I have just been going through my main QV for Shares table and I have selected 107 indices, shares, ETFs and cryptocurrencies which I have given benchmark status. I look at each in the light of my preferred indicators (trend line breaks, moving averages, Coppock indicators, pattern breakouts, common sense and the balance of charts looking bullish v those looking bearish).

At one extreme all the indicators for all the benchmarks could be heading higher. This would suggest that we were in a bull market in full flight. At the other extreme they could all be heading lower. The second state much better describes where we are now. This doesn’t preclude a change of direction but it makes buying now a gamble.

The chart above of the S&P 500 illustrates what many charts look like presently. All my indicators for this chart are heading down and there has been no change of direction. Below I am going to go through the list of benchmarks and against them put a number for any of my three indicators (TLB. MA, C) which look bullish. There are very few numbers. No number means heading down. Typically 2B means buy signals from the moving averages and a trend line break but nothing yet from Coppock.

The list of benchmarks

- Indices

- Nasdaq 100/ NDX

- Nasdaq Technology index/ NDXT

- S&P 500/ SPX

- Megacaps

- Apple/ AAPL

- Microsoft/ MSFT

- Alphabet/ GOOGL

- Amazon/ AMZN

- Tesla/ TSLA

- Taiwan Semiconductor Manufacturing/ TSM

- ETFs

- Alps O’Shares Global Internet Giants/ OGIG

- IShares MSCI World Momentum/ IWMO

- KraneShares CSO China Internet / KWEB – 2B

- ARK Innovation / ARKK

- Ishares Semiconductor/ SOXX

- SPDR Technology/ XLK

- Invesco QQQ/ QQQ (tracks Nasdaq 100)

- First Trust Cloud Computing/ SKYY

- IShares Expanded Tech Software/ IGV

- IShares Russell 3000/ IWV

- Fidelity Nasdaq Composite/ ONEQ

- Leveraged ETFs

- Wisdomtree Nasdaq 100 3x Daily Leveraged/ QQQ3

- Direxion Semiconductor 3x Daily Leveraged/ SOXL

- Direxion Daily S&P Bull 500 3x Daily Leveraged/ SPXL

- Direxion Technology Bull 3x Daily Leveraged/ TECL

- Investment trusts

- Allianz Technology Trust/ ATT

- Polar Capital Technology Trust/ PCT

- Chinese technology

- Alibaba/ BABA – 2B

- BiliBili/ BILI

- Futu Holdings/ FUTU – 2B

- Meituan/ 3690 – 2B

- Nio/ NIO

- Pinduoduo/ PDD – 2B

- UP Fintech Holdings/ TIGR

- Cryptocurrencies

- Bitcoin/ BTCUSD

- Ether/ ETHUSD

- UK quality growth

- Ashtead/ AHT

- Croda International/ CRDA

- Dechra Pharmaceuticals/ DPH

- Halma/ HLMA

- Games Workshop/ GAW

- Liontrust Asset Management/ LIO

- London Stock Exchange Group/ LSEG – 3B

- Yougov/ YOU

- US technology

- Adobe Systems/ ADBE

- Atlassian/ TEAM

- Autodesk/ ADSK

- Epam Systems/ EPAM

- Etsy/ ETSY

- Globant/ GLOB

- Intuit/ INTU

- Intuitive Surgical/ ISRG

- Mercadolibre/ MELI

- Netflix/ NFLX

- Nvidia/ NVDA

- Salesforce.com/ CRM

- Sea Limited/ SE

- Servicenow/ NOW

- Hot technology shares

- Avalara/ AVLR

- Bill.com/ BILL

- Block Inc/ SQ.

- Cadence Design Systems/ CDNS

- Carvana/ CVNA

- Cloudflare/ NET

- Coupa Software/ NET

- Crowdstrike/ CRWD

- Datadog/ DDOG

- Docusign/ DOCU

- Five9/ FIVN

- Fiverr/ FVRR

- Hubspot/ HUBS

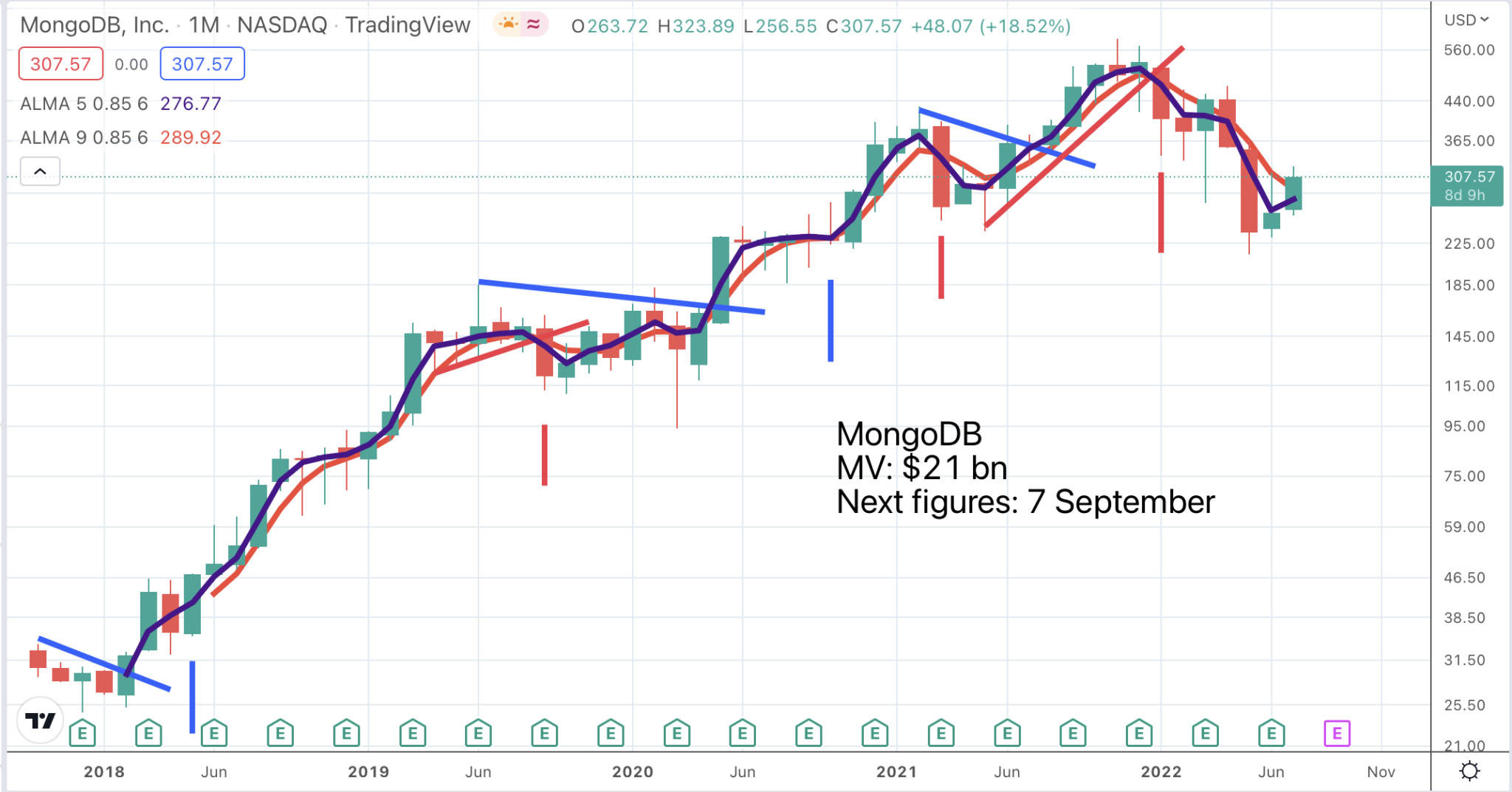

- MongoDB/ MDB

- Monolithic Power Systems/ MPWR

- Okta/ OKTA

- Palo Alto Networks/ PANW

- Paycom Software/ PAYC

- Rapid7/ RPD

- Ringcentral/ RNG

- Shopify/ SHOP

- Synapse/ SNPS

- The Trade Desk/ TTD

- Twilio/ TWLO

- Veeva Systems/ VEEV

- Verisk Analytics

- Zebra Technologies/ ZBRA

- Zendesk/ ZEN

- Zoom Video Communications/ ZM

- Zscaler/ ZS

- Fast food

- Chipotle Mexican Grill/ CMG

- Domino’s Pizza Inc./ DPZ – 2B

- Speculative technology

- Affirm Holdings/ AFRM

- C3.AI/ AI

- Confluent/ CFLT

- Fastly/ FSLY

- Lemonade/ LMND

- Lightspeed Commerce/ LSPD

- Snowflake/ SNOW

- Unity Software/ U

- Upstart Holdings/ UPST

- Financial technology

- Blackrock/ BLK

- Morningstar/ MORN

- MSCI Inc./ MSCI

- Nasdaq Inc./ NDAQ

- S&P Global Inc./ SPGI

- Medical technology

- Charles River Laboratories/ CRL

- Repligen Corporation/ RGEN

- UnitedHealth/ UNH – 2B

- West Pharmaceutical Services/ WST

- Luxury goods

- Brunello Cucinelli/ BC

- Ferrari/ RACE

- Hermes/ RMS

- LVMH/ LVMH

- Environment

- Enphase Energy/ ENPH – 2B

- SolarEdge Technologies/ SEDG

Strategy

This is a chart of my old favourite, QQQ3. It gives a great idea of what is happening. We are presently having a rally but there is no way of telling whether it might last or is just a rally. All my indicators are still pointed firmly down.

However there is one straw in the wind that might be significant. In the group of benchmark stocks is a larger group that I have described as hot technology shares. This group came to prominence in the bull market and especially in the period between 2016 and early 2021 when many shares enjoyed spectacular rises. These shares have been smashed in the bear market but had a good day on Wednesday, 20 July 2022; that is something that can be the first sign of a bottoming out process.

I am going to pick one share from the list of a company that has phenomenal fundamentals, data storage business, MongoDB (the DB stands for data base). Since the company was founded in 2009 it has been growing at a tremendous rate. The company is still on fire.

“We generated revenue of $285m, a 57pc year-over-year increase and above the high end of our guidance.

Atlas revenue grew 82pc year over year, representing 60pc of revenue. And we had another strong quarter of customer growth, ending the quarter with over 35,200 customers. We are really pleased with our Q1 performance and see it as continued validation of the massive market we are pursuing, our strong product market fit and our ability to execute. Atlas continues to be a key growth engine as new and existing customers run more and more of their mission-critical workloads on Atlas.

Q1 2023, 1 June 2022

None of my three indicators is signalling buy. The Coppock indicator is falling, there is no golden cross on the moving averages although the shorter moving average has turned higher, which is a promising development and there is no significant breach of a downtrend line. The only thing we have is a buy signal on my buy on a green strategy (every time we get a green candlestick after a red one, we buy) but this is very much a win in the end strategy although it could be combined with my other indicators so that you build up a position on green candlesticks and then sell everything if my three indicators turn down.

There is a case in the stock market that almost any sensible strategy if pursued for long enough will generate positive returns. For example, if you keep buying MDB on the greens from now on, against the background of those positive fundamentals, your average purchase price will either fall or you will find yourself invested in a rising market. If MongoDB shares ever reach new peaks, which looks more likely than not, then any strategy will prove rewarding.

One psychological problem (remember Robert Greene and the greedy little man that lurks inside many of us) is the desire to buy as close to the bottom as possible. This can only be done by luck because in the early stages it is so hard to distinguish between a rally in a bear market and the beginning of a new bull market.

What is relevant is that most of my Coppock indicators have fallen a long way and some of them are starting to flatten out. In the past I can see that when Coppock flattens out, especially after a prolonged fall, this more often than not is an early warning of a change of direction. However I have little history as yet of using Coppock with individual shares so I have to tread cautiously.

If we forget about trying to buy at the bottom and think more in terms of being on board while a share is rising life becomes easier because we can then wait for all my indicators to turn positive and we have the comfort of buying while the Coppock indicator is rising which, historically, has been a reliable indicator of a rising share price. While the Coppock indicator is rising there is no need to sell. Once Coppock starts to fall this doesn’t mean you have to sell immediately but it means the shares are at risk and should be sold on confirmation from my other indicators.

If you look closely at the chart above you will see two Coppock sell signals (red vertical line) with no buy signal (blue vertical line) in between. This is where common sense comes in. The Coppock indicator for MongoDB turned down in March 2021. They then gave a powerful buy signal based on my other two indicators (trend line break and a golden cross on the moving averages). They also reached a new all-time high so with all this going on it could have been very tempting to buy back in. The second consecutive Coppock sell signal is based on a resumed decline in Coppock after a brief flattening and helped confirm that the trend line break and dead cross on the moving averages should be acted on and the shares should be sold.

I am agnostic about the market at the moment which is maybe what one should be all the time, taking your cue from the indicators. It feels as though we may have reached a low point with the Nasdaq having declined, peak to trough, by 35pc.

The chart for Alps O’Shares Global Internet giants ETF, which includes so many of the shares from the Quentinvest table, shows an even more dramatic decline.

Peak to trough this chart is down 62.5pc and looks as though it may be trying to build a base though no buy signals as yet. The Coppock indicator has been falling since March 2021. This stock is an important benchmark because if it turns higher triggering my buy signals that will clearly be good news for the US stock market generally and for technology shares particularly.

I am sitting on the fence but watching closely. Another interpretation of what has happened to OGIG shares is that all the bull phase triggered by Covid and the associated lockdowns has been unwound so it may not be too surprising that the shares are trying to find a base. Life is slowly getting back to normal and so are share prices.