Apollo chief economist Torsten Slk reckons AI could be the secret weapon to tackle America’s debt. In a weekend note he leans on Congressional Budget Office projections showing that if AI adoption drives steady GDP growth and holds inflation down, the U.S. could cut borrowing costs and narrow budget deficits.

Slk points to productivity gains, automation and efficiency boosts across industries as the engines of higher output, while a calmer price backdrop would let the Fed keep rates lower.

Over time, those twin effects could stabilize a debt trajectory that under current trends is set to climb. Why it matters: With Washington wrestling trillion-dollar deficits, AI innovation may offer a market-friendly fiscal fix. Investors will be watching how AI’s impact shows up in upcoming growth and inflation data.

GuruFocus, 28 July 2025

Lower borrowing costs and friendly inflation numbers would put a rocket under a bull market, which is already straining at the leash.

This is a chart of QQQ, an ETF which tracks the Nasdaq 100 and is a good proxy for the index. On this chart of 3M candlesticks (each candlestick equals three months), the Coppock indicator moves in long, slow swings but gives good signals. I have shown them on the chart. The first two signals are notional since there were no Coppock calculations with less than 24 candlesticks on the chart. Blue to red smiley has been a good time to hold shares, and we have a recent blue.

An appealing alternative to QQQ is QQQ3, which is almost certain to outperform over time.

The charts are compatible with a massive bull market on the horizon, but we need something or things to make this big bull happen. There are some candidates, all revolving around AI.

Candidate number one, see quote above, is the potential for AI to help the US live with high levels of debt while lowering interest rates.

Candidate number two is the belief of Eric Schmidt, former CEO of Google, that AI is going to trigger incredible double-digit gains in productivity, not just in the US but spreading across the world. If this proved correct, it would put huge pressure on countries with their heads in the sand, Iran, North Korea, Cuba, Venezuela, Pakistan, Russia et al to join the party or see their entire populations rush for the exit.

Candidate number three and possibly most exciting of all is the prospect of a robotics boom. Musk is not one to pull his punches (see below), but this is exciting stuff.

Tesla CEO Elon Musk offered some pretty eye-popping aspirations for the company during remarks on Saturday.

Musk made a virtual appearance at the Tesla Owners of Silicon Valley 2025 ” Takeover” party in San Mateo, California. The group is, essentially, a fan club and community for Tesla and Musk enthusiasts. Its Takeover event draws attendees from all over the world, according to organizers.

The headline from the event might just have been an admittedly aspirational comment about $30 trillion a year in humanoid robot revenue.

Tesla is using its artificial intelligence and manufacturing capabilities to build its Optimus humanoid robots. Version three of “Optimus is the right design to go to volume production,” said Musk. Tesla plans to make a few hundred of those by the end of 2025. Originally, Tesla planned to have a few thousand, but the new design slowed things down a little. Tesla still plans to ramp production higher in 2026.

Tesla is betting big on AI, using it for robots and to train its self-driving cars. Robots are “probably the world’s biggest product…There’s a market for 20 billion robots,” said Musk. “Hypothetically, if Tesla was making one billion of these a year…maybe on the order of $30,000 per robot, I’m just guessing here (ed: the rest are not guesses, then), that’s $30 trillion in revenue.”

It’s an incredible prediction. “Long way to go between here and making one billion robots a year,” added Musk.

Musk commands credibility with his outrageous predictions because he overcame similar scepticism to reach mass production of electric cars. His timing may be optimistic but investors believe he will get there in the end.

There isn’t a significant market for humanoid robots yet. Nvidia CEO Jensen Huang has said that robots can become the world’s largest market. (Housing, consumer electronics, and cars are three of the largest today.)

The world spends “what $50 trillion on human labor a year now?” says Futurum chief market strategist Shay Boloor. Useful robots are “pretty disruptive if you can conquer it.”

Musk, for his part, doesn’t fear the labor disruption, believing it will end up creating an age of abundance with hard labor essentially eliminated. “I’ve never seen any technology advance as fast as AI,” said Musk, describing it as a supersonic tsunami.

It’s all pie in the sky for now, but quite a vision of the future.

Dow Jones Newswires, 28 July 2025

These may seem absurdly futuristic predictions, but stockmarkets are driven by the future. Anything concrete happening on the robots’ front would light the blue touch paper for the stock market generally and for front-line shares like Nvidia. Jensen Huang is becoming increasingly vocal on the prospects for robots.

Nvidia CEO Jensen Huang said other than artificial intelligence, robotics represents the chipmaker’s biggest market for potential growth, and that self-driving cars would be the first major commercial application for the technology.

“We have many growth opportunities across our company, with AI and robotics the two largest, representing a multitrillion-dollar growth opportunity,” Huang said Wednesday at Nvidia’s annual shareholders meeting, in response to a question from an attendee.

A little more than a year ago, Nvidia changed the way it reported its business units to group both its automotive and robotics divisions into the same line item. In May, Nvidia said the business unit had $567 million in quarterly sales, or about 1% of the company’s total revenue. Automotive and robotics was up 72% on an annual basis.

Nvidia’s sales have been surging over the past three years due to unyielding demand for the company’s data center graphics processing units, or GPUs, which are used to build and operate sophisticated AI applications such as

Total sales have soared from about $27 billion in its fiscal 2023 to $130.5 billion last year, and analysts are expecting nearly $200 billion in sales this year, according to LSEG.

The stock climbed to a record on Wednesday, lifting Nvidia’s market cap to about $3.75 trillion, putting it just ahead of Microsoft as the most valuable company in the world.

While robotics remains relatively small for Nvidia at the moment, Huang said applications will require the company’s data center AI chips to train the software as well as other chips installed in self-driving cars and robots.

Huang highlighted Nvidia’s Drive platform of chips, and software for self-driving cars, which Mercedes-Benz is using. He also said the company recently released AI models for humanoid robots called Cosmos.

“We’re working towards a day where there will be billions of robots, hundreds of millions of autonomous vehicles, and hundreds of thousands of robotic factories that can be powered by Nvidia technology,” Huang said.

Nvidia has increasingly been offering more complementary technology alongside its AI chips, including software, a cloud service and networking chips to tie AI accelerators together. Huang said Nvidia’s brand is evolving, and that it’s better described as an “AI infrastructure” or “computing platform” provider.

“We stopped thinking of ourselves as a chip company long ago,” Huang said.

CNBC, 25 June 2025

There are going to be false starts because what they are trying to make the technology do is a huge leap forward.

It feels like every player aiming for humanoid robots is in it for themselves, Kapoor said. But there’s a robotics-startup graveyard for a reason. The robots get into real-world scenarios, and they’re simply not good enough. Customers give up on them before they can get better.

“The running joke is that every robot has a team of 10 people trying to run it,” Kapoor said.

Business Insider 30 November, 2024

At the moment, it seems that your guess is as good as mine when it comes to when self-driving cars and humanoid robots are going to arrive in serious numbers. It always seems to be around the next corner, but one thing is certain: it is coming, and when it does, the stock market impact will be colossal.

The fact that it is difficult to make it happen is the challenge that humanity thrives on, and we have major companies in the US, built on technology and with gigantic research and development budgets dwarfing anything seen in previous decades, let alone centuries. The pace of progress is certain to be rapid.

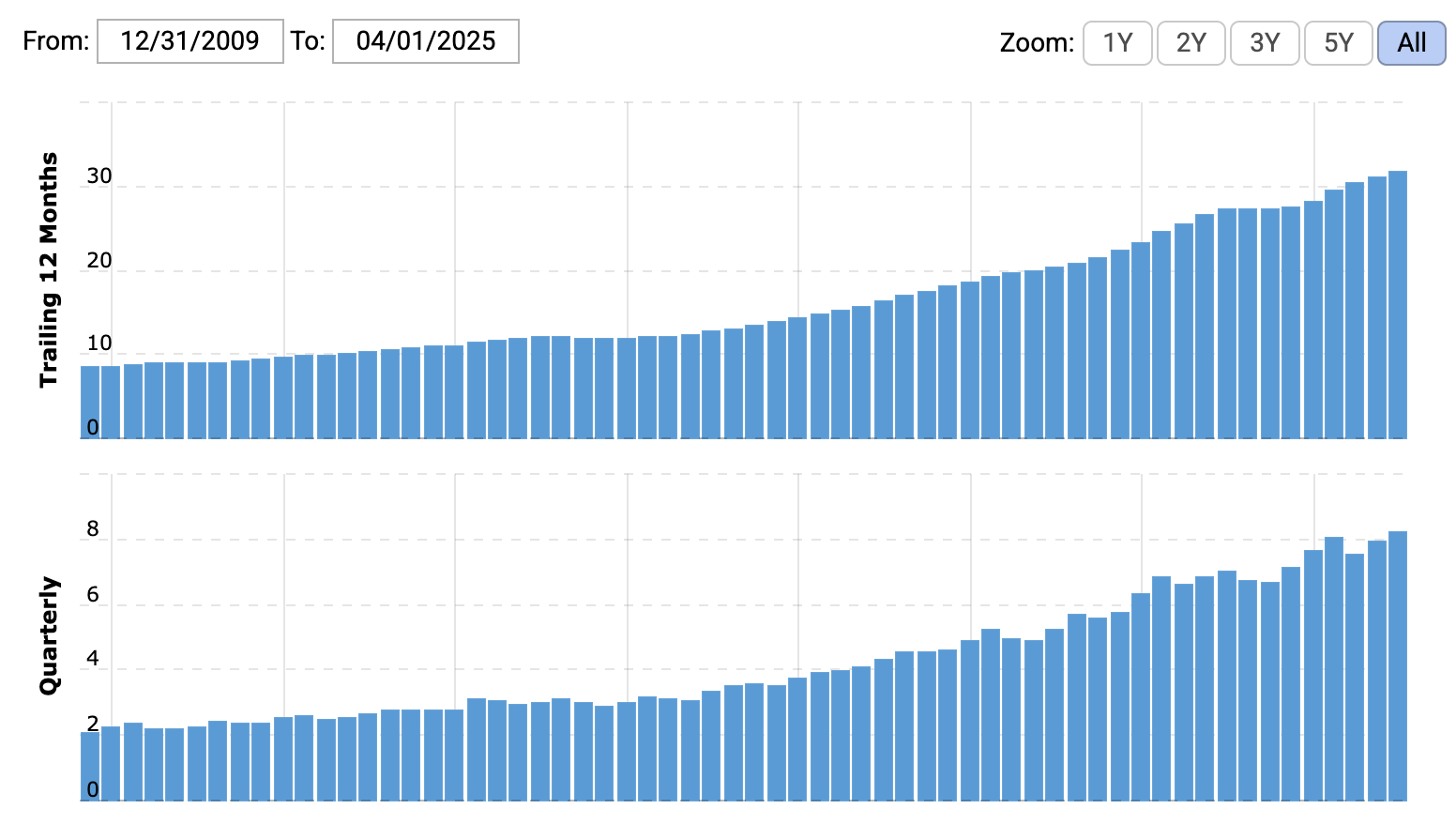

One clue to prospects is what is happening to spending on research and development. Microsoft has quadrupled its spending since 2009 and increased it from derisory levels since 1990. It is a good proxy for what is happening elsewhere. The rate of increase has noticeably steepened in the last eight years. I guess that Microsoft in 2025 will spend more on r&d than was spent by the whole planet 50 years ago, and this would apply even in real terms, adjusted for inflation. When I was younger, most corporations regarded R&D spending as money down the drain.

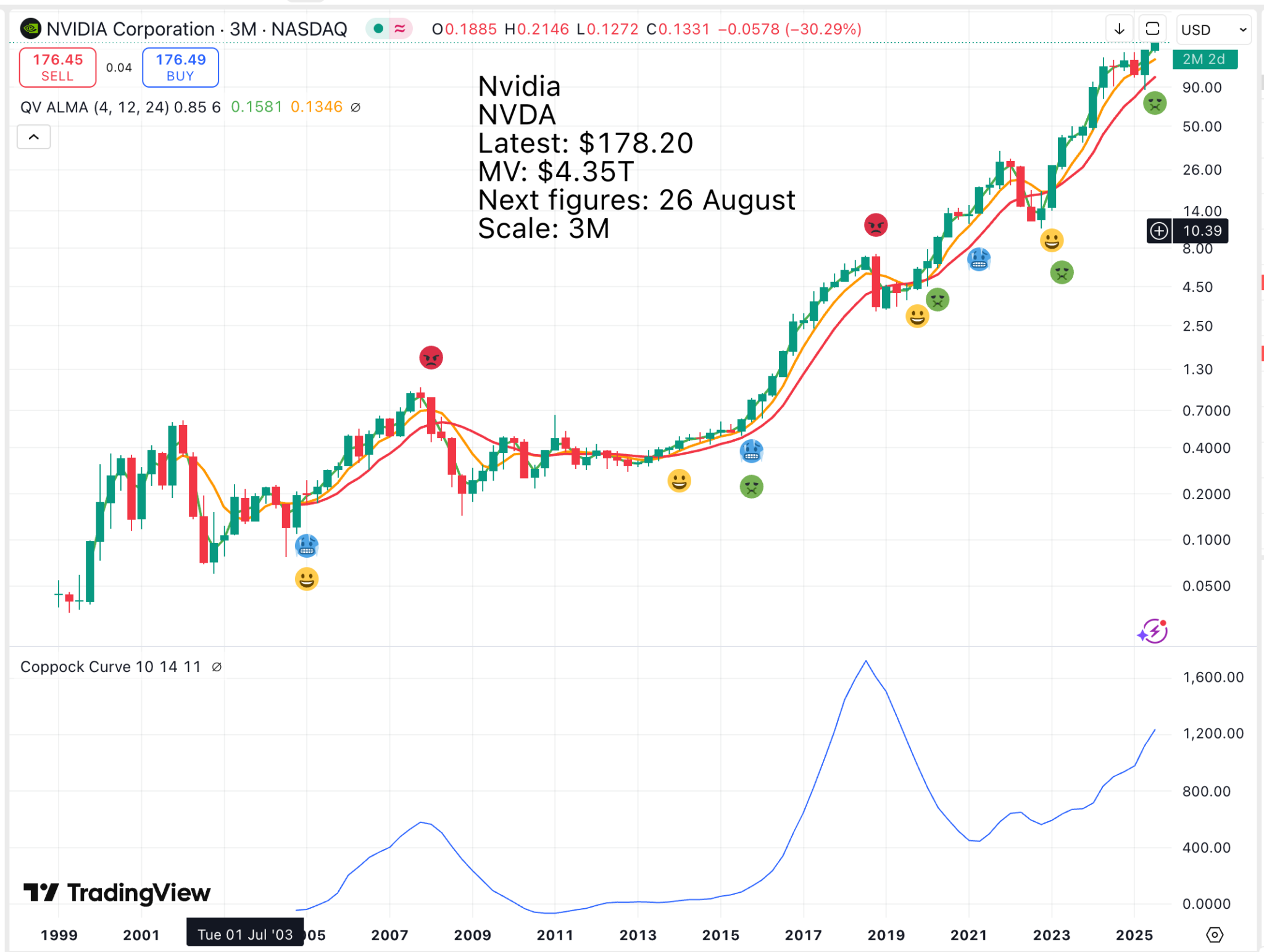

I am working on the principle that Coppock buy signals can be generated using either one-month or three-month candlestick charts. These three-month candlestick charts paint a positive picture for Nvidia.

The blue smiley equals a new Coppock buy signal. The yellow smiley equals a buy signal following a bunching of the moving averages. A green smiley represents a chart breakout. In general, it can be seen that blue smiley (Coppock turning higher) to red smiley (Coppock turning down) is a good time to hold the shares. Red to blue is a time for caution.

The yellow and green smileys signal additional buy signals.

The bull case for Nvidia is that a major ‘something new’ is happening. As Jensen Huang says, Nvidia is becoming much more than a chip company. He talks about it becoming a computing platform provider. So what is a computing platform?

A computing platform is the environment, both hardware and software, where computer programs and applications run. It encompasses the underlying hardware architecture, the operating system, and other runtime libraries, providing the necessary infrastructure for software to execute. Essentially, it’s the stage on which software performs its tasks.

AI Overview

That sounds massive to me and suggests that the TAM (total addressable market), which Nvidia is targeting from a position of market leadership, is gigantic. So gigantic that there will be competition, but everybody else is playing catch-up, and Nvidia is not standing still.

I don’t know when robots and self-driving cars will kick in as a serious factor in Nvidia’s share price, but when they do, their power will be enormous.

Share Recommendations

QQQ

QQQ3

Nvidia NVDA

Strategy – Making Forward Spread Bets

There are two options when making a spread bet on IG. You can make a Daily Funded Bet on which interest is charged daily. This is running around six per cent. Alternatively, if you expect to be a long-term holder, you can make a Forward bet, which is better value.

If you go onto your spread betting platform and search for a share, say Robinhood, you will see quotes for selling and buying prices. This is for a DFB, a daily funded bet. Above one of the options is forward. Click on the down arrow, and you will see three or four options. The last one, if there is a fourth, is for 100x bets, which you don’t want and which are only available on certain shares and for professionals. Choose the third one, presently closing in March 2026.

Both selling and buying prices will change and will be higher than current prices, and the spread will be wider. Click on buy, and the spread is the cost of opening a position. It is around two per cent, once you have annualised it. When you sell, you will pay a similar spread again, but that only happens if you sell.

Also, on the right, you will see a heading ‘info’. Click on this and you will see various options, including rollover. If you enable rollover, then your position will automatically be rolled over when it expires in March 2026. I confirmed with IG that this rollover is done at the mid-market price, which means there is no additional charge.

Making forward bets is a little more complicated, but can lead to significant savings over time.