A portfolio built around high-quality growth will generate long-term gains

Share prices are more volatile than the underlying businesses. As I write share prices have been falling. The Nasdaq 100 is down over 11 pc from the 2 September peak. Shares in exciting businesses, which have risen so much in recent years, are often down even more sharply. Twilio peaked at $341 on 13 October and is currently $271, a decline of over 20pc.

Twilio is a company with massive ambitions. Co-founder and CEO, Jeff Lawson, said during the group’s latest earnings call “Our goal is to build the world’s leading customer engagement platform.”

Given what the company has achieved to date and the latest results, Q3 revenues up 52pc to $448m, this is not an unrealistic goal albeit that if it happens the business will be worth vastly more than the current $41bn. Against that though Twilio shares have risen fivefold, trough to peak, since March and 15-fold since February 2018. On top of that they are loss-making and valued at 25 times expected 2020 sales. It is not entirely surprising that they are coming in for some profit-taking and they are just one of many businesses in a similar situation.

Investors generally are experiencing what I experience. When I look at these businesses they are amazing, amazing in what they are doing, amazing in the energy and excitement pulsating through them, amazing for the size of the opportunities they are addressing. I can see that one day, in the not so distant future, Twilio could be worth a multiple of its current value. It is even possible that it could be a trillion dollar business one day if it does become the world’s leading customer engagement platform. But it cannot go from ground zero to the stars in a straight line. There will be periods of consolidation and profit taking. The shares will rise in steps like the whole market.

So the question is how to deal with these setbacks and periods when shares mark time, sometimes for several months.

This volatility is particularly the case because many operators in the stock market are traders rather than investors. Often using computers and algorithms they are trying to ride the upwaves and miss the downturns. This reinforces the volatility and is incredibly hard to do successfully, which is why most traders on IG lose money.

My solution is to stop trying to call the market and focus on building a portfolio of shares in exciting, growing businesses.

Additions to live portfolio

Afterpay/ APT Buy @ A$98.27 (3) “The new money management services being developed will expand our ecosystem while reinforcing our value proposition to our customers.” Afterpay, 28 October 2020

Blackline/ BL @ $94.71 “We serve less than 2pc of our addressable market. There is a very large untapped opportunity for the majority of companies struggling with manual and unsustainable accounting processes.” Therese Tucker, CEO, Blackline, 30 Oct. 2020

Five9/ FIVN @ $142.87 (3) “Our pipeline continues to grow to an all-time high, once again, reaching more than double what it was just a year ago.” Danial Burkland, president, Five9, 30 October 2020

Meidong Auto/ 1268 @ HK$31.45 “The market share of the luxury segment increased by 3.1 percentage points to 13.7pc.” Meidong Auto

Monolithic Power Systems/ MPWR @ $314 “Monolithic Power Systems is a fabulous company.” Michael Hsing, CEO & founder, 29 October 2020

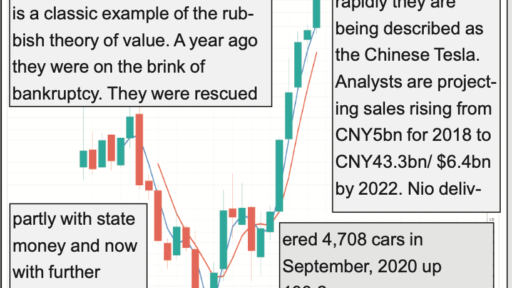

Nio/ NIO @ $31.68 (2) “Tesla is the supermodel while Nio is the girl next door.” William Li, CEO and founder, Nio

Snap/ SNAP @ $38.67 “The adoption of augmented reality has happened faster than we had previously imagined, and we feel well positioned to execute on the many opportunities that lie ahead.” Evan Spiegel, CEO, Snap, 20 October 2020

Zendesk/ ZEN @ $107.88 (2) “COVID-19 has forced organisations to focus on how they can better engage with their customers, suppliers, and employees.” Mikkel Svane, Zendesk

Afterpay/ APT Buy @ A$98.27

Afterpay grows apace, expands geographically and makes its first move into banking

Afterpay was founded by Nick Molnar and Anthony Eisen in 2015. The business operates a platform, which enables its customers to pay for goods in four interest free instalments. The group makes its money from merchants on the platform, who pay a fee in return for the customers and Afterpay’s role in funding the transactions. The group started life in Australia but has expanded to NZ, the US, the UK and beyond. Afterpay is an ANZ phenomenon, which is rapidly going global. The company only began trading in 2015, yet it already dominates Australia and New Zealand, is growing rapidly in the US and the UK, has launched in Canada and is at an early stage of establishing itself in mainland Europe and Asia.

It is also spreading its wings beyond the buy now pay later market with a link up with Australian bank, Westpac, to facilitate the introduction of Afterpay savings accounts and cash flow tools for customers in Australia.

What is important about these moves is not that they are likely to contribute much to sales and profits in the short run but they make clear (a) just how ambitious are the management and (b) that these are just stepping stones in a path which is going to include many more exciting initiatives.

This is especially significant because Afterpay is operating in a ferociously competitive market. In the UK it is challenging market leader, Klarna and in the US, which has already become the group’s biggest market by number of subscribers, the group is up against Paypal, which recently launched a product, which looks like a straight copy of Afterpay. The shares fell sharply on the Paypal announcement but have since recovered. Afterpay’s 30 year old cofounder, Nick Molnar said five years ago that he expected Paypal to enter the market and there is no sign the group’s growth is slowing. One might equally say that Paypal should be worried by a business, which is growing so fast, is led with such energy and which is clearly intent on taking a bite out of Paypal’s lunch.

The shares are on a high valuation, which may lead to more volatility but they score full marks for excitement, energy, ambition and outstanding execution.

“In October, Afterpay and Westpac Group entered into a Collaboration Agreement to facilitate the introduction of Afterpay savings accounts and cash flow tools for customers in Australia. The Afterpay-branded savings and transaction accounts, facilitated by Wetspac’s digital bank-as-a-service technology, will be linked to a customers’ existing Afterpay accounts. The new offering will provide customers with an alternative to traditional banking products and will empower them to have greater control over their budget; has the potential to facilitate new revenue streams over time and improve risk management and processing costs in Afterpay’s existing activities; is globally scalable as it uses cloud-native technology from 10x Future Technologies.” 28 October 2020

“Acquisition of Pagantis is progressing well and is on track for completion by the end of the 2020 calendar year, pending regulatory approval by the Bank of Spain. Pagantis provides us with a licence to operate in Spain, France, Italy and Portugal as well as pending licence passport applications in Germany and Poland. A cross functional detailed 100 day integration and launch plan has been developed to ensure we can launch as soon as possible post completion.

Plans to expand into Asia are progressing well:

- Established a base in Singapore to drive the development of the South East Asia market. Initial development of the EmpatKali opportunity in Indonesia is also underway.

- Introduced Afterpay’s in-store payment service to all US retailers nationwide.

- Launched Express Checkout which gives consumers the ability to complete purchases directly from retailers’ product pages, driving higher conversion and average order values.

- Entered into a strategic partnership with Stripe to allow its millions of users to quickly and seamlessly offer Afterpay to their customers, driving higher conversion rates and expanding their reach among online shoppers.

- Planning and development of Afterpay savings accounts and cash flow tools for customers underway as part of the new money management services. Minimum Viable Product launch expected in Australia Q4 FY21.” 28 October 2020

Blackline/ BL Buy @ $94.71

Blackline’s accounting and back office automation software plays key role in digital transformation

Blackline was founded in 2001 by Therese Tucker. The initial goal was to help customers replace Excel with a suite of accounting software. In 2013 the group recieved $200m in external funding and in 2015 formed an alliance with a financial consulting firm to offer a business process as a service (BPaaS) platform. Acquisitions in mainland Europe and the UK have helped the group with its automation of recurring financial processes.

Blackline is the largest technology company to be founded and led by a woman. Although we should not become too excited by her because she is stepping down but says the opportunity is larger than ever and the company has strong leadership to take it forward.

The Red Shoe example, see chart copy, makes it clear why customers are coming to Blackline to reap the benefits of back office automation. It saves on staff, allows them to focus on more interesting work, eliminates errors and as we can see delivers a dramatic return on investment.

It is no wonder than in the latest quarter to 30 September 2020 the company has recruited such heavyweight customers as Dolby Laboratories, Domino’s Pizza UK & Ireland, Hain Celestial, Nestle Health Science and Vimeo. The company says it now has more than 20 customers with annual recurring revenue over $1m.

This growth also applies to mid-market businesses and the company added a record number of new logos [companies] in Q3. As chief operating officer, Mark Huffman, noted “The simplicity of our modern accounting playbook (MAP) offering and its immediate ROI [return on investment] continues to resonate with mid-market CFOs.

The company also noted: “SOLEX also delivered another strong quarter with twice as many new logos as in the prior year. SOLEX deals were global and included wins in APJ (Asia Pacific Japan) as well as EMEA. Given a growing SOLEX pipeline we believe we have a positive setup going into the end of the year.” [SOLEX is a comprehensive all in one eSign solution].

A sign of the group’s ambitions is that it has made nearly 100 tech hires in the last year and 8,500 people have already registered for Beyond the Black, their largest customer event of the year.

“I am pleased to report that the demand environment has steadily improved, and we have seen increasing activity and momentum throughout the third quarter driving another quarter of solid results. The momentum we have experienced is validation that finance transformation is mission-critical and climbing to the top of the CFO’s priority list. We believe BlackLine is well positioned to capitalize on this demand environment. As the leader in this space, we have and we’ll continue to invest in our market to support our growth initiatives and best serve our customers. At the start of the pandemic, we made a strategic decision to stay the course with investments in key areas, such as organizational leadership, R&D, customer success and our partner ecosystem. We believe our strong results validate these investments.” Thereses Tucker, CEO & founder, 30 Oct., 2020

“Earlier this month, we announced the acquisition of Rimilia, a leading provider of accounts receivable automation solutions. We got to know the Rimilia team over the last year, and I am thrilled to welcome them into the BlackLine family. Their culture and values are very much aligned with ours, and we look forward to a successful combination of our two companies. The acquisition expands our core customer capabilities to automate another big problem for the modern day controller. This $10bn untapped market opportunity is top of mind for most companies we talk with. One of the things that excites us most about Rimilia is their shared passion for finance and accounting transformation through intelligent automation. Rimilia’s AI-powered accounts receivable automation has created great value for its more than 100 customers. Similar to the financial close market, the accounts receivable market is largely unpenetrated with the majority of companies using legacy manual processes to manage their order-to-cash process. According to independent third-party analysis, it’s estimated that the total addressable market for accounts receivable software is approximately $10bn, and it’s early, and their competitive space is highly fragmented. We are very excited to enter this new and increasingly relevant market that increases BlackLine’s combined TAM to more than $28bn.” Therese Tucker, CEO, 30 October 2020

Five9/ FIVN Buy @ $142.87

Virtual contact centre software provider, Five9, sees accelerating growth as key CX disruptor

Five9 is the leading provider of cloud contact centre software. Founded in 2001 the company rapidly gained momentum as contact centres began to understand the potential of the Internet and started looking for alternatives to traditional, on-premise solutions. Delivered on demand the solution enables clients to quickly deploy agents’ seats in any geographical location with only a computer, headset and broadband Internet. Five9 supplies software to enable business and organisations to virtualise and increasingly automate contact centres. The old days of football pitch sized contact centres with 100s of bored employees wearing headphones are fast disappearing.

But this is not just about automation to save money. As Five9 put in when reporting its latest outstanding set of quarterly results:

“As you can see, more than ever, Five9 is delivering a comprehensive next-generation CX [customer experience] platform that is helping enterprises transform how they, in turn, deliver a more intelligent, personalized and agile experience to their customers.”

This is a highly competitive space. Another much favoured QL stock, Twilio spoke in its latest quarterly results about its ambitions to become the world’s leader in software for customer engagement. But what is very clear is that Five9, which is effectively a pure contact centre specialist, is more than holding its own with a string of metrics to demonstrate that growth is accelerating. Business brought in by its systems integrator partners is expected to treble over the year. The overall group pipeline has doubled and growth in overseas markets, admittedly from a small base, is tripling and quadrupling depending on which region you are looking at. The group has also made a key acquisition of a company, Inference, which is a key player in the intelligent virtual agent space.

“IVAs use conversational AI, enabling natural dialogue between computers and humans and are a major evolution from touchtone or voice-activated IVAs, which depended upon structured, fixed grammar interactions. These more accurate and user-friendly IVAs result in significant savings through increased call deflection rates, better informed agents or both.”

Ten years from now Five9 will likely be a dramatically larger business.

“I’ll now turn to discuss the underlying market drivers for our strong performance. First, the transition to the cloud continues unabated, including for larger enterprises, and we believe will continue for many years to come. Second, it’s become imperative to digitize customer experience as part of a company’s overall digital transformation. Third, these two megatrends, the move to the cloud and digital transformation, have been accelerated by COVID-19. We see this in the significant increase in the demand for agents in general, and in particular, the demand for agents working from home, with a mutual benefit to businesses and agents. And finally, fourth, as I will elaborate upon in a moment, the demand of AI-driven automation is clearly increasing. In short, as we all know full well, the new front door for many types of businesses, from yoga gear to e-learning, telemedicine to electronics and so on, is the contact center. And we believe that this front door will open wider in the future.” Rowan Trollope, CEO & founder, Five9, 30 October 2020

“Our SI [systems integrator] momentum continues. Once again this quarter, our SI bookings more than doubled compared to last year, and we anticipate our SI bookings to finish 2020 at more than triple what they were in 2019. We’re also now significantly more diversified by SI partner than we were last year. Second, we’re very pleased with the performance of our AT&T partnership. Following AT&T’s rapid onboarding and the successful launch of AT&T cloud contact centre we’re now jointly delivering initial customer deployments and quickly growing our global pipeline together. And finally, third, we continue to enjoy significant international traction. Our products localised for multiple languages are enabled with in-country connectivity to a host of local carriers and supported by in-region support personnel and partners. Although the numbers are still small, our international momentum continues with record bookings in EMEA and Latin America, with EMEA growing three times and Latin America growing four times year-over-year in Q3.” RT, CEO & founder, 30 October 2020

Meidong Auto/ 1268 Buy @HK$31.45

Meidong Auto focus on efficiency drives fast growth in China’s booming market for luxury cars

Meidong Auto is a luxury auto dealership group focusing on serving consumers in lower tier cities in China. Since it went public in 2013 the group has delivered compound growth of 29.2pc in sales and 31.1pc in profit and has paid out 45pc of its profit in dividends. The group works with luxury brands such as Porsche, BMW/ Mini, Lexus and mid-to high end brands like Toyota and Hyundai. The group operates 58 showrooms in 39 cities.

Surveys suggest that in three years from 2019 to 2022 China’s middle class will grow to 550m people, which is considerably larger that the entire population of the US.. Within that estimates suggests that there are already 100m Chinese who belong to the top 10pc of wealth in the world. This means that China is fast emerging as not only the world’s most important consumer market for goods of all kinds but is also becoming the top market for luxury goods including luxury car marques. Last but not least China does not have long established brands with rich histories, brands like BMW, Porche, Lexus and Audi and Chinese consumers attach huge cachet to imported goods. It all adds up to booming demand for imported luxury car brands and this is the powerful tail wind which is helping to drive strong growth in sales at Meidong Auto, a Chinese car distribution business with showrooms in over 60 Chinese cities.

As we can see from the quote below although sales of luxury cars fell during the Covid period their share of the overall car market has been growing dramatically from 10.6pc a year ago to 13.7pc recently. Subsequently, helped by growth in the luxury car market of 27pc in the year to 30 June this share has grown again to reach 14.8pc. Even while the overall market was struggling Meidon Auto continued to grow with sales rising an amazing 24.5pc in the first half of 2020, spanning the entire period of lockdown in China. It is not just powerful tailwinds that are making Meidong Auto so successful. The group has a mantra of intense focus on efficiency and it is clearly working. They are also acquisitive. Last year they bought a BMW dealership rather than build a greenfields site and totally transformed the business. No wonder they want more deals.

“In the first half of 2020, despite the significant reduction in customer foot traffic, the group was still able to achieve sales growth through a higher customer conversion rate and other measures while further reducing its inventory turnover to 12 days. Revenue of new passenger vehicles sales amounted to RMB7,487.9m (first half of 2019: RMB6,015.2m), an increase of 24.5pc as compared to last year. Luxury brands remained as the major revenue source of the group, accounting for 84.3pc of total new passenger vehicles sales. BMW, Porsche, Lexus and Audi recorded sales of new passenger vehicles of RMB2,978.4m, RMB1,544.5m, RMB1,726.1m and RMB57.1m respectively, accounting for 39.8pc, 20.6pc, 23.1pc and 0.8pc of new passenger vehicles sales. In terms of sales volume, the group sold 23,691 new passenger vehicles in total during the period, representing an increase of 7.9pc yoy in sales volume.” Meidon Auto, interim results, 20 August

“Despite the overall weakness of the automobile market, China’s luxury car market remained relatively resilient. The sales of luxury cars in China over the first half of 2020 decreased by 6pc yoy to 1.41m units while the market share continued to increase. According to the statistics of the China Passenger Car Association, during the six months ended 30 June 2020 (the “Period”), the overall market share of the luxury segment increased by 3.1 percentage points to 13.7pc compared to the same period last year. With the gradual improvement of the COVID-19 situation, the automobile market in China started to see solid recovery since March 2020 and resumed growth in May 2020 as compared with the same period last year. The luxury segment has been leading the recovery of the overall automobile market in terms of consumption demand momentum. Based on the statistics of China Passenger Car Association, the luxury car market recorded a 27pc growth in June 2020 compared to the same period of last year, while the market share reached its historical high to 14.8pc.” Meidong Auto, interim results, 20 August ‘20

Monolithic Power Systems/ MPWR @ $314

Monolithic Power Systems to almost double capacity to $2bn a year over next six quarters

Monolithic Power Systems was founded in 1997 by Michael Hsing. The group provides power circuits for systems found in cloud computing, telecom infrastructures, automotive, industrial applications and consumer applications. The company is based in Washington and has facilities in California and Taiwan but makes most of its sales in Asia. Its principal focus is on analog and mixed-signal circuits. It operates in more than 15 locations worldwide.

Monolithic Power Systems (“MPS”) is a leading semiconductor company that designs, develops and markets high-performance power. MPS’s core strengths include deep system-level and applications knowledge, strong analog design expertise and innovative proprietary process technologies. These combined strengths enable MPS to deliver highly integrated monolithic products that offer energy efficient, cost-effective, easy-to-use solutions for systems found in computing and storage, automotive, industrial, communications and consumer applications.

MPS’s mission is to reduce total energy consumption in its customers’ systems with green, practical and compact solutions.

They have locations in Asia (primarily in China, India, Japan, Korea, Singapore and Taiwan), Europe (primarily in France, Germany, Spain, Switzerland and the United Kingdom), and the United States. Not surprisingly with its headquarters in Washington, MPWR feels and behaves very much like any other fast-growing US high technology company. But in other respects it is a business almost as Chinese as Meidong Auto. The founder is Chinese, many of the operations are in China, although it is increasingly diversifying into the rest of the world. Most significantly 89pc of sales are in Asian markets, which ties the group firmly into the world’s fastest growing region.

Latest results for Q3 were unsustainably strong because of a catch-up effect as Asia recovered from the earlier lockdown. However a clue to prospects is that the group is rapdily building capacity to support sales rising to $2bn.

“I would probably say that automotive is one of the more exciting end markets for us for the next several years. Now if you look at our track record in 2019 and 2020, 2019 was affected by the recession, 2020 by factory closings related to the COVID-19 pandemic. So again, those are circumstances that were largely outside of our control. But what we’re seeing is that we’re expanding now from our traditional infotainment base into some of these more exciting technologies, including the lighting systems, the ADAS and the autonomous driving. So we think that this is a sustainable revenue growth should be well ahead of what our corporate average is going to be. At one time, we were promoting the concept of being able to grow consistently at 20pc to 60pc per year, but that would probably back off of that, down to a more reasonable between 30pc and 40pc, but still a very exciting end market for us “ Bernie Beigen, CFO, 29 October 2020

“MPS achieved record third quarter revenue of $259.4m, 39.3pc higher than revenue in the second quarter of 2020, and 53.7pc higher than the comparable quarter in 2019. As noted in our 14 September, 2020 update to our Q3 financial guidance, our revenue increased beyond expectations for two key reasons: First, we were able to fulfill our customers’ demand that had been delinquent due to past capacity constraints; second, certain China-based customers requested previously scheduled shipment dates be pulled into the third quarter of 2020. We believe this request was related to trade and regulatory policy changes that occurred during the quarter. These two factors contribute significantly to this quarter’s performance relative to the prior quarter of 2020 and to Q3 of 2019. Looking at our revenue by market, third quarter 2020 communications revenue of $54.7m was up 81.8pc from the second quarter of 2020, primarily due to a pull-in of customers requested ship dates. Communications sales represented 21.1pc of our total third quarter 2020 revenue. In our consumer markets, third quarter 2020 revenue of $70.2m increased 47.4pc from revenue reported for the prior quarter of 2020. This extraordinary growth in consumer reflects a combination of market share gains in gaming, wearables and IoT applications, along with normal seasonality.” 29 October 2020

Snap/ SNAP Buy @ $38.67

Social media superstock, Snap, sails through lockdown with fastest Q3 growth rate since 2017

Snap is an American camera and social media company founded in September, 2011 by Evan Spiegel, Bobby Murphy and Reggie Brown although only the first two now play a role in the business. The company refused offers reportedly ranging up to $30bn from Facebook and Google before IPO-ing in March 2017. Later that year Tencent acquired a 12pc stake. The shares fell on high losses and slowing growth but have since recovered strongly.

Snap co-founder and CEO, Evan Spiegel, is best known to many people as the husband of former Victoria’s Secret supermodel, Miranda Kerr. But it turns out there is a bit more to him than that and I am beginning to realise that he is a remarkable business talent and that Snap could be on course to becoming a very large business indeed. Spiegel was born in 1990, which makes him 30 now. He co-founded Snap, while still a student at Stanford University and became the world’s youngest billionaire in 2015.

As it happens with surprising frequency the shares initially plummeted as the excitement of the IPO died away. Part of the reason was that the business was reporting huge losses but also slowing growth in users, which fell very slightly in 2018 over 2017. Investors were worried that the business was running out of steam and that tech giants like Facebook and Google, both of which had tried to buy Snap before the IPO, were going to copy and steal Snap’s business. Spiegel didn’t sell, even for a reported $30bn and he and co-founder, Bobby Murphy, the 32 year old chief technology officer of Snap, are fully engaged in seizing what they see as a great opportunity.

Part of the excitement at Snap is the torrent of innovation (see latest launches below) and much of the credit for this goes to the more understated Murphy. I don’t use Snap or any of its features so have zero familiarity with the products like its disappearing photos and messages but I can see a business which is classic 3G (great story, great chart, great growth) and with a palpable aura of excitement. A classic lockaway.

“We added 11m daily active users this quarter for a total of 249m, up 4pc quarter-over-quarter and 18pc year-over-year, demonstrating the benefits of years of investment in our product and partnerships across a wide range of geographies. We generated $679m in revenue this quarter, up 52pc year-over-year, outperforming our expectations and highlighting the substantial value we drive to both direct response and brand advertisers during this continued period of uncertainty. Our year-over-year growth rates for both daily active users and revenue were higher this quarter than they were in Q3 of the prior year. In fact, they represent our highest Q3 growth rates since 2017.” Evan Spiegel, CEO & founder, Snap, 20 October 2020

“One key driver of growth across all of our markets has been product innovation and infrastructure improvements. Following the successful rebuild of our Android application last year, we are rolling out a newly streamlined messaging infrastructure that we expect will make messaging faster and more efficient, which will help drive increased engagement, especially as we expand our community across different countries and devices. These foundational investments in our core architecture have also enabled us to innovate faster and release new product features at a rapid pace. In the last year alone, we launched Brand Profiles, Minis, Places on the Map, Dynamic Ads, Bidded AR Lenses, Dynamic Lenses, Camera Kit, Snap ML Lenses, and new creative tools, with lots more to come. We’ve also continued to invest in the technology that underlies our AR platform to empower new experiences for our community. We drew on several years of technical investment and creative experience to launch a number of extremely popular Lenses this quarter. For example, our recently launched Anime Lens uses our Snap ML technology to turn people into anime characters in real time and our community engaged with this Lens 3 billion times in its first week. As we push the envelope on what is possible in augmented reality with these new Lenses, we are even more excited to contribute these new learnings and capabilities to Lens Studio, so our community can leverage them in their own creations.” Evan Spiegel, 20 October 2020

Zendesk/ ZEN Buy @ $107.88

Zendesk sees a notable pickup in Q3 2020 after two slower quarters as businesses shift online

Zendesk is an American customer services software company. The group was founded in Denmark in 2007 by Mikkel Svane, Morten Primdahl and Alexander Aghassipour. They moved to California in 2014, acquired a Singapore provider of live chart software and moved into the AI chat space. It has since used acquisitions including buying in the software that powers the platform. Zendesk was born in 2007 (in Denmark; they moved to San Francisco in 2009) with a clear mission.

“We wanted to democratise customer service by making the tools available to any organization, big or small. We wanted to focus on the employees that are the actual users of the product and make something that could be simple and enjoyable to use.

We wanted to help organizations rethink what customer service means to them and to reveal the opportunities that seamless and delightful customer experiences could provide.

And we wanted the whole experience—not just the software experience, but the actual customer service experiences themselves—to be “beautifully simple.” That phrase guided us then and it guides us now.”

Their timing was perfect. They were entering a space where there had been little innovation for a decade. At the same time the Internet was offering new ways to deliver services, creating a new online market for those services and bringing customer service and engagement to the heart of corporate operations. Zendesk played to all those trends and as a result has grown customer numbers from 1,000 in 2009 to 170,000 now.

At the same time it has been adding to the number of services it can provide those customers and attracting larger customers for its offerings. This is reflected in a net expansion rate (growth from existing customers) of between 110pc and 120pc.

There has also been strong growth in RPO (remaining performance obligations) which reflects business with its larger customers.This number grew 43pc in the latest quarter while overall sales rose 24pc.

This is a sharp improvement on performance in the first two quarters when businesses reacted to Covid-19 by stopping spending. The trend has strengthened because businesses know they need to adapt (a) to a dramatic spike in online business and (b) to survive in a changing world. Zendesk looks superbly placed.

“So we entered our last quarter of the year with momentum on our side. In the third quarter, we turned the corner on the biggest impacts to our business in COVID-19. Our new business growth continued as churn returned to pre-pandemic levels. Our expansion business too returned to strong growth as our contracting trended closer to pre-pandemic levels too. All of these trends set us up well for the rest of the year. I’m particularly happy that we crossed the $1bn annual revenue run rate during this third quarter and also that we are guiding to exceed our $1bn revenue target for the full-year. This is of course a journey we’ve been on, since 2016, when we first said that is inspiration.” Mikkel Svane, CEO and cofounder, 29 October 2020

“In many ways we were lucky. Putting software in the cloud and offering your software as a service were still new practices when we launched, but since then we’ve seen an ever growing trend of organizations moving their enterprise software out of the basement and embracing subscription models. As new technological trends have subsequently developed—mobile and social being the most impactful—Zendesk has been well positioned to embrace and incorporate them into our platform. More important than these technological changes, though, have been the changes in attitude toward customer service and its value for every organization. Since 2007, the “voice of the customer” has grown exponentially. Not coincidentally, we think organizational attitudes toward customer service are changing just as rapidly. We believe the view that customer service is just a “necessary cost” of running a business is disappearing. Today, more and more organizations are realizing that customer service can be critical in managing brands, maintaining loyalty, containing crises, and expanding business.” Mikkel Svane, CEO & cofounder, letter in the 2015 prospectus