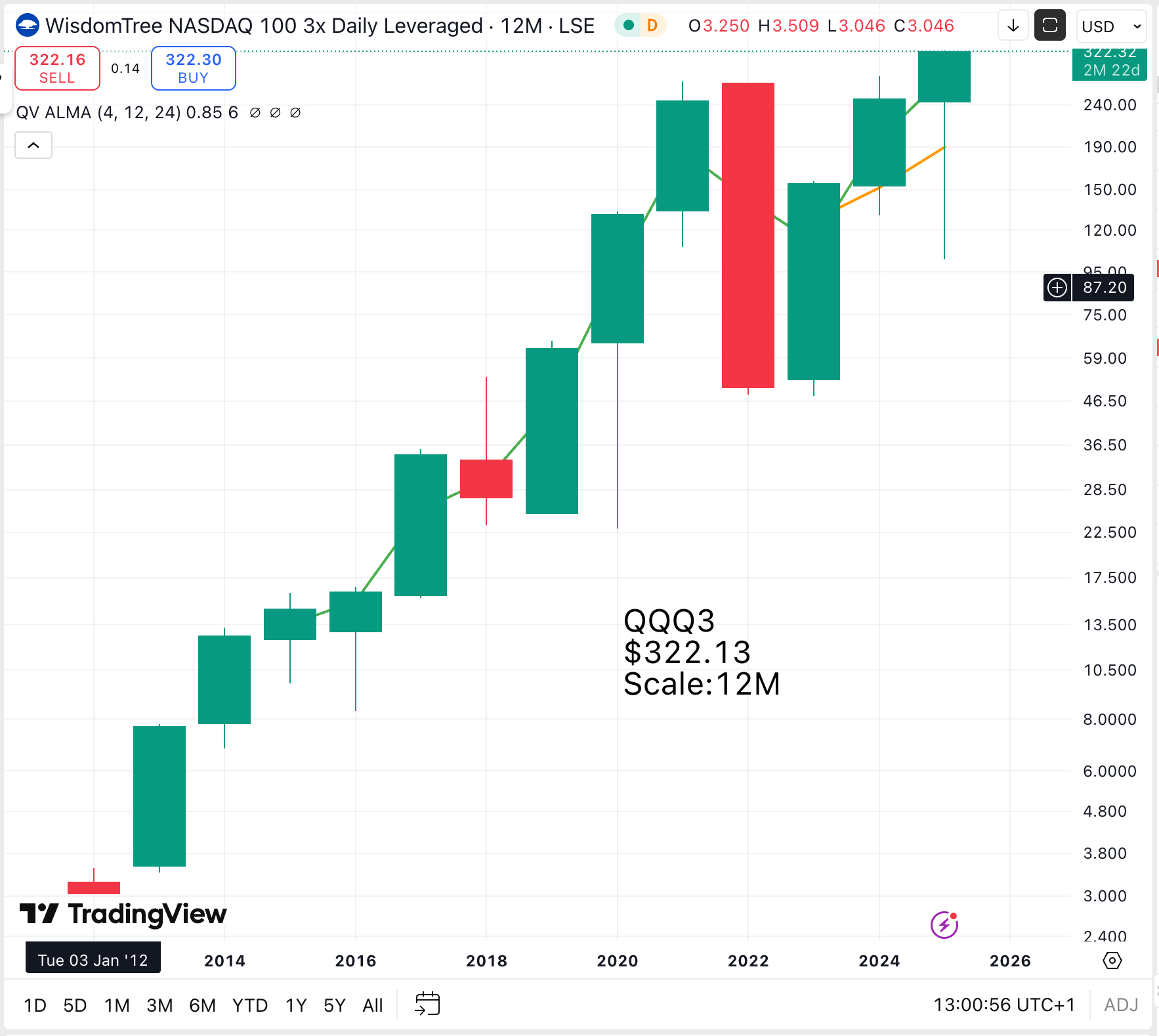

This is an epic chart and sets the scene for a massive extension of the bull market in US stocks in the coming years. Another leveraged ETF, TECL, looks the same, as do some of the mega caps, for example, Nvidia, Microsoft, Meta Platforms, Alphabet, Taiwan Semiconductor and Broadcom have great charts and other Tech Titans like Apple and Tesla are simmering. The conditions are in place for an epic charge in share prices. There is also what some are describing as the stock market’s secret weapon, $7 trillion, sitting in money market funds. A significant fall in interest rates, combined with a charging US bull market, could bring money flooding into stocks.

I don’t think Coppock means much on such a long-term chart, but no arguing with the strength of the upward trend, backed by Nvidia’s pivotal position in the Generative AI revolution. Who knows where that is going, but it grows more amazing by the day, with AI already writing and performing songs, writing books, driving cars, automating factories, reinventing warfare, healing the sick, but probably not raising the dead.

Home Erectus went millions of years against the background of a largely unchanged world. The only thing we know about the 22nd century is that it will be almost unrecognisable from the way things are now. My grandchildren are growing up in a world changing both explosively and at an accelerating rate as humanity makes another giant leap forward.

I found this quote about the East India Company.

The East India Company was probably the most powerful corporation in history. At its height, it dominated global trade between Europe, South Asia and the Far East, fought numerous wars using its own army and navy, and conquered and colonised modern day India, Pakistan, Bangladesh and Burma.

Discover & Learn

Hong Kong grew to incredible prosperity in the era of the four Hongs, Jardine Matheson, Swire Pacific, Hutchison Whampoa and Wheelock Marden. Taiwan is dominated by Taiwan Semiconductor Manufacturing, and South Korea has Samsung. A similar phenomenon appears to be happening in America with the emergence of gigantic, hugely powerful corporations with the cash flow to drive the technology revolution forward. It is incredible what is happening.

Capex, as the term is abbreviated, is a proxy for technology companies’ spending on AI because the technology requires gargantuan investments in physical infrastructure, namely data centers, which require large amounts of power, water and expensive semiconductor chips. Google said during its most recent earnings call that its capital expenditure “primarily reflects investments in servers and data centers to support AI”.

Meta’s year-to-date capital expenditure amounted to $30.7bn, doubling the $15.2bn figure from the same time last year, per its earnings report. For the most recent quarter alone, the company spent $17bn on capital expenditures, also double the same period in 2024, $8.5bn. Alphabet reported nearly $40bn in capex to date for the first two quarters of the current fiscal year, and Amazon reported $55.7bn. Microsoft said it would spend more than $30bn in the current quarter to build out the data centers powering its AI services. Microsoft CFO Amy Hood said the current quarter’s capex would be at least 50% more than the outlay during the same period a year earlier and greater than the company’s record capital expenditures of $24.2bn in the quarter to June.

“We will continue to invest against the expansive opportunity ahead,” Hood said.

For the coming fiscal year, big tech’s total capital expenditure is slated to balloon enormously, surpassing the already eye-popping sums of the previous year. Microsoft plans to unload about $100bn on AI in the next fiscal year, CEO Satya Nadella said Wednesday. Meta plans to spend between $66bn and $72bn. Alphabet plans to spend $85bn, significantly higher than its previous estimation of $75bn. Amazon estimated that its 2025 expenditure would come to $100bn as it plows money into Amazon Web Services, which analysts now expect to amount to $118bn. In total, the four tech companies will spend more than $400bn on capex in the coming year, according to the Wall Street Journal.

The multibillion-dollar figures represent mammoth investments, which the Journal points out is larger than the European Union’s quarterly spending on defense. However, the tech giants can’t seem to spend enough for their investors. Microsoft, Google and Meta informed Wall Street analysts last quarter that their total capex would be higher than previously estimated. In the case of all three companies, investors were thrilled, and shares in each company soared after their respective earnings calls. Microsoft’s market capitalization hit $4tn the day after its report.

Even Apple, the cagiest of the tech giants, signaled that it would boost its spending on AI in the coming year by a major amount, either via internal investments or acquisitions. The company’s quarterly capex rose to $3.46bn, up from $2.15bn during the same period last year. The iPhone maker reported blockbuster earnings Thursday, with rebounding iPhone sales and better-than-expected business in China, but it is still seen as lagging farthest behind on development and deployment of AI products among the tech giants.

Tim Cook, Apple’s CEO, said Thursday that the company was reallocating a “fair number” of employees to focus on artificial intelligence and that the “heart of our AI strategy” is to increase investments and “embed” AI across all of its devices and platforms.

The Guardian, 2 August 2025

The giants also spend heavily on r&d.

The 5 Big Tech companies – Amazon, Alphabet (Google), Meta (Facebook), Apple and Microsoft are big spenders on R&D. Collectively, these 5 companies, spent $229.1 Billion on R&D in the 12 months ending March 31, 2024!

AI overview

All this spending on capex and r&d is an investment in future growth and amounts to a staggering $629bn plus for the largest companies. The reason these companies continue to grow at such astonishing rates is that they are pouring a fortune into making it happen. And the same applies to many smaller companies. The beauty of the technology revolution is that there is so much for them to spend money on.

Many of the wise and the good, e.g., the CEO of Morgan Stanley, are worried that we are in a bubble. Bull markets climb a wall of worry. If you let the sceptics frighten you, you will never be able to hold stock for the big bull runs. If you stop and think about it, what the hell does the CEO of Morgan Stanley know about it? He knows nothing we don’t, and I don’t suppose he is selling his stocks.

Barron’s carried an article suggesting that quantum computing stocks may be in a bubble.

Seasoned investors, and quite a few cynics, often warn about the dangers of the taxi-driver trade. When a market in something becomes so hot that you’re hearing about it from the front seat of your Uber, it might be time to sell.

Quantum computing is having that kind of moment.

The United Nations deemed this year the International Year of Quantum. This week, the Nobel Prize in Physics was awarded to a trio of scientists focused on quantum mechanics. Stocks tied to the nascent technology are soaring.

While everyone from retail investors to day-trading speculators is talking about the quantum trade, others are asking the inevitable follow-up question: Is this a bubble doomed to burst?

Financial market bubbles tend to form when the value of an asset class inflates to levels that far exceed what it can actually deliver.

Investors paid enormous sums for tulip bulbs in the early 17th century, thinking their prices would rise indefinitely and fund the construction of houses and businesses. A single failed auction in 1637, however, burst the world’s first recorded speculative bubble and painfully reminded investors that all the bulbs could really do was grow flowers.

Quantum computing promises a lot more than colorful foliage, with Bank of America describing the powerful qubits it seeks to create as possibly “the biggest revolution for humanity since discovering fire.” But that doesn’t mean investors aren’t at risk of getting burned.

A collection of the four so-called pure-play quantum computing stocks — Rigetti Computing, D-Wave Quantum, IonQ, and Quantum Computing — has risen nearly fourfold on average over the past year. However, the technology has limited commercial use and generates relatively little revenue.

To make matters more complicated, it’s unclear when these companies will earn enough to turn a profit. IonQ once said it was targeting profitability by 2030. But since it appointed a new CEO, that timeline hasn’t been reaffirmed. Other companies, like Rigetti, haven’t committed to a target.

For now, the stocks trade largely on sentiment and headlines, as was the case during Nvidia’s annual developer conference, when vague timelines triggered investor panic.

Those four companies generated sales of around $26 million over the three months ending in June. They now have a collective market value of around $55 billion. That is more than American industrial icon General Motors, which sold around $47 billion worth of cars over the same period.

In that respect, it’s easy to see why some are worried about a bubble forming in quantum stocks. On the other hand, others say investors don’t appreciate how transformational the technology is likely to become.

“How do we value a technology that will change everything, create new drugs and materials, increase longevity, and enhance encryption and logistics, etc?” says Bank of America analysts led by Haim Israel in a note published this summer.

They see a quantum market worth $2 trillion by the middle of the next decade, with applications ranging from encryption to deep learning and the real-time usage of Big Data analysis. A widely cited McKinsey report forecasts a more muted range of $28 billion to $72 billion by 2035.

That is a wide gap in potential and a long time from now. Doubly so for an investor holding stocks valued at eye-watering levels compared with overall sales. Rigetti, for example, has a market capitalization of around $14 billion, but $8 million in annual revenue.

Tom Hulick, CEO of Strategy Asset Managers, says today’s valuations are simply “too divorced from reality” for a long-term investor. “There is no ceiling for how high retail speculators can push a stock in the interim,” he added.

The technology has yet to address some of its principal challenges, too. Particles like trapped ions and photons are a fundamental part of a quantum computer, and make up the basic units of information, called qubits. Qubits are sensitive to environmental noise or any disturbances at the atomic level, which is why quantum computers have a propensity for errors.

The technology is expected to become more widely deployed by the end of the decade, when companies like International Business Machines plan to release fault-tolerant systems that can catch and correct mistakes as they occur.

Meanwhile, the bubble might keep inflating until it is tested by the cold reality of fundamentals. And by then, your taxi driver may have moved on to something else.

Barrons, 8 October 2025, Martin Baccardax

There is an interesting point about bubble stocks. Bubbles only happen with hard-to-value shares with exciting stories of what may happen in the far-off future. Quantum Computing is like that; if and when it works, it could be transformational for life on Earth. We are seeing the tiny beginnings of what could be a tsunami of change. This is almost impossible to value, but it makes the shares super volatile and hopeless for anyone who wants a quiet life.

At one level, an $11bn valuation is absurd for a company like D-Wave Quantum Computing with extremely modest sales. But equally, it is chickenfeed against the potential. So many shares look overpriced in the early days of a big change.

Markets, especially tech, were hit hard on Friday by Trump’s tariff rant. My man Dan, Dan Ives of Wedbush Securities, says any sell-off in tech is a buying opportunity. Most likely, he is right. All previous setbacks have created opportunities. Why should this one be different?

The Saturday Daily Telegraph carried a two-page spread on the prospect of a new 1929-style financial crash. It was written by Jeremy Warner, who, back in the day, was my editor when I wrote a column for the Independent on Sunday.

He referred to warnings from ‘the great and the good’, including The Bank of England and long-time JP Morgan CEO, Jamie Dimon. Are these guys right? I have no idea, but there is one key difference with 1929. In 1929, the great and the good were talking about a plateau of permanent prosperity, and investors were complacent. This time, the great and the good are nervous. My take on this is that the great and the good are usually wrong.

Plus, I have been listening to Jensen Huang. Is he talking his book when he says the AI revolution is just getting started? Yes. But is he right? I think the answer to that is yes, too. In 1860, there was a famous debate about evolution between Thomas Huxley and Bishop Wilberforce. Wilberforce asked Huxley if he was descended from an ape on his grandfather’s or his grandmother’s side. Huxley said he would rather be descended from an ape than use his intellect to attack facts that he did not understand.

That devastating response settled the argument for most people, and evolution rapidly became accepted as the obvious explanation of how life ‘evolved’ on this planet. I imagine a debate between Jensen Huang and members of the great and the good, like Jamie Dimon, might proceed on similar lines. I think Huang would destroy Dimon because Dimon is arguing generalities and conventional wisdom, whereas Huang has a unique insight into what is actually happening.

Dimon is worried that investors might lose their money. But risk is the essence of equity investment. If you want to win big, you have to take risks. AI in all its manifestations looks to a simple layman like me an incredible opportunity that will change life in ways we can hardly imagine. That is going to take time and a great deal of money. It feels like the early days to me.

What may worry people is that investment spending, unlike consumer spending, can easily be turned on and off; that’s the risk, but this spending acceleration looks to have a long way to run and is mostly funded by cash flow.

So here are two more stocks that are going into my Top 30 portfolio and look super-exciting to me.

Below is Rocket Lab’s description of its operations.

Founded in 2006, Rocket Lab is an end-to-end space company with an established track record of mission success. We deliver reliable launch services, satellite manufacture, spacecraft components, and on-orbit management solutions that make it faster, easier, and more affordable to access space. Headquartered in Long Beach, California, Rocket Lab designs and manufactures the Electron small orbital launch vehicle, a family of flight-proven spacecraft, and the Company is developing the large Neutron launch vehicle for constellation deployment. Since its first orbital launch in January 2018, Rocket Lab’s Electron launch vehicle has become the second most frequently launched U.S. rocket annually and has delivered more than 200 satellites to orbit for private and public sector organizations, enabling operations in national security, scientific research, space debris mitigation, Earth observation, climate monitoring, and communications. Rocket Lab’s spacecraft have been selected to support NASA missions to the Moon and Mars, as well as the first private commercial mission to Venus. Rocket Lab has three launch pads at two launch sites, including two launch pads at a private orbital launch site located in New Zealand and a third launch pad in Virginia.

Rocket Lab web site

At this stage, I don’t know much about Rocket Lab’s business, but they have a terrific story.

We operate the world’s most reliable and responsive small launch vehicle, Electron, operating at the fastest cadence of any small launch vehicle in history, having just completed its sixty-ninth launch. With our hypersonic testing variant, Haste, we are revolutionizing the way missile defense technology is tested in a hypersonic environment. A new reusable rocket, Neutron, perfectly answers the call for a diversified launch of the national security and can deploy entire constellations of spacecraft at once to build out the dome’s proliferated architecture. We’ve already won more than half a billion dollar contract with the FDA to build and operate a significant piece of their PWSA [Proliferated Warfare Space Architecture] network. There’s a golden opportunity to build upon that here with our existing capability.

And, look, the list goes on. But I won’t belabor the point. Our advantage is our commercial speed and proven execution. The way programs like this have been built in the past, dominated by the large defense primes, just won’t work the same time this time around to meet the administration’s urgent timeline. It needs agility and innovation, vertical integration, and on-time delivery and execution. That’s what we’ve delivered time and time again across our programs to date, and what we stand ready to deliver for the Golden Dome. There’s no better mission on the books that demonstrates the full depth of our capabilities than the Victor’s Hayes mission for the Space Force.

Across its tactically responsive space program, we’re the only provider delivering a complete end-to-end launch plus spacecraft solution. We’re bringing the full stack of offerings across the satellite design, component integration and testing, flight software, ground, mission, and launch license and the launch itself and on-orbit operations. We own the entire mission life cycle and its capability for national security that very, very few others can provide. It’s also a great demonstration of how commercial capability like ours can be leveraged to bring the concept of responsive space into operational reality. Exactly what the US administration is seeking with Golden Dome.

This mission has a twenty-four-hour call-up requirement, which quite frankly is business as usual for Rocket Lab USA, Inc. these days, and we recently cleared the program milestone, Victor’s Hayes. That moves us into the final integration and testing phase of our spacecraft for the mission and launch of Electron later this year. Another program with major milestone tick is a transport layer constellation bill for the SDA. The program has signed off our satellite design and approach for manufacturing, which means we can now move into full-scale production of these 18 spacecraft and further revenue from this $515 million program.

As this constellation gets underway, we’re also preparing for a much larger opportunity within the SDA [Space Development Agency] and its next tranche of satellite contracts. This is where our strategy of bringing key satellite technologies in-house makes us an attractive commercial partner. Our incoming sensor payloads, for example, are also in play for an SDA award and through other bidders. We can control the cost and reduce the schedule risk through our vertical integration in a way that others can’t, and we hold the keys to that technology and components that are foundational to these contracts. Excuse me. And finally, for space systems, another strategic area of focus for this past quarter has been in supporting the administration’s plans for Mars exploration.

It was great to see a $700 million provided for a Mars telecommunications orbiter in a recent budget. The path to Mars for human spaceflight must begin with the ability to communicate there. And this is something that we’ve always strongly pushed for. In fact, we were the only company that proposed an independently launched Mars telecom orbiter as part of the end-to-end, Mars sample return mission. So our ambition is clearly in line with the administration’s vision for Mars. Much of our technology is already across major Mars missions like NASA and Sight Lander, the Ingenuity helicopter, the cruise stage that brought perseverance to Mars, and, of course, the escapade spacecraft that are ready for launch here soon.

Peter Beck, CEO, Rocket Lab, Q2 2025, 8 Augfust 2025

The shares have risen significantly in 2024, but that is a classic rubbish theory of value. Space exploration and satellites have come from nobody is paying attention to the forefront of minds in 2025, and investors can see that Rocket Lab is a serious business with a lot going on and an open-ended opportunity.

This is a ‘story’ stock, but none the worse for that, and crowd theory is on the side of this one (crowd theory means plenty of investors yet to discover the story growing the crowd). We are just at the dawn of the space age, and Rocket Lab is a player.

Interactive Brokers doesn’t have the same exciting technology pitch as Robinhood, but in a world of strong and rising stock markets, their focus on being efficient at executing for their clients and helping them become more successful investors is a powerful growth engine.

Given our rapid growth, continuous additions and enhancements to our platforms, and periodic volume surges, having a platform that is scalable is critical. We enhanced our ATS [alternative trading system] this quarter by improving its performance and ability to handle large spikes in volume by up to 20x on high volume days, ensuring we are better equipped for market surges and capable of delivering top-tier execution for our clients. We also made enhancements to our smart order router, which is designed to provide best execution, which includes price improvement and the possibility of receiving rebates. It is this price execution advantage we offer that keeps our sophisticated customer base engaged on our platform.

Nancy Steube, director of investor relations, Q2 2025, 17 July 2025

The fundamental growth of this business is strong.

We will be adding our four millionth customer in the third quarter, just one year after adding our three millionth. While the market may move in any direction in the short run, we are looking to capture the long-term trend towards more global investing across multiple customer types and jurisdictions, giving investors the ability to invest in the companies they like, paying in the currencies they have, around the clock.

Paul Brody, CFO, Interactive Brokers, Q2 2025, 17 July 2025

The company is optimistic about prospects for shares generally and its business particularly.

I expect this environment to be very, very favorable to brokerage firms in general. And investment banks in general and specifically for Interactive Brokers. This is a great time for us.

Thomas Peterffy, chairman, Interactive Brokers, Q2 2025, 17 July 2025

Share Recommendations

QQQ3

Nvidia NVDA

IonQ. IONQ

D-Wave Quantum Computing. QBTS

Rigetti Computing. RGTI

Rocket Lab Corp. RKLB

Interactive Brokers. IBKR

Strategy – Be Ready To Embrace Risk

All these stocks are already in the Top 30 portfolio except RKLB and IBKR, which are new additions. These stocks are risky, but they are playing for huge stakes, which makes them exciting. In the early days of Tesla, every man and his dog thought the shares were overpriced, and they became one of the most shorted stocks in history. Just look at them now.