Charts point down, fundamentals point up as the technology revolution rockets on

Back in the day doctors use to bleed patients in the mistaken belief that this would make them better. Today’s stock markets, especially in the USA, seem to be the same. Periodically they seem to need a period of blood letting before they can resume their secular climb. As a leveraged investor I feel this especially strongly but even without leverage there have been some ferocious falls. An ETF with the code KWEB, which specialises in Chinese Internet shares, is down from $105 to $38 in less than a year even though many Chinese Internet shares are still delivering strong growth.

I am watching these Chinese shares for signs of a turning point. One indicator I am looking at is the Coppock Curve a weighted momentum index which needs to turn negative to set the scene for a new buy signal. This has duly happened. After peaking at around 140 it is now nearly minus 100 so the next signal, given by the indicator turning higher, will be interesting.

The charts are still pointing down for many shares but they are starting to come into conflict with the excellent fundamentals underpinning the performance of many shares, especially in technology where the unfolding revolution continues apace.

IT consultancy and software provider, ServiceNow, is a good example of what is happening. The charts turned down and the shares got hammered, falling from a peak $707.6 to a low point around $480 in three months. Then they reported earnings, which were modestly ahead of expectations. The shares rocketed back over $600. They may now bounce around but it seems increasingly likely that the latest period of weakness is similar to the seven others which have occurred since 2012. The long term rising trend looks intact, which is where the whole idea of never selling comes in.

I am too leveraged to do that but with an unleveraged portfolio never selling remains the way to go as long as your holdings retain their core 3G characteristics which ServiceNow clearly does, like most of the shares in the QV portfolio. Investors loved the tone of the ServiceNow statement that accompanied the figures. “We’re growing like a fast-moving start-up with the profitability of a global market leader. We’re on a clear growth trajectory to $15bn plus [in sales] by 2026.“

One difficulty for investors is that with every period of rising share prices valuations are pushed a little higher. At the peak price ServiceNow was valued at $141bn which is 20 times projected revenues for 2022. In 2016 ServiceNow was briefly valued at around $6bn or 3.2 times sales that were delivered in 2017. The latter looks very cheap but shows why shares can be volatile.

The key thing for investors is that as long as the business continues to grow strongly, corrections always provide buying opportunities. In this issue of Great Stocks I am going to look at shares delivering strong growth where it is reasonable to assume that as with ServiceNow share price corrections such as we have just been seeing provide buying opportunities.

I would caution that in some of these cases the charts are still pointing down but then buying at the absolute low point is always going to be more luck than judgement. I would also admit that as always I tend to have a bias towards short-term strength in making my selections.

Alphabet. GOOGL. Buy @ $2,690 – “In Q4, Cloud revenue grew 45pc year over year to $5.5bn.”

Amazon. AMZN. Buy @ $3054 – “… we continue to feel optimistic and excited about the business.”

Apple. AAPL. Buy @ $168 – “We never stop creating. We never stop innovating.”

Atlassian. TEAM. Buy @ $321 – “Cloud sales from our channel partners were up 131pc in Q2 2022”

Bill.com. BILL Buy @ $238.50 – “Total revenue for the quarter nearly tripled year-over-year.”

Datadog. DDOG. Buy @ $163.5 – “… not only do we continue to see a very strong demand environment, we also kept innovating at a rapid pace.”

ServiceNow. NOW Buy @ $581.5 – “Our organic growth machine is in full flight, and our pipeline is stronger than ever.”

Snowflake. SNOW. Buy @ $297.5 – “… the race is on to lay the foundation for a digital data-driven infrastructure. Snowflake is and will be a critical enabler of this journey.”

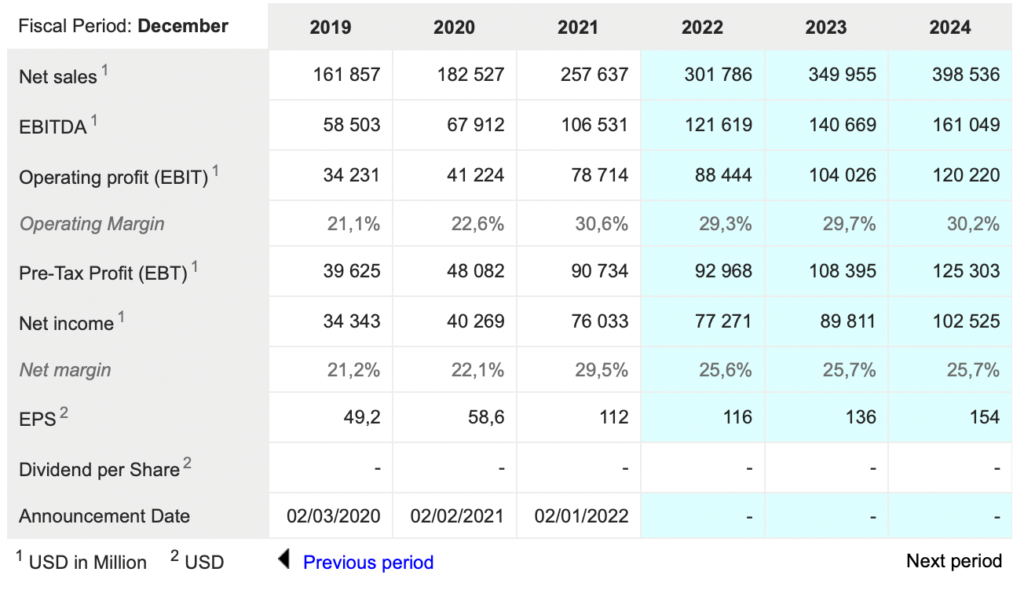

Alphabet. GOOGL. Buy @ $2,690 (equivalent to $134.25 after the planned 20:1 share split due to take effect on 15 July 2022). Times recommended: 26. First recommended: $985.19. Last recommended: $2,978

Alphabet announces 20 for 1 share split and keeps investing to deliver strong growth

Alphabet has announced a 20:1 share split due to take effect on 15 July which is likely to be a support for the shares in the run up to that date. It has also recently announced continued strong trading. Q4 2021 sales rose 32pc. Sales for the whole year grew 41pc to $257.6bn, which is incredible going for such a large business.

Alphabet is a technology conglomerate with who knows what exciting things happening behind the scenes. There are three fabulous businesses at the heart of the group, Google Search, You Tube, which received a huge boost from lockdown and Google Cloud.

Part of what enables Alphabet to grow so fast is that it generates loads of cash which is available to invest in each of its core businesses and much else besides. It even had enough left over to purchase $50bn of its own shares in 2021.

It is amazing what is going on at businesses like Alphabet in terms of the communities that they support. “Last year, the number of YouTube channels that made at least $10,000 revenue was up more than 40pc year over year, and we are continuing to improve support for artists and creators.” It’s like Alphabet is not just a business it is a way of life which is becoming increasingly vital to billions of people on the planet.

The third biggest of Alphabet’s Crown Jewels is the Cloud business and that is growing at a formidable rate. “In Q4, Cloud revenue grew 45pc year over year to $5.5bn…… “Our sales force, which we have more than tripled since 2019, delivered strong results across geographies, products and industries, and we continue to invest. For the full year 2021, compared with the full year 2020, we saw over 80pc growth in total deal volume for Google Cloud Platform and over 65pc growth in the number of deals over $1bn.“

The other staggering thing about these huge businesses and so many US businesses is the pace of innovation. It’s a bit like evolution, which has speeded up dramatically over the aeons and is now running at an unimaginable pace. The same is happening with innovation. Company reports now are often mainly about all the exciting new changes they are making to improve existing products and introduce new ones. We live in a world of accelerating change. The companies like Alphabet making that happen are becoming behemoths with no end to the growth in sight.

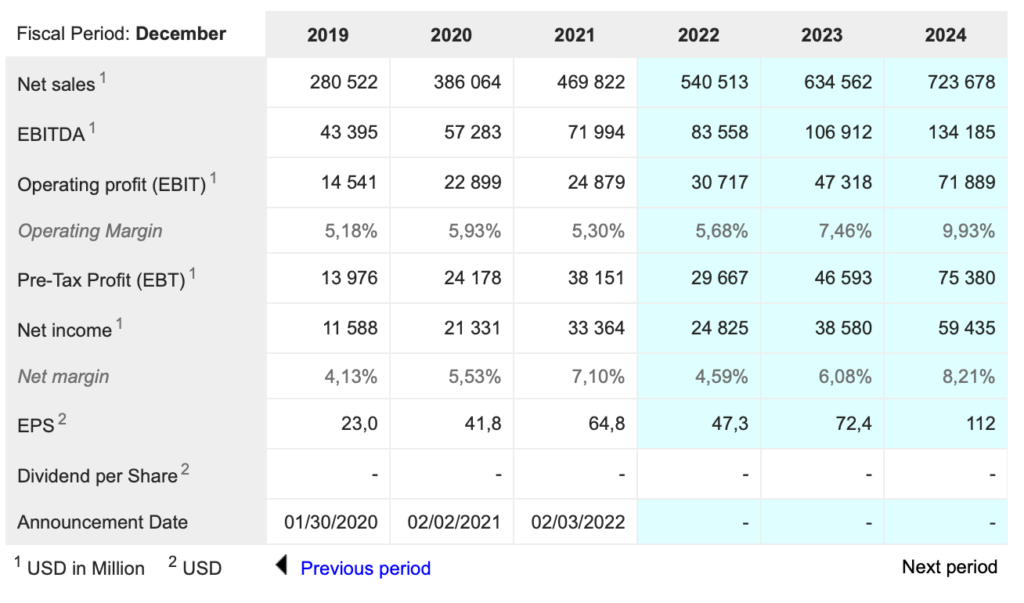

Amazon. AMZN. Buy @ $3054. Times recommended: 32. First recommended: $ 984. Last recommended: $3,509

Amazon spends twice as much on research and development as the whole of Italy

Amazon is a tricky one for me to recommend because the chart looks somewhat like a top. However if I stop paying attention to the charts, especially the ones that look negative and just go with the fundamentals and my gut instincts it is easy to feel positive about Amazon and many other exciting technology-based businesses.

CEO, Andy Jassy, was also bullish on prospects. “We continue to feel optimistic and excited about the business as we emerge from the pandemic. When you combine how we’re staffing and scaling our fulfillment network to bring even faster delivery to more customers, the extraordinary growth of AWS [Amazon Web Services] with 40pc year-over-year growth (and now a $71bn revenue run rate), the addition of marquee new entertainment like The Lord of the Rings: The Rings of Power and Thursday Night Football, and a plethora of new capabilities that we’re building in areas like Alexa, Ring, Grocery, Pharmacy, Amazon Care, Kuiper, and Zoox, there’s a lot to look forward to in the months and years ahead.”

As with all the companies featured in this issue the pace of innovation remains incredible as does the scale of investment in growth. Gigantic as Amazon already is it looks odds-on to become a great deal bigger in future with a trillion dollars in sales just another stepping stone.

I also suspect Amazon would look good on a sum of the parts basis. AWS alone must surely be worth a trillion dollars which leaves $600bn for all the rest – the e-commerce behemoth, Amazon Prime with over 200m subscribers and where prices are currently being increased from $12.99 to $14.99 for US subscribers and the fast growing advertising business. Amazon advertising revenue was $9.7bn in the last reported quarter, up 32pc on a year earlier and making it the third largest ad platform after Alphabet and Facebook.

Last but not least is the staggering pace of innovation. Amazon shareholder reports are like shopping lists of innovations across all areas of the business. It is as though Amazon is one giant innovation machine. Just to give the flavour of what is going on. In 2020 Amazon spent $42.7bn on R&D. By contrast the whole of Italy spent around 26bn euros ($27bn). In the current year Amazon’s spend is already running at over $60bn. That is more r&d spend than most companies have revenue and explains why the group is able to innovate on so many fronts simultaneously.

European leaders whinge constantly about these tech giants. They should be so lucky. Thank goodness we are out of hidebound Europe. Come on Boris; take a leaf out of the American playbook and take the shackles of British entrepreneurs. Governments and bureaucrats are useless at running economies so stop trying and give the people a chance.

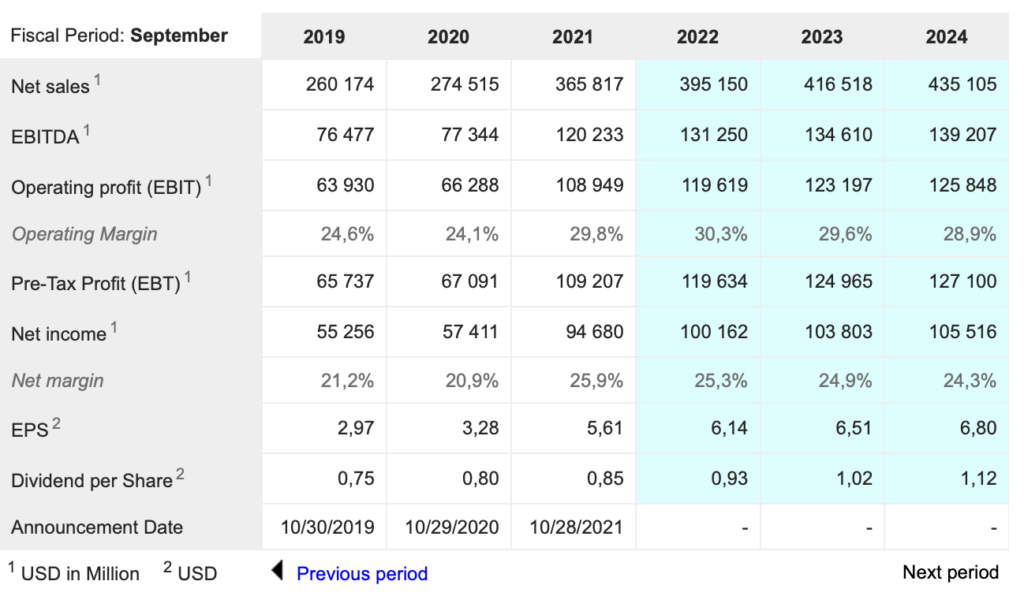

Apple. AAPL. Buy @ $168 Times recommended: 31 First recommended: $39.46 Last recommended: $165

Since 2012 Apple has bought back nearly 10bn shares lowering share count by 36pc

In some ways I feel as though I am going through the motions when I write about companies like Alphabet, Amazon and Apple. We know they are amazing companies. Unless we have retired to the Outer Hebrides as someone I know has done by effectively going to live alone on the northern tip of Scotland these companies will touch our lives in many ways. They are among the great innovators of the modern era.

As CEO, Tim Cook, said when reporting Q1 2022 results. “Today, we are proud to announce Apple’s biggest quarter ever. Through the busy holiday season, we set an all-time revenue record of nearly $124bn, up 11pc from last year and better than we had expected at the beginning of the quarter. And we are pleased to see that our active installed base of devices is now at a new record with more than 1.8bn devices.” How many times have we heard something like this from Apple in the past and how many times will we hear it in the future. This is an incredible company, which is one reason why, in a struggling market, the shares are still trading close to their all-time high.

As Cook went on to say. “We never stop creating. We never stop innovating. You can see that spirit reflected throughout our products from the incredible performance and capability of our M1 chips to our powerful yet easy to use operating systems to our unrivaled iPhone camera systems to the beauty and magic of AirPods. That’s why each of our major products leads the industry in customer satisfaction for their respective category. People expect Apple to solve hard problems with easy-to-use products. And iPhone [invented under Steve Jobs leadership 15 years ago] has never been more popular.”

These are the things that matter almost more than the numbers. “During the December quarter, we set an all-time revenue record for iPhone, thanks to the strength of our incredible iPhone 13 lineup. This is the best iPhone lineup we’ve ever had, and the reaction from the press and our users have been off the charts. This past quarter, we also set another all-time revenue record for Mac, with customers eager to get their hands on an M1-powered MacBook Air, iMac, or MacBook Pro. We’ve been thrilled with the response from Pro users to the M1 Pro and M1 Max chips and to see how Apple silicon is blowing them away with its power, performance, and efficiency.”

Strong product sales and the growing installed base are driving strong services revenue and high gross profit margins. “The growth in the installed base was broad-based as we set all-time records in each major product category and in each geographic segment. Our services set an all-time revenue record of $19.5bn, up 24pc over a year ago, with December quarter records in every geographic segment. Company gross margin was 43.8pc, up 160 basis points from last quarter due to volume leverage and favorable mix, partially offset by higher cost structures. Products gross margin was 38.4pc, up 410 basis points sequentially, driven by leverage and mix. Services gross margin was 72.4pc, up 190 basis points sequentially, mainly due to a different mix.”

The superlatives just keep coming. “Net income of $34.6bn and diluted earnings per share of $2.10, both grew more than 20pc year over year and were all-time records. Operating cash flow of $47bn was also an all-time record.”

This performance is great for shareholders. “Due to our strong operating performance and holiday quarter seasonality, we ended the quarter with $203bn in cash, plus marketable securities. We decreased commercial paper by $1bn, leaving us with total debt of $123bn. As a result, net cash was $80bn at the end of the quarter. Our business continues to generate very strong cash flow, and we’re also able to return nearly $27bn to shareholders during the December quarter. This included $3.7bn in dividends and equivalents and $14.4bn through open market repurchases of 93m Apple shares. We also began a $6bn accelerated share repurchase program in November, resulting in the initial delivery and retirement of 30m shares.”

Since 2012 the number of Apple shares outstanding has gone from 26.5bn to 16.9bn. On top of that the group pays rising dividends. It truly is a value creation machine for shareholders.

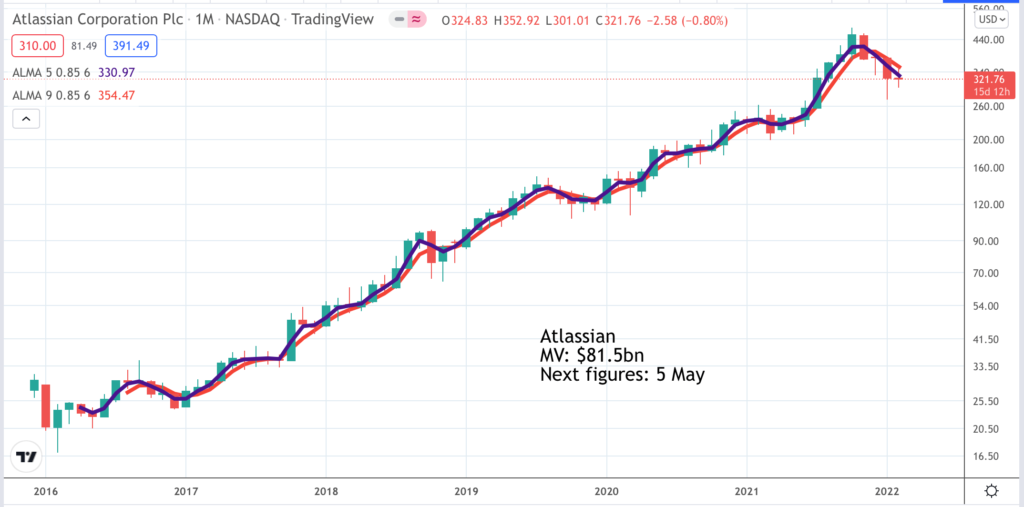

Atlassian. TEAM. Buy @ $321. Times recommended: 20 First recommended: $110. Last recommended: $458

Transition to the cloud helps Atlassian drive 64pc growth in subscription revenue

Atlassian is a fabulous business, superbly managed, trading well and with huge opportunities in front of it. The latest results beat expectations. So what has happened to the shares in the last four months. They have lost almost exactly a third of their value. Excuse my French but – bloody stock market!

The problem with a share quote is that the valuation of the business is no longer done in a rational way but by an ever-changing committee of manic depressives. When they feel high the price goes through the roof. When they feel down it tumbles and this happens, in the short term at least, almost regardless of what is going on with the business.

This is what makes it so hard to make money from short-term investing because you are trying to anticipate these wild emotional swings. You can try using charts but you won’t be alone doing that either.

The alternative as practised by Warren Buffett, many other wise investors and most especially by the founders and main owners of the business is to invest for the long term and think like an owner.

Atlassian is an Australian software company that more or less invented the category of software to help teams of employees work together more effectively. It is so Australian you can almost imagine the employees singing Waltzing Matilda as they come into work, if they do, many work at home using their own brilliant software.

Atlassian was founded in 2002 by Mike Cannon-Brookes and Scott Farquhar, who are still both young and joint CEOs. The company was founded long enough ago that only now is it making the transition from traditional software (licence and upgrades) to SaaS software, constantly updated from the cloud and generating revenue from subscriptions.

This is what they say about their business. “Customers look to Atlassian for innovative products that take the “work” out of teamwork, and we’re committed to coming through for them. We’re building a cloud platform that lets us ship new capabilities and products quickly. By anticipating the trends in our three addressable markets, investing heavily in R&D, playing the long game with our uniquely efficient GTM [go to market] model, and staying true to our values, Atlassian is delivering a metric tonne of value.”

It’s working (pun intended). “Coming off a solid start to the fiscal year, the Atlassian flywheel kept our momentum high and delivered a bonza ?? Q2. We landed over 10,000 net new customers this quarter, 98pc of whom chose Cloud, and made steady progress migrating our on-premises customers. Total revenue grew 37pc year-over-year, driven by subscription revenue, which grew 64pc year-over-year.”

Atlassian is a class act. “Between migrations, customers expanding their footprint in the Cloud, strong adoption of Premium editions, and new customer additions driven by Free editions, Cloud Q2 revenue was up 58pc year-over-year. Of note: approximately one-third of total Cloud migrations in Q2 came from Data Centre. Continuous improvements to our platform allow us to welcome even our largest and most regulated customers to Atlassian Cloud.”

As they might say themselves, as a business Atlassian is ‘a little ripper’. Like bitcoin these days nobody can say definitively what this wonderful business is worth but what I am sure is that the current reaction, however long it lasts and deep it goes, is against the main trend which is up.

As they also say it is all about the talent. “Atlassian is recruiting the most talented people to support our goals, even if they don’t turn up to an office every day. Over 40pc of the new Atlassians hired in calendar 2021 live more than two hours away from the nearest Atlassian office. That number will keep growing as we ramp up the pace of hiring over the next several quarters. Hiring is the key to Atlassian’s future and our top priority – full stop. We deeply believe in the massive market opportunities in front of us, and investing in people is our path to seize these opportunities. It’s also our biggest challenge. Behind every headline about the “Great Resignation” are a hundred companies duking it out for the best talent. We believe Atlassian can, and will, win the right people on the strength of our award-winning culture, compelling mission, competitive compensation, and flexible work environment.”

Atlassian looks a buy any time but the next buy signal will be exciting. Read about it here on Quentinvest.

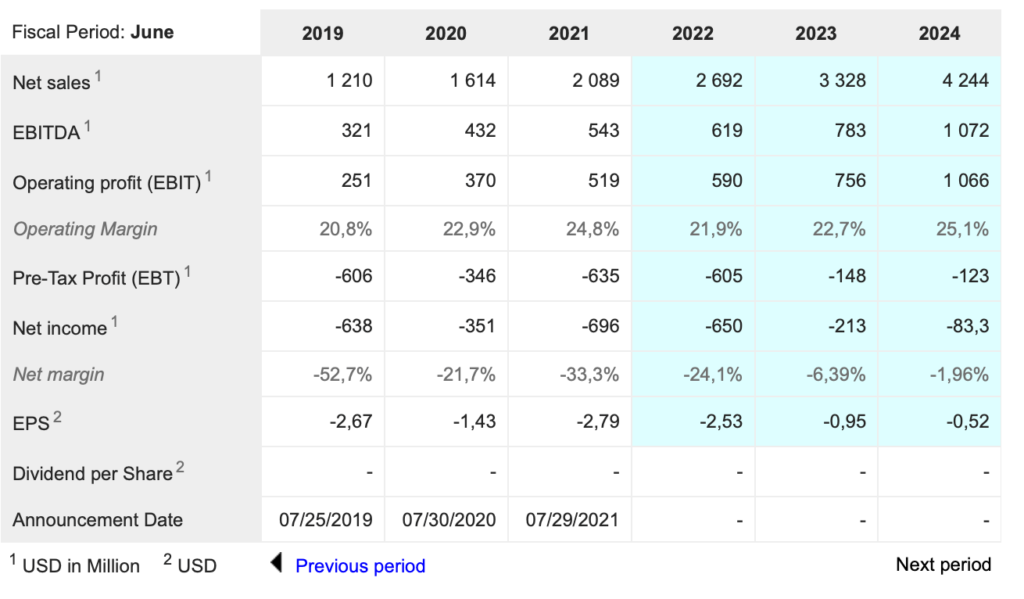

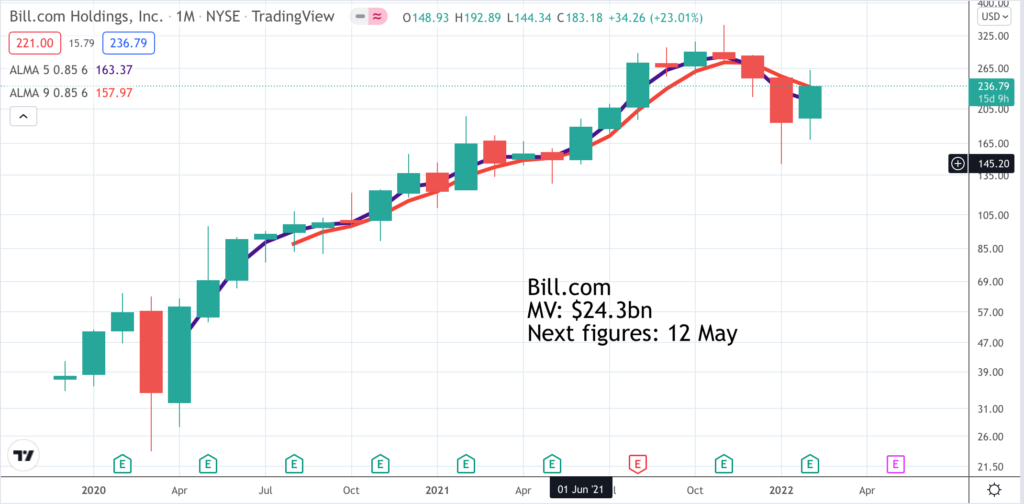

Bill.com. BILL Buy @ $238.50. Times recommended: 17. First recommended: $37. Last recommended: $334

Bill.com trebles revenue in a year, appoints new superstar chief revenue officer

Bill.com is growing at a breakneck pace. “Total revenue for the quarter nearly tripled year-over-year. Bill.com’s organic core revenue increased 85pc year-over-year, while revenue from our Divvy spend management solution grew 188pc year-over-year. Q2 marks the fifth consecutive quarter of an accelerating core revenue growth as customer adoption of our platform has continued unabated. We ended the quarter at breakeven from a non-GAAP earnings perspective, well ahead of our expectations. We are well on our way to becoming a profitable, multibillion dollar revenue company, delivering the all-in-one platform for small and midsized business financial operations.”

This company is so hot it is smoking. Needless to say the shares are all over the place as the maniacs and the depressives fight it out. In November the shares peaked at $348.50, by January they had dropped to $143, a decline of 59pc and the latest price is somewhere around the middle of those two extremes.

When I look at earnings projections they normally go about three years out so to the year to 30 June 2024 in the case of Bill.com. Presently the company is valued at around 22 times sales for fiscal 2024 based on enterprise value (market value less net cash in hand) divided by sales. My impression is that no matter how fast the business is growing a figure of 20 times sales three years out may be about as far as investors are prepared to go in this market. At the peak this valuation ratio had reached 32.7 which may help explain the extreme volatility.

On that analysis if the big bad bear starts to drive the price below 20 times 2024 sales, perhaps on the outbreak of war between Ukraine and the Russian mafia, the shares would be falling into cheap territory. There is certainly no hint in the latest quarterly result of any loss of momentum in the business; on the contrary growth is accelerating.

What does Bill.com do? “We are helping SMBs [small and medium sized businesses] transform at a significant scale. As of the end of Q2, more than 350,000 businesses were leveraging our solutions to simplify and automate their back offices. These businesses trust our platform to manage their financial operations and process their payments, which in the second quarter totalled more than $55bn in TPV [total payments volume]. Bill.com is a champion of SMBs. Our mission is to make it simple to connect and do business. Most SMBs are still encumbered by manual back-office processes that are inefficient, opaque and are time-consuming. Bill.com’s platform serves as a digital accelerant for these businesses, transforming their financial operations. With Bill.com, SMBs get more visibility and control of their cash flow, freeing them up to work on the fun and rewarding part growing their businesses.”

Bill.com recently acquired Divvy, a spend management solution which grew 188pc in the latest quarter. In an intriguing development the CEO and co-founder of Divvi has become the chief revenue officer for the whole group. It sounds like he must be a bit of a player; especially since his promotion led to Bill.com’s former CRO leaving the company.

Nor is he the only new recruit. “In Q2, we welcomed Sarah Acton as our Chief Marketing Officer. Sarah brings a wealth of brand and leadership experience from her years at Yahoo! and LinkedIn. She has built leading global brands across both business and consumer markets. Sarah will accelerate our marketing and brand-building efforts and play an important part in our future growth. We are thrilled to have her on the Bill.com team.”

Bill.com is a classic enterprise software business with a glittering future. “We are in the early stages of digital transformation for businesses. We have a strong track record of introducing new services to meet customer demand, and we are accelerating our pace of innovation to capture the tremendous opportunities ahead of us.”

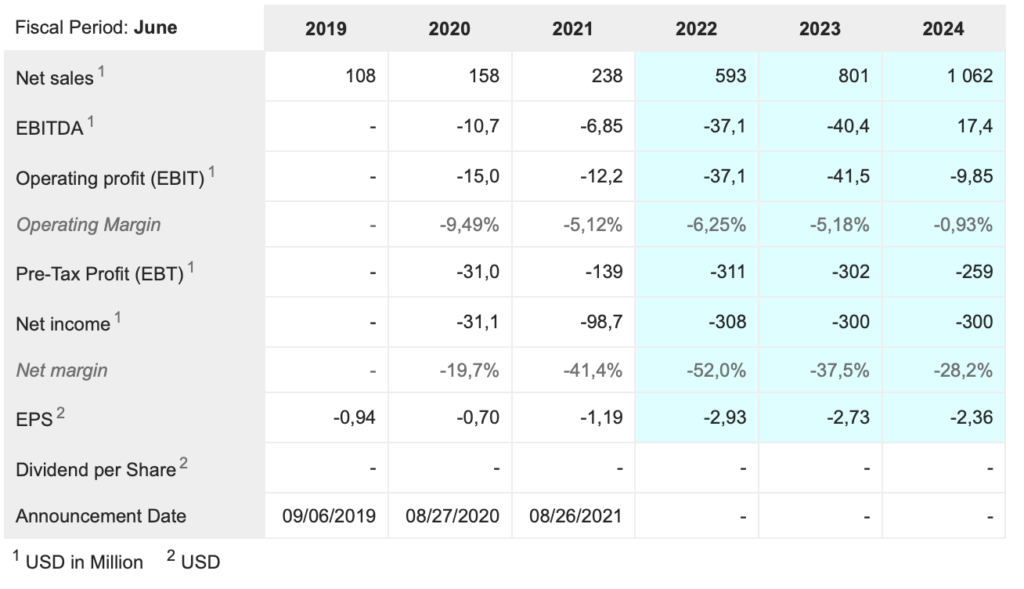

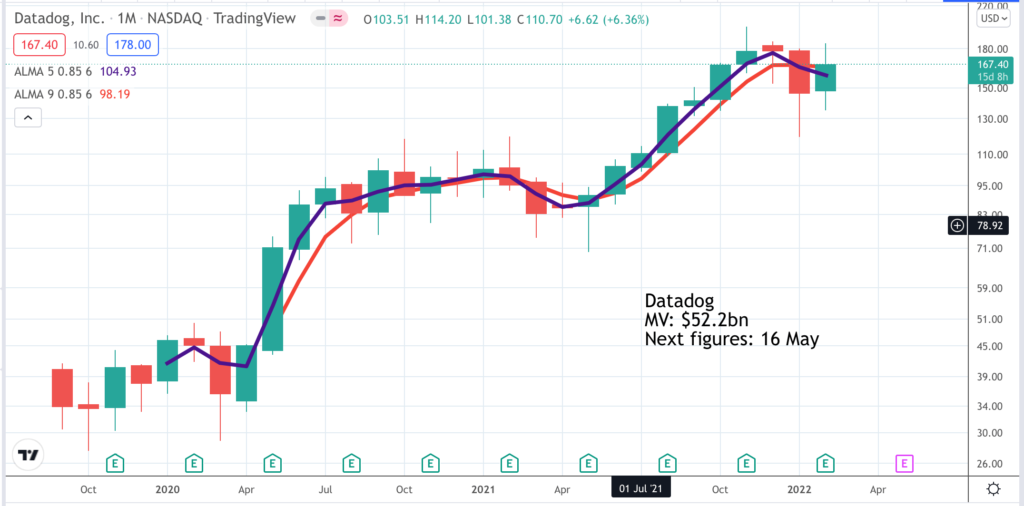

Datadog. DDOG. Buy @ $163.5. Times recommended: 14 First recommended: $55.50. Last recommended: $180

Analyst describes Datadog as a ‘diamond in the rubble’ of the tech crash

Datadog is yet another QV favourite where the business is roaring ahead. “We are very pleased with our performance in Q4 where we showed high growth at scale as well as strong business efficiencies. Looking back at 2021, not only do we continue to see a very strong demand environment, we also kept innovating at a rapid pace. And our team executed extremely well to help our customers manage complexity in the cloud area. Let’s start with a quick summary of Q4. Revenue was $326m, an increase of 84pc year over year and above the high end of our guidance range. We had about 18,800 customers, up from about 14,200 at the end of last year. We ended the quarter with about 2,010 customers with ARR of $100,000 or more, up from 1,228 at the end of last year. These customers generated about 83pc of our ARR. We had 216 customers with ARR [annual recurring revenue] of $1m or more, which is more than double the 101 we had at the end of last year. The leverage and efficiency of our business model is coming through with free cash flow of $107m. And our dollar-based net retention rate continued to be over 130pc as customers increase their usage and adopted our newer product.”

To say these guys nailed it is an understatement. If shares were cars Datadog is a Ferrari. This is partly thanks to a great reception for newly introduced products. “Next, our platform strategy continues to resonate in the market. As of the end of Q4, 78pc of customers were using two or more product, up from 72pc a year ago. 33pc of customers were using four or more products, up from 22pc a year ago. And as a sign of further adoption of our platform, we saw that 10pc of our customers were using six or more product, which is up from 3pc last year. We saw strong growth across our platform in Q4. Year-over-year growth of infrastructure monitoring ARR has accelerated in Q4 compared to Q3. In addition to that, APM [application performance monitoring] suite and log management products continue to be in hyper-growth mode. And we’re very pleased to report that our newer products added about $100m in ARR in 2021. These are the newer products we launched in 2019, which excludes core infrastructure, core APM, and log management.”

Datadog is presently trading at around 25 times expected sales for calendar 2023 so maybe a little pricy on my simplistic rule that 20 times market value to sales is high enough in this market. Against that Datadog is really special. I love this company, which is delivering a tidal wave of innovation. As founder and CEO, Olivier Pomel, says. “We continue to believe we’re in early days with our opportunities in observability. And we are just starting our efforts in cloud security and developer-focused products. We have much to do, and we’re excited about what we’re working on for 2022 and beyond.” In the latest quarter Datadog spent a staggering $133m on research and development, up from $67m for the same quarter in 2020. These guys are really going for it.

Like Bill.com Datadog has just appointed a new chief revenue officer suggesting a stronger push on sales and marketing lies ahead. They have also strengthened their partnership with cloud king AWS (Amazon Web Services). “We also announced a global strategic partnership with AWS. This is a recognition of our success and growth with AWS and our commitment to further invest to accelerate our joint opportunities. Among the areas of further partnership, we have already integrated Datadog more tightly into the AWS marketplace. We are also working with AWS to build deeper integrations not only for observability, but also for security use cases, and we are also planning to extend our joint go-to-market activities.”

AWS, with sales of $71bn a year (see above), makes a powerful partner for a company like Datadog with total sales last year just over $1bn.

One analyst, looking at the beaten down tech sector described Datadog as “a diamond amidst the rubble”, which is very much how I feel. He concluded “So, top 10 software beatdowns, our No. 1 pick on fundamentals and stock price potential is Datadog. Have at it, value bores!” I love it. He even gave an end of year share price target for Datadog of $329. Full markets for courage but if these great stocks can fall so fast they can rise fast too.

Snowflake. SNOW. Buy @ $297.50. Times recommended: 6 First recommended: $311. Last recommended: $359. Highest recommended: $386

Snowflake’s net retention rate is a staggering 173pc as it addresses ‘enormous’ market opportunity

Snowflake is a first for me. I have recommended it six times and every single recommendation is presently out of the money yet I am recommending it again. The reason why is that I am fascinated by the explosive fundamentals. We are due to get figures from Snowflake on 3 March for fiscal 2022 (year end 31 January) and they are likely to show continuing explosive growth. If they don’t the shares will plummet but that seems unlikely. When it last reported Snowflake was growing at a triple figure rate and the accompanying statement was very positive.

Many companies say they are just getting started but that seems especially true in the case of Snowflake. Here is the basic case for Snowflake made by an analyst who is a bull of the stock.

“Snowflake’s platform is a cloud agnostic data platform that allows users to consolidate their various platforms into one source of data. This has massive benefits for the user given systems that aren’t consolidated don’t play nicely together, and the usefulness of the data in those platforms is therefore reduced. Snowflake fixes that very widespread problem, and that’s why its customer count and organic revenue continue to soar.

The company reckons the market for its platform is currently $90bn, but like all things cloud, that number should grow substantially over time. That means Snowflake’s runway is enormous given its current run rate of ~$1.2bn in annual revenue.”

Snowflake has been endorsed by some of the largest companies in the world, given its count of customers over $1m in annual revenue has grown at ~2.5X that of its general customer count. This is because Snowflake is attracting large companies, but also because once it signs a customer, its dollar-based retention rate is ridiculously good. The most recent quarter saw this metric at 173pc, which is indicative of customers not only staying on with the platform, but spending much more in year two of their partnership with Snowflake than year one. This, again, supports the outstanding demand growth story for Snowflake. It also means Snowflake can grow much more quickly than its customer acquisition rate.

Snowflake has a transaction based revenue model so its revenue depends on how much its customers use the platform. Data consumption is growing explosively which is driving that incredible retention rate figure.

The distant future is wildly unpredictable but this bullish analyst is looking for Snowflake revenues to top $21bn by fiscal 2031, which is effectively calendar 2030. This forecast which does not look at all unreasonable given the size and growth of the data market helps explain why every time Snowflake’s shares plunge buyers come in to push them back up again.

This analyst, who is rapidly becoming one of my best friends, concludes:

“Snowflake reached a peak of 118X forward sales in late-2020, but today, it trades for less than half that at 50X sales. Again, I’m not trying to convince you that this is some sort of value stock, but for a company that is performing the way Snowflake is, I can easily make the leap that this is good value. Snowflake is as cheap as it has ever been on a P/S basis, and I’m certainly taking notice. The share price has been lower than today, but on a valuation basis, Snowflake is right at the trough despite the share price being higher; this is the result of constantly-rising revenue estimates.

The market will always be willing to pay a premium for leaders, and for all the reasons I detailed above, Snowflake is a leader in my view. In conjunction with the chart, I think the valuation says we’re much closer to the end of this selling episode than the top, and I’m very bullish as a result.”

Snowflake seems like the last stock to buy when top growth shares are getting slaughtered but it is just such a fabulous business I think there is a case for being brave. Like others the chart is heading lower. I will certainly alert you to the next buy signal but like the analyst I like this stock right now.