Direxion Daily Financial Bull 3x/ FAS tracks US financial services giants times three

Direxion Daily Financial Bull 3x Code: FAS Quoted: US Latest price: $104.50 Annual expenses ratio: 1.00pc . Tracks: Russell 1000 Financial Services index Distribution yield (dividend yield): 0.57pc UCITS: No

“FAS provides 3x leveraged exposure to the Russell 1000 Financial Services Index—a subset consisting of large-cap financial companies from the Russell 1000 Index. FAS charges a steep fee for such exposure; however, the product isn’t designed for long-term investors. The fund rebalances daily. As a result, compounding and path dependency make its long-term returns difficult to predict when compared with its underlying index. Despite this, FAS’s asset base is indicative of strong investor interest, while its excellent liquidity is all-important in this tactical space. As always, if you plan on buying the fund, be sure to mind your exposure and rebalance appropriately.

The return of a leveraged ETF for a period longer than a day is the product of the series of leveraged daily returns for the fund within the period. It is not the return of the benchmark multiplied by the ETF’s target leverage point (3 in the case of Direxion leveraged 3X ETFs). The funds’ returns can be positively impacted by a smoothly trending index, or negatively by a volatile index for a period longer than one day. Leveraged ETFs with relatively high leverage points, should be monitored regularly to ensure that desired exposure levels are maintained. If exposure levels grow beyond, or drop below, the levels sought by the investor, reallocation should be strongly considered.

These funds are intended for use only by sophisticated investors who:

Understand and accept substantial losses in short periods of time;

Understand the unique nature and performance characteristics of funds which seek leveraged daily investment results; and

Have time to manage positions frequently to respond to changing market conditions and fund performance.”

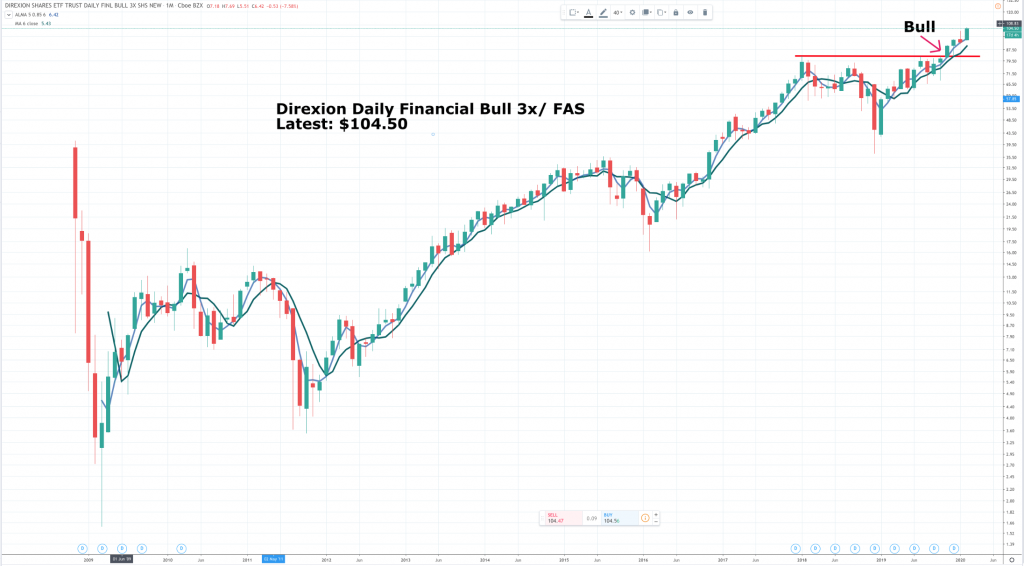

The bottom line is that these shares are great in a bull market but can kill you in a bear market. Even so it is clear that for investors who can stand the short term volatility the long term returns can be very impressive. Ten years of 27.9pc annual returns would turn £1,000 into over £11,000 but there will have been some ferocious dips along the way. Imagine what a 20pc reaction does to a 3x leveraged fund. You can see from the chart what happened in 2009 but also what happened thereafter.

We cannot see the largest holdings in the FAS portfolio because the fund is rebalanced daily; I guess they do this on a virtual basis or the trading costs would be insurmountable. The Russell 1000, an index maintained by London Stock Exchange, its full name is FTSE Russell 1000, includes the 1000 largest quoted US companies so the financial services sub-sector will be the largest financial services businesses, names like Goldman Sachs, JP Morgan Chase, American Express, Capital One, Morgan Stanley, BlackRock, Bank of America Merrill Lynch and the like. Also big in financial services are the tech giants, Alphabet, Amazon and Apple and other businesses like Visa, Mastercard and PayPal. I haven’t been able to work out whether these shares are in the index or not.

What can be said is that a strong US economy and a background of constant innovation in all kinds of businesses including financial services provides a strong following wind for these businesses to do well and they are, which in turn translates into a strong performance by the FAS ETF.

The problem elaborated above is that three times leverage makes for great volatility so this ETF is prone to sickening plunges. The second problem is that, unlike the index it is nominally tracking, it is rebalanced every day. This means its performance may differ from that of the index. It also means that the perfect market is one rising steadily and then it will do very well. A more volatile market may lead to what chartists call whiplashing where you buy high, sell low and then buy back high again. In a volatile market the ETF would likely underperform the index.

However, with all these provisos, I still think a fund that is broadly leveraging the performance of the US financial services industry by three times should do well over time and the evidence does lead to that conclusion. I wouldn’t bet your shirt on it but as a constituent of a well chosen portfolio it should make a positive contribution.

According to the chart in the five months encompassing November 2008 to April 2009 FAS shares ranged between $41.05 and $1.65. This is a volatile ETF and those were volatile times but I am still not sure I believe those numbers. However what you can see from the chart and from common sense is that staggered purchases of this ETF could make great sense. Buy some every three months and you would be doing incredibly well so that could be a strategy to consider going forward. You may also be worried that now is a high price to start buying. The problem is the price always looks high after a rise until it goes higher. It really comes down to what you feel are the prospects for the global economy, the US economy and the US financial services sector. I think prospects are good in all those areas so I am happy to be a bull of FAS and to start a buying programme right now. One advantage is that you are buying after a nice chart breakout so prospects do look positive.