I am starting to see signs that Chinese stocks may be poised to turn higher after a long decline. Meituan is a fast growing Chinese shopping platform. It had over 290m monthly active users and 600m registered users as of April 2018. In Q2 2021, GTV of Meituan food delivery business increased by 59.5pc year over year. The daily average number of food delivery transactions increased by 58.9pc year over year to 38.9m.

Latest results showed strong growth barrelling ahead. “For the full year of 2021, our total revenue increased by 56pc year-over-year to RMB179.1bn. We continue to innovate and leverage technology to provide consumers with a more diverse and high-quality services. We are delighted to see that our annual transacting users increased to 690.5 m by the end of 2021. The average number of transactions – transacting user increased to 35.8 in 2021 from 28.1 in 2020, despite the COVID macro impact.”

In order to buy Meituan I am looking for a triple B buy signal (broken down trend line, golden cross by the moving averages and a rising Coppock). A the moment we have one of the 3Bs so this does not qualify as a blue for my blue to red trading strategy. Note that the earlier blue to red worked very well with a doubling or even tripling of the share price over the holding period.

I don’t have an earlier triple B buy signal although effectively I am sure there would have been one around May/ June 2019. It takes 22 months of trading before you can generate the figures for a Coppock indicator so we have nothing before May 2020.

This is another chart to illustrate what is happening with Chinese shares quoted on Nasdaq and in Hong Kong. As you can see the blue to red strategy looks as though it would have worked well though as usual I must caution that it is much easier to do with 20:20 hindsight than in real time.

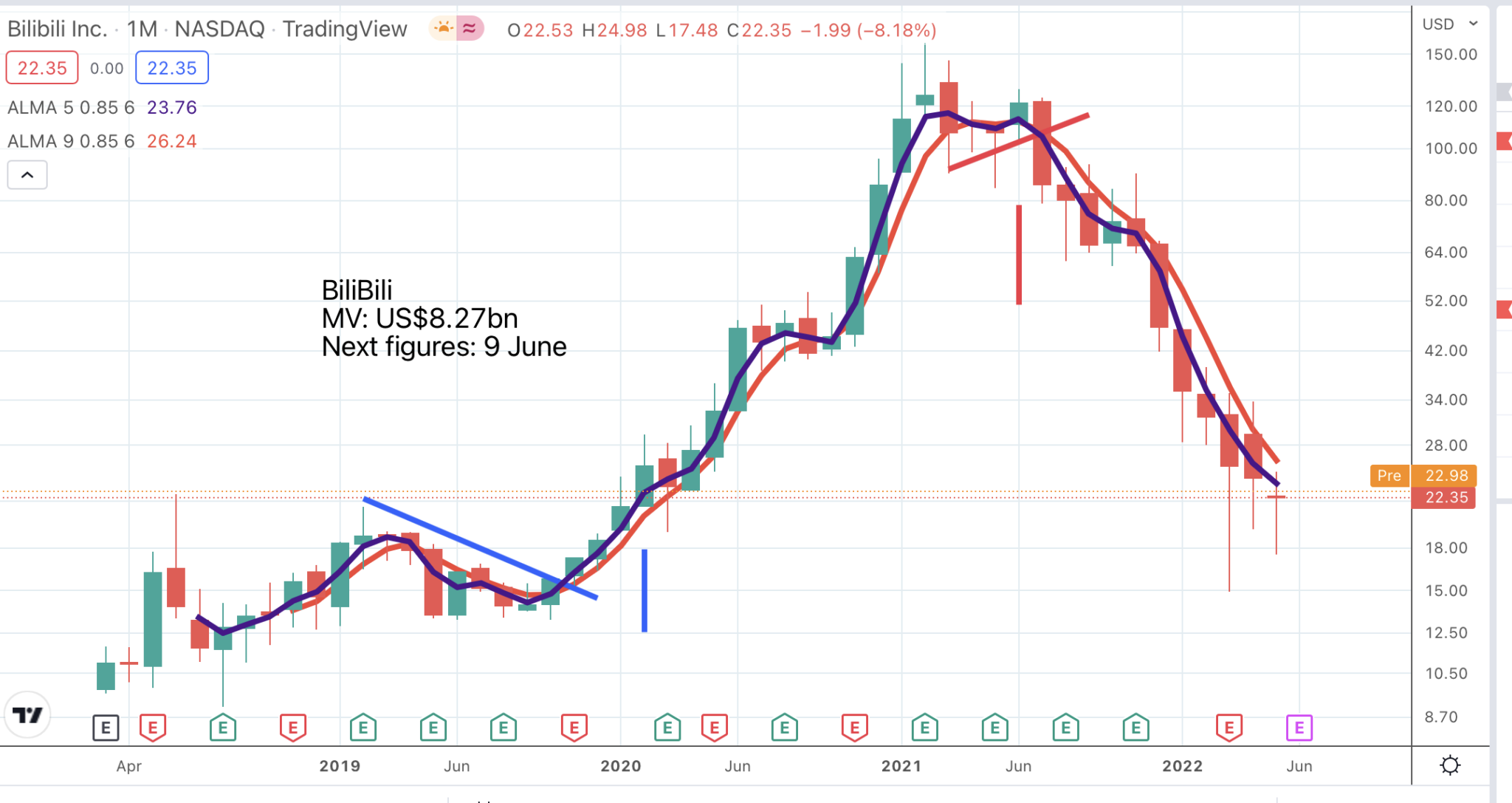

We don’t have any kind of buy signal at the moment following a clear sell signal in the summer of 2021. If we do get a blue it would make sense to act on that and look closely at fast-growing shares in individual Chinese businesses like Nio (electric cars), BiliBili (video sharing and video on demand) and Futu (online stockbroking and fund management).

None of these has yet given a buy signal but they have all fallen sharply from earlier peak levels and are showing signs of building a base so a period of rising prices could begin shortly. Blue to red trading strategies would have worked well with all these shares in the past, allowing you to profit from strong rises between 2020 and 2021 while avoiding most of the sharp fall in sharp prices that began in the summer of 2021.

The chart above illustrates the blue to red strategy as applied to BiliBili. It worked incredibly well capturing an increase from around $20 to around $100. And you have been out of the shares since June or July 2021 which was also a good idea.

I’m sure a scientist would say that there is no reason what has happened in the past should have any bearing on what is going to happen in the future. In terms of its predictive quality my 3B buying signal, when it finally comes, should not tell us anything about what the share price is going to do. I can see that; why should it?

And yet the message from looking at share after share after share is that it does. Psychology, momentum, trend chasing, whatever is so important in determining the behaviour of share prices that they do have a marked tendency to move up and down in long swings. We have had a long swing up, followed by a long swing down and I am looking for a sign that we are above to have another long swing up. It may not be as cast in stone as the laws of physics but observation suggests that what I am looking for is a very good bet. I might even say a very good spread bet.

It hasn’t happened yet. One reason for not jumping the gun is that like me you probably never expected BiliBili to fall this far but also other shares may signal buying before BiliBili and they will be the ones to buy first.

Futu Holdings has been another blue to red classic. The red sell signal in the summer of 2021 has kept us out of the shares for a sharp period of decline. There are now encouraging signs that we could be close to a 3B buy signal. The Coppock curve has declined from 1,807, where the red vertical line is marked on the chart to minus 104 currently. It is flattening out which is what you would expect if it is about to turn higher.

Another straw in the wind is that after a sequence of 10 red (bearish) candlesticks we now have a completed green (bullish) candlestick for May. June is green so far but has just begun. Nevertheless on my buy on a green strategy Futu is already a buy for bold investors.

Futu remains a strongly growing business that would be 3G but for the plummeting share price. “Our total revenue was HKD 1.6 bn, up 35pc from HKD 1.18bn in the fourth quarter of 2020, ending a strong year as full year 2021 revenue grew 115pc to over HKD 7bn.”

A key feature of my blue to red trading strategy is that it makes no attempt to capture all the gain in any particular share price. All we are doing is buying into shares in a fast growing, exciting 3G company on a clear (blue) buy signal and then selling on a red sell signal. The idea is to make a large profit and make it safely, avoiding the risk of holding a share which either does nothing for a long period or goes into a precipitous decline.

If the strategy works as well as I hope then it makes it safer to use leverage by buying shares in a spread betting account where timing of buying and selling is so important. This both enormously increases the gains and means that you can operate the strategy without the complication of worrying about tax.

The last element in this strategy which I am also exploring is the idea of making additional purchases in mid uptrend on fresh minor breakouts using the additional equity created by the earlier rise. This creates something like the QQQ3 effect where daily rebalancing turns a four fold rise in the underlying Nasdaq 100 index into an 86-fold rise in the shares of QQQ3. This becomes safer to do if you know that you have an exit strategy.

Yet again I must repeat that this is harder to do in practice than in theory. One thing that could be helpful is that the Coppock indicator turns down when upwards momentum starts to fade. This means we can and often do have a Coppock sell signal while the shares are still rising. But now, as a result of Coppock turning down, we are on red alert. If we see the other two signals from the trend line and the moving average we know we need to sell. We may also take the view, if we are showing very good profits, that it may be time to cash in and keep our powder dry for a new set of 3B buy signals.