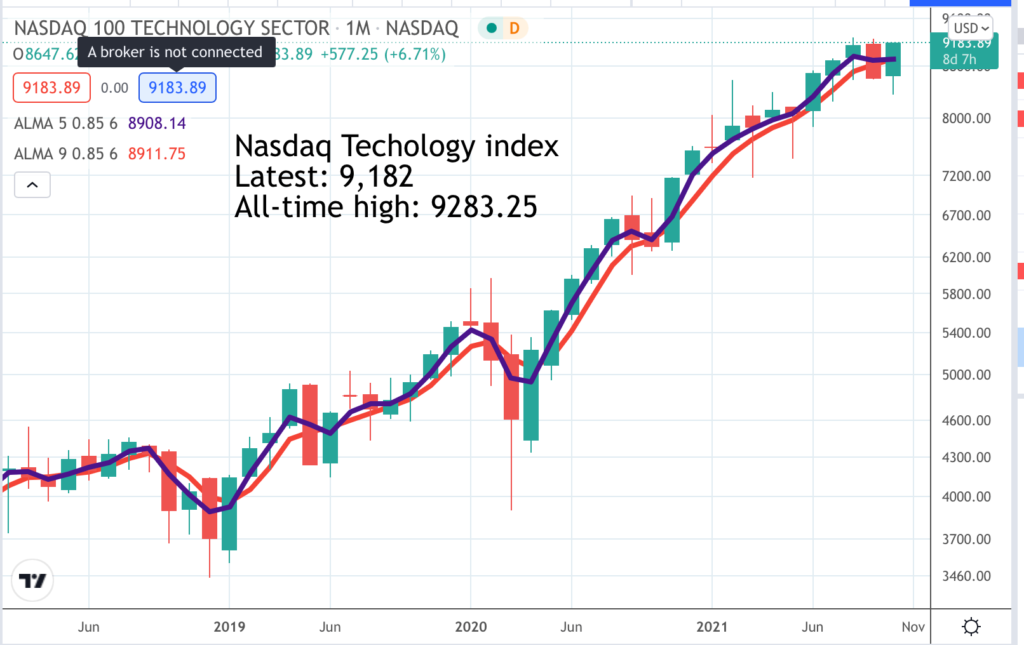

The general impression is that ETFs are looking strong, especially those related to US technology shares which have been my favoured sector for years. This fabulous technology bull market is not over, probably not by a long chalk. It is even possible in the words used by so many bullish US technology company CEOs that it is still just getting started. These are exciting times for investors.

The area that has had a bloody nose is anything to do with China. This is a strange one because the companies look as exciting as ever. They are innovative. They are operating in all the exciting areas like electric cars, e-commerce, social media, biopharmas, medical technology, fintech, trading platforms and so on. They have access to a huge market that can be somewhat inaccessible for non-Chinese companies and they are growing at a fantastic rate.

The problems seem to lie with the Chinese authorities and tensions between the US and China over listing requirements and accounting standards. My feeling is that eventually these problems will be resolved and these shares will climb but it is certainly proving a bumpy ride.

Another area that doesn’t look too hot is health care where many ETFs are trending lower. Again it seems likely that this is a temporary phenomenon.

The big area for me though is technology and the waves of fabulous fast growing US companies disrupting and reinventing the world and increasingly using AI (artificial intelligence) and ML (machine learning) to do it. AI is becoming a new buzzword and companies demonstrating their ability to use it to disrupt vertical markets are shooting higher.

So far there is only one ETF that I have found that specialises in AI and it actually has a conventional portfolio dominated by big tech names. More people are saying that AI is going to drive the next and maybe greatest wave of innovation seen yet so this is definitely a space to watch but any tech ETF is going to have plenty of AI exposure.

There is also now a bitcoin futures ETF which is going to be one to watch for the future. At the moment it seems to have been responsible for driving the bitcoin price close to all-time highs.

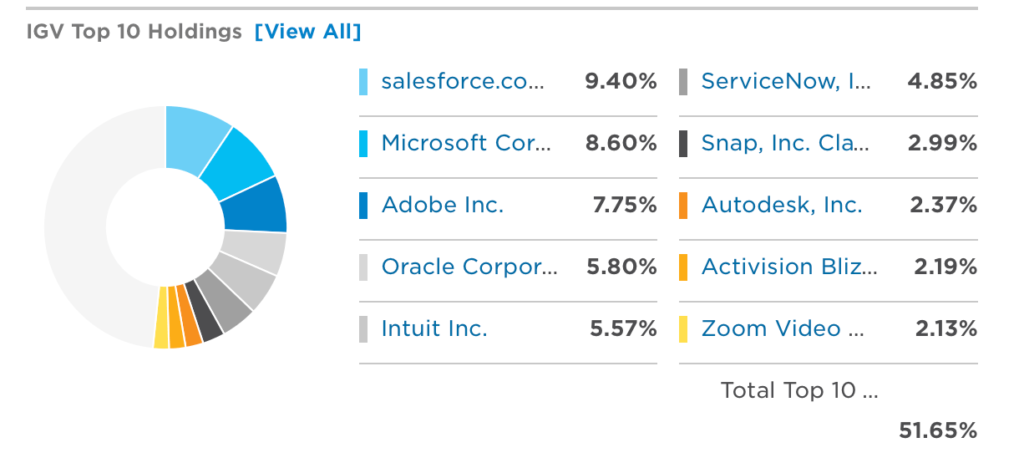

It might be interesting to look in slightly more detail at one ETF in the table. IGV is the code for iShares Expanded Tech Software. The latest price s $436.39 and the shares look well worth buying. Below is a list of the top 10 holdings accounting for over 50pc of the total value of the fund.

The only one of these shares not in the QV for Shares portfolio is Oracle and they could be. I just haven’t got around to it yet with so many exciting shares to choose from on US stock markets. The two shares that have been struggling a bit are Activision Bllzzard and Zoom Video which are sitting at the bottom of the list as a result. Snap is also having issues with ad revenue and its shares have dropped sharply.

Even so there is every reason to expect this ETF to continue to trend strongly higher.

Another ETF looking exciting but one for bold investors is FAS which is the code for Direxion Financial Bull 3x leveraged. The three times leverage means these shares hurtle all over the place but mostly higher in line with the performance of US shares. in March 2020 the shares fell from $108 to $14 but have since recovered to $147.58 and are up from a low of $2 in 2009. The fund provides leveraged exposure to a market cap-weighed index of large US financial services companies.

Also exciting is FNGS, FNGS is an ETF that provides exposure to an index of FANG companies (Facebook, Apple, Amazon, Netflix, and Google [Alphabet Inc.]), as well as other companies that exhibit similar characteristics. Launched in November 2019 it has almost trebled since then and looks strongly placed to keep climbing. The current price is $33.34.

Another perennial favourite is IWMO, iShares World Momentum, at $67.84. It tells you something about the way the world is going that two thirds of the companies in the list are American including nine of the top 10 holdings. The main holdings are the usual culprits including Tesla which is now second on the list. This ETF has almost trebled since January 2016 and I would be hopeful that it will continue that level of performance going forward.

The outperformance of the US stock market is one of the most remarkable financial phenomena of all time. Since 1986 the Nasdaq 100 is up 138 times. Over a similar period the FTSE 100 is up a little over four times. It is no wonder that money from all over the world is pouring into US shares.

For someone like me who spends his days studying the most exciting US shares the explanation for this outperformance is there for all to see. US companies, especially technology companies, are innovating, growing and buzzing with excitement in a way which is unmatched almost anywhere else in the world.

Just months ago it seemed that a growing cadre of Chinese companies was joining the party with some spectacularly fast growing businesses locking into the fast expanding spending power of the Chinese middle class. For inscrutable reasons Xi Jinpeng has knocked that on its head. It is not the growth that has stopped happening but the feeling of a hostile and unstable political climate.

The UK and Europe keep trying to join the party but so far without a great deal of success. Yet again there seems to be an element of first mover advantage and winner takes all. The better the US does the more attractive it becomes to companies and even talented individuals as witness the number of outstanding US companies that are led by great leaders who came from outside the US (Elon Musk is South African born) although often they were educated there.

When I first started investing it was difficult to buy US stocks because of a rule that you had to pay a premium to buy dollars from a relatively fixed pool. Like many other absurd restrictions this was abolished by Margaret Thatcher, who I still regard as maybe the best peacetime prime minister this country has ever had.

It is now even easier to buy US stocks than UK stocks for UK citizens because there is no stamp duty on US stocks and many of them can be traded with zero commission. As a result people like me are almost entirely invested in US stocks. At the moment I have one UK stock and one Australian stock and otherwise I am entirely in US stocks.

It is the same with ETFs. There is very little point in holding ETFs that are not mainly invested in US technology shares; that is where the action is and all the signs are that that is where it is going to stay. We live in an age of dramatic technological change which is being driven to a large extent by American companies.

When Trump was in charge of America people were obsessed with his absurd and often unpleasant behaviour. Now they worry that he has been replaced by a man who, if he was a UK citizen, would have had a freedom pass for almost 15 years but none of this matters to the corporate world. They just carry on doing their thing and growing from small to big to huge as they do it.