There is a scene in the film Crocodile Dundee, where Dundee, who comes from the Australian Outback, is in New York and is attacked by a knife-wielding mugger. Dundee looks at the attacker’s knife, tell his attacker,’call that a knife’ and pulls out a monster knife with a vicious serrated edge that he had tucked into his belt. The attacker flees.

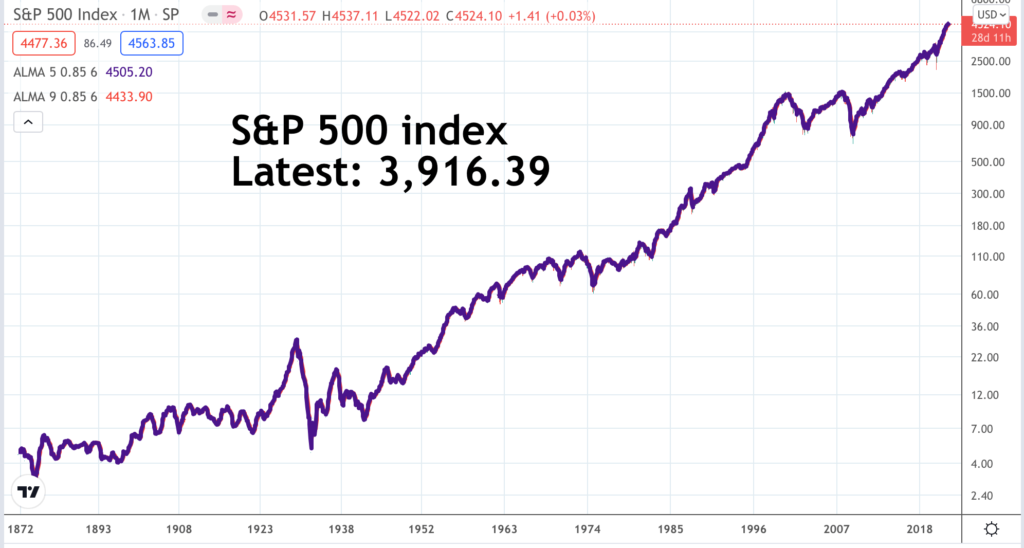

I feel a bit the same looking at this chart and especially at the supposedly incredible 1929 bull market. Call that a bull market. Then look at what has happened since 1932 or even just since 2009. The strength of the US stock market is the phenomenon of our age and everybody should strive to get a piece of the action.

Quentinvest is all about helping you do just that.

I have recently developed a buying strategy which I call buying the green. It is very simple. If a stock closes the month with a monthly candlestick which is green (i.e the shares have closed higher on the month) I treat that as a buy signal.

It works because these signals are not just being applied to any old shares but only the 3G+Magic shares that are included in the QV for Shares table. The buy signals may be no big deal in themselves but the shares you will be buying are. They are literally shares in the creme de la creme of the world’s most exciting companies, chosen for their outstanding growth characteristics.

I buy on greens myself and I find it works very well. Note that this list is not quite the same as The List although there is considerable overlap. Some of these shares are giving green buy signals but are in recovery mode so would not be in The List. Others flashing red so not giving a buy signal are very much in full-on growth mode and would be in The List. Just to recap The List is all the shares (200 at the last count) that are in the QV for Shares portfolio and which I believe should be in a really exciting, diversified by companies, growth share portfolio.

Thanks to zero commissions on US shares and fractional investing it has become surprisingly practical to put together a 200-share portfolio and my advice is that everybody should try to assemble just such a portfolio. This is exactly what I am trying to do myself and so far it is working very well. As it happens I don’t need fractional investing because my chosen allocation for each share I hold is big enough to accommodate shares like Amazon and Alphabet on high nominal prices.

Why would you buy a share in recovery mode? Because you already have them and want to average down and also because shares that start to recover often end up in full on growth mode further down the line. Experience shows that most of the shares in the QV for Shares table end up doing well sooner or later so buying on green buy signals will usually prove a good idea.

Some shares are flashing serious reds with moving averages heading lower and I describe these as ‘behaving badly’. In line with my dynamic investing strategy outlined in a recent issue of Great Charts these can be sold with a view to reinvesting in other shares still performing strongly. Over time you may well find the discarded shares performing well again and they can be repurchased, which is why I call it a dynamic strategy. You are endlessly refocusing your portfolio around the best performers.

There is no real need to do this. It is for insurance as much as anything else. Buy and hold works very well. I do it because it lends itself to my aggressive use of margin trading. It keeps me fleet footed closing positions experiencing temporary weakness. It means I keep buying and selling the same shares but I have tried to make this a strength, not a weakness, of the way I operate. If it is going to happen anyhow, when the market corrects and I get margin calls, I might as well accept it and try to anticipate serious weakness rather than just react to it.

Below is the latest list of Buying the Green shares with codes and prices. Some prices may be a little out of date because it takes so long to keep looking them up again and again but they should be in the right ball park. All these shares go into the table at the recommended prices.

Abbott Labs. ABT. Buy @ $126.50

Abbvie. ABBV. Buy @ $121

Abcam. ABC Buy @ 1533p

Accenture. ACN. Buy @ $337

Accesso. ACSO. Buy @ 802p

ADC Therapeutics ADCT. Buy @ $29

Adobe. ADBE buy @ $667

Advanced Micro Devices. AMD. buy @ $110

Afterpay. APT. Buy @ $133 (being acquired by Square)

Agora. API Buy @ $33.24

AirBnb. ABNB. Buy @ $157.50

Align Technology. Buy @ $713

Allogene Therapeutics. ALLO Buy @ $24.50

Alphabet. GOOGL. Buy @ $2910

Amazon. AMZN. Buy @3509

Ambarella. AMBA. Buy @ $123.50

American Tower Corporation. AMT Buy @ $294

Anaplan. PLAN. Buy $67.50

Apple AAPL Buy @ $154.50

Aptar Group. buy @ $134

Aptitude Software. APTD. Buy @ 692p

Argenx SE. ARGX. Buy @ @335

Argo Blockchain ARB. Buy @ 134p

Asana ASAN. buy @ $77

Ashtead. AHT. Buy @ 5714p

ASML. ASML. Buy @ $842

Atlassian. TEAM. Buy @ $370

Avalara. AVLR. Buy @ $186.50

Avantor. AVTR. Buy @ $39.50

Baillie Gifford European. BGEU. Buy @ 167.50p

Basler International. DWWS. Buy @ €130

Berkshire Hathaway B. BRK.B. Buy @ $285

Bill.com. BILL Buy @ $279.50

Bio-Rad Laboratories. BIO. Buy @ $804

Bio-Techne. TECH. Buy @ $506

BioExcel Therapeutics. BTAI. Buy @ $29.50

Bitcoin BTCUSD. Buy @ $47376

Blackrock. BLK. Buy @ $941

Blue Prism. PRSM. Buy @ 1130p

Boohoo. BOO. Buy @ 280.5p

Booking.com. BKNG. Buy @ $319

Broadcom. AVGO. Buy @ $496

Bumble. BMBL. Buy @ $55

Burford Capital. BUR. Buy @ 884p

Cable One CABO. Buy @ $2112

Cadence Design Services. CDNS. Buy @ $164

Casey’s General Stores CASY. Buy @ $204

Charles River Laboratories. CRL. Buy @ $444

Chewy. CHWY. Buy @ $88

Chipotle Mexican Grill. CMG. Buy @1900

Cloudflare. NET. Buy @ $126

Corporate Travel Management. CTD. Buy @ A$22.60

Coupa Software. COUP. Buy @ $252

Craneware. CRW. Buy @ 2430p

Crocs International CROX. Buy @ $145.50

Croda International. CRDA. Buy @ 9184p

Crowdstrike. CRWD. Buy @ $276.50

CyberArk Software CYBR. Buy @ $167.50

Datadog. DDOG. Buy @ $138

Dechra Pharmaceutics DPH. Buy 5250p

Delivery Hero. DHER Buy @ €129.50

Dexcom DXCM. Buy @ $534

Diploma. DPLM Buy @ 3100p

Disney, Walt. DIS. Buy @ $183

Domino’s Pizza Enterprises DMP. Buy @ A$152.50

Domo. DOMO. Buy @ $89

DotDigital. DOTD. Buy @ 287p

Dropbox. DBX. Buy @ $31.50

Dynatrace. DT. buy @ $69.50

Ecolab ECL. Buy @ $224.50

Edwards Lifesciences. EW. buy @ $119

Epam Systems. EPAM Buy @ $631

Estee Lauder. EL. Buy @ $345

Ether. ETHUSD Buy @ $3764

Etsy. ETSY. Buy @ $218.50

Everbridge EVBG. buy @ $159

Experian Buy @ 3235p

Facebook. FB. Buy @ $382

Ferrari. RACE. Buy @ $218

Figs. FIGS. Buy @ $42.5

Fiserv. FISV. Buy @ $118

Fisher & Paykel Healthcare FPH. Buy @ A$31.5

Focusrite TUNE Buy @ 1800p

Fortinet FTNT. Buy @ $305

Frontier Development. FDEV. Buy @ 2815p

Gamestop. GME Buy @ $217

Genus. GNS. Buy @ 5985p

Globant. GLOB. Buy @ $321

Guardant Health GH. Buy @ $127.5

Halma. HLMA. Buy @ 3040p

HelloFresh Group. HFG. Buy @ €92.50

Hilton Food Group. HFG. Buy @ 1168p

Horizon Therapeutics HZNP. Buy @ $110

Hubspot. HUBS. Buy @ $688

Hydrofarm. HYFM. Buy @ $51.50

Impax Environmental Markets IEM. Buy @ 528p

InMode INMD. Buy @ $130.5

Inspire Medical Systems INSP. Buy @ $222.5

Intuit. INTU. Buy @ $566

Intuitive Surgical. ISRG. Buy @ $1059

IQE. IQE Buy @ 53p

ITM Power. ITM. Buy @ 499p

Shares World Momentum IWMO. Buy @ $66.46

James Cropper. CRPR. Buy @ 1400p

JD Sports Fashion. JD. Buy @ 1041p

JTC. JTC. Buy @ 760p

Just Eat Takeaway. JET. Buy @ 7035p

Keyence Coro 6861. buy @ JPY67030

Keywords Systems. KWS. Buy @ 3162p

Learning Technology Group. LTG. Buy @ 227.5p

Lightspeed PoS. LSPD. Buy @ $113.5

Litecoin. LITEUSD. Buy @ $176

Liontrust Asset Management. LIO. Buy @ 2425p

London Stock Exchange Group. LSEG. Buy @ 8050p

Lonza. LONN. Buy @ CHF774

L’Oreal OR. Buy @ €399

Masimo Corporation MASI. Buy @ $275

Maxcyte. MXCT. Buy @ 1115p

MercadoLibre. MELI. Buy @ $1900

Mettler-Toledo International MTD. Buy @ $1551

Microsoft. MSFT. Buy @ $303

Microstrategy. MSCR. Buy @ $693

Moderna MRNA. Buy @ $386

Monday.com MNDY. Buy @ $396

MongoDB. MDB. Buy @ $395

Monolithic Power Systems MPWR. Buy @ $496

Morningstar. MORN. Buy @ $273.50

MSCI. MSCI. Buy @ $644

NDAQ. NDAQ. Buy @ $198

Novanta. NOVT. Buy @ $ 152

Nvidia. NVDA. Buy @ $224

O’Shares Global Internet Giants. OGIG. Buy @ $57.5

Okta. OKTA. Buy @ $264

Palo Alto Networks. PANW. buy @ $458

Par Technology. PAR. Buy @ $69

Paycom Software. PAYC. Buy @ $491

Paylocity. PCTY. Buy @ $272

Pegasystems. PEGA Buy @ $139

Pepsico. PEP. Buy @ $157.50

Pinduoduo. PDD. Buy @ $108.50

Plus500. PLUS. Buy @ 1470p

Polar Capital Technology Trust. PCT. Buy @ 2576p

Pool Corporation. POOL. Buy @ $486

Prolofgis. PLD. Buy @ $137.50

Invesco QQQ Trust (tracks Nasdaq 100) QQQ. Buy @ $382

Rapid7. RPD. Buy @ $121.50

Renishaw. RSW. Buy @ 5465p

Repligen. RGEN. Buy @ $285

Rightmove. RMV. Buy @ 720p

Robinhood. HOOD. Buy @ $45.50

Roblox. RBLX. Buy @ $84.50

S4 Capital. SFOR Buy @ 824p

S&P Global Inc. SPGI. Buy @ $447

Salesforce.com. CRM. Buy @ $272

Sanne Group. SNN. Buy @ 931p

Sartorius StedimBiotech. DIM. Buy @ €524

Sea Limited. SE. Buy @ $343.5

ServiceNow. Now. Buy @ $651

Shopify. SHOP. Buy @ $1545

Silvergate Capital Corporation. SI. Buy @ 4116.50

Smartsheet. SMAR. Buy @ $80.5

Snap Inc. SNAP. Buy @ $75.5

S&P 500 EDF Trust. SPY. Buy @ $452

Spiral-Sarco Engineering. SPX. Buy @ 416295p

Splunk. SPLK. Buy @ $156.5

Spotify. SPOT. Buy @ $237.5

Square. SQ. Buy @ $271.5

Stamp Inc. STMP. Buy @ $328.5

Stryker. SYK. Buy @ $276.50

Synopsys. SNPS. Buy @ $334

Tencent. 700 Buy @ HK$488

The Joint Corp. JYNT. Buy @ $103

Turning Point Therapeutics. TPTX. Buy @ $76.5

UnitedHealth. UNH. Buy @ $417

Upstart Holdings. UPST. Buy @ $226.5

Varonis Systems. VRNS. buy @ $69

Verisk Anaytics. VRSK. Buy @ 4203

Volex. VLX. Buy @ 439p

Waste Connections. WCN. Buy @ $129.5

Waste Management. WM. Buy @ $155.5

Water Intelligence. WATR. Buy @ 1340p

West Pharmaceutical Services WST. buy @ $449

Wisetech Global WTC. Buy @ A$48.5

Wisdomtree Nasdaq 100 3x Daily Leveraged. QQQ3. Buy @ 4221.50

Workday. WDAY. Buy @ 4272.5

Xero. XRO. Buy @ A$151.50

Yougov. YOU. Buy @ 1440p

Zai Laboratories ZAI. Buy @ $148.5

Zebra Technologies. ZBRA. Buy @ $582

Zoetis. ZTS. Buy @ $205

ZoomInfo. Technologies. ZI. By @ $64

Zscaler. ZS. Buy @ $277

Shares behaving badly

AB Dynamics. ABDP

Activision. ATVI

Alibaba. BABA

Alteryx. AYX

ASOS. ASC

Bandwidth. BAND

Boston Beer. SAM

Freshpet. FRPT

GoDaddy. GDDY

GrowGeneration. GRWG

Hargreaves Lansdown HL.

Inogen INGN

Irobot. IRBT

Lendingtree. TREE

Logitech International. LOGI

Lyft. LYFT

Magellan Financial Group. MFG

Pliant Therapeutics. PLRX

Ringcentral. RNG

Shake Shack. SHAK

Teledoc Health. TDOC

TripAdvisor. TRIP

Vuzix. VUZI

Wandisco. WAND

Wix.com. WIX

Zendesk. ZEN

Zillow Z

Zoom Video Communications. ZM

There are no prices with the shares behaving badly because these shares are not recorded in the QV for Shares table which is based on a never sell strategy. They are for your information as shares that I would no longer hold. The core of the strategy is the shares you do hold and what you do with them which for many people will be simply buy and hold. The vast majority of investors will benefit from buying, holding and never selling as long as they make sure to have a forward looking portfolio based on the sort of exciting 3G+M shares I choose for the Quentinvest portfolio and make sure to refresh their portfolios with new ideas as they come along.

My ambition of a 200-share portfolio is helpful in many ways. One is that you don’t have to over-analyse a stock. For most of us that doesn’t help anyhow because then we are competing against people who really do know what is going on. My preference is for a large portfolio full of shares in a wide selection of great companies. These are not hard to spot. If they don’t seem to be great they probably aren’t.

Fill your portfolio with as many quality names as you can and just wait for time to do its magic and values to appreciate. Given time, years rather than months, the results can be amazing. A big portfolio also means lots of news, lots of things happening and that is great fun too.

Another crucial merit of large portfolios is that they are less stressful. If one, two or even several shares hit serious turbulence it shouldn’t do much harm. If the whole stock market hits turbulence that is a storm which will pass.

Buying the green is just an easy way to spot timely moments to start a position or add to a holding.