Brunello Cucinello is the archetypal example of – if you need to ask the price you can’t afford it. I love their stuff but everything has an extra nought on the price compared to what you would expect to spend almost anywhere else outside the world of super luxury. It is reminiscent of the world of Regency England where aristocrats would spend hundreds of pounds on a pair of boots when a year’s salary for a domestic servant might have been £5.

There is a whole world (a surprisingly large one) of people out there who want the best and can afford it. As a result Brunello Cucinelli with its fabulous Italian luxury clothes cannot meet demand and most probably, like Ferrari, Hermes and others will do its best to make sure that this happy state of affairs continues.

Like Hermes they are adding to capacity.

During 2022, we also oversaw the purchase of a large area on the outskirts of Solomeo where in the years to come our factory will be developed further.

FY 2022, 9 January

Brunello Cucinelli operates from a place called Solomeo in central Italy which is a sort of designer hamlet, steeped in history, where BC owns the castle, the plaza, everything except the church and maybe even owns that; perhaps because of its role it is able to build new structures outside the hamlet to reflect its global ambitions.

I really like their stuff. Years ago, as a way of slowly stopping smoking, I told my wife that from then on I would only smoke Monte Cristo No. 3, a famous and very expensive brand of Cuban cigar. I stopped smoking them long ago. Now to avoid filling my wardrobe with even more stuff I rarely wear I have said that I am only going to buy my clothes from Brunello Cucinelli, which means I will really want whatever it is that I buy (and will have to save for months in order to do so).

But imagine how good I will feel swanning around wearing this maestro’s wonderful clothes. You feel a million dollars because they cost a million dollars and they kinda look a million dollars too.

I want to make Brunello Cucinelli a superstar. They are classic 3G and they certainly have the magic but I can’t really find ‘something new’ except for this inflection point that they say was reached in 2022; that sounds exciting.

Brunello Cucinelli feels to me like an Italian version of Hermes with this same somewhat otherworldly reporting of the company’s trading performance and near spiritual view of its role in the world. One difference is that BC, which is heading for sales of one billion euros in 2023 is valued at Eu5bn versus Eu182bn for Hermes and over Eu400bn for LVMH.

There seems to be a great deal of headroom for BC to become a much larger business given that it already has a significant presence in the Americas, in Europe and in Asia so is already a global business.

The company is in great form.

The considerable orders in the portfolio of the Spring-Summer 2023 collection and the extraordinary start of the Fall-Winter 2023 sales campaign lead us to envisage an excellent year, with a forecast for a fine growth of around 12pc and consequently the achievement of a relevant goal, namely one billion euros in turnover.

FY 2022, 9 January

I can just imagine that if Signore Cucinelli went to Bernard Arnault of LVMH and offered to sell his business he could name his price. Hermes is 34 times as valuable as Brunello Cucinelli but has around 12 times the sales. There is a reason for that. Hermes is insanely profitable with operating margins of 40pc v around 15pc for Brunello Cucinelli.

My guess is that a major part of the explanation for this is that Brunello Cucinelli is primarily a clothing company whereas Hermes is primarily an accessories business selling those incredible bags. This may offer an opportunity for BC as the brand becomes more visible and people are prepared to pay a huge premium to have a bag with their logo on it.

Hermes and LVMH also look great investments.

These fashion companies really are different. Take this quote from the latest shareholders’ letter.

In the first half of 2022, a wave of lightheartedness washed over the métiers, injecting boldness into new creations and originality into events for the public through a theme conducive to creativity.

Hermes, letter to shareholders, September 2022

What on earth does that mean!

They are obviously doing something right with operating profit margins in 2022 reaching an incredible 42pc. Hermes is an incredible, incredible company. In a world that seems to be embracing luxury goods more enthusiastically than ever they are perfectly positioned to prosper and their shares just climb and climb.

LVMH breaks records in 2022

The graphic below sums up how LVMH did in 2022.

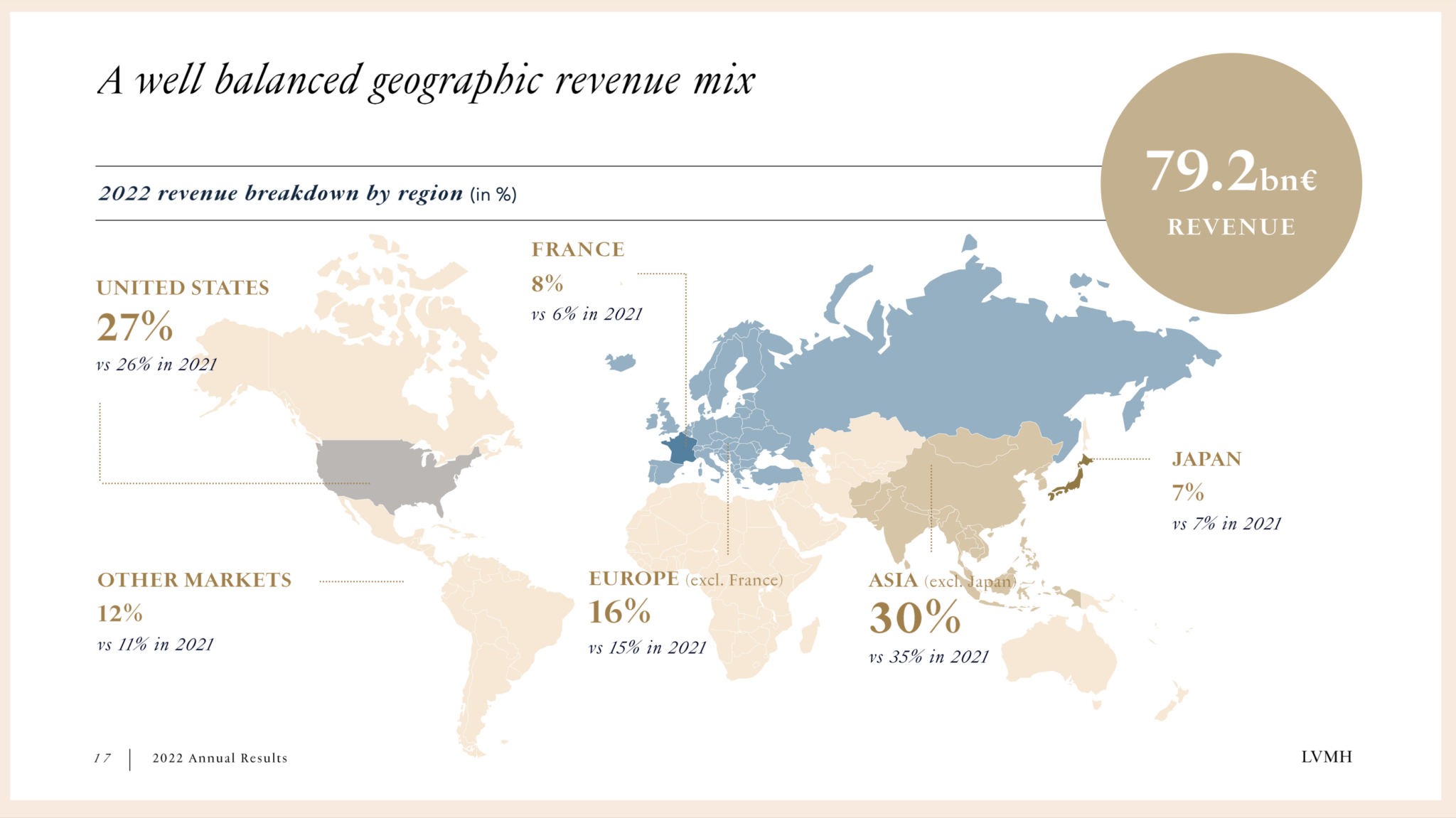

Another graphic for LVMH shows how global these businesses are.

What I have not been able to find is a specific something new but I am beginning to suspect that if there is something it relates more to the whole sector rather than any one company. Something seems to be happening to demand for luxury goods. Maybe in a world of scarcity people are deciding to buy less but better, one amazing suit rather than 10, one incredible pair of jeans, one great pair of boots and, of course, one insanely expensive designer hand bag.

All the charts look amazing.

Ferrari races ahead

I came out yesterday to find my little BMW parked in the street between two Ferraris. It is surprising how many of them there are around now and the company is trading strongly, like the other luxury goods concerns.

“Last year ended with outstanding financial results that met and exceeded our guidance and set new records across all metrics, such as a net profit of Euro 939m and an industrial free cash flow generation of Euro 758m. These figures provide the base for an even stronger 2023, fuelled by a persistently high demand for our products worldwide,” said Benedetto Vigna, Ferrari CEO. “Despite a complex global macro scenario, we look ahead with great confidence, encouraged by the many signs and achievements of an evolving Ferrari. We are constantly innovating our products and processes, and getting closer to our decarbonisation targets. All this is possible thanks to the collaboration, will to progress, continuous learning, focus and confidence that set our people apart”.

FY 2022, 2 February 2023

Strategy

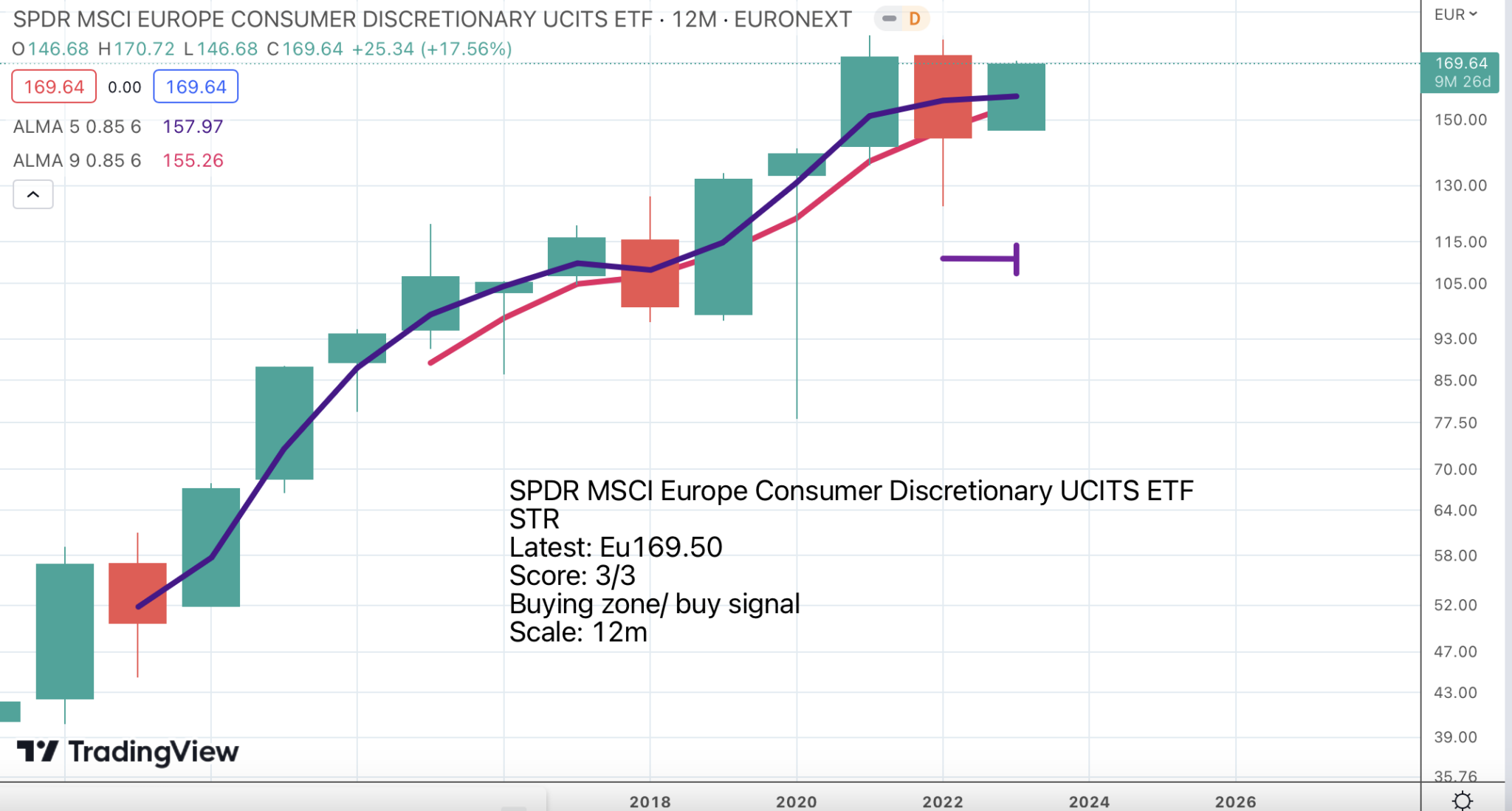

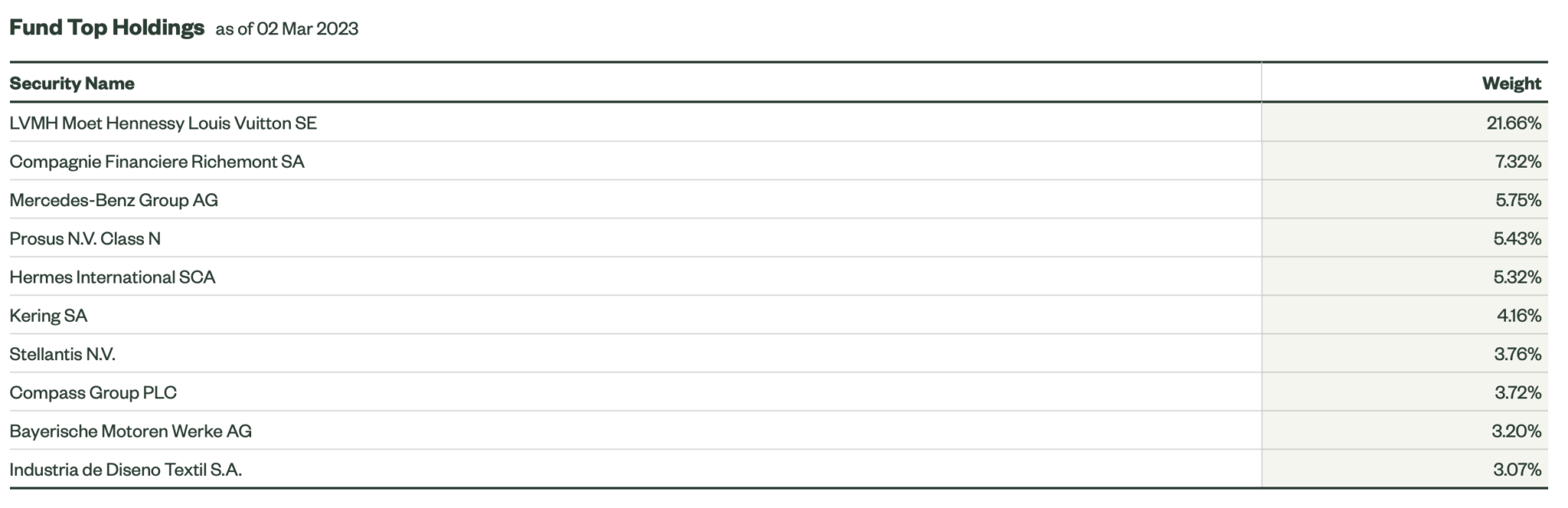

The ETF with the largest holding in LVMH is SPDR Europe Consumer Discretionary, charted below. The chart looks very solid although no breakout yet.The 10 largest holdings are also shown below. This ETF would look an interesting purchase on a move to a new high but for the moment I would prefer to hold shares in the luxury goods shares companies directly. All four look worth buying. My preference is for Brunello Cucinelli but that is probably because I like the clothes so much.

I first found out about Brunello Cucinelli when Ted Sarandos, then the content officer for Netflix, now co-CEO, said he loved their suits and he is a very stylish guy.

Recommendations

Brunello Cucinelli. BC. Buy @ Eu80

Hermes. RMS. Buy @ Eu1735

LVMH. LVMH. Buy @ Eu815

Ferrari. RACE. Buy @ US$271

SPDR Europe Consumer Discretionary ETF STR. Buy @ Eu169.5