Affirm Holdings – new star for the fintech/ buy now pay later sector

Affirm Holdings. AFRM. Buy @ $109. MV: $33bn. Next figures: 11 November. New entry

I noticed Affirm when it first floated because its dramatic gains in opening dealings on the US stock market lifted the share price of another buy now pay later star, Australian-quoted Afterpay which was already in the QV for Shares portfolio and reporting blistering growth in customer and merchant numbers using the service. I was a little wary of Affirm because of the heavy dependence on a single merchant, Peloton.

Three things have changed. Afterpay has agreed to be bought by another QV for Shares company, Square so creating a vacancy in the portfolio. Peloton is still driving strong growth at Affirm but such is the spectacular growth of the rest of the business that it is falling sharply as a percentage of sales. Thirdly and most important. I have had a closer look at Affirm and realised that it is a much more impressive business that I had initially assumed. These guys really are planning a major disruption of the way Americans and all of us buy stuff.

The basic concept of buy now pay later (BNPL) is very simple. Instead of paying up front for the stuff they buy consumers pay a quarter up front and the balance in three further instalments at two weekly intervals. It is ideally suited to people who use their regular pay checks to buy goods. Importantly for the Generation Z and Millennial generations who are the most enthusiastic users of BNPL services there is no interest payable.

The effect is that BNPL replaces credit cards, which are increasingly regarded by everybody as a disastrously expensive way of making purchases. I realised long ago that credit cards were ruinously expensive with their sky high interest rates and only use debit cards where the money goes out of your account either immediately or at the end of the month with no interest payable.

BNPL is like the best of both – extended terms but no interest to pay. It is funded by the merchants, who are on the system and pay transaction fees to the BNPL companies. It is worth their while to do this because the easy payments mean that consumers are more inclined to buy and spend more when they do. Overall consumers using BNPL may spend as much as 20pc more than they would otherwise have done.

Everybody wins and the companies offering BNPL have been enjoying explosive growth as they spread out across the world. The star performer in the UK is Klarna which is regularly rumoured to be planning a flotation. Afterpay is the dominant player in ANZ and growing fast in the UK and the US but is now becoming part of Square. Affirm is strongest in North America having recently acquired a BNPL operator in Canada.

Affirm is different from other BNPL operators in that it offers longer term interest bearing loans for larger purchases. This is how they describe what they do.

“Legacy payment options, archaic systems, and traditional risk and credit underwriting models can be harmful, deceptive, and restrictive to both consumers and merchants. They are not well-suited for increasingly digital and mobile-first commerce, and are built on legacy infrastructure that does not support the innovation required for modern commerce to evolve and flourish.

Our platform addresses these problems.

Today, it comprises three core elements: a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. Our point-of-sale solution allows consumers to pay for purchases in fixed amounts without deferred interest, hidden fees, or penalties. We empower consumers to pay over time rather than paying for a product entirely upfront. This increases consumers’ purchasing power and gives them more control and flexibility. Our platform facilitates both true 0pc APR payment options and interest bearing loans. With 0%pc APR, consumers pay zero interest and zero additional costs.

On the interest bearing loans we facilitate, we charge simple interest, which means consumers pay fixed amounts of interest that they agree to up front, and the interest never compounds. We believe in treating people fairly, which is why consumers never pay more than what was agreed to at checkout, even if they miss a payment. Paying with Affirm not only protects consumers from hidden fees but allows them to avoid traps such as deferred interest.

We offer merchants highly effective commerce solutions that enhance demand generation and customer acquisition. Our solutions empower merchants to more efficiently promote and sell their products, optimize their customer acquisition strategies, and drive incremental sales. Our flexible payment solutions allow merchants to solve affordability for their customers, providing a revenue accelerator while avoiding discounting and other expensive marketing and promotional channels. We also provide valuable product-level data and insights — information that merchants cannot easily get elsewhere — to better inform their marketing strategies.

Our approach allows us to add value throughout the full customer lifecycle, from acquisition, to conversion, to repeat transactions. Our consumer-focused app unlocks the full suite of Affirm products for a delightful end-to-end consumer experience. Consumers can use our app to manage payments, open a high-yield savings account, and access a personalized marketplace. Our marketplace serves as a discovery platform which allows consumers to find products and make purchases from partner merchants. In addition our app allows merchants to provide tailored offers based on consumers’ spending patterns, shopping habits, and purchase intent.”

I am going to give Affirm the same 3G+M treatment I gave Lightspeed in the last alert.

First the chart – Affirm started its IPO process with an expected price range of $41-$44. It finally priced above this at $49 to value the business at $49. It then experienced a period of incredible volatility, a high of $146.90 followed by a low of $46.50 just four months later. Since then the shares have been moving explosively higher helped by news of very strong trading. The history is short but there is no reason not to put a tick in the box for the chart G.

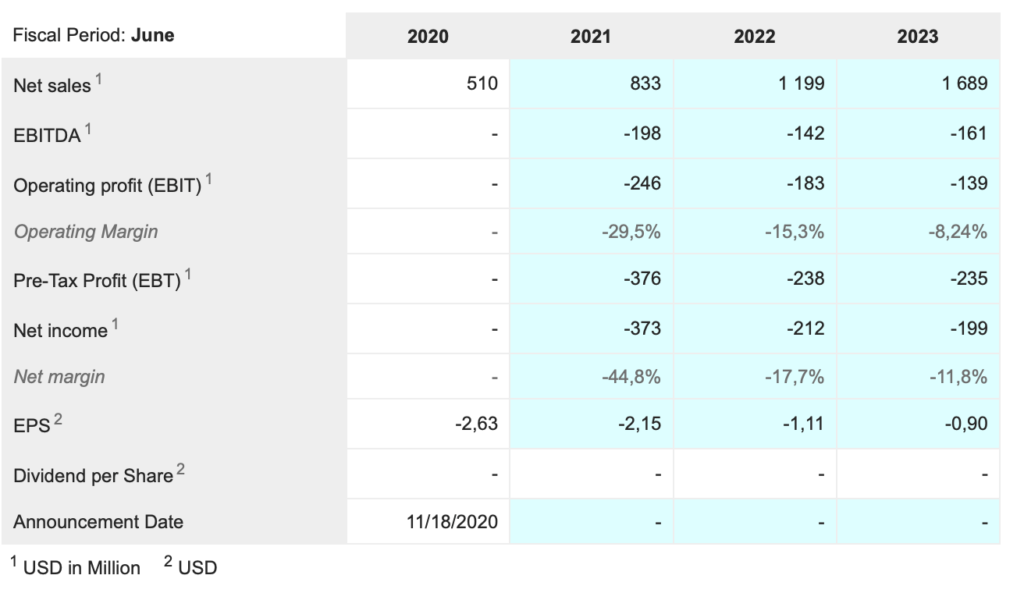

What about the growth? Again there is not a great deal of history but what there is is impressive. Between full year 2019 (to 30 June 2019) and fiscal 2020 sales grew from $132m to $257m. The was followed by growth from $87.9m for Q1 2020 to $174m for Q1 2021 (ending 30 September 2021). Since then we have had the numbers for Q4 and full year 2021 which inspired a dramatic leap in the share price. The latest figures showed growth accelerating and especially strong growth in the numbers excluding the impact of their largest customer Peloton.

“In the fourth quarter, we accelerated our year-over-year growth rate in both GMV [gross merchandising volume] and revenue for the second consecutive quarter to 106pc and 71pc, respectively. Excluding our largest merchant Peloton, which saw GMV growth of over 328pc in the fiscal fourth quarter of 2020 (i.e. the previous year), our fourth quarter GMV grew 178pc.”

The strong growth excluding Peloton is leading to a sharp fall in customer concentration. “Owing to the strong growth of our business, merchant concentration continues to decline, as Peloton contributed 9pc fourth quarter GMV compared to 32pc in the prior year’s fourth quarter.”

The customer base, both consumers using the platform and merchants offering Affirm is also growing very strongly.

“More and more consumers are choosing Affirm’s honest and transparent payment alternatives. Active consumers, which we measure over the prior 12-month period accelerated, effectively doubling to 7.1m. Not only are we seeing strong growth in new consumers, we are also seeing an encouraging trend among existing consumers. While we’ve expanded into higher frequency and lower AOV [average order value] category, transaction frequency for active consumers has increased by 8pc from 2.1 to 2.3.

At the end of the fourth quarter, active merchants, those merchants who have transacted on the platform over the prior 12-months, increased to almost 29,000 compared to just 5,700 in the prior year. This is thanks in large part to our partnership with Shopify.”

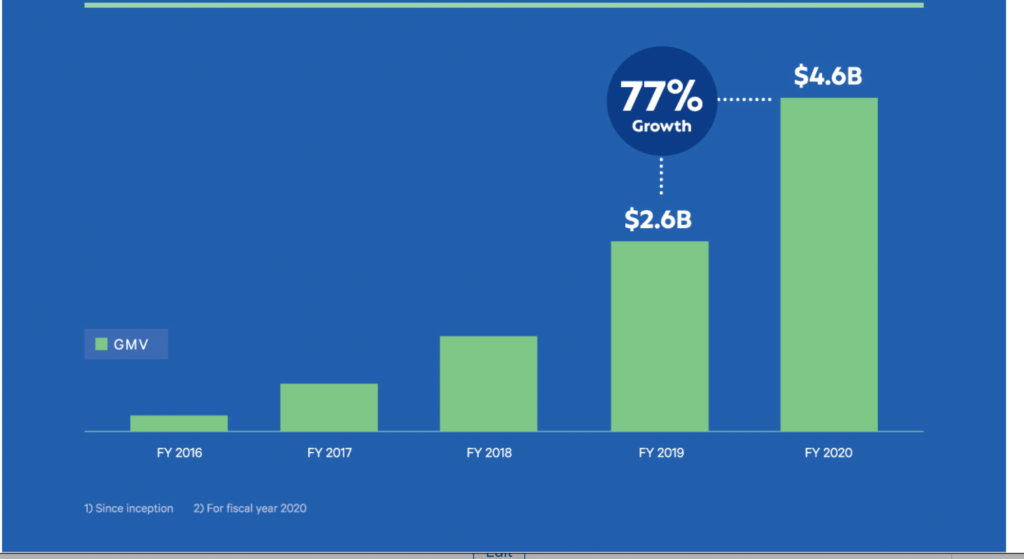

You can compare the latest figure for GMV with this chart from the prospectus. For full year 2021 the GMV figure was $8.3bn. If we annualise the GMV figure for Q4 2021 GMV comes out at $10bn, more than double the figure for full year 2020.

All this adds up to a clear tick in the growth G box.

Next we look at the story G – what is the story driving the growth at Affirm and does it look to have legs well into the future. There is a powerful tail wind driving growth in all the BNPL businesses from the growing reluctance of consumers of all ages to pay higher credit card interest charges. This is further accelerated by the growing spending power of Gen Z and Millennials who are keen shoppers but even more interest averse than their seniors.

But what really excites me is the pace of innovation at Affirm. In line with my zen theory that great companies have a mission way beyond just making money Affirm sees itself as engaged in a world-changing project. Affirm was founded in in 2012 by four co-founders among whom was Max Levchin who was one of the co-founders of PayPal and is the CEO of the group. He is still only 46 and is just the sort of inspirational figure to take a business and really drive it forward.

So here is the mission.

“Around 10 years ago, we founded Affirm with a simple mission to deliver honest financial products that improve lives. We started by reinventing payments to make them transparent, simpler, smarter, and more delightful.

Our core insight was that the generations coming of age after the financial crisis of 2008 were no longer willing to tolerate getting into permanent debt by putting it all in the card, or getting burned by late fees and deferred interest. These young consumers and many likeminded older ones, grew fundamentally suspicious of credit and retreated into the simplicity of their debit cards.

This created no less than a once in a generation opportunity to transform credit, and thus, began the great unbundling of the credit card. The credit card was the ultimate buying bundle, a single product allowing you to put purchases of all sizes together in a one basket with the freedom to pay for them later. Unfortunately, if you couldn’t pay for them later, and in full, endless debt became nearly inevitable and that credit card could quickly become the financial equivalent of a ball and chain. That’s where Affirm came in.

We deconstructed rather we unbundled the credit card, starting with the largest purchases. We made these easier, more transparent and helped consumers be smarter about buying now and paying later. In order to do all of this, we built proprietary technology from the ground up and developed sophisticated capital markets expertise.“

This unbundling means that unlike some of the other BNPL companies Affirm will also help with larger purchases offering payments over longer time scales that do involve paying interest but at lower rates and with no fine print to trap consumers into escalating debt.

As Levchin said after doing a deal with Amazon – “We are as customer-obsessed as Amazon”. And we know what that has done for the ecommerce giant.

Innovations are coming thick and fast.

“Meanwhile, the great credit card unbundling continues to accelerate in both the United States and internationally. The next frontier of unbundled payment is daily spend, groceries restaurants, incidental purchases. This is why we’re so excited to be rolling out the very first card of its kind, the Affirm Debit+ card. I will tell you a lot more about it in a moment. As we speed into our fiscal year ’22, I believe Affirm is strongly positioned to capture much more of the vast opportunity in front of us. We will do that by remaining obsessively focused on our two constituents, the merchant and the consumer, and by leveraging our core strengths to continue building products that delight both sides of our network.”

The company. has big plans going forward.

“So what comes next, we have an ambitious plan for the fiscal year, and more importantly, for the decade ahead. To fuel the expansion of our business and to increase our share of the growing market, we’re focusing on three key areas for fiscal year ‘22.

Increasing our consumer reach and frequency, growing our merchant and partner network, and extending our product offering. Our partnerships with enterprise merchants and platforms like Shopify introduced more consumers and high velocity merchants to Affirm’s honest and transparent offering.

In our current fiscal year, we have continued to ramp merchant activation of Shop Pay Installment. When we reported earnings back in May, we shared with you that we had on boarded 12,500 Shopify merchants at the time. And today, that number stands at hundreds of thousands. Our focus now is to drive more consumers to experience Shop Pay Installment. To do so, we’re activating both Shopify and Affirm’s consumer networks via a range of marketing channels.”

The magic as usual is lots of things but one important and potentially magical something new is the Affirm Debit+ card. Indeed the company itself even describes it as something ‘almost magical’.

“What excites me the most about the year ahead, is the Affirm Debit+ card. Currently in the hands of several hundred people, we’ve worked very hard to create a product design to meet the bar of convenience set by the best card people have in their wallet today. But we didn’t stop there. Our team has designed and developed the most meaningful innovative debit card since its inception more than 50-years ago, putting unparalleled choice and flexibility directly into the hands of the consumer.

The consumer can use the Affirm Debit+ card in place of the regular debit card. It connects seamlessly to their existing bank account, and no new checking account is required. Once you swipe or tap your card, you can use the intuitive debit plus companion app to turn any eligible transaction into an Affirm pay-over-time product. All it takes is a couple of taps within a day after the transaction occurs. It’s just that simple.

This effortless access to a smarter, more transparent way of paying over time at brick-and-mortar and online is very close to being indistinguishable from magic. But as always with Affirm, there are no magic tricks, or tricks of any kind, just excellent technology. The beauty of our card is that it’s powered by software, which means that you can expect us to regularly add new features and functionality via app updates.

So Affirm looks very much the full package – 3G plus loads of magic.

Affirm looks to me like a super exciting company but I think investors must expect the shares to be volatile. If sales come in at $1.2bn, for the year to 30 June 2022, which looks cautious to me, then the valuation is around 30 times sales. Earlier generations would have been stunned by such a multiple – of sales not profits! But we live in a different world. One intriguing rule of thumb I have seen is that in today’s world shares in an exciting fast-growing business are reasonably valued if the multiple of market cap to sales is around half the growth rate. On this basis Affirm looks about right but there is by no means universal agreement about this valuation technique.

The one I sometimes use is to assume that around 20pc of sales will eventually fall through to net income once the company has matured to the point that spending on r&d and sales and marketing are much lower as a percentage of sales. On this basis an MV/ sales ratio of 30 equates to a PE ratio of 150, which does not look unreasonable for a company growing fast and addressing a very large opportunity.

I also think it is important not to allow the numbers to get in the way of common sense. The reason for buying shares in Affirm is the strong possibility that the success of the last decade will continue through the next decade and continuing innovation on a massive scale will make the business much, much bigger. We know these miracles can happen because companies like Apple, Amazon and Alphabet, which got into their stride a couple of decades ago are now valued at 1 trillion dollars or more after massively scaling their businesses.

The simple proposition with the QV for Shares service is that if you build a portfolio which only consists of shares in companies with this sort of potential you will do well, maybe very well, maybe even incredibly well. I believe Affirm Holdings is one of these high potential companies.

The volatility is caused in part by the growing influence of investors who chase rising shares with no clear conviction about why they are buying. The rush to buy drives the shares higher but can easily give way to an equally frenzied rush to sell. Investors see their profits melting away and haven’t done enough homework to have any real conviction in the shares they do buy.

This is why my 3G+M mantra is so useful. We have done our homework. We do know the shares we buy are the real deal and that belief can sustain us through what may be some vertiginous ups and downs. We also should have the further comfort of knowing that in a large portfolio there should be greater overall stability than will be experienced at individual shares.