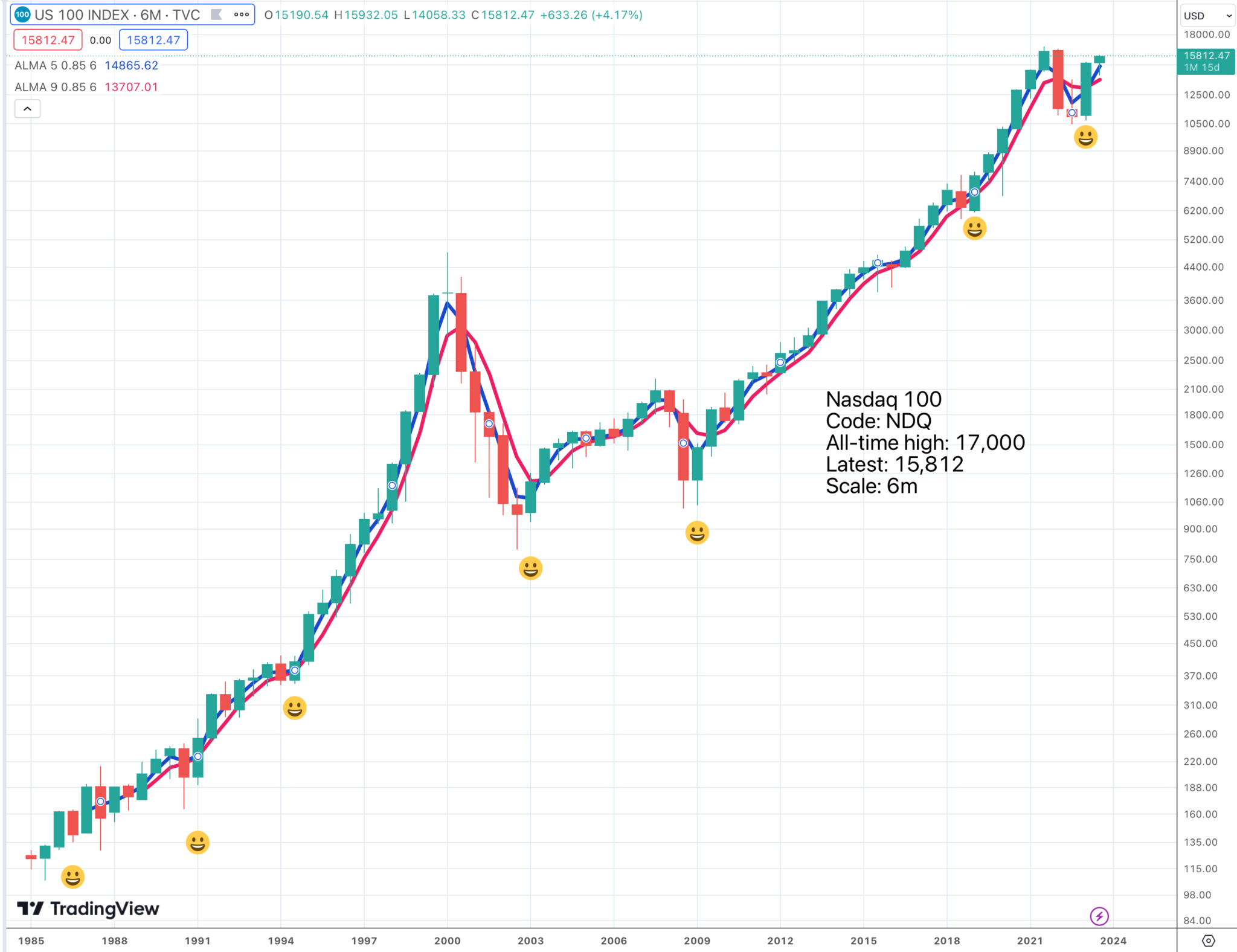

This is a straight ETF, no leverage, but it has nevertheless proved an excellent investment in the past and it is looking very promising right now.

There is a golden cross by the moving averages on this very long term chart, where each candlestick equals six months. It is only the second such buy signal in the history of the ETF and the first one was an incredible success.

Table of Contents

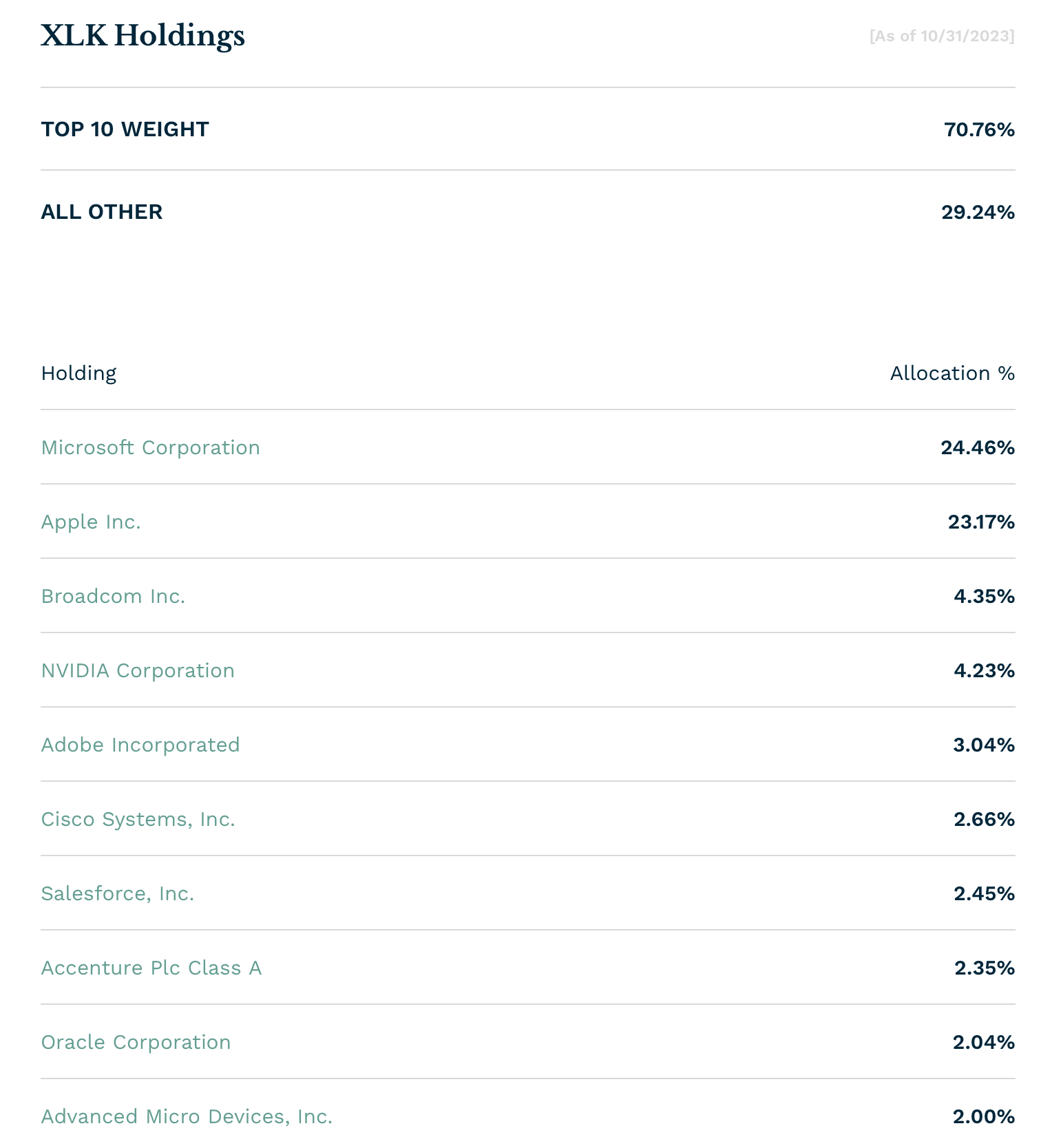

IP stocks make up over 50pc of XLK

The first thing you may notice is that the big guns in the portfolio are dominated by names in my innovation portfolio (IP for short). Over 50pc of the portfolio is accounted for by Apple, Microsoft and Nvidia, all IP constituents. If you hold the IP stocks, you don’t really need this ETF but it makes a good alternative without the volatility of QQQ3.

Remember though that QQQ3 does not just offer exaggerated performance but is also continually being rebalanced around the best-performing stocks. On the other hand XLK is hitting new all-time peaks which QQQ3 is some way from doing.

One thing that does strike me is that the strong performance of XLK is a good omen for the performance of all the IP stocks and suggests that Apple, for example, which has yet to break convincingly out of its post 2021 peak consolidation will do so in due course. Apple’s massive global footprint and the power of its brand surely mean that the company is going to have a huge role to play in the AI era.

Looking at it I think this chart is better than I imagined. It looks strong, very similar to the Microsoft chart but with a pullback after the initial slightly tentative breakout. If it does start to move there is plenty of consolidation to drive the price significantly higher.

The fact that both Apple and Microsoft and other big guns have such promising looking charts also bodes well for the performance of QQQ3. The chart looks very promising though still well short of former peaks. Many people think QQQ3 is just for short-term traders but the chart suggests that buy, hold, accumulate is a good way to play this one – blind faith in other words.

Strategy – Selected Charts Looking Promising

The number of charts of major stocks looking good bodes well for the performance of the Nasdaq 100, of which these shares are major constituents. My alert with the man and the scythe is already looking like yesterday’s news albeit the strength of this stock market is incredibly narrowly based. The Mega Caps go from strength to strength while many lesser names struggle.

Share Recommendations

Technology Select. XLK. Buy @ $181.96

Other stocks mentioned were all recommended in the previous alert so hardly need repeating.