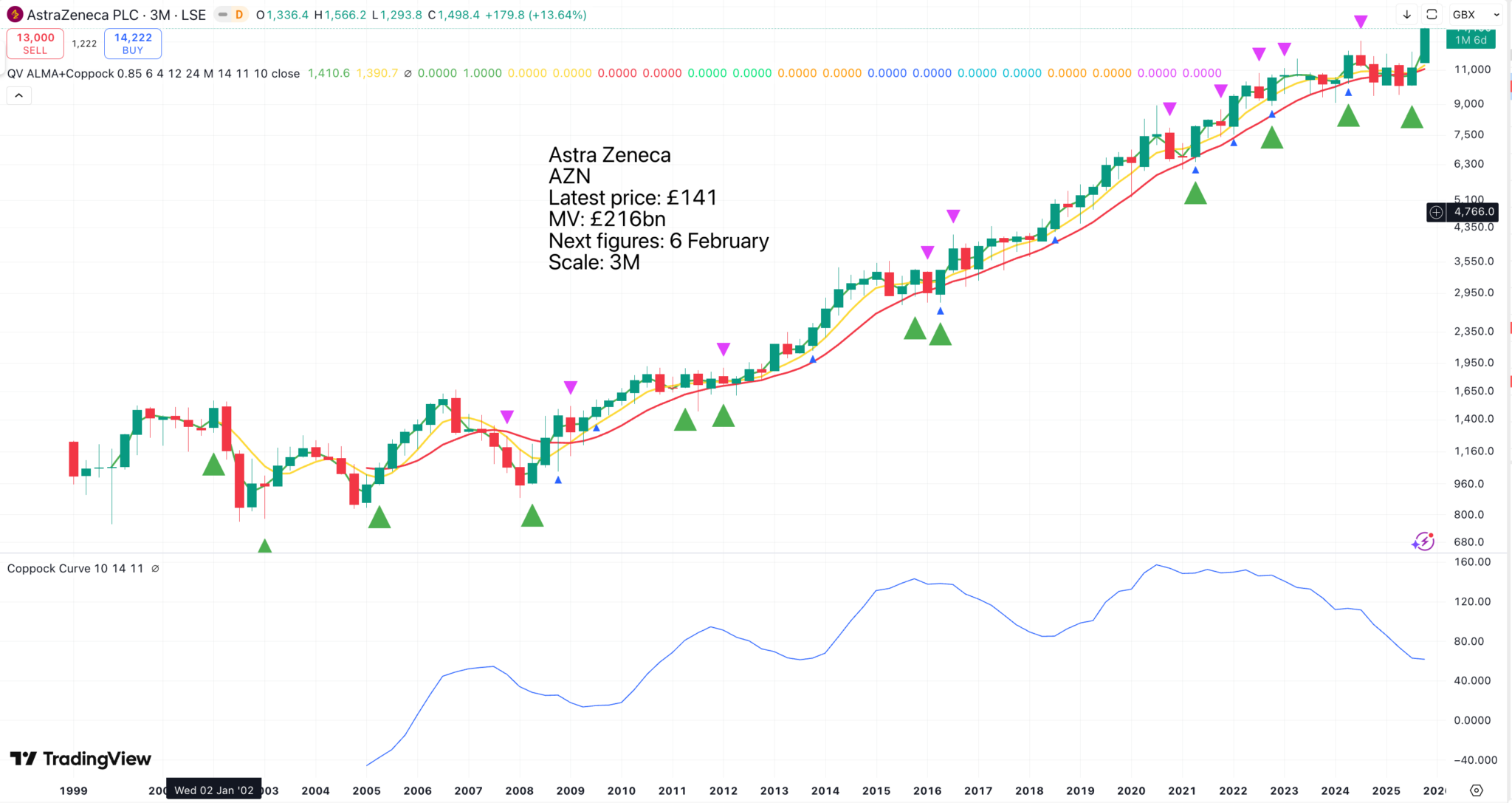

The chart looks spectacular with a pattern breakout, a moving average buy signal and Coppock looking set to turn higher after a long decline.

AI tells us that AstraZeneca is doing well.

AstraZeneca shares are strong due to a combination of strong recent financial results, particularly from its oncology and cardiovascular divisions, and a robust pipeline of new drugs expected to drive future growth. Key factors include forecast-beating sales in the third quarter, a strong performance from drugs like Tagrisso and Enhertu, and the successful development of new treatments in late-stage trials. Investor confidence is further supported by a U.S. drug-pricing deal that reduced policy uncertainty.

Key drivers of share strength

Strong financial performance: The company reported a strong third quarter with sales from its oncology division, including drugs like Imfinzi and Imjudo, beating expectations. Other key drugs, such as Tagrisso (cancer) and Farxiga (kidney disease/diabetes), also exceeded forecasts.

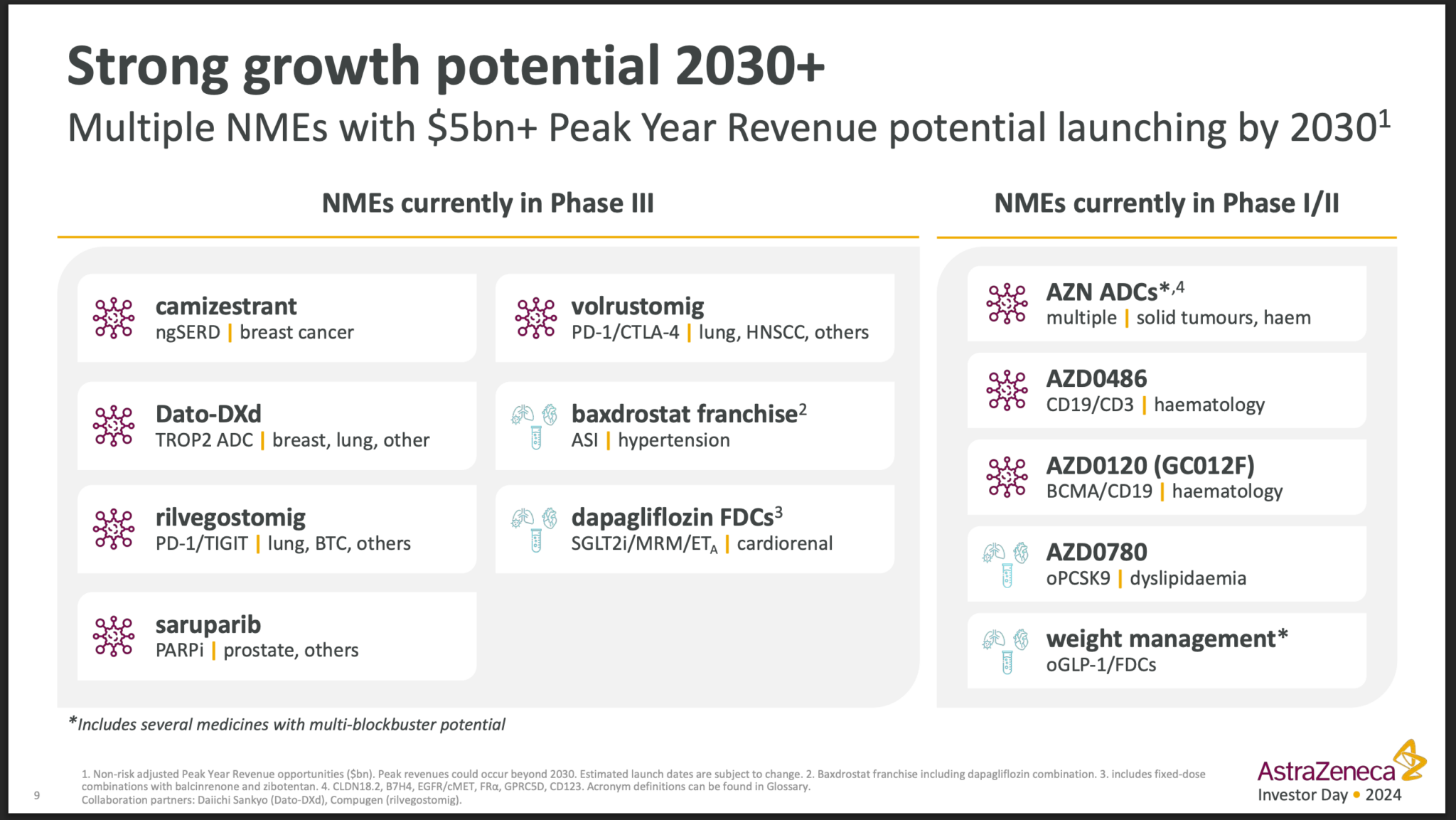

Robust drug pipeline: AstraZeneca has one of the strongest drug pipelines in the industry, with a large number of projects in development, including new molecular entities in late-stage trials. This pipeline has the potential to generate billions in new revenue.

Successful new drug launches: The company is seeing strong growth from new indications for existing drugs, such as its bladder and lung cancer treatments.

Strategic advancements: A significant factor was a recent deal with the U.S. president on drug pricing, which reduced policy uncertainty for the company and its investors.

Attractive valuation and growth potential: Despite recent gains, some analysts believe the stock is still undervalued relative to its growth potential, with a favorable PEG ratio. Projections for significant sales and earnings growth in the coming years are also supporting the positive outlook.

AI overview

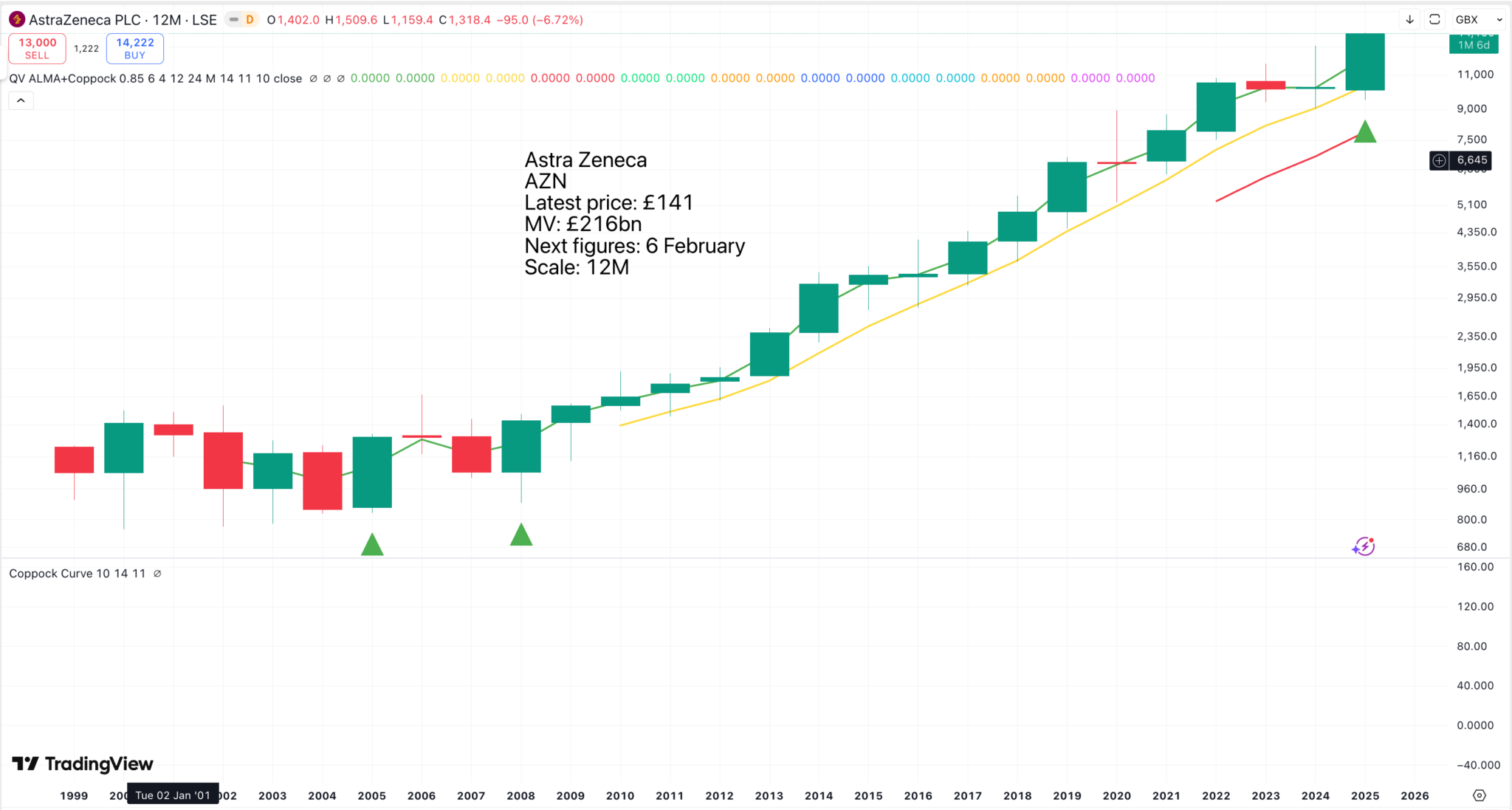

I looked at a 12-month candlestick chart.

On this chart we can see that it all started to happen in 2013. Something significant happened in October 2012 that set the scene for this much-improved performance by Astra Zeneca.

The CEO of AstraZeneca is Pascal Soriot. He has held the position since October 2012 and is an Executive Director on the company’s board. Soriot has been credited with revitalizing the company by focusing on R&D and strategic therapeutic areas like oncology. Soriot has led the company to become an oncology powerhouse, increasing investment in R&D and refocusing innovation efforts on areas such as heart disease, diabetes, oncology, respiratory diseases, and inflammation.

Background: Has a history of international leadership roles in the pharmaceutical industry.

Wikipedia, 25 November 2025

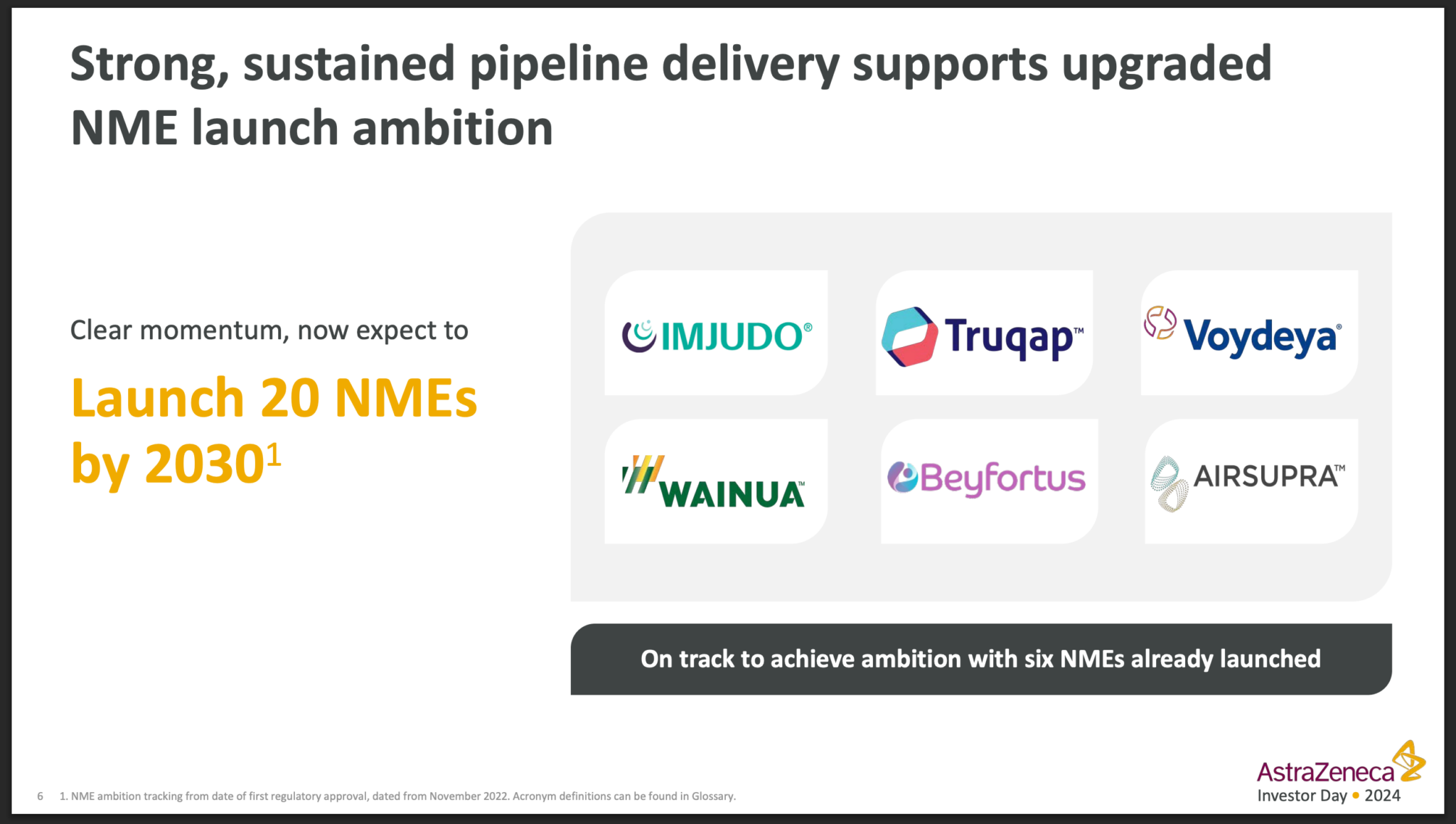

AstraZeneca has exciting plans

Every time I research one of these pharma stocks I learn something new, this time it was about NMEs. AstraZeneca is a research powerhouse with major facilities in Cambridge, UK, Gothenberg, Sweden, Shanghai, China, Gaithersburg, Maryland and Boston, Massachusetts. So what are NMEs.

In pharmaceuticals, an NME stands for New Molecular Entity, which is an active drug ingredient that contains no active moiety previously approved by the FDA in the United States. NMEs represent significant innovations in medicine because they are entirely new drugs, not just variations of existing ones. They require extensive testing to prove their efficacy and safety before they can be approved for market.

Key characteristics of NMEs

Novelty: NMEs are new compounds that have never been marketed as a drug before.

Regulatory scrutiny: They undergo a rigorous development and approval process by regulatory bodies like the FDA to ensure they are safe and effective.

Broader category: The term NME can include both New Chemical Entities (NCEs), which are small molecules, and New Biological Entities (NBEs).

Innovation: The development of NMEs is a key indicator of pharmaceutical innovation, with a growing number of approvals for treatments targeting rare and difficult diseases.

Example of an NME in development

A company might discover a new compound that shows promise in treating a specific disease.

This compound is considered an NME because it has never been approved before.

Before it can become a medicine, it must undergo a full program of pre-clinical and clinical trials to evaluate its safety and efficacy in humans.

AI overview

There is a great deal happening at AstraZeneca with exciting potential.

This target is intriguing because Eli Lilley is heading for sales of around $65bn in 2025 and is valued around $1 trillion v $285m for AstraZeneca, which is hoping for sales of $80bn in 2030. One clue to this disparity is in the relative profit margins. Eli Lilley’s margins are approaching double those of AstraZeneca.

For the full year 2024, Eli Lilly had a higher profit margin than AstraZeneca. Eli Lilly’s net profit margin was approximately 23.5%, compared to AstraZeneca’s 13%.

Below are the key profitability metrics for both companies for the full year ending December 31, 2024:

Metric Eli Lilly AstraZeneca Gross Profit Margin 81.3% 82.2% Operating Margin 28.6% 18.5% (approx. based on reported operating profit/revenue) Net Profit Margin 23.5% 13.0% Key Takeaways:

Gross Margin: Both companies had a very similar, and high, gross profit margin of over 81% in 2024.

Operating Margin: Eli Lilly’s operating margin was significantly higher than AstraZeneca’s, indicating better efficiency in managing operating expenses (R&D, marketing, etc.) relative to revenue.

Net Margin: Eli Lilly also demonstrated a substantially higher net profit margin, nearly double that of AstraZeneca, meaning it generated more net income as a percentage of its total revenue.

For the latest twelve months ending September 30, 2025, Eli Lilly has continued its strong performance with TTM (trailing twelve months) net profit margins rising to nearly 31%, while AstraZeneca’s TTM [trailing 12-month] net income to common margin stands at 16.2%.

AI overview

It seems AstraZeneca needs to take a long, hard look at Eli Lilley and ask themselves why the latter is so much more profitable. No surpise to find that AI has the answers.

Eli Lilly’s greater profitability is primarily driven by the extraordinary commercial success and high demand for its GLP-1 (glucagon-like peptide-1) class drugs, Mounjaro and Zepbound, which target the rapidly expanding and highly profitable diabetes and weight-loss markets.

Key Factors Driving Eli Lilly’s Profitability

Blockbuster Drug Success: Mounjaro (for type 2 diabetes) and Zepbound (for obesity) have achieved massive sales, with combined revenue exceeding $10 billion in a single quarter in 2025. This has resulted in a 54% year-over-year revenue increase in Q3 2025 alone, a much faster growth rate compared to most other large pharmaceutical companies.Dominant Market Position: The market for weight-loss and diabetes treatments is projected to be worth over $150 billion by 2030, and Eli Lilly, along with its rival Novo Nordisk, holds a commanding position. Eli Lilly’s dual GIP/GLP-1 mechanism provides a competitive advantage that has helped it capture significant market share.Strong Profit Margins: Eli Lilly maintains a high gross profit margin, around 80.9%, which translates into higher net income compared to AstraZeneca’s 16.2% net income margin in 2024.High Investor Confidence: The tremendous success of its lead drugs has led to soaring investor enthusiasm, with Eli Lilly reaching a market capitalization of $1 trillion, the first healthcare company to do so. This high valuation reflects market confidence in the company’s future growth potential.

AstraZeneca’s Performance Profile

AstraZeneca is also a successful and growing pharmaceutical company, but its revenue streams are more diversified and its primary focus is different from Eli Lilly’s in terms of market dynamics.

Diversified Portfolio: Oncology is AstraZeneca’s largest segment, comprising about 41% of its total revenue in 2025. It also has strong performance in respiratory, cardiovascular, and renal conditions.Solid, But Slower Growth: While AstraZeneca has demonstrated strong and consistent performance, with total revenue up 18% in 2024, its growth rate is not as explosive as Eli Lilly’s, which is experiencing an unprecedented boom from a single, high-demand product class.Different Valuation Metrics: AstraZeneca has a lower price-to-earnings (P/E) ratio than Eli Lilly, suggesting a more conservative market valuation compared to the premium placed on Eli Lilly’s high-growth prospects.

In essence, while both are robust pharmaceutical companies, Eli Lilly is currently capitalizing on a unique, high-demand, and extremely profitable market segment, leading to superior profit figures relative to AstraZeneca.

AI overview

I can’t stop wondering what the hell did I do before AI arrived. I think what we are looking at here may be the two most exciting major pharmaceutical stocks in the world though there are others I have not studied.

AstraZeneca has impressive plans.

I could show you much more about both these companies to demonstrate how exciting they are but that would be overkill. It ties in with my belief that something transformational is happening in the world of drug discovery. We are at the dawn of an era of incredible progress and many shares in this and related fields are going to prosper.

Share Recommendations

AstraZeneca. AZN (London quoted)

Eli Lilley LLY

I will be adding AstraZeneca to my Top 50 list.