Palantir CEO, Alex Karp, ranted against short sellers, calling out specifically Michael Burry after a filing revealed the investor of “The Big Short” fame had bets against the artificial intelligence software company, as well as Nvidia, at the end of the last quarter.

“The two companies he’s shorting are the ones making all the money, which is super weird,” Karp told CNBC’s “Squawk Box” on Tuesday. “The idea that chips and ontology is what you want to short is bats— crazy.”

“He’s actually putting a short on AI. … It was us and Nvidia,” Karp added.

When reached via email by CNBC seeking comment on Karp’s remarks, Burry declined to comment.

Palantir shares slid 8% on Tuesday even after the software company beat Wall Street estimates for the third quarter and offered upbeat guidance. Investors have grown increasingly wary of lofty valuations in AI-linked names. Palantir’s stock, which was up 173% for the year heading into Tuesday’s trading, has a forward price-earnings ratio of 228. Nvidia fell 4% after gaining over 50% this year.

“I do think this behavior is egregious and I’m going to be dancing around when it’s proven wrong,” said Karp of short sellers.

Burry’s hedge fund, Scion Asset Management, disclosed put options with a notional value of about $187 million against Nvidia and $912 million against Palantir as of Sept. 30. in a filing. The filing didn’t specify the strike prices or expiration dates of the contracts.

It’s unclear whether Burry is profiting from Tuesday’s declines. The filing reflects his positions at the end of September, and he may have adjusted his portfolio by now. Burry declined to comment on his positions.

“It’s not even clear he’s shorting us. It’s probably just, ‘How do I get my position out and not look like a fool?’” Karp said.

The disclosure comes after Burry hinted at renewed caution in markets in a cryptic post on X last week.

“Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play,” he wrote to his 1.3 million followers on the platform.

Burry gained fame for his prescient bet against mortgage-backed securities before the 2008 financial crisis, a trade chronicled in Michael Lewis’ book “The Big Short” and the Oscar-winning film of the same name.

“With the shorts it’s very complex … honestly I think what’s going on here is market manipulation,” Karp said. “We delivered the best results anyone’s ever seen. It’s not even clear he’s not doing this to get out of his position. I mean these people, they claim to be ethical, but they are actually shorting one of the great businesses of the world.”

Alex Karp, CEO, Palantir, Tech, 4 November 2025

Burry’s short selling is a classic example of value investing versus story investing. He hates the high valuation put on Palantir shares (and it is high). I, and many other retail investors, love the story. It is also about AI. Will it deliver attractive returns on the huge investments being made?

This is where you need to listen to Sam Altman and Sarah Friar, CEO and CFO, respectively, of OpenAI. Friar says OpenAI’s growth is only limited by how much computing power it can bring on stream. Altman hints that OpenAI, with latest sales $12bn, could have sales of $100bn by 2027. Such incredible growth could only be achieved if it were driven by bottomless demand and rapidly increasing computing power.

Friar said in one interview that they had to delay bringing new products on stream until the computing power was available to make them work.

Burry versus Karp almost comes down to a matter of faith. Do you believe the world is going through a transformational technology event, or do you think it is all a bubble? Much of this is about personality. I am an optimist and a natural believer. Others, like Burry, see bubbles everywhere. Funnily enough, Altman is a little like that with those big, mournful eyes. He is worried that a bubble may be developing, but he is super-optimistic about OpenAI. He needs Friar, who is as gung-ho as I have ever seen, but also a person who makes it happen. What she believes in is herself. As well she might, she has come a long way for a girl born in Northern Ireland.

I have been thinking about OpenAI. I think they have a brilliant strategy. I have a load of boring bureaucracy to deal with right now, a perfect storm of lost documents. If an AI assistant could do it for me, what would that be worth – £1,000 a year, £5,000 a year? Who knows? It depends on how complicated your life is; mine is easily worth £5,000, plus I have two companies, another £5,000 for each of those. Why not? I could then be the flamboyant genius, Sherlock Holmes, while AI does all the boring background stuff, a bit like Watson keeping his records.

I asked AI about all-purpose digital assistants. They are pretty much what you would expect, but still amazing.

By “all-purpose digital assistant,” OpenAI refers to an advanced AI agent that can autonomously understand and execute a wide variety of complex tasks across different digital environments, moving beyond simple conversational responses. This concept represents a significant evolution from traditional, task-specific assistants (like Siri or Alexa) towards a more generalised and proactive AI partner.

Key characteristics and capabilities of this all-purpose digital assistant include:

Autonomy and Proactivity: Unlike traditional assistants that wait for specific instructions for each step, the all-purpose assistant can operate independently after an initial goal is set. It can break down complex problems into sub-tasks, plan its own workflow, and execute the steps needed to achieve the objective.

Broad Capabilities & Tool Use: It integrates and switches seamlessly between various internal and external tools to perform tasks, such as:

Browsing the web visually and textually to gather and synthesise information.

Analysing data using a code interpreter (e.g., Python).

Accessing third-party applications (e.g., email, calendar, project management tools) through APIs and connectors to perform actions like scheduling meetings, sending emails, or updating databases.

Handling multimodal input/output, meaning it can process and generate any combination of text, audio, images, and video.

Context and Memory: It maintains context over entire conversations and past interactions, learning from user preferences and data to provide personalised and relevant assistance over time.

User Control and Safety: The user remains in control, with the ability to interrupt, steer, or pause the AI’s actions at any point. The assistant requests permission before taking significant actions (like making a purchase or sending an email) and is designed with safety protocols to handle sensitive information securely.

Adaptability: It can self-correct when it encounters errors or gets stuck, and can ask the user for clarification when needed, making the interaction iterative and collaborative.

In essence, the goal is to create a highly capable, “agentic” AI that functions as an extension of the user, handling a wide range of personal and professional tasks to boost productivity and efficiency significantly.

In Georgette Heyer books, top aristos like earls don’t just have an army of servants but secretaries, who handle everything, like Jeeves in P.G. Woodhouse books. That is how I see the future of AI. Another analogy is with Hal, the computer in the film 2001: A Space Odyssey. Hal ran the ship and knew the answers to everything.

OpenAI’s technology is improving at an exponential rate. Before 2030, this all-purpose digital assistant could be a reality backed by the colossal computing power that OpenAI would then have in place. Imagine 2bn people paying an average $5,000 a year. The resultant revenue number is $10,000,000,000,000, otherwise known as $10 trillion. Now imagine that OpenAI is valued at 10 times sales. This would give a valuation of $100 trillion. Twenty times sales would be $200 trillion.

All these numbers are plucked out of the air, and OpenAI can hardly expect to be the only game in town, but you start to see the stakes these companies are playing for and why demand for more powerful computing is so insatiable. Plus, AI won’t just solve our problems and deal with the boring stuff. It will run our businesses, drive our cars, clean our homes, entertain us, and take us to the stars. So many things; so many wonders to come.

Against this background, do you really want to be massively short two of the most exciting AI stocks on the planet? I would have thought not, but markets can be erratic in the short term, so who knows? My best guess as to what is happening to Palantir is that a huge bull position was built up ahead of expected amazing results, and this needs to be unwound.

Share Recommendations

Nvidia. NVDA

Palantir. PLTR

OpenAI (if you can find a way to buy the shares)

I have just been rereading Alex Karp’s letter to shareholders. His opening remarks are significant.

This remains the beginning, the first moment of a first chapter.

We are still at the very start of things.

Alex Karp, CEO and co-founder, Palantir, Q3 2025, 3 November 2025

There is more.

In the United States, our commercial business has now more than doubled in the last twelve months, growing 121% and generating $397 million in the last quarter.

This segment of our operations is an absolute juggernaut.

And we believe that it will become, on its own, one of the most significant business stories of the century in American economic life.

Alex Karp, CEO and co-founder, Palantir, Q3 2025, 3 November 2025

All you must do is accept that this guy knows what he is talking about, and he hasn’t done badly so far.

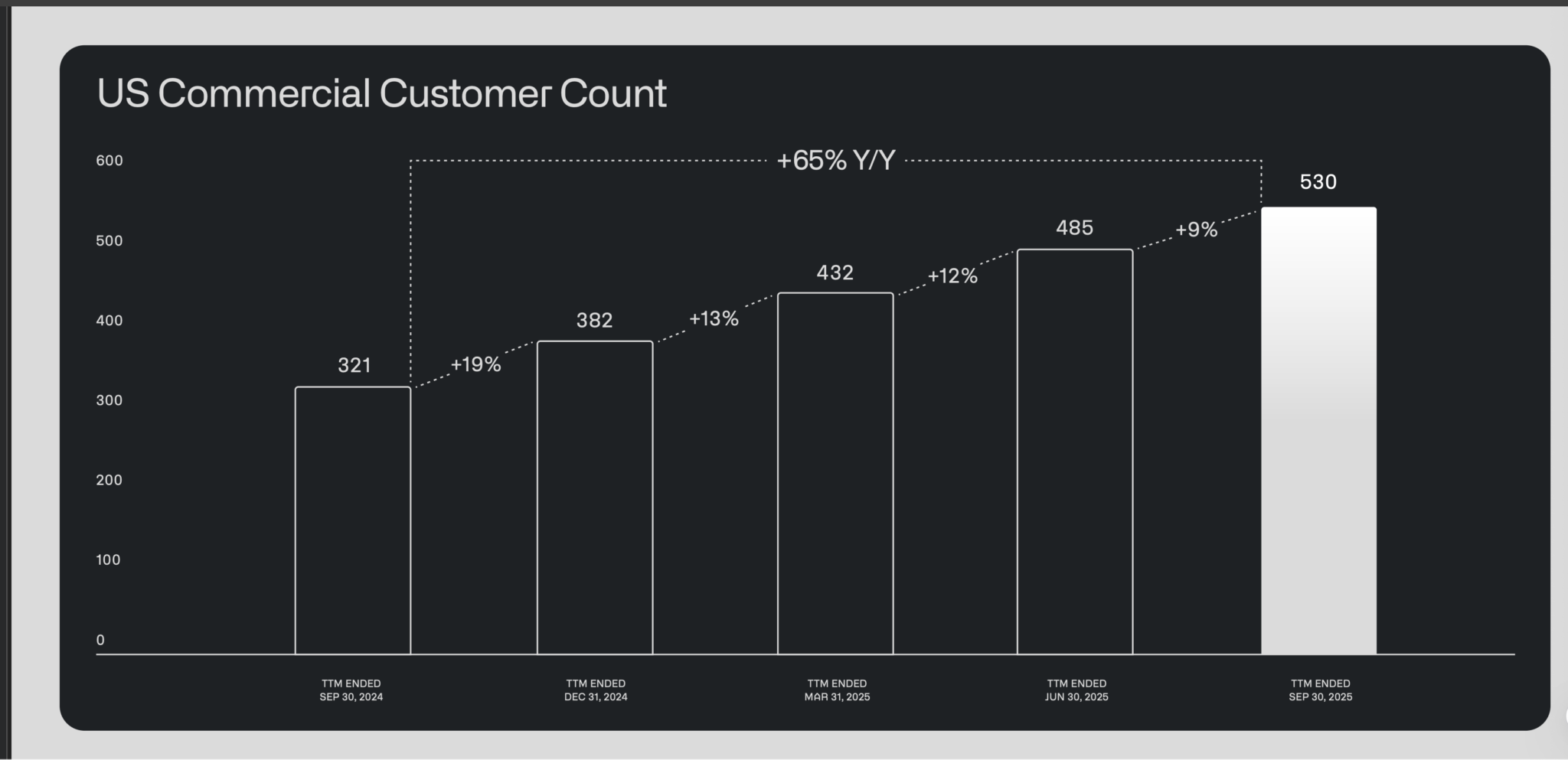

This chart illustrates the growth of Palantir’s US commercial customer count. It is up 65 per cent year-on-year, which is impressive growth.

There are 33.3 million businesses in the US, of which 18.6 million are customers of utilities, so they are likely to be the larger ones. At 530 customers, it is easy to imagine that Palantir is just scratching the surface of its potential market. And Palantir is incredibly profitable. Approaching 50pc of revenue flows into profits and free cash flow.

This money is available to reward shareholders. Palantir is unlikely to make significant acquisitions because it will never find a comparably profitable company to buy. It doesn’t need to target higher research and development spend because the whole company is an innovation machine. It doesn’t need high capital expenditures because that is not part of their business model. Even marketing is unlikely to be a significant expense because Palantir’s boot camp strategy virtually guarantees sales, and Palantiring is likely to become a viral phenomenon. If the other guys are doing it, you dare not be left behind. Palantir is all about intellectual property and absorbing customers into its ecosystem. Once there, it is hard for them to leave, and why would they want to when their return on investment is so high?

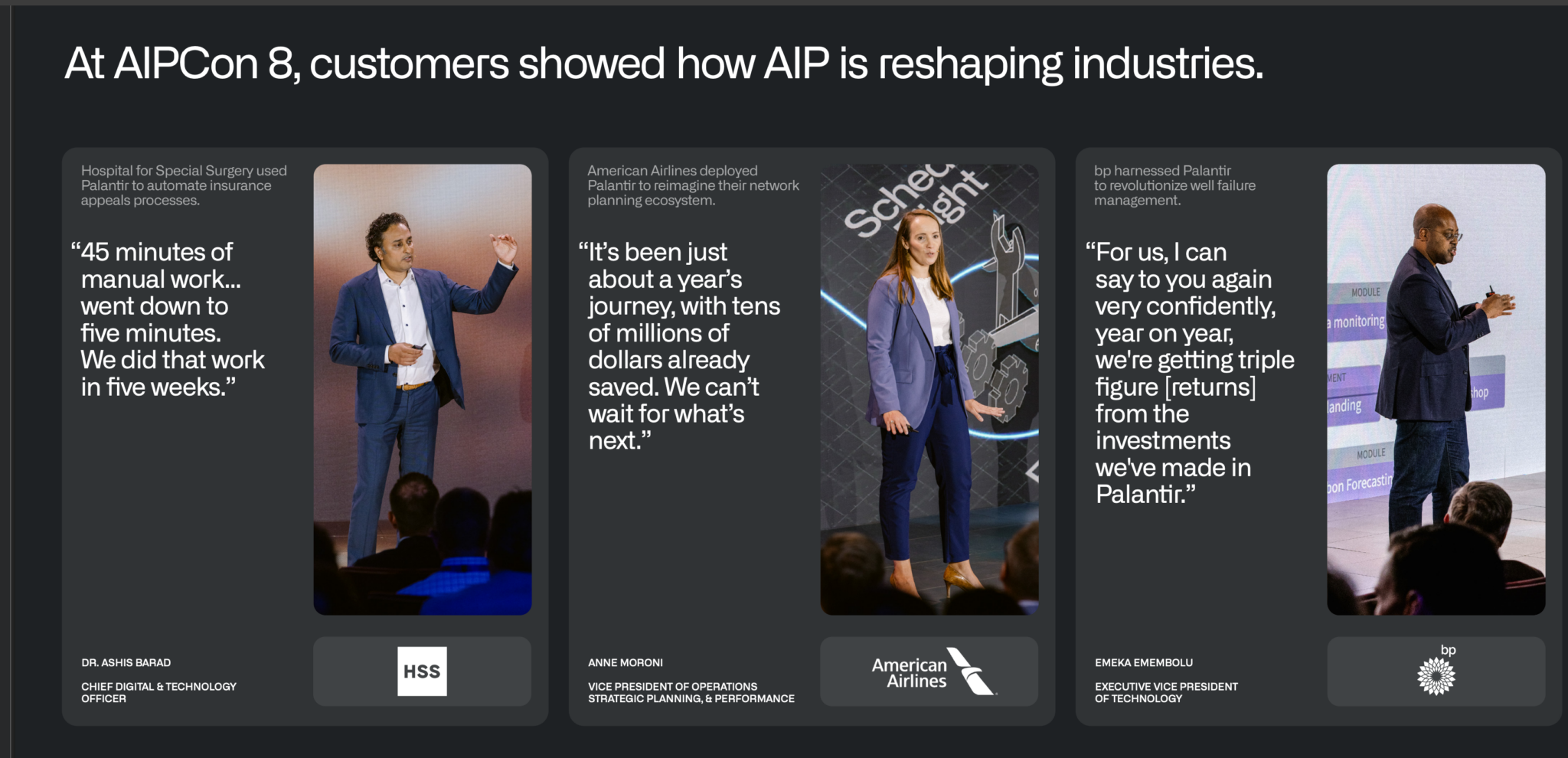

Palantir’s technology has an electrifying impact on its customers. This is why it will keep growing dramatically like a snowball rolling down a hill.

Strategy – Be A Believer And Buy The Dips

It’s time to be fearless. Nvidia, Palantir and OpenAI are among the most incredible growth stocks of all time. Buy them, own them, believe in them. My daughter thinks my OpenAI numbers are insane. Fair enough. It is just to give a flavour of the opportunities out there.

I have a theory that shares need to crouch to spring. Maybe that is what is happening. Warren Buffett is a smart guy, and he thinks Nvidia is overvalued. Maybe it is. Doesn’t mean you shouldn’t buy the shares. Top quality is always overvalued. Is a Van Gogh worth a million times the efforts of a regular landscape painter? It isn’t, but the pricing won’t change.

Warren Buffett says, like me, that ‘stock analysis is totally pointless’. Way to go, Warren, although he may be breaking his rule with Nvidia. Buffett has a philosophical belief in value that I don’t share. What I believe in is quality and excitement. Shares which have those characteristics may be volatile, but ultimately they are always worth the money.

I have just been watching a Goldman Sachs guy discussing why Buffett is such a successful investor. One thing Buffett said really resonated with me. Imagine that at birth, you are issued a punch card with 20 holes to be punched out. Each one represents a stock you can buy. Once all the holes are punched out, you can’t ever buy any more shares; that would concentrate the mind.

It would make you think carefully about what you bought, but it would also make you very reluctant to sell. And that could be the killer option. Fidelity did a study of the most successful investors. The second most successful had forgotten they had the stock. The most successful were dead!

I can imagine that AI stocks could face a dràmatic sell-off. A chartist friend of mine once said the plane needs to be flying before it can crash. These stocks are flying, and Palantir is a spectacularly richly valued stock.

Another Buffett message is that, as per the comments above, if you don’t try to trade the stocks you own but just ‘forget’ you own them, you should be OK. The trick is to own shares in great businesses, which has been the key to Buffett’s success.

Word is that Buffett thinks Nvidia is highly valued. I checked this with AI, and here is what I learned.

Warren Buffett has not publicly stated that Nvidia is highly valued in an explicit, recent comment. He and his late business partner, Charlie Munger, generally avoided commenting directly on individual high-flying tech stocks like Nvidia because they felt uncomfortable estimating their future earnings over the long term.

Here is what is known about Buffett’s stance on Nvidia and its valuation:

Avoidance, not explicit criticism: Buffett’s investment philosophy focuses on buying stocks at a “reasonable price” based on predictable future earnings. He likely avoids Nvidia because the rapid growth and speculative nature of the AI market make those earnings difficult for him to predict, not necessarily because he thinks the current market valuation is a “bubble”.

Skepticism of AI hype: Both Buffett and Munger expressed general skepticism about the overall “hype” surrounding artificial intelligence at the 2023 Berkshire Hathaway annual meeting. Munger noted he was “personally skeptical of some of the hype” and Buffett compared the advent of AI to the creation of the atomic bomb, highlighting the potential consequences rather than investment opportunities.

No direct ownership (mostly): Berkshire Hathaway does not own a direct stake in Nvidia. However, it does hold small positions in S&P 500 index funds (SPDR S&P 500 ETF Trust and Vanguard S&P 500 ETF), which in turn hold Nvidia stock, so he has indirectly profited from its rise.

Analyst opinions: The idea that Nvidia is highly valued is a common debate among other investors and analysts. Some market commentators and analysts have suggested Nvidia’s valuation is high (e.g., trading at over 35 times sales and 84 times forward earnings at one point), while others argue its strong fundamentals and market dominance in AI justify the price.

In summary, the statement that “Buffett says Nvidia is highly valued” is a paraphrase of his general investing principles applied to Nvidia’s situation, rather than a direct quote from the investor himself.

AI overview

After reading this, you may be wondering what you should do. If you are not sure, the best idea may be to do nothing and allow the dust to settle. Nvidia, Palantir, OpenAI and many other US stocks are among the greatest businesses the world has ever seen. I think it will pay to keep the faith.