Either Simmering Or Exploding; Top 20 Stocks Race Ahead; New Entry

Oracle is already a Top 20 stock and looks more exciting than ever following the latest results. There is a massive ‘something new’ happening at Oracle, which is turning a successful business into a 21st-century Tech Titan. Oracle is an exploder.

Clearly, we had an amazing start to the year because Oracle has become the go-to place for AI workloads. We have signed significant cloud contracts with the who’s who of AI, including OpenAI, xAI, Meta, NVIDIA, AMD and many others. At the end of Q1, remaining performance obligations, or RPO, is now up to $455 billion. This is up 359% from last year and up $317 billion from the end of Q4. Our cloud RPO grew nearly 500% on top of 83% growth last year.

Safra Catz, CEO, Oracle, Q1 2026, 9 September 2025

This incredible growth in RPO is starting to feed through into performance.

We have also been on an accelerated journey to adopt AI internally to run more efficiently. I expect our operating income will grow mid-teens this year and higher still in FY ’27.

Safra Catz, CEO, Oracle, Q1 2026, 9 September 2025

There is plenty of good news for shareholders.

At quarter end, we had $11 billion in cash and marketable securities and short-term deferred revenue balance was $12 billion, up 5%. Over the last 10 years, we’ve reduced the shares outstanding by 1/3 at an average price of $55, which is, at this point, much less than 1/4 of our current stock price. This quarter, we repurchased 440,000 shares for a total of $95 million. In addition, we paid out dividends of $5 billion over the last 12 months, and the Board of Directors again declared a quarterly dividend of $0.50 per share. Given our RPO growth, I now expect fiscal year ’26 CapEx will be around $35 billion. As a reminder, the vast majority of our CapEx investments are for revenue-generating equipment that is going into the data centers and not for land or buildings. As we bring more capacity online, we will convert the large RPO backlog into accelerating revenue and profit growth.

Safra Catz, CEO, Oracle, Q1 2026, 9 September 2025

Oracle is on a roll.

Clearly, it was an excellent quarter and demand for Oracle Cloud infrastructure continues to build. I expect we will sign additional multibillion-dollar customers and that RPO will likely grow to exceed $0.5 trillion. The enormity of this RPO growth enables us to make a large upward revision to the cloud infrastructure portion of our financial plan. We now expect Oracle Cloud Infrastructure will grow 77% to $18 billion this fiscal year and then increase to $32 billion, $73 billion, $114 billion and $144 billion over the following 4 years. Much of this revenue is already booked in our $455 billion RPO number, and we are off to a fantastic start this year.

Safra Catz, CEO, Oracle, Q1 2026, 9 September 2025

Everywhere you look, the news is good.

Now while much attention is focused on our GPU-related business, our non-GPU infrastructure business continues to grow much faster than our competitors. We are also seeing our industry-specific cloud applications drive customers to our back-office cloud apps. And finally, the Oracle database is booming with 34 multi-cloud data centers now live inside of Azure, GCP and AWS, and we will deliver another 37 data centers for a total of 71. All these trends point to revenue growth going higher.

For fiscal year 2026, we remain confident and committed to full year total revenue growth of 16% in constant currency. Beyond fiscal year ’26, I’m even more confident in our ability to further accelerate our top and bottom line growth rate. As mentioned, we will provide an update on our long-range financial targets at our Financial Analyst Meeting at Oracle AI World in Las Vegas in October.

Safra Catz, CEO, Oracle, Q1 2026, 9 September 20

Remember Credo Technology and its inflexion point in 2025, which has driven explosive growth. It looks as though Oracle is having one of those moments.

Larry Ellison, still chief technology officer, and, at 81 years old, looking more than ever like a swarthy gigolo some lady has rented for the night, is buzzing with excitement.

Eventually, AI will change everything. But right now, AI is fundamentally transforming Oracle and the rest of the computer industry, though not everyone fully grasp the extent of the tsunami that is approaching. Look at our quarterly numbers. Some things are undeniably evident. Several world-class AI companies have chosen Oracle to build large-scale GPU-centric data centers to train their AI models. That’s because Oracle builds gigawatt scale data centers that are faster and more cost efficient at training AI models than anyone else in the world. Training AI models is a gigantic multitrillion-dollar market. It’s hard to conceive of a technology market as large as that one. But if you look close, you can find one that’s even larger. And it’s the market for AI inferencing. Millions of customers using those AI models to run businesses and governments. In fact, the AI inferencing market will be much, much larger than the AI training market.

AI inferencing will be used to run robotic factories, robotic cars, robotic greenhouses, biomolecular simulations for drug design, interpreting medical diagnostic images and laboratory results, automating laboratories, placing bets in financial markets, automating legal processes, automating financial processes, automating sales processes. AI is going to write that is generate the computer programs called AI agents. That will automate your sales and marketing processes. Let me repeat that. AI is going to automatically write the computer programs that will then automate your sales processes and your legal processes and everything else and in your factories and so on. Think about it. AI inferencing, it’s AI inferencing that will change everything. Oracle is aggressively pursuing the AI. And we’re not doing badly in the AI training market, by the way. With inferencing figure, oracle is aggressively pursuing the inferencing market as well as the AI training market.

We think we are in a pretty good position to be a winner in the inferencing market because Oracle is by far the world’s largest custodian of high-value private enterprise data. With the introduction of our new AI database, we added a very important new way for you to store your data in our database. You can vectorize it. And by vectorizing it, by vectorizing all your data, all your data can be understood by AI models. Then we made it very easy for our customers to directly connect all their databases, all their new Oracle AI databases and cloud storage, OCI Cloud storage to the world’s most advanced AI reasoning models, ChatGPT, Gemini, Grok, Llama, all of which are uniquely available in the Oracle Cloud. After you vectorize your data and link it to an LLM, the LLM of your choice, you can then ask any question you can think of.

Larry Ellison, chairman, co-founder and chief technology officer, Oracle, Q1 2026, 9 September 2025

So why is Oracle doing so well? Larry Ellison also attempted to explain that.

A lot of people are looking for inferencing capacity. I mean people are running out of inferencing capacity. I mean the company that called us — I mentioned it, I think either last quarter or the quarter before, someone called us, we’ll take all the capacity you have that’s currently not being used anywhere in the world. We don’t care. And I’ve never gotten a call like that. That’s a very unusual call. That was for inferencing, not training. There is a huge amount of demand for inferencing. And if you think about it, in the end, all this money we’re spending on training is going to have to be translated into products that are sold, which is all inferencing.

And the inferencing market, again, is much larger than the training market. And yes, we are building — like everybody else, we’re building agents with our applications. But we’re doing much more than that. No one’s shown me a ChatGPT 3.5, again, 3 years ago, 3.5 — 3 years ago, a little less than 3 years ago, when the ChatGPT amazed the world, and you could simply talk to your computer and ask questions and get well reasoned well questions based on the latest and most precise information as long as you ask those questions about publicly available data, and there’s a lot of publicly available data.

But if you combine the publicly available data with the enterprise data, which companies really don’t want to share, you have to do it in such a way that your private enterprise data stays private, yet the large language model can still use it for reasoning so as to answer your question, like how do the latest tariffs or the latest steel prices or whatever affect my quarterly results? Affect my ability to deliver products, affect my revenue, affect my cost, answer those kinds of questions. To answer those kind of questions, we have to — and we have. We had to change our database, fundamentally change our database so you can vectorize all data. That’s the form in which large language models understand information after it’s been vectorized. And then allowing people to ask any question they want about anything.

And we — that’s exactly what we’ve done. But unless you have a database that is secure and reliable and linked to all of the popular LLMs, and we’ve done all of that, unless you have that and you have to tell me who else has that besides Oracle. Unless you have that, it’s going to be very hard for you to deliver a ChatGPT-like experience on top of your data as well as publicly available data. That’s a unique value proposition for Oracle. And that’s because, again, we’re the custodian of all of much more data than any of the application companies. They have their application data. They measure their customers in tens of thousands. We measure our customers in millions of databases. So we think we’re better positioned than anybody to take advantage of inferencing.

Larry Ellison, chairman, co-founder and chief technology officer, Oracle, Q1 2026, 9 September 2025

CEO, Safra Katz, added to this.

By the way, aside from just our GPU and all of that, we have become the de facto cloud for many of our customers. Again, they want to put some things in our public cloud or in our competitors’ public cloud working with the Oracle database. But simultaneously, there are a lot of reasons why they want what’s called either a dedicated region or cloud a customer. We give our customers so much choice that there’s very unusual for us not to be able to meet a customer’s needs in one way or another.

And then, of course, we have every piece of the stack. We have the infrastructure. We have the database that you’re going to hear a lot about as really the only reasonable store for data that you want to use AI models against. And then we have all of these applications that are just taking off. So we just have a lot of different layers. They’re all moving in the same direction, and they all benefit our customers when used together.

Larry Ellison, chairman, co-founder and chief technology officer, Oracle, Q1 2026, 9 September 2025

Bottom line, Oracle’s history as the king of databases positions them perfectly to benefit from the AI boom. And they have the cash, the muscle, and the customer base to turn thoughts into action. You are never too old for new excitement.

This brings us to that chart above. It’s very long-term (12-month candlesticks) and shows an explosive breakout from an incredible 24-year-long upward-sloping consolidation. A decade from now, people will look back at the Oracle share price chart and see that screaming buy signal and wish they had bought a few shares.

The simmering stock, by the way, is QQQ3, which is blue touch paper for the whole US stock market. It is going to reach escape velocity eventually, and when it does – WOW!

On the performance front, my Top 20 shares, now 27, because in the last alert I forgot to include Carvane, one of the original 10, is already up over 14pc with some big winners. This is spectacular for a portfolio I only launched on 21 May 2025, with new names being added as recently as this month.

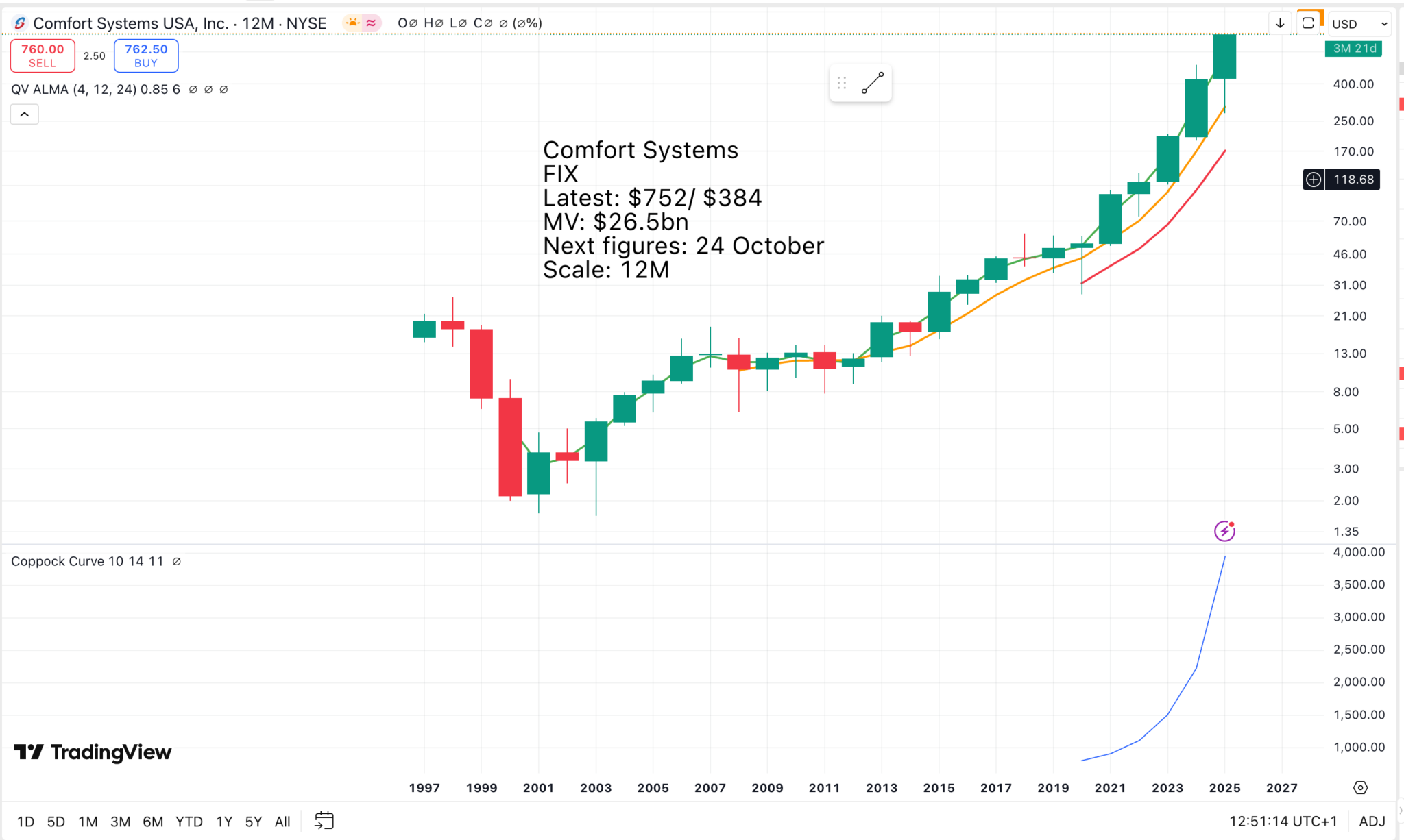

The latest name, the 28th Top 20 stock, which at this rate will soon become a Top 30, is Comfort Systems, another emerging player in the AI infrastructure boom, which is becoming a global phenomenon.

Great chart, as you can see above, and the business is on fire.

We had a fantastic quarter with amazing execution by our teams. This is the first time that our quarterly revenue has exceeded $2 billion. We earned an unprecedented $6.53 per share this quarter, which is an increase of 75% compared to a year ago. Our mechanical business had a sharp increase in profitability, and our electrical segment was higher as well. Service revenue and profits also increased by double-digit percentages. Bookings were strong, and our backlog at the end of the quarter grew to a new high of $8.1 billion.

Demand remained strong, especially in technology, and we continue to book work with good margins and good working conditions for our valuable people. We are going into 2025 with significant same-store growth in both sequential and year-over-year backlog. I am happy to announce the acquisition and welcome Rightway Plumbing, a great plumbing business based in Florida that we expect will earn $60 to $70 million per year in revenue. We also increased our quarterly dividend by 5¢ to 50¢ per share, and we actively purchased shares during the first half of 2025. Despite a backdrop of tariff ambiguity and economic uncertainty, we feel fortunate to have good demand, especially for large and complex projects.

Brian Lane, CEO, Comfort Systems, Q2 2025, 25 July 2025

This is an impressive business, growing on all fronts.

Our backlog at the end of the second quarter was a record $8.1 billion, a large sequential and year-over-year increase. Since last year, our backlog has increased by $2.4 billion or 41%. And $2.2 billion of the increase was same store. On a sequential basis, backlog increased by $1.2 billion or 8%, of which $1.1 billion was same store. Second quarter bookings were especially strong in the tech sector, both in our traditional construction business as well as the modular part of our business. We are entering 2025 with same-store backlog 37% higher than at this time last year, and our project pipelines remain at historically high levels.

Industrial customers accounted for 63% of total revenue in 2025, and they are major drivers of pipeline and backlog. Technology, which is included in industrial, was 40% of our revenue. A substantial increase from 31% in the prior year. Manufacturing revenues were strong but declined modestly as our businesses chose to book a higher proportion of technology-related projects. Particularly data center construction. Institutional markets, including education, health care, and government, remain strong and represent 24% of our revenue. The commercial sector, which is a smaller part of our business, provided about 13% of revenue. Most of our service revenue is for commercial customers.

Construction accounted for 85% of our revenue with projects for new buildings representing 58% and existing building construction 27%. We include modular in new building construction, and year-to-date, modular was 18% of our revenue. We currently have over 2.7 million square feet of building capacity dedicated to our modular business, and we expect to have around 3 million square feet by early next year. Service revenue was up 10% and is 15% of total revenue. Service profitability was strong this quarter, and service continues to be a growing and reliable source of profit and cash flow.

As mentioned before, we are entering 2025 with a backlog that is 37% higher on a same-store basis than we had at this time last year, and we have superb teams working hard for our customers every single day.

Trent McKenna, chief operating officer (COO), Comfort Systems, Q2 2025, 25 July 2025

My impression is that increasingly it is not people but computers that they are comforting.

As befits a plumbing and electrical business, these guys are down to earth.

Well, we have a lot of work to do. Think our guys are the best in the world at doing it. Our customers want it. They’re willing to pay for it. So I think we just feel pretty great about at least the foreseeable demand and our ability to profitably meet it. We don’t really have additional guidance on margins and stuff. These margins are pretty eye-popping. And we’re still digesting them. But we feel pretty darn bullish about our prospects going forward.

Bill George, CFO, Comfort Systems, Q2 2025, 25 July 2025

Absolutely. I mean, you know, ’25 is we’re full. Right? You’re looking at ’26, ’27 for sure looking at opportunities longer out. As you as you know, we got bigger projects that run longer. Take longer to get them done in the front end to get them to get them signed, sealed, and delivered. But, yeah, you know, customers are looking out ’26, ’27. It’s it’s a great time to be in the construction business, buddy.

Trent McKenna, chief operating officer (COO), Comfort Systems, Q2 2025, 25 July 2025

Acquisitions are a big part of the Comfort Systems growth story. This strategy is explained in detail below. It is a lot to read, but worth it if you plan to buy the shares.

The serial acquirer structure can work particularly well when focused on specific niches where the management team at the top has expertise, though if you’re Buffett, such categorical restrictions are mostly unnecessary (except for his unwavering distaste for “tech” companies).

Comfort Systems is essentially a network of locally-focused specialty contracting businesses, working mainly to provide electrical, HVAC [heating, ventilation and air conditioning], and plumbing services for a range of customers, including schools, hospitals, pharmaceutical labs, restaurants, retail stores, apartments, data centers, and manufacturing facilities.

Over two decades, Comfort Systems has made more than 40 acquisitions, snapping up regional contractors and aligning them under the same umbrella company.

The “mechanical contracting” industry lends itself especially well to this structure, given that installation and maintenance work is hyper-localized, with most competitors being independent operators who build a book of business over a lifetime of relationships.

As in, the markets for HVAC, plumbing, and electrical services tend to be dominated by local operations, not sprawling companies operating under the same brand, and correspondingly, relationships are everything. A small town grocery store in Oklahoma that needs a new air-conditioning system is going to call up the same HVAC contractor they’ve known for 30 years, and go to Church with, for help.

Comfort Systems, with its ambitions of being a nationwide player in an industry dominated by small competitors operating at the zip code level, found a backdoor solution to the problem: Acquire competitors working in tangential areas of specialty contracting at fair prices and then use the profits from those subsidiaries to make more acquisitions with, compounding its intrinsic value snowball bigger and bigger.

How well has this worked for them? Since 2001, Comfort Systems has compounded its share price at north of 22% a year — a wonderful result indicative of their acquisitions being done prudently and at attractive enough prices to be accretive to shareholders.

Furthermore, the company has boasted 26 consecutive years of positive free cash flow, paired with 13 years of increasing dividends and negative net debt (more cash than borrowings).

That is…impressive. But let’s discuss what goes into these acquisitions and whether it’s a sustainable business model.

Let me quickly dispel you of the notion that these might be the sorts of predatory acquisitions that certain private equity firms make, buying up family businesses and gutting them for the sake of efficiency.

No, that’s not what Comfort Systems does at all. Actually, they do the opposite.

They buy companies hoping they’ll continue doing exactly what they’ve been doing — they don’t want to mess things up at all. What they will do, though, is offer them administrative support, removing the nuisances of the back office and freeing them to simply focus on what they do best.

From payroll to legal, banking, HR, tax filing, cybersecurity, and other related affairs that are tremendous burdens and often weak points for many smaller companies, joining Comfort Systems can be a competitive advantage for its subsidiaries in the sense that, if your competitors are bogged down by paperwork, they can actually move faster by being a part of a decentralized parent company.

Additionally, as a larger, more diversified business, Comfort Systems brings serious financial backing to its subsidiaries, not only helping them borrow at more attractive rates to finance projects but also helping them score more deals.

Think about it: if you’re pouring millions of dollars into a new data center to support cloud computing and AI, that could be a multi-year project just to get the construction completed, and given the sensitive nature of the computer racks being housed there, you’re going to want to have some very sound service contracts in place to ensure that your space remains properly ventilated and cool enough to prevent the servers from overheating (something that Comfort Systems’ specializes in.)

Consequently, you want the contractor you started the project with, who made all the initial HVAC installations, to be the one you continue working with for many years, and as such, you don’t want to have to worry about your contracting partner going out of business. With small independent contractors, that’s a real risk.

When working with Comfort Systems, much less so. Everything else being equal, then, a customer would choose Comfort Systems 10/10 times, opting to work with one of its local subsidiaries that is financially backstopped by a multi-billion-dollar, publicly-traded corporation.

Everything else isn’t equal, though. Not only do Comfort Systems’ subsidiaries bring legitimacy and financial firepower that other local operators can’t match, but they’re also the best at what they do, according to industry reports. Out of 600 specialty contractors last year, the industry publication Engineer News-Record ranked them 6th.

Okay, but why would anyone sell their profitable, operationally excellent contracting business to Comfort Systems — surely it’s not entirely just for back-office support or financial legitimacy?

The short answer to this is yes, of course, each acquisition is unique, and the motivations for selling can vary widely. Oftentimes, it might be a matter of succession planning, where you have a founder who has built a business over two or three decades, and yet no one in the family wants to take it over. In that case, the founder could sell his business to Comfort Systems to take control of the operations while they cash out and ride off into the sunset.

Other scenarios might include simply tapping into liquidity, perhaps for retirement purposes or other financial goals. As in, the founder of an electrical services company might sell to Comfort Systems to unlock cash upfront. Meaning, the business may generate $5 million dollars a year in profit, but Comfort Systems might be offering a $50 million cash check today (the equivalent of another 10 years of work).

Again, the reasons vary, and there are deal structures with baked-in earn-outs and various possible financing structures that either immediately allow the founder to step away, phase out, or keep working with a salary and a bonus structure, and the point is really that these are customized win-win deals, where everyone usually walks away happy. These aren’t distressed purchases.

What Does a Comfort Systems’ Acquisition Target Look Like? Typically, Comfort Systems makes acquisitions of companies they’ve known for years, sometimes decades. After determining that, say, an HVAC installation company based in Connecticut with 20 employees is an intriguing acquisition, they’ll work with 3rd-party auditors to verify the legitimacy of their target company’s financials and operations, and then they’ll make an acquisition offer.

But, historically, they’ve been very good at being patient about acquisitions. Mechanical contracting is a multi-hundred-billion-dollar industry, and Comfort Systems has only a 2-4% market share, so they have a long runway of acquisitions to make, according to CEO Brian Lane, which is why they don’t rush into doing deals.

I’m sure they have a long list of companies they’ve bumped up against over the years who they know are trustworthy and have strong reputations in their contracting niches/geographic areas, yet they wait for the right moment when they can make an acquisition at a price when the expected rate of return is at least 12%.

On average, they plow about 75% of their earnings toward acquisitions, which is the primary thing fueling their growth (the CEO has estimated that over the long-term, the underlying business should only grow at 2-3% a year), and the remaining excess profit is put toward modest share repurchases and dividends.

How’s the Business Doing These Days? At any given moment, Comfort Systems, across its subsidiaries, has around 8,000 ongoing projects, most of which can be completed in less than a year and average about $1.8 million in size (so they do many relatively small projects).

Their backlog of orders, which are deferred revenues that actually show up as liabilities on the balance sheet, have 4x’d in the last few years. In other words, they have far more demand for their services than they can meet, and thus, they have an entire year’s worth of revenue in the pipeline, some of which they’ve already collected deposits for, that they must “earn” over time by completing those projects.

As long as the rate of customers waiting to work with Comfort Systems is growing faster than they can complete projects, the backlog will keep growing.

And you might think, what’s behind this boom? Surely, this is a cyclical business, and you never want to buy cyclical businesses at the peak of their cycle (when investors are the most optimistic and valuations are the richest). It’s a fair point.

What’s interesting about Comfort Systems is that they’re not purely a company tied to new constructions. When there are construction booms in the U.S., they benefit by being called to do much of the necessary plumbing, HVAC, and electrical work, but these services are also evergreen in a way.

For example, existing buildings will eventually need their HVAC systems replaced, especially if they’re worried about their carbon footprint and want to increase their energy efficiency. So, in times of economic slowdown, Comfort Systems’ new-construction projects fall off, but they see a dramatic shift toward maintenance, repairs, and renovations, as building owners try to squeeze more out of their existing facilities rather than make a larger capital outlay for new construction during times of economic uncertainty.

Not to say they’re recession-immune, but their business mix shifts, and maintenance servicing is actually typically more profitable than new installations, so there’s a degree of economic resiliency here, similar to another company we covered, AutoZone, where their business benefits from recessions as people delay new car purchases and spend more on maintaining their older vehicles.

This, in part, is why Comfort Systems has been able to consistently grow revenue per share at 18.6% per year since 2015, and 30.6% for earnings per share

Still, the last three years have been exceptionally good, with profit margins rising to nearly double historical averages, while revenues have grown at 30% a year since 2021.

Namely, this is due to Comfort Systems being particularly well-suited to servicing data centers and other tech customers. As cloud computing and AI have driven a massive surge in data center construction, Comforts Systems has been one of the biggest beneficiaries — technology customers, as a percentage of the company’s total sales, have increased 11 percentage points year-over-year to more than a third of sales in 2024.

Due to the highly specialized nature of the work that Comfort Systems does in places like data centers and semiconductor fabrication facilities, it earns above-average profit margins on this work, which is why Wall Street fell head over heels for this company as growth accelerated.

The conclusion here shouldn’t be that Comfort Systems is entirely dependent on AI and cloud computing to drive more data center construction, but it has unequivocally been the biggest marginal driver of its business of late.

And, as you might have noticed, AI is a fast-changing area, and major tech companies are already revising their expectations around data center capex, especially as new technologies like DeepSeek have upended the industry. (Deepseek highlighted that it may be possible ‘to do more with less,’ suggesting demand for data centers going forward may not be as ravenous as previously thought.)

It’s little wonder, then, that the company has declined more than $200 per share from its January peak of $550 per share to a recent low of $313 per share (and now back toward $400). Uncertainty around tariffs affecting many of their raw materials hasn’t helped, either.

But AI isn’t the only powerful trend offering a tailwind to Comfort Systems. In general, the re-industrialization of America is good for Comfort Systems.

Whether that be with billions of dollars in government support for semiconductor production in the U.S., as with the CHIPS Act; or subsidies for renewable energy, as with the Inflation Reduction Act; or with tariffs, meant to support domestic producers, there are a variety of forces encouraging more industrial construction in the U.S.

Many of those projects will go to Comfort Systems for installation help and will sign service contracts to have them provide maintenance for several years (i.e., not just one-off new-construction business but more recurring business, too, as HVAC/plumbing/electrical systems in buildings age and require more maintenance).

Value Investing, April 2025. somalley3

Comfort Systems reminds me of an incredibly successful UK company, called Halma, whose shares I have been recommending during most of my life working in stock markets. Halma is arguably the most successful company in the history of the UK stock market, and although I am not recommending them here, they still look good.

Share Recommendations

Oracle ORCL

Comfort Systems. FIX

Strategy – Keep Buying My Top Table stocks

I am thinking that the new name for my Top 20 stocks, now 28 with Comfort Systems, could be Top Table stocks – TTs for short. It is a great discipline for me to decide whether a stock has TT potential or not. Both Oracle and Comfort Systems have the qualities I am looking for in spades.