Applovin’s Incredible Opportunity; CEO Foroughi Says Q4 2025 Should Be A ‘Fun Quarter’

Applovin is one of the most exciting investment opportunities on the US stock market. Billionaire co-founder and CEO, Nick Foroughi, is talking about two inflexion moments, the first in Q4 from 1 October 2025, when their new Axon product goes live and then a little further down the road when the business goes global.

The shares are already up 60 times since the beginning of 2023, so this potential is not unknown to investors, but given that it has not even started yet, I think there is more excitement to come, and Applovin could be a multibagger from here.

There is a lot to read, but it should be worth it.

To understand where Foroughi thinks AppLovin is going, we need to understand where it is now and get a better understanding of what it does.

Founded in 2012 by Adam Foroughi (current CEO), John Krystynak, and Andrew Karam, AppLovin saw opportunities in the rapidly evolving mobile games space, which was in the early stages of the smartphone era.

In the 13 years that will follow, many things will happen, including multiple potential takeovers for valuations that are about a hundredth of where the company trades today.

Despite the challenges and constant swings, AppLovin somehow was able to acquire and develop a portfolio of solutions that has formed into a one-of-a-kind platform for mobile games advertising.

What AppLovin Actually Does?

If you’re familiar with the ad industry and know how it works, I can save you some time by saying AppLovin is like Google (GOOG) for mobile games. What does it mean? Well, in the digital advertising space, there are four key jobs to be done.

One, inventory. Inventory refers to the “place” where an ad is placed. For example, familiar inventory on Meta’s Instagram (META) is on the feed, Reels, etc.; Familiar inventory on YouTube is before a video is played. In the mobile games space, inventory is typically between stages of a game, or when you want to unlock certain items.

Two, sell-side platform. For an ad to be placed, the inventory provider needs to sell it, typically through a platform that’s taking bids from multiple advertisers.

Three, demand-side platform. Just as an ad needs to be sold, it needs to be bought. Because advertisers don’t want to bid separately for each distinct inventory set, they typically go to a demand-side platform that places bids across multiple inventories, or in this case, multiple games.

Four, measurement, attribution, and analytics. The advertisers need to know whether or not their ad worked, or more accurately, what is the return on ad spend. That way they can decide how much more or less to spend, and where to do it.

Interestingly, nothing says that these four jobs needs to be done by separate entities. In fact, the most successful ad platforms, like Meta, Google, or Amazon (AMZN) are doing all four jobs at once.

In AppLovin’s case, its demand-side solution is AppDiscovery, the sell-side solution is Max, and its measurement and analytics solution is Adjust. Connecting it all is the company’s proprietary Axon engine that’s underlying the optimization of the supply side and the demand-side. It relies on data gained from real-time bidding and how much money buyers are willing to pay.

It also has an Apps segment with over 400 games for inventory, but that’s not really significant (AppLovin might sell it at some point).

So, what you need to take away here is the following. AppLovin’s integrated platform unlocked a multibillion market in mobile games, which used to rely on antiquated ways of targeting for ads. This creates a virtuous cycle where all mobile games want to connect to AppLovin, making its platform even more attractive for all participants.

Why Is It Such A Great Business?

Advertising has long been considered the best business model in the world, and within the advertising space, performance-based advertising is arguably the cream of the crop.

Think about it this way: If an advertiser knows the return on their ad spend, and its positive, this is in some way like printing money (put in x, get back x + ROAS). If that’s the case, you’re going to do as much printing money as you can, with the only constraint being the optimal size of the opportunity.

In simple words, you’re going to spend as much as you can until you don’t generate a positive return anymore.

This extremely lucrative flywheel has never been meaningfully relevant in a mobile games industry that couldn’t do the targeting and attribution. Then came AppLovin.

Seeking Alpha, 15 January 2025, YR Research

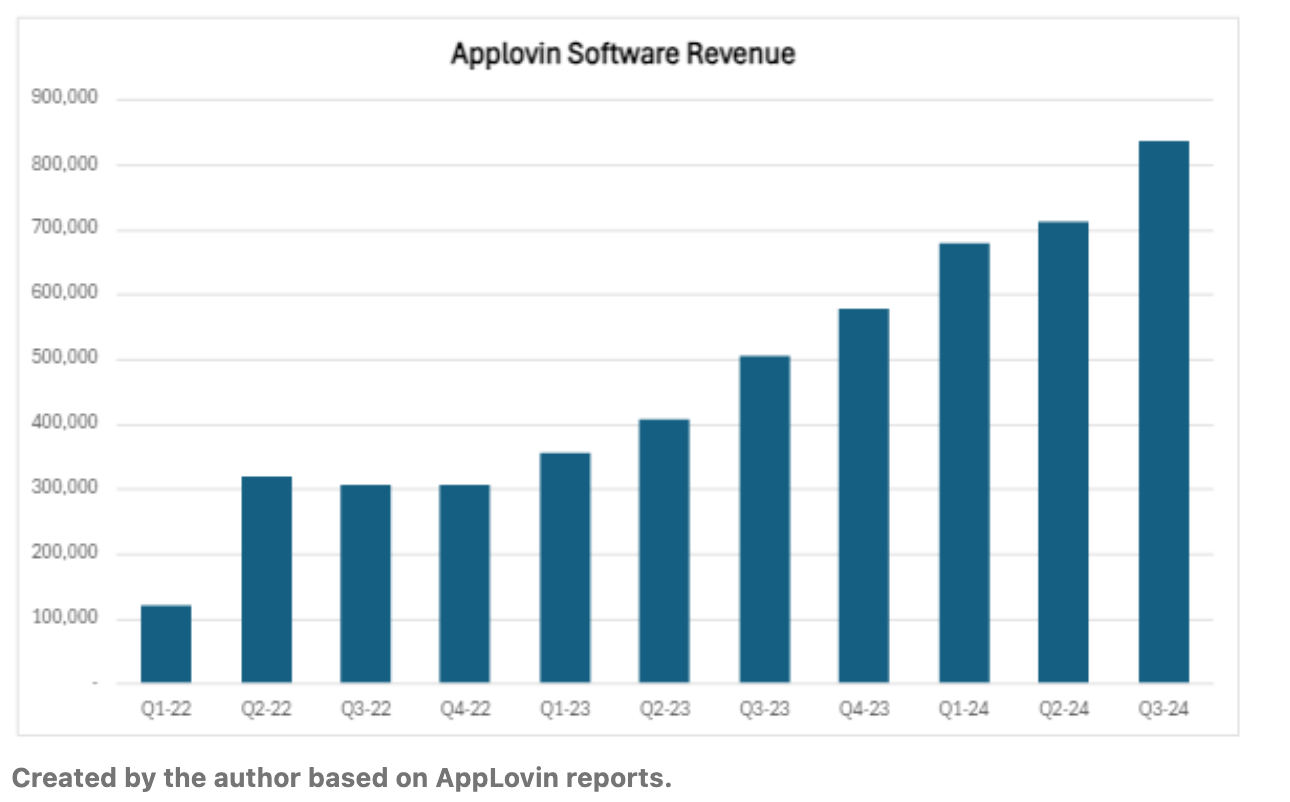

From Q1-22 to Q3-24, AppLovin’s Software revenue grew over 7x, on track to surpass $3 billion in annual sales in 2024. This is entirely driven by the company’s ability to continuously improve its attractiveness for advertisers.

And, good news for AppLovin and its shareholders, advertising is a very high margin business, with gross margins above 70% in the recent quarter. It is also a business with impressive operational leverage, with all opex lines dropping significantly over the past two years.

In the most recent quarter, AppLovin’s operating margin reached nearly 45%, leading to operating profit of $530 million, and EPS of $1.29, up over 4x Y/Y.

Outlook & The Multi-Billion-Dollar E-Commerce Question

We now know just how strong AppLovin’s business is. The question is are we too late to the party, and the short answer is no.

AppLovin targets 20%-30% annual revenue growth for the foreseeable future, as the monetization of the 1.4 billion daily mobile gamers is still in its very early days.

Going back to our four jobs to be done in digital advertising, it’s important to understand that each of this individual “jobs” has its own layers, and each layer’s improving could drive the flywheel even further. That’s why AppLovin’s management is saying that 20% is a baseline, and 30% will be achieved in years of technological unlocks.

All that is solely regarding advertising for other games. Perhaps I should have mentioned it before, but essentially 100% of ads shown in mobile games today are advertising other mobile games.

However, AppLovin recently did a pilot for e-commerce ads in mobile games, which they said went extraordinarily well. They are already getting budgets from advertisers, with many experts so mind blown from the results they are questioning if they are too good to be true.

On that note, AppLovin’s management said they expect e-commerce to become a significant revenue driver already in 2025, meaning they are quite confident.

If they do end up succeeding in e-commerce, it’s a much, much larger budget pool to tap into, and things can escalate very quickly.

Seeking Alpha, 15 January 2025, YR Research

At the end of his piece, the author discusses the valuation, which takes us into how long is a piece of string territory. What I am interested in is the planned move from the mobile games advertising business to also being an e-commerce business. As the author says:- ‘If they do end up succeeding in e-commerce, it’s a much, much larger budget pool to tap into, and things can escalate very quickly.’

It is this opportunity which could take the shares stratospheric. I am not going to try to deliver my own judgment on this potential. What do I know? What I am interested in is what Foroughi says about the opportunity ahead.

First is the health of the existing business.

Q2 2025 was another great quarter, driven by continued strength in gaming advertising. Our growth comes from improved technology, increased demand as well as from supply side expansion. The MAX marketplace creates the supply that drives our growth as well as the growth in the market. As marketing technologies in the industry continue improving, we expect the supply will keep growing quickly. While we don’t disclose exact MAX marketplace growth rates, it has consistently been double digits, far outpacing growth in the in-app purchasing gaming market.

The ongoing improvement in our models drive sustainable growth rates beyond the market growth rates, while we continue to expand our dominant leadership position. Based on all the opportunity in front of us in our core market, we are confident we can sustain 20% to 30% year-over-year growth driven by just gaming.

Adam Foroughi, co-founder and CEO, Applovin, Q2 2025, 6 August 2025

But according to him, this is just the launchpad for a far more exciting opportunity.

However, what gets us more excited now than ever before in our history is the opportunity to really expand outside our core market.

Recently, we took the first step towards opening up our platform broadly, quietly launching our new AXON ads manager, our self-service portal, which will serve as the foundation for our next decade of growth. Our ad manager has many benefits. It puts day-to-day controls directly in advertisers’ hands, reducing friction. It enables credit card billing, eliminating the hassle of monthly invoicing. It provides the architecture for agents that can eventually automate every workflow. It establishes the framework for automatically generated ads. It simplifies onboarding through our recently launched Shopify app. It deepens integrations with attribution providers, giving customers more accurate reporting.

With the rollout going smoothly, we were ready to widen access. On October 1, 2025, we plan to open the AXON ads manager on a referral basis, perfectly timed for the holiday season. Feedback from these partners will guide our global public launch in the first half of 2026. To date, web advertising campaigns have been limited to the United States. On October 1, we plan to open our platform to most major international markets.

Adam Foroughi, co-founder and CEO, Applovin, Q2 2025, 6 August 2025

Mark your diaries, 1 October 2025 is a key date in the history of Applovin. The report for the period to 30 September 2025 is due in early November. There will be no figures for the impact of the new initiative, but the company should have an idea of how the launch is going. In early February 2026, the company will report on Q4 2025, which will have actual numbers which could be game-changingly exciting.

It would not be surprising to see a big move in Applovin shares between now and next February. If the launch flops, the shares would collapse, but that is not what Foroughi is expecting. I have no idea what is going to happen, but I am ready to back Foroughi, who is a go-getting guy with a spectacular record of achievement behind him and plans for much more in the future.

Here is how he describes the opportunity.

Now stepping back, we have spent the last decade assembling the pieces, reach of more than 1 billion users, best-in-class optimization and now a self-service interface. Together, they position us to help any business of any size anywhere in the world grow profitably. That is good for our partners. It’s good for economies around the world, and it’s great for job creation. The opportunity is so big that we will be launching the platform under its own brand, AXON. Once AXON is fully open next year, we plan to begin paid marketing to recruit new advertisers, which will drive predictable compounding growth.

We have been building performance-driven advertising products longer and better than most anyone. Operating at our current scale with an incredibly small amount of advertiser relationships highlights the magnitude of the opportunity ahead. Our strategy is simple: build world-class products, launch them when they meet our high bar and compound from there. Patient, disciplined execution produces durable success, and we hope our track record gives you the same confidence we have in our future. We’re incredibly excited about what’s ahead.

Adam Foroughi, co-founder and CEO, Applovin, Q2 2025, 6 August 2025

It is working for me. I am super excited. I have noticed something too. You might think it is too late to buy Applovin shares, but investors are super sceptical. Yeah, he talks the talk, but can he walk the walk? They want to see results. If Q4 is as explosive as Forughi is hinting it could be, then the buyers are going to be out in force, and the shares could soar.

I have been checking out Foroughi, and he is like Musk in his ambitions, suggesting that the impact of Applovin’s new business could be so dramatic that it could impact the global economy. WOW!

The other thing to note about Applovin is how strong the business metrics are.

At the end of the quarter, we closed the sale of our Apps business to Tripledot Studios. This quarter, the financial results for the Apps business are included within discontinued operations, and we will keep our commentary limited to the advertising business only.

During the quarter, revenue increased by a very healthy 77% from last year to approximately $1.260 billion, while adjusted EBITDA nearly doubled to an impressive $1.020 billion, achieving an 81% adjusted EBITDA margin. The majority of our revenue growth in the quarter was driven by our core gaming business.

While e-commerce continues to perform well, we limited onboarding of new customers to focus on the preparation for the self-serve launch in Q4. Quarter-over-quarter flow-through from revenue to adjusted EBITDA was a very strong 81%, illustrating our continued dedication to operating lean.

At the end of the second quarter, we had $1.2 billion in cash and cash equivalents, which includes $425 million in net cash received from the sale of the Apps business. In the second quarter, we generated $768 million in free cash flow, up a staggering 72% year- over-year. Our free cash flow was slightly lower than last quarter due to the timing of payments for interest on our bonds, which are semiannual and certain taxes associated with the prior year. This quarter, we repurchased and withheld approximately 900,000 shares for a total cost of $341 million funded through free cash flow. As a result of our ongoing strategic share management activities, we were able to reduce our weighted average diluted common shares outstanding this year from 346 million in the fourth quarter to 342 million this quarter.

Matthew Stumpf, CFO, Applovin, Q2 2025, 6 August 2025

The sale of the Apps business and the chunky share price ($600+) make me suspect that the future will see a change of name and a share split. This business is motoring. It didn’t start trading until 2014, so it has existed for barely more than a decade, during which time it has become a $200 billion market value business.

It is remarkable (my word was ‘wild’, but Grammarly didn’t like it) how exciting this company appears.

So look, like we’ve got big aspirations with our platform. The advertising solution right now to web commerce advertisers and more broadly, other categories we’ve talked about is looking really strong. Obviously, we have very small penetration in terms of advertiser base against what our global advertisers count.

And the way we look at our business is if the model works this well at this small amount of penetration, what happens when we can really open it up and go service all the small businesses in the world. Our aspirations are to help any business of any size be able to acquire customers profitably. And if we can do that, we’ll achieve the goals that we’ve set for ourselves.

So the value of us being able to go out in performance market, the platform, is that we’ve got one of the most lucrative financial models the world has ever seen. I mean, obviously, you can see the amount of cash that we print. And we’re very good performance marketers. So we’re very good performance marketers. It’s plausible that we will be using our own models to recruit advertisers off of our own inventory. There’s plenty of moms with small businesses and dads with small businesses sitting in games, playing games all day that could use our platform to market themselves.

You can imagine us running ads on Facebook, on LinkedIn, on TikTok. But it really does come down to the fact that we’ve got such a lucrative financial model and we try to run lean and automate every step of that process. And we believe that if we can automate the onboarding of advertiser flow from when an advertiser can find out about us from an ad all the way through to going live and then scaling on our platform, the model will be very lucrative on an LTV to CAC basis, and we won’t have to staff up a large sales force.

Nick Foroughi, CEO, Applovin, Q2 2025, 6 August 2025

An insight into how this guy thinks is that when it looked as though TIKTOK US was going to come up for sale, he tried to buy it. My favourite analyst, Dan Ives of Wedbush Securities, reckons TIKTok US plus its coveted algorithm could be worth as much as $200bn.

Some quotes are insightful, even though I struggle to understand.

We talk a lot about the market in mobile gaming and people fixate on the in-app purchasing market. And what we’re trying to do is just highlight the fact that our business grows from improvements in technology and demand, which drives CPM and expansion of supply. The MAX mediation platform is really high penetration into the market, so we’re not going to be able to grow it particularly quickly by taking more mediation from other platforms at this point. What we were highlighting was that the base platform, just the audience inside MAX, is growing swiftly, double-digit growth, so multiples greater than what you would expect when people try to size up the gaming market growth rates of 3% to 5%.

The other thing that is super valuable to understand in that is that inside that marketplace, we historically have always talked about how there’s not a share gain concept. As the marketing platforms improve, that platform grows. The eyeballs playing games play more games every single day. Inventory goes up. That drives growth on our platform. It drives growth on the platforms that are the other bidders inside that ecosystem. And then we benefit the most because we’re taxing every transaction for the most part that happens outside of us at the MAX fee. And then obviously, our own DSP is a super lucrative business model when we win the inventory.

[CPM (Cost Per Mille or Cost Per Thousand) is an advertising pricing model where an advertiser pays for every 1,000 times their ad is displayed, or impressions. This model is primarily used for brand awareness campaigns, aiming to maximize exposure and get an advertisement in front of as many people as possible, rather than focusing on immediate actions like clicks or purchases.]

[DSPs are a platform that manages multiple ad exchanges through a single interface to facilitate the buying and selling of digital ad inventory.]

Nick Foroughi, CEO, Applovin, Q2 2025, 6 August 2025

Applovin is the king of the adtech pack.

AppLovin’s rise to the top can be traced back to the company’s Q3 2024 earnings results back in November, when its quarterly revenues smashed analyst expectations at $1.2 billion. And the watchword on Wall Street was AI, which helped drive monetisation for AppLovin’s network of mobile advertisers via its revamped ad optimisation solution, Axon 2.

“We’ve seen very few, only a handful of software implementations that are compelling at scale inside what we’re calling these AI technologies, and we’re one of those,” AppLovin CEO Adam Foroughi told investors. The company’s stock soared at the results, and by the end of the month, its share price was up almost 100 percent.

Since then the firm has jettisoned its mobile games division to focus on its ad tech business, and the company’s market cap has climbed almost 300 percent over the last year – despite hitting a bump in February when accusations of fraud wiped $20 billion from AppLovin’s market value.

Video Week, Dan Meier, 21 May 2025

Then Foroughi dropped some hints about why Q4 2025 could be so exciting.

Let’s look back over the last year at our numbers, and then I’m going to give you qualitatively sort of what was going on with growth in the business. In Q4, we saw a huge ramp-up in the e-commerce category when we went into this pilot state, recruited hundreds of advertisers that we disclosed. And that was a big ramp-up in Q4, where, in Q1, we got the full benefit of that run rate. And if you look back at the quarter-over-quarter growth, Q4 and Q1 were really high growth rates.

Now the reason for that is that the new type of customer that comes into our platform is extremely incremental to our business like we’ve talked about in the past. Then, since then, we knew that we had highlighted a whole bunch of things that we had to go build into the platform to be able to service advertisers at the level that we like to do. And we like to set a really high bar for the products we deliver. We wanted to build the ads manager, which we released and we will continue to innovate and iterate through. We wanted to build dynamic product ads that came out in the last couple of quarters. We wanted to do better integrations with attribution companies, which happened inside the quarter. And we wanted to launch a Shopify app and other apps that allow for seamless integration amongst the advertiser base.

So we ended up constraining the advertiser onboarding process for a couple of quarters while we made sure that the product was at the level that we wanted to get it to. Now we’re looking at, in Q4, talking about a referral-based opening. That, in itself, I’m going to define that for you so you understand what we’re talking about, but accounts on the platform, they obviously like our solutions because they’re spending substantial amounts of money on our platform. We’ll get the chance to refer their colleagues into our platform and have them go live in a self-service way.

We expect that will increase the advertiser count quite quickly and also allow us to go through live examples of advertisers coming in self-service all the way to scale on our product. Assuming all that goes well, then we talked about opening up the platform entirely to the world in first half of next year. We think as advertiser count grows on our business, especially in categories outside of gaming, you’re going to see a lot of upside in the numbers that we’re able to report.

Nick Foroughi, CEO, Applovin, Q2 2025, 6 August 2025

This thing about Q4 is important because it could be such a game-changer for Applovin. This is their chance to play with the big boys and become a Tech Titan.

By constraining the advertiser count, we’re limiting growth. Now we’re focused on growing the cohort that’s live, which we saw growth from the cohort that’s live that Matt, in his prepared remarks, said majority of our growth came from gaming. So if you assume a large, large amount of the growth in the quarter came from gaming and you’re roughly 9% quarter-over-quarter, gaming is still a 30% to 40% grower for us, so well above our 20% to 30% long-term goals that we’ve stated.

Now e-commerce, we went from a state where we ramped it in Q1 and then controlled, as I said, on the advertiser onboarding while we got these tools ready to go. And so where we were at was that sort of 10% range that we were targeting for the year. There’s a reason I expect it to have grown above that because gaming is growing so quickly. And for 2 quarters now, we’ve mentioned that gaming was a big contributor to growth.

As we go into Q4, that’s a huge holiday shopping season. So not only are you going to see the cohort that we have live spend a lot more. You’re also going to have new onboarding happening for the first time in our history at a rate that’s much higher than we will

have ever seen before. So we fully expect that e-commerce will see a pretty substantial ramp-up through that, what you can call a soft launch period and then, obviously, as we go into a broader global release, the impact from that.

And then the last point to remember is another one of my prepared remarks highlighted the fact that we have constrained the advertisers we even have live today by not allowing them to buy our audience that’s international. The vast majority of our user audience is outside the U.S. We will be releasing almost all markets once we go into this October 1 release.

Nick Foroughi, CEO, Applovin, Q2 2025, 6 August 2025

I don’t understand exactly what Applovin is all about, but here is another quote with more insight. As we know, with AI compute power + data in equals valuable intelligence (tokens as Jensen Huang of Nvidia calls them, out), so access to data is a big part of the Applovin business model and helps create that magical flywheel effect

There’s — one, there’s no way to know that, right, because that’s future looking, and we’re going to go acquire a lot of data as we open up the platform. But in terms of architecture of the models, the 2 models are distinctly different because on the 1 hand, a user is going to a website and on the other hand, a user is going to app store and that app store isn’t even something that we can measure. And so you’ve got 2 frameworks.

And then as you touched on in gaming, when we launched AXON 2.0, we already had pretty good market penetration. Now we didn’t work with the largest customers, so we continue to get better as we broke into the largest customers in the category. But I want to say we had 50%, 60% penetration and now market penetration in gaming, as you all know, we’re almost a requirement at this point given how good we are.

In e-commerce, when we launched in the pilot, why we were so excited about the result is that the first beauty shop that went live, the model knew nothing about the shopper behavior inside the beauty category. And we talked about this. That was the big concern. Could AppLovin’s tech actually go out and figure out predictively how to convert a user to go buy from a beauty store with no knowledge?

Now we’ve talked about the one disclosure we gave hundreds of e-commerce businesses live on the platform. That’s a pathetic amount versus the grand scope of how big these categories are. I mean, Shopify alone has millions of shops, right? So you have so much potential for data accumulation.

And then just remember, the data in our platform is not unique to one or the other part of the business. So we’ve always felt that games will benefit a lot from our ability to break into these other categories. You can imagine if someone buys a $4,000 handbag from a store, that person is probably a whale for a match-three game. Now I can tell you that, but I can tell you the technology is going to come up with a lot of cross-correlations and conclusions that are a lot more powerful than that.

So in terms of opportunity for us, not only does opening up the platform get us more demand, which is going to be massively accretive and incremental to our business. It gets us more data. And so every single quarter, you’re going to have that flywheel effect that, then paired with our engineers’ ability to take added data and improve the technology and its interpretation of that data creates a real strong foundation for growth for a long time to come.

Nick Foroughi, CEO, Applovin, Q2 2025, 6 August 2025

AI is central to Applovin’s business.

What we believe, because we can see it, our ads drive a lot of intent and drive 2 conversions very, very quickly, and we’ve been able to extract a lot of value out of the space. I mean if you take the disclosure that I gave you in — I think it was Q1, hundreds of advertisers, I believe it was in the 600s, and $1 billion run rate. The market penetration in terms of market of scale of advertisers to total market is probably 1% or less in that number. And to get to $1 billion run rate, clearly, even if they’re complaining about feature missing, the money is showing up at a level that you wouldn’t expect for that little market penetration.

So then as you go extrapolate to getting new customers on, we think the products that we deliver work. We think their mindsets will change over time because they’ll realize platforms are different, and that’s good for their business. It’s not bad for their business.

Now the last thing I’ll leave you with is we do believe in automation entirely throughout the funnel. We don’t allow gaming companies to use any sort of manual targeting in our platform. The platform allows them to input a goal, put it in a budget and get that result. And that’s what they pay us for, the technology being extremely precise and removing that human mind out of the equation.

We bring the same view to this category. All these technologies in advertising are going to move to AI, automating most of this funnel in the future. We’ve already done that in our largest part of our business, and we are committed to doing that in this category and not allowing people to override what is a smarter system than the human being.

Nick Foroughi, CEO, Applovin, Q2 2025, 6 August 2025

As with all my Top 30 companies, I am on a learning curve, and Applovin is no exception. Each quote adds more to our understanding of the incredible opportunity facing this business.

One, there’s international businesses like local shop in Japan versus domestic U.S. businesses. Second, there’s the traffic. And for us, historically, because we’ve grown word of mouth, getting customers that were local to markets was always tricky. So it was much easier for us to get companies that were international buyers. And the revenue was driven by where is the audience and how monetizable is the audience. And so to date, I want to say this off the top of my head, and Matt can correct if I’m wrong, but it’s roughly half-half on domestic U.S. versus rest of world. And remember, we don’t tend to operate inside China. And so you start with that. You go, okay, well, we have — and the only disclosure we’ve given you on the e- commerce vertical, that $1 billion run rate, I look at that and go, well, if we open up all these other countries for the most part, is 1 going to become 2 overnight. Probably not because most of these western companies can’t go out and buy Japan and Korea and things that are really localized in language. But there’s a lot of markets that look and feel similar to the U.S.

So once we open it up, one is going to become much more than one. We just don’t know where it’s going to land. And then as we open up the platform, that local Japanese company should be able to come into our platform. And like we said, if we don’t see them organically coming in, we’re going to market to them and ensure they’re coming in. The one in Korea is going to come on the platform, and we’ll start getting penetration in every one of the markets that our users are in. And that incremental advertiser in these categories, as I touched on, the revenue from that is worth so much to us that we have the type of financial model that will allow us to go get coverage all over the world.

Nick Foroughi, CEO, Applovin, Q2 2025, 6 August 2025

Below is a strong hint at where Applovin could be going.

Your second question was percentage of e-com revenue in the future, correct? Like we’re starting at 10. Now we’ve said — I think on the last earnings call, I think I said 0.5% market penetration. It’s probably — I mean we’re certainly sub-1% of Meta reports over 10 million advertisers, and we’re going after all businesses of all sizes. We don’t have a lot of advertisers. So the opportunity in that category, both in terms of advertiser count and in terms of scale of TAM is much greater than gaming.

So as we go forward, if we’re doing our job right and performance is as we would expect based on the data that we have so far, it’s going to quickly become more and more of our business. And will 1 day our business become 90% web-based advertising, 10% mobile gaming? I don’t know. But what I think, because of the data flywheel and the system that benefits both sides and the improvements that we continue to have on gaming is that gaming is going to get bigger and that other category is going to get really big.

Nick Foroughi, CEO, Applovin, Q2 2025, 6 August 2025

Think about that last paragraph. The new business launching on 1 October could become 10 times the size of the existing gaming business, which is itself growing fast. No wonder they are excited.

Finally, we have an electrifying quote relating to what may happen in Q4 2025, to be reported in early February 2026.

Look, the referral program is to make sure that our advertisers who find success on our platform thus far are effectively curating the next set of advertisers. And prior to that, it was our team doing that, and we were very, very restrictive. So we think our advertisers are going to cause an onboarding moment that will be multiples bigger than what we were manually curating.

Now it’s not necessarily true that we’re going to take our queue that’s built over the last year and just say, everyone you’re in. They’re still going to have to get invited to get into the platform. So it will be still curated onboarding. The reality is like Q4 is going to end up being a fun quarter. You’ve got the advertiser cohort that we didn’t have last Q4 that was growing in the quarter to the point where we reported huge numbers and then had huge numbers in Q1. But we’re going to have those advertisers primed and ready to go for the full Q4. We’re going to have advertisers inviting their friends onto our platform in Q4, and we’re going to be opening up international all at the same time.

So there’s going to be a lot of fun moment — moments for us and our customers in this e-commerce or web-based category that will set sort of a new baseline for that business. And then obviously, then we will go through hopefully another inflection when we really truly open up the platform and try to get into a state where we’re more stable long term.

Nick Foroughi, CEO, Applovin, Q2 2025, 6 August 2025

Remember how I started talking about the two inflexion points, the first in Q4 2025 and the second at some unspecified time in the future, but sooner rather than later.

And there is a ton of inn ovation coming.

There are different levels of agents. There’s an agent that can respond and answer questions and give you responses to those questions and help you along. That’s sort of an onboarding widget that whether we want to call this AI or not, now AI has made it a lot more capable, is something that’s probably going to be in present early in the release of this product.

The more complex level is an agent that does everything for you. You’re an advertiser and you wonder how your campaign is doing, analyze the performance, talk to me about the ads I’m running, that’s a complex agent task. But analysis task at the advertiser level is not trivial. That will be on the way, too.

And then you’ve got a third form, and I wouldn’t call this an agent. I call it tools, but I keep referencing this generative AI-based ad creative tools. We’re going to give our customers the ability to automatically create advertisements, whether video or end card. What that will do is create way more diversity of advertisement on our platform for the model to go use to personalize ad to the other side and hopefully much higher response rate from the consumer.

In particular, small businesses don’t have the resources to go build ads that adapt for our platform, given the ads that adopt for our platform tend to engage the user for 30 to 60 seconds instead of 3 to 6 seconds like they do on social. And so we want to give them those tools so that they can have the same capacity the larger brands do so that they can buy at the maximum capability that their business justifies on our platform.

All of these things will come. I mean — and then we’ll talk about the next tools behind it because no product in our world stops being iterative. We launch. We then add tools. We try to make the advertiser’s life seamless and fully automated, and we will keep giving them tools that we think will benefit them, which in turn benefits consumers and us.

Nick Foroughi, CEO, Applovin, Q2 2025, 6 August 2025

Share Recommendations

Applovin APP

Strategy – Load Up On Applovin

This is by a distance the longest Alert I have ever sent out. Perhaps the best plan is to buy some Applovin shares to make sure you have an interest, then read it.