Biologic, Argenx SE, has Fast-Growing Drug Sales And A Red Hot Pipeline

First, we need to know what a biologic is.

A biologic is a complex medicine derived from living organisms, such as proteins, which can target specific parts of the immune system to treat diseases like cancer, diabetes, arthritis, and inflammatory conditions. Unlike traditional chemical drugs, biologics are made from a biological source and are used to control inflammation, block specific proteins, or modulate immune responses. Examples include vaccines, growth factors, and monoclonal antibodies

AI Overview

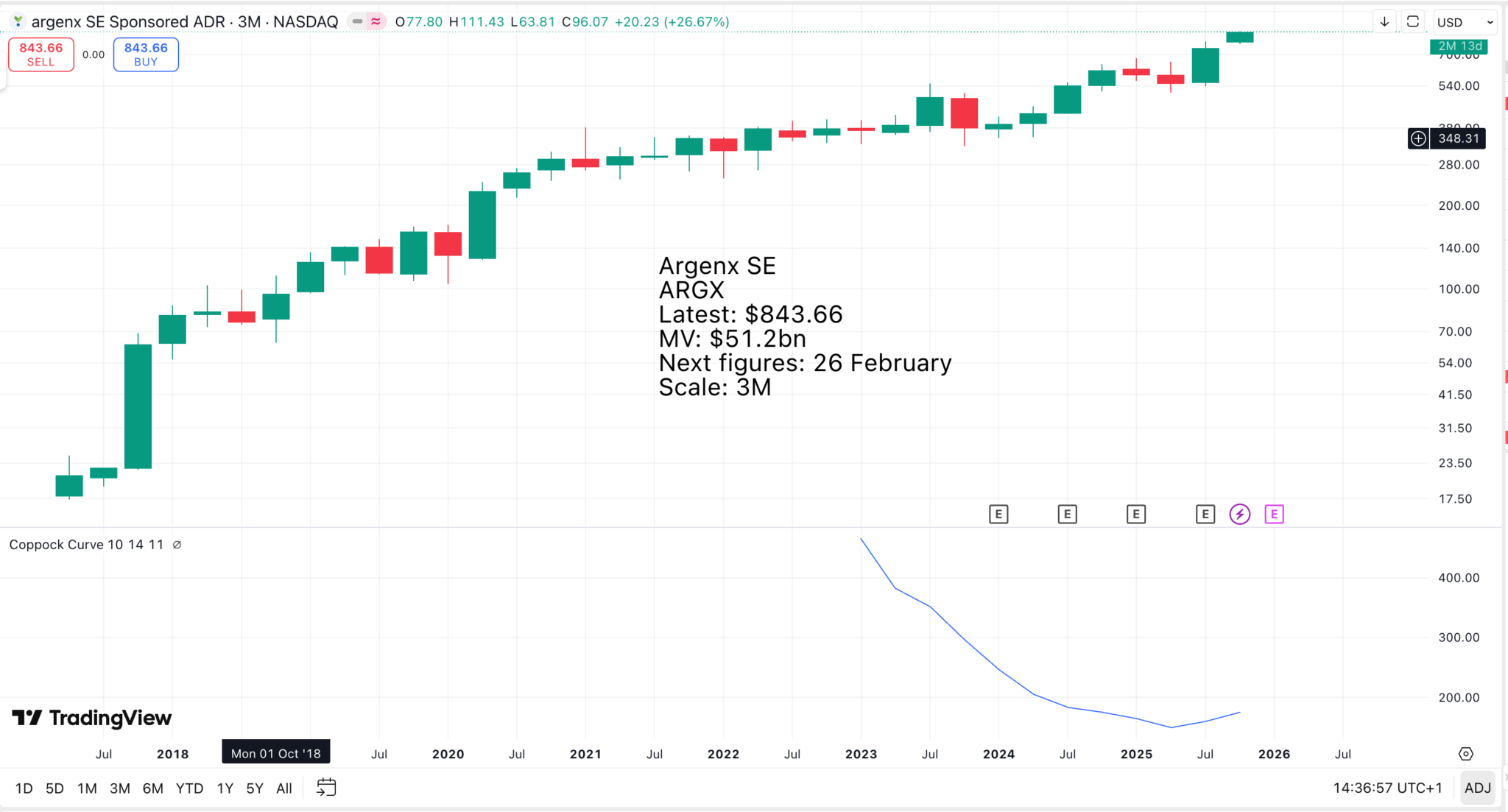

Argenx SE is the world’s biggest and fastest-growing biologic with big plans for the next five years to 2030.

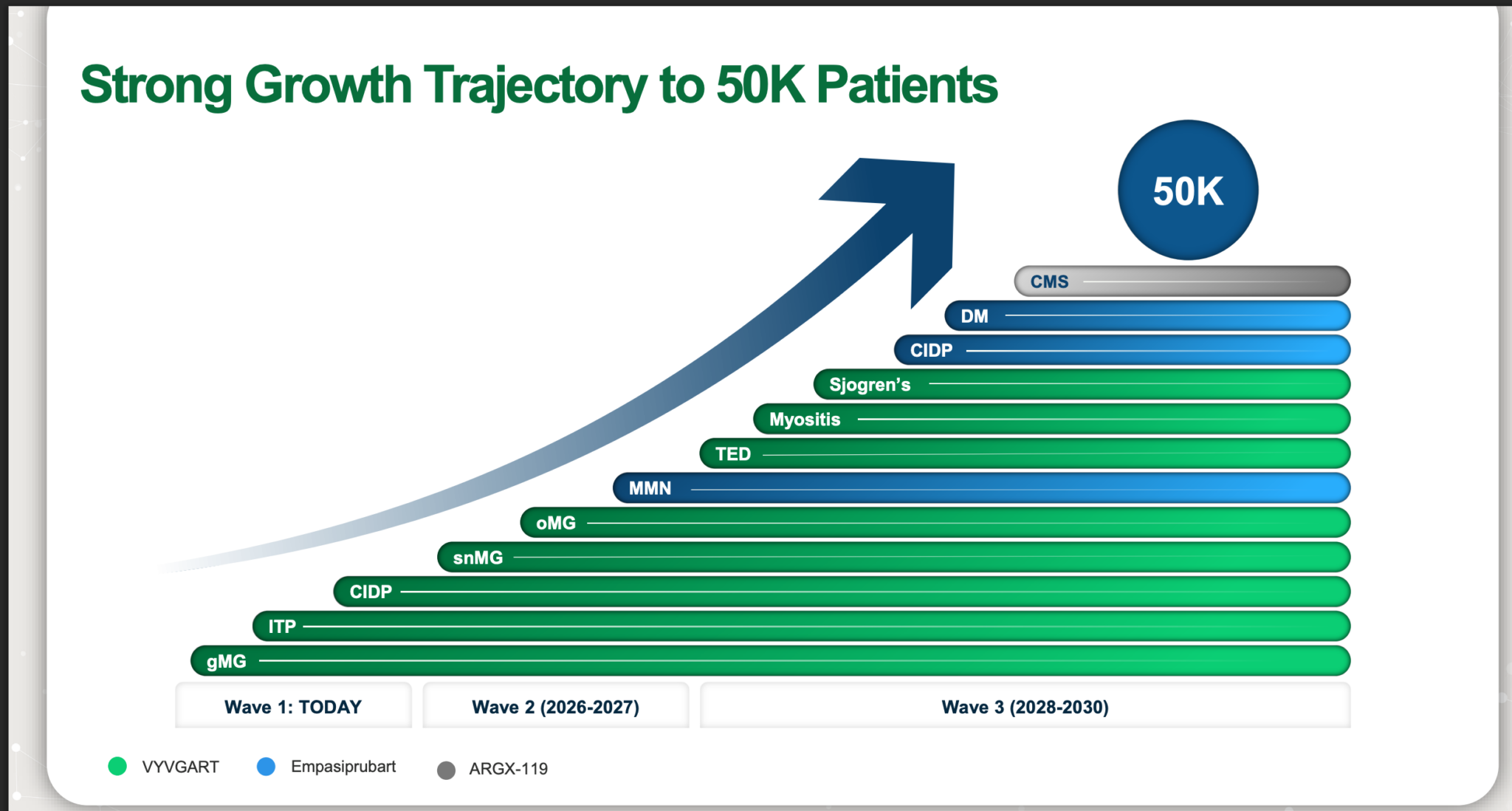

Let’s look first at the patients on treatment. In the latest quarter, Q2 2025, ArgenxSE reported sales not much short of $1bn. This continues a period of strong growth.

The latest results were achieved with 15,000 patients, which means many fewer on average over the last 12 months. There were 10,000 at the end of 2024

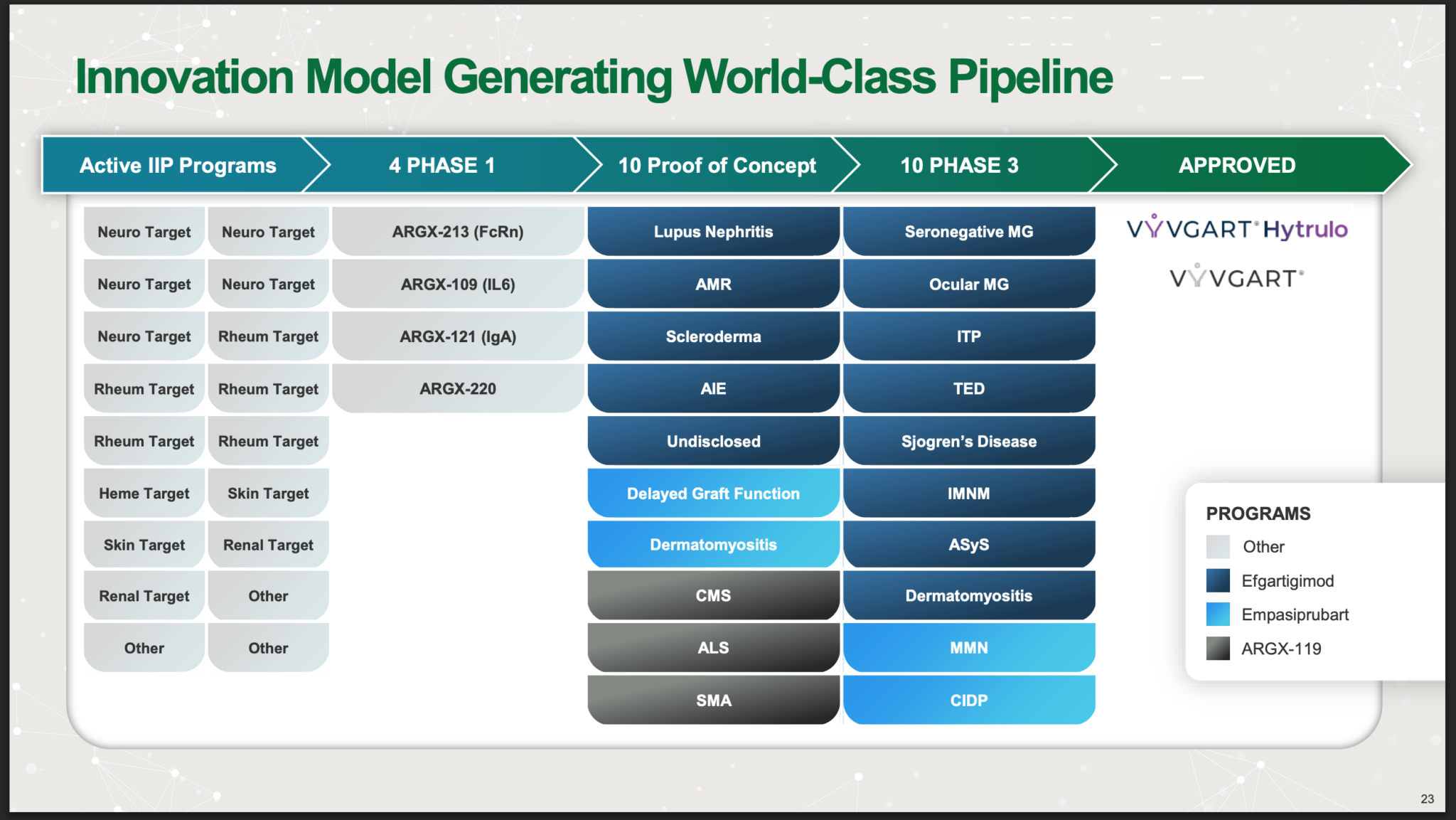

An incredible amount is going on at Argenx SE.

Let’s see what these things mean.

The Immunology Innovation Program (IIP) is a core business strategy of argenx connecting the specialized insight into disease and target biology of our external scientific and academic collaborators with our unparalleled experience as antibody engineers.

Co-creation has led to a deep pipeline of highly differentiated product candidates.

Through the IIP, we hope to together transcend breakthrough research and publications to our ultimate and unifying mission of creating new potential treatment options for patients.

Innovation and co-creation are at the core of our strategy. We integrate our unique antibody engineering capabilities with the deep disease and target biology expertise of our collaborators. By innovating at the discovery level, we have built a broad pipeline of differentiated potential immunology solutions to offer patients.

We innovate at both the variable region or V region (where antigens and foreign proteins are recognized) and the constant region or Fc region (where antibodies modulate other cells in the immune system).

“Stepping into these strategic, academic, industry collaborations. This is a wonderful ecosystem that we are creating, by bringing that expertise together.” Professor Bart Lambrecht

Argenx SE, The Science of Collaboration

Further along the pipeline, Argenx has four Phase 1 candidates, which are drugs at the earliest stage of development.

Argenx has four new preclinical candidates that are expected to enter Phase 1 trials in 2025: ARGX-213 (targeting FcRn), ARGX-121 (targeting IgA), ARGX-109 (targeting IL-6), and ARGX-220 (a “sweeping antibody” with an undisclosed target). These candidates are part of the company’s Immunology Innovation Program (IIP).

New Phase 1 candidates

ARGX-213: Targets the neonatal Fc receptor (FcRn), building on argenx’s leadership in FcRn-targeting medicines.

ARGX-121: A first-in-class molecule designed to target IgA.

ARGX-109: Targets interleukin-6 (IL-6), a cytokine involved in inflammation.

ARGX-220: A first-in-class “sweeping antibody” where the specific target has not yet been disclosed.

Argenx SE, The Science of Collaboration

Argenx has 10 candidates at the proof of concept stage.

Argenx SE (Euronext & Nasdaq: ARGX), a global immunology company committed to improving the lives of people suffering from severe autoimmune diseases, today reported preliminary financial results for the full-year 2024, including global product net sales, and announced its strategic priorities for 2025.

“2024 was a transformative year as we significantly expanded our global patient reach with VYVGART and advanced a world-class pipeline of precision therapies,” said Tim Van Hauwermeiren, Chief Executive Officer of argenx. “The team’s strong execution has positioned argenx to be a profitable company in 2025, providing us flexibility to invest in the next wave of innovation across the company. Today, we are all in on our innovation mission, applying our successful innovation playbook to bring transformational outcomes to even more patients by unleashing the next wave of autoimmune indications and therapies, and securing our future by advancing multiple programs against first-in-class targets. We are positioned for significant expansion in 2025 with the FDA decision on approval of our pre-filled syringe, global CIDP rollout, and label-expansion studies underway for MG. To further support our growth, we are thrilled to have 10 ongoing registrational and 10 proof-of-concept studies in 2025, teeing us up for several data readouts across our pipeline in the next 12-24 months.

“Innovation is the cornerstone of everything we do, from the foundational science all the way to payor negotiations; it is our goal to deliver innovative and disruptive science for the benefit of patients who need better access to transformational safe, effective, and convenient precision therapies. Innovation has no meaning unless it reaches the marketplace, and we will continue to prioritize patient outcomes in all that we do.”

Argenx SE, The Science of Collaboration

Further along, Argenx has 10 drugs in phase 3 trials.

Phase 3 is sometimes written as phase III. These trials compare new treatments with the best currently available treatment (the standard treatment).

Phase 3 trials aim to find out: which treatment works better for a particular type of cancer (or other condition), more about the side effects, how the treatment affects people’s quality of life. They may compare standard treatment with: a completely new treatment, different doses of the same treatment, having the same treatment more, or less, often, a new way of giving a standard treatment, such as radiotherapy

Phase 3 trials usually involve many more patients than phase 1 or 2. This is because differences in success rates may be small. So, the trial needs many patients to be able to show the difference.

Sometimes phase 3 trials involve thousands of people in many different hospitals and even different countries. Most phase 3 trials are randomised. This means the people taking part are put into treatment groups at random

Cancer Research UK (trials don’t have to be for cancer treatment, they can be for anything such as the problems with the immune system targeted by Argenx)

The goal is FDA (Food and Drug Administration) approval. So far, Argenx has Vyvgart Hytrulo and Vyvgart as approved drugs, and these are driving the strong growth in sales. The conditions being treated by Vyvgart are gMG and CIDP.

gMG stands for Generalized Myasthenia Gravis, a chronic, autoimmune disease that causes weakness in the body’s voluntary muscles, such as those in the arms, legs, face, and throat. It is caused by a breakdown in communication between nerves and muscles, and symptoms can vary in severity and fluctuate throughout the day, often worsening with exertion.

CIDP stands for Chronic Inflammatory Demyelinating Polyneuropathy, a rare and debilitating autoimmune disorder affecting the peripheral nervous system. Argenx develops and markets treatments for this condition, with its medication, VYVGART Hytrulo, being the first new therapy for CIDP in over 30 years and recently approved in major markets like the US and EU.

AI Overview

Tennis champion Monica Seles recently went public about her gMG condition.

Nine-time Grand Slam champion Monica Seles has revealed she was diagnosed with myasthenia gravis – a neuromuscular autoimmune disease – three years ago.

The 51-year-old has chosen to go public with the rare long-term condition, which causes muscle weakness, to raise awareness before this month’s US Open. Seles first noticed symptoms of the condition, which can affect most parts of the body – including the muscles that control the eyes, around five years ago. “I would be playing [tennis] with some kids or family members, and I would miss a ball,” former world number one Seles told The Associated Press. “I was like, ‘Yeah, I see two balls.’ These are obviously symptoms that you can’t ignore. “It took me quite some time to really absorb it, speak openly about it, because it’s a difficult one. It affects my day-to-day life quite a lot.” Seles decided to reveal her condition in the hope of using her platform to educate people about the disease, for which there is currently no cure. The American won eight major titles by the age of 19, after capturing her first aged 16 at the 1990 French Open. But she won just one more after she was stabbed with a knife by a fan during a match in Hamburg in 1993 and took time away from the sport to recover. Seles played her last match in 2003 having won 53 tournaments and spent 178 weeks at number one.

BBC Sport, 21 August 2025

Seles has partnered with Argenx to raise awareness of gMG, with an estimated 160,000 sufferers in America alone.

Argenx sees itself as on track to have 50,000 patients by 2030.

This could easily prove conservative, given the size of the markets being addressed. A year’s course of treatment can cost up to $450,000. This is to alleviate symptoms and improve muscle strength, so the treatment has to be continued indefinitely. It is a great deal of money, but it means Argenx is recompensed for the huge cost of drug development and has the funds to develop new indications for existing drugs and new drugs for patients desperately in need of improved treatment.

A ballpark figure for Argenx’s likely sales in 2030 is around $25bn, and by then its pipeline could have advanced to the stage where it holds exciting promise for years to come. Argenx is presently valued at around $50bn, or twice potential 2030 sales. Between now and then, the valuation could rise dramatically, not least because of Argenx’s position as the lead player in the treatment of a growing number of rare and debilitating diseases.

The CEO and co-founder of Argenx is Tim Van Hauwermeiren, who has been CEO since 2008, and has presided over all the growth of this extraordinary business despite being only 53 years old. He has built an incredible team around him. In terms of employees, the company is small with around 1,900, using the latest estimates for September 2025.

In rough numbers, assuming sales around $5bn for the next 12 months and 2,000 employees, that is $2.5m sales per employee, which helps the business be profitable and cash generative. Sales could be much higher over the next 12 months, conceivably nearer $10bn, using very round numbers.

Again, using very round numbers, it seems conceivable that the shares, currently $843, could be as much as $5,000 by 2030, to value the company at around $250bn, against sales of perhaps $25bn.

Share Recommendations

Argenx SE. ARGX