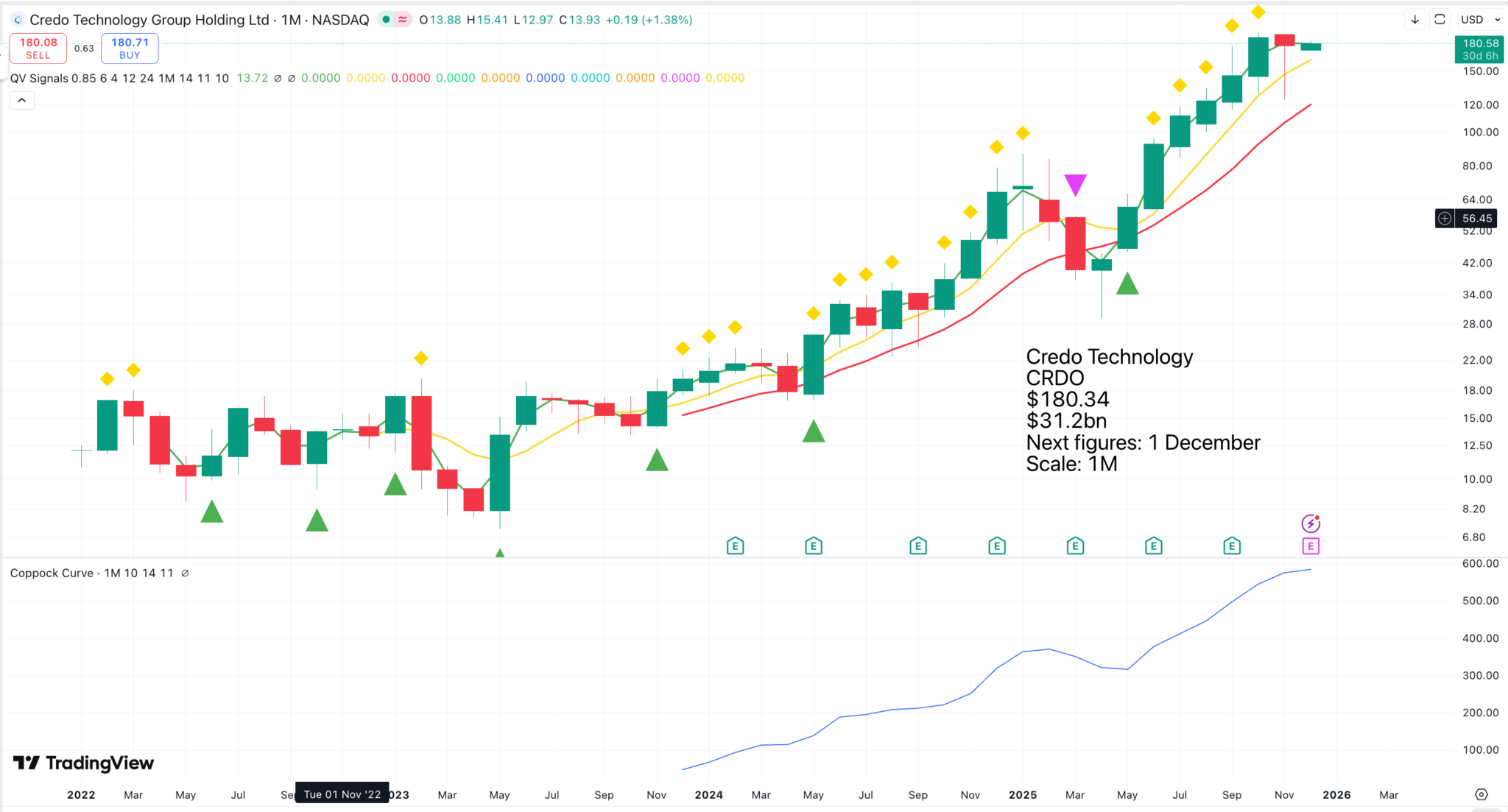

The buy signals on this chart are not put there by me; they are generated by algorithms developed by me and the genius who is behind everything technological at Quentinvest. The green triangles signal moving average buy signals. The magenta triangles signal Coppock sell signals, just one on this chart since 2022. The yellow diamonds are a new addition. They signal new all-time highs, not 12-month highs as used in the usual new high tables, but all-time highs.

They are not intended to optimise buying on any particular chart. They are a capital allocation strategy telling you which share to buy at any given moment, not so much when but which. They make mistakes, so they need to be used as part of a long-term strategy. Most exciting is a new high after a period without a new high, especially if it looks like a chart breakout, which often it will.

You can either buy on the first new high in a sequence or every single new high, depending on how aggressive you want to be. The results for either of these strategies would have been spectacular with Croda International, the explosively fast-growing business supplying networking equipment for data centres.

Croda International is reporting today, after Wall Street closes. The results will almost certainly be amazing. Who knows what the shares may do, but they will be a buy on the next new high and so on, ad infinitum. By the time you read this, the results will be out, and they were amazing (see below).

The perfect new high is one which comes after a gap and with an important ‘something new’ on the fundamentals. Credo had an important ‘something new’ with their earnings call in December 2024 when they started talking about an ‘inflexion point’.

Credo Technology Group Holding Ltd. first started talking about an anticipated “inflection point” in their business in communications in 2024 related to their financial performance in the second half of fiscal year 2025.

Specific details on the timing:

In December 2024, during their Q2 fiscal 2025 earnings call, CEO William Brennan mentioned they had been “anticipating an inflection point in our revenues during the second half of fiscal ’25” for “several quarters” prior.

The company officially reported that this turning point had arrived and was visible in their Q3 fiscal 2025 results, which were released on March 4, 2025.

The “inflection point” referred to an acceleration in revenue growth, primarily driven by strong demand for their high-speed connectivity solutions from hyperscale customers for AI platform deployments.

AI overview

In 2023, the growth rate began to accelerate, and it exploded in 2025. The bizarre event on the chart was the unwarranted pullback in early 2025 from a peak $85 to a low of below $30. Talk about manic depressive investors. Credo is growing at an extraordinary rate.

In the second quarter, we delivered record revenue of $268 million, representing 20% sequential growth from Q1 and an extraordinary 272% increase year-over-year. Non-GAAP gross margin came in at a robust 67.7%, and we generated approximately $128 million of non-GAAP net income.

These are the strongest quarterly results in Credo’s history, and they reflect the continued build-out of the world’s largest AI training and inference clusters. AI clusters are no longer measured in tens of thousands of GPUs. They’re now measured in hundreds of thousands and soon millions. The scale, density and complexity of these systems are pushing every aspect of interconnect. Reliability, power efficiency, signal integrity, latency, reach and total cost of ownership have all become mission-critical. This is the challenge our customers face, and it’s where Credo is uniquely positioned to deliver the solutions they need to succeed.

Dan Brennan, CEO, Credo Technology, Q2 2026, 1 December 2025

This inflexion point in Credo’s growth is a massive ‘something new’ and has exciting implications for the share price going forward. I talk about companies having a ‘day in the sun’ moment. Credo is having one of those, and there is much more to come.

Our existing AEC and IC businesses both address multibillion-dollar market opportunities with excellent visibility for continued growth. But the truly exciting part of this quarter is that we’ve added 3 entirely new growth pillars, each representing distinct multibillion-dollar market opportunities that significantly expand our total addressable market and extend the reach and depth of our connectivity leadership. The first new growth pillar is Zero Flap optics, the first laser-based optical connectivity family that delivers AEC class network reliability, enabled by a customized optical DSP that is tightly coupled with our pilot software and integrated with a switch level SDK, our Zero Flap optics integrate with our customers’ network software.

Link Health telemetry data on each optical link enables autonomous detection and mitigation of conditions that cause link flaps before they bring down the cluster. This enables a step function improvement in network reliability. We’re currently in live data center trials with our lead partner, and we expect to begin sampling a second U.S. hyperscaler later this fiscal year. Our ZF optics solutions expand our addressable market to any length of connection within the data center. We anticipate initial revenue in fiscal ’27 and long term, a market that will be a multibillion-dollar opportunity. The second new pillar of growth was announced in September. Credo has combined forces with Ottawa-based Hyperlume, a team of experts specializing in high-performance microLED technology.

Credo has been investing in micro LED innovation over the past 18 months with the intent of developing a new class of connectivity solutions. Uniting with the Hyperlume team will accelerate our time to market. As a first product, we’ll develop and bring to market a pluggable optical solution that utilizes micro LEDs as the light source. Our same 3-tiered innovation playbook will be the catalyst to pioneering this entirely new connectivity category we call active LED cables or ALCs. ALCs will deliver the same reliability and power profile as an AEC, but in a thin gauge cable that can reach up to 30 meters and is ideal for row scale scale-up networks. Customer reaction has been very positive. We plan to sample the first ALC products to lead customers during our fiscal ’27 with initial revenue ramping in fiscal ’28.

We believe the ALC TAM will ultimately be more than double the size of the AEC TAM. Finally, we announced the third new pillar of long-term revenue growth, OmniConnect gearboxes, a family of products that will enable a disaggregated and optimized approach to XDU connectivity. In November, together with our lead customer, we unveiled the first gearbox that will address that memory wall by redefining memory to compute connectivity, a solution we call Weaver. Today’s on-package high-bandwidth memory is capacity and throughput limited as well as expensive and supply chain constrained. Weaver allows designers to move to commodity DDR memory and achieve up to 30x more memory capacity and 8x the bandwidth.

The key enabler for the OmniConnect family is Credo’s purpose-built 112-gig VSR SerDes* that enables a 10x improvement in beachfront I/O density and has a reach of up to 10 inches. The Weaver gearbox from 112-gig BSR** to DDR effectively overcomes the physical and logical limitation of current memory to compute connectivity solutions. Our first customer for Weaver announced their plan to deliver an XPU*** targeted for inference with 2 terabytes of memory capacity, a complete game changer for workloads such as real-time AI video generation and full self-driving, where memory capacity and bandwidth are the primary gating factors. Industry forecasters project the memory to compute connectivity market to be a multibillion-dollar market by the end of the decade.

*A VSR (Very Short Reach) SerDes is a specialized serializer/deserializer chip designed for short-distance data communication within data centers, prioritizing low power consumption and low latency over long-distance signals. It is optimized for channels with up to 15-25 dB of loss and is used in applications like AI accelerators, optical modules, and SSDs where power and area efficiency are critical.

**The term “112-gig BSR” refers to a 112-gigabit per second (Gb/s) Bandwidth-optimized Serializer/Deserializer (SerDes) with a Board-level Short Reach. This technology, developed by Credo Technology Group, is a high-speed data interconnect solution designed to enable very high memory capacity and bandwidth in next-generation computing systems, particularly for AI and machine learning applications.

***An XPU is a general term for any accelerator processor designed to handle specific workloads efficiently, such as artificial intelligence (AIcap A cap I𝐴𝐼) or high-performance computing (HPCcap H cap P cap C𝐻𝑃𝐶). The “X” in XPU is a variable, meaning it can represent a CPU, GPU, FPGA, or a combination of different processor types working together in a unified system. XPUs are a category of specialized processors that include devices like Data Processing Units (DPUs), Infrastructure Processing Units (IPUs), and custom AI accelerators.

Dan Brennan, CEO, Credo Technology, Q2 2026, 1 December 2025

This is what makes fast-growing technology companies so exciting because they never rest on their laurels. Even while its existing business is booming, Credo is planting the seeds for the next generation of growth. It has the huge advantage that when it develops new products, it is selling them to existing customers who already know and trust Credo, and these customers place BIG orders.

Share Recommendations

Credo Technology. CRDO